What we’re reading (2/5)

“Stocks Fall After Powell Says Caution Is Needed On Rate Cuts” (Wall Street Journal). “The S&P 500 backed off its record high and bond yields jumped Monday after investors’ hopes for a Federal Reserve interest-rate cut next month were all but dashed.”

“Palantir Stock Jumps 19% As AI Demand Drives Revenue Beat” (CNBC). “In a letter to shareholders, Palantir CEO Alex Karp said the company’s expansion and growth ‘have never been greater,’ especially as demand for large language models in the U.S. ‘continues to be unrelenting.’ Palantir has been rolling out its Artificial Intelligence Platform, or AIP, and Karp said the company carried out nearly 600 pilots with the technology in 2023, up from fewer than 100 in 2022.”

“How The U.S. Became The World’s Biggest Gas Supplier” (New York Times). “America’s gas export boom initially caught many policymakers by surprise. In the early 2000s, natural gas was relatively scarce at home, and companies were spending billions of dollars to build terminals to import gas from places like Qatar and Australia. Fracking changed all that.”

“Disentangling Demand And Supply Of Media Bias: The Case Of Newspaper Homepages” (Tin Cheuk Leung, Koleman Strumpf). “In this study, we propose a novel approach to detect supply-side media bias, independent of external factors like ownership or editors’ ideological leanings. Analyzing over 100,000 articles from The New York Times (NYT) and The Wall Street Journal (WSJ), complemented by data from 22 million tweets, we assess the factors influencing article duration on their digital homepages. By flexibly controlling for demand-side preferences, we attribute extended homepage presence of ideologically slanted articles to supply-side biases. Utilizing a machine learning model, we assign ‘pro-Democrat’ scores to articles, revealing that both tweets count and ideological orientation significantly impact homepage longevity. Our findings show that liberal articles tend to remain longer on the NYT homepage, while conservative ones persist on the WSJ. Further analysis into articles’ transition to print and podcasts suggests that increased competition may reduce media bias, indicating a potential direction for future theoretical exploration.”

“Real Identity Of Bitcoin Founder ‘Satoshi Nakamoto’ Could FINALLY Be Revealed In Court…And May Unlock £36billion Fortune” (The U.S. Sun). “A UK court will now decide if Craig Wright, 54, is the mysterious, anonymous crypto-king who disappeared from the internet over a decade ago. Wright, an Australian computer scientist who lives in London, has been arguing since 2016 that he is the real Nakamoto - a claim largely dismissed by the cryptocurrency world.”

What we’re reading (2/4)

“Powell Insists The Fed Will Move Carefully On Rate Cuts, With Probably Fewer Than The Market Expects” (CNBC). “Federal Reserve Chair Jerome Powell vowed in an interview aired Sunday that the central bank will proceed carefully with interest rate cuts this year and likely will move at a considerably slower pace than the market expects. In a wide-ranging interview with ‘60 Minutes’ after last week’s Federal Open Market Committee meeting, Powell expressed confidence in the economy, promised he wouldn’t be swayed by this year’s presidential election, and said the pain he feared from rate hikes never really materialized.”

“Our Economy Isn’t ‘Goldilocks.’ It’s Better.” (Paul Krugman New York Times). “I believe that the risk of an economic slowdown is much higher than that of resurgent inflation and that rate cuts should come sooner rather than later. But that’s not the kind of argument that’s going to be settled on the opinion pages. What I want to talk about, instead, is what the good economic news says about policy and politics.”

“Week Of Whipsawing Treasurys Casts Doubt On Soft-Landing Trade” (Wall Street Journal). “The strongest U.S. jobs report in a year has dented investors’ hopes that the Federal Reserve will drastically slash interest rates this year, the latest reversal for those betting the economy is on track to achieve a soft landing.”

“Number Of Companies Going Bust Hits 30-Year High” (BBC). “The number of companies that went bust last year in England and Wales hit a 30-year high, according to the latest figures. More than 25,000 company insolvencies were registered in 2023, the highest number since 1993, as firms struggled with rising costs and interest rates. Companies faced higher energy bills, while consumer spending was squeezed by the cost of living crisis. The new figures show one in 186 active firms went bust in 2023.”

“This Ancient Material Is Displacing Plastics And Creating A Billion-Dollar Industry” (Washington Post). “[C]ork is experiencing a revival as more industries look for sustainable alternatives to plastic and other materials derived from fossil fuels. The bark is now used for flooring and furniture, to make shoes and clothes and as insulation in homes and electric cars. Portugal’s exports reached an all-time high of 670 million euro ($728 million) in the first half of 2023. But cork is more than a trendy green material. In addition to jobs, the forests where it grows provide food and shelter for animals, all while sequestering carbon dioxide. And unlike most trees grown commercially, cork oaks are never cut down, meaning their carbon storage capacity continues through the 200 years or more they live.”

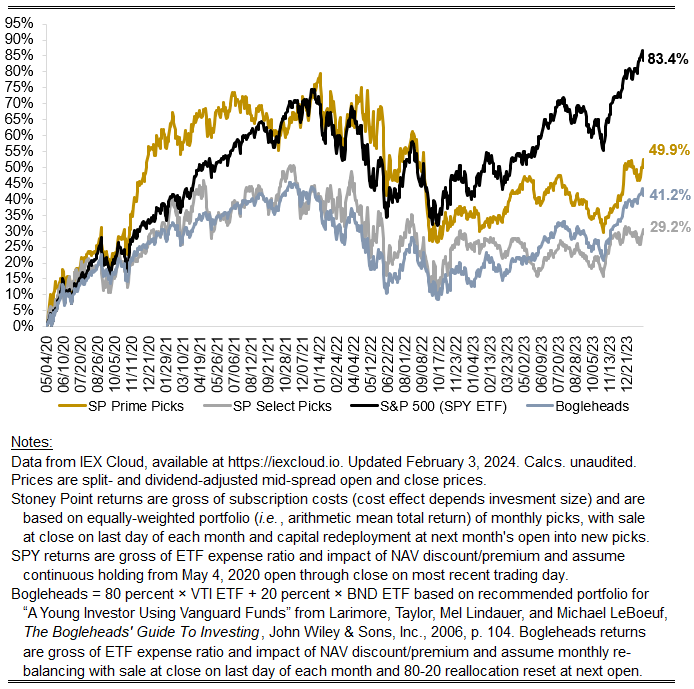

January performance update

Hi Friends, here with a performance update for January.

