What we’re reading (11/27)

“Investors See Interest-Rate Cuts Coming Soon, Recession Or Not” (Wall Street Journal). “Wall Street is gearing up for rate cuts. Twenty months after the Federal Reserve began a historic campaign against inflation, investors now believe there is a much greater chance that the central bank will cut rates in just four months than raise them again in the foreseeable future. Interest-rate futures indicated Monday a 52% chance the Fed will lower rates by at least a quarter-of-a-percentage point by its May 2024 policy meeting, up from 29% at the end of October, according to CME Group data. The same data pointed to four cuts by the end of the year.”

“E-Commerce Stocks Rally After Black Friday Shoppers Spend Record Online” (CNBC). “Black Friday online spending reached a record $9.8 billion in the U.S., up 7.5% from a year earlier, according to Adobe Analytics. Online sales on Cyber Weekend, the days between Black Friday and Cyber Monday, surged 7.7% to $10.3 billion. Cyber Monday sales are expected to reach up to $12.4 billion, making it the biggest U.S. online shopping day of the year, according to Adobe.”

“Deutsche Bank Makes The Highest S&P 500 Forecast On Wall Street — And Says That May Be Too Conservative” (Morningstar). “A team led by Bankim Chadha, the chief U.S. equity & global strategist, said the S&P 500 SPX has seen solid earnings this year, but ‘perceptions’ remain lackluster, due to still low year-over-year earnings per share (EPS) growth and corporate uncertainty over the macroeconomic outlook. They say that could change in the fourth quarter when year-over-year earnings growth is expected to near 10%.”

“How This First-Time Founder Became A Chicken Tender Billionaire” (Inc.). “When Todd Graves first pitched the idea for Raising Cane's as a college student back in 1994, his Louisiana State University professor hated the concept. A fast-food restaurant that sold only chicken fingers went completely against industry norms. At that time, the sector was focused on adding more variety and healthy items to menus. The professor told Graves that he had not done enough research and gave his hypothetical business plan the lowest grade in the class, a B-. In reality, however, Graves had done plenty of research. ‘I'd basically written the Bible on a chicken finger restaurant. I even knew what our aprons would cost,’ recalls Graves, who spoke to Inc.”

“How Whitney Wolfe Herd’s Fateful Deal With A Russian Mogul Deprived Early Bumble Employees Of A Stock Windfall When She Became A Billionaire” (Business Insider). “For early Bumble employees…the company's unorthodox approach to equity, including selective use of an obscure form of compensation referred to internally as ‘shadow equity,’ remains a perplexing and bitter memory that is difficult to reconcile with Bumble's positive accomplishments and oft-repeated maxim — ‘Bee Kind.’”

December picks available soon

I’ll be publishing the Prime and Select picks for the month of December before Friday, December 1 (the first trading day of the month). As always, SPC’s performance measurement for the month of November, as well as SPC’s cumulative performance, will assume the sale of the November picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Thursday, November 30). Performance tracking for the month of December will assume the December picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Friday, December 1).

What we’re reading (11/25)

“Black Friday Shoppers Spent A Record $9.8 Billion In U.S. Online Sales, Up 7.5% From Last Year” (CNBC). “Black Friday e-commerce spending popped 7.5% from a year earlier, reaching a record $9.8 billion in the U.S., according to an Adobe Analytics report, a further indication that price-conscious consumers want to spend on the best deals and are hunting for those deals online.”

“Home Prices Are Tumbling In These 25 Cities, Giving Hope To Buyers While Costing Owners Who Bought At The Peak Up To $223 Per Day” (Business Insider). “Property values are starting to slide across the nation — for better or worse. Houses are cheaper than they were last year in 25 of the 100 biggest US real estate markets, according to a November 20 report from real estate research site Point2.”

“Struggling Cities Face More Pain From AI Boom” (Tyler Cowen in Bloomberg). “Artificial intelligence is likely to transform our world in many ways, but one that hasn’t received much attention is the technology’s looming impact on real estate. As AI becomes an essential component of both business and daily life, the value of places where those who work on AI want to live will rise, provided these locales have reasonable infrastructure. At the same time, the value of lower-tier cities left out of the AI boom will diminish.”

“Tesla Vs. Toyota Is The New Hot Battle In Cars” (Wall Street Journal). “When Toyota began spreading its hybrid technology to vehicles beyond the Prius, it came at a hefty premium. In 2005, for example, Toyota’s Highlander hybrid cost almost $10,000 more than the base version of the sport-utility vehicle and was engineered to maximize efficiency at the expense of performance. Or, put another way, customers paid more for some noticeable compromises. Today, that’s changed. Toyota hasn’t said what the new Camry will cost, but the current hybrid version starts at a little less than $2,500 more than the base version of the sedan. And Toyota is touting the new hybrid will have more horsepower than the current base version.”

“Pro Dollarization” (John Cochrane). “With President Milei's election in Argentina, dollarization is suddenly on the table. I'm for it. Here's why…Start with "why not?'' Dollarization, not a national currency, is actually a sensible default. The dollar is the US standard of value. We measure length in feet, weight in pounds, and the value of goods in dollars. Why should different countries use different measures of value? Wouldn't it make sense to use a common standard of value? Once upon a time every country, and often every city, had its own weights and measures. That made trade difficult, so we eventually converged on international weights and measures. (Feet and pounds are actually a US anachronism since everyone else uses meters and kilograms. Clearly if we had to start over we'd use SI units, as science and engineering already do.) Moreover, nobody thinks it's a good idea to periodically shorten the meter in order to stimulate the economy, say by making the sale of cloth more profitable. As soon as people figure out they need to buy more cloth to make the same jeans, the profit goes away.”

What we’re reading (11/24)

“Mortgage Rates Fall For Fourth Week But Stay Above 7%” (CNN Business). “The 30-year fixed-rate mortgage fell to an average of 7.29% in the shortened week ending November 22, according to data from Freddie Mac released on Wednesday, a day earlier than normal due to the Thanksgiving holiday. That was down from 7.44% the week before. A year ago, the 30-year fixed-rate was 6.58%.”

