What we’re reading (1/16)

“China’s Economy Expanded By 3% In 2022” (CNN Business). “China’s economy expanded by 3% in 2022, far below the government’s target, according to the country’s National Bureau of Statistics on Tuesday. It also marks one of the worst performances in nearly half a century. But economic growth grew by 2.9% in the fourth quarter, beating market expectations. A Reuters poll of economists had previously estimated expansion of just 1.8%.”

“A College Student Created An App That Can Tell Whether AI Wrote An Essay” (NPR). “Teachers worried about students turning in essays written by a popular artificial intelligence chatbot now have a new tool of their own. Edward Tian, a 22-year-old senior at Princeton University, has built an app to detect whether text is written by ChatGPT, the viral chatbot that's sparked fears over its potential for unethical uses in academia.”

“How Europe Is Decoupling From Russian Energy” (Apricitas Economics). “[T]hanks to a rapid buildout of liquefied natural gas capacity, new sources of energy imports, reduced consumption, and fortuitously warm weather, the EU has significantly improved its energy outlook since this summer—and the worst possibilities for this winter look to have been avoided.”

“Scientists Redirect Lightning Strikes Using A Weather-Controlling Super Laser” (StudyFinds). “Researchers with the Polytechnic Institute of Paris guided the strikes from thunderclouds to places where they don’t cause damage. The team says the new technique could save power stations, airports, launchpads, and other buildings from disaster.”

What we’re reading (1/15)

“The Top 1% Captured Nearly Twice As Much New Wealth As The Rest Of The World Over Last Two Years” (CNN Business). “Though their riches have slipped somewhat over the past year, global billionaires are still far wealthier than they were at the start of the pandemic. Their net worth totals $11.9 trillion, according to Oxfam. While that’s down nearly $2 trillion from late 2021, it’s still well above the $8.6 trillion billionaires had in March 2020.”

“BlackRock Vs. Goldman In The Fight Over 60/40” (Wall Street Journal). “BlackRock says the losses—the worst in nominal terms for a 60/40 portfolio since the financial crisis of 2008-9 and the worst in real terms in a calendar year since the Great Depression—show that the structure is outdated. Goldman demurs, arguing that the odd big loss is inevitable in any strategy and that 60/40 remains a valid basic approach. Strategists and fund managers at other large money managers and banks have been piling in on both sides.”

“90% Of Online Content Could Be ‘Generated By AI By 2025,’ Expert Says” (Yahoo! Finance). “Generative AI, like OpenAI's ChatGPT, could completely revamp how digital content is developed, said Nina Schick, adviser, speaker, and A.I. thought leader told Yahoo Finance Live…’I think we might reach 90% of online content generated by AI by 2025, so this technology is exponential,’ she said. ‘I believe that the majority of digital content is going to start to be produced by AI. You see ChatGPT... but there are a whole plethora of other platforms and applications that are coming up.’”

“Tyler Winklevoss Says SEC Charges Over Gemini Are ‘Super Lame’ And A ‘Manufactured Parking Ticket’” (Insider). “Tyler Winklevoss called regulators ‘super lame’ after his company was hit by charges linked to a $900 million funds crisis. On Thursday the Securities and Exchange Commission (SEC) charged Genesis' lending arm Genesis Global Capital and digital currency exchange Gemini for the unregistered offer and sale of crypto asset securities through the Gemini Earn lending program.”

“The Condo King Of Miami Bets His New Fisher Island Luxury Project Can Weather A Recession” (CNBC). “Jorge Perez, also known as ‘the condo king of Miami,’ and his Related Group are behind the 10-story, 50-unit project that boasts a sell-out price of $1.2 billion. They paid $122.6 million for the land, at the top of the market. Units start at $15 million. The project includes a $90 million, 15,000 square foot penthouse and a $55 million ground-floor villa with a half-acre backyard. The building will also have its own slip for mega yachts. Sales just started last month.”

What we’re reading (1/14)

“Just How Common Is Corporate Fraud?” (DealBook). “It suggests that only about a third of frauds in public companies actually come to light, and that fraud is disturbingly common. Mr. Dyck and his co-authors estimate that about 40 percent of companies are committing accounting violations and that 10 percent are committing what is considered securities fraud, destroying 1.6 percent of equity value each year — about $830 billion in 2021.”

“Workers Lose Ground To Inflation Despite Big Wage Gains” (Wall Street Journal). “A historically tight labor market pushed up average hourly earnings by 4.6% in December from a year earlier, the Labor Department said this week, compared with a 6.5% annual inflation rate in the same period. Likewise, average hourly earnings rose 4.9% in December 2021 from a year earlier, compared with a 7% annual inflation rate.”

“5 Unintended Consequences Of The EV Revolution” (Vox). “That’s all about to change. In the next few years, electric vehicles will replace many cars with internal combustion engines, and the White House has called for half of new vehicles to be electric by the end of the decade. This transition is a critical part of adapting to climate change, since EVs don’t produce tailpipe emissions and will reduce the world’s dependence on fossil fuels. But electric cars will also be an awkward fit for today’s transportation infrastructure, and not just because gas stations might one day go the way of horse stables.”

“A Battle Between Disney And Activist Peltz Brews. Here’s How The Situation May Unfold” (CNBC). “Sometimes a board observer position can be beneficial, particularly for investors who do not have a lot of board experience and are less likely to be a regular contributor to board discussions. But offering Peltz a position as a board observer is like saying to Whitney Houston, ‘You can join the band, but you are not allowed to sing.’ There is no way that Disney thought for a second that Peltz would accept this offer, and there is no way he should have accepted it.”