Prime: -0.35%

Select: -0.10%

SPY ETF: +2.27%

Bogleheads portfolio (80% VTI + 20% BND): +1.36%

It wasn’t a great month for value stocks, coming on the heels of a full-year 2023 where growth beat value by a substantial margin. That’s a pretty good description of the last decade or so, when growth consistently beat value, defying the observed “value premium” that is fairly robust in historical stock market returns data. I don’t expect the recent experience of growth beating value to persist forever, for sensible reasons (the question is for how long?) and I’m not alone.

To use one crude but common measure, value stocks tend to have low price-to-earnings (P/E) ratios while growth stocks tend to have high P/E ratios. There lots of other ratios, but they generically are trying to do the same thing: normalize a capitalized asset value by a proxy for the cash flows the asset throws off. No one would disagree that the value of an asset should be the risk-adjusted present value of its expected future cash flows. Assuming future cash flows are a function of current cash flows (e.g., earnings tomorrow = earnings today + growth in earnings between today and tomorrow), valuation ratios like P/E simply proxy for the reciprocal of expected returns. I say “proxy” because the the “E” is earnings, not cash flows, and is usually a measure of current earnings, not future, earnings; but these technicalities affect the measure for all companies, so when you look at the cross-section of P/E ratios you should get a ranking of companies that approximates an ordering of their expected returns, with a healthy dose of error.

A little more formally, say P = CF1/(1+r)^1 + CF2/(1+r)^2 + … CFN/(1+r)^n, where P = price today, CFi = cash flow for the ith year, r is the discount rate or the expected return on the stock, and n goes to infinity. In a simple model where r is assumed constant and cash flows grow at a constant rate, this all collapses to roughly P = CF0*(1+g)/(r - g). For a stock, dividends are the relevant measure of cash flows, and dividends equal earnings (E) - reinvested earnings, or earnings * (1 - IR) where IR is the investment rate. So the simple equation becomes P = E*(1+g)*(1-IR)/(r-g), and more complicated versions of it aren’t too different, at least not in ways that are important for this point. Factor out the E and divide both sides by it to get P/E = (1+g)(1-IR)/(r-g). That is, P/E is a function of growth, investment, and expected returns. All else equal (growth and investment), a relatively higher P/E (growth stocks) should be associated with a lower r in the cross-section of stocks, and a relatively lower P/E (value stocks) should be associated with a higher r in the cross-section of stocks, which is the historical empirical pattern — just not lately. That is a mechanical explanation, but a more intuitive one is something like the following: take the reciprocal of P/E (that is, E/P) and think about what it means for one company to have a higher E/P (value stocks) than others. All else equal, it means the market has bid down the price of that company, demanding higher returns (in expectation) to bear the risk of holding that stock, i.e., the stock price itself tells you something about the returns the market overall is demanding and therefore must expect to hold that stock, and you just need to normalize it appropriately to extract the signal the market is giving off about its returns expectations.

With all that in mind, the “growth premium” lately is sort of puzzling. But it makes a little more sense when you consider that, collectively, the stock of just six companies has a weight of almost 1/3 of the entire S&P 500. Those are Microsoft, Apple, Nvidia, Amazon, Meta, and Alphabet (Class A and Class C). Nvidia alone (~4% weight in the overall index) was up 25% in January and has been explosive over the last year. Together, the six companies contributed 1.68% to the index’s roughly 2% gain on the month (or roughly 3/4 of the SPY ETF’s return). The prospects of those companies may merit the returns they’ve experienced, but being so richly valued from a P/E standpoint and then subsequently experiencing relatively high returns, as we have seen over and over again with these companies in recent years, sort of implies their high returns of late aren’t manifesting for reasons that were obvious a priori. Otherwise, they probably would have had lower P/E ratios, say, a year ago, than they did. Rather, that fact pattern suggests to me that their prospects have continued to surprise to the upside. It’s worth asking if it is reasonable to expect not just good results to persist, but for results to continue to be better than everyone currently expects.

Stoney Point Total Performance History

What we’re reading (2/2)

“Should ESG Investing Be Criminalized?” (Morningstar). “What is the outlook for ESG investing?”

“Invest In America, Live In Europe—A Mantra Some Just Can’t Shake” (Wall Street Journal). “Even Europeans are starting to wonder why they bother to invest in their own region. The economy is stuttering while the U.S. booms. It’s an also-ran in a world dividing into blocs led by the U.S. and China. And its biggest companies wouldn’t even make the top 10 in the S&P 500. The ‘Magnificent Seven’ big U.S. stocks are, as of two weeks ago, collectively worth more than all western European listed stocks together. What’s the point? There are three answers. European stocks aren’t the European economy. The European economy may not be as bad as it seems. And European stocks are cheap, so as bad as it is, much is already priced in. There’s one pushback: Since the end of 2021, the region’s stocks have actually been pretty good.”

“Why Is It So Hard To Find A Job Right Now Despite Low Unemployment?” (Business Insider). “Lynne Vargas calls it ghost hiring. Vargas, a special education instructor, has been mired for months in various stages of interviews for three teaching jobs. The processes have dragged on so long that sometimes she wonders whether the roles are real. With one position, she waited three months after an interview. Then she got fed up.”

“Mark Zuckerberg Made More Than $28 Billion This Morning After Meta Stock Makes Record Surge” (CNN Business). “On Friday, shares of Meta (META) jumped more than 20% on the news of a quarterly dividend of $0.50 per share to be paid out on March 26 to shareholders of record as of February 22.”