“Voters See American Dream Slipping Out Of Reach, WSJ/NORC Poll Shows” (Wall Street Journal). “Only 36% of voters in a new Wall Street Journal/NORC survey said the American dream still holds true, substantially fewer than the 53% who said so in 2012 and 48% in 2016 in similar surveys of adults by another pollster. When a Wall Street Journal poll last year asked whether people who work hard were likely to get ahead in this country, some 68% said yes—nearly twice the share as in the new poll.”

“The Fight For The Soul Of A.I.” (New York Times). “As impressive as they all were [OpenAi employees], I remember telling myself: This isn’t going to last. I thought there was too much money floating around. These people may be earnest researchers, but whether they know it or not, they are still in a race to put out products, generate revenue and be first.”

“A Common, Illegal Tactic Retailers Use To Lure Consumers” (Washington Post). “It’s not hard to find a deal right now; the challenge is knowing whether it’s real. Retailers go into overdrive during the holiday season, flooding inboxes with roaring Black Friday discounts. But many markdowns are not what they seem, industry experts warn. Some sales for 30, 40 and 50 percent off are simply rollbacks, returning prices to their starting points — behavior that has gotten some retailers in legal trouble for violating consumer guidelines.”

“Rising Corporate Bankruptcies And Debt Defaults Are Another Headwind For The Economy, Experts Warn” (Business Insider). “There's a wave of corporate defaults and bankruptcies that could be coming as high interest rates batter US companies. Experts warn it could raise the odds of a recession as high interest rates take their toll on businesses and consumers alike. 516 companies have filed for bankruptcy as of the end of September, according to S&P Global. That number already surpasses the total number of bankruptcy filings recorded in 2021 and 2022.”

What we’re reading (11/23)

“Recession? The Inverted Yield Curve Is Stabilizing. What It Means.” (Barron’s). “The yield curve inversion appears to have stopped narrowing, and that’s not necessarily a bad thing.”

“25% Of Americans Still Have Holiday Debt From Last Year: ‘If You’re In A Hole, Stop Digging,’ Says Money Expert” (CNBC). “For some shoppers, the upcoming holiday season may lead to piling on more debt. About 25% of Americans are still paying off holiday debt from 2022, according to WalletHub’s November holiday shopping survey.”

“Electric Vehicles: Automakers Fail To Dent Tesla’s Lead” (The Week). “‘Normally a 50% increase in sales is considered very good,’ said Jack Ewing in The New York Times. But when it comes to electric vehicles, it’s an alarming slowdown. EVs are still selling ‘faster than any other major category of automobiles.’ They now account for 8% of the total market for new cars sold in the U.S., up from 6% a year earlier. But recently released sales numbers show growth dipping from a year ago, when EV sales were rising at a pace of about 70% year. The data cast ‘doubt on whether generous federal tax credits for EV buyers were working as well as policymakers had hoped,’ and General Motors and Ford, who have pledged billions toward manufacturing more battery powered cars, seem noticeably anxious. Ford recently paused $12 billion in planned spending on EV production, while GM has pushed back launches of a slate of electric trucks and SUVs.”

“The Unproductive Entrepreneurship Of Silicon Valley” (Daniel Drezner). “[W]hat if the reason for government intervention comes from the incompetence and malfeasance of, you know, the entrepreneurs of Silicon Valley? Never forget that it was the likes of Andreessen that invested considerable amount of time and capital into cryptocurrencies, proclaiming that U.S. ‘hyperinflation’ meant a switch to crypto was inevitable. Ironically, it was precisely when U.S. inflation spiked that crypto crashed. The crypto market was not regulated much at all, and the result has been an awful lot of schemes, scams, and cons defrauding the uninformed. That accurately describes what Silicon Valley progeny Sam Bankman-Fried tried to do, and the outcome for him and his investors was pretty bad.”

“The Housing Market Will Be Stuck In A Rut For A Long Time Even If The US Avoids A Recession, Fannie Mae Says” (Business Insider). “The housing market isn't coming out of its deep freeze anytime soon, even if the US economy manages to steer away from a recession in the next year, according to Fannie Mae economists. The government-sponsored mortgage giant highlighted the stagnant US housing market, with existing home sales down 18.9% year per-year in June, according to Fannie Mae's estimate. Mortgage applications, similarly, have fallen to a 28-year-low.”

What we’re reading (11/22)

“Dow Closes Nearly 200 Points Higher Wednesday As Markets Head Into Thanksgiving” (CNBC). “More than half of the stocks trading on the New York Stock Exchange were up Wednesday, indicating widening breadth for the market rally. The tech-heavy Nasdaq also saw greater participation, with 62.9% of the stocks in the index rising. Small- and mid-caps outperformed Wednesday, rising 0.7% and 0.6%, respectively.”

“Binance Guilty Plea Shows What Crypto’s Really About” (Wall Street Journal). “So it turns out that of the two largest crypto exchanges, one was a fraud and the other was a money launderer. Whoever could have guessed? Skeptics of bitcoin and other cryptocurrencies have had their prejudices reinforced. The two main use cases—fraud and crime—have been exposed to the public in dramatic fashion, so now all we have to do is sit back and wait for the inevitable collapse in value.”

“Deutsche Bank, Which Revamped Its Compliance Department 18 Months Ago, Is Revamping Its Compliance Department” (Dealbreaker). “Just over a year-and-a-half ago, Deutsche Bank had a startling revelation: Perhaps, just possibly, the firm’s almost unfathomably awful decade, riddled as it was with fines and failures and regulators complaining about its compliance procedures, had something to do with weakness in, uh, its compliance procedures. Armed with the uncharacteristic bit of self-knowledge, Deutsche proceeded to overhaul those procedures. As the very same compliance department’s busy last 18 months show, said overhaul didn’t exactly work. So the Germans are going to take a page from its many, many regulatory detractors, and simply try the same thing in expectation of a different outcome.”