“Goldman Sachs Plans To Nudge Out An Additional 800 Staffers By Skimping On Bonuses After Already Laying Off More Than 3,000 Employees, Report Says” (Insider). “After cutting more than 3,000 jobs on Wednesday, Goldman Sachs is planning to oust about 800 more employees in a less direct fashion, company insiders say. Another round of employees is expected to quit in the coming weeks after Goldman Sachs issues annual bonuses, according to sources close to the company who spoke to the New York Post. The forthcoming bonuses are expected to be ‘so skimpy that disgusted recipients will pack up and leave,’ the sources told the Post.”

What we’re reading (1/13)

“S&P 500 Ends At Highest In Month, Indexes Gain For Week As Earnings Kick Off” (Reuters). “The S&P 500 and Nasdaq finished at their highest levels in a month on Friday, with shares of JPMorgan Chase and other banks rising following their quarterly results, which kicked off the earnings season.”

“America’s Biggest Banks Are Girding For A Recession But Aren’t Feeling One Yet” (Wall Street Journal). “The nation’s largest banks said rising interest rates are likely to push the U.S. into a recession this year, though they are only starting to feel the effects in their quarterly earnings.”

“RIP Meme Stocks. You Were Terrible Investments” (Fast Company). “When struggling retailer Bed Bath & Beyond announced last week that it was unsure it was going to be able to stay in business, and followed that news with a grim earnings report on Tuesday, it felt like the proverbial nail in the coffin of one of the strangest, and most pointless, bubbles in market history: meme-stock mania.”

“U.S. Will Hit Its Debt Limit Thursday, Start Taking Steps To Avoid Default, Yellen Warns Congress” (CNBC). “Treasury Secretary Janet Yellen on Friday notified Congress that the U.S. will reach its statutory debt limit next Thursday. After that, the Treasury Department this month will begin ‘taking certain extraordinary measures to prevent the United States from defaulting on its obligations,’ Yellen wrote in a letter to new House Speaker Kevin McCarthy, R-Calif.”

“Crypto.com Is Cutting 20% Of Its Workforce To Blunt The Blow From FTX's Collapse And The Crypto Winter, Broadening Layoffs In The Industry” (Insider). “Crypto.com said Friday it's letting go a fifth of its employees as the FTX implosion added a fresh layer of pain to an already slumping cryptocurrency market, with the crypto exchange's move the latest in headcount reductions in the industry and the wider tech space.”

What we’re reading (1/12)

“Investors Are Underestimating Inflation Again” (CNN Business). “Investors are holding their breath in anticipation of Thursday morning’s Consumer Price Index inflation report — arguably the most important piece of economic data so far this year. There’s a lot riding on the outcome — if inflation keeps falling, that could support a market rally, while higher-than-expected inflation could send stocks sinking.”

“Elon Musk’s Starlink Is Only The Beginning” (Vox). “Space internet has the reputation for slow service. With its questionable signal strength and hardly Netflix-friendly bandwidth, the internet that’s beamed down from low-Earth orbit is the kind of thing you only turn to as a last resort or if you’re stuck on a long-haul flight. But in 2023, satellite-based internet is getting a major revamp.”

“Apple CEO Tim Cook To Take A 40% Pay Cut This Year” (Wall Street Journal). “Chief Executive Tim Cook has asked for a big cut in compensation this year. Mr. Cook’s total compensation target for 2023 will be $49 million, the company said in a Thursday filing. It said that is more than 40% lower than his target compensation of 2022. The iPhone giant said its board committee on executive compensation took into consideration shareholder feedback as well as a recommendation from Mr. Cook in making the adjustment.”

“The Economics Of Non-Competes” (Marginal Revolution). “The value of noncompete clauses is easy to illustrate. Say you run a hedge fund. Many members of your trading team will have partial access to your firm’s trading secrets, and if they leave they can take those secrets with them. In the absence of noncompete agreements, firms would be more likely to “silo” information — becoming less efficient and less able to pay higher wages. Nondisclosure agreements for workers in such positions are common, but they are difficult to enforce — making noncompete agreements more relevant. How exactly might you find out if some other newly created hedge fund is using your trading algorithms?”

“Crypto’s Tax Shelter Problem” (Institutional Investor). “Bankman-Fried, the 30-year-old crypto wunderkind from California accused by U.S. authorities of money laundering, defrauding customers and lenders, committing securities and commodities conspiracy, and violating campaign-finance laws, seems to have been under the impression that he might sidestep U.S. agencies, regulators, and law enforcement from his beachy tax shelter idyll.”

What we’re reading (1/11)

“Computer Breakdown Sows Chaos Across US Air Travel System” (AP News). “Thousands of flights across the U.S. were canceled or delayed Wednesday after a system that offers safety information to pilots failed, and the government launched an investigation into the breakdown, which grounded some planes for hours.”

“Big Cuts Are Coming to Goldman Sachs” (Wall Street Journal). “Job cuts have begun at Goldman Sachs. A wave that’s expected to grow to as many as 3,200 layoffs, one of the largest by the bank since the 2008 financial crisis, started on Tuesday, including at its premier equity capital markets division, sources told DealBook. More across-the-board cuts are expected to be announced on Wednesday.”

“Why Your Gas Bill Might Be Way Higher This Winter” (Vox). “Compared with last winter, the average household will spend 28 percent more this year to heat a home with gas, according to the US Energy Information Administration. That number will be higher still if the winter turns out to be colder than expected, and it conceals some regional variation: in Southern California, one utility is warning of ‘shockingly high’ January bills.”