“U.S. Strikes More Than 85 Targets In Iraq And Syria In Initial Barrage Of Retaliatory Attacks” (CNBC). “The United States launched attacks against Iran-backed militias in Iraq and Syria on Friday, its first retaliatory strikes for the killing of three American soldiers in Jordan last weekend, according to an official at the Department of Defense.”

What we’re reading (2/1)

“Why Tim Cook Is Going All In On The Apple Vision Pro” (Vanity Fair). “Inside Apple Park, the tech giant’s CEO talks about the genesis of a “mind-blowing” new device that could change the way we live and work. A-list directors are already on board—’My experience was religious,’ says James Cameron—but will your average iPhone user drop $3,500 on a headset?”

“McKinsey’s Leader Survives, But Voting Reveals Cracks At Elite Consulting Firm” (Wall Street Journal). “The voting laid bare dissatisfaction within one of the world’s most lucrative partnerships. It also exposed the potential drawbacks of an unusual governance structure that gives McKinsey’s partners the power to choose their leader every three years. The structure works when business is booming as partners who bring in millions have little reason to agitate for change. The past few years have been anything but stable.”

“The Fed Is Taking It Slow. But The Markets Want More.” (New York Times). “U.S. economic reports have been sparkling. The economy appears to be booming, the labor market looks strong and inflation seems to be on the decline. Yet this seemingly propitious combination has locked the Federal Reserve into inaction. At its policymaking meeting this week, the Fed decided to do precisely nothing. It held the main policy rate, known as the federal funds rate, steady at about 5.3 percent, where it has stood since August.”

“U.S. Winning World Economic War” (Axios). “The United States economy grew faster than any other large advanced economy last year — by a wide margin — and is on track to do so again in 2024…America’s outperformance is rooted in its distinctive structural strengths, policy choices, and some luck. It reflects a fundamental resilience in the world's largest economy that is easy to overlook amid the nation's problems.”

“Matt Levine’s Money Stuff: Texas Tempts Tesla” (Money Stuff). “[T]he bet here for Elon Musk is reasonable: If he moves Tesla to Texas, and then demands that Tesla’s board pay him $100 billion to keep a reasonable fraction of his time and attention on Tesla, and Tesla’s extremely accommodating board says ‘sure whatever you want,’ and a majority of shareholders approve the pay package, and one disgruntled shareholder sues, and the case goes to Texas business court, and the complaining shareholder comes into court citing conflicts of interest and the board’s lack of independence and the Delaware cases on ‘entire fairness,’ and Elon Musk comes into court saying ‘well that may all be true but what you are missing is that I am Elon Musk,’ and Texas Governor Greg Abbott is in the first row of spectators with a big sign saying ‘TX <3 U ELON,’ is the Texas business court, in its first real high-profile case, going to say ‘actually it’s illegal to pay Elon Musk that much’? It absolutely is not. That much is pretty predictable.”

What we’re reading (1/31)

“Fed Signals Cuts Are Possible But Not Imminent As It Holds Rates Steady” (Wall Street Journal). “The Federal Reserve signaled it was thinking about when to lower interest rates but hinted a cut wasn’t imminent when it held rates steady at its first policy meeting of the year on Wednesday. The central bank held its benchmark federal-funds rate steady in a range between 5.25% and 5.5%, the highest level in more than two decades, as it awaits more convincing evidence that a sharp downturn in inflation at the end of last year will endure.”

“Why Cut Rates In An Economy This Strong? A Big Question Confronts The Fed.” (New York Times). “Right now, officials think that the neutral rate is in the neighborhood of 2.5 percent. The Fed funds rate is around 5.4 percent, which is well above neutral even after being adjusted for inflation. In short, interest rates are high enough that officials would expect them to seriously weigh on the economy. So why isn’t growth slowing more markedly? It takes interest rates time to have their full effect, and those lags could be part of the answer. And the economy has slowed by some important measures. The number of job openings, for instance, has been steadily declining.”

“Beta Is Back” (Morningstar). A a big, bold controversial take that beta now works as it should.

“The Great American Natural Gas Reckoning Is Upon Us” (Vox). “The Biden administration last week announced that it was pausing the permitting process for some new natural gas export projects, including a facility that would be the second-largest gas export terminal in the United States. It’s a move the White House said will help the US meet its climate change goals, but it’s not clear how it will affect the economy, energy markets, or the environment.”

“The Nurture Of Nature And The Nature of Nurture: How Genes And Investments Interact In The Formation Of Skills” (Houmark, Ronda, and Rosholm, American Economic Review). “This paper studies the interplay between genetics and family investments in the process of skill formation. We model and estimate the joint evolution of skills and parental investments throughout early childhood. We document three genetic mechanisms: the direct effect of child genes on skills, the indirect effect of child genes via parental investments, and family genetic influences captured by parental genes. We show that genetic effects are dynamic, increase over time, and operate via environmental channels. Our paper highlights the value of integrating biological and social perspectives into a single unified framework.”

February picks available now

The new Prime and Select picks for February are available starting now, based on a model run put through today (January 30). As a note, I will be measuring the performance on these picks from the first trading day of the month, Thursday, February 1, 2024 (at the mid-spread open price) through the last trading day of the month, Thursday, February 29, 2024 (at the mid-spread closing price).

What we’re reading (1/29)

“Why Oil Prices Rose After Shrugging Off A Crisis” (Wall Street Journal). “Futures on Brent crude gained more than 6% last week to settle at $83.55 a barrel Friday, their highest level since early November. The rise came after winter storms slammed U.S. oil production and new data showed the country’s economy has remained resilient, suggesting robust demand for fuel ahead. The jump roused an oil market that has been surprisingly sleepy, given the growing threat that the Israel-Hamas war will spread into a wider conflict. On Monday, Brent crude retreated 1.4% despite another attack by Yemen’s Houthi rebels on an oil-carrying vessel over the weekend.”

“What Evergrande’s Collapse Might Mean For Global Business” (DealBook). “A Hong Kong court on Monday ordered the liquidation of Evergrande, the heavily indebted Chinese property giant. The decision comes two years after the company defaulted, setting off a financial crisis at other developers and adding to the challenges facing the world’s second-largest economy.”

