What we’re reading (10/4)

“Wonking Out: Biden Should Ignore The Debt Limit And Mint a $1 Trillion Coin” (Paul Krugman, New York Times). Caveat emptor—not sure this kind of devaluation is advisable, but worth reading nonetheless: “there’s a strange provision in U.S. law that empowers the Treasury secretary to mint and issue platinum coins in any quantity and denomination she chooses. Presumably the purpose of this provision was to allow the creation of coins celebrating people or events. But the language doesn’t say that. So on the face of it, Janet Yellen could mint a platinum coin with a face value of $1 trillion — no, it needn’t include $1 trillion worth of platinum — deposit it at the Federal Reserve and draw on that account to keep paying the government’s bills without borrowing.”

“Car Sales Plunge As Chip Shortages Choke Off Supply” (CNN Business). “New car sales plunged over the last three months in the United States despite strong demand, as the shortage of computer chips and other supply chain issues caused shutdowns at auto factories and choked off the supply of vehicles. General Motors reported sales fell a third from a year-ago last quarter, and they were off 40% from the same quarter of 2019 before the pandemic roiled the car market. Sales at Stellantis, the company formed by the merger of Fiat Chrysler and France's PSA Group, fell 19% from a year ago, and 27% from the pre-pandemic period.”

“Balancing Honesty And Optimism In Silicon Valley” (DealBook). “‘It’s a thin line between a start-up and a Ponzi scheme,’ Mr. Ries [an entrepreneur] said. ‘Generally speaking, you are asking people to invest in something that doesn’t yet exist on the basis that you will bring it into existence.’ That requires a certain amount of bravado, optimism and experimentation, a combination that has often been rewarded: Zappos bought shoes from a shoe store before it shipped them from its warehouse, Apple announced its first iPhone before it had figured out how to mass-produce its prototypes, and Reddit populated its site with fake users to demonstrate desired behavior.”

“Powell Said The Fed Has No Plans To Ban Crypto. Here Is What Experts Say May Lie Ahead For Crypto Regulation As Authorities Tighten Their Grip.” (Insider). “When Federal Reserve Chair Jerome Powell said he has no intentions of banning cryptocurrency during a Congress testimony just days after China intensified its crackdown by banning all related transactions, many in the digital asset space were pleased but not surprised. ‘It's hard for me to believe that US regulators would decide that was the best course of action given the role that cryptocurrencies are playing in so many citizens' lives,’ Bobby Zagotta, US CEO of crypto exchange Bitstamp, told Insider. ‘I think doing that would be incredibly disruptive and it would really put the US and the economy in a compromised situation.’”

“Pandora Papers: Biggest Ever Leak Of Offshore Data Exposes Financial Secrets Of Rich And Powerful” (The Guardian). “The secret deals and hidden assets of some of the world’s richest and most powerful people have been revealed in the biggest trove of leaked offshore data in history. Branded the Pandora papers, the cache includes 11.9m files from companies hired by wealthy clients to create offshore structures and trusts in tax havens such as Panama, Dubai, Monaco, Switzerland and the Cayman Islands.”

What we’re reading (10/3)

“The Market Is Right To Be Spooked By Rising Bond Yields” (Wall Street Journal). “Why, you might reasonably ask, are stocks suddenly spooked by bond yields? In the boom up to March, stocks and yields marched higher together, and for the past two decades higher yields have generally been better for stocks. The difference is that investors see the central banks turning hawkish, even as economic growth slows, because they can’t ignore high inflation.”

“El-Erian Sees Fed Risking Disorderly Taper Without Quick Action” (Bloomberg). “Mohammed El-Erian has some advice for Federal Reserve Chairman Jerome Powell about tapering: Get going. The bond-market influencer has for months urged the Fed to reduce its asset purchases before inflation runs rampant and batters financial markets. A week ago, Powell said the U.S. central bank could begin scaling back in November and complete the process by mid-2022. ‘When it comes to an orderly taper, the window is closing,’ El-Erian, the chief economic adviser at Allianz SE and president of Queens’ College, Cambridge, said Friday on Bloomberg TV’s The Open.”

“Wall St Week Ahead Bruised Market Eyes Treasury Yields To Gauge Stocks' Path” (Reuters). “Investors are focusing on Treasury yields as a key factor in determining how stocks will fare the rest of the year, after a month in which equities notched their steepest losses since the coronavirus pandemic began. The S&P 500 index posted its biggest monthly drop since March 2020 in September, while pulling back as much as 5% below its all-time high for the first time this year.”

“Ozy Media Is Shutting Down After Reports About Misconduct And Lies At The Company” (CNBC). “Ozy Media CEO Carlos Watson informed employees Friday that the board had voted to shut down the company, according to a person familiar with the matter. In a five minute phone call late in the afternoon, Watson informed Ozy’s staff of the decision, said the person, who asked not to be named because the conversation was private. A dejected-sounding Watson did not take any questions, the person said.”

“Romanov Wedding Is A Royal Russian Flashback” (Vanity Fair). “It’s been over a century since the last one, but Russia still knows how to do a royal wedding. Grand Duke George Mikhailovich Romanov, a Spanish-born, Oxford-educated 40-year-old, is the Tsesarevich, meaning “heir apparent” to the Russian Empire … if such a monarchy still existed. On Thursday, he wed Victoria Romanovna Bettarini, an Italian national who converted to the Russian Orthodox Church (hence the Romanovna middle name). It was like nothing Russia has seen in a long time.The groom’s family, the Romanovs, first came to power in 1613, and include names you may recall from history class or Hulu such as Peter the Great, and, through marriage, Catherine the Great.”