“The Great Re-Evaluation” (Arnold Kling, The Great Re-Evaluation). “I think that the pandemic accelerated people’s re-evaluations of many of their commitments. We came out of it more strongly committed to activities we value highly, including passionate interests and family relationships. But we became less committed to jobs and classes that have only instrumental value to us. Young people were affected the most.”

“Forget Core CPI, Market Pros Are Searching For Supercore Inflation” (Wall Street Journal). “When the Labor Department releases its latest inflation reading on Thursday, most investors will still look first at the monthly change in the so-called core consumer-price index, which excludes food and energy categories to provide a better sense of inflation’s longer-term trajectory. Some, though, will quickly look past that number to metrics such as core services excluding housing—or even core services excluding housing and medical care. And even that won’t be entirely satisfying.”

What we’re reading (1/10)

“Oil And Gas Are Back And Booming” (Wall Street Journal). “Thanks to a mix of events, from the Russian invasion of Ukraine to the U.S. economic recovery, fossil fuels are showing surprising resilience, despite President Biden’s push to transition to clean energy and the industry’s own history of boom-bust investing and heavy reliance on debt.”

“The Buy Now, Pay Later Bubble Is About To Burst” (The Atlantic). “As familiar as Americans are with the concept of credit, many of us, upon encountering a sandwich that can be financed in four easy payments of $3.49, might think: Yikes, we’re in trouble. Putting a banh mi on layaway—this is the world that buy-now, pay-later programs have wrought. In a few short years, financial-technology firms such as Affirm, Afterpay, and Klarna, which allow consumers to pay for purchases over several interest-free installments, have infiltrated nearly every corner of e-commerce.”

“Wells Fargo, Once The No. 1 Player In Mortgages, Is Stepping Back From The Housing Market” (CNBC). “Wells Fargo is stepping back from the multitrillion-dollar market for U.S. mortgages amid regulatory pressure and the impact of higher interest rates. Instead of its previous goal of reaching as many Americans as possible, the company will now focus on home loans for existing bank and wealth management customers and borrowers in minority communities, CNBC has learned.”

“Fed Chair Powell: Bringing Down Inflation Requires ‘Measures That Are Not Popular’” (CNN Business). “Federal Reserve Chairman Jerome Powell made his first public appearance of the year on Tuesday, stressing the importance of central bank independence and his commitment to bringing down inflation. The painful rate hikes the Fed is implementing to tackle high prices don’t make officials particularly popular, Powell said during a panel discussion at an event hosted by Sweden’s central bank, the Sveriges Riksbank.”

“FTX Bankruptcy Documents Show List Of Investors Set To Be Completely Wiped Out, Including Tom Brady And Robert Kraft” (Insider). “The spectacular implosion of FTX has led to big investment losses for the football star Tom Brady, the New England Patriots owner Robert Kraft, and the fashion model Gisele Bündchen. As part of its bankruptcy process, FTX Monday released a list of its top equity holders, detailing just how many investors were set to be wiped out from the downfall of the crypto exchange.”

What we’re reading (1/9)

“The Debate Swirling Inside HR Departments: How To Lay Off Workers” (Wall Street Journal). “Executives considering downsizing are currently grappling with the same problem: finding the most effective way to let employees go. Is it better to get layoffs over with all at once even at the risk of cutting too deep? Is firing over Zoom more humane than making an employee come into the office to lose their job? How much severance pay is fair?”

“Where Are The Workers? From Great Resignation To Quiet Quitting” (Lee, Park, and Shin, working paper). “To better understand the tight post-pandemic labor market in the US, we decompose the decline in aggregate hours worked into the extensive (fewer people working) and the intensive margin changes (workers working fewer hours). Although the pre-existing trend of lower labor force participation especially by young men without a bachelor's degree accounts for some of the decline in aggregate hours, the intensive margin accounts for more than half of the decline between 2019 and 2022. The decline in hours among workers was larger for men than women. Among men, the decline was larger for those with a bachelor's degree than those with less education, for prime-age workers than older workers, and also for those who already worked long hours and had high earnings. Workers' hours reduction can explain why the labor market is even tighter than what is expected at the current levels of unemployment and labor force participation.”

“Wall Street Braces For A Weak Earnings Season” (New York Times). “Stocks may have eked out gains so far in the new year, but it may not last. With corporate earnings season kicking off this week, Wall Street is pricing in a rough quarter ahead — including for itself, with Goldman Sachs and other banks preparing for layoffs.”

“The Dystopia We Fear Is Keeping Us From The Utopia We Deserve” (New York Times). “In his fascinating, frustrating book ‘Where Is My Flying Car?’ J. Storrs Hall argues that we do not realize how much our diminished energy ambitions have cost us. Across the 18th, 19th and 20th centuries, the energy humanity could harness grew at about 7 percent annually. Humanity’s compounding energetic force, he writes, powered tthe optimism and constant improvement of life in the 19th century and the first half of the 20th century.’ But starting around 1970, the curve flattened, particularly in rich countries, which began doing more with less.”

“4 Changes In The Labor Market That Could Signal A Recession” (Vox). “The economy is confusing right now. Many economists are predicting the United States will slip into a recession in the next year. Inflation remains stubbornly high, and the Federal Reserve continues to aggressively raise interest rates. But the labor market has held up: Employers are struggling to fill open positions and the unemployment rate remains low.”

