What we’re reading (3/17)

“Inflation vs. Recession: The Fed Is Walking A Tightrope” (New York Times). “The Fed announced Wednesday that it would start raising interest rates for the first time since 2018, and the initial reaction of financial markets was welcoming. The stock market rose, bond yields wavered and commodity prices moderated. But whether the economy can withstand rising rates during a period of geopolitical turmoil and a lingering pandemic is a question without an immediate answer.”

“The Disturbing New Relevance Of Theories Of Nuclear Deterrence” (The Economist). “The problem of credibility becomes far more complicated in a showdown between nuclear-armed powers, which both have sufficient weaponry to retaliate against any first strike with a devastating attack of their own. If the first use of nuclear weapons is all but assured to bring ruin on one’s own country as well, then efforts to use the threat of nuclear attack to extract concessions are likelier to fail. Wars may nonetheless occur. The invasion of Ukraine could be seen as an example of the stability-instability paradox: because the threat of a nuclear war is too terrible to contemplate, smaller or proxy conflicts become ‘safer’[.]”

“Amazon Closes Deal To Acquire MGM” (Wall Street Journal). “The move comes after Amazon certified to the FTC that it had provided all the information requested by antitrust investigators reviewing the transaction. That step put the deal on a regulatory clock with the agency that has now expired, leaving the company free to move forward, a person familiar with the matter said. Amazon provided the FTC with more than three million documents over the past eight months as part of the review process, the person familiar with the matter said.”

“Revising Down The Rise Of China” (Lowy Institute). “The future of China’s ongoing global rise is of great importance to both China and the rest of the world. Predicting long-term economic performance is inherently difficult and open to debate. Nonetheless, we show that substantial long-term growth deceleration is the likely future for China given the legacy effects of its uniquely draconian past population policies, reliance on investment-driven growth, and slowing productivity growth.”

“Are Home Prices Going To Crash? A Real-Estate Expert Who's Written Multiple Books On Investing Strategy Breaks Down Why Prices Could Grow ‘Faster Than We Can Get A Handle On’“ (Insider). “Predicting the market is tricky. While [loan officer David] Greene sees more gains to be had, others caution of a correction. And some experts and industry veterans suggest that anyone who stands to benefit from the continued run on the housing market — particularly investors, real estate agents, and mortgage brokers — are naturally going to keep pumping air into the bubble.”

What we’re reading (3/16)

“Fed Raises Interest Rates For First Time Since 2018” (Wall Street Journal). “Federal Reserve officials voted Wednesday to lift interest rates and penciled in six more increases by year’s end, the most aggressive pace in more than 15 years, in an escalating effort to slow inflation that is running at its highest levels in four decades.”

“US Stocks Trade Higher After Fed Raises Interest Rates And Investors Digest Potential For 7 Hikes In 2022” (Insider). “The Fed raised the Fed Funds rate to a range of 0.25% to 0.50%. The range previously sat at 0.00% to 0.25% since the Fed cut rates amid the onset of the pandemic in March 2020. And more rate hikes are on the way, according to the Fed's dot plot, which tracks expectations from members of the Fed.”

“Is It Time To Buy Travel Stocks?” (RiskHedge). “The world is truly opening up this time. Australia and New Zealand opened their borders last month. Ireland, where I live, just scrapped mask mandates. Vaccine passports are a thing of the past in several European countries. Flown in the past few weeks? If so, you likely noticed airports are packed. TSA data shows passenger numbers are now 90%+ of pre-COVID levels. The number of Americans flying overseas jumped 130% compared to last year.”

“Why Isn’t Crypto An Effective Hedge?” (Marginal Revolution). “The last few months of chaos show what Bitcoin and other crypto assets are good for: They are advanced tools of globalization, luxury goods for complex, well-functioning markets — not protections against the depredations of hostile governments. One common story, especially popular in libertarian circles, has been that when inflation runs rampant and governments confiscate private wealth, crypto will be a vital refuge. It increasingly appears that this story is wrong.”

“How Life As A Trucker Devolved Into A Dystopian Nightmare” (New York Times). “Today, long-haul truckers are some of the most closely monitored workers in the world. Cameras and sensors dot their trucks, watching the road, the brakes and even the driver’s eye movements. Once, when his truck’s cabin heater broke, [driver] Mr. [Jon] Knope was forced to sleep in freezing temperatures for several days while traveling across northern Ohio and New York because an automated system made sure his engine was turned off at night. The company told him there was no way to override the system.”

What we’re reading (3/15)

“Fund Managers Now See Equity Bear Market In 2008-Like Gloom” (Bloomberg). “Most investors now expect global equities to slump into a bear market this year as the growth outlook has tumbled to the lowest level since the 2008 financial crisis amid fears over the impact from the war in Ukraine.”

“How Bloomberg Media Beat The Pandemic Blues With Explosive Growth” (Poynter). “Most print-based media — newspapers and magazines — have been struggling for at least a decade to pick up the pace of digital transformation. Just as momentum was building, two years of COVID-19 and the accompanying downturn interrupted revenue progress as many advertisers pulled back. Not so at Bloomberg Media, whose best-known holding is Bloomberg Businessweek. The company announced some eye-popping 2021 results last week[.]”