September 2021 Performance Update

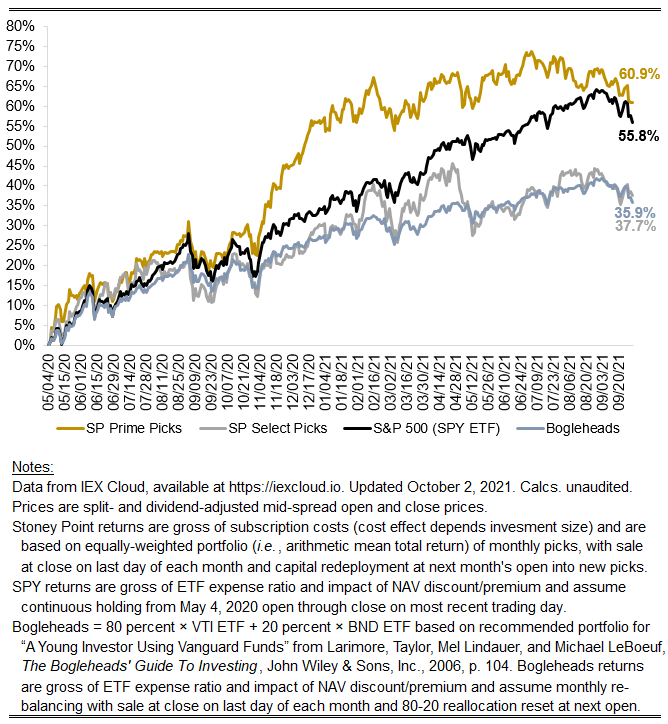

Hi friends, here with a monthly performance update. If you paid attention to U.S. equities in September, you already know the market was bad. A little less bad for both of our strategies, however. Here are the key numbers:

Prime: -5.05%

Select: -4.41%

S&P 500-tracking “SPY” ETF: -5.18%

Bogleheads: -4.25%

September’s results are basically in line with my general goal for Stoney Point’s performance: when the market is down, try not to be more down, and then when the market is up, try to be more up. That’s a pretty good recipe for substantial outperformance over a three-to-five-year (or longer) hold. But it’s shockingly hard to do. If you want to outperform when the market is up, one way to do it is through leverage, which for retail traders can be accomplished through (1) buying options, which have “embedded” leverage mathematically, on the stocks you like instead of the underlying stocks themselves, (2) buying the stock of highly leveraged companies, or (3) putting debt on your own balance sheet to buy the stocks you like (caution: you might get margin called!). The problem with leverage is that it works in both directions: when the market is down, you’re going to be more down. If, for example, you maxed out the margin financing allowable at retail brokerages under prevailing regulatory limitations (Regulation T), which is 1:1 debt-to-equity, and invested all that capital on buying SPY last month, you would’ve been down 10.36% instead of just the 5.18% you would be down if you simply used your own capital for 100% of the investment (the math: equity return = asset return*(1+debt/equity ratio), i.e., for SPY, last month if maxing out margin limits, 10.36% = 5.18%*(1+1/1)). And that’s before accounting for interest, which for margin financing can be between 5-10% annually).

Since leverage isn’t a good option, avoiding the market downs requires, basically, timing the market downs. That is, knowing when to bet the farm on SPY puts or when to go 100% cash or, in the case of last month, 100% oil futures or something. It’s possible to get that right once in a while, but very difficult to do consistently. Better—in my view—to put yourself in a position to have a relatively medium to long-term hold, accept the months when the market is down, and have confidence your strategy will play out when the market is up.

In that light, I’m quite please with Select’s performance last month, as it substantially outperformed the market (to me, the market is “SPY”) and hence is making relative progress in closing that gap. Prime also outperformed, but I’m not sure the result was different from the market’s performance in the statistical (i.e., true) sense.

An aside about September:

Stock market lore holds that September tends to be bad for the market as a whole.

“Why is September so bad? No one knows. Here’s one theory, though: Because it’s the end of summer, and it’s depressing.”

-Joe Weisenthal, Business Insider, September 9, 2009

This sounds like nonsense to me without some sound theoretical but basis for why September should be bad. I guess the psychological effect Joe Weisenthal suggests in the quote above could in fact meet that standard, though I’m not sure September is depressing—it’s beautiful here in the mid-Atlantic. Anyway, September really is replete with terrible events in market history! As the Weisenthal article above points out, all of the following happened in September:

September 4, 1929 was the market peak before the crash in 1929

There was unprecedent volatility in September 1987 preceding Black Monday in October

September 16, 1992 was the day the UK devalued the pound and exited the European Exchange Rate Mechanism (netting George Soros a solid billion)

September 2000 was the peak of the tech bubble

September 11, 2001 was the worst attack on U.S. soil in history (market was down 7% in response)

In September 2008, Lehman went bust (and so did AIG and Fannie and Freddie!)

The “September Effect” is, in fact, a statistical anomaly treated seriously by investment practitioners and academics.

It all reminds me of the multi-century-old adage I discussed in a prior post describing the so-called “Halloween Anomaly”: “Sell in may and go away. But remember to come back in September” (an alternative response is “but buy back on St. Leger Day”, that is, the date of a famous horse race in Doncaster in England in September).

It all very well might be nonsense, but September 2021 certainly won’t disabuse any true believers of the notion.

Stoney Point Total Performance History

What we’re reading (10/2)

“Private Equity is Notoriously Opaque. Researchers and Investors Say This is No Longer OK.” (Institutional Investor). “Measuring performance with internal rates of return…makes it difficult for investors to compare the returns of different private equity funds and to contrast the strategy with what they would have earned in the public markets. Monk and his co-authors argue that the measure is heavily influenced by returns earned early in a fund's life. As an example, the report cites private equity funds from the 1970s and 1980s, whose returns earned since inception are exceptional because of this property.”

“Employees’ Online Comments Can Predict Corporate Misconduct, Study Says” (Wall Street Journal). “A study from researchers at Harvard Business School and the Netherlands’ Tilburg University found that information extracted from employee reviews left on company-review site Glassdoor.com was useful in predicting misconduct beyond other readily observable factors, such as a firm’s performance, press coverage, industry risk and prior violations.”

“Climate Change Is The New Dot-Com Bubble” (Wired). “There are good VCs being venturesome with their capital. There are funds that are investing in green things. But—and God help me for wishing it—there's no Google, no Apple or Microsoft, no monster in the middle taking its cut. There isn't one carbon market; there isn't one set of standards to follow; there are dozens of options, which means there isn't really anything at all. Whole careers are dedicated, wonderful people, great science, online carbon calculators, but for right now it rounds to nothing. Amazon Web Services hosts open climate data, but I wish there were an AWS for climate. I wish I could tell you what it should do.”

“China's Housing Conundrum” (Project Syndicate). “[E]ngineering a slow, controlled deflation of China’s real estate bubble will not be easy. With the banking sector having lent heavily to residential projects (Evergrande alone has borrowed from almost 300 banks and financial firms), a sharp drop in housing prices could prove painful and cascade catastrophically into other sectors. In principle, banks are protected by substantial down payments, often amounting to 30% or more of the purchase price. But given China’s epic house-price boom in the twenty-first century, 30% may prove not nearly enough when a collapse comes. (After the 2008 financial crisis, US housing prices dropped by 36%, and by significantly more in some regions.)”