“The Fallout From Sam Altman’s Return To OpenAI” (Dealbook). “OpenAI’s board will be revamped. Gone are Tasha McCauley, Helen Toner and Ilya Sutskever, three of the four directors who ousted Altman. An “interim” board will take over, led by Bret Taylor, the former Salesforce co-C.E.O., and including Larry Summers, the former Treasury secretary, and Adam D’Angelo, the Quora C.E.O. and a holdover from the last board. That board will help select a bigger permanent one, according to The Verge, which may include representation for Microsoft, OpenAI’s biggest investor. Satya Nadella, Microsoft’s C.E.O., called the development “a first essential step on a path to more stable, well-informed, and effective governance.” It’s not clear what other changes are coming.”

“Dollarization For Argentina?” (Scott Sumner, EconLib). “With Javier Milei’s recent election victory, there is speculation that Argentina might drop the peso and dollarize its economy. I won’t speculate on how likely that is to occur, as I don’t know much about the political situation in Argentina. But I do have a few comments on the economics of dollarization: 1. Dollarization would solve the problem of hyperinflation. 2. If Argentina intends to dollarize, now would be a good time to do so. 3. Dollarization is not a panacea. Argentina still needs Chilean-style economic reforms, and there’s no guarantee that dollarization would lead to those reforms. 4. Dollarization is less risky than a currency board, but not completely free of risk.”

What we’re reading (11/21)

“Binance Crypto Chief Changpeng Zhao Pleads Guilty To Federal Charges” (Washington Post). “Changpeng Zhao, founder of the world’s largest crypto exchange, pleaded guilty Tuesday to violating the Bank Secrecy Act and has agreed to step down as chief executive of Binance, which will pay a $4.3 billion fine, according to court documents.”

“Nvidia’s Sales Surge, With No End In Sight For AI Boom” (Wall Street Journal). “In its latest period, its fiscal third quarter, sales more than tripled to $18.1 billion, well above Wall Street forecasts in a survey of analysts by FactSet. Profits also surged, rising to $9.2 billion compared with $680 million a year earlier and above estimates.”

“Microsoft Exec Says OpenAI Employees Can Join With Same Compensation” (CNBC). “It is not immediately known if the offer is contingent on Altman’s employment at Microsoft. Scott did not respond to CNBC’s request for comment on X. But, the comment gives some clarity to what Microsoft is willing to pay employees and how many it would hire.”

“US Stocks End Streak Of Gains As Fed Minutes Indicate A Restrictive Policy Outlook” (Insider). “US stocks fell on Tuesday with the S&P 500 snapping a five-session winning streak as the latest Fed minutes hinted at a hawkish-leaning central bank. The report dampened hopes for an imminent Fed pivot to rate cuts. Still, no further rate hikes are expected, and an overwhelming majority continue to expect rates to remain at the current 5.25%-5.50% range.”

“US Home Sales On Pace For The Worst Year Since 1993” (CNN Business). “Home sales may have their worst year in 30 years. Sales slumped in October and prices continued to climb, as mortgage rates surged last month and inventory remained extraordinarily low. That kept homebuyers out of the market, according to a monthly report from the National Association of Realtors released Tuesday.”

What we’re reading (11/16)

“Amazon Will Allow Auto Dealers To Sell Cars On Its Site, Starting With Hyundai” (CNBC). “Beginning in 2024, Amazon will let shoppers purchase a new car online, then pick it up or have it delivered by their local dealership. Consumers will be able to search for available vehicles in their area, make a selection, then check out on Amazon using their preferred payment and financing method. The company said the new feature will ‘create another way for dealers to build awareness of their selection and offer convenience to their customers.’”

“These Stocks Are Trailing The Market By The Widest Margin In 25 Years” (Wall Street Journal). “Smaller, speculative companies are in the midst of a furious autumn stock-market rally, but they still have an interest-rate problem. The S&P 600, an index of small companies with an average market value of $1.8 billion, has climbed 8% from its recent low on Oct. 27, slightly trailing the S&P 500. Yet for 2023, it is on pace to trail its large-cap counterpart by the widest margin in a calendar year since 1998. The S&P 600 is up 0.1%, while the S&P 500 has climbed 17%. The Federal Reserve’s interest-rate campaign has hurt small-caps more than their larger peers because small companies tend to issue more floating-rate debt.”

“One-Third Of U.S. Newspapers As Of 2005 Will Be Gone By 2024” (Axios). “The decline of local newspapers accelerated so rapidly in 2023 that analysts now believe the U.S. will have lost one-third of the newspapers it had as of 2005 by the end of next year — rather than in 2025, as originally predicted. Most communities that lose a local newspaper in America usually do not get a replacement, even online.”

“Forget Climate Change & NBFIs, The Biggest Systemic Risk Are The Unrealized Losses In The Banking System” (American Enterprise Institute). “I estimate that, as of June 30, 2023, there were 2372 banks that collectively held 54 percent of the total assets in the banking system with mark-to-market adjusted Tier 1 leverage ratios under 4 percent, the prompt corrective action threshold that classifies a bank as ‘significantly undercapitalized’.”

“America’s Top 1% Don’t Make As Much As You Might Think” (Tyler Cowen in Bloomberg). “Can a single self-published paper really refute decades of work by three famous economists? If the paper is the modestly titled ‘Income Inequality in the United States: Using Tax Data to Measure Long-Term Trends,’ then the answer — with qualifications — is yes…At the very least, the presumption in favor of Piketty, Saez and Zucman is now gone. For the time being, there are better arguments, based on better data, that suggest very different conclusions.”