“What About Gradualism?” (EconLib). “[W]hat did we learn from the 1982 experience? Did this show that gradualism doesn’t work? Not exactly, as a necessary precursor for gradualism never occurred. The 1982 recession showed that gradualism is not easy to implement, but it provided no evidence on whether it would work if implemented. So what is the necessary precondition for gradualism to work? The central bank must engineer a gradual slowdown in the growth rate of NGDP. That’s the only reliable method for achieving a ‘soft landing’.”

“Big Tech Is Thriving Despite The Layoffs” (Axios). “Microsoft announced this past week that it would cut 1,900 workers from its gaming division. Microsoft recently closed its acquisition of Activision Blizzard, which is where most of the cuts — representing about 8% of the company's total gaming workforce of 22,000 — are landing. Google also announced a smaller round of layoffs earlier this month and said some cuts would continue to be made throughout the year. Google and Microsoft's stocks both hit record highs this week.”

“FanDuel Parent Flutter Lists On The NYSE, Challenging DraftKings As Sports-Betting Pure Play” (CNBC). “FanDuel parent Flutter listed on the New York Stock Exchange on Monday, offering U.S. investors an alternative to the biggest pure play in sports betting, DraftKings. It’s a secondary listing for the international sportsbook, which will retain its primary listing on the London Stock Exchange and inclusion in the FTSE 100 index. But Flutter’s most important market for revenue and growth is the United States, where FanDuel is the market share leader. In the fourth quarter, FanDuel had 43% market share based on gross revenue and 51% based on net revenue.”

What we’re reading (1/28)

“Plummeting Inflation Raises New Risk For Fed: Rising Real Interest Rates” (Wall Street Journal). “Federal Reserve officials start the year with a problem they would ordinarily love to have: Inflation has fallen much faster than expected. It does, nonetheless, pose a conundrum. The reason: If inflation has sustainably returned to the Fed’s 2% target, then real rates—nominal rates adjusted for inflation—have risen and might be restricting economic activity too much. This means the Fed needs to cut interest rates. The question is, when and by how much?”

“Why Strip Malls Are Having A Revival” (WBBM Newsradio). “As shopping malls across America struggle to attract customers, fill floor space and ultimately stay open, strip malls are apparently seeing a surge in value and popularity. And it's basically thanks to the COVID-19 pandemic.”

“Falling Inflation, Rising Growth Give U.S. The World’s Best Recovery” (Washington Post). “The European economy, hobbled by unfamiliar weakness in Germany, is barely growing. China is struggling to recapture its sizzle. And Japan continues to disappoint. But in the United States, it’s a different story. Here, despite lingering consumer angst over inflation, the surprisingly strong economy is outperforming all of its major trading partners.”

“‘We’re All Climate Economists Now’” (New York Times). “Nearly every block of time at the Allied Social Science Associations conference — a gathering of dozens of economics-adjacent academic organizations recognized by the American Economic Association — had multiple climate-related presentations to choose from, and most appeared similarly popular. For those who have long focused on environmental issues, the proliferation of climate-related papers was a welcome development. ‘It’s so nice to not be the crazy people in the room with the last session,’ said Avis Devine, an associate professor of real estate finance and sustainability at York University in Toronto, emerging after a lively discussion.”

“What Prevents & What Drives Gendered Ideological Polarisation?” (The Great Gender Divergence). “Across much of the world, men and women think alike. However, in countries that are economically developed and culturally liberal, young men and women are polarising. As chronicled by John Burn-Murdoch, young women are increasingly likely to identify as ‘progressives’ and vote for leftists, while young men remain more conservative. What explains this global heterogeneity?”

February picks available soon

I’ll be publishing the Prime and Select picks for the month of February before Thursday, February 1 (the first trading day of the month). As always, SPC’s performance measurement for the month of January, as well as SPC’s cumulative performance, will assume the sale of the January picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Wednesday, January 31). Performance tracking for the month of February will assume the February picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Thursday, February 1).

What we’re reading (1/26)

“Economists Predicted A Recession. So Far They’ve Been Wrong.” (New York Times). “Many economists spent early 2023 predicting a painful downturn, a view so widely held that some commentators started to treat it as a given. Inflation had spiked to the highest level in decades, and a range of forecasters thought that it would take a drop in demand and a prolonged jump in unemployment to wrestle it down.”

“Cooler Inflation Keeps Door Open For Rate Cuts This Year” (Wall Street Journal). “The U.S. economy notched another month of mild inflation in December, keeping the Federal Reserve on track to deliberate when and how quickly to reduce interest rates later this year. The Fed’s preferred inflation measure, the personal-consumption expenditures price index, rose 2.6% in December from a year earlier, the Commerce Department said Friday, well below the 5.4% increase at the end of 2022.”

“Fed’s Preferred Inflation Gauge Falls Below 3% For First Time Since March 2021” (Yahoo! Finance). “The inflation data could fuel expectations that the central bank will soon start cutting interest rates after two years of hikes. During the December Fed press conference, Powell told Yahoo Finance's Jennifer Schonberger that the Fed would want to be "reducing restriction on the economy" well before inflation hits 2%.”

“FTX Was Never Really Bankrupt” (Project Syndicate). “The prosecution in Sam Bankman-Fried’s criminal trial drilled into the jurors’ heads that FTX customer losses exceeded $8 billion, but never substantiated that claim. In reality, the crypto exchange had sufficient assets to make creditors whole all along – a fact that would likely change the public’s perception of its founder.”

“The Media Is Melting Down, And Neither Billionaires Nor Journalists Can Seem To Stop It” (The Hollywood Reporter). “The media sector is facing a crisis unlike anything seen since the 2008 financial mess, with layoffs and cost-cutting at every turn. The cuts have all occurred in the backdrop of declining web readership at many major publishers over the past year, as tech giants like Meta (Instagram, Facebook) and Google try to keep consumers on their own platforms while old standby referrers like Twitter/X no longer deliver as many readers and the social media landscape fractures.”