What we’re reading (1/7)

“Why Does Private Equity Get To Play Make-Believe With Prices?” (Cliff Asness in Institutional Investor). “Though some will plead the opposite, it’s not that hard to adjust even private marks in line with the market. If you’re levered long equities (and yep, PE’s ‘low-risk and low-beta’ investments are often levered long) and equities fall by 25 percent, you probably dropped at least that. Perfect estimates are not the point, and shouldn’t be the enemy of good estimates (for instance, some argue private equity betas are near 1.0 even with leverage, but nobody serious argues they are near zero). Sure, sometimes it’s more complicated. But remember, PE managers are among the world’s foremost experts in company valuation. You wouldn’t think the question ‘Approximately what would we get if we sold in today’s market?’ would be particularly tricky for them. That is, of course, if they actually wanted to tell you the answer and if you actually wanted to hear it. It does take two to do the nonmarking tango.”

“Ant Group Says Its Founder, Jack Ma, Will Relinquish Control” (New York Times). “One of China’s most influential financial tech companies, Ant Group, said on Saturday that the billionaire entrepreneur, Jack Ma, planned to relinquish control of the company. Mr. Ma’s retreat from the company he founded comes after the ruling Communist Party waged an unprecedented crackdown on Big Tech. Beijing had made Mr. Ma’s Ant Group and its sister company, the e-commerce giant, Alibaba, the crown jewels of his online empire, early targets in the campaign to curb the power of internet giants.”

“Burned By layoffs, Tech Workers Are Rethinking Risk” (TechCrunch). “Tech isn’t as collegial as it used to be. Rocket ships are being unveiled as sputtering messes, mission-driven startups don’t feel so mission oriented when responding to investor pressure, and widespread layoffs offer a loud reminder that jobs are breakable contracts not sacrosanct vows.”

“Poultry Farm Says Millions Of Chickens Could Starve From Rail Delays” (Wall Street Journal). “Service problems at Union Pacific Corp. have sparked a dispute between the railroad and one of the country’s biggest chicken processors, which says the lives of millions of birds are endangered by repeated delays in the delivery of corn. California-based Foster Farms has asked for regulatory intervention for the second time in six months, saying delayed shipments from Union Pacific have dwindled its corn inventory. The company said it has diverted feed from dairy cattle to the chickens, which are susceptible to quicker death.”

“Lumber Market Must Weather A ‘Treacherous’ 2023 After Last Year’s Staggering 66% Price Crash As A US Housing Slump Deepens” (Insider). “Lumber prices plunged 66% last year as the once red-hot US housing market faltered – and the commodity's troubles will likely continue in 2023, according to strategists.”

What we’re reading (1/6)

“Dow Closes 700 Points Higher on Signs Of Slowing Wage Growth” (Wall Street Journal). “The Labor Department’s monthly jobs report showed that employers added 223,000 jobs in December, the smallest gain in two years but more than the 200,000 expected by economists. The ability of U.S. companies to keep hiring shows that the job market has held up even as the Fed’s rate increases have sparked worries about a potential recession.”

“The Bubble Has Not Popped” (Cliff Asness, AQR). Value spreads are still near 30-year highs.

“Got A Stash Of Bed Bath & Beyond Coupons? You’d Better Use Them Soon” (CNN Business). “The struggling home goods retailer issued a dire prediction on Thursday, calling into doubt its ability to stay in business much longer and said it was exploring a path forward that includes filing for bankruptcy. A bankruptcy filing, which reportedly could come in a matter of weeks, might spell the end of its iconic coupon programs, especially if the company pursues a bankruptcy process that involves liquidation rather than just restructuring.”

“St. Louis Fed’s Bullard Presents ‘The Prospects for Disinflation in 2023’” (Federal Reserve Bank of St. Louis). “Federal Reserve Bank of St. Louis President James Bullard presented ‘The Prospects for Disinflation in 2023’ on Thursday at an event hosted by CFA Society St. Louis. Bullard noted that GDP growth appears to have improved in the second half of 2022 and the labor market performance remains strong. Inflation remains too high but has declined recently, he added.”

“In 2022, The IRS Went After The Very Poorest Taxpayers” (Reason). “‘The taxpayer class with unbelievably high audit rates—five and a half times virtually everyone else—were low-income wage-earners taking the earned income tax credit,’ reported TRAC [Syracuse University’s Transaction Records Access Clearinghouse], noting that the poorest taxpayers are ‘easy marks in an era when IRS increasingly relies upon correspondence audits yet doesn't have the resources to assist taxpayers or answer their questions.’”

What we’re reading (1/5)

“ChatGPT Creator Is In Talks For Tender Offer That Would Value It At $29 Billion” (Wall Street Journal). “OpenAI, the research lab behind the viral ChatGPT chatbot, is in talks to sell existing shares in a tender offer that would value the company at around $29 billion, according to people familiar with the matter, making it one of the most valuable U.S. startups on paper despite generating little revenue.”

“Hedge Funds Gave Startups Billions. What Are They Worth?” (Bloomberg). “Mining data from thousands of mutual funds over the past year, Bloomberg tracked down their valuations for 46 private companies that also count the five hedge fund firms as investors. Of those, about 70% of the private companies had been marked down by mutual funds through September last year, with an average decline of 35%. Some holdings were slashed by as much as 85%…In some cases, the data show hedge fund marks haven’t caught up.”

“The Perfect Fraud For Our Times” (Dealbreaker). “The special-purpose acquisition company isn’t bound by many rules. Indeed, that is one point of them—to elide the disclosure and due-diligence rules required by an ordinary initial public offering…But SPACs are bound by at least one rule, and that is: Until a deal is actually consummated, the money collected stays in an interest-earning trust account and not, say, in the CFO’s Robinhood account to play around with meme stocks and crypto, even if those might earn investors a few more basis points than the trust account. Which in the case of the aforementioned now-former CEO, they didn’t.”

