What we’re reading (9/18)

“Where Has All the Money Gone?” (Project Syndicate). “Amid all the talk of when and how to end or reverse quantitative easing (QE), one question is almost never discussed: Why have central banks’ massive doses of bond purchases in Europe and the United States since 2009 had so little effect on the general price level?…A plausible generalization is that increasing the quantity of money through QE gives a big temporary boost to the prices of housing and financial securities, thus greatly benefiting the holders of these assets. A small proportion of this increased wealth trickles through to the real economy, but most of it simply circulates within the financial system.”

“China Faces A Potential Lehman Moment. Wall Street Is Unfazed” (CNN Business). “The implosion of Lehman Brothers, 13 years ago this week, showed how the collapse of a single entity can send shockwaves around the world. Echoes from that event are resounding today as a massive property developer on the other side of the world teeters on the brink of default. The risk is that the collapse of Evergrande, a Chinese real estate company with a staggering $300 billion of debt outstanding, could set off a chain reaction that spreads overseas.”

“There And Back Again: The COVID Global Market Roundtrip In Map Form” (Vident Financial). “Last year, the world went through a sudden, terrifying pandemic which involved massive government shutdowns and one of sharpest economic contractions in history. Markets responded in kind. And then they made the long trip back home to something resembling normal.”

“Amid COVID Surge, States That Cut Benefits Still See No Hiring Boost” (Reuters). “The August slowdown in U.S. job creation hit harder in states that pulled the plug early on enhanced federal unemployment benefits, places where an intense summertime surge of coronavirus cases may have held back the hoped-for job growth.”

“BlackRock Fund Manager Says He’s Cut Gold Holdings To ‘Almost Zero.’ Here’s Why.” (MarketWatch). “Near term, he [BlackRock’s Global Allocation Fund Manager Russ Koesterich] said there are likely ‘better hedges against inflation in the equity market and rather than own an asset that doesn’t produce cash flow, we would rather hedge some of the near term upside with stocks that have pricing power.’”

What we’re reading (9/17)

“They're Ignoring That There's Too Little Money Now” (Real Clear Markets). “As Keynes had written more than a decade before, in the early twenties, the greatest monetary evil is this: the shortage of money and its deflation which quite vigorously savages labor most of all. The entire economy suffers, of course, but it is the unfortunate single worker who has no protection from these far-reaching and, from the worker’s perspective, incorporeal ills. Whenever money is too dear, the actual wealth of any nation is undercut because money rather than sustainable enterprise is prioritized. Heightened liquidity preferences reorient the very nature of business; risk taking, or animal spirits, diminish if not disappear near entirely.”

“The Housing Crisis Is The Top Concern For Urban Residents” (Vox). “Housing costs and homelessness in America’s cities are so bad that people in growing metro areas now appear more concerned about those issues than Covid-19, public safety, taxes, education, and jobs, according to a new poll by the Manhattan Institute and Echelon Insights. The poll surveyed 4,000 adults from August 11-20, sampling 200 people each in the ‘20 metropolitan areas with the largest numerical population growth from 2010-2019.’”

“Are 401(k)s Worth It?” (U.S. News & World Report). “401(k) plans typically come with a number of expenses which might include management fees and recordkeeping fees. ‘Plans are required to distribute fee disclosures annually,’ says Julian Schubach, vice president of wealth management at ODI Financial in Lynbrook, New York. Still, it can be difficult to find these communications. ‘Most participants have no idea what fees they are paying,’ Schubach says.”

“World Bank Cancels Flagship ‘Doing Business’ Report After Investigation” (Wall Street Journal). “The Doing Business report has been the subject of an external probe into the integrity of the report’s data. On Thursday, the bank released the results of that investigation, which concluded that senior bank leaders including Ms. Georgieva [current head of IMF; full disclosure: my former employer] were involved in pressuring economists to improve China’s 2018 ranking. At the time, she and others were attempting to persuade China to support a boost in the bank’s funding.”

“Bud Light hopes This Beer Is The Next Big Thing” (CNN Business). “Anheuser-Busch has announced the launch of Bud Light Next, the company's first-ever zero-carb beer. The beverage, which hits shelves in early 2022, comes as health-conscious customers have gravitated toward light beers in recent years — and beer in general is in the middle of a big resurgence.”

What we’re reading (9/16)

“The Housing Theory Of Everything” (Works In Progress). “Try listing every problem the Western world has at the moment. Along with Covid, you might include slow growth, climate change, poor health, financial instability, economic inequality, and falling fertility. These longer-term trends contribute to a sense of malaise that many of us feel about our societies. They may seem loosely related, but there is one big thing that makes them all worse. That thing is a shortage of housing: too few homes being built where people want to live. And if we fix those shortages, we will help to solve many of the other, seemingly unrelated problems that we face as well.”

“U.S. Housing Regulator Proposes Tweaks To Capital Rules For Fannie Mae, Freddie Mac” (Reuters). “The regulator overseeing housing giants Fannie Mae and Freddie Mac proposed on Wednesday changes to recently imposed capital and leverage requirements on the pair.”

“Stock Buybacks Beat Capital Spending For Many Big Companies” (Wall Street Journal). “Spending on share buybacks increased much faster than capital expenditures in the first half of the year, after pullbacks in both categories last year amid the pandemic, S&P said in response to a Wall Street Journal data request. Share repurchases at companies in the S&P 500 increased to $370.4 billion, up 29% from the first six months of 2020. Capital spending—which usually goes toward assets such as land, buildings and technology—rose to $337.17 billion, up 4.8% from the year-earlier period.”

“Citigroup, JPMorgan Expect Lower Third-Quarter Markets Revenue” (U.S. News & World Report). “Citigroup Inc expects third-quarter markets revenue to decline by a ‘low-to-mid teens’ percentage from a year earlier and JPMorgan Chase & Co expects a decrease of about 10%, according to executives of the two big banks. The lower revenues are a result of trading that has ‘normalized’ from exceptionally high levels last year, when the pandemic was in full force, the executives said on Tuesday at a virtual investor conference held by Barclays.”

“Hedge-Fund Billionaire Ray Dalio Says Regulators Will ‘Kill’ Bitcoin If It Gets Too Successful” (Insider). “Ray Dalio, founder of Bridgewater Associates, said on CNBC he foresees regulators taking control of bitcoin if there's mainstream success for the cryptocurrency. ‘I think at the end of the day if it's really successful...they will try to kill it. And I think they will kill it because they have ways of killing it,’ Dalio said on CNBC during the SALT conference in New York.”

What we’re reading (9/15)

“What’s Your Raise Really Worth? Inflation Has Something to Say About It.” (Wall Street Journal). “This should be the best of times for low-wage workers, as pandemic-induced labor shortages force employers to sharply raise pay. Yet for many, it doesn’t feel that way, because those same disruptions have pushed inflation to near its highest rate in over a decade.”