What we’re reading (1/25)

“What To Watch In Friday’s Spending Report: A Last Look At Inflation Before The Fed Meeting” (Wall Street Journal). “Prices ticked up slightly in December, economists estimate, but the longer-run trend shows inflation cooling while consumers spent strongly and incomes grew—all ingredients of a soft landing for the economy.”

“The ‘Worst Possible Outcome’ For The Fed Is An Unnecessary Recession, Not Reversing A Cut” (Claudia Sahm). “The Fed faces many challenges. After hiking the federal funds rate aggressively by 5 1/4 percentage points from March 2022 through July 2023, it’s time to start cutting. Inflation has decreased substantially from its peak in the summer of 2022. The consensus is that inflation ended 2023 with a two-handle on both total and core, at 2.6% and 2.9%, respectively. (The Bureau of Economic Analysis will publish the numbers on Friday.) That’s a massive improvement in inflation—down from a peak of 7.1% for total and 5.6% for core. Moreover, there is no reason that the last mile must be the hardest. In addition, families are convinced that inflation is coming down. Here from the Surveys of Consumers out of the University of Michigan (#goblue) on inflation expectations[.]”

“PE Worries Climb As Investors Increasingly Claw Back Incentive Fees” (Institutional Investor). “With private equity firms unable to sell or take their companies public, managers are growing concerned about the risk that investors will ‘claw back’ incentive fees they paid in previous years. Citco reported a 35 percent increase in questions and requests for support from private equity firms for clawback risks in 2023 alone. Citco provides administration services for private equity firms and hedge funds that manage approximately $800 billion. Clawbacks, which protect investors from paying incentive fees on gains one year, only to experience a loss the next, are a common feature of contracts between private market firms and the allocators. Clawback provisions bar managers from collecting more than a certain percentage (usually 20 percent) of the profits of a fund over its lifespan. If they do, managers are required to return the “excess” incentive fees to their investors.”

“Money Isn’t Free” (Dealbreaker). “As investment strategies go, it doesn’t get much easier: Borrow money from the Federal Reserve at 4.88% or so, then deposit it right back with said central bank, which pays you 5.4%. Free money! Plus, you even get to help set the first rate, if you bought enough interest-rate swaps to drive up rate-cut expectations. And you would, because of course if you’re participating in this happy little arbitrage, you’re a bank or credit union with access to the Bank Term Funding Program, set up to reassure depositors that banks wouldn’t go belly-up in the wake of the Silicon Valley Bank/Signature Bank concomitant catastrophe. And boy, have you/they ever: Banks, which are in no apparent danger of running out of money, have been borrowing billions every week since November, when the BTFP’s rate and the Fed’s bank reserve balance rate flipped. Even if it’s gotten a little less fun recently, as the Street becomes less sanguine about a rate-cutting bonanza, pushing the former up a bit, it’s still pretty good—and you had to get while the getting’s good, because the whole party was coming to an end on March 11. Or, you know, now. Appearances to the contrary, Jay Powell doesn’t like looking stupid.”

“Commodity Markets Are In A ‘Super Squeeze’ — And Higher Prices Could Be Here To Stay” (CNBC). “Global commodity markets are in a ‘super squeeze’ amid supply disruptions and lack of investment — and it’s only going to get worse as geopolitical and climate risks exacerbate the situation, HSBC said.”

What we’re reading (1/24)

“Boeing Made A Change To Its Corporate Culture Decades Ago. Now It’s Paying The Price.” (New York Times). “By 2020, Boeing itself had in a way been stretched, redesigned and repowered in a series of corporate restructurings that each yielded its own defects. Since the mid-1990s, the company has bought out McDonnell Douglas, a domestic rival, moved its headquarters twice, shifted some assembly to the East Coast (which allowed the company to sidestep the unions) and changed chief executives the way you would planes in Atlanta. What got lost in all this shuffling is a corporate culture that once prized engineering and safety, replaced by one that seemed to be more focused on delivering profits over perfection.”

“SPAC Mania Is Dead. The SEC Wants to Keep It That Way.” (Wall Street Journal). “The Securities and Exchange Commission, which Gensler chairs, voted 3-2 Wednesday to adopt rules that seek to make it clearer to SPAC investors if they are getting a raw bargain. Once the rules take effect in about five months, according to lawyers familiar with the deals, they will likely drive another nail into the coffin of a recent Wall Street fad fueled by market froth and regulatory arbitrage.”

“What Happened To David Graeber?” (Los Angeles Review of Books). “By his own account politically unemployable in American academia, he claimed that, though the academy of that era sheltered myriad ‘authoritarian Marxists,’ anarchism was considered beyond the pale, as I can confirm from personal experience. But with his remarkable energy and productivity, he landed on his feet in London, eventually scoring a richly deserved professorship at the London School of Economics. Debt continued his work at the juncture of anthropology and economics that had begun with Theory of Value. The two disciplines overlap, after all, in being concerned with the nature of exchange, the origin of money, and in describing structures of inequality, among other matters. The book had a remarkable reception; never before has an anarchist been enthusiastically blurbed by the editor of the classic capitalist organ Financial Times.”

“A Colorado Pastor Says God Told Him To Launch A Crypto Venture. He’s Now Accused Of Pocketing $1.3 Million From His Followers” (CNN). “After months of prayers and cues from God, he was going to start selling cryptocurrency, he announced in a YouTube video last April. The Signature and Silvergate banks had collapsed weeks earlier, signaling the need to look into other investment options beyond financial institutions, he said. With divine wisdom, he said, he was ‘setting the rails for God’s wealth transfer.’ Shortly afterward, Regalado and his wife, Kaitlyn Regalado, launched a cryptocurrency, INDXcoin, and began selling it to members of his Victorious Grace Church and other Christian communities in the Denver area. They sold it through the Kingdom Wealth Exchange, an online cryptocurrency marketplace he created, controlled and operated.”