“Tesla Isn't Apple, Elon Musk Isn't Steve Jobs, And Its Cars Aren’t The Next iPhone” (Insider). “What should be more concerning to investors is it's becoming less clear by the day how Tesla itself can remain competitive in an EV market that's growing fast and in danger of leaving the company behind.”

“What Is Going Wrong With American Higher Education?” (Marginal Revolution). “In my own field, economics, the prospect of having to do a “pre-doc” and then six years for a Ph.D. is driving away creative talent. On the research side, there is an obsession with finding the correct empirical techniques for causal inference. Initially a merited and beneficial development, this approach is becoming an intellectual straitjacket. There are too many papers focusing on a suitably narrow topic to make the causal inference defensible, rather than trying to answer broader, more useful but also more difficult questions.”

What we’re reading (1/4)

“Alan Greenspan Says US Recession Is Likely” (CNN Business). “Former Federal Reserve Chairman Alan Greenspan believes a US recession is the ‘most likely outcome’ of the Fed’s aggressive rate hike regime meant to curb inflation. He joins a growing chorus of economists predicting imminent economic downturn. His views are particularly important. Not only did Greenspan serve five terms as Fed chair under four different presidents between 1987 and 2006, but he was the last chair to successfully navigate a soft landing, in 1994. In the 12 months that followed February 1994 Greenspan nearly doubled interest rates to 6% and managed to keep the economy steady, avoiding recession.”

“Amazon To Lay Off Over 17,000 Workers, More Than First Planned” (Wall Street Journal). “The Seattle-based company in November said that it was beginning layoffs among its corporate workforce, with cuts concentrated on its devices business, recruiting and retail operations. At the time, the company expected the cuts would total about 10,000 people, but a person with knowledge of the issue said the number could change, The Wall Street Journal reported. Thousands of those cuts began last year.”

“Jeff Bezos May Return To Helm Amazon, Says Forecaster Of Double-Digit Stock Market Losses Last Year” (MarketWatch). “It’s still early enough in the year to look at 2023 predictions, so this time we’ll go with one from an analyst who called the market correctly at the end of 2021. ‘The S&P 500 will have its worst year since 2008,’ said Michael Batnick, managing partner at Ritholtz Wealth Management. ‘I predict this year it will fall more than 15%. The combination of high multiples, high inflation, supply chain issues, and the Fed raising interest rates will prove to be too much for investors to handle.’ The S&P 500 dropped 19% last year.”

“Microsoft And OpenAI Working On ChatGPT-Powered Bing In Challenge To Google” (The Information). “Microsoft could soon get a return on its $1 billion investment in OpenAI, creator of the ChatGPT chatbot, which gives humanlike text answers to questions. Microsoft is preparing to launch a version of its Bing search engine that uses the artificial intelligence behind ChatGPT to answer some search queries rather than just showing a list of links, according to two people with direct knowledge of the plans.”

“The Method In The Markets’ Madness” (The Atlantic). “[I]f fundamentals explain a lot of the market’s overall drop, why all the turbulence? Well, the stock market is a kind of prediction machine, and, as Yogi Berra supposedly said, ‘It’s tough to make predictions, especially about the future.’ They’re especially hard to make at the moment, when so much about what’s going to happen next year is genuinely uncertain.”

What we’re reading (1/3)

“Apple’s Market Cap Falls Under $2 Trillion As Sell-Off Continues” (CNBC). “Apple shares fell more than 3% trading on Tuesday, giving the iPhone maker a market capitalization under $2 trillion for the first time since May. Apple fell $3.74% to a price of $130.20 per share, a 52-week low, giving the company a valuation of $1.99 trillion at market close on Tuesday. Apple first hit a $2 trillion valuation in August 2020, as the pandemic boosted its sales of computers and phones for remote work and school. It briefly hit a market value over $3 trillion during trading in January 2022.”

“Remote Work Is Poised To Devastate America’s Cities” (New York Magazine). “The nation’s office buildings aren’t as empty as they were before COVID vaccines became widely available in spring 2021. But they’re still far less populated than they were in 2019. A recent analysis of Census Bureau data from the financial site Lending Tree found that 29 percent of Americans were working from home in October 2022. In New York City, financial firms reported that only 56 percent of their employees were in the office on a typical day in September.”

“Office Owners Already Reeling From Remote Work Now Face Recession Risk In 2023” (Wall Street Journal). “Owners of office buildings stumbled through 2022, when their holdings underperformed most every other type of commercial real estate. Things look poised to get worse in 2023. Landlords have been longing for employees to head back to office buildings in greater numbers. But the national return rate has crept up slowly. For the past three months, it has plateaued at about half of what it was before the pandemic.”

“Caroline Ellison Wanted To Make A Difference. Now She’s Facing Prison.” (Washington Post). “‘I agreed with Mr. Bankman-Fried and others to provide materially misleading financial statements to Alameda’s lenders,’ she said. ‘I am truly sorry for what I did. I knew that it was wrong.’ The judge asked if she knew it was illegal, too. ‘Yes,’ she said.”

“More Than A Penny’s Worth: Left-Digit Bias And Firm Pricing” (Avner Strulov-Shlain, The Review of Economic Studies). “Firms arguably price at 99-ending prices because of left-digit bias—the tendency of consumers to perceive a $4.99 as much lower than a $5.00. Analysis of retail scanner data on 3500 products sold by 25 US chains provides robust support for this explanation. I structurally estimate the magnitude of left-digit bias and find that consumers respond to a 1-cent increase from a 99-ending price as if it were more than a 20-cent increase.”