“Only 35% Pass Wall St.’s Toughest Test. How Much Does That Matter?” (New York Times). “Over time, the C.F.A. curriculum came to be seen as foundational knowledge for analysts and portfolio managers who were willing to plow through the material to gain an edge. But as the designation became more popular, pass rates dropped. The number of candidates peaked above 270,000 in 2019, and an average of 44.2 percent passed.”

What we’re reading (10/1)

“Yellen Lends Support For Effort To Remove The Debt Ceiling Altogether” (CNBC). “With a potential default looming for the U.S. in October, Treasury Secretary Janet Yellen said Thursday she would just as soon see the power over debt limits taken away from Congress. A bill introduced in May would repeal the national debt ceiling, and Yellen said ‘yes, I would’ when asked during a House hearing if she backs the effort. She noted Congress makes the decisions on taxes and spending, and should provide the ability to pay those obligations.”

“Mail Delivery Slowdown: USPS To Slow Delivery Starting October 1” (CBS News). “Mail delivery for many Americans will slow starting on Friday, part of Postmaster General Louis DeJoy's blueprint for overhauling the U.S. Postal Service in order to slash costs. But critics say the slower delivery standards could cause problems such as late bill delivery while more broadly undermining the public's faith in the USPS…[s]tarting [today], the postal service's current three-day delivery standard for first-class mail — letters, bills, tax documents and the like — will drop to delivery anywhere within the U.S. within five days. “

“Boy, Robinhood And Citadel Securities Sure Were Chatty During That Whole GameStop Thing” (Dealbreaker). “More or less from the moment Robinhood and others began to place limits on retail customers’ trading of GameStop and other meme shares, those thereby blocked from doing so have presumed nefarious motives. The degenerates and diamond hands looked at the relationship between, say Robinhood and Citadel Securities, a company which contributes it share of 80% of Robinhood’s revenue, and whose sister hedge fund had rather a vested interest in seeing the short-squeeze crushing founder Ken Griffin’s buddy end, and concluded that the fix was in. Well, the internal communications over at Robinhood in the run-up to the trading restrictions isn’t likely to disabuse them of that notion.”

“Inside America’s Broken Supply Chain” (Washington Post). “The commercial pipeline that each year brings $1 trillion worth of toys, clothing, electronics and furniture from Asia to the United States is clogged and no one knows how to unclog it. This month, the median cost of shipping a standard rectangular metal container from China to the West Coast of the United States hit a record $20,586, almost twice what it cost in July, which was twice what it cost in January, according to the Freightos index. Essential freight-handling equipment too often is not where it’s needed, and when it is, there aren’t enough truckers or warehouse workers to operate it.”

“Review Analysis: Stanford Students Are More Likely To Wear Masks On Bicycles Than Helmets” (Stanford Review). “On Wednesday, September 22nd, in the 1:00 pm hour, I observed 400 Stanford cyclists on Lasuen Mall, a popular campus street for bicycles. I simply noted whether each cyclist wore a mask, a helmet, neither, or both. Here are the final tallies: Total cyclists: 400 - (100%)[;] No mask, no helmet: 195 - (49%)[;] Mask, no helmet: 134 - (34%)[;] Helmet, no mask: 42 - (10%)[;] Mask and helmet: 29 - (7%)[.] That works out to a masking rate of 41% and helmet-wearing rate of 17%. So, Stanford students are about twice as likely to wear a mask on a bicycle as a helmet…at one of America’s leading research universities, students wear masks on bicycles at a higher rate than they wear helmets.”

October Prime + Select picks available now

The new Prime and Select picks for October are available starting now, based on a model run put through today (September 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Friday, October 1, 2021 (at the mid-spread open price) through the last trading day of the month, Friday, October 29, 2021 (at the mid-spread closing price).

What we’re reading (9/30)

“‘Most Americans Today Believe The Stock Market Is Rigged, And They’re Right’” (Bloomberg). “New research shows insider trading is everywhere. So far, no one seems to care…[i]n theory, the law governing insider trading is clear-cut: Under the Securities Exchange Act of 1934, executives who abuse their access to nonpublic information, either by trading on it themselves or passing it along to someone else, can be charged with fraud and sent to jail. But regulators and lawyers say identifying and prosecuting the offense is deceptively difficult, and lawmakers…have been calling for reform.”

“We Asked 3 Major Investors What Happens Next In The Market — None Of Them See Big Returns” (CNBC). “In response to bonds that offer negative real returns, big investors are seeking alternative investments that provide a yield and that aren’t correlated to stocks, according to Ashbel Williams, executive director and CIO of the Florida State Board of Administration. He manages more than $195 billion in assets for one of the largest U.S. pension funds. He invests in assets including planes, trains, timber, and music and TV rights, he said. Bonds now make up a smaller percentage of his holdings, down to 18% or 19% from about 25% a decade ago, Williams said.”

“Jerome Powell's Week From Hell” (CNN Business). “Everything is going wrong for one of the world's most powerful figures. Jerome Powell's chances of getting another four-year term as head of the Federal Reserve took a hit Tuesday after Senator Elizabeth Warren called him a ‘dangerous man’ for being too soft on Wall Street banks. That blow came on the heels of two Fed officials stepping down amid a trading scandal that even Powell acknowledged is ‘obviously unacceptable.’ Meanwhile, the Treasury Department moved up the timeline for when it will run out of cash, raising the specter of a calamitous US default come October 18.”

“Real-Estate Investors Are Less Optimistic About The U.S. Housing Market — Here’s Why” (MarketWatch). “Small scale real-estate investors are less enthusiastic about the state of the U.S. housing market — and their reasons for worry largely mirror those of the average home buyer today, according to a new survey. Real-estate data company RealtyTrac reported that 48% of individual real-estate investors view the investment market as being worse or much worse than it was a year ago, based on the results of a survey the company conducted. That’s up from 45% of investors in last year’s edition of the same survey. RealtyTrac polled mom-and-pop investors who purchase between one to 10 properties a year — including both investors who flip the homes and those who hold onto them as rental units. These investors own most of the single-family rental properties in the country.”