“Part-Time Retirement Programs Are On The Rise” (Wall Street Journal). “Phased retirement programs—which allow workers nearing retirement age to cut back on their hours while keeping some pay and benefits—are growing in popularity. Human-resource executives say the pandemic has opened bosses to flexible work arrangements, while the fierce hiring market and higher-than-expected rate of retirements have motivated managers to find ways to retain older workers with key skills.”

“Stock Volatility And The War Puzzle” (Cortes, Vossmeyer, Weidenmier, NBER). “U.S. stock volatility is 33 percent lower during wartime and periods of conflict. This is true even for World Wars I and II, which would seemingly increase uncertainty. In a seminal paper, Schwert (1989) identified the “war puzzle” as one of the most surprising facts from two centuries of stock volatility data. We propose an explanation for the puzzle: the profits of firms become easier to forecast during wartime due to massive government spending.”

“Thieves In The Night: A Vast Burglary Operation Ring From Chile Has Been Targeting Wealthy U.S. Households” (Vanity Fair). “In the coming months, according to an inside source, federal teams are set to fan out and come down hard on the thieves, hoping to finger the shadowy figures they believe oversee the operations: Chilean ringleaders back home and in the U.S. as well as their partners—Colombian coordinators and fences, who manage to turn the stolen caches into cash. But first, some background.”

What we’re reading (3/13)

“My Conversation With The Excellent Sam Bankman-Fried” (Tyler Cowen, Marginal Revolution). “let’s talk about Dogecoin for a second, which I think is the purest of a type of coin, of the meme coin. I think the whole thing with Dogecoin is that it does away with that pretense. There is no sense in which any reasonable person could look at Dogecoin and be like, ‘Yes, discounted cash flow.’ I think that there’s something bizarre and wacky and dangerous, but also powerful about that, about getting rid of the pretense.”

“How The Pandemic Broke Silicon Valley’s Stranglehold On Tech Jobs” (Wall Street Journal). “In a feedback loop that could transform the economic geography of the U.S., millions of Americans are moving, and companies are following them—tech companies in particular. In turn, this migration of companies and investment is attracting more workers to places that in the past usually lost talent wars. This is a reversal of a decadelong trend in the opposite direction.”

“Morgan Stanley Trader Exits After Racking Up Millions In Losses” (Bloomberg). “[The trader], who traded dividends in the New York-based bank’s equities division, will be departing after transactions he oversaw went awry, according to people with knowledge of the matter…[t]rading dividends is a niche of Wall Street financial engineering that lets investors bet on the dividend flows from a basket of shares or even single companies. Market uncertainty in recent weeks has hit dividend books across the street, opening up those trading desks to unexpected losses, one person said.”

“Welcome To Londongrad, Where Kleptocrats Wash Their Money Clean” (New York Times). “For years, Russian wealth has poured into Britain with few questions asked, helping to finance political campaigns and buoying the luxury property market. Russian oligarchs have been so happy to avail themselves of Britain’s laissez-faire regulatory climate to park their wealth and launder dirty money that the nation’s capital has earned the moniker Londongrad.”

“Here’s What The ‘Most Favored Nation’ Status Means — And Why Russia Still Has It” (CNN Business). “As a member of the World Trade Organization, Russia is treated as a most favored nation, which gives it equal access to all of the WTO members' markets and guarantees equal tariffs. In short, the label is like a rubber stamp for permanent normal trade relations. Should Congress vote to approve its removal, normal trade with Russia will effectively end, paving the way for higher tariffs.”

What we’re reading (3/11)

“Stocks Turn Lower To Finish The Week” (Wall Street Journal). “Stocks opened the day higher, as traders bought stocks after Russian President Vladimir Putin said in televised remarks that there had been positive developments during talks with Ukraine, even as Russian forces continue to pound Ukrainian cities. By the afternoon, the S&P 500, Dow Jones Industrial Average and Nasdaq Composite had all turned lower, as investors weighed the risk of heading into the weekend holding stocks.”

“China Has Tools To Help Russia’s Economy. None Are Big Enough To Save It.” (New York Times). “To help Russia evade sanctions, China would have to offer a viable substitute to the American dollar. But Chinese money — the renminbi — is barely used outside of China. Only 3 percent of the world’s business is done using the redback. Even Russia and China conduct their trade mostly in U.S. dollars and euros.”

“Businesses Can't Pay Sufficiently Now, Or In The Future” (RealClear Markets). “[T]he two ‘D’s’ of demography and deglobalization are about to unleash a tidal wave of cost-pushing pressure no economy will be able to withstand. Among those making this case is British Economist Charles Goodhart. In an interview with the Wall Street Journal this week, the former member of the Bank of England’s Monetary Policy Committee (because they’re all Economists) warned that inflation will go higher than it is now and will stay this way ‘for decades.’”

“As SPAC Bubble Burst, Hedge Funds Doubled Their Holdings” (Institutional Investor). “The current glut of SPACs is, in part, due to the difficulty these blank-check companies have had in hooking up with merger partners. Almost 800 SPACs filed for IPOs last year, raising $162.5 billion — more than half of the $300 billion raised since the financial crisis of 2008, SPAC Insider reports. But last year only 71 merger deals were announced, and just 53 completed.”