“What to Expect From Gary Gensler’s Testimony” (DealBook). “The S.E.C. chair Gary Gensler will testify before the Senate Banking Committee today, after five months on the job. Since his confirmation, his public statements have generated much debate, many headlines and more than a few market movements. This morning, based on his prepared remarks, he’ll make the case for additional resources to achieve a more expansive agenda than many of his predecessors at the commission.”

“America Is Substantially Reducing Poverty Among Children” (The Economist). “It seemed like a blustery overpromise when President Joe Biden pledged in July to oversee, “the largest ever one-year decrease in child poverty in the history of the United States”. By the end of the year, however, he will probably turn out to have been correct. Recent modelling by scholars at Columbia University estimates that in July child poverty was 41% lower than normal.”

“Hedge Fund Activist Jeff Ubben Asks SEC To Mandate Carbon Pricing Disclosures” (Institutional Investor). “Jeff Ubben, the activist hedge fund manager who founded Inclusive Capital Partners a little more than a year ago, is calling for the Securities and Exchange Commission to make companies include a price for carbon as part of their climate-related ESG disclosures. Ubben, who is also a board member of ExxonMobil, made his comments in a September 8 letter to the SEC. It was one of thousands sent since SEC Commissioner Allison Herren Lee earlier this year asked for public comments regarding upgrades to the SEC’s climate change disclosures.”

“Does The Market Care About Ethical Investment? It Depends” (The Hill). “Corporate ESG actions can be voluntary or involuntary, and this distinction is important in understanding the true impact of ESG on company value. But new government mandates to pursue ESG goals are likely to prove costly to American shareholders and workers.”

Is a stock market “correction” coming?

I don’t spend a lot of time talking about asset allocation on this blog, because this blog is focused on equities. For the moment, this blog is mostly agnostic about other asset classes and when and how people move money among them. A priori, I don’t think most people are very good at timing the market (including me!)—and, why would they be, since no one can predict the future very well, much less predict it better than everyone else they are competing with in capital markets, which is what you need to be able to do to be very, very good at that sort of thing.

With that said, a lot of people think U.S. stocks are due for a big correction:

Here is what Jim Cramer has to say: “September is the cruelest month, and it’s playing out that way once again, with rolling corrections all over the place”;

And here is CNN: “After notching heady gains this year, US stocks could be in for a back-to-school reality check. What's happening: The S&P 500 has been in the red for five consecutive trading sessions, its longest losing streak since February”;

Here is Reuters: “Investors are girding their portfolios for potential stock market volatility, even as equities hover near fresh highs after logging seven straight months of gains”;

And here is Yahoo! Finance: “Don't let the hardcore bulls tell you otherwise, the proof is in the pudding (large companies' warnings).”

They aren’t alone: equity analysts at BofA, Deutsche, Morgan Stanley, and others have all said as much in recent weeks.

“Correction” is a word the business press and equity research analysts throw around casually, but it is in fact a very specific word and a very controversial word in this context. “Correction” does not mean “returns are likely to be modest” or “things are getting riskier and volatility is likely to be higher”. Forecasting a “correction” means you have high conviction in a material decline in stock prices. It means your expected return is significantly negative over some relevant period in the future, and that negative return is likely to manifest in a sudden and sharp (rather than gradual) drop-off in valuations. It means that you think prices are not just higher than they have been in the past, but higher than they should be (i.e., higher than intrinsic values). And it means that you think prices are systematically—that is, across the market—higher than they should be.

“Correction” is kind of a euphemism for a belief that all of those very strong assumptions are simultaneously true, and true right now at that. The finance media doesn’t usually get into all of that (equity analysts tend to be a little more specific, but just barely). And the arguments they do offer tend to be specious. Consider the sampling above:

Theoreticians have been looking for a basis to justify Cramer’s belief that summer/early fall is a bad time for asset prices for quite literally 400 years and still haven’t found any (see my post on the so-called “Halloween anomaly”). I guess he gets points for observing that, empirically, results this time of year have tended not to be great, but only in the same way that Ptolemy gets points for his observations about the cosmos despite ultimately being completely wrong about the underlying structure governing his observations. The latter is what makes predictions reliable.

CNN’s claim about “five consecutive trading sessions” being “in the red” is meaningless in light of the fact that stock prices follow a random walk (past price paths don’t—or at least shouldn’t—have any bearing on future price paths).

Reuter’s suggestion that investors are nervous because stock prices keep hitting highs doesn’t make a lot of sense in light of the fact that the stock market has a positive average expected return (due to inflation, the time value of money, compensation for risk, etc.). Given that, stocks should be hitting new highs all the time without it signaling imminent peril. This concern is weirdly recited all the time, probably because it has some surface-level intuitive appeal.

Yahoo! Finance’s reasoning is the most compelling to me: companies’ management may have private info that you and I and the market don’t know about, so their warnings could be prescient. BUT the market has heard their warnings and the supposed correction hasn’t manifested despite them. Is there some reason I, specifically, should interpret their warnings as meaning stock prices are dropping 10% ASAP when thousands (millions?) of other U.S. stock market participants are yawning at them?

At the end of the day, if you believe a correction is coming, you need to believe not only that cash flows are going to soften or risk levels will increase, but further than cash flows are going to soften more or faster than the market already believes and/or that risk is increasing more or faster than the market already believes.

Whatever we are in for, “correction” probably isn’t the right word for it. Cash flows may soften more or faster than expected and/or risk might rise more or faster than expected, but if we already knew about it, the correction would already be here. Alas, it is not.

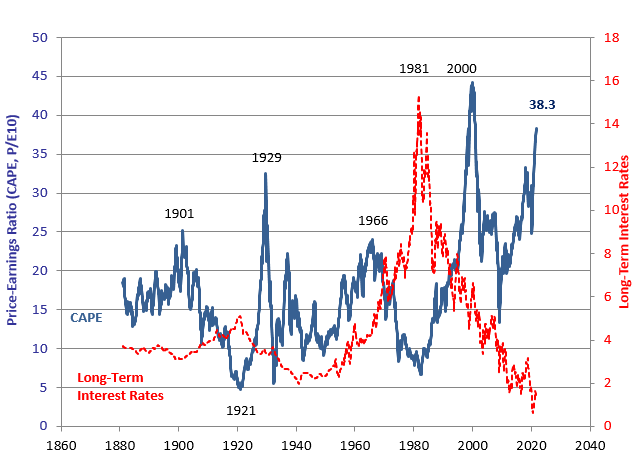

Among the cautious observers, the more sophisticated ones are probably thinking a lot about the following chart, from Nobel Laureate Robert Shiller’s website. The chart shows the price-to-earnings ratio for the stock market as a whole, where earnings are normalized by taking a simple average over the trailing 10-year period (adjusted for inflation). Earnings and prices should be linked—since prices at any moment in time should just be the capitalized value of the future earnings stream—such that the P/E ratio should mean-revert. As the chart makes clear, the ratio is high right now. For it to revert back to the long-term average, expected earnings need to rise faster than prices or, equivalently, prices need to fall faster that expected earnings. So far this year, the story has been that high expected growth in earnings would justify the high level of prices such that the prices at current levels (or higher) could be sustained with the ratio still mean-reverting. But now there is concern that real earnings growth might not be as robust as previously expected in light of the delta variant (and other emerging coronavirus variants), higher-than-expected inflation, etc. If these concerns manifest in reality, price appreciation should be lower than in recent periods.