What we’re reading (11/15)

“US Stocks Close Higher As Investors Cheer Fresh Data Showing Inflation Is Easing” (Business Insider). “US stocks closed higher on Wednesday, extending gains from Tuesday's sharp rally after fresh data showed a continued decline in inflation. The Producer Price Index fell 0.5% in October from the prior month, representing the largest decline since April 2020 and a sharp reversal from the 0.4% gain seen in September. On an annual basis, the PPI rose 1.3%, down from 2.2% in September. The reading follows Tuesday's Consumer Price Index report, which showed prices paid by consumers rose less than expected last month.”

“The Elusive Soft Landing Is Coming Into View” (Wall Street Journal). “Six months ago, the consensus among economists surveyed by The Wall Street Journal was that the economy would enter a recession over the next 12 months. In October’s survey, the average forecast of economists was for no recession. After Tuesday, the probability appears to have dropped further. That, at least, seems to be the verdict of investors who sent stocks up sharply and Treasury bond yields down on news that inflation was surprisingly docile in October. If they are right, it would be highly unusual. In the past 80 years, the Federal Reserve has never managed to bring inflation down substantially without sparking a recession.”

“The Inflation Rally Goes Global” (DealBook). “Market optimists have moved up their bets on rate cuts. Futures markets this morning pointed to the Fed starting to lower borrowing costs by May, sooner than previous estimates of closer to the end of 2024. Less aggressive is Mohit Kumar, the chief financial economist at Jefferies, who wrote today that big rate cuts would begin after the presidential election next year. Jefferies predicts the Fed’s prime lending rate going to 3 percent by the end of 2025 from its current level of 5.25 to 5.5 percent.”

“The Market Thinks The Fed Is Going To Start Cutting Rates Aggressively. Investors Could Be In For A Letdown” (CNBC). “While Fed officials haven’t indicated how many months in a row it will take of easing inflation data to reach that conclusion, 12-month core CPI has fallen each month since April. The Fed prefers core inflation measures as a better gauge of long-run inflation trends. Traders appear to have more certainty than Fed officials at this point. Futures pricing Wednesday indicated no chance of additional hikes this cycle and the first quarter percentage point cut coming in May, followed by another in July, and likely two more before the end of 2024, according to the CME Group’s gauge of pricing in the fed funds futures market.”

“The Rise And Fall Of The World’s Most Successful Joint Venture” (New York Times). “No one uses words like symbiotic today. In Washington, two political parties that agree on almost nothing are united in their depictions of China as a geopolitical rival and a mortal threat to middle-class security. In Beijing, leaders accuse the United States of plotting to deny China’s rightful place as a superpower. As each country seeks to diminish its dependence on the other, businesses worldwide are adapting their supply chains.”

What we’re reading (11/14)

“Cooling Inflation Likely Ends Fed Rate Hikes” (Wall Street Journal). “Inflation’s broad slowdown extended through October, likely ending the Federal Reserve’s historic interest-rate increases and sparking big rallies on Wall Street. Consumer prices overall were flat last month and rose 3.2% from a year earlier, a slower pace than in September, the Labor Department said Tuesday. Overall inflation hit a recent peak of 9.1% in June 2022.”

“S&P 500 Notches Best Day Since April, Dow Leaps Nearly 500 Points On Soft Inflation Report” (CNBC). “Stocks rallied Tuesday, building on their strong November gains, as Wall Street cheered new U.S. inflation data that raised hopes of the Federal Reserve wrapping up its rate-hiking campaign. The Dow Jones Industrial Average jumped 489.83 points, or 1.43%, to end at 34,827.70. The S&P 500 rallied 1.91%, briefly trading above the key 4,500 level, to settle at 4,495.70. It was the best day since April for the broad-market index. The Nasdaq Composite jumped 2.37% to close at 14,094.38.”

“RIP Goldman Sachs” (Business Insider*). “‘It's not the swashbuckling traders of old, and I do think there's some lost romance there,’ says Dees, my fellow analyst who now heads global banking and markets for Goldman. ‘There's a lot of people who look and say, ‘Ah, that period of yesteryear where someone could put a trade on distressed credits in Thailand and make a billion dollars and beat his chest’ — I get it. But that's not realistic. They're nostalgic for a thing that can't exist today at any bank, under the current regulatory system. This place is still about excellence. It's just going to have to be in a different format.’”

“Macro Outlook 2024: The Hard Part Is Over” (Goldman Sachs). “We continue to see only limited recession risk and reaffirm our 15% US n recession probability. We expect several tailwinds to global growth in 2024, including strong real household income growth, a smaller drag from monetary and fiscal tightening, a recovery in manufacturing activity, and an increased willingness of central banks to deliver insurance cuts if growth slows.”

“Investor Michael Burry Of ‘Big Short’ Fame Has Closed Bets Against S&P 500, Nasdaq” (Yahoo! Finance). “Burry's hedge fund Scion Capital disclosed Tuesday in a federal filing with the SEC that it had closed out "put" positions on the SPDR S&P 500 ETF (SPY) and Invesco QQQ Trust (QQQ), which tracks the Nasdaq 100 index, as of the end of September. Those bearish bets amounted to more than $1.6 billion as of the last trading day of the second quarter. The indexes fell 3.6% and 3%, respectively, during the third quarter.”

* Note: As of today, Insider is apparently going back to going as “Business Insider” (see letter from the editor, here).

What we’re reading (11/13)

“Silicon Valley VCs Wanted To Believe SBF’s Lies. Now They Want You To Believe Their Excuses” (Los Angeles Times). “Sequoia Capital wants you to know that it was ‘deliberately misled and lied to’ by convicted cryptocurrency scam artist Sam Bankman-Fried during the discussions that led to its $213.5-million investment in Bankman-Fried’s firm, FTX, last year. That’s an extraordinary admission, given that Sequoia is one of Silicon Valley’s oldest and largest venture investing firms, with an estimated $28.3 billion in assets under management. Yet that’s what Sequoia partner Alfred Lin, who was involved in advancing the FTX investment, asserted following Bankman-Fried’s conviction on seven fraud counts Thursday. ‘Today’s swift and unanimous verdict confirms what we already knew,’ Lin tweeted that day: ‘that SBF misled and deceived so many, from customers and employees to business partners and investors, including myself and Sequoia.’”