“The Late Charlie Munger’s Final Stock-Portfolio Update Is Out - And It Shows His Iconic Approach To Investing” (Business Insider). “Remarkably, Daily Journal held the exact same amount of Bank of America, Wells Fargo, and US Bancorp shares a decade later, on December 30 last year. While it slashed its Posco position to 9,745 shares in the fourth quarter of 2014, it didn't touch it again until the fourth quarter of 2022, when it exited the holding.”

What we’re reading (1/23)

“S&P 500 Hits Another High” (Wall Street Journal). “Overall, shares of big U.S. companies edged higher, with the S&P 500 adding 0.3%. The tech-heavy Nasdaq Composite gained 0.4%. The Dow Jones Industrial Average slipped 0.3%, or about 96 points, pulling back after closing above 38000 for the first time Monday. The blue-chip index was stung by the decline in 3M as well as pullbacks in shares of Goldman Sachs Group and Home Depot.”

“A Sentimental View Of The Stock Market” (Paul Krugman). “[W]hat should we make of the surge in consumer sentiment? On one hand, it makes a lot of sense given the reality of an economy with low unemployment and inflation. On the other hand, the timing may have been driven by a financial indicator most Americans really should be ignoring.”

“Mass Layoffs Hit LA Times, California’s Biggest Newspaper” (SFGate). “The Los Angeles Times, the largest newspaper in California and one of the biggest by circulation in the entire United States, was hit with a heavy round of layoffs Tuesday. The move to terminate more than 110 positions within the company has been widely rumored for several weeks — even prompting a one-day walkout protest from the newsroom last week — but the scale of the layoffs, and when those layoffs would happen, was not widely known until Tuesday morning.”

“What Do Shareholders Want? Consumer Welfare And The Objective Of The Firm” (Keith Marzilli Ericson). “Shareholders want a firm's objective function to place some weight on consumer welfare, motivated by both self-interested and altruistic motivations. Firms have a unique technology for improving consumer welfare: lowering inefficient price markups, which increases consumer welfare more than it lowers profits. Optimal pricing formulas can be adapted to account for shareholders' marginal rate of substitution between profits and consumer welfare. Calibrations from preference parameters show many shareholders should place non-trivial weights on consumer welfare. A survey experiment on a representative sample elicits how shareholders would vote on resolutions giving strategic guidance to firms on what objective to pursue. Only 7% would vote for pure profit maximization. The median individual is indifferent between $0.44 in profits or $1 in consumer surplus, with those owning stocks preferring a lower weight on consumer welfare than non-stockholders.”

“Copper, Abundance, And Scarcity” (Arnold King). “The Malthusian argument is that copper prices should be headed up, because copper is an essential component in electricity transmission. The goal to “electrify everything” is going to make copper expensive. The Simonian argument (due to Julian Simon) is that human ingenuity is the ultimate resource. We may be able to find more copper somewhere beneath the earth. We may find a cheap substitute for copper. We may find a way to get more electricity transmission out of a given amount of copper. The Hotelling-Kling argument is that regardless of whether Malthus or Simon is correct, the futures price of copper already reflects this. There is no reason for me to bet against the futures market, since I have no superior information about the outlook for supply and demand for copper.”

What we’re reading (1/22)

“Charles Schwab Just Survived A Year From Hell. The Trouble Isn’t Over Yet.” (Wall Street Journal). “Charles Schwab last year weathered a banking crisis, layoffs and a sharp drop in its stock price. Inside the company, employees are preparing for another uncertain year. The largest publicly traded U.S. brokerage on Wednesday reported a third consecutive quarter of year-over-year revenue and profit declines, hit hard by higher interest rates. Net income in 2023 dropped to $5.1 billion, down 29%. Shares fell 17% last year and are down 7% year to date.”

“The Market Has Had A Fabulous Run, But This Peak Doesn’t Really Matter” (New York Times). “Suppose you had gotten the market cycle as wrong as you possibly could, but had nonetheless decided to become a long-term stock investor — and had actually stuck with it, despite colossal losses. That would have meant buying at the market peak of Oct. 9, 2007. You would have lost most of your money by the spring of 2009, but you would have gained it back, and then some. These are the returns of the S&P 500 from Oct. 7, 2007, through Jan. 18, [2024] according to FactSet: [c]onsidering price alone, the index gained 7.1 percent annualized, or 207 percent cumulatively. With reinvested dividends, the index gained 9.3 percent annualized, or 325 percent cumulatively.”

“From 942-Year-Old Directors To ‘Financial Anomalies,’ These Red Flags Reveal Whether A Shell Company Might Be A Fraud, According To Moody’s” (Business Insider). “Moody's found instances of individuals holding a ridiculous number of jobs simultaneously, including one person who was observed to have 5,751 roles in nearly 3,000 companies. The data includes 11.5 million outlier directorship flags, the report said. Other unusual employee details include the extreme age listed for some employees, either ludicrously old or young. The data revealed that some firms have ‘beneficial owners’ older than 122, and some as young as 0. More than 4,000 directors were listed as younger than five years old, while another director at a Belgium-based firm was even listed as 942 years old, putting this person's birthdate somewhere around the year 1082.”

“FAA Urges Door Plug Checks On Second Boeing Model ‘As Soon As Possible’” (Washington Post). “The Federal Aviation Administration is recommending that airlines inspect the door plugs on a second type of Boeing plane, after one blew out midflight in another model and caused a dramatic emergency landing.”

“Harvard Teaching Hospital Seeks Retraction Of Six Papers By Top Researchers” (Wall Street Journal). “The Dana-Farber Cancer Institute, a Harvard Medical School affiliate, is seeking to retract six studies and correct 31 other papers as part of a probe involving four of its senior cancer researchers and administrators. More than 50 papers, including four co-authored by Chief Executive and President Dr. Laurie Glimcher, are part of a continuing review, according to Dr. Barrett Rollins, the cancer institute’s research-integrity officer. Some requests for retractions and corrections have already been sent to journals, he said. Others are being prepared. The institute has yet to determine whether misconduct occurred.”

