What we’re reading (1/7)

“The Stock Rally Has Stalled. Now Comes Earnings Season” (Wall Street Journal). “U.S. stocks defied expectations to rally in 2023 but have struggled to extend gains into the new year. The S&P 500 shed 1.5% in the first week of January. Tech stocks, which led the market last year, have stumbled, with Apple and Microsoft falling 5.9% and 2.2%, respectively, in the past week. For many investors, quarterly results and commentary from executives will help signal if the recent stock-market declines are warranted or whether companies’ profits are strong enough to renew the rally.”

“I.R.S. To Begin Trial Of Its Own Free Tax-Filing System” (New York Times). “The Internal Revenue Service is rolling out a free option for filing federal tax returns this year to some residents of a dozen states. Last month, the agency published details of its plan to test an in-house filing system, in which taxpayers submit their federal tax returns directly to the agency online at no cost. Residents of 12 states are eligible to participate if they meet certain criteria…While the direct filing system is starting on a limited basis, it has already faced some resistance, particularly from commercial tax-preparation companies.”

“Short Sellers Lost More Money Betting Against Tesla Than Any Other Company Last Year” (CNN Business). “That estimate, from markets analytics firm S3 Partners, isn’t a shock – Tesla shares slightly more than doubled during the course of the year. But for the shorts to take that kind of hit, there needs to be not only gains for the shares, but also a large group betting the other way.”

“AQR Tops Multistrategy Funds In 2023” (Institutional Investor). “AQR posted strong gains in its multistrategy portfolios, topping most of the other well-known funds in its categories. The firm’s AQR Absolute Return strategy, the longest-running multistrategy offering, was up 18.5 percent in 2023 after surging 43.5 percent the previous year, according to someone who has seen the results.”

“Can Stocks Surpass 2022 Highs? Yes, But The Math Looks Scarier From There” (Wall Street Journal). “A parallel can be drawn with 2013, when a corporate upswing was also kicking off following an earnings rout. Investors who bought then saw the price of their stocks increase at a compound annual rate of 10% over the following decade, without adjusting for inflation. To deliver this, the broad S&P Composite 1500 had to go from trading at 17 times earnings to 23 times, as earnings only grew 8%. Replicating this performance over the next 10 years would take valuations to a whopping 28 times. If earnings grow from their trough at the long-term historical average of 6%, valuations would have to climb to 32 times to achieve the same gains. History suggests they are much more likely to compress to around 21 times, which would imply an annual price return of 7% or less.”

What we’re reading (1/2)

“Fisher Investments In Sale Talks” (Wall Street Journal). “Advent International is in talks to acquire Fisher Investments, the money-management firm known for its ubiquitous advertisements, according to people familiar with the matter.”

“Apple Shares Fall 4% After Barclays Downgrade” (CNBC). “Barclays analyst Tim Long wrote in a note to clients Tuesday that the iPhone 15′s current ‘lackluster’ sales, specifically in China, presaged similarly weak iPhone 16 sales — weakness that Long expects will hold true for Apple’s hardware sales broadly.”

“Millennials May Be The Real Winners Of Baby Boomers’ Pandemic Wealth Accumulation” (CreditNews). “Millennials own a small fraction of America’s real estate wealth, but that could change in the coming decade as they inherit trillions of dollars in property from their boomer parents.”

“Is America On The Mend?” (New York Times). “The big question in the years that followed was whether America would ever fully recover from that shock. In 2023 we got the answer: yes. Our economy and society have, in fact, healed remarkably well. The big remaining question is when, if ever, the public will be ready to accept the good news.”

“The Seven Biggest Work Trends Of 2023” (BBC). “The mainstreaming of hybrid set-ups means workers still have unprecedented flexibility and are unlikely to lose it entirely. Kastle Systems, which tracks employee access-card swipes for many businesses, has shown office attendance in 2023 is still a fraction of what it was pre-pandemic. Going forward, many jobs will have a hybrid schedule – a privilege formerly afforded to a select few, mostly senior employees.”

December performance update

Hi friends, here with a monthly performance update.

Prime: +8.03%

Select: +0.79%

SPY ETF: +4.71%

Bogleheads portfolio (80% VTI + 20% BND): +5.05%

In last month’s performance update, I noted that I had incorporated a few additional value indicators into the SPC model, the addition of which was intended to gain precision in identifying “value” stocks. It’s tough to attribute Prime’s significant outperformance this month to those changes, but the December result is nevertheless encouraging. More broadly over the year, Prime underperformed its rough benchmark (SPY). The lion’s share of that underperformance occurred in the front half of the year; in the last three months, Prime actually outperformed SPY on a cumulative basis, with most of the outperformance in that period attributable to December after the inclusion of the additional indicators. There is still a lot of ground to be made up in terms of the relative performance back to May 2020, but let’s see what 2024 holds.

Happy new year!

Stoney Point Total Performance History

January picks available now

The new Prime and Select picks for January are available starting now, based on a model run put through today (December 30). As a note, I will be measuring the performance on these picks from the first trading day of the month, Tuesday, January 2, 2023 (at the mid-spread open price) through the last trading day of the month, Wednesday, January 31, 2023 (at the mid-spread closing price).