“War And Sanctions Have Caused Commodities Chaos” (The Economist). “Today Russia’s invasion of Ukraine is unleashing the biggest commodity shock since 1973, and one of the worst disruptions to wheat supplies since the first world war. Although commodity exchanges are already in chaos, ordinary folk have yet to feel the full effects of rising petrol bills, empty stomachs and political instability. But make no mistake, those things are coming—and dramatically so if sanctions on Russia tighten further, and if Vladimir Putin retaliates. Western governments need to respond to the commodity threat as determinedly as to Mr Putin’s aggression.”

What we’re reading (3/9)

“Oil Drops 12% For Worst Day Since November As Wild Ride Triggered By Russia Disruption Continues” (CNBC). “The move in oil lower came amid indications of possible progress by the U.S. in encouraging more oil production from other sources. Reuters reported that Iraq said it could increase output if OPEC+ asks. Secretary of State Antony Blinken also signaled that UAE would support increased production by OPEC+.”

“Food Crisis Grows As Spiralling Prices Spark Export Bans” (Reuters). “The conflict in Ukraine is threatening global grain production, the supply of edible oils and fertiliser exports, sending basic commodity prices rocketing and mirroring the crisis in energy markets. Palm oil is the world's most widely used vegetable oil and is used in the manufacture of many products including biscuits, margarine, laundry detergents and chocolate. Palm oil prices have risen by more than 50% this year.”

“How The Putin Shock Might Affect The World Economy” (Paul Krugman, New York Times). “[F]ood may actually be a bigger issue than energy. Before Putin’s war, Russia and Ukraine combined accounted for more than a quarter of the world’s wheat exports. Now Russia is sanctioned and Ukraine is a war zone. Not surprisingly, wheat prices have shot up from less than $8 a bushel before Russia began massing its forces around Ukraine to around $13 now.”

“January Was The Eighth Straight Month Where More Than 4 Million Americans Walked Out Of Their Jobs” (Insider). “[It’s] an extraordinary streak, both for its length and the intensity of nationwide quitting. Monthly quits trended at about 3.5 million before the pandemic rocked the US economy. Walkouts have now landed well above that level for the better part of the last year. Record-high quits were also seen as recently as November, with 4.5 million workers leaving their jobs that month alone.”

“Amazon Board Approves 20-For-1 Stock Split, $10 Billion Share Repurchase” (Wall Street Journal). I guess Amazon thinks the market is mispricing its shares. On the one hand, they probably have better insight into the company’s prospects. On the other hand, managers’ forecasts tend to biased relative to truth.

What we’re reading (3/8)

“Goldman Sachs Says Investors Unprepared for U.S. Curve Inversion” (Bloomberg). “It’s ‘a matter of arithmetic’ that ‘an extremely inverted inflation curve makes inversions of the nominal yield curve that are either earlier in the cycle or deeper’ than investors have been used to in recent decades, [Goldman Sachs Chief Global Rates Strategist Praveen] Korapaty writes.”

“Russian Default’s Limited Financial Fallout” (Fisher Investments). “Some form of Russian sovereign bond default is looking rather likely, but the implications seem considerably smaller than 1998’s, which played a central role in that year’s correction.”

“You Can Still Find ‘Cheap’ Gas — If You Know Where To Look” (CNN Business). “The data show that there's a wide range of pricing in most markets, even in many of the states where the average price is now well above $4. Most stations try to stay just below that mark, even if that means charging $3.999, which is the most common price for a gallon of regular gas at US stations Tuesday, according to the Oil Price Information Service, which tracks prices for AAA.”

“Making Sense Of Why Executives Are Eager To Get Employees Back In The Office” (CNBC). “‘I’ve heard so many times from executives about the importance of whiteboarding, but that sentiment is always coming from the person who is controlling the pen in that whiteboard sessions,’ [Brian] Elliott [President of the Future Forum] said. ‘The truth is whiteboarding leads to group think. If you allow people to submit ideas on their own, not in a room with others, studies show you’ll get more creativity.’”

“U.S. Probes Options Trade That Gained On Microsoft-Activision Deal” (Wall Street Journal). “Federal prosecutors and securities regulators are investigating large bets that Barry Diller, Alexander von Furstenberg and David Geffen made on Activision Blizzard Inc. shares in January, days before the videogame maker agreed to be acquired by Microsoft Corp., according to people familiar with the matter. The three men have an unrealized profit of about $60 million on the options trade, based on the recent Activision share price of around $80, according to the people.”

What we’re reading (3/7)

“Time for Supply” (John Cochrane and Jon Hartley, Project Syndicate). “Nothing matters more for human flourishing than long-term economic growth. So, no economic trend is more worrisome than growth falling by half, especially for the well-being of the less fortunate. The eruption of inflation settles a long debate. Sclerotic growth is not the result of demand-side ‘secular stagnation,’ fixable only with massive fiscal and monetary stimulus. Sclerotic growth is a supply problem. We need policies to increase the economy’s productive capacity – either directly or by reducing costs.”

“Gasoline Prices Surge Above $4 A Gallon, With No End In Sight” (Wall Street Journal). “Prices at the gas pump are soaring to near record levels across the U.S., threatening to further pressure consumers and an economy already struggling with sky-high inflation. On Monday, the national average price for regular gasoline hit $4.065 a gallon, the highest price since July 2008 and approaching the record of $4.114 reached that same month, according to AAA.”

