February 2022 performance results

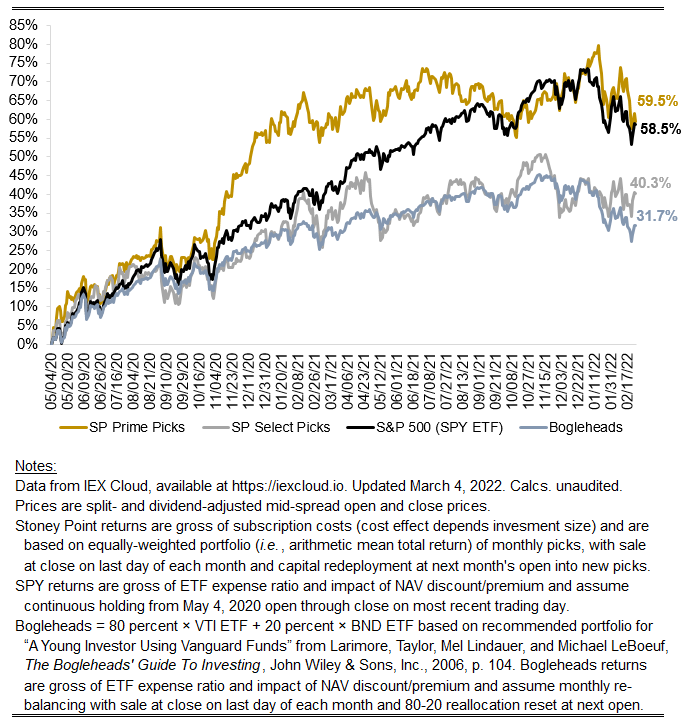

Hi friends, here with a performance update. The key numbers are:

Prime: -4.60%

Select: -0.13%

SPY ETF: -3.12%

Bogleheads: -2.61%

It was a wild month, with several macro factors materially affecting market conditions and the asset pricing environment writ large. First, the market gained conviction around the path and pace of future rate hikes, which are expected to be significant. A key difference in February compared to prior months, in relation to rate-hike expectations, is a developing view that forward-looking growth may be softer than previously believed. Second, and aggravating concerns about growth, the ongoing invasion and attempted takeover of Ukraine has arguably elevated risk premia across all asset classes, and has shocked input costs that are important for many corporate entities, and therefore the stock prices of those corporate entities. Given that backdrop, it is not surprising that equities experienced significantly higher volatility in the month as markets tried to digest the news flow. In fact, the annualized volatility on the S&P 500 in February was nearly 2x the comparable measure for the prior 12 months.

My thesis with respect to how Stoney Point’s model performs generally in an environment like this remains unchanged from last month: our Prime picks were down significantly in the month, like the market overall but to a greater extent; but our Select picks were basically flat. The average of both portfolios was -2.36%, 75 basis points better than the market overall as measured by the SPY ETF.

My thesis with respect to the potential rotation into a period of secular value stock outperformance relative to growth stock performance also remains unchanged. That thesis is intimately tied to a belief that interest rate normalization will result in more historically “typical” market conditions and that the value premium was typically positive historically. We will see how these predictions play out.