What we’re reading (12/29)

“What Did Wall Street Get Right About Markets This Year? Not Much” (Wall Street Journal). “The S&P 500 finished the year up 24%, just 0.6% from its January 2022 record. The Dow Jones Industrial Average advanced 14% to top 37000 for the first time and set seven record closes in the final days of 2023. A mania surrounding artificial intelligence and big technology stocks sent the Nasdaq Composite soaring 43%, its best year since 2020. It is a far cry from the doom and gloom many were bracing for at the start of 2023. A year ago, everyone from the strategists at Wall Street banks to rap artist Cardi B was calling for a recession. Instead, inflation continued falling, consumers kept spending and the unemployment rate fell to 3.4%, the lowest level since 1969.”

“The Stock Market Hasn't Seen A Winning Streak Like This Since 1985” (Business Insider). “The S&P 500, Nasdaq 100, and Dow Jones Industrial Average are set to notch nine-week win streaks that began on October 30…In 1985, the S&P 500 and Nasdaq 100 posted 11-week win streaks, according to data going back to 1971.”

“Five Investors On How To Navigate The Bond Market In 2024” (Wall Street Journal). “The model soft landing was engineered by the Alan Greenspan-chaired Fed in 1995: The central bank doubled the fed-funds rate to 6% before cutting it back, without spurring a slowdown. Notably, banks didn’t restrict their lending. Today, they are tightening terms on everything from individual borrowers to big corporations.”

“Tech Stocks Just Wrapped Up One Of Their Best Years In Past Two Decades After 2022 Slump” (CNBC). “Across the industry, the big story this year was a return to risk, driven by the Federal Reserve halting its interest rate hikes and a more stable outlook on inflation. Companies also benefited from the cost-cutting measures they put in place starting late last year to focus on efficiency and bolstering profit margins.”

“Tiger Global’s Coleman Regains Control Of Venture Unit After Losses, Client Complaints” (Bloomberg). “The rush to deploy almost $20 billion that Tiger raised near the height of the venture capital boom led to a 33% writedown of its private portfolio last year and an additional 6% this year, prompting questions about whether [Chase] Coleman had let the firm spin out of his control. Tiger announced last month that Shleifer, the driving force behind the VC expansion, will transition into a senior adviser role — the most significant management shakeup since the firm’s founding in 2001.”

What we’re reading (12/28)

“Startup Bubble Fueled By Fed’s Cheap Money Policy Finally Burst In 2023” (CNBC). “[M]oney was cheap and plentiful. The Federal Reserve’s near-zero interest rate policy had been in effect since after the 2008 financial crisis, and Covid stimulus efforts added fuel to the fire, incentivizing investors to take risks, betting on the next big innovation. And crypto. This year, it all unwound.”

“The State Of Deals” (New York Times). “Despite some notable transactions, the year presented challenges to the bankers and lawyers who advise corporate clients on big takeovers and initial public offerings. Global M.&A. fell to a 10-year low. About 53,529 deals worth a combined $2.9 trillion were announced, down 17 percent annually by volume, according to data from L.S.E.G.”

“Steve Ballmer Is Set To Make $1 Billion A Year For Doing Nothing” (CNN Business). “For most people, passive income is a bit of extra pocket change that requires minimal effort to earn to supplement a main source of income. For Steve Ballmer, it’s $1 billion. Ballmer, the sixth richest person in the world, is due to collect that much in dividends from Microsoft in 2024. This comes after the tech giant boosted its quarterly dividend payout to 75 cents a share, or $3 a share annually.”

“The Zeitgeist Is Changing. A Strange, Romantic Backlash To The Tech Era Looms” (The Guardian). “Cultural upheavals can be a riddle in real time. Trends that might seem obvious in hindsight are poorly understood in the present or not fathomed at all. We live in turbulent times now, at the tail end of a pandemic that killed millions and, for a period, reordered existence as we knew it. It marked, perhaps more than any other crisis in modern times, a new era, the world of the 2010s wrenched away for good.”

“Trick Your Brain Into Being Better With Money” (Wall Street Journal). “‘Our brains are fundamentally not wired to make the decisions that we’re asking ourselves to make,’ she said. ‘You’re asking a single individual to stand up against a whole host of organizations who are incentivized to get you to part with your money as quickly as possible.’”

January picks available soon

I’ll be publishing the Prime and Select picks for the month of January before Tuesday, January 2 (the first trading day of the month). As always, SPC’s performance measurement for the month of December, as well as SPC’s cumulative performance, will assume the sale of the December picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Friday, December 29). Performance tracking for the month of January will assume the January picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Tuesday, January 2).

What we’re reading (12/17)

“Wall Street's Most Vicious Vultures Are About To Get Torn To Shreds” (Insider). “Over at Carlyle Group, distributable earnings — profits that can be returned to shareholders — fell to $367.4 million in the third quarter, down 43% from the same time last year. At KKR, distributable earnings in the third quarter were down 6.6% compared to the same time the year before, much better than the 23% year-on-year drop the firm reported in the second quarter. This summer, the ratings agency Moody's downgraded Blackstone, Apollo, and KKR because of their large commercial real-estate holdings (only 66% of US workers have returned to the office full time, most reports indicate).”