“Nickel Prices Soar 90% To New Record High On Worries About Shortages From Major Supplier Russia” (Insider). “Nickel prices in London logged a record surge on Monday amid escalating concerns that production in Russia will be disrupted in the wake of Moscow's invasion of Ukraine. The three-month nickel contract leapt 90% to trade above $55,000 a metric ton on the London Metal Exchange, according to pricing from Bloomberg. That marks a new all-time high, and the jump of more than $26,000 marked the biggest single-day dollar gain ever.”

“Investors Are Terrible At Forecasting Wars” (The Economist). “[M]ost investors lose money during wars, because they fail to see them coming…One problem faced by investors is that they are poorly equipped to assess risks associated with “black-swan” events, which have very low probabilities but which can be extremely costly…Philip Tetlock, a Canadian scholar, notes that building predictive abilities requires repeated feedback so that participants can hone their accuracy over time. Once-in-a-career events do not offer that.”

“The Man Behind GameStop Mania Is Coming For Bed Bath & Beyond” (CNN Business). “[Ryan] Cohen's company RC Ventures bought a nearly 10% stake in Bed Bath & Beyond (BBBY), making the investment firm a top-5 shareholder, Cohen said in a letter to the retail chain's board of directors Sunday…Cohen, who took a stake in GameStop (GME) in 2020 and became chairman of the company's board last year, clearly wants to shake things up. In his letter to the board, he criticized Bed Bath & Beyond's current strategy and urged the company to make changes.”

What we’re reading (3/6)

“Visa And Mastercard Suspend Russian Operations” (BBC). “Visa and Mastercard have announced they will suspend all operations in Russia in protest at its invasion of Ukraine. But Russia's major banks, including state-backed Sberbank, have already downplayed the impact the move will have on consumers. Shoppers will still be able to use Mastercard and Visa-branded cards for purchases within Russia until they reach their expiry dates. But cards issued abroad will no longer work at businesses or ATMs in Russia.”

“Russia’s Invasion Of Ukraine Puts Cryptocurrencies At The Heart Of War” (Vanity Fair). “[W]hile the leaders of the tech companies are resolute in the side of history they want to be on, those in the crypto world are clearly struggling with this moral quandary over the role crypto is now playing to help the Russians. ‘The question is, is there any world or any scenario in which breaking the anonymity or decentralized nature of crypto is considered necessary, and if so, would this qualify? If Putin wanted to use crypto to get around certain sanctions, would even the most orthodox crypto maximalist be supportive of that?’ a crypto trader and investor told me.”

“Investors Start Buying Ukraine, Russia Bonds” (Wall Street Journal). “Investors are starting to buy Ukrainian and Russian bonds that plummeted to discounted prices, betting that they will recover if the war between the two countries comes to an end. The trade is high-risk, given uncertainty over what Ukraine will look like after the war and how long the financial cordon around Russia will last. It also poses reputational dangers because of the human cost of the conflict and the increasing unwillingness of many financial institutions and corporations to be associated with Russia in any way.”

“Russia Says Sovereign Bond Payments Depend On Sanctions” (Reuters). “Russia's sovereign bond payments to non-residents will depend on sanctions imposed by the West, the country's finance ministry said on Sunday, stoking fears of a technical default on tens of billions of dollars of eurobonds. The ministry said it would service and pay sovereign debts in full and on time but that payments would depend on the sanctions that Western governments imposed on Russia over the invasion of Ukraine.”

“This Is Peak Subscription” (Vanity Fair). “The maturity of the subscription market varies by industry, but in some of the categories best known for these kinds of services, there are indicators that the ceiling is close, at least in the United States. In streaming video, Netflix has long been the industry standard, but its growth rate has begun to decline, and some analysts believe that it doesn’t have much room left to find new eyeballs in America…when ViacomCBS recently announced that it was changing its name to Paramount to go all in on its subscription streaming platform, Paramount Plus, the company’s stock sank—an indicator, he said, that investors are unsure of how much money is left to be made.”

What we’re reading (3/5)

“A Strong Jobs Report Shows How The U.S. Economy Has Learned To Live With The Coronavirus” (New Yorker). “[T]he February report showed that the economy has displayed sustained strength: the employment figures for December and January were revised upward, and the updated figures show that the economy has created almost 1.75 million jobs over the past three months. That’s close to six hundred thousand a month—roughly three times the rate before the pandemic. Since November, the employment-to-population ratio, which is a broad measure of the labor market’s strength, has risen by six-tenths of a percentage point to 59.9%, the highest since the pandemic began. That, too, is a positive sign—especially during a period when the Omicron wave spread across the country.”

“Lloyd Blankfein, Cold Warrior: The Veteran Banker Watches As The System He Helped Build Turns Into A Weapon.” (New York Magazine). “‘I know this will sound very unbankerlike,’ he said, ‘but I think it crossed everyone’s moral threshold.’ […] ‘What makes these sanctions different has to do with an apparent mistake on Putin’s part: Central-bank reserves aren’t always kept in a big bank vault, and Russia had stored its money in countries that are the most enraged about the invasion…[t]hat left Russia with as little as $12 billion in cash on hand and, with sanctions against its major banks, few avenues to convert its gold and other reserves into hard currency. ‘What does it mean to have $640 billion of reserves?’ Blankfein asked. ‘Putin is not sitting on a bed, throwing it up in the air and watching it fall down on his head like Scrooge McDuck.’”