Shiller Cyclically Adjusted Price-To-Earnings

It’s worth keeping in mind, though, that even if that story is right, it doesn’t necessarily imply some sort of dramatic, sudden double-digit depreciation in prices the likes of which the media and equity analysts are forecasting now. Another chart from Shiller makes that point clear. The chart first converts the P/E ratio described above to an implied annualized yield (higher current P/E ratio implies lower yield, lower current P/E ratio implies higher yield, all else equal). Then, the chart compares that yield to subsequent average annual stock market returns over the next 10 years. The chart is pretty clear that lower current P/E-implied yields (i.e., higher P/E ratios) correlate to lower-than-average subsequent returns.

But—and here’s the key point—high P/E ratios don’t imply sudden, shockingly catatonic returns. Just lower-than-average returns. Specifically, if you regress the subsequent returns on current P/E-implied yield, what you’ll find is that the data since 1871 implied annualized average real returns of about 3.5% percent. And that’s an average across the distribution of the entire market. That allows plenty of room for finding good opportunities without sitting in cash.

No doubt, things could change and the big decline folks have in mind could happen; but it is not likely it would occur based on things we know now. And the things we don’t know now are pretty tough to predict.

Shiller Cyclically Adjusted Price-to-Earnings Yield and Subsequent Annualized 10-Year Excess Returns

What we’re reading (9/14)

“Democrats Release Details Of Proposed Tax Increase” (Wall Street Journal). “House Democrats spelled out their proposed tax increases on Monday, pushing higher rates on corporations, investors and high-income business owners as they try to piece together enough votes for legislation to expand the social safety net and combat climate change. The plan would increase the top corporate tax rate to 26.5% from 21%, impose a 3-percentage-point surtax on people making over $5 million and raise capital-gains taxes—but without the changes to taxation at death sought by the Biden administration.”

“Harvard Says It Will Not Invest In Fossil Fuels” (New York Times). “The announcement, sent out on Thursday, is a major victory for the climate change movement, given Harvard’s $42 billion endowment and prestigious reputation, and a striking change in tone for the school, which has resisted putting its full weight behind such a declaration during years of lobbying by student, faculty and alumni activists.”

“Meritocracy's Cost” (Charles Murray in the Claremont Review of Books). “As Young predicted, far too many members of today’s elites really do believe that they deserve their place in the world. They have gotten too big for their britches. They are unseemly, albeit in different ways. The billionaire’s 30,000-square-foot home is visibly unseemly. But so is a faculty lounge of academics making snide remarks about rednecks—meaning the people without whom the academics would have no working mechanical transportation, be in the dark after sundown, have to use chamber pots, and, literally, starve. Today’s elites have a remarkable obliviousness about the lives and contributions of ordinary people that bespeaks an unseemly indifference—not to mention disdain—for those people.”

“Pandemics Initially Spread Among People Of Higher (Not Lower) Social Status: Evidence From COVID-19 And The Spanish Flu” (Social Psychological and Personality Science). “According to a staple in the social sciences, pandemics particularly spread among people of lower social status. Challenging this staple, we hypothesize that it holds true in later phases of pandemics only. In the initial phases, by contrast, people of higher social status should be at the center of the spread. We tested our phase-sensitive hypothesis in two studies. In Study 1, we analyzed region-level COVID-19 infection data from 3,132 U.S. regions, 299 English regions, and 400 German regions. In Study 2, we analyzed historical data from 1,159,920 U.S. residents who witnessed the 1918/1919 Spanish Flu pandemic. For both pandemics, we found that the virus initially spread more rapidly among people of higher social status. In later phases, that effect reversed; people of lower social status were most exposed. Our results provide novel insights into the center of the spread during the critical initial phases of pandemics.”

“9,000 Years Ago, Funerals In China Involved A Lot Of Beer” (Ars Technica). “At a 9,000-year-old burial site in China called Qiaotou, archaeologists recently unearthed a number of ceramic vessels. Some of the vessels were shaped like the long-necked, round-bellied bronze pots that people used for alcoholic drinks millennia later. And that made Dartmouth College anthropologist Jiajing Wang and his colleagues wonder whether these earlier clay versions might have once held beer, too. Bits of the residue left inside eight of the 13 pots turned out to contain phytoliths (fossilized plant remains) from rice, tubers, and a plant called Job’s tears. Starch molecules in the residue showed signs of being heated and fermented. Wang and his colleagues also found yeast and mold, key ingredients in fermentation.”

What we’re reading (9/13)

“U.S. Stock Market Faces Risk Of Bumpy Autumn, Wall Street Analysts Warn” (Wall Street Journal). “Analysts at firms including Morgan Stanley, Citigroup Inc., Deutsche Bank AG and Bank of America Corp. published notes this month cautioning about current risks in the U.S. equity market…[S]everal analysts said that they believe there is a growing possibility of a pullback or, at the least, flatter returns. Behind that cautious outlook, the researchers said, is a combination of things, including euphoric investment sentiment, extended valuations and anticipation that inflation and supply-chain disruptions will weigh on corporate margins.”

“Stocks Look Dangerously Overvalued And Are At Risk Of A Sharp Correction As Investors Misjudge The Sustainability Of Explosive Earnings Growth, DB Says” (Insider). “US stocks are priced for perfection following a robust year of post-pandemic earnings growth, but high valuations suggest a sharp market sell-off could be imminent, according to a Thursday note from Deutsche Bank. On nearly every valuation metric, US stocks are trading at "historically extreme" levels, according to the bank. Trailing and forward price to earnings, enterprise value to EBITDA, and cash flow valuation metrics are well into the 90th percentile, Deutsche Bank highlighted.”

“The Stock Market Fails A Breathalyzer” (Wall Street Journal). “Joby Aviation, which plans to begin an electric air taxi service in 2024, is worth more than Lufthansa, EasyJet or JetBlue. Does that seem right? In this market, why not? Heck, earlier this year, Tesla was worth more than the next nine car manufacturers combined, though now only the next six. Beyond Meat, made with pea protein, is worth more than the entire market for peas eaten globally—like the bumper sticker says: Imagine whirled peas. Do fundamentals even matter? I can go on. Used-car sales platform Carvana is worth more than Volvo, Honda, Ford or Hyundai. Airbnb is worth more than Marriott and Hilton combined. Crypto-exchange Coinbase is worth more than the Nasdaq.”

