September 2021 Performance Update

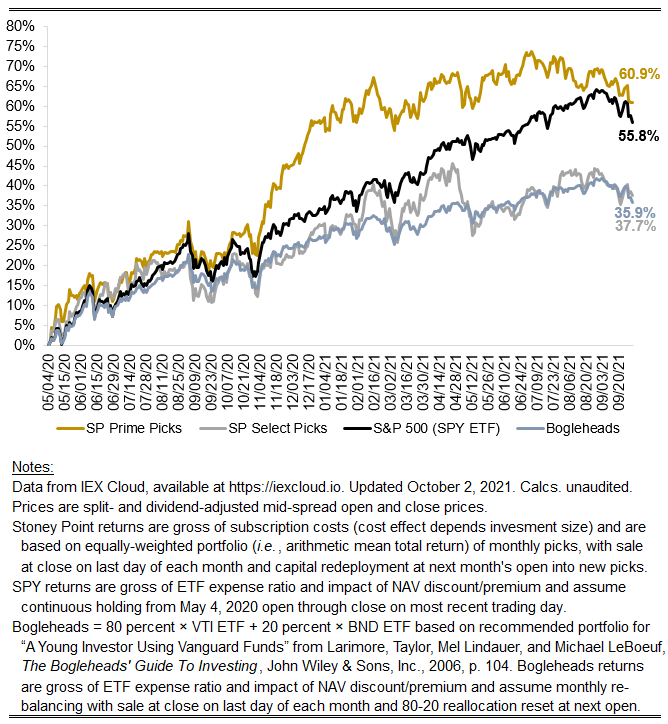

Hi friends, here with a monthly performance update. If you paid attention to U.S. equities in September, you already know the market was bad. A little less bad for both of our strategies, however. Here are the key numbers:

Prime: -5.05%

Select: -4.41%

S&P 500-tracking “SPY” ETF: -5.18%

Bogleheads: -4.25%

September’s results are basically in line with my general goal for Stoney Point’s performance: when the market is down, try not to be more down, and then when the market is up, try to be more up. That’s a pretty good recipe for substantial outperformance over a three-to-five-year (or longer) hold. But it’s shockingly hard to do. If you want to outperform when the market is up, one way to do it is through leverage, which for retail traders can be accomplished through (1) buying options, which have “embedded” leverage mathematically, on the stocks you like instead of the underlying stocks themselves, (2) buying the stock of highly leveraged companies, or (3) putting debt on your own balance sheet to buy the stocks you like (caution: you might get margin called!). The problem with leverage is that it works in both directions: when the market is down, you’re going to be more down. If, for example, you maxed out the margin financing allowable at retail brokerages under prevailing regulatory limitations (Regulation T), which is 1:1 debt-to-equity, and invested all that capital on buying SPY last month, you would’ve been down 10.36% instead of just the 5.18% you would be down if you simply used your own capital for 100% of the investment (the math: equity return = asset return*(1+debt/equity ratio), i.e., for SPY, last month if maxing out margin limits, 10.36% = 5.18%*(1+1/1)). And that’s before accounting for interest, which for margin financing can be between 5-10% annually).

Since leverage isn’t a good option, avoiding the market downs requires, basically, timing the market downs. That is, knowing when to bet the farm on SPY puts or when to go 100% cash or, in the case of last month, 100% oil futures or something. It’s possible to get that right once in a while, but very difficult to do consistently. Better—in my view—to put yourself in a position to have a relatively medium to long-term hold, accept the months when the market is down, and have confidence your strategy will play out when the market is up.

In that light, I’m quite please with Select’s performance last month, as it substantially outperformed the market (to me, the market is “SPY”) and hence is making relative progress in closing that gap. Prime also outperformed, but I’m not sure the result was different from the market’s performance in the statistical (i.e., true) sense.

An aside about September:

Stock market lore holds that September tends to be bad for the market as a whole.

“Why is September so bad? No one knows. Here’s one theory, though: Because it’s the end of summer, and it’s depressing.”

-Joe Weisenthal, Business Insider, September 9, 2009

This sounds like nonsense to me without some sound theoretical but basis for why September should be bad. I guess the psychological effect Joe Weisenthal suggests in the quote above could in fact meet that standard, though I’m not sure September is depressing—it’s beautiful here in the mid-Atlantic. Anyway, September really is replete with terrible events in market history! As the Weisenthal article above points out, all of the following happened in September:

September 4, 1929 was the market peak before the crash in 1929

There was unprecedent volatility in September 1987 preceding Black Monday in October

September 16, 1992 was the day the UK devalued the pound and exited the European Exchange Rate Mechanism (netting George Soros a solid billion)

September 2000 was the peak of the tech bubble

September 11, 2001 was the worst attack on U.S. soil in history (market was down 7% in response)

In September 2008, Lehman went bust (and so did AIG and Fannie and Freddie!)

The “September Effect” is, in fact, a statistical anomaly treated seriously by investment practitioners and academics.

It all reminds me of the multi-century-old adage I discussed in a prior post describing the so-called “Halloween Anomaly”: “Sell in may and go away. But remember to come back in September” (an alternative response is “but buy back on St. Leger Day”, that is, the date of a famous horse race in Doncaster in England in September).

It all very well might be nonsense, but September 2021 certainly won’t disabuse any true believers of the notion.