“IMF Warns That War In Ukraine Will Have ‘Severe Impact’ On Global Economy” (Axios). “‘While the situation remains highly fluid and the outlook is subject to extraordinary uncertainty, the economic consequences are already very serious,’ the IMF said in a statement…The IMF also said it planned to bring Ukraine's request for $1.4 billion in emergency financing to its board for consideration as early as next week.”

“Elon Musk Says Russia’s War Means More Oil Production Needed Now” (Yahoo!Finance). “‘Hate to say it, but we need to increase oil & gas output immediately,’ the billionaire tweeted Saturday, as Russia’s invasion of Ukraine chokes off fuel supplies and drives up gas prices…’Obviously, this would negatively affect Tesla, but sustainable energy solutions simply cannot react instantaneously to make up for Russian oil & gas exports,’ said Musk.”

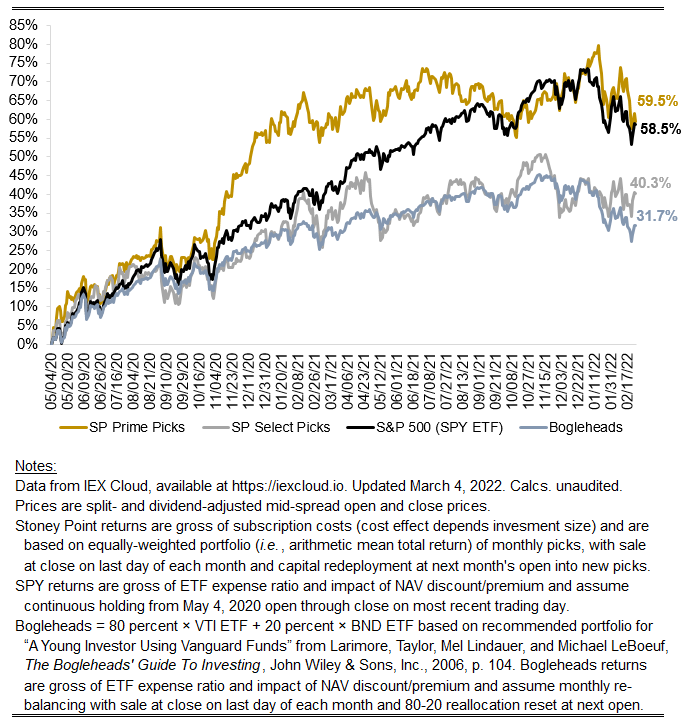

February 2022 performance results

Hi friends, here with a performance update. The key numbers are:

Prime: -4.60%

Select: -0.13%

SPY ETF: -3.12%

Bogleheads: -2.61%

It was a wild month, with several macro factors materially affecting market conditions and the asset pricing environment writ large. First, the market gained conviction around the path and pace of future rate hikes, which are expected to be significant. A key difference in February compared to prior months, in relation to rate-hike expectations, is a developing view that forward-looking growth may be softer than previously believed. Second, and aggravating concerns about growth, the ongoing invasion and attempted takeover of Ukraine has arguably elevated risk premia across all asset classes, and has shocked input costs that are important for many corporate entities, and therefore the stock prices of those corporate entities. Given that backdrop, it is not surprising that equities experienced significantly higher volatility in the month as markets tried to digest the news flow. In fact, the annualized volatility on the S&P 500 in February was nearly 2x the comparable measure for the prior 12 months.

My thesis with respect to how Stoney Point’s model performs generally in an environment like this remains unchanged from last month: our Prime picks were down significantly in the month, like the market overall but to a greater extent; but our Select picks were basically flat. The average of both portfolios was -2.36%, 75 basis points better than the market overall as measured by the SPY ETF.

My thesis with respect to the potential rotation into a period of secular value stock outperformance relative to growth stock performance also remains unchanged. That thesis is intimately tied to a belief that interest rate normalization will result in more historically “typical” market conditions and that the value premium was typically positive historically. We will see how these predictions play out.

Stoney Point Total Performance History

What we’re reading (3/4)

“How The West Unplugged Russia From The World’s Financial Systems” (Wall Street Journal). “This unplugging of the world’s 11th-largest economy opens a new chapter in the history of economic conflict. In a world that relies on the financial system’s plumbing—clearing banks, settlement systems, messaging protocols and cross-border letters of credit—a few concerted moves can flatten a major economy. Russia now faces a repeat of one of the most painful episodes in its post-Soviet history—the financial crisis of 1998, when its economy collapsed overnight[.]”

“Talking War And Market Volatility With A Giant of Economics” (New York Times). “‘Basically, we’re in a period where we have had an injection of uncertainty into the world, so speculative prices are going to go up and down in response,’ he [2013 Nobel Laureate Eugene Fama] said. ‘People are continuously trying to evaluate information. But it’s impossible for them, given the amount of uncertainty that’s out there, to come up with good answers.’”

“Short Sellers Clean Up On Russian Stocks” (Institutional Investor). “Most of the short seller gains were made after President Biden said the U.S. believed Putin was planning to invade Ukraine, as the Moscow stock market hit its high on February 16, the day before that announcement…[a]s of Wednesday, RSX [VanEck Vectors Russia ETF] shorts were up $310 million in year-to-date mark-to-market gains, Dusaniwsky told Institutional Investor in an email late Wednesday.”