“Home Buyers Are Ready To Buy. But Sellers Aren’t Selling.” (Wall Street Journal). “Home sales this year are on track to be the lowest since at least 2011. But as mortgage rates retreated from nearly 8% in October to below 7% last week, buyers are responding. Mortgage applications have increased for six straight weeks on a seasonally adjusted basis, though they are still down from year-ago levels, according to the Mortgage Bankers Association. Real-estate agents say they expect more buying activity in the new year, after home shoppers return from a break over the holidays. ‘There’s just a lot of pent-up demand,’ said Lisa Sturtevant, chief economist at Bright MLS, a real-estate listings database that covers parts of six eastern states and Washington, D.C. “

“We Predict 6 Interest-Rate Cuts In 2024” (Morningstar). “In addition to the first cut in March 2024, we’re expecting a total of six cuts for the whole year. That will bring the federal-funds rate down from currently at a 5.25% to 5.50% range. It will take that down to a 3.75%-4.00% target range. So, that’s a 150-basis-point reduction from current levels by the end of 2024. And then, we’re expecting further cuts, another 150 basis points of cuts in 2025, taking the federal-funds rate down to 2.25% by the end of that year. And then, even in 2026, we expect it to get down as low as 1.75%. So that’s taking the federal-funds rate really all the way back down to about prepandemic levels. Long-term rates should fall accordingly, and that will help ensure that the economy grows at its full potential, and we don’t see a recession in that we ultimately see the soft landing that is very much possible.”

“We’re Still At Risk For Another ‘Everything Shortage’” (Freight Waves). “Ultimately, the reason we’re no longer in a supply chain crisis isn’t that companies did anything particularly amazing to overhaul their manufacturing and distribution systems. Rather, we just started to slow down our buying from the peak of 2020 to 2021 — and corporations were able to catch up at last.”

“Vase Bought At Goodwill For $3.99 Sells For More Than $100,000” (New York Times). “On Wednesday, the vase was auctioned for $107,100 to an unidentified private art collector in Europe. About $83,500 went to Ms. Vincent and about $23,600 went to Wright Auction House. Specialists who evaluated the piece determined it was part of the ‘Pennellate’ series that Mr. Scarpa designed in the 1940s. It’s unclear how many vases of this kind were made, Mr. Wright said.”

What we’re reading (12/16)

“A Quant Winter’s Tale” (Financial Times). “[W]hat went so horribly wrong for many factor-focused quant funds like AQR from 2018? Answers vary, but a few common theories have emerged. Some think that investment strategies based even on copious amounts of historical data cannot work for perpetuity — market regimes come and go, and as anomalies become well-known, they often disappear.”

“Despite Record Home Prices, Housing Is About To Drag Inflation Down” (Wall Street Journal). “So it might seem strange that shelter inflation is expected to slow. But shelter inflation is based on rents, not housing prices, and rent growth over the past year has fallen to 3.3% through November, according to Zillow, lower than the average during 2018-19.”

“Baseball Star Shohei Ohtani's New Contract Is A Massive Tax Avoidance Scheme. Nice!” (Reason). “By taking most of his pay in what's effectively a fixed annuity rather than getting it all in his paycheck, Ohtani could save as much as $98 million in state taxes if he relocates out of California by 2034, according to an analysis by the California Center for Jobs & the Economy.”

“Argentina’s New President Javier Milei Does Away With Culture Ministry 24 Hours After Taking Office” (The Art Newspaper). “It only took a day into his term as Argentina’s new president for Javier Milei to get rid of the Ministry of Culture. Milei was inaugurated on 10 December, and the following day, the boisterously libertarian economist and former television commentator fulfilled his campaign promise with typical bravado.”

“Surge In Number Of ‘Extremely Productive’ Authors Concerns Scientists” (Nature). “Up to four times more researchers pump out more than 60 papers a year than less than a decade ago. Saudi Arabia and Thailand saw the sharpest uptick in the number of such scientists over the past few years, according to a preprint posted on bioRxiv on 24 November. The increase in these ‘extremely productive’ authors raises concerns that some researchers are resorting to dubious methods to publish extra papers.”

What we’re reading (12/10)

“Investor Group Launches $5.8 Billion Buyout Bid For Macy’s” (Wall Street Journal). “Arkhouse Management, a real-estate focused investing firm, and Brigade Capital Management, a global asset manager, on Dec. 1 submitted a proposal to acquire the Macy’s stock they don’t already own for $21 a share, people familiar with the matter said. That represented a roughly 32% premium to where shares closed the day before.”

“A String Of Lawsuits Takes Aim At Regulators” (DealBook). “When Meta sued the Federal Trade Commission last week — the social networking giant’s latest effort to block new restrictions on its monetization of user data — it used an increasingly common argument against government regulators: The complaint alleged that the structure of the F.T.C. was unconstitutional and that its in-house trials were invalid. The lawsuit is the latest in a growing campaign to weaken regulators that could upend enforcement at a suite of agencies — including the F.T.C., the Securities and Exchange Commission and the Internal Revenue Service.”

“Troubled Retailer Sears Quietly Reopens Two Stores. What Is Behind The Comeback?” (CNN Business). “To the casual shopper, Sears, one of America’s oldest retailers, may appear to be on life support. The department store chain that once reinvented how Americans shopped now barely has a brick-and-mortar footprint after a 2018 bankruptcy and hundreds of store closures. But talk of Sears’ demise may be premature: just two months ago, a previously shuttered Sears in Burbank, California, quietly turned the lights back on. Two weeks after that, another reopened in Union Gap, Washington.”