What we’re reading (1/2)

“After A Rough 2022, U.S. Stock Futures Rise Ahead Of First Trading Week Of 2023” (MarketWatch). “Markets were closed Monday in observance of the New Year’s holiday. Investors are in for a busy shortened week, with a slew of economic data due, including S&P Global manufacturing PMI and construction spending expected Tuesday, the Job Openings and Labor Turnover Survey on Wednesday and the December jobs report due Friday. On Wednesday, the Fed will also release minutes from its latest meeting.”

“3 Different Paths The Economy Could Take In 2023” (Vox). “Heading into the new year, economists say that 2023 will likely bring changes. Inflation is expected to slow as the effects of the Federal Reserve’s interest rate hikes continue to ripple through the economy. But that could also mean the United States slips into a recession and more people lose their jobs or have a difficult time finding a new one.”

“Stay For Pay? Companies Offer Big Raises To Retain Workers” (Wall Street Journal). “Workers who stay put in their jobs are getting their heftiest pay raises in decades, a factor putting pressure on inflation. Wages for workers who stayed at their jobs were up 5.5% in November from a year earlier, averaged over 12 months, according to the Federal Reserve Bank of Atlanta. That was up from 3.7% annual growth in January 2022 and the highest increase in 25 years of record-keeping. Faster wage growth is contributing to historically high inflation, as some companies pass along price increases to compensate for their increased labor costs.”

“Wealth Across The Generations” (Marginal Revolution). “[Quoting Jeremy Horpendahl] ‘The main takeaways: Millennials are roughly equal in wealth per capita to Baby Boomers and Gen X at the same age. Gen X is currently much wealthier than Boomers were at the same age: about $100,000 per capita or 18% greater[.] Wealth has declined significantly in 2022, but the hasn’t affected Millennials very much since they have very little wealth in the stock market (real estate is by far their largest wealth category)’”

“Warren Buffett Called Out Stock-Market Gamblers, Savaged Bitcoin, And Praised Elon Musk And Jeff Bezos Last Year. Here Are His 10 Best Quotes Of 2022.” (Insider). Among them: “Deceptive ‘adjustments’ to earnings – to use a polite description – have become both more frequent and more fanciful as stocks have risen. Speaking less politely, I would say that bull markets breed bloviated bull.”

What we’re reading (1/1)

“The Year That Brought Silicon Valley Back Down To Earth” (CNN Business). “Near 0% interest rates [at the start of 2022] meant startups still had easy access to the funding that had fueled their high valuations and risky ventures. But the year is ending on a much different note. A perfect storm of factors have forced a dizzying reality check for the once high-flying tech sector, making it one of the biggest losers of 2022.”

“Nasdaq Closes Out Its First Four-Quarter Slump Since Dot-Com Crash” (CNBC). “A lot has changed in technology since the dot-com boom and bust. The internet went mobile. The data center went to the cloud. Cars are now driving themselves. Chatbots have gotten pretty smart. But one thing has remained. When the economy turns, investors rush for the exits.”

“Third Of World In Recession This Year, IMF Head Warns” (BBC). “‘We expect one third of the world economy to be in recession,’ [IMF Managing Director] Ms [Kristalina] Georgieva said on the CBS news programme Face the Nation. ‘Even countries that are not in recession, it would feel like recession for hundreds of millions of people,’ she added.”

“Your Coworkers Are Less Ambitious; Bosses Adjust To The New Order” (Wall Street Journal). “Where have all the go-getters gone? At law firm Nixon Peabody LLP, associates have started saying no to working weekends, prompting partners to ask more people to help complete time-sensitive work. TGS Insurance in Texas has struggled to fill promotions, and bosses often have to coax staffers to apply. And Maine-based marketing company Pulp+Wire plans to shut down for two weeks next year now that staffers are taking more vacation than they used to.”

“U.S. Pours Money Into Chips, But Even Soaring Spending Has Limits” (New York Times). “The new chip factories would take years to build and might not be able to offer the industry’s most advanced manufacturing technology when they begin operations. Companies could also delay or cancel the projects if they aren’t awarded sufficient subsidies by the White House. And a severe shortage in skills may undercut the boom, as the complex factories need many more engineers than the number of students who are graduating from U.S. colleges and universities.”

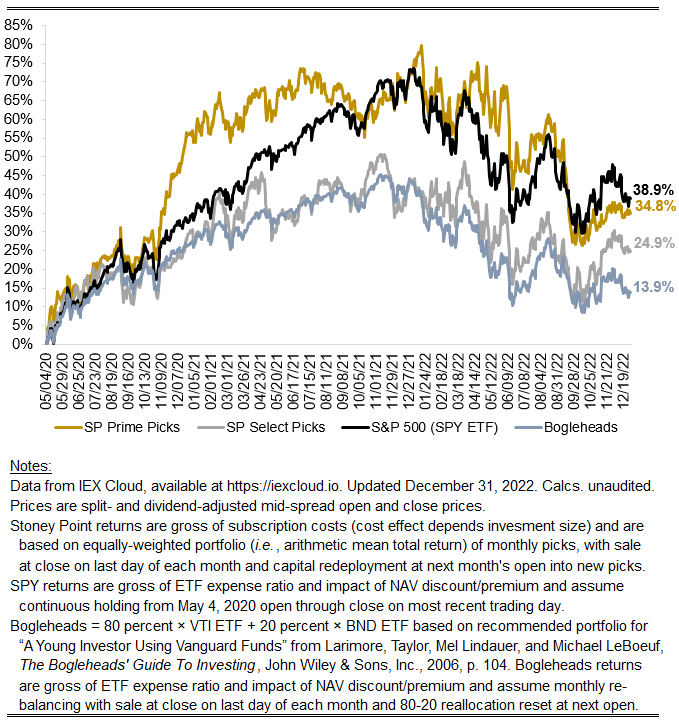

December 2022 performance update

Hi Friends, wrapping up 2022 with December’s performance:

Prime: -2.16%

Select: -3.53%

SPY ETF: -6.01%

Bogleheads Portfolio (80% VTI + 20% BND): -5.17%

It was strong December with both Stoney Point portfolios significantly outperforming the market (by nearly 4 percentage points for Prime and roughly 2.5 percentage point for Select). Volatility remains elevated and, qualitatively, “fear” seems to be the predominant sentiment, at least among outspoken institutional market participants.

The headline for 2022 overall was that it was a bad year for equities. The market (as proxied by the SPY ETF) was down roughly 19.5 percent, the biggest calendar-year evaporation in aggregate corporate net worth since 2008. Prime’s performance broadly mirrored that although a bit worse, being down roughly 21.7 percent. Encouragingly after a slow few years, the drawdown in equities allocated to the Select strategy was considerably more muted, with that portfolio being down only 12.4 percent for the year.

The story in 2022 was mostly about rate hikes. More recently, on the back of the rate hikes, concerns are growing about a steep deceleration or decline in corporate earnings in 2023. Everyone seems to agree that a recession is coming. Alas, consensus on something like that is usually a good indicator that the valuation consequences of the presenting event have already been impounded into asset prices. I continue to believe “value”-oriented strategies will re-emerge as big winners in the years ahead after a long hiatus. While value has underperformed for a long time recently, it is noteworthy that the samples used in early studies quantifying the strong, positively predictive power of value ratios (e.g., Fama and French 1992) generally included the rate-hiking cycle of the early 80s and long period of elevated rates thereafter.

Some months ago I mentioned changes I anticipated putting through to the algorithm that guides my selection of securities for the Prime and Select portfolios. I am happy to say those edits—which are the first I have made to the algorithm since the start of this endeavor in May 2020—have now been fully incorporated. I am excited to see if and how they affect performance in 2023. The strategy (or system used to rank particular stocks against one another in the cross section) now reflects a weighted average of three factors:

The original Stoney Point value factor: until recently, this was the sole factor used to rank stocks for both Prime and Select. It is a proprietary value ratio that attempts to merge the insights of more traditional value factors (e.g., book-to-market ratios) and a less-famous literature on what scholars call the “implied cost of capital.” The essential logic of the latter literature is that the market’s expectation of returns for various securities can be extracted from current prices and various cash flow forecasts.

A new risk factor: this uses extensions of Merton’s (1974) famous structural credit risk model based on options pricing techniques to construct a novel risk factor. Statistical tests performed by yours truly suggest it relates to returns in a way that is not already captured by the most common extant asset pricing models.

Sentiment: I mentioned this before, but an intuitive flaw in any fundamentals-based algorithmic stock selection strategy is that reported fundamentals are inherently backward looking. This can be avoided somewhat by looking at things like analyst forecasts, but documented bias in analyst forecasts casts serious doubt on the reliability of their estimates as forward-looking measures (the analysts were basically the last to pick up on Enron’s frauds, after all). I use information from the analyst community in this new sentiment factor, but not in isolation. Market prices themselves, and other market data, provided alternative close-to-real-time measures of changes in sentiment with respect to particular stocks.

Let’s see what 2023 has in store.

Stoney Point Performance History

January picks available now

The new Prime and Select picks for January are available starting now, based on a model run put through today (December 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Tuesday, January 3, 2023 (at the mid-spread open price) through the last trading day of the month, Tuesday, January 31, 2023 (at the mid-spread closing price).

What we’re reading (12/30)

“Stock, Bond And Crypto Investors Remain On Edge After Brutal Year For Markets” (Wall Street Journal). “This year was a bust for markets. Stocks tumbled. Bonds were hit by their worst selloff ever. And cryptocurrencies were eviscerated, leading to the collapse of industry giants including FTX. The tumult across global markets had a chilling effect on Wall Street and beyond. Companies that hoped to go public scrapped their plans. Banks that typically cash in on fees for advising on deals and initial public offerings are slashing bonuses because of the drought. And retirees saw their savings shrink. The S&P 500 fell 19% for the year, while the Dow Jones Industrial Average dropped 8.8%. The Nasdaq Composite declined 33%, hurt by a steep slide in technology shares. All three indexes logged their biggest declines since 2008, the year Lehman Brothers collapsed. Trading was quiet ahead of the holiday weekend, with stocks ending a touch lower.”

“The Year The Long Stock Market Rally Ended” (New York Times). “Jan. 3, the first day of market trading in 2022, looked like just another day in a stock rally that began when Barack Obama was still president. The S&P 500 hit a record high. Tesla, the company that upturned the auto industry and made many investors rich, rose 13.5 percent and came close to its own all-time peak. That Monday, it turned out, was actually the end of a market that for over a decade had gone mostly in one direction, with the S&P 500 rising more than 600 percent since March 2009.”