“Western Sanctions On Russia Are Like None The World Has Seen” (The Economist). “Economic measures to cut Russia off from the world’s financial arteries are the most powerful implements a West unwilling to meet a nuclear adversary on the battlefield has dared wield in response to the invasion of Ukraine. But it has wielded them savagely. No major economy in the modern world has ever been hit so hard by such weapons.”

“The Push To Ban Russian Oil Is Gaining Steam. Here’s What That Means For US Energy Prices” (CNN Business). “‘I'm all for that. Ban it,’ House Speaker Nancy Pelosi said this week. A bipartisan bill, unveiled this week by Democratic Sen. Joe Manchin of West Virginia and Republican Lisa Murkowski of Alaska, would do just that.”

What we’re reading (3/2)

“Powell Says Fed Is On Track To Raise Rates In Two Weeks” (Wall Street Journal). “Federal Reserve Chairman Jerome Powell said he would propose a quarter-percentage point rate increase at the central bank’s meeting in two weeks amid high inflation, strong economic demand and a tight labor market, offering an unusually explicit preview of anticipated policy action.”

“War in Ukraine Has Investors Thinking About A Second Cold War” (New York Times). “Financial markets have long been sensitive to geopolitical events — elections, supply disruptions and trade tensions — that can move prices. And in just a few days, the invasion of Ukraine has prompted a series of economic maneuvers that can quickly transform the way countries raise money, where they buy raw materials and with whom they do business.”

“Russian Dollar-Mortgage Holders Feel Ruble Crunch” (RadioFreeEurope). “In March, Yelena Balanovskaya and her husband took out a dollar-denominated mortgage to buy their dream apartment…[p]aying back the $200,000 loan, they thought, would not be a problem. Nine months later, it's an albatross around their neck. As the ruble has collapsed against the dollar, her $2,200 monthly payments have nearly doubled, from 77,000 rubles to 142,000. And if the ruble doesn't recover, Balanovskaya fears she won't be able to make her payments in the future.”

“Russian Stocks In London Wipe Out 98% Of Value In Two Weeks” (Bloomberg). “U.K.-listed depositary receipts of Russian companies are evaporating in value as sanctions take effect. The Dow Jones Russia GDR Index, which tracks London-traded Russian companies, has plunged 98% in two weeks. The slump has wiped out $572 billion from the market value of 23 stocks, including Gazprom PJSC, Sberbank of Russia PJSC and Rosneft PJSC, according to Bloomberg calculations.”

“Nightlife Inflation: The Cost of Going Out Is Going Up” (New York Times). “Ponyboy, a club in Greenpoint, Brooklyn, raised the prices of its drinks by one dollar, said James Halpern, the owner, who added that he felt bad about passing costs on to his customers. ‘Nightlife should be for everybody, not just for the elitists who can afford it,’ he said. He noted that Ponyboy’s electricity costs have nearly doubled and that he is paying more for various staples. A case of limes, which cost $20 or $30 a few years ago, now goes for $100, he said.”

What we’re reading (3/1)

“Russian Ruble Is Now Worth Less Than 1 U.S. Cent After SWIFT Bank Sanctions” (Time). “The ruble plunged to a record low of less than 1 U.S. cent in value Monday after Russia was cut off from the global bank payments system in retaliation for Moscow’s invasion of Ukraine. The Russian currency dropped nearly 26% to 105.27 per dollar, down from about 84 per dollar late Friday.”

“Russia Is A Potemkin Superpower” (Paul Krugman, New York Times). “I’ve been especially struck by reports that the early days of the invasion were hampered by severe logistical problems — that is, the invaders had a hard time providing their forces with the essentials of modern war, above all fuel. It’s true that supply problems are common in war; still, logistics is one thing advanced nations are supposed to be really good at. But Russia is looking less and less like an advanced nation.”

“How Vladimir Putin Miscalculated The Economic Cost of Invading Ukraine” (The New Yorker). “This time last week, it seemed like Putin had sound reasons for being skeptical about the prospect of truly damaging sanctions. Russia supplies the European Union with about forty per cent of its natural-gas imports and about a quarter of its crude oil imports…[l]ess than a week later, Russia is an economic pariah.”

“As The Tanks Rolled Into Ukraine, So Did Malware; Then Microsoft Entered The War” (The Indian Express). “Within three hours, Microsoft threw itself into the middle of a ground war in Europe — from 5,500 miles away. The threat center, north of Seattle, had been on high alert, and it quickly picked apart the malware, named it ‘FoxBlade’ and notified Ukraine’s top cyberdefense authority. Within three hours, Microsoft’s virus detection systems had been updated to block the code, which erases — ‘wipes’ — data on computers in a network.”

“Founder Of Crypto Trading Platform BitConnect Indicted For $2 Billion 'Global Ponzi Scheme’” (Nextgov). “A federal grand jury indicted the founder of a cryptocurrency investment and trading platform on charges related to fraud and creating a “global Ponzi scheme. 36-year-old Indian national Satish Kumbhani is the founder of BitConnect, an online trading platform for investors to exchange virtual currencies. Kumbhani allegedly misled investors about BitConnect’s lending operations, which were said to have used proprietary technology that gave crypto investors large returns on market transactions.”