“What Is The Goal Of The 60/40 Portfolio?” (Manhattan Institute). “No one can agree whether the main purpose is to diversify or to reduce risk — and they aren’t quite the same thing. I am not a fan of one-size-fits-all financial strategies. Yes, I see the value of making investment as simple as possible, but the right balance of risk and reward is a personal decision, and the most common strategies are either arbitrary or agnostic about crucial details. Which brings me to the subject of this column: the popular yet endlessly criticized 60/40 asset allocation strategy. With bond prices tanking and correlations flipping, last year the 60/40 portfolio had its worst returns in decades. Then again, maybe that was just a blip and investors just need to wait it out.”

“Strip Clubs, Lewd Photos And A Boozy Hotel: The Toxic Atmosphere At Bank Regulator FDIC” (Wall Street Journal). “A toxic work environment at the FDIC, one of the nation’s top banking regulators, has for years caused employees to flee from an agency they say enabled and failed to punish bad behavior, according to a Wall Street Journal investigation based on interviews with FDIC employees as well as legal filings, union grievances, Equal Employment Opportunity complaints, emails, text messages and other internal documents.”

“Inside The Strange, Secretive Rise Of The ‘Overemployed’” (Insider). “[L]ess than a year into the job at IBM, when a recruiter from Meta came calling, [Bryan] Roque had a thought. The normal thing would be to quit his old job and accept the new position, which was also fully remote. But what if he kept his old job, and secretly took on the new one, too? All he had to do was two-time IBM, and he could double his income as well as his job security.”

“Airlines Predict Record Thanksgiving US Holiday Travel” (Reuters). “Airlines for America, an industry group representing American Airlines United Airlines, Delta Air Lines and others, forecasts 29.9 million passengers between Nov. 17-27, an all-time high and up 9% over the 27.5 million in the same period last year -- and up 1.7 million passengers over pre-COVID record levels.”

What we’re reading (11/12)

“Is The Stock Market Rally About To Rev Up?” (Wall Street Journal). “FOMO in the stock market is back. A lightning-fast rebound has driven the S&P 500 up in nine of the past 10 sessions and 7.2% over the past two weeks, the best such stretch of the year. Now, many investors are betting the rally has legs. Some have piled into funds tracking U.S. stocks, while others have abandoned trades that would profit in times of market turmoil. Many have slashed bearish wagers against the S&P 500 and tech-heavy Nasdaq-100 index, fearful of getting caught flat-footed if the big gains continue.”

“Welcome To Hochatown, The Town Created By Airbnb” (New York Times). “But the company’s [AirBnB’s] report also contained a data point that is reverberating through Airbnb boom towns like Hochatown: For the first time since the pandemic recovery, Airbnb’s supply of rental homes is outpacing demand, with supply increasing 19 percent year over year, compared to just 14 percent for demand. That gap can spell disaster for hosts, particularly those who bought houses at the peak of the market with the idea of renting them out. In extreme cases, they are being forced to sell at a loss.”

“Ray Dalio’s Response To ‘The Fund,’ A New Book That Dissects Bridgewater Associates” (Institutional Investor). “Dalio and Bridgewater, which threatened legal action against Copeland and his publisher before the book came out, blasted it Tuesday. In a LinkedIn post, Dalio said the book is ‘another one of those sensational and inaccurate tabloid books written to sell books to people who like gossip. The only thing that’s different about this one is that it’s about me and Bridgewater.’ The billionaire went on to say that Copeland applied for a job at Bridgewater and was rejected before he went on to become a reporter who ‘made a career of writing distorted stories about me and Bridgewater.’ Dalio has said similar things in the past about Copeland and his unfavorable reporting about the founder and the firm. Copeland is an award-winning investigative journalist for The New York Times, who previously spent 10 years covering hedge funds for The Wall Street Journal and worked at Institutional Investor.”

“Your 401(k) Is Falling Behind. Here’s What You Should Do.” (Wall Street Journal). “As tempting as it may be to meddle with your investments, history suggests most investors have a lousy record of timing the market. Financial advisers say the vast majority of Americans should stick to time-tested advice and simply do nothing.”

“36-Hour Shifts, 80-Hour Weeks: Workers Are Being Burned Out By Overtime” (NBC News). “From firehouses and police stations to hospitals and manufacturing plants, workers say they are being required to work increasing overtime hours to make up for post-pandemic worker shortages — leaving them sleep-deprived, scrambling to cover child care duties, and missing birthdays, holidays and vacations. While the extra hours can provide a financial boost, some workers say the trade-off is no longer worth it as they see no end in sight to a problem that has now lasted for several years.”

What we’re reading (11/11)

Happy Veterans Day!

“Claudia Sahm: ‘We Do Not Need A Recession, But We May Get One’” (Financial Times). “What I do know is that the US economy is leaving 2023 in a better place than when it came into it, and a better place than the vast majority of commentators thought it would be in. On balance, inflation is still higher than we had expected, but for almost two years running we’ve had unemployment below 4 per cent, [strong] inflation-adjusted GDP growth and real consumer spending, too. So if you take it all together, that’s really good. And the thing that happened this year that wasn’t supposed to happen was inflation came down markedly and unemployment stayed low. That opens up a conversation of whether we need to have a recession. I have said the whole time that we do not need a recession, but we may get one.”

“Bonds vs. Bond Funds: How Higher Rates Are Changing The Calculation” (Wall Street Journal). “During the yearslong period of near-zero interest rates, the answer seemed simple: Funds had low fees and were easy to buy and sell, and share values rose alongside bond prices. If any one bond defaulted, losses were minimal. The historic declines suffered by major bond funds last year highlighted the risks of that approach. Rising rates crushed funds’ share prices. That is because bond prices drop when new higher-yielding bonds come on the market and make older, lower-yielding bonds less attractive. Because funds’ share values are based on the market price of their bonds, someone who bought shares a few years ago could end up cashing out today with less money than they put in.”