“A Perfect Storm For Container Shipping” (The Economist). “A giant ship wedged across the Suez canal, record-breaking shipping rates, armadas of vessels waiting outside ports, covid-induced shutdowns: the business of container shipping has rarely been as dramatic as it has in 2021. The average cost of shipping a standard large container (a 40-foot-equivalent unit, or FEU) has surpassed $10,000, some four times higher than a year ago…[t]he spot price for sending such a box from Shanghai to New York, which in 2019 would have been around $2,500, is now close to $15,000. Securing a late booking on the busiest route, from China to the west coast of America, could cost $20,000.”

“What Did Institutions Really Do?” (Economic History Research). “Landowners [in 18th/19th century Britain] remained the paramount faction in national politics and, until the end of the nineteenth century, they were the economic winners of industrialization. Already buoyed by rising land values around coal and water power sites, they continued to extract significant rents from their legislative dominance. As tax receipts accelerated—five times faster than national product—during the eighteenth century, the land tax barely changed. The aristocracy passed on the costs of fighting Britain’s wars to the commercial middle class through the excise and customs, the extraction of which was aided by a quadrupling in the size of the fiscal bureaucracy.”

What we’re reading (9/12)

“In A Huge Blow, Judge Rules Apple Can't Force Developers To Exclusively Use Its App Store Payment System” (CNN). “Apple can no longer prohibit app developers from directing users to payment options outside its App Store, a judge ruled on Friday. The decision, which followed a contentious court battle with the maker of the hugely popular Fortnite video game, is a major blow to Apple — but the company also scored a partial victory as the judge stopped short of calling it a monopoly.”

“Natural-Gas Market Conditions Look Unnatural” (Wall Street Journal). “U.S. Henry Hub natural-gas prices, at around $5 per million British thermal units (MMBtu), have more than doubled from a year earlier. When the benchmark broke the $4 mark in early August it was a rare milestone—especially so far ahead of the winter heating season…[a] severe winter in the U.S. could mean that domestic markets may have to compete with hungry Asian and European buyers. If European and Asian natural-gas prices stay at their current levels, both Mr. Brownell and Luke Jackson, analyst at S&P Global Platts, figure that Henry Hub prices would have to jump to $10 or more to provide an incentive to fulfill domestic natural-gas demand. Prices haven’t been that high since 2008, when the U.S. was producing about 40% less natural gas.”

“Asset Managers Are Doing Great” (Institutional Investor). “The combined revenue of the 27 publicly traded managers analyzed by the asset management consultant jumped by 34.2 percent from a year earlier. Their total AUM reached $32 trillion in the second quarter, rising 5.5 percent year-over-year. Private market managers have outperformed their public market peers due to fewer fee pressures…[p]rivate asset managers are less sensitive to fee pressure because their clients don’t have low-cost substitutes..[p]assive investment products like exchange-traded funds gained more popularity during the pandemic, pressing asset managers trading in the public markets to lower their costs.”

“The Incredible Shrinking Fee” (Morningstar). “[I]n 2020, the asset-weighted average fee--so, effectively the average fee paid by investors to invest in mutual funds and ETFs--came in at 0.41%. Now that was down from 0.44% in 2019. In dollars and cents, that amounted to effectively $6.2 billion collectively worth of fund fee savings, savings that were pocketed by investors and put back to work in the market, savings that will continue to compound to their benefit for the foreseeable future. Now, if we take a step back further, what we see is that 0.41% asset-weighted average fee is now less than half of what investors paid for funds going back two decades. So, there's been meaningful progress that's been made over the course of the past 20-plus years.”

“How the High SKEW Index Can Help Skewer Bubble Fears” (Fisher Investments). “[T]he CBOE SKEW Index…is touching record highs. Some see this as a warning sign of volatility ahead. We see it quite differently—as a sign investors aren’t blind to the alleged ‘risks’ some say stocks are ignoring. The SKEW is an odd indicator from the options pits that generally garners scant attention until it goes bananas. The Chicago Board Options Exchange—CBOE, the inventor of listed options trading and creator of the more widely watched CBOE Volatility Index or ‘VIX’—launched SKEW in February 2011 as a way to track perceived risk of a major market drop. To do so, the index aims to determine investor demand for hedging against an S&P 500 decline. It compares the cost to buy call options on the S&P 500 Index versus put options on the same, rising when put costs exceed calls.”

What we’re reading (9/11)

“Remembering 9/11” (DealBook). “Within the business district surrounding the twin towers, it was ‘nearly impossible to find an employee of any major financial firm who was not wondering about the fate of someone, a business school classmate, a rival deal maker or a familiar voice at the other end of a trading line.’ There were thousands of workers missing from Wall Street, which then employed about 200,000 people.”

“‘We’re the Only Plane in the Sky’” (Politico). “Nearly every American above a certain age remembers precisely where they were on September 11, 2001. But for a tiny handful of people, those memories touch American presidential history. Shortly after the attacks began, the most powerful man in the world, who had been informed of the World Trade Center explosions in a Florida classroom, was escorted to a runway and sent to the safest place his handlers could think of: the open sky.”

“The Falling Man” (Esquire). “In the picture, he departs from this earth like an arrow. Although he has not chosen his fate, he appears to have, in his last instants of life, embraced it. If he were not falling, he might very well be flying. He appears relaxed, hurtling through the air. He appears comfortable in the grip of unimaginable motion. He does not appear intimidated by gravity's divine suction or by what awaits him.”

“The Heroes Of 9/11 — And Long After” (New York Post). “We know the names of a lot of heroes who died that day: Todd Beamer, who said ‘Let’s roll’ on Flight 93 and didn’t let the flight become another missile. NYPD officer John Perry, who was handing in his retirement paperwork that morning but ran to the towers to help. FDNY chaplain Fr. Mychal Judge, who died bringing comfort to others. NYPD officer Moira Smith, the first to report the attacks that morning, who never stopped helping. We know the stories: The man in the red bandana who made many trips up to save people while others headed down. Engine 54, Ladder 4, Battalion 9 in Midtown, which suffered the largest loss that day of any firehouse when 15 of its firefighters did not return.”

“How The Wall Street Journal Published On 9/11” (Wall Street Journal). “The story of the men and women who worked for this newspaper on 9/11 has been underreported, no doubt because of the paper’s understandable concerns of coming across as self-aggrandizing. Such apprehensions are unnecessary. What the Journal achieved on 9/11 was an All-American triumph—and a template for how to sustain a collective body blow, set aside trauma and respond. On 9/11, the Journal’s headquarters—located across the street from the World Trade Center—was decimated by fallout from the Twin Towers. In its 112-year history, the Journal had never faced a comparable threat to silence its presses.”