“The Progressive Case For Bidenomics” (New York Times). “About the good economic news: This week two excellent economic reports were added to the pile. On Wednesday, the Bureau of Labor Statistics reported that in the third quarter, labor productivity rose at an annual rate of 5.2 percent, which is really, really fast. It’s too soon to call a trend, but there is increasing reason to hope that our economy is capable of growing considerably faster than we previously thought.”

“Big VC Funds Are Underperforming Smaller Ones And Their Future Is Dim” (Institutional Investor). “Only 17 percent of venture funds larger than $750 million have returned to investors more than 2.5-times the total value to paid-in capital, after fees and expenses. Meanwhile, 25 percent of funds smaller than $350 million achieved the same, according to an analysis of PitchBook data on more than 1,300 funds dating back to 1978 by Santé. Put another way: a smaller fund is roughly 50 percent more likely to return more than 2.5-times TVPI than a large one.”

What we’re reading (12/9)

“Decisive Moment Arrives With $4 Trillion Stocks Rally At Stake” (Bloomberg). “Investors are facing a pivotal week as a key measure of inflation that hits Tuesday and the Federal Reserve’s interest-rate decision on Wednesday are expected to set the tone for the stock market and economy heading into 2024.”

“A New Era Of Income Investing Is Turning Boomers Into Bond Buyers” (Wall Street Journal). “Decades of stellar stock-market returns produced by a series of bull markets that began in 1982 coincided with boomers’ prime working years and made their nest eggs grow. Their good fortune continues in retirement. The recent surge in interest rates that sent bond yields near a 15-year high is the “single best economic and financial development in 20 years” for retirees, said Joe Davis, global chief economist at Vanguard. That shift is turning the stock-loving Woodstock generation into bond buyers. With current yields on 10-year U.S. Treasury notes at 4.23%, boomers, ages 59 to 77, have reason to move money into the more conservative investments. The Gen Xers behind them—now around ages 43 to 58—are eyeing those moves, too.”

“Now Is A ‘Fantastic Time’ To Add Small- And Midsize-Company Stocks To Your Portfolio, Says Investing Pro” (CNBC). “Stocks in S&P small- and mid-cap indexes both currently trade at about 14 times estimated earnings for 2024, compared with a ratio of about 20 for the S&P 500. That means small- and mid-caps trade at a roughly 30% discount to large-caps. What’s more, small and medium stocks are looking cheap relative to their history. Midsize stocks are trading at a 14% discount relative to their average P/E dating back to 2005, according to data provided to CNBC Make It by CFRA chief investment strategist Sam Stovall. Small-company stocks are trading at a 19% discount to their historical average.”

“Dodgers’ Decade-Long Pursuit Of Shohei Ohtani Finally Comes Through” (Sports Illustrated). “In the end, of course, it is always about money—and in this case more than any ever handed to an athlete: $700 million over 10 years. But it was Ohtani who told his agent, Nez Balelo, to craft a deal with so much deferred money that it would reduce the Dodgers’ hit toward their competitive tax rate.”

“Jeremy Grantham Warns Stocks Could Fall As Much As 52% As A Recession Awaits The US Economy — But Says To Look To These 2 Investments For Long-Term Outperformance” (Insider). “In January 2022, Grantham published a note titled ‘Let the Wild Rumpus Begin,’ in which he said a bubble in the S&P 500 was due to unwind spectacularly. Since then, the index has been just about flat. But he’s standing by that call, as he's seen bigger rallies unfold after calling a bubble. Take 1998, for example, when he warned of the dot-com bubble. Despite being at record valuations, the S&P 500 rose another 50% after his prediction. While he was early, Grantham's forecast, of course, proved correct in 2000, when the market began its 46% descent. He was also prescient about the 2008 crisis by both predicting the market's crash and nailing the bottom within days of the low in March 2009.”

What we’re reading (12/7)

“The Most Important Debate On Wall Street: Is Inflation Licked?” (Wall Street Journal). “Most of Wall Street thinks inflation has been conquered. There is a lot at stake if they are wrong…[s]till, the Fed’s preferred inflation gauge remains elevated at around 3%. And some investors are concerned it could be hard to get all the way back to 2%, leaving stocks and bonds vulnerable to a pullback.”

“What A Slowing Jobs Market Might Mean For Interest Rates” (New York Times). “Bonds have been on an impressive monthlong rally fueled by investors’ hopes that the Fed will begin cutting interest rates next year. That bet may be tested as soon as Friday with the release of new payroll data that Wall Street expects will show the labor market cooling further.”

“Greedflation: Corporate Profiteering ‘Significantly’ Boosted Global Prices, Study Shows” (The Guardian). “Profiteering has played a significant role in boosting inflation during 2022, according to a report that calls for a global corporation tax to curb excess profits. Analysis of the financial accounts of many of the UK’s biggest businesses found that profits far outpaced increases in costs, helping to push up inflation last year to levels not seen since the early 1980s.”