“Massive Pension Investors Are Betting Big Bucks That The Office Isn't Dead In NYC And San Francisco. Here's Why They're Ignoring The Narrative And Going Bargain Hunting Instead.” (Insider). “Just under $17 billion of commercial real-estate sales took place in New York in the first half of 2021, according to data from CBRE, putting the year on track for even less dollar volume than the $36 billion sold in 2020, when the pandemic inflicted its worst damage on the economy. In 2019, almost $61 billion of commercial real estate was sold in NYC, according to CBRE.”

What we’re reading (9/29)

“Stocks Could Slide Further As Interest Rates Rise And Big Tech Drags The Market” (CNBC). “Big Tech and growth names are sensitive to higher rates since their high valuations are based on future growth and cash flow. When interest rates rise, the value of that future cash flow is discounted. But Oppenheimer technical analyst Ari Wald said the fact that Big Tech is selling off means that those popular large cap growth stocks are joining the many other stocks that already had big downturns. ‘It hadn’t spilled over into the large cap and now it has. We see that as a sign of capitulation,’ he said. Wald added he sees more downside for the S&P 500′s July low of about 4,230.”

“Men Over 45 Who Identify As Having ‘Excellent Investment Experience’ Are More Likely To Panic Sell During A Market Downturn, MIT Study Finds” (Insider). “[A] study from MIT has identified the cohort of people that are most likely to panic sell at the worst possible time: men over the age of 45 who are either married or identify as having ‘excellent investing experience.’ Cohorts with more dependents or an account size of less than $20,000 are also more likely to ‘freak out’ and panic sell. The MIT paper analyzed the trading behavior of more than 600,000 brokerage accounts attached to more than 200,000 households to identify who is selling and potentially be able to predict when they might sell in the future.”

“Elizabeth Warren Will Oppose Fed Chair Powell’s Renomination, Calls Him ‘Dangerous Man’ To Lead Fed” (CNN Business). “Democratic Senator Elizabeth Warren announced Tuesday that she will oppose Federal Reserve Chairman Jerome Powell's renomination, making her the highest-profile lawmaker to do so. ‘Your record gives me grave concern. Over and over you have acted to make our banking system less safe. And that makes you a dangerous man to head up the Fed,’ Warren told Powell during a Senate Banking Committee hearing.”

“Houlihan Lokey Co-President Accused Of Double-Dealing As He Bought Jet With Tech CEO” (New York Post). “A top Wall Street banker is being accused of bizarre double-dealing at a California tech firm where he serves as a board member. Scott Adelson, co-president of the prominent investment bank Houlihan Lokey, allegedly leaked information to the would-be acquirer of QAD Inc. — a publicly traded software firm based in Santa Barbara, Calif. — even as he secretly entered a deal to buy a private jet with the company’s CEO, according to an explosive lawsuit.”

“Federal Judges With Financial Conflicts” (Wall Street Journal). “The Wall Street Journal analyzed nearly a decade’s worth of legal and financial records and discovered 131 federal judges who unlawfully heard cases where they had a financial interest…[o]ver the past several weeks, the Journal has informed these judges of their recusal violations. As a result, 56 federal judges have notified courts in 329 cases around the U.S. that they heard cases improperly and that parties to the case could ask for them to be reopened.”

What we’re reading (9/28)

“Why Do We Think That Inflation Expectations Matter For Inflation? (And Should We?)” (Jeremy Rudd, Federal Reserve). “Economists and economic policymakers believe that households’ and firms’ expectations of future inflation are a key determinant of actual inflation. A review of the relevant theoretical and empirical literature suggests that this belief rests on extremely shaky foundations, and a case is made that adhering to it uncritically could easily lead to serious policy errors.”

“Here Comes $90 Oil” (CNN Business). “The V-shaped recovery in the oil patch continues to take even the biggest bulls on Wall Street by surprise. Goldman Sachs ramped up its already optimistic forecast on Sunday, calling for Brent crude to hit $90 a barrel by the end of the year. That's up from its previous call for $80. The Wall Street bank expects US crude to hit $87 a barrel, up from $77 previously.”

“Are Investors Becoming Warier Of Chinese Assets?” (The Economist). “If investors expect Chinese policy to continue to be volatile, then they could start to demand an additional risk premium for holding a swathe of assets. ‘The intensity of policy change has caught investors off guard,’ says Chetan Ahya of Morgan Stanley, a bank. ‘It’s not clear to investors what the end game is for each sector, so there’s a lot of uncertainty, and it’s this uncertainty that adds to the risk.’ Indeed, a risk premium may already be becoming apparent for some assets.”

“Activist Hedge Fund Starboard Has Big Stake In Huntsman” (Wall Street Journal). “Activist hedge fund Starboard Value LP has a more-than-8% stake in Huntsman Corp. and plans to agitate for change at the chemicals producer, according to people familiar with the matter. Huntsman has a market value of roughly $6.3 billion, making Starboard’s stake worth around $500 million or more. Huntsman, based in The Woodlands, Texas, makes chemicals for a variety of uses including plastics, cars and construction materials. The exact changes Starboard intends to push for to improve its stock performance couldn’t be learned. Huntsman’s shares are little changed since the company’s 2005 initial public offering, closing Monday at $28.07 versus $24.50 on their first day of trading.”

“Goldman Sachs, Ozy Media And A $40 Million Conference Call Gone Wrong” (New York Times). “When YouTube learned that someone had apparently impersonated one of their executives at a business meeting, its security team started an investigation, the company confirmed to me. The inquiry didn’t get far before a name emerged: Within days, Mr. Watson had apologized profusely to Goldman Sachs, saying the voice on the call belonged to Samir Rao, the co-founder and chief operating officer of Ozy, according to the four people.”

What we’re reading (9/27)

“It's Hard To Be Bearish On The Stock Market As Risk-Happy Millennials Inherit $2 Trillion Per Year, Fundstrat's Tom Lee Says” (Insider). “‘Bull market until 2038? This is a possible base case...[i]f demographics are destiny, US stocks will do very well,’ Lee wrote in June, pointing out that every stock market peak since 1900 has coincided with a generation's peak. It is a theory shared by ARK Invest's Cathie Wood, who has cited Lee's research as evidence. ‘I do believe that both crypto and the equity markets are going to be powered by millennials,’ Wood said at a conference last week.”