What we’re reading (2/28)

“Russia’s Money Is Gone” (Matt Levine, Bloomberg). “Russia’s foreign reserves consist, in the first instance, of a set of accounting entries. But in a crisis the accounting entries don’t matter at all. All that matters are relationships, and if your relationships get bad enough then the money is as good as gone.”

“U.S. Escalates Sanctions With A Freeze On Russian Central Bank Assets.” (New York Times). “The Treasury Department on Monday moved to further cut off Russia from the global economy, announcing that it would immobilize Russian central bank assets that are held in the United States and impose sanctions on the Russian Direct Investment Fund, a sovereign wealth fund that is run by a close ally of President Vladimir V. Putin.”

“Blockade On Russia Central Bank Neutralizes Defense Against Sanctions, U.S. Says” (Wall Street Journal). “The coordinated action blocks the central bank from selling dollars, euros and other foreign currencies in its reserves stockpile to stabilize the ruble. Announcing the move Monday in Washington before U.S. markets opened, U.S. officials said they intended the sanctions to stoke already surging inflation, and the actions against the Bank of Russia are intended in effect to neutralize the country’s monetary defenses.”

“Russian Oligarchs Move Yachts As U.S. Looks To ‘Hunt Down’ And Freeze Assets” (CNBC). “The property of targeted Russian executives is likely to take another hit, as the Biden administration recently announced the creation of a taskforce that will take aim at their lucrative assets, including yachts and mansions. France is putting together a list of properties owned by Russian oligarchs, including cars and yachts, that could be seized under sanctions by the European Union.”

“Shell Follows BP Out Of Russia As UK Oil Companies Abandon Putin” (CNN Business). “The UK-based oil company said Monday it would dump its 27.5% stake in the Sakhalin-2 liquified natural gas facility, its 50% stake in a project to develop the Salym fields in western Siberia and its 50% interest in an exploration project in the Gydan peninsula in northwestern Siberia.”

March picks available now

The new Prime and Select picks for March are available starting now, based on a model run put through today (February 27). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Tuesday, March 1, 2022 (at the mid-spread open price) through the last trading day of the month, Thursday, March 31, 2022 (at the mid-spread closing price).

What we’re reading (2/27)

“Western Allies Agree To Expel Some Russian Banks From SWIFT Payments System” (Axios). “Why it matters: The measures will effectively cut Russia out of the world's most important financial messaging system and undermine the Kremlin's ability to use its central bank reserves to blunt the impact of other sanctions.”

“U.S. Stocks Poised To Plunge Over Ukraine-Russia Worries. Nasdaq Futures Down 3%.” (Barron’s). “On Sunday night, Dow Jones Industrial Average futures lost 466 points, or 1.4%, while the S&P 500 futures lost 2.5% and Nasdaq Composite futures lost 2.9%. The price of West Texas Intermediate, the U.S. benchmark oil, jumped 6.6%, to $97.60 a barrel as of 6:24 p.m. Eastern time Sunday.”

“Car Parts, Chips, Sunflower Oil: War In Ukraine Threatens New Shortages” (Wall Street Journal). “Russia’s invasion of Ukraine is piling new troubles onto the world’s already battered supply chains. The fighting has shut down car factories in Germany that rely on made-in-Ukraine components and hit supplies for the steel industry as far as Japan. It has severed airways and land routes that had become crucial since the pandemic began gumming up sea trade.”

“‘Pharma Bro’ Martin Shkreli Banned for Life From Public-Company Roles” (Bloomberg). “The former pharmaceutical company CEO, better known as “Pharma Bro,” faced Securities and Exchange Commission allegations of misleading investors in a hedge fund he founded and misappropriating funds. He’s ‘unfit to serve as an officer or director of any public company,’ the U.S. District Court for the Eastern District of New York said.”

“Who Buys The Dirty Energy Assets Public Companies No Longer Want?” (The Economist). “The first law of thermodynamics states that energy cannot be created or destroyed, just transferred from one place to another. The same seems to apply to the energy industry itself. Pressed by investors, activists and governments, the West’s six biggest oil companies have shed $44bn of mostly fossil-fuel assets since the start of 2018.”

What we’re reading (2/26)

“ESG And Alpha: Sales Or Substance?” (Institutional Investor). “Trillions of dollars are now invested in light-green ESG funds, and there is little evidence that they will deliver planetary impact or the promised higher returns. What harm will this do?”

“The Case For Bitcoin As ‘Digital Gold’ Is Falling Apart” (CNBC). “With inflation at historic highs, you’d expect this would be bitcoin’s time to shine — U.S. consumer prices last month rose the most since February 1982, according to Labor Department figures. Instead, the cryptocurrency has lost almost half of its value since reaching an all-time high of nearly $69,000 in November. That’s led analysts to question whether its status as a form of ‘digital gold’ still rings true.”

“What Would Paul Volcker Do?” (The Hill). “Volcker would quickly surmise that inflation is undesirably high, similar to the inflation of the late 1960s but less severe than the late 1970s. The Fed would be required to tighten monetary policy — raising rates and unwinding a portion of the Fed’s balance sheet — but by how much? Volcker would keep his eye on the Fed’s longer-run objective of low inflation as the foundation for sustained economic expansion and maximum employment. He would apply lessons learned from the past, in both policies and communications.”