“Google In-House Attys Joked About ‘Fake Privilege,’ Jury Told” (Law360). “Two in-house Google lawyers communicating on an internal company chat joked about ‘fake privilege’ — a practice of unnecessarily involving a lawyer in a matter to make it confidential — an attorney for Epic Games showed jurors in a California federal antitrust case against the tech giant.”

“Xi Jinping’s ‘Old Friends’ From Iowa Get A Dinner Invitation” (Bloomberg). “A group of Chinese President Xi Jinping’s “old friends” from Iowa have been invited to a dinner he will attend in California next week — 38 years after they welcomed the then-unknown party official for a hog roast, farm tours and a Mississippi River boat ride as they showed him how capitalists do agriculture.”

“Inside An OnlyFans Empire: Sex, Influence And The New American Dream” (Washington Post). “In the American creator economy, no platform is quite as direct or effective as OnlyFans. Since launching in 2016, the subscription site known primarily for its explicit videos has become one of the most methodical, cash-rich and least known layers of the online-influencer industry, touching every social platform and, for some creators, unlocking a once-unimaginable level of wealth…If OnlyFans’s creator earnings were taken as a whole, the company would rank around No. 90 on Forbes’s list of the biggest private companies in America by revenue, ahead of Twitter (now called X), Neiman Marcus Group, New Balance, Hard Rock International and Hallmark Cards.”

What we’re reading (11/10)

“How Risky Is Private Credit? Analysts Are Piecing Together Clues” (Wall Street Journal). “‘If rates stay higher for longer—or higher forever—then these companies are not equipped,’ said Ramki Muthukrishnan, head of U.S. leveraged finance at S&P Global. He said companies would struggle to pay their debt. Just 46% of the companies in the analysis would generate positive cash flow from their business operations under S&P’s mildest stress scenario, in which earnings fell by 10% and the Fed’s benchmark rates increased by another 0.5 percentage point, the ratings firm said.”

“Citadel’s Ken Griffin Sees High Inflation Lasting For Decades” (MarketWatch). “…Ken Griffin, head of the Miami-based hedge-fund manager Citadel, said higher baseline inflation may go on for decades, caused by structural changes that are pushing the world toward de-globalization.”

“Moody’s Cuts U.S. Outlook To Negative, Citing Deficits And Political Polarization” (CNBC). “‘In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues,’ the agency said. ‘Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.’”

“Has IBM Built The Next Generation’s 401(k) Plan?” (Morningstar). “Whatever its name, the introduction of the RBA converts IBM’s employee-retirement plan into a hybrid scheme. It will now consist partially of a defined-contribution plan and partially of a defined-benefit plan. Such arrangements are not unique, but they are unusual—particularly when openly coupled with the decision to cancel the company’s 401(k) match program.”

“How To Hijack A Quarter Of A Million Dollars In Rare Japanese Kit Kats” (New York Times). “These particular Kit Kats would become the key players in an ultimately frustrating saga of shell email accounts, phantom truckers, supply-chain fraud and one seriously bewildered cargo freight broker. Interviews and emails shared with The New York Times tell the story of just one instance of ‘strategic theft,’ a growing corner of the criminal world that the F.B.I. has said accounts for some $30 billion in losses a year — with food being among the top targets.”

What we’re reading (11/9)

“Even If The Fed Stays On Hold, Jerome Powell Is Keeping His Options Open” (Wall Street Journal). “Fed Chair Jerome Powell indicated the central bank wouldn’t declare an end to its historic interest-rate increases until it had more evidence that inflation was cooling. Price and wage pressures have eased recently, leading more investors to think the Fed is done raising rates. Powell disappointed those investors in a speech Thursday by explaining why he thinks the Fed is more likely to tighten policy than ease it if any change is warranted.”

“What History Tells Us About The Feel-Bad Economy” (New York Times). “Here’s how I think about it: The supply chain disruptions caused by the pandemic made it inevitable that prices of some goods would rise sharply. The only way to have avoided overall inflation would have been to force major price cuts for other goods and services. And everything we know from history suggests that trying to impose deflation — falling prices — on large parts of the economy would have had disastrous effects on employment and output, something like the quiet depression Britain inflicted on itself after World War I when it tried to go back to the prewar gold standard.”

“Robinhood Misses Q3 Revenue Estimates On Muted Trading Activity” (Reuters). “Robinhood's transaction-based revenue decreased 11% year-over-year to $185 million amid a 13% decline in equities and a 55% decrease in cryptocurrencies. Monthly active users dropped 16% to 10.3 million from a year earlier.”

“Thousands Of AMC Shareholders Wanted The Board To Go, But Abstentions Carried The Day” (MarketWatch). “Tens of thousands of AMC Entertainment Holdings Inc. shareholders voted to, in essence, throw out the entertainment company’s board, but the proposal went nowhere because of no-shows and abstentions.”

“The Fight Over Return-To-Office Is Getting Dirty” (Insider). “As the return-to-office battle has heated up in the past six months, there has been a marked increase in declarations that remote work is less productive. But diving deeper into this evidence reveals flawed logic — and a media industry obsessed with proving bosses right.”

What we’re reading (11/8)

“Warner Bros. Discovery Stock Sinks 19% As Ad Revenue Falls, Zaslav Warns Of ‘Generational Disruption’” (CNBC). “Warner Bros. Discovery’s results reflected dire trends in the legacy media industry. Ad revenue in Warner Bros. Discovery’s TV networks segment fell 12% compared with a year earlier, reflecting a decline in audiences for general entertainment and news programming, as well as soft ad trends in the U.S., the company said.”