“Individuals Embrace Options Trading, Turbocharging Stock Markets” (Wall Street Journal). “By one measure, options activity is on track to surpass activity in the stock market for the first time ever…[s]ome analysts say the zeal for options trading is translating to bigger swings in individual stocks, and fueling the momentum behind many rallies. When individual investors buy call options, the Wall Street firms that sell options often hedge their positions by buying the shares, further contributing to rising markets.”

“Going Public? Here Is A How-To Guide” (The Economist). “[G]oing public combines mixed emotions, much complexity and myriad idiosyncracies. Despite that, and undeterred by recent wobbles in equity markets, startups have been listing in droves. So far this year tech firms have raised $60bn, according to Dealogic, a data provider, more than at the height of the dotcom bubble in 2000. Include all types of business and the figure is close to $250bn…[o]ne headhunting agency is said to have more than 50 searches under way for finance chiefs at startups hoping to go public soon.”

“Goldilocks Is Dying” (Nouriel Roubini, Project Syndicate). “The recovery in the first half of 2021 has given way recently to sharply slower growth and a surge of inflation well above the 2% target of central banks, owing to the effects of the Delta variant, supply bottlenecks in both goods and labor markets, and shortages of some commodities, intermediate inputs, final goods, and labor. Bond yields have fallen in the last few months and the recent equity-market correction has been modest so far, perhaps reflecting hopes that the mild stagflation will prove temporary.”

“The Supply-Chain Mystery” (The New Yorker). “Americans are not facing Soviet-style empty shelves, or having to scrap for the basics. In aggregate, we are hardly in a condition of scarcity. Still, supply-chain trouble suggests that something is off with the way we’re operating in the world, and that we don’t yet know the extent of our vulnerabilities. The issues can also be a serious impediment to a broader economic recovery.”

What we’re reading (9/26)

“What The ‘Smart Money’ Knows About China’s Evergrande Crisis” (Wall Street Journal). “Between its inception at the end of 1992 and this Aug. 31, the MSCI China stock index has returned an average of 2.2% annually, including dividends. Over the same period, the MSCI Emerging Markets index grew 7.8% annually; the S&P 500, 10.7%. That covers a nearly 30-year period in which China’s economy often grew by at least 10% a year. Nevertheless, you would have earned much better returns on U.S. Treasury securities than on Chinese stocks. Maybe China, which holds more than $1 trillion in U.S. Treasurys, knew something that Wall Street didn’t. And knowing what the Chinese government is thinking is harder than ever.”

“Costco, Nike And FedEx Are Warning There’s More Inflation Set To Hit Consumers As Holidays Approach” (CNBC). “Shipping bottlenecks that have led to rising freight costs are cooking up a holiday headache for U.S. retailers. Costco this week joined the long list of retailers sounding the alarm about escalating shipping prices and the accompanying supply chain issues. The warehouse retailer, which had a similar cautionary tone in May, was joined by athletic wear giant Nike and economic bellwethers FedEx and General Mills in discussing similar concerns. The cost to ship containers overseas has soared in recent months. Getting a 40-foot container from Shanghai to New York cost about $2,000 a year and a half ago, just before the Covid pandemic. Now, it runs some $16,000, according to Bank of America.”

“How Bad Are Supply Chains? Costco Is Renting Ships” (CNN Business). “Costco (COST), home of the ultimate big box store, is not mincing words about what it's like to run a consumer business in the middle of a pandemic. ‘Inflationary factors abound: higher labor costs, higher freight costs, higher transportation demand, along with container shortages and port delays, increased demand in certain product categories, various shortages of everything from computer chips to oils and chemicals, higher commodities prices,’ Chief Financial Officer Richard Galanti told analysts after markets closed Thursday. ‘It's a lot of fun right now.’ […] [S]upply chains are so badly tangled that the company said it has chartered three ocean vessels for the next year to transport containers between Asia and the United States and Canada.”

“Warren Buffett May Not Be Into Crypto, But His Granddaughter Is” (Institutional Investor). “For Nicole Buffett, creating NFTs of her paintings, especially during the pandemic, when in-person art shows and gallery openings have been a near impossibility, allowed her to expand her circle of buyers globally — a large proportion of them young, entrepreneurial, and tech-savvy. ‘NFTs are really art as money, art as currency, which means there’s more accessibility for artists and for people who want to buy art,’ she tells Institutional Investor. ‘It’s great just to have more eyeballs on the work…I will help people get set up so they can buy art on the blockchain, but the currency of the NFT space is Ethereum. I do still take dollars for physicals.’”

“A Hamster Has Been Trading Cryptocurrencies In A Cage Rigged To Automatically Buy And Sell Tokens Since June - And It's Currently Outperforming The S&P 500” (Insider). “A hamster in Germany is redefining ‘A Random Walk Down Wall Street’ author Burton Malkiel's belief that a blindfolded monkey throwing darts at a stock ticker list in the newspaper could do just as good as a human investment professional. The livestreamed hamster, named Mr. Goxx, has been independently trading a portfolio of various cryptocurrencies since June 12, and so far its performance has been impressive. As of Friday, the portfolio was up nearly 24%, according to the @mrgoxx twitter feed that documents daily performance, along with every trade made by the hamster. Mr. Goxx's performance outpaces bitcoin and the S&P 500 over the same time period.”

October picks available soon

We’ll be publishing our Prime and Select picks for the month of October before Friday, October 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of September, as well as SPC’s cumulative performance, assuming the sale of the September picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Thurs., September 30). Performance tracking for the month of October will assume the October picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Friday, October 1).

What we’re reading (9/25)

“The European Energy Crisis Is About To Go Global” (OilPrice.com). “It was only a matter of time, really. In a globalized world, energy crunches can hardly remain regionally contained for very long, especially in a context of damaged supply chains and a rush to cut investment in fossil fuels. The energy crunch that began in Europe earlier this month may now be on its way to America. For now, all is well with one of the world's top gas producers…[b]ut supply is tightening, Argus reported earlier this month. In July, according to the report, U.S. coking coal exports dropped by as much as 20.3 percent from June.”

“Here Come The Crypto Rules” (DealBook). “Financial regulators are racing to regulate stablecoins. These digital currencies pegged to a stable asset like the dollar are used in crypto trading, banking and decentralized finance, addressing the problem of price volatility that plagues Bitcoin and others. Stablecoins have become an important bridge between digital currencies and the traditional financial system. But despite their name, stablecoins may be shaky. The urgency among regulators to rein in the industry has, in turn, generated a flurry of crypto industry lobbying all over Washington…[i]n their short history, lightly regulated stablecoin issuers have shown that they don’t always have the cash reserves they claim.”