What we’re reading (1/20)

“Meet the Investors Trying Quantitative Trading At Home” (Wall Street Journal). “For years, ordinary people could only watch—or pay quant funds’ hefty management fees. Now, they are getting in the game. Home computers are more powerful than ever. Websites offer tutorials. Hobbyists share tips on social media. A host of books, YouTube videos and online-trading platforms such as Composer, Alpaca.markets and QuantConnect.com have sprung up to make it easier for amateurs to trade like the pros.”

“Bank Credit Is Shrinking For The First Time Since The Great Recession - And That’s A Red Flag For The Economy” (Business Insider). “A key gauge of economic health in the US has sunk into negative territory, adding credence to some of Wall Street's more pessimistic growth predictions. Bank credit levels have now fallen for three quarters in a row, according to the Board of Governors of the Federal Reserve System – the first sustained contraction since 2010. This is only the second such decline in more than half a century. The last one was during the Great Recession, brought about by the global financial crisis of 2008-2009.”

“Why The Davos Smart Set Sounds Dumb” (Politico). “It is not that the observations and arguments are notably dumb, though it is rare to hear something arrestingly smart. The signature of most conversations about current events is how emphatically commonplace they are. Business leaders, scientists, public intellectuals, cabinet ministers and the roster of operatives who accompany them all to Davos tend to be very high news consumers. Many of these people are themselves frequently in the news or have regular access to principals of government and industry. Outsiders, however, should liberate themselves from the illusion that these insiders really know the score. Their views are no more banal than the average person who also follows the news, but they are typically no less so.”

“The Phone-Transcript Mystery In The Morgan Stanley Block Trading Settlement” (Axios). “Morgan Stanley has agreed to pay $250 million after it emerged that the head of its block trading desk, Pawan Passi, had tipped off hedge funds to large upcoming sales — after explicitly promising his clients that he wouldn't do so….[t]he case sheds a tiny bit of light on how far the government will go when it's investigating a bank….[t]he statement of facts in the case includes multiple transcribed phone calls between Passi and hedge funds. But they weren't obtained easily. The wording is intriguing: ‘These calls were not recorded by Morgan Stanley, nor did they take place on a regularly-recorded line, unless otherwise noted. Rather, the Government obtained the calls described below, as well as other calls in which Morgan Stanley employees discussed block trades, in the course of its investigation.’”

“Spot Bitcoin ETFs Are Taking Wall Street By Storm. Experts Say Options Are Next” (CNBC). “Cboe Global Markets’ Catherine Clay believes options are a natural progression for bitcoin ETFs. ‘We believe that the utility of the options, what they provide to the end investor in terms of downside hedging, risk-defined exposures into bitcoin, really would help the end investor and the ecosystem,’ the firm’s global head of derivatives told CNBC’s ‘ETF Edge’ this week.”

What we’re reading (1/19)

“S&P 500 Closes At A New All-Time High As Fresh Data Drives Optimism For Rate Cuts” (Business Insider). “Strong economic data fueled the S&P 500 to a record on Friday, with markets getting more optimistic about potential rate cuts from the Federal Reserve. Soon after trading began, the benchmark index was already on pace to clear its all-time closing high of 4,796.56 set two years ago. And by midday, it cleared its intraday record of 4,818.62.”

“A Hot Debt Market Is Slashing Borrowing Costs For Riskier Companies” (Wall Street Journal). “Companies with low credit ratings are rushing to slash their borrowing costs even before the Federal Reserve makes a single interest-rate cut. As of Thursday morning, companies such as SeaWorld Entertainment and Dave & Buster’s had asked investors to cut the interest rates on some $62 billion of sub-investment grade loans in January—already the largest monthly total in three years, according to PitchBook LCD…Prices of so-called leveraged loans, which are often used to fund private-equity buyouts, have climbed especially high, in part because a slowdown in those deals has led to lack of new loans entering the market.”

“AQR: How To Model Future Returns And Risks Of Private Credit” (Institutional Investor). “According to AQR, there are factors that could drive up private credit’s return, including the illiquidity premium, the borrower’s willingness to pay more for the flexibility and certainty that private credit offers, fewer defaults, better workouts when things go wrong, and the disintermediation of banks. But there are strikes against private credit, too. Private credit managers charge higher fees, and AQR suggests that investors may overpay for price smoothing. Credit quality deterioration could also be hidden from investors, as private credit managers report information less frequently than their public credit peers.”

“China’s Economy Is In Serious Trouble” (Paul Krugman, New York Times). “[T]he Chinese economy seems to be stumbling. Even the official statistics say that China is experiencing Japan-style deflation and high youth unemployment. It’s not a full-blown crisis, at least not yet, but there’s reason to believe that China is entering an era of stagnation and disappointment.”

“Nato Warns Of All-Out War With Russia In Next 20 Years” (The Telegraph). “Civilians must prepare for all-out war with Russia in the next 20 years, a top Nato military official has warned. While armed forces are primed for the outbreak of war, private citizens need to be ready for a conflict that would require wholesale change in their lives, Adml Rob Bauer said on Thursday.”

What we’re reading (1/14)

“It Won’t Be A Recession—It Will Just Feel Like One” (Wall Street Journal). “The good news is the probability of a recession is down sharply, according to The Wall Street Journal’s latest survey of economists. The bad news is that, for a lot of people, it is still going to feel like a recession.”

“Driven Out” (Modern Farmer). “Long-haul trucking used to be a secure and respected career. Today, it’s a job with high turnover and a lack of security. Many headlines today talk about the future of trucking, which includes the possibility of autonomous fleets replacing human-driven ones at some point down the line. But the predicament in which truckers find themselves now actually goes back in time by several decades.”

“Is The Mortgage Interest Deduction A Good Idea?” (Marginal Revolution). “I usually don’t like arguments like the one that follows, as purely short-run second best considerations tend to rub me the wrong way. Nonetheless I had never thought of it before, so I am happy to present it for our collective enlightenment: ‘Mortgage interest deductions and other homeownership subsidies are widely believed to be harmful because they redistribute resources from lower-income renters to higher-income homeowners. We argue that renters actually benefit from these policies in general equilibrium for two reasons. First, the rental supply curve is relatively inelastic, which means that rents fall when these policies reduce rental demand. Second, many renters spend most of their income on housing, and these renters gain substantially from rent decreases. We calibrate a quantitative model to match empirical evidence on these factors and show they are strong enough that subsidizing homeownership actually increases welfare.’”