“Why Bonds Are Making A Huge Comeback” (Morningstar). “Just two months ago, the Core Bond Index was flirting with an unprecedented third straight year of declines as yields surged to their highest level since 2007, thanks to an unexpectedly resilient economy. “People are surprised by the speed with which the narrative has shifted,” says Kelsey Berro, a fixed-income portfolio manager at JPMorgan Asset Management.”

“From Unicorns To Zombies: Tech Start-Ups Run Out Of Time and Money” (New York Times). “WeWork raised more than $11 billion in funding as a private company. Olive AI, a health care start-up, gathered $852 million. Convoy, a freight start-up, raised $900 million. And Veev, a home construction start-up, amassed $647 million. In the last six weeks, they all filed for bankruptcy or shut down. They are the most recent failures in a tech start-up collapse that investors say is only beginning.”

What we’re reading (12/6)

“Ego, Fear And Money: How The A.I. Fuse Was Lit” (New York Times). “At the heart of this competition is a brain-stretching paradox. The people who say they are most worried about A.I. are among the most determined to create it and enjoy its riches. They have justified their ambition with their strong belief that they alone can keep A.I. from endangering Earth.”

“The Inside Story of Microsoft’s Partnership with OpenAI” (The New Yorker). “On the video call with Nadella, Microsoft executives began outlining possible responses to Altman’s ouster. Plan A was to attempt to stabilize the situation by supporting Murati, and then working with her to see if the startup’s board might reverse its decision, or at least explain its rash move. If the board refused to do either, the Microsoft executives would move to Plan B: using their company’s considerable leverage—including the billions of dollars it had pledged to OpenAI but had not yet handed over—to help get Altman reappointed as C.E.O., and to reconfigure OpenAI’s governance by replacing board members. Someone close to this conversation told me, ‘From our perspective, things had been working great, and OpenAI’s board had done something erratic, so we thought, let’s put some adults in charge and get back to what we had.’”

“OpenAI Employees Really, Really Did Not Want To Go Work For Microsoft” (Insider). “One current OpenAI employee admitted that, despite nearly everyone on staff signing up to follow Altman out the door, ‘No one wanted to go to Microsoft.’ This person called the company ‘the biggest and slowest’ of all the major tech companies — the exact opposite of how OpenAI employees see their startup.”

“McKinsey Shrinks New Partner Class By Roughly 35%” (Wall Street Journal). “As the economy has slowed, companies in a range of industries have been re-evaluating their corporate overhead and cutting white-collar jobs. That retrenchment appears to be having an effect on consulting demand. McKinsey early this year launched a restructuring that eliminated roughly 1,400 roles, among the firm’s biggest head-count reductions to date. The firm, along with rival Bain, also delayed start dates for new M.B.A. hires.”

“Wall Street CEOs Try To Convince Senators That New Capital Rules Will Hurt Americans As Well As Banks” (CNBC). “Wall Street CEOs on Wednesday pushed back against proposed regulations aimed at raising the levels of capital they’ll need to hold against future risks. In prepared remarks and responses to lawmakers’ questions during an annual Senate oversight hearing, the CEOs of eight banks sought to raise alarms over the impact of the changes. In July, U.S. regulators unveiled a sweeping set of higher standards governing banks known as the Basel 3 endgame…If unchanged, the regulations would raise capital requirements on the largest banks by about 25%, Dimon claimed.”

What we’re reading (12/5)

“The Bigger Airlines Get, The Worse They Become” (New York Times). “If there’s one lesson we’ve learned from the recent history of the airline industry, it’s this: The bigger airlines get, the worse they become. The prices get higher, the seats smaller, the service ever snarkier. The mergers over the past 15 years that produced the “big three” of United Airlines, Delta Air Lines and American Airlines (eliminating Continental, Northwest and US Airways) — which, along with Southwest Airlines, now dominate the market — have not done Americans any favors. We’ve ended up with airlines that offer less for more and have become better than ever at getting bailouts from Congress. That’s the context in which JetBlue Airways is now seeking to buy Spirit Airlines, the nation’s largest ultra-low-cost airline.”

“Smaller Airlines Seek Mergers To Compete With Industry Giants” (New York Times). “The dominant position of the big four airlines featured prominently in JetBlue’s defense arguments in a federal antitrust case brought by the Justice Department against its acquisition of Spirit. In his closing arguments on Tuesday, Ryan Shores a lawyer for JetBlue, said that smaller airlines ‘need the network breadth to be able to compete with the larger airlines.’”

“Crypto Trading On Robinhood Surges 75% Amid Bitcoin Hype While Stock Activity Goes Flat” (Business Insider). “Crypto notional trading volumes jumped roughly 75% in November from October's levels, the company said Monday. Meanwhile, equity and options contracts trading roughly remained the same.”

“Box’s Stock Drops 11% On Tepid Revenue Forecast” (MarketWatch). “Box posted fiscal third-quarter net income of $10.7 million, or 4 cents a share, compared with net income of $9.9 million, or 3 cents a share, in the year-ago quarter. Adjusted earnings were 36 cents a share. Revenue increased 5% to $261.5 million from $249.5 million a year ago. Analysts surveyed by FactSet had expected on average net income of 38 cents a share on revenue of $262 million.”