What we’re reading (9/10)

“U.S. Airlines Warn Of Dimming Outlook Amid Delta Variant” (Wall Street Journal). “Airlines warned Thursday of another pandemic-driven hit to profits in the months ahead, as the Delta variant interrupts a rebound in air travel. Major carriers said new travel bookings have slowed in recent weeks and cancellations have increased, tempering airlines’ outlook after less than two months earlier some had projected the recovery would continue to strengthen.”

“The Elizabeth Holmes Courtroom Drama” (DealBook). “The trial of Elizabeth Holmes began yesterday with opening arguments. Holmes, the founder and former C.E.O. of Theranos, a blood testing start-up, has been charged with 12 counts of wire fraud and conspiracy to commit wire fraud; if convicted, she faces up to 20 years in prison. Lawyers on both sides framed the debate set to dominate the trial: whether Holmes was knowingly cheating investors or blindly taken in by Silicon Valley’s ‘fake it ’til you make it culture’ as well as by her former business and romantic partner Ramesh Balwani.”

“Investor Overconfidence Linked To Selective Memory” (Ars Technica). “There's extensive academic literature on the risks faced by investors who are overly confident of their ability to beat the market. They tend to trade more often, even if they're losing money doing so. They take on too much debt and don't diversify their holdings. When the market makes a sudden lurch, they tend to overreact to it…[w]ith the cost of going wrong, you'd think that people who risk money in stocks would learn from their past mistakes. But a new study suggests that our memory's tendency to take an optimistic past gets in the way, with people inflating their gains and forgetting their losses.”

“The Bill Ackman SPAC Debacle Is The Perfect Example Of What Happens When A Market Bubble Meets A Star Investor's Hubris” (Insider). “Ackman seems desperate to not do his SPAC in expected way. Perhaps he is waking up to a fact many other investors are realizing: that SPACs aren't all they're cracked up to be. The rate of formation of new SPACs has drastically declined in recent months, many investors in existing SPACs have asked for their money back, and the performance of now-public SPAC companies has been dismal.”

“Climate Policy Should Pay More Attention To Climate Economics” (John Cochrane, National Review). “Climate policy is ultimately an economic question. How much does climate change hurt? How much do various policy ideas actually help, and what do they cost? You don’t have to argue with one line of the IPCC scientific reports to disagree with climate policy that doesn’t make economic sense…the best guesses of the economic impact of climate change are surprisingly small…[e]ven extreme assumptions about climate and lack of mitigation or adaptation strain to find a cost greater than 5 percent of GDP by the year 2100. Now, 5 percent of GDP is a lot of money — $1 trillion of our $20 trillion GDP today. But 5 percent of GDP in 80 years is couch change in the annals of economics. Even our sclerotic post-2000 real GDP grows at a 2 percent annual rate. At that rate, in 2100, the U.S. will have real GDP 400 percent greater than now, as even the IPCC readily admits. At 3 percent compound growth, the U.S. will produce, and people will earn, 1,000 percent more GDP than now.”

What we’re reading (9/9)

“Bad News, Bulls: Bank Of America Sees Stocks Flatlining Through 2022” (Fortune). “The S&P 500 has posted a mighty rally so far this year, having already more than doubled from pandemic lows last year while reporting massive earnings growth. But some more bearish strategists aren’t convinced the party can go on into 2022. Bank of America, for one, is now predicting stocks will largely flatline through next year.”

“LuLaRoe Exposed: Inside An Alleged Billion-Dollar ‘Pyramid Scheme’” (Vanity Fair). “According to a 2019 suit filed by the Washington state attorney general, [the LuLaRoe] multilevel-marketing company is…a pyramid scheme that bilked thousands of people out of millions of dollars. According to the attorney general’s office, LuLaRoe made some of their retailers believe that if they invested between $500 and $5,000 in startup costs, they could ‘rescu[e] their families during financial crisis.’ (The suit was settled in 2021.)”

“Why U.S. Housing Prices Aren’t As Crazy As You Think” (A Wealth Of Common Sense). “There are structural and market forces that are causing these price gains, even if it all feels out of hand. You have household formation among the biggest demographic (millennials), generationally low interest rates, constrained supply from a lack of homebuilding following the housing crash and a pandemic that induced people to buy. But there’s another reason the housing market isn’t as crazy as you think — housing prices in the rest of the developed world have outpaced prices in the U.S. for some time now.”

“Digital Currencies Pave Way For Deeply Negative Interest Rates” (Wall Street Journal). “The main monetary power of the digital dollar comes from the abolition of bank notes. If people can’t hoard physical money, it becomes much easier to cut interest rates far below zero; otherwise the zero rate on bank notes stuffed under the mattress looks attractive. And if interest rates can go far below zero, monetary policy is suddenly much more powerful and better suited to tackle deflation.”

“American Probe Into German Company Elicits German Probe Into German Company” (Dealbreaker). “The Bundesanstalt für Finanzdienstleistungsaufsicht sounds terrifying. Generally speaking, it’s not, unless you are a short-seller or journalist with the temerity to uncover potential wrongdoing at a German company. If you’re one of those German companies, however, it’s usually a cuddly teddy bear. Much as it would like to, however—and certainly much as Allianz CEO Oliver Bäte would like it to—BaFin simply can’t ignore the growing number of U.S. regulatory probes in the same way it ignored the growing stack of client lawsuits over the company’s collapsed Structured Alpha hedge funds. And so, with regret, and belatedly as ever, the Germans are opening a probe of their own.”

What we’re reading (9/8)

“Elliott Management Has A More Than $1 Billion Stake In Citrix Systems” (Wall Street Journal). “Activist hedge fund Elliott Management Corp. has a more than $1 billion stake in Citrix Systems Inc. and wants the software company to take action to boost its lagging stock price, according to people familiar with the matter…[w]hile Elliott’s exact demands couldn’t be learned, it previously called for Citrix to focus on its core offerings and better allocate capital when the investor built a stake of more than 7% in June 2015. Jesse Cohn, Elliott’s managing partner who oversees its U.S. activist investing, joined Citrix’s board the following month as part of a settlement agreement.”

“Wall Street's Hottest Investor Is Betting Big On A Handful Of Stocks. Critics Say She's Playing With Fire” (CNN Business). “Some tech stock veterans also wonder if Wood is just an investing flavor of the month, comparing her to once-popular portfolio managers like Kevin Landis of Firsthand Funds, Alberto Vilar of Amerindo and Garrett Van Wagoner, who ran a popular emerging-growth fund in the late 1990s. Many of those tech funds imploded following the 2000 bubble…is Wood destined for similar ignominy?”