“In Regulating A.I., We May Be Doing Too Much. And Too Little.” (Tim Wu, New York Times). “To regulate speculative risks, rather than actual harms, would be unwise, for two reasons. First, overeager regulators can fixate shortsightedly on the wrong target of regulation. For example, to address the dangers of digital piracy, Congress in 1992 extensively regulated digital audio tape, a recording format now remembered only by audio nerds, thanks to the subsequent rise of the internet and MP3s. Similarly, today’s policymakers are preoccupied with large language models like ChatGPT, which could be the future of everything — or, given their gross unreliability stemming from chronic falsification and fabrication, may end up remembered as the Hula Hoop of the A.I. age…Second, pre-emptive regulation can erect barriers to entry for companies interested in breaking into an industry.”

“Why The Fed Shouldn’t Get Credit For The Fall In Inflation” (Wall Street Journal). “Does the Federal Reserve deserve credit for the decline in inflation? The economic evidence is clear: No, not a lot. On the face of it, inflation plummeted after the Fed, flat-footed at first, finally caught up by imposing a rapid series of rate increases. Dig into what actually happened, and there is no obvious link between the Fed action and the slowdown in inflation.”

“Inside Google Billionaire’s Airship That’s Just Been Cleared For Flight And Can Carry 200 Tons Of Humanitarian Cargo” (The U.S. Sun). “Once it flies, the Pathfinder 1 will be the largest aircraft to take to the skies since the tragic Hindenberg disaster in 1937, when Zeppelins were largely abandoned. On the second of its scheduled 1937 transatlantic crossings, the Hindenburg burst into flames over Lakehurst, New Jersey, killing 35 out of 96 passengers and one member of ground crew. The incident triggered a reflexive fear of hydrogen based, in what has come to be known as ‘Hindenberg syndrome’. To combat this paranoia, the Pathfinder 1 will use only non-flammable helium, as opposed to explosive hydrogen.”

“Will We See Less Comovement In Global Economic Growth?” (Marginal Revolution). “In this new world, with these major common shocks neutered, a country’s prosperity will be more dependent on national policies than on global trends. Culture and social trust will matter more too, as will openness to innovation — and, as fertility rates remain low or decline, so will a country’s ability to handle immigration. A country that cannot repopulate itself with peaceful and productive immigrants is going to see its economy shrink in relative terms, and probably experience a lot of bumps on the way down. At the same time, excuses for a lack of prosperity will be harder to come by. The world will not be deglobalized, but it will be somewhat de-risked. Dare we hope that these new arrangements will produce better results than the old?”

What we’re reading (11/6)

“Why Household Wealth Took Off During The Pandemic” (The Week). “The median net worth of American families grew 37% from 2019 to 2022, according to the survey. Not only is this a huge jump considering the economic uncertainties of the pandemic, it's also "the largest since the Fed started its modern survey in 1989," CNBC reported. The Covid-19-era wealth bump is more than double the prior growth record of 18% between 2004 and 2007.”

“These Funds Offer A Way To Lock In High Bond Yields” (Wall Street Journal). “Investors looking to lock in higher yields are turning to a lesser known type of bond fund. Defined-maturity exchange-traded funds have surged in popularity recently. As their name suggests, the bond funds mature and liquidate on a specific date, similar to how an individual bond pays back its principal.”

“Injured By Chicken Nuggets: What’s Known About The Tyson Recall” (Washington Post). “The U.S. Department of Agriculture is recalling about 30,000 pounds of ‘Tyson fully-cooked fun nuggets breaded shaped chicken patties.'‘ The chicken is pressed into dinosaur shapes. Consumers reported finding small metal pieces in the product that caused at least one minor injury. The recall is considered a ‘Class I’ recall and is considered the most serious of three classifications. According to a USDA spokesperson, Class I recalls happen if there is a reasonable probability that using the product presents a health hazard that could cause serious harm or even death.”

“OpenAI Unveils Latest AI Model, Customizable GPTs And Digital Store” (CNN Business). “During its first developer conference held in San Francisco on Monday, OpenAI unveiled a series of artificial intelligence tool updates, including the ability for developers to create custom versions of ChatGPT. It is also launching a digital store and cutting base prices for developers while also pledging to pay some who use OpenAI products on their platforms.”

“Ray Dalio Once Interrogated His Pregnant Protégé In Front Of His Top Execs Until She Cried” (Insider). “Dalio announced to the room that he would first "probe" and then deliver what he called a ‘diagnosis.’ In the probe he asked her to confirm that she had fallen short in his assignment. The diagnosis was that she was an idiot, a point he made over and over. ‘You're a dumb shit!’ Dalio spat. ‘You don't even know what you don't know.’”

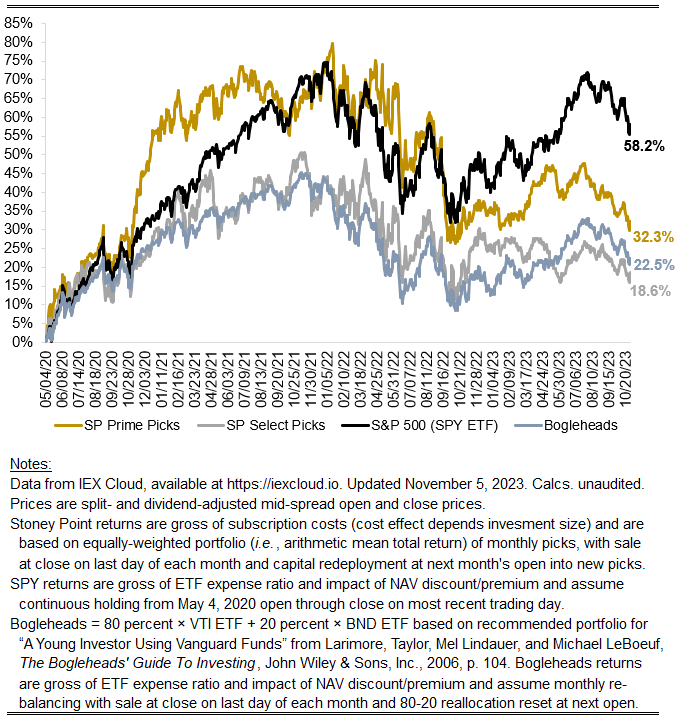

October performance update

Here with an update on last month’s performance:

Prime: -1.22%

Select: -0.24%

SPY ETF: -1.97%

Bogleheads: -2.27%

A pretty bad month for the market overall, with the S&P 500-tracking ETF down nearly 200 basis points and the usually-pretty-steady Bogleheads portfolio down even more. SPC’s strategies held up better than the market, with Prime and Select down, but still outperforming by over 70 and 170 basis points, respectively. A cursory review of news last month reveals substantial risks arising from nearly all corners of the world: Ukraine, Israel, evidence of a slowing economic picture in the United States. All of these factors likely transmitted to large-cap U.S. equities through one channel or another (some obvious, some less so).

One technical note: one of my Select picks last month — ATVI — was acquired in the long-awaited Microsoft deal. ATVI’s last day of trading was October 12, and stockholders received $95.00/sh. in cash. The calculations shown below assume (I think quite reasonably) that a hypothetical ATVI stockholder following the Select strategy would immediately reinvest the proceeds in MSFT (the buyer) for the remainder of the month rather than, say, holding the proceeds in cash for a negative real return. This assumption is my general practice for cash deals, regardless of whether the buyer’s stock returns for the remainder of the month are positive or negative. In this instance, they were positive, with MSFT returning 2.10 percent from the close of trading on Oct. 12 through the close of trading on October 31.

Stoney Point Total Performance History

What we’re reading (11/4)

“Stock Market Falling Deeper Into Undervalued Territory” (Morningstar). “The pullback in October has been relatively broad-based as each of the style categories has fallen by similar amounts. As such, based on our valuations, we continue to advocate for an overweight position in value, underweight in core/blend, and market weight in growth. By market capitalization, large-cap stocks fared better to the downside whereas mid-cap and small-cap took the brunt of the selloff, making those categories even more undervalued compared with our valuations.”

“Warren Buffett’s Berkshire Hathaway Sits On Record $157 Billion Cash Pile” (Wall Street Journal). “The stash leaves Berkshire equipped to pounce if Buffett, the company’s chief executive and chairman, finds an attractive opportunity to buy a business. Charlie Munger, Berkshire’s vice chairman and Buffett’s longtime business partner, told the Wall Street Journal in a recent interview that the odds of another big acquisition under the pair were ‘at least 50/50.’”

“What Happened To Airbnb?” (Vox). “What started as a scrappy idea offering an affordable alternative to hotels has now made Airbnb a target for lawmakers and a magnet for critics. Airbnb may not be collapsing, as some doomsayers are predicting, but it is facing a reckoning — an existential questioning of what it offers and where it will go from here.”

“New York City Is Enforcing A ‘De Facto Ban’ On Airbnb. Will Travelers Be Better Off Without It?” (Insider). “‘In just the first two months since the rules have gone into effect, the negative consequences are clear — visitors to New York City now have fewer accommodation options in fewer neighborhoods, hotels have increased their nightly rates, and, predictably, activity has gone underground with a myriad of unregistered listings popping up on unregulated third-party websites,’ an Airbnb spokesperson said in an email to Insider Tuesday.”

“How The Real Estate Broker Business Could Change” (New York Times). “Real estate experts say the current system won’t stand. Right now, home sellers essentially pay fees for both their own agent and the buyers’ agent, with a typical commission around 5 to 6 percent, split between the two brokers. That structure is largely enforced by the National Association of Realtors, which has about 1.5 million dues-paying members. If a seller doesn’t agree to those terms, the listing isn’t shown on the multiple listing services that underpin most home sales.”

What we’re reading (11/3)

“US Employers Pulled Back On Hiring In October, Adding 150,000 Jobs In Face Of Higher Borrowing Rates” (Associated Press). “The nation’s employers slowed their hiring in October, adding a modest but still decent 150,000 jobs, a sign that the labor market may be cooling but remains resilient despite high interest rates that have made borrowing much costlier for companies and consumers.”

“S&P 500 Clinches Best Week Since November 2022” (Wall Street Journal). “The S&P 500 rallied Friday, capping its best weekly performance since November 2022, after the latest monthly jobs report suggested the Federal Reserve’s interest-rate raising campaign is working. The broad index gained 0.9%, bringing its gains for the week to 5.9%. The index is up 14% this year. The Dow Jones Industrial Average added about 200 points, or 0.7%, on Friday, while the Nasdaq Composite rose 1.4%. Those indexes also recorded their biggest weekly percentage gains of the year.”

“Shipping Giant Laying Off 10,000 As Pandemic Boom Turns To Bust” (CNN Business). “Shipping giant Maersk is laying off thousands more workers as weak demand and lower freight prices pummel its revenues — a sign the pandemic-driven boom in shipping is turning to bust. One of the world’s biggest shipping firms said in its third-quarter results Friday that its revenues had almost halved to $12 billion compared with the same period last year.”

“The Great Social Media–News Collapse” (The Atlantic). “Over the past decade, Silicon Valley has learned that news is a messy, expensive, low-margin business—the kind that, if you’re not careful, can turn a milquetoast CEO into an international villain and get you dragged in front of Congress. No surprise, then, that Big Tech has decided it’s done with the enterprise altogether.”

“Over 75% Of U.S. Workers Say They Could Complete The Same Amount Of Work In 4 Days Rather Than 5” (CNBC). “Among US workers, over 75% say they could complete their current workload in a four-day workweek rather than five, according to a recent report from Fiverr. Millennials, who make up around 35% of today’s workforce, were the most passionate about the four-day workweek with 87% agreeing.”