“Supreme Court Wary Of Remaking Income Tax” (Wall Street Journal). “The Supreme Court looked unlikely to impose strict new limits on Congress’s power to tax income, with some conservative and liberal justices alike signaling wariness about upending long-settled principles of the federal tax code. Tuesday’s arguments involved a relatively small payment required by a one-time charge under the 2017 tax overhaul. Challengers are seeking a ruling limiting income that can be taxed to money “realized” by taxpayers—that is, cash they receive or in some fashion control, as opposed to a mere increase in the value of their holdings.”

What we’re reading (12/4)

“Don’t Put Your Eggs in One Basket. That Investing Principle Still Holds.” (New York Times). “There’s no shortage of reports from asset management firms arguing that hedge funds and private equity funds need to be added into the intelligent investor’s mix. And you can also delve into futures and options that can limit your losses, at a cost. Once you’ve started down this route, why not go further afield? Cryptocurrency: People in the industry claim that it’s an asset class and should be represented in your portfolio. I’ve not seen solid evidence that any of these things are needed as core investments.”

“Who Got A Lot Richer And Who Didn’t During The Pandemic” (Wall Street Journal). “The pandemic made Americans richer across every racial, ethnic and income group—though not equally. Home values shot up, and with fewer opportunities to spend money during lockdowns, many people paid down debt and boosted savings. Between 2019 and 2021, the median household’s net worth increased 30% to $166,900, according to a report out Monday from Pew Research Center.”

“Unknown Traders Appear To Have Anticipated October 7 Hamas Attack, Research Finds” (CNN Business). “Bets against the value of Israeli companies spiked in the days before the October 7th Hamas attacks, suggesting some traders may have had advance knowledge of the looming terror attack and profited off it, according to new research released Monday…Those bets against the value of the MSCI Israel Exchange Traded Fund (ETF) in the days before the October 7 attack ‘far exceeded’ the short selling activity that took place during the Covid-19 pandemic, the 2014 Israel-Gaza war and the 2008 global financial crisis, the paper finds.”

“Bill Gates: How I Invest My Money In A Warming World” (New York Times). “We’re not doomed, nor do we have all the solutions. What we do have is human ingenuity, our greatest asset. But to overcome climate change, we need rich individuals, companies and countries to step up to ensure green technologies are affordable for everyone, everywhere — including less wealthy countries that are large emitters, like China, India and Brazil.”

“William Rehnquist Proposed To Sandra Day O’Connor. She Said No.” (Washington Post). “Decades before they would serve together on the Supreme Court, William Rehnquist and Sandra Day O’Connor were engaged in a different type of courtship. The two grew close while attending Stanford Law School — they regularly shared notes and eventually became a couple. Although Sandra Day, as she was known then, eventually broke up with Rehnquist and married a different Stanford Law classmate, John O’Connor, an author revealed to NPR in 2018 that she first turned down a marriage proposal from Rehnquist, the future chief justice, in the early 1950s.”

What we’re reading (12/3)

“Will High Interest Rates Trigger A Debt Disaster?” (Project Syndicate). “Deficits and high debt-to-GDP ratios are not the problem. What matters is the difference between the interest rate and the growth rate. For many years, the US Congressional Budget Office has regularly projected that high interest rates and low growth rates would lead to a debt explosion. But those projections were always wrong – until the US Federal Reserve started jacking up interest rates last year.”

“Momentum Investing Has Struggled For 20 Years. Here’s Why” (Wall Street Journal). “From 1940 through mid-2002, a portfolio rebalanced monthly owning the 10% of stocks with the greatest trailing-year returns, while simultaneously shorting the 10% of stocks with the trailing year’s worst returns, appreciated at an annualized pace of 17.4%, before transaction costs. Since then, this portfolio has declined at a 3.6% annualized pace. In contrast, the trend of the overall stock market remained steady throughout both periods: 11.4% annualized appreciation before mid-2002 and 10.4% thereafter. What changed? A new study attributes the shift primarily to Morningstar in mid-2002 changing the methodology for its mutual-fund star-rating system.”

“There Really Was A Corporate Conspiracy To Inflate Egg Prices, And It's Been Proven In Federal Court” (Dealbreaker). “Some precedent now indicates that nefarious corporate scheming may indeed be possible within the U.S. egg market. On November 21, 2023, a federal jury in the Northern District of Illinois delivered its verdict finding that the two largest domestic egg producers, Cal-Maine Foods Inc. and Rose Acre Farms Inc., together with two egg-industry trade groups, conspired to reduce supply in order to artificially drive up the price of eggs.”

“Hundreds Of Stocks Have Fallen Below $1. They’re Still Listed On Nasdaq.” (Wall Street Journal). “As of Friday, 557 stocks listed on U.S. exchanges were trading below $1 a share, up from fewer than a dozen in early 2021, according to Dow Jones Market Data. The majority of these stocks—464 of them—are listed on the Nasdaq Stock Market, whose rules require companies to maintain a minimum share price of $1 or risk being delisted.”

“Gold Bars And Tokyo Apartments: How Money Is Flowing Out Of China.” (New York Times). “The outbound shift of money in part indicates unease inside China about the sputtering recovery after the pandemic as well as deeper problems, like an alarming slowdown in real estate, the main storehouse of wealth for families. For some people, it is also a reaction to fears about the direction of the economy under China’s leader, Xi Jinping, who has cracked down on business and strengthened the government’s hand in many aspects of society.”