“Russia's War And The Global Economy” (Nouriel Roubini, Project Syndicate). “A major risk now is that markets and political analysts will underestimate the implications of this geopolitical regime shift. By the close of the market on February 24 – the day of the invasion – US stock markets had risen in the hope that this conflict will slow down the willingness of the US Federal Reserve and other central banks to raise policy rates. But the Ukraine war is not just another minor, economically and financially inconsequential conflict of the kind seen elsewhere in recent decades. Analysts and investors must not make the same mistake they did on the eve of World War I, when almost no one saw a major global conflict coming. Today’s crisis represents a geopolitical quantum leap. Its long-term implications and significance can hardly be overstated.”

“Ukraine Could Turn Boomflation Into Stagflation” (Axios). “Russia's invasion of Ukraine creates a new wrench in the gears of the global economy that will simultaneously worsen inflation pressures and damage growth prospects. That makes it a stagflationary shock, essentially making things worse on all economic fronts at once.”

What we’re reading (2/25)

“Putin’s Ukraine Slaughterhouse” (Wall Street Journal). “Ukraine’s forces are putting up brave resistance despite being overwhelmed in firepower. One soldier sacrificed himself to blow up a bridge to stop a Russian tank column. Another offered an expletive to a Russian gunboat demanding surrender before he and a dozen others were killed by shelling. Europe and the U.S. should be ashamed for not doing more to help Ukrainians defend themselves.”

“Russian Forces Advance On Kyiv” (The Economist). “‘Moscow’s thinking on this war seems to have been coloured by war optimism,’ says Michael Kofman of cna, a research group. ‘It looked as though Russian forces were expecting a quicker [Ukrainian] military collapse and easier gains.’ British defence intelligence said that it was unlikely that Russia had achieved its ‘its planned Day 1 military objectives’, noting that “Ukrainian forces have presented fierce resistance across all axes of Russia’s advance.”

“U.S. To Impose Sanctions On Vladimir Putin And Top Aide, White House Says” (CNBC). “The United States will impose a slate of sanctions on Russian President Vladimir Putin and Foreign Minister Sergey Lavrov, the White House announced Friday. The United Kingdom and the European Union had announced similar sanctions earlier in the day. Putin and Lavrov join a growing list of elite Russian government officials the U.S. has sanctioned in response to Russia’s actions in Ukraine.”

“Sanctions And Consequences” (DealBook). “The conflict has whipsawed markets as governments impose more sanctions and companies scramble to ensure the safety of workers in the region. The initial fall in stocks and rise in energy prices after Russia’s invasion has moderated, but the world remains on edge as the broader geopolitical implications of the war take shape.”

“Russian Billionaires Lose $39 Billion In A Day On Ukraine Attack” (Bloomberg). “The damage was across asset classes. Russia’s benchmark MOEX Russia Index closed 33% lower in Moscow, the fifth-worst plunge in stock market history in local currency terms. It marked the first time since 1987’s Black Monday crash that a decline of that magnitude hit a market worth more than $50 billion.”

What we’re reading (2/24)

“Russia's Attack On Ukraine Means These Prices Are Going Even Higher” (CNN Business). “Economists are racing to assess the impact of the attack, which could spark the biggest war in Europe since 1945. The conflict is unlikely to tip the global economy back into recession, they say, but market tumult, the threat of punishing sanctions and potential supply disruptions are already pushing up the wholesale price of energy and some agricultural products. Consumers will pay more for gasoline and food as a result.”

“A Simple Model Of What Putin Will Do For An Endgame” (Marginal Revolution). “In my simple model, in addition to a partial restoration of the empire, Putin desires a fundamental disruption to the EU and NATO. And much of Ukraine is not worth his ruling. As things currently stand, splitting Ukraine and taking the eastern half, while terrible for Ukraine (and for most of Russia as well), would not disrupt the EU and NATO. So when Putin is done doing that, he will attack and take a slice of territory to the north. It could be eastern Estonia, or it could relate to the Suwalki corridor, but in any case the act will be a larger challenge to the West because of explicit treaty commitments. Then he will see if we are willing to fight a war to get it back.”

“Putin’s Attack On Ukraine Echoes Hitler’s Takeover Of Czechoslovakia” (Washington Post). “In March 1938, during the run-up to World War II, Hitler had first engineered the Nazi takeover of Austria, which already had strong pro-Nazi sympathies. Seven months later, he was plotting the seizure of part of Czechoslovakia, claiming that ethnic Germans in the Sudeten regions bordering eastern Germany were being mistreated.”

“Russia-Ukraine Crisis Shakes Markets, But Long-Term Outlook Is Better” (New York Times). “Riding out a storm in the stock market has been a good strategy over the long term. One year after the 1941 bombing of Pearl Harbor, the S&P 500 gained 15 percent. A year after the U.S. invasion of Iraq in 2003, it was up 35 percent. History shows that just one year after most stock-market-shattering crises, the S&P 500 stock index has risen.”

“Citadel Is Further Paring Back $2 Billion Melvin Investment” (Wall Street Journal). “Citadel LLC is further paring back its $2 billion investment in Melvin Capital Management after the hedge fund stumbled in its effort to recover from a near collapse triggered by surges in GameStop Corp. and other ‘meme stocks’ early last year.”