“China Declares Cryptocurrency Transactions Illegal; Bitcoin Price Falls” (Wall Street Journal). “China’s central bank said all cryptocurrency-related transactions are illegal, reinforcing the country’s tough stance against digital rivals to government-issued money. In a statement posted on its website on Friday afternoon, the People’s Bank of China said the latest notice was to further prevent the risks surrounding crypto trading and to maintain national security and social stability. Cryptocurrencies weakened following the statement.”

“Did I Miss The Value Turn?” (Research Affiliates). “When most liquid asset classes are set to deliver a negative or near-zero real return, value stocks stand out as the only asset class likely to generate a 5%–10% real return over the coming decade. The opportunity to buy value stocks may be short-lived and we may wait decades for an opportunity of a similar scale.”

“Bar Talk: Informal Social Interactions, Alcohol Prohibition, And Invention” (Michael Andrews, working paper). “To understand the importance of informal social interactions for invention, I examine a massive and involuntary disruption of informal social networks from U.S. history: alcohol prohibition. The enactment of state-level prohibition laws differentially treated counties depending on whether those counties were wet or dry prior to prohibition. After the imposition of state-level prohibition, previously wet counties had 8-18% fewer patents per year relative to consistently dry counties.”

What we’re reading (9/24)

“Evergrande Debt Crisis Is Financial Stress Test No One Wanted” (Bloomberg). “Sunny Peninsula…was supposed to house 5,000 families in dozens of towers spread across an area the size of 30 soccer fields. Many of the buyers were white-collar workers benefiting from the fastest urbanization in human history. But the project now looks more like the set of a disaster movie. Half-finished apartment blocks stand empty and abandoned…China Evergrande Group, until recently the world’s largest property developer, owns dozens of stalled sites like Sunny Peninsula across China. Buckling under more than $300 billion in liabilities, the company is close to collapse, leaving 1.5 million buyers waiting for finished homes.”

“Who’s Buying Evergrande?” (New York Times). “International investors in Evergrande’s bonds are preparing for turmoil — and in some cases buying more. Evergrande’s debt is in the portfolios of man major investment firms, and some hedge funds have been adding more to their holdings as prices have tumbled. A group of bondholders has tapped restructuring advisers at Kirkland & Ellis and at Moelis. For its part, Evergrande has hired the firms Houlihan Lokey and Hong Kong Admiralty Harbour Capital. How might the negotiations play out?”

“Evergrande’s Struggles Reflect China’s Efforts to Rein in Multiyear Debt Boom” (Wall Street Journal). “China is hardly alone in its fondness for debt, but unlike the U.S., China doesn’t borrow to cut taxes or finance social transfers. It instead invests in manufacturing, infrastructure and property. It is a logical model so long as the investment genuinely makes the country more productive. For a long time, it did. But China isn’t immune to the law of diminishing returns. Since 2008, it has needed ever more debt to deliver the same increment to economic output. Between 2008 and 2019, total debt—government, household and business—rose from 169% to 306% of gross domestic product, but GDP growth fell from 10% to 6%.”

“Evergrande’s Crisis Highlights China’s Shortcomings” (The Economist). “Part of what makes China’s financial industry daunting is its size. Banking assets have ballooned to about $50trn and they sit alongside a large, Byzantine system of shadow finance. Total credit extended to firms and households has soared from 178% of gdp a decade ago to 287% today. The industry suffers from opacity, a lack of market signals and the erratic application of rules. Property is part of the problem. Families funnel their savings into apartments rather than casino stockmarkets or state-run banks. Real-estate developers raise debts in the shadow-banking system in order to finance epic construction booms. As well as being big, the system is inefficient at allocating capital, dragging down growth.”

“Why The Head Of The IMF Should Resign” (The Economist). “A new investigation has found that [World] [B]ank staff improperly altered the scores of China and three other countries. They wanted to spare China an embarrassing fall in the [Doing Business] rankings in 2017, just as its reforms were gathering steam. According to the investigation, the China tweaks were carried out at the behest of the bank’s then president, Jim Yong Kim, and his second-in-command, Kristalina Georgieva, who is now head of the IMF.”

What we’re reading (9/23)

“Fed’s Intentions On Rates Remain Muddled” (Wall Street Journal). “Getting to zero [in monthly asset purchases] is important to Fed officials because they effectively see completing the tapering process as a precondition to raising rates: They don’t want to find themselves in a situation where they need to hike while they are still purchasing assets. But they have tried to frame this as merely providing them with an option to tighten, a decision that will ultimately hinge on how much progress the job market has made, and how sticky the recent bout of inflation ends up being.”

“Fed Chair Powell Says He's Powerless To Protect The Economy If Congress Lets The US Default On Its Debt” (Insider). “The Federal Reserve won't come to the economy's rescue if the US defaults on its debt, Jerome Powell, the chair of the central bank, said Wednesday. Congress is, once again, coming dangerously close to a debt-ceiling crisis. Lawmakers have until mid-October to either raise or suspend the borrowing limit, or allow the US to default on its debt. The latter outcome would freeze spending on several critical public programs, spark massive job losses, throw financial markets into chaos, and likely plunge the US into a self-inflicted recession.”

“Beyond Evergrande’s Troubles, A Slowing Chinese Economy” (New York Times). “Global markets have watched anxiously as a huge and deeply indebted Chinese property company flirts with default, fearing that any collapse could ripple through the international financial system. China Evergrande Group, the developer, said on Wednesday that it had reached a deal that might give it some breathing room in the face of a bond payment due the next day. But that murky arrangement doesn’t address the broader threat for Beijing’s top leaders and the global economic outlook: China’s growth is slowing, and the government may have to work harder to rekindle it.”

“Crypto Equated To Toxic Pre-Crisis Swaps By Banking Watchdog” (Bloomberg). “The U.S. agency that had once been the great hope of the cryptocurrency world is now issuing strong warnings to the industry that it’s in danger of echoing the toxic culture before the 2008 financial crisis. Michael Hsu, the acting chief of the Office of the Comptroller of the Currency, argued Tuesday that cryptocurrencies and decentralized finance may be evolving into threats to the financial system in much the same way certain derivatives brought it near collapse more than a decade ago. Notorious credit default swaps were engineered by math wizards in much the same way crypto has emerged, he said. ‘Crypto/DeFi today is on a path that looks similar to CDS in the early 2000’s,’ Hsu told the Blockchain Association in a webcast.”