“A Conspiracy Theory For Japan’s Lost Decade” (Capital Flows and Asset Markets). “[I]s there a political cycle that explains Japan’s malaise? Well yes, I think so. First of all, losing World War II was highly detrimental to Japanese growth. Prior to World War II the Japanese economy was rapidly catching depression era USA. In 1980, as Japanese economic growth surged, again Japan was becoming a threat to the USA. But in 1980s, the bureaucrats and CEOs of Japan Inc would have been men who would have distinct memories of the last outcome when Japan threatened to overtake the USA. For this reason I think Japan agreed to the Plaza accord, which saw the Yen appreciate significantly. With an export led economy, this yen appreciation should have been devastating for the Japanese economy.”

“US Cannabis Investing: An Overview” (Enterprising Investor). “The cannabis sector is slowly emerging from its long period of prohibition, and the investment opportunities are turning heads. Retail investors believe in the industry’s future and want to participate before regulations change. The institutions covering the sector are keeping a close eye on it even if most have yet to dip their toes in.”

What we’re reading (1/13)

“Why The Strength Of The Dollar Matters So Much For Stock Investors” (Wall Street Journal). “[A]bout 40% of corporate earnings come from outside the U.S. ‘What happens in a strong-dollar environment is those earnings buy fewer dollars.’ [according to Marc Chandler, chief market strategist for Bannockburn Global Forex.] The same logic works in reverse. If the dollar weakens, revenue from outside the U.S. tends to be bigger in dollar terms—giving a boost to revenue and profits, if other things stay the same. From Nov. 1 to Dec. 29, the Dollar Index—which measures the value of the greenback versus other major currencies—fell 5% amid signs that inflation is moving toward the Federal Reserve’s target and that the central bank is more likely to cut rates than to raise them in coming months. That in turn helped drive a multiweek winning streak that lifted stocks near their highest levels of the year.”

“‘It’s The Only Thing That Actually Matters’: A Weaker US Dollar Would Help The Dow Rocket To 50,000” (Business Insider). “‘Our work suggests that every 10% drop [in the US dollar] should translate into a ~3% benefit to S&P 500 earnings per share via currency translation, all else equal,’ [Bank of America’s Savita] Subramanian said. Economists at Bank of America expect the US dollar will depreciate by 3% on a trade-weighted basis in 2024, representing a tailwind for corporate profits and therefore stock prices.”

“Did The Creator Of Barbie Engage In Tax Evasion?” (Dealbreaker). “In last year’s hit movie ‘Barbie,’ there is a scene where Barbie meets her creator Ruth Handler. Handler tells Barbie that she was Mattel until the IRS got to her. The creator of Barbie is not a supermodel, but instead a ‘five-foot nothing with a double mastectomy and tax-evasion issues.’ […] numerous biographies of Handler never mention her being convicted or even charged with tax evasion. Furthermore, she has not even been suspected of engaging in tax fraud. Instead, in 1978, a federal grand jury indicted her and other Mattel officers for making false statements to the Securities and Exchange Commission. This was due to an SEC investigation after Mattel reported operating losses while also claiming that the company was recovering and growing.”

“The Billionaires Spending A Fortune To Lure Scientists Away From Universities” (New York Times). “In an unmarked laboratory stationed between the campuses of Harvard and the Massachusetts Institute of Technology, a splinter group of scientists is hunting for the next billion-dollar drug. The group, bankrolled with $500 million from some of the wealthiest families in American business, has created a stir in the world of academia by dangling seven-figure paydays to lure highly credentialed university professors to a for-profit bounty hunt. Its self-described goal: to avoid the blockages and paperwork that slow down the traditional paths of scientific research at universities and pharmaceutical companies, and discover scores of new drugs (at first, for cancer and brain disease) that can be produced and sold quickly.”

“A $126 Grocery Tab That Explains The Vibes Paradox” (Axios). “If you look at the level of prices, they are way up since 2020. If you look at the rate at which prices are changing, it has returned to fairly normal levels. This intuition is crucial to understanding this confusing moment for inflation trends and public opinion around them.

What we’re reading (1/8)

“Tech Giants Drive Stock Rebound” (Wall Street Journal). “U.S. stocks posted solid gains Monday, easing investor anxieties after the market’s rough start to 2024 last week. Both the S&P 500 and the Nasdaq Composite logged their best days since November, climbing 1.4% and 2.2%, respectively.”

“United Airlines Finds Lloose Bolts On Several Boeing 737 Max 9s After Grounding” (CNBC). “No one was seriously injured in the accident aboard the Alaska Airlines flight, though the blown-out panel produced a force so violent that some headrests and seatbacks were ripped from the cabin and the cockpit door was flung open, according to initial details of a federal safety investigation. No passengers were seated in the two seats next to the panel.”

“Investors Bail On Boeing Following Max 9 Grounding” (DealBook). “Air safety officials have ordered the grounding of the Max 9, one of Boeing’s best-selling models, and airlines around the world have canceled hundreds of flights as they await instructions from regulators in the U.S. and elsewhere.”

“The Mystery Of The Coin That Shouldn’t Exist” (New York Times). “A decade ago, a funny money mystery fell into the hands of scientists and students at the Pontifical Catholic University of Peru in Lima. The university had been acquiring 19th- and 20th-century Peruvian coins from local dealers, and graduate students in the chemistry department were analyzing the pieces for their thesis work. But one coin, a 10-cent piece known as a dinero, stood out. The dinero was marked “1899.” The problem was that official records indicated no coins of that denomination were minted in Peru that year — according to the people who made the money, the coin never existed.”

“Tiger Woods Splits With Nike” (Business Insider). “Tiger Woods and Nike are ending their nearly three-decade partnership. The legendary golfer announced Monday that he and the sportswear brand were going their separate ways as Woods prepared for ‘another chapter.’”