“Gensler’s Brewing Battle With Robinhood Could Prove Bloody” (New York Post). “[I]t’s never a smart thing to pick a fight with your chief regulator…[b]ut Robinhood isn’t picking the fight…the people there know what Gensler has proposed recently — a possible banning of something known as Payment for Order Flow, or PFOF — has existential ramifications for the brokerage firm. The firm makes most of its money through the practice. Its stock tanked last week on Gensler’s comments to the financial publication Barron’s about a possible ban.”

“The Debate We Should Be Having About The Federal Reserve” (The Hill). “[One] area of concern relates to financial distortions associated with the injection of excess liquidity via prolonged periods of quantitative easing by the Fed and other major central banks. Measures originally intended for financial emergencies are now being deployed by monetary authorities to achieve traditional macroeconomic goals. This in turn has caused financial markets to become addicted to a never-ending stream of easy money to sustain ever higher asset prices. Unsurprisingly, it has also encouraged speculative excesses. Unconventional Fed policies might unintentionally be contributing to a rise in inequality.”

“Investors Are Ignoring The Parallels Between Stocks Today And ‘Heady’ Years Of 1929, 1999 And 2007. Do This Next, Says Strategist.” (MarketWatch). “The S&P 500 is trading at a lofty 22.5 times forward earnings and its price-to-sales ratio of 3.1 times is far costlier than in 2000. The Nasdaq-100 tracking QQQ exchange-traded fund is trading at a 70% premium to its 200-week moving average, the biggest since 1999/2000…[t]he last time SPACs were as big as they are today? That’s right 1928/1929…[s]imilar to 1920 and 2000, margin debt has shot to new highs…Individual investors make up 20% of average daily volume for stocks, twice the level of two years ago. Many big market tops of the past — 1929, 1999/2000 — were marked by big jumps in investor activity.”

What we’re reading (9/7)

“World Shares At Record High As Investors Count On Fed Largesse” (Reuters). “Global stocks inched higher on Tuesday to a record high for the eight straight session as investors wagered the U.S. Federal Reserve is likely to delay the start of tapering its asset purchases after the soft U.S. jobs data…[t]he latest rally, which started after Federal Reserve Chair Jerome Powell's dovish speech at Jackson Hole Symposium late last month, received a further boost from a surprisingly soft U.S. payrolls report on Friday.”

“Traders Return To London Metal Exchange’s 144-Year-Old Ring” (Wall Street Journal). “Staff from the exchange’s eight dealing firms arrived early for work Monday, 18 months after Covid-19 swept through London and the 144-year-old LME closed the open-outcry ring for the first time since World War II. Dealers checked if equipment that matches trades and ‘squawks’ orders back to their head offices was working before commencing trading that would determine prices used in metal contracts world-wide.”

“Inside Instacart's Frenzied Summer Of Unsuccessful Dealmaking With Uber And DoorDash” (Business Insider). “Instacart's frenzied summer of unsuccessful dealmaking raises new questions about its business. While the grocery delivery service quadrupled in size last year due to the pandemic lockdown, it's now dealing with the reality of what its business will look like in less extraordinary times—and a more competitive landscape.”

“David Autor's Mix Of Insight, Error, And Confusion” (The Library of Economics and Liberty). A retort to the NYT op-ed from MIT economist David Autor that was featured in ‘What we’re reading’ yesterday. “It’s true that those who plan to work the fry station at White Castle shouldn’t plan on doing well in the labor market if they want that job long term. But surely Autor knows that the vast majority of people who take those jobs while young are not in those jobs 10 or even 5 years later. Those jobs are a stepping stone to better jobs and can teach young people some basic labor market skills: being punctual, taking responsibility, taking direction, and organizing their time, to name four important ones. That means that there actually is a lot of future in working the fry station at White Castle. Imagine that Autor had said: ‘There’s no future in going to middle school, grades 6 to 8.’ Everyone would see the problem with that reasoning. You won’t do well if you plan to be, and succeed in being, in middle school for the next 10 years. But everyone understands that middle school is a step on the way to better things.”

“Opportunity Unraveled: Private Information And The Missing Markets For Financing Human Capital” (Daniel Herbst and Nathaniel Hendren, working paper). “Investing in college carries high returns, but comes with considerable risk. Financial products like equity contracts can mitigate this risk, yet college is typically financed through non-dischargeable, government-backed student loans. This paper argues that adverse selection has unraveled private markets for college-financing contracts that mitigate risk.”

What we’re reading (9/6)

“Good News: There’s A Labor Shortage.” (David Autor, New York Times). “Many employers are alarmed about the current labor shortage — the phenomenon of a labor market with more job openings than unemployed workers. There are two supposed problems, they allege. First, that the labor shortage is caused by government benefits that discourage work. And second, that the shortage will harm the economy. Both claims are wrong.”

“Aluminum Hits Decade High After Guinea Coup Imperils Bauxite Supplies” (Wall Street Journal). “Aluminum prices rose to their highest level in 10 years Monday after a military coup in mineral-rich Guinea threatened to snarl the lightweight metal’s supply chain. Three-month aluminum forward contracts on the London Metal Exchange rose 0.9% to $2,757 a metric ton, their highest level since early 2011. Shares of mining companies and aluminum producers also jumped.”

“Your 401(k) Is Pocketing Fees On Your Investment. Many People Don’t Realize It.” (Washington Post). “Many people don’t realize they are paying multiple fees that generally fall under two categories: administrative fees and investment-related fees. Bundled into those charges are expenses for legal, accounting and record-keeping services. You might be paying for access to customer service help or investment advice. Funds that are actively managed might incur higher fees. If you work for a small company, your plan fees and expenses might be higher. ‘Fees remain a huge issue in the 401(k) industry,’ said Edward Gottfried, director of product at Betterment’s 401(k) business. ‘They’re frequently too high and rarely transparent enough to retirement savers.’”

“Renaissance Execs Will Pay $7 Billion to Settle a Decade’s Worth of Disputed Taxes. Here’s What Jim Simons Earned During That Period.” (Institutional Investor). “By any measure, Renaissance Technologies’ $7 billion settlement with the Internal Revenue Service is stunning and historical…[t]he dispute stems from the tax treatment of certain options transactions undertaken by Renaissance’s legendary Medallion fund from 2005 to 2015, according to the letter. No other Renaissance fund engaged in this practice. ‘The dispute turned on whether the options should be respected as separate instruments for tax purposes or, as the IRS contended, disregarded so as to treat the Medallion entities that held the options as if they actually held the individual securities positions in the option portfolios,’ Renaissance explained in the letter.”

“Lyft, Uber Say They Will Defend Drivers Sued Under Texas Abortion Law” (Los Angeles Times). “Lyft Inc. and Uber Technologies Inc. pledged to pay legal fees for drivers who are sued under Texas’ new restrictive abortion law, which threatens to hold anyone who helps a woman obtain the procedure legally liable.”