“Crypto Faces Existential Threat As Crackdown Gathers Steam” (Bloomberg). “Cryptocurrency firms are fighting for lobbyists and fielding subpoenas in what could be an existential fight over how the multitrillion-dollar industry should be regulated…[a]s the cryptocurrency industry gears up for a regulatory battle, some lobbyists, who asked to withhold their names to discuss client matters, said they were so deluged by crypto firms looking to hire them in August that they had to turn down some potential clients. Some of the crypto firms said they were being targeted by or expected to be targeted by regulators, the lobbyists said.”

What we’re reading (9/22)

“How Bad Is It?” (DealBook). “On top of Evergrande, a number of other Chinese property developers also appear “highly distressed,” said Jenny Zeng of AllianceBernstein. Goldman Sachs strategists estimate that an Evergrande collapse could cut China’s G.D.P. by $350 billion in the next year. But for now, the global repercussions of Evergrande’s troubles aren’t considered on the same scale as those that followed Lehman’s collapse, even if some of the debt owed by Chinese developers is held by foreign firms, who could get burned if the cash isn’t there.”

“Why Everybody’s Hiring But Nobody’s Getting Hired” (Vox). “The Bureau of Labor Statistics says there are 8.4 million potential workers who are unemployed, but it also says there are a record 10.9 million jobs open. The rate at which unemployed people are getting jobs is lower than it was pre-pandemic, and it’s taking longer to hire people. Meanwhile, job seekers say employers are unresponsive.”

“Debt Ceiling Modest Proposal -- Perpetuities” (John Cochrane, The Grumpy Economist). “The Treasury computes the total amount of debt by its face or principal value, not its market value. If the Treasury issues a bond that pays $1 coupons each year for 10 years and then pays $100 at maturity, the treasury counts this as $100 additional debt. The Treasury ignores the coupon payments, and how much the bond actually sells for, i.e. how much the Treasury actually borrows, when the bond is auctioned. Now you see my answer: Perpetuities have coupons, but no principal…[t]oo clever? Maybe. OK, undoubtedly yes. But if economics lunchroom talk can consider trillion-dollar coins, we can talk about perpetuities. Or maybe a serious attempt to do this would bring US treasury accounting into the 1960s, with cutting-edge concepts like market values not face values, duration not average principal maturity, and interest cost concept that goes beyond coupons, so that the debt limit and treasury accounting is more economically meaningful.”

“Move fast And Bank Things: Crypto-Based ‘DeFi’ Takes On Wall Street” (Fortune). “As a largely unregulated part of the economy, DeFi has exploded in tandem with demand for cryptocurrencies like Bitcoin and Ethereum. Most of the action takes place on Ethereum, the second-biggest crypto network, whose blockchain comes with a built-in programming language, Solidity, that makes it easy to build so-called decentralized apps. For now, the ecosystem is populated primarily by people who range from comfortable with to rabidly passionate about crypto—with all its risk and legal uncertainty. “

“Who Owns Your Life Insurance Policy? It Might Be A Private-Equity Firm” (Wall Street Journal). “Americans own more than 160 million individual life insurance and annuity policies. A big, unexpected change is ahead for many of them. Traditional life insurers are leaving the business in droves. The responsibility for death benefits, which might be a half-century away, or for annuity income streams that run over decades, is increasingly in the hands of a new breed of insurance-company owner.”

Notable activist hedge fund’s recent returns not actually very good

Suppose you manage a pension fund on behalf of a big union and you want to reward members with at least at least market-average returns on their hard-earned savings. What’s one way to not achieve that goal? Apparently, allocate that capital Elliott Management, one of the most prominent, headline-grabbing, and (probably) expensive investment managers in the world (emphasis added):

Paul Singer’s Elliott Management has a fearsome reputation that has turned it into a $48 billion behemoth. But the hype surrounding the firm doesn’t match its results, according to a new report by the Communications Workers of America and the SOC Investment Group. The SOC Investment Group works with pension funds sponsored by unions affiliated with the Strategic Organizing Center, a coalition of four unions representing more than four million members with more than $250 billion in assets under management.

Not only is Elliott’s hedge fund an underperformer, so are the companies that its activism targets, the report claimed.

…

Whatever Singer’s standing among hedge fund honchos, the report noted that over the past several years, Elliott has underperformed both the S&P 500 and a 60-40 blend of stock and bond investments. As of March 31, over the prior 12 months Elliott gained 14.78 percent net of fees, while the S&P 500 gained 56.35 percent, and a 60-40 blend rose 31.67 percent, the report said.

“Elliott has not provided superior risk-adjusted returns and despite much marketing rhetoric, has yielded absolute returns inferior to conventional investments,” according to the report.

Over five years, it said the annualized performance of Elliott was 9.21 percent, compared with a 16.30 annualized gain for the S&P 500 and a 11.15 percent gain for the 60-40 blend.

What we’re reading (9/21)

“The Stock Market Is Afraid Again. Here's What That Means For Your Investments” (CNN Business). “It's been a wobbly week on Wall Street and CNN Business' Fear and Greed Index is flashing ‘Fear.’ The stock market is in a weird place. It has fallen in most of the trading sessions this month. The S&P 500 (SPX), which is the broadest measure of the US stock market, only has four higher closes this month, and one of those was more or less flat. Meanwhile, the Fear & Greed Index is sitting at 35, which signals fear.”

“How Evergrande Could Turn Into ‘China’s Lehman Brothers’” (Caixin). “For the past two months, hundreds of people have been gathering at the 43-floor [of] Zhuoyue Houhai Center in Shenzhen, where China Evergrande Group’s headquarters occupy 20 floors. They held banners demanding repayment of overdue loans and financial products. Police with riot shields had to be on site to keep things under control.” Per ZeroHedge: “at its core, [Evergrande] is just one giant shadow-banking black box whose time has finally run out.”

“SEC Is Investigating Activision Blizzard Over Workplace Practices, Disclosures” (Wall Street Journal). “Federal securities regulators have launched a wide-ranging investigation into Activision Blizzard Inc., including how the videogame-publishing giant handled employees’ allegations of sexual misconduct and workplace discrimination, according to people familiar with the investigation and documents viewed by The Wall Street Journal. The Securities and Exchange Commission has subpoenaed Activision, known for its Call of Duty, World of Warcraft and Candy Crush franchises, and several of its senior executives, including longtime Chief Executive Bobby Kotick, according to the people and documents.”