November performance update

Hi friends, here with a monthly performance update for November:

Prime: +5.25%

Select: +8.22%

SPY ETF: +8.87%

Bogleheads Portfolio (80% VTI + 20% BND): +8.25%

Under typical circumstances I would be overjoyed about a 5.25 percent monthly return (~85 percent when annualized) for SPC’s flagship strategy and a 8.22 percent return for the “B-team” Select strategy. Of course, November was explosive for the market as a whole, with SPY up 8.87 percent, besting its average annual return historically. The macroeconomic backdrop would seem to have been unusually supportive of the value of corporate assets , with a consensus emerging this month that a so-called “soft-landing” (deceleration in consumer prices without a recession) is on offer.

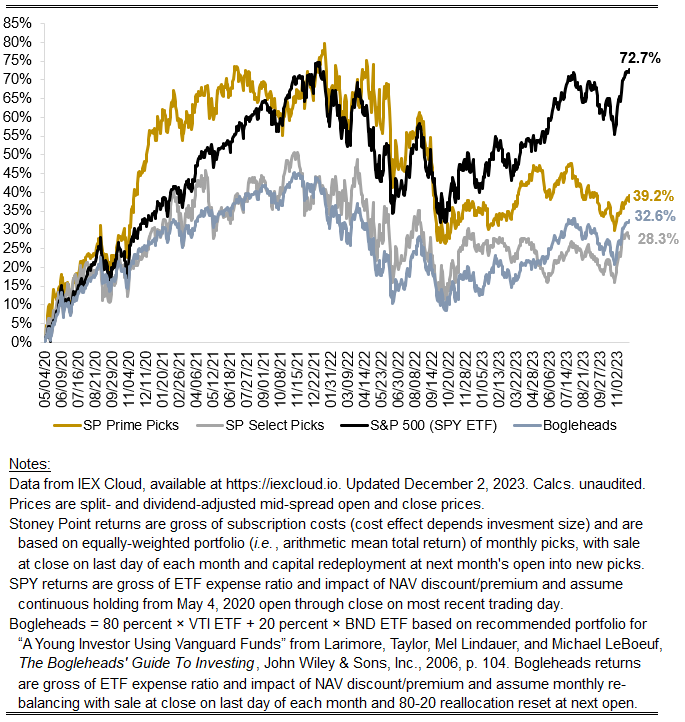

It’s worth dwelling on the picture below for a moment, which starts early in the pandemic and tells quite a story. There was a sharp rise in equity values concurrent with policy measures that rendered money unusually cheap (lowering hurdle rates and raising NPVs, in the case of monetary policy; raising profit expectations and thus raising NVPs, in the case of fiscal policy). This effect was not unique to corporate equities, of course — residential real estate equity investments experienced the same lift, for example, as did many other assets/products. Price appreciation across the economy is, by definition, inflation of the sort that concerns central bankers, warranting the reverse policy response (higher rates, lower NPVs) which is the story of 2022 in the chart. But here we are in 2023 and, despite more fits and starts, the trend kind of parrallels 2020/2021 (for the market overall), which is just kind of extraordinary! Consider what the 72.7 percent for the SPY ETF implies: the capital stock of the S&P 500 is worth nearly twice as much in aggregate as it was in May of 2020, three and a half years ago. That rate of appreciation dwarfs the base rate one would extrapolate from the history of that index dating back to the 20s, and probably similar composite indices that date back to the 19th century. I expect — but haven’t checked — that it dwarfs the rate of return on a hypothetical index one might construct that includes stocks all the way back to the 1700s and 1600s (e.g., V.o.C., B.o.E., etc.).

The comparison of the black line to the others also tells a story: compared to S&P 500, the Stoney Point strategies heavily weight indicia that characterize “value stocks” (low market values relative to fundamental/theoretical drivers of value). This is by design, though the market has rewarded it comparably less lately. The Bogleheads portfolio also differs from the SPY ETF in ways that are important for understanding the chart. Notably, the Vanguard VTI ETF (which gets 80 percent in the portfolio), tracks the CRSP US Total Market index, which reflects the performance of a much wider cross section of U.S. equities than the S&P 500, including mid- and small-cap companies. Smaller equities have also been rewarded less lately, particularly in 2022. But there are reasons to think that is changing alongside the emerging consensus about a soft landing: in November, the most widely followed U.S. small-cap index, the Russell 2000, was up nearly 12.5 percent, that is to say roughly a third better than the S&P 500.

One footnote I would be remiss not to mention: I’ve incorporated a few additional value indicators into the SPC model starting with December’s picks. Some of these are novel, some less so; the philosophy behind including them is to gain precision in identifying “value” stocks. The denominator for all of these “value” ratios is the same: current price. Realized returns are tautologically equal to End Price / Current Price - 1, so value ratios equal to x / Current Price (where x is some fundamental determinant of value) are all different ways of extracting information about the overall market’s expectation for future returns. Where value-oriented investors often disagree is what the best “x” is.

Stoney Point Total Performance History

December picks available now

The new Prime and Select picks for December are available starting now, based on a model run put through today (November 30). As a note, I will be measuring the performance on these picks from the first trading day of the month, Friday, December 1, 2023 (at the mid-spread open price) through the last trading day of the month, Friday, December 29, 2023 (at the mid-spread closing price).