What we’re reading (9/5)

“How Close Is The U.S. Economy To Normal?” (Morningstar). “[T]he surge in delta-variant coronavirus cases will only moderately delay the return to normal. Vaccinated individuals are mostly safe from severe illness, while those who haven't received vaccines largely aren't concerned about coronavirus risk.”

“U.S. Ports See Shipping Logjams Likely Extending Far Into 2022” (Wall Street Journal). “Leaders of some of the busiest U.S. ports expect congestion snarling maritime gateways to continue deep into next year, as the crush of goods from manufacturers and retailers looking to replenish depleted inventories pushes past shipping’s usual seasonal lulls.”

“Froth In The Stock Market Makes Impending Correction Look Almost ‘Obvious,’ Miller Tabak Strategist Says” (CNBC). “‘There’s a huge amount of froth in the marketplace right now much like we’ve seen in other important tops of the market that only became obvious in hindsight,’ Maley told CNBC’s ‘Trading Nation’ on Thursday. Maley sees warning signs in today’s market that look similar to red flags during the 1999-2000 and 2007-2008 peaks. During the dotcom bubble, for example, he says stocks shot sky-high no matter the fundamentals much like AMC and GameStop have this year.”

“The Everything Bubble & TINA 2.0” (FTX Research). “If global central banks and governments are going to continue to print money, investors are faced with a TINA [There Is No Alternative] 2.0 predicament, where cash is literally burning a hole in their pockets, pushing them not just into risk assets, but further out the risk curve, exacerbating wealth inequality along the way, leading to even further risk taking. So are we in an everything bubble? There’s most certainly pockets of excess in nearly every corner of the financial markets, but there’s also ample opportunity.”

“Stocks Actually Perform Better When Investors Are Uncertain About Economic Policy, Despite Fears To The Contrary, Says A Wall Street Chief Strategist” (Business Insider). “Investors have been trained to believe that the stock market hates uncertainty, but historical performance tells a different story, according to Leuthold Group chief investment strategist James Paulsen…[u]ncertainty is high now among investors as they wonder when the Fed will taper its monthly bond purchases (and by how much), when the Fed will raise interest rates, and whether Congress will be able to spend as much as President Biden wants them too.”

What we’re reading (9/4)

“Wall St Week Ahead Investors Grow Wary As Stocks Hit New Highs” (Reuters). “Investors are girding their portfolios for potential stock market volatility, even as equities hover near fresh highs after logging seven straight months of gains…[i]n derivatives markets, the gap in price between the front month Cboe Volatility Index futures contract and the VIX index itself is higher than it has been about 85% of the time over the last five years. This suggests some investors expect the calm in stocks to give way to more pronounced price swings in the coming weeks and months.”

“What Every Investor Should Understand About Stagflation—But Often Doesn’t” (Wall Street Journal). “The prospect that inflation’s recent spike may be more than transitory, coupled with the possibility the economy will grow slowly, has raised the specter of the ‘stagflation’ era of 50 years ago. But be careful about making investment decisions based on what happened in that era—marked by a combination of stagnant growth and higher inflation. While the general outlines of the stagflation era are widely known, there are many misconceptions about how particular asset classes fared.”

“Bitcoin Miners And Oil And Gas Execs Mingled At A Secretive Meetup In Houston – Here’s What They Talked About” (CNBC). “On a residential back street of Houston, in a 150,000 square-foot warehouse safeguarding high-end vintage cars, 200 oil and gas execs and bitcoin miners mingled, drank beer, and talked shop on a recent Wednesday night in August…Bitcoin miners care most about finding cheap sources of electricity, so Texas – with its crypto-friendly politicians, deregulated power grid, and crucially, abundance of inexpensive power sources – is a virtually perfect fit. The union becomes even more harmonious when miners connect their rigs to otherwise stranded energy, like natural gas going to waste on oil fields across Texas.”

“What You’ve Lost In This Bull Market” (Wall Street Journal). “You probably feel safer riding your bicycle fast if you’re wearing a helmet. You’d be more inclined to take curves on a mountain road at high speed in a sturdy SUV than you would in a compact car. In much the same way, the low-interest-rate policy of the Federal Reserve and other central banks around the world has made the market environment less risky—thereby prodding investors into behavior that’s more risky.”

“Network Effects Are Overrated” (DealBook). “The problem with this [network effects] narrative is that it ignores the numerous ways in which the new digital platforms actually make businesses more vulnerable to competitive attack compared with the analog models that they have disrupted. The ease with which customers can switch undermines captivity and the asset-light nature of these businesses both lowers entry barriers and the level of activity required to break even.”

What we’re reading (9/3)

“U.S. Payroll Growth Slowed In August” (Wall Street Journal). “U.S. hiring slowed sharply in August as the surging Delta variant dented the pace of the economic recovery. The U.S. economy added 235,000 jobs last month, the Labor Department said Friday, falling far short of economists’ estimates for 720,000 new jobs. Job growth last month was also down from upwardly revised monthly payroll gains of 1.1 million in July and 962,000 in June.”

“Get Ready For A Possibly Record-Breaking Rush Of IPOs This Fall” (CNBC). “The IPO pipeline this fall is filling up quickly. The IPO market has already had its busiest year since the internet bubble in 2000, and the fall will likely set a record. Roughly 90 to 110 initial public offerings are expected in the next four months, putting 2021 on track for about 375 deals raising $125 billion, according to a new report from Renaissance Capital. Should that happen, it would make 2021 the biggest year ever for total capital raised and the busiest year by deal count since the 2000 internet bubble.”

“Corporate America Is Lobbying For Climate Disaster” (Paul Krugman, New York Times). “Why does Mickey Mouse want to destroy civilization OK, that’s probably not what Disney executives think they’re doing. But the Walt Disney Company, along with other corporate titans, including ExxonMobil and Pfizer, is reportedly gearing up to support a major lobbying effort against President Biden’s $3.5 trillion investment plan — a plan that may well be our last chance to take serious action against global warming before it becomes catastrophic.”

“Private Equity’s Potential Payday From Build Back Better” (American Prospect). “Legislation with the size and scope of the $4 trillion ‘Build Back Better’ agenda is like a Bat-Signal for lobbyists, urging them to swarm Capitol Hill without delay. Literally thousands of companies, organizations, and trade groups have lobbied on one or more of the bills in this package. But one industry’s representatives keep showing up over and over again, whether in formal lobbying sessions in Congress or more informal meetings: private equity.”

“Nobel Prize-Winning Economist Joseph Stiglitz Explains Why Today's Bull Market Isn't Sustainable - And Why He Welcomes The US Labor Shortage” (Business Insider). “The reason he welcomes the ongoing recovery towards maximum employment is that it would move the economy ‘out of this world of zero-interest rates.’ ‘It distorts risk-taking. It creates bubbles,’ he said about major US indices hitting record highs on a daily basis. ‘It would actually be a good move - have a tighter labor market and a restoration of interest rates to more normal levels.’”