“Stocks Fall To End Wall Street’s Worst Year Since 2008, S&P 500 Finishes 2022 Down Nearly 20%” (CNBC). “As the calendar turns to a new year, some investors think the pain is far from over. They expect the bear market to persist until a recession hits or the Fed pivots. Some also project stocks will hit new lows before rebounding in the second half of 2023.”

“After $18 Trillion Rout, Global Stocks Face More Hurdles In 2023” (Bloomberg). “More tech tantrums. China’s Covid surge. And above all, no central banks riding to the rescue if things go wrong. Reeling from a record $18 trillion wipeout, global stocks must surmount all these hurdles and more if they are to escape a second straight year in the red.”

“Deal-Making Thrived, Then Hit A Road Bump” (DealBook). “Heading into 2022, Wall Street’s deal-makers thought it would be hard to maintain last year’s record-breaking pace for mergers and acquisitions. Still, few thought their businesses would fall by too much. But the M.&A. business hit turbulence in the middle of the year and hasn’t recovered.”

What we’re reading (12/29)

“Consumers Kept The Economy Hot In 2022. Now They’re Losing Steam” (CNN Business). “Consumer spending remained resilient throughout much of 2022. However, stubbornly high inflation has taken its toll and knocked the stuffing out of the financial cushion. With interest rates poised to go higher in 2023 and economic uncertainty sure to grow, consumers could be starting to run dry at the worst time.”

“Just 5 Trading Days Accounted For 94% Of The S&P 500’s Decline In 2022 - And They Could Signal What’s To Come In 2023, DataTrek Says” (Insider). “In fact, just five days are responsible for 94% of the index's losses this year. Those days saw markets fall as much as 4.3% and center around inflation concerns, big corporate earnings misses, and reactions to the Federal Reserve's monetary tightening decisions. And these down days could shed some light on how the stock market moves in 2023. ‘This framework of 'a handful of days make the year' is also a good one with which to consider 2023,’ DataTrek said.”

“Here’s Why Egg Prices Surged In 2022. Those Elevated Costs Could Last Into The First Quarter Of 2023, Expert Says” (CNBC). “Average egg prices jumped 49.1% in November compared with those a year earlier — the largest annual percentage increase among all grocery items in that period, according to the consumer price index, a barometer of inflation. By comparison, the overarching ‘food at home’ category was up 12%. The increase is even more acute when measured by the cost of a dozen large, Grade A eggs, which more than doubled to $3.59 in November from $1.72 the year-earlier month, according to data from the Federal Reserve Bank of St. Louis…About 57.8 million birds have been affected by avian flu in 2022, according to U.S. Department of Agriculture data as of Dec. 28. These figures include birds such as turkeys and ducks.”

“GE Is Not A Lost Cause As Healthcare Spinoff Gets Set To Join S&P 500” (TheStreet). “News broke on Wednesday evening that GE Healthcare will enter the S&P 500 when it is spun off from General Electric (GE) and begins trading at the Nasdaq under the symbol GEHC. This happens next Wednesday, January 4, 2023.”

“An Epic Dollar Rally Goes Into Reverse—And Investors Expect Further Declines” (Wall Street Journal). “As of Dec. 28, the dollar has risen 8.9% this year as measured by the WSJ Dollar Index, which tracks its value against 16 other currencies. That would mark its biggest yearly rise since 2014. The index peaked in late September at the highest level in data going back to 2001. But the dollar is ending the year on the defensive, having given back roughly half of its gains since that high-water mark, as investors bet that U.S. inflation is slowing.”

What we’re reading (12/28)

“The Bull-And-Bear Case For 2023” (DealBook). “Wall Street as a whole hasn’t been so divided about the prospects for the next year since the global financial crisis, reflecting deep uncertainty over U.S. monetary policy, corporate profits and a wider debate about whether the world’s biggest economy will fall into recession. The average forecast expects the S&P 500 to end 2023 at 4,009, according to Bloomberg, the most bearish outlook since 1999. But the predictions range from a low of 3,400 to as high as 4,500, representing [the widest dispersion since 2009].”

“Wall Street’s Bankers Brace For Big Pay Cuts, But Bosses Don’t Want Whining” (Wall Street Journal). “Fees from advising on deals, stock offerings and bond sales are down more than 40% from this time last year, wiping out more than $50 billion in revenue, according to data from Dealogic. That is the biggest year-over-year dollar decline on record, worse even than in the financial crisis.”

“Why So Many Accountants Are Quitting” (Wall Street Journal). “More than 300,000 U.S. accountants and auditors have left their jobs in the past two years, a 17% decline, and the dwindling number of college students coming into the field can’t fill the gap.”

“To See The Weakness Of The ‘Inflation’ Argument, Walk The Aisles Of Whole Foods” (RealClear Markets). “For the purposes of this write-up, the question that emerges from expensive groceries and nosebleed sunscreen is whether the relatively high costs at a grocery chain where more and more Americans shop is indicative of ‘inflation.’ Aren’t rising prices inflation? Actually, no. To say they are inflation is like saying suntans cause the sun to shine. Causation is plainly reversed. At best, higher prices are a consequence of inflation, not a driver. With Whole Foods and its relatively higher prices, it’s important to stress that there’s no inflation to speak of.”

“Southwest Ruined Holiday Flying Almost All By Itself, Data Shows” (Insider). “Southwest canceled 2,694 flights on Tuesday, accounting for 84% of all US cancellations that day, according to data from flight-tracking site FlightAware. The data shows that in total, 3,210 flights into, out of, or within the US were canceled on Tuesday. Spirit came in second place in terms of US flight cancellations, cutting 102 flights.”