“The Trillion-Dollar Fantasy” (Institutional Investor). “As ESG investing has been accelerating, the planet has experienced the warmest two decades on record, Antarctica has been melting, U.S. income inequality has been gapping, and species have been disappearing at rates unseen for millennia. And the Dow Jones Industrial Average is hitting new highs and asset managers are collecting attractive fees to oversee a popular new investment category.”

“After Merkel” (The Economist). “Mrs Merkel has at times seemed more monarch than chancellor. She will leave office with sky-high approval ratings. Three of the four coalitions she led were ‘grand’ ones with the Social Democratic Party (spd), which suited her centrism but tranquilised politics. She has so dominated the centre that outright criticism of her has come to seem almost lèse-majesté. That has inspired a wave of free-speech martyrs on the conservative fringes, the closest Germany gets to a culture war. In Europe Mrs Merkel has been the indispensable leader. Beyond it, her stout defence of liberal values and her modest demeanour have been reassuring in an age of noisy populism and nationalist showmen.”

What we’re reading (9/20)

“Natural-Gas Prices Surge, And Winter Is Still Months Away” (Wall Street Journal). “It is supposed to be offseason for demand, and prices haven’t climbed so high since blizzards froze the Northeast in early 2014. Analysts say that it might not have to get that cold this winter for prices to reach heights unknown during the shale era, which transformed the U.S. from a gas importer to supplier to the world…[t]he number of rigs drilling for gas has been basically flat since spring despite much higher prices. When prices rose above $5 in 2014, there were more than three times as many rigs drilling gas wells as the 100 operating now, according to Baker Hughes Co.”

“How Did Investors End Up On the Other Side of This Trade?” (Institutional Investor). “The stock market selloff in early 2020 took with it a number of high-profile volatility-trading funds that were designed to do the opposite: provide a source of uncorrelated returns. Now Markov Processes International has produced new research indicating that at least one fund was behaving as though it was selling risky hedges, or insurance in simple terms, against a stock selloff to other market participants. That’s the opposite of many of the funds’ objectives, according to investors familiar with the funds. It’s unlikely that investors intended to be in the business of providing tail-risk hedges. But that may be exactly what they did[.]”

“Amazon Is Piling Ads Into Search Results And Top Consumer Brands Are Paying Up For Prominent Placement” (CNBC). “Search for ‘toothpaste’ on Amazon, and the top of the web page will show you a mix of popular brands like Colgate, Crest and Sensodyne. Try a separate search for ‘deodorant’ and you’ll first see products from Secret, Dove and Native. Look a little closer, though, and you’ll notice that those listings are advertisements with the “sponsored” label affixed to them. Amazon is generating hefty revenue from the top consumer brands because getting valuable placement on the biggest e-commerce site comes with a rising price tag.”

“You Can Kill Single-Family Zoning, But You Can’t Kill The Suburbs” (Slate). “ Symbolically, the passage of SB 9 is a huge deal in the national movement to break down the apartment bans that effectively segregate American cities and shows just how far the policy window has shifted in the past five years…[o]n the ground, however, the reality will not be instant housing abundance—or the destruction of the suburbs, for better or for worse. Zoning is a powerful obstacle to denser, more affordable development—but reforming zoning can only do so much.”

“Why Taxing Stock Buybacks Is the Wrong Fix For Executive Pay” (DealBook). “The system of public capital depends on corporations’ selling stock, but we do not require that companies sell stock. There is no public duty (except in regulated industries such as banking) to maintain any specific level of capital. Here’s one way to think about it: If it is not wrong for a corporation to sell $3 billion in stock, is it wrong for it to sell $4 billion and later buy back $1 billion? In the end, it is the same thing. Buybacks are simply a means, via the intermediary of investors, of reallocating capital from companies with a surplus to companies with a capital need. And too much capital can be just as harmful as too little, leading to a misallocation and a waste of social resources.”

What we’re reading (9/19)

“Don’t Lose Sight Of The Inflation Monster” (Washington Post). “Americans are sitting on trillions of dollars of savings they accrued during the pandemic…[i]t’s been so long since the United States has suffered from endemic inflation that most adults are unprepared for what it will do. Annual 5 percent inflation may seem low, but it’s not. Because each price rise is built on the previous one, a 5 percent annual rate means that prices would double every 14 years.”

“Inflation Challenges Stock-Market Underpinnings As Investors Look Ahead To Fed Meeting” (MarketWatch). “Investors worry inflationary pressures will spill into company earnings, possibly as soon as the third quarter, challenging the underpinnings of the “phenomenal” stock-market performance in the pandemic, explained [Jensen Investment Management CIO Eric] Schoenstein. He sees Jensen clients seeking to tilt toward higher quality stocks, as they want exposure to ‘resilient’ companies that can handle the risks of a rising cost environment.”

“Banks Strike Back, But Returns Remain Strong With Fintech” (Wall Street Journal). “Down the road, banks might have some tailwinds. Deposits will likely stay cheap for some time, even as interest rates start to tick higher and perhaps gum up capital markets. As credit costs creep back up to normal levels, losses might eat into net yields on loans, making it less attractive to share any economics with an outside partner. Yet at the same time, any technology partner that is able to demonstrate an ability to keep credit losses minimized could be even more valuable to banks and investors. And banks might stay hungry enough for loan growth that the costs of partnerships are justified.”

“U.S. Banking Lobby Groups Oppose Proposed Tax Reporting Law” (Reuters). “The largest U.S. banking lobby groups banded together on Friday to make another push to kill a proposed bank account reporting law being drawn up as part of the congressional reconciliation package.”

“Geriatric Millennials Have The Most Power In The Workforce Right Now” (Insider). “According to a recent analysis by the Harvard Business Review that looked at 9 million employee records from more than 4,000 companies, midcareer employees are driving the [Great Resignation]. Resignation rates are highest among 30- to 45-year-old employees, increasing on average by more than 20% over the past year…[t]he reasons for the resignations are plenty, per the HBR: Employers may be less inclined to hire less experienced workers, creating more demand for mid-level workers; this cohort may have postponed switching jobs until some of the dust settled from the pandemic's economic effects; and the pandemic has caused some to reevaluate what they want in both their job and in life.”