What we’re reading (9/2)

“Should I Sell When The Stock Market Wobbles? Some Advice” (Washington Post). “A little more than a week ago financial markets appeared on the edge of a precipice, about to be overwhelmed by the delta variant’s insidious spread and the plateauing economic recovery. Yet just days later, the S&P 500 put in back-to-back record highs. Such market tremors and uncertainty are disconcerting for market professionals. But they are particularly nerve-wracking for private investors, especially perhaps for the 15% who only began investing last year. The question for non-professional investors is, when the storm clouds gather, should you stick or twist?”

“Active Traders Are Seeing Their Account Balances Continue To Rise” (CNBC). “A new Schwab report on self-directed brokerage accounts within 401(k) plans indicates that active traders have done well in the past year. The average account balance in the Schwab Personal Choice Retirement Account in June was up by 22%, to $348,183 from $285,616 a year earlier. The report includes data collected from approximately 174,000 retirement plan participants with balances between $5,000 and $10 million. While brokerage accounts are normally associated with active traders, the average Schwab trader isn’t exactly a rabid day trader. The average account made 13.8 trades in Q2, about one trade a week, down from 19.6 in the first quarter.”

“Enjoy the Calm, But Don’t Forget Volatility” (Fisher Investments). “While they are regular occurrences, substantial pullbacks draw reams of attention—and pundits’ explanations about why more trouble must lie in store. But letting this influence your portfolio decisions generally isn’t beneficial. If you can identify a bear market—a typically lasting, fundamentally driven decline exceeding -20%—early enough, taking action can help, allowing you to sidestep negativity and buy back in at lower levels later…[b]ut sentiment-driven wiggles are much more common. Timing them is flawed strategy, in our view.”

“Home Prices And The M2 Surge” (Calafia Beach Pundit). “The M2 money supply is now (as of the end of July) about $3.7 trillion above its long-term trend line. That extra $3.7 trillion can be found almost entirely in retail bank checking and deposit accounts, all of which are readily convertible into spendable cash. We have never before seen anything like this in the monetary history of the US. We have seen things like this in Argentina, however, where soaring inflation has always been preceded and accompanied by huge growth in the money supply. Milton Friedman must be rolling over in his grave these days.”

“SPAC Rout Erases $75 Billion In Startup Value” (Wall Street Journal). “The blank-check boom has turned into a rout. More than six months after the SPAC craze crested, a broad selloff has wiped about $75 billion off the value of companies that came public through special-purpose acquisition companies, according to a Dow Jones Market Data analysis of figures from SPAC Research. A group of 137 SPACs that closed mergers by mid-February have lost 25% of their combined value. At one point last month, the pullback topped $100 billion. The analysis doesn’t include companies that hadn’t closed mergers as of mid-February or those that are no longer trading.”

August 2021 performance update

Hi friends, here with a quickly monthly performance update. The key numbers:

Prime picks: -1.48%

Select picks: +0.31%

SPY S&P 500-Tracking ETF: +2.55%

Bogleheads portfolio (80% VTI + 20% BND): +1.82%

While pleased to the Select portfolio continuing its better 2021 than 2020, I am naturally disappointed by Prime’s August. On the one hand, we had a few big losers in the month (IPGP down 22.29%, TTWO down 8.23% possibly related to China gamer-crackdown news); on the other hand, that’s the nature of running a more concentrated portfolio than finance treatises would typically advise. Some down months are surely to be expected, but tough to swallow when the market is up as much as it was in the month. Frankly, if the market is going to rise relatively linearly (note the more or less straight black line below on a YTD basis), one would be hard pressed not to index hard on it. The history of financial markets teaches that the market overall doesn’t, however, tend to just increase linearly. It’s a long game and there are plenty of risks on the horizon (more China news, rate increases/Fed tapering asset purchases, growth re-forecasting, delta/lambda/other novel covid variants), so in the meantime I’ll look ahead and hope for better results in months to come in the event the rotation back to value stocks that some analysts think is likely to occur does in fact manifest.

Stoney Point Total Performance History

What we’re reading (9/1)

“The World Is Still Short Of Everything. Get Used To It.” (New York Times). “The Great Supply Chain Disruption is a central element of the extraordinary uncertainty that continues to frame economic prospects worldwide. If the shortages persist well into next year, that could advance rising prices on a range of commodities. As central banks from the United States to Australia debate the appropriate level of concern about inflation, they must consider a question none can answer with full confidence: Are the shortages and delays merely temporary mishaps accompanying the resumption of business, or something more insidious that could last well into next year?”

“Fidelity Wants to Add 9,000 Jobs by Year-End” (Wall Street Journal). “Fidelity Investments plans to hire another 9,000 employees this year to help its businesses keep pace with the surge in demand for stock-trading and other personal-investing services…[d]rawn to the market’s rally, individual investors have changed the fortunes of the brokerage industry. The no-commission stock trades and low-fee investment funds now offered by many firms have brought in plenty of new clients. They also have thinned money managers’ profit margins and forced them to compete on price. Traditional products, like stock- and bond-picking mutual funds, have been leaking client money.”

“Social Security Won't Be Able To Pay Full Benefits By 2034, A Year Earlier Than Expected Due To The Pandemic” (CNN Business). “Social Security will have to cut benefits by 2034 if Congress does nothing to address the program's long-term funding shortfall, according to an annual report released Tuesday by the Social Security and Medicare trustees….[b]y that time, the combined trust funds for Social Security will be depleted and will be able to pay only 78% in promised benefits…[t]he Covid-19 pandemic and economic recession are to blame for moving up the depletion rate by a year, driven by the big drop in employment and resulting decline in revenue from payroll taxes. The trustees also project a higher mortality rate through 2023 and a delay in births in the short term.”

“Wealthy Lobbyists Have Already Slashed Biden’s Tax Reform by Three-Quarters” (New York Magazine). “[President] Biden campaigned on a proposal to increase taxes on the wealthy by roughly $3.5 trillion over a decade. Nobody in Washington currently believes he will sign a tax hike anywhere close to that magnitude. The current predictions floating around — Politico’s tax newsletter is one publication that has used this estimate — peg the total at around a trillion, give or take. The most striking thing about the decision by moderate Democrats to scale back Biden’s plan by some three-quarters is that we have no idea what the rationale is.”

“Demographics, Wealth, And Global Imbalances In The Twenty-First Century” (Adrien Auclert, et al., working paper). “We use a sufficient statistic approach to quantify the general equilibrium effects of population aging on wealth accumulation, expected asset returns, and global imbalances…our model predicts that population aging will increase wealth-to GDP ratios, lower asset returns, and widen global imbalances through the twenty-first century. These conclusions extend to a richer model in which bequests, individual savings, and the tax-and-transfer system all respond to demographic change.”