What we’re reading (11/30)

“Cigna, Humana In Talks For Blockbuster Merger” (Wall Street Journal). “The companies are discussing a stock-and-cash deal that could be finalized by the end of the year, assuming the talks don’t fall apart, according to people familiar with the matter.”

“Carlyle GrouAand WP Carey Set To Join S&P MidCap 400; Others To Join S&P SmallCap 600” (PR Newswire). “S&P Dow Jones Indices will make the following changes to the S&P MidCap 400 and S&P SmallCap 600 effective prior to the open of trading on Thursday, November 30: Carlyle Group Inc. (NASD: CG) will replace ICU Medical Inc. (NASD: ICUI) in the S&P MidCap 400…WP Carey Inc. (NYSE: WPC) will replace Worthington Industries Inc. (NYSE: WOR) in the S&P MidCap 400. Worthington Industries will replace Avantax, Inc. (NASD: AVTA) in the S&P SmallCap 600.”

“Charlie Munger’s Life Was About Way More Than Money” (Wall Street Journal). “It’s 1931, and a boy and girl, both about seven years old, are playing on a swing set on N. 41st St. in Omaha. A stray dog appears and, without warning, charges. The children try to fight the dog off. Somehow, the boy is unscathed, but the dog bites the girl. She contracts rabies and, not long after, dies. The boy lives. His name? Charles Thomas Munger. Charlie Munger, the brilliant investing billionaire who died on Tuesday in a California hospital 34 days before his 100th birthday, told me that story when I interviewed him last month. I’d asked the vice chairman of Warren Buffett’s Berkshire Hathaway: What do you think of people who attribute their success solely to their own brilliance and hard work? ‘I think that’s nonsense,’ Munger snapped, then told his story, which I can’t recall him ever publicly recounting. ‘That damn dog wasn’t 3 inches from me,” he said. “All my life I’ve wondered: Why did it bite her instead of me? It was sheer luck that I lived and she died.’ He added: ‘The records of people and companies that are outliers are always a mix of a reasonable amount of intelligence, hard work and a lot of luck.’”

“Hedge Fund Dollar Bulls Hold Fast Even As US Currency Erases Gains” (Bloomberg). “Hedge funds piled into bullish dollar bets this month despite the currency’s slide on softening US economic data and increasing expectations that the Federal Reserve’s most aggressive rate-hiking cycle in a generation is near an end.”

“Perhaps Intergenerational Mobility Has Not Declined In The United States After All” (Marginal Revolution). “From the latest American Economic Review: ‘A large body of evidence finds that relative mobility in the US has declined over the past 150 years. However, long-run mobility estimates are usually based on White samples and therefore do not account for the limited opportunities available for nonwhite families. Moreover, historical data measure the father’s status with error, which biases estimates toward greater mobility. Using linked census data from 1850 to 1940, I show that accounting for race and measurement error can double estimates of intergenerational persistence. Updated estimates imply that there is greater equality of opportunity today than in the past, mostly because opportunity was never that equal.’ That is from Zachary Ward of Baylor University. If that is true, and it may be, how many popular economics books from the last twenty years need to be tossed out? How many ‘intergenerational mobility is declining’ newspaper columns and magazine articles? Ouch. No single article settles a question, but for now this seems to be the best, most up to date word on the matter.”

What we’re reading (11/28)

“Charlie Munger, Who Helped Buffett Build Berkshire, Dies At 99” (Bloomberg). “Charles Munger, the alter ego, sidekick and foil to Warren Buffett for almost 60 years as they transformed Berkshire Hathaway Inc. from a failing textile maker into an empire, has died. He was 99.”

“Pressure Mounts On Private Equity-Backed Company Finance Chiefs As Market Shifts” (Wall Street Journal). “Private-equity firms have turned to smaller, tuck-in acquisitions to expand the companies they back as debt remains expensive and valuations for many larger businesses remain elevated. But some company CFOs are so used to focusing on managing day-to-day operations that they struggle to adapt to a sponsor’s more expansive objectives, according to Neely, who worked at several other private equity-backed companies before joining Specialty1. ‘[CFOs may think] I don’t even have my house in order yet and you want me to go look at this other house that you potentially want to buy?’ he said.”

“The Pension: That Rare Retirement Benefit Gets A Fresh Look” (New York Times). “Only about one in 10 Americans working in the private sector today participates in a defined-benefit pension plan, while roughly half contribute to 401(k)-type, defined-contribution plans, which are funded with their pretax dollars and, in many cases, employer contributions.”

“Home Prices Kept Rising Even As Mortgage Rates Surged, S&P Case-Shiller Says” (CNBC). “Nationally, prices were 3.9% higher in September compared with the same month a year earlier, up from a 2.5% annual gain in August, according to the S&P CoreLogic Case-Shiller Index. This occurred as the average rate on the 30-year fixed mortgage climbed toward 8%.”

“Shein’s Big I.P.O. Test” (DealBook). “The company and its underwriters are betting that investors will be more receptive to I.P.O.s, even though high-profile market debuts this fall largely fizzled out. Shein is also testing whether it can endure what’s likely to be an increase in political heat on the China-founded e-commerce giant.”