What we’re reading (12/27)

“Did the Tesla Story Ever Make Sense?” (Paul Krugman, New York Times). “The question is: Where are the powerful network externalities in the electric vehicle business? Electric cars may well be the future of personal transportation. In fact, they had better be, since electrification of everything, powered by renewable energy, is the only plausible way to avoid climate catastrophe. But it’s hard to see what would give Tesla a long-term lock on the electric vehicle business.”

“Tesla’s 2022 Collapse Hits 69% After Deepest Selloff Since April” (Bloomberg). “The tailspin in Tesla Inc. shares accelerated Tuesday, marking their longest losing streak since 2018, as a report of a plan to temporarily halt production at its China factory rekindled fears about demand risks.”

“Cash Cushions Dwindle At U.S. Pension Funds” (Wall Street Journal). “Cash holdings hit 1.9% of assets at state and local government pension funds and 1.7% of assets at corporate pension funds as of June 30, according to an annual snapshot from Wilshire Trust Universe Comparison Service. Those figures compare with the 15-year average of 2.45% at public pensions and 2.07% at corporate pensions. The recent figures are lower than in 2008, when some retirement funds had to sell whatever they could to pay benefits during the financial crisis. Pension managers have always faced a dilemma: keep too much of a fund’s assets in cash and you drag down returns. Keep too little in cash and you risk having to liquidate assets at unfavorable prices.”

“The World Just Doesn’t Have Enough Planes As Travel Roars Back” (The Straits Times). “Boeing and Airbus, the planemaking giants that largely enjoy a duopoly supplying passenger jets, are sold out for their most popular single-aisle models through until at least 2029. Compounding the demand from airlines as people once again take to the skies with a vengeance and carriers look to refresh ageing fleets are supply chain challenges – everything from getting the necessary components to labour shortages.”

“The Economy’s Fundamental Problem Has Changed” (The Atlantic). “After the Great Recession, we went through a decade in which economic life was defined by a lack of demand. Now, after the COVID recession, we’ve entered a period in which economic life is defined by a lack of supply.”

January picks available soon

We’ll be publishing our Prime and Select picks for the month of January before Monday, January 2 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of December, as well as SPC’s cumulative performance, assuming the sale of the December picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Friday, December 30). Performance tracking for the month of January will assume the January picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Monday, January 2).

What we’re reading (12/24)

“Investors Just Pulled A Record $42 Billion From Stocks In One Week In An Attempt To Cut Their Tax Bill After Grim 2022 Losses, BofA Says” (Insider). “Outflows from equities boomed to $41.9 billion, the largest ever amount for ‘tax-loss harvesting,’ said the investment firm said in its weekly Flow Show note, the last one to close out a bruising year for stocks.”

“Goldman Grumbling Grows For Banking Giant To Sack CEO David Solomon” (New York Post). “[T]he grumbling about Solomon is spreading to the managing director and partner class. High-priced Wall Street talent don’t call all the shots at any firm, of course. But Goldman’s MDs and partners have historically been a powerful force when the board decides the fate of current management, which makes Solomon’s hold on his job increasingly precarious as more and more of them defect from his camp.”

“Michael Bloomberg Eyes Dow Jones, WaPo Purchase As Media Ramps Up M&A: Report” (Yahoo! Finance). “Dow Jones is ultimately owned by News Corp's (NWSA) Rupert Murdoch, who is himself reportedly considering a recombination of Fox (FOXA) and the mass media and publishing company. According to an October report from Murdoch-owned The Wall Street Journal (WSJ), the 91-year-old businessman is in early discussions to rejoin the two entities of his media empire, which formerly split in 2013. Disney acquired the bulk of Fox's entertainment assets in a $71 billion deal back in 2019. The WSJ report added that both companies have established special board committees to study a possible deal and evaluate potential financial terms.”

“Stock Selloff Hits Life Insurers’ Fastest-Growing Product” (Wall Street Journal). “The hottest thing in life insurance for more than a decade might be cooling off. A long-running stock-market rally and low interest rates combined to create the perfect conditions for indexed universal-life policies. Sales of these policies rose from 4% of life-insurance sales in 2008, as measured by new annualized premiums, to 28% in the third quarter, according to industry-funded research firm Limra. The millions of Americans who now own them saw those ideal conditions reversed in 2022, exposing the policies’ high fees and complexity.”

“Two Sigma Insurance Quantified Has Brought Sophisticated Data Analysis To Underwriting” (Forbes). “Two Sigma, a New York-based hedge fund that uses sophisticated technology, has taken its analytical skills into insurance underwriting with Two Sigma Insurance Quantified.”

What we’re reading (12/23)

“S&P 500 And Nasdaq Close Higher Friday, But Fall For A Third Straight Week” (CNBC). “The major indexes oscillated earlier in the session after the core personal consumption expenditures price index, the Federal Reserve’s preferred gauge of inflation, came in slightly hotter than economists expected on a year-over-year basis, indicating that inflation is sticking despite the Fed’s efforts to fight it.”

“Are You ‘Extremely Hardcore’ Or Not? How Elon Musk Is Dividing Silicon Valley’s Elite” (Wall Street Journal). “Elon Musk has sometimes seemed like the person Silicon Valley would create if venture-funded engineers figured out how to build humans in a lab: the bold innovator fearlessly disrupting one industry after another with a nerdy verve. And yet these days, Silicon Valley’s investors, leaders and commentators are profoundly divided about tech’s billionaire icon, in ways that are revealing about Mr. Musk and about the state of the industry.”

“Why Is Elon Musk Lighting Billions Of Dollars On Fire?” (The Atlantic). “Maybe you have not had the best year. But take some consolation from the fact that you did not YOLO yourself into overpaying for an unprofitable social-media platform, publicly try to wriggle out of the deal, get lawyered into ponying up, liquidate billions of dollars of stock in a down market to do so, take over a company you did not really want, shitpost your way into a revenue crisis, quit paying your bills, antagonize your super-users, wink-wink at Nazis, and decimate your staff, all the while damaging your other, more lucrative businesses. Or at least probably not, unless you are Elon Musk. Twitter’s new owner might have fared better than Sam Bankman-Fried, the disgraced cryptocurrency magnate who improbably saved Musk from winning the title of Tech Fortune–Craterer of the Year. But Musk nevertheless spent 2022 lighting billions of dollars and his reputation on fire.”

“Bill Gates Shares His Plans To No Longer Be One Of The World's Richest People” (Vanity Fair). “Bill Gates said that after his recent divorce and discovering that he's going to become a grandfather for the first time, he's realized just how unimportant being one of the richest men on earth is if he can't use that money to improve the world.”

“Protester, 45, Is Charged With Disorderly Behaviour After Allegedly Shouting ‘Who Elected Him?’ During Proclamation Ceremony For King Charles” (Daily Mail). “A man has been charged after he allegedly shouted ‘Who elected him?’ at King Charles proclamation ceremony. Thames Valley Police said on Friday that Symon Hill, 45, of Church Hill Road, Oxford, has been charged with using threatening or abusive words, or disorderly behaviour…Hill is due to appear at Oxford Magistrates’ Court on January 31.”

What we’re reading (12/22)

“A New Chat Bot Is A ‘Code Red’ For Google’s Search Business” (New York Times). “Although ChatGPT still has plenty of room for improvement, its release led Google’s management to declare a “code red.” For Google, this was akin to pulling the fire alarm. Some fear the company may be approaching a moment that the biggest Silicon Valley outfits dread — the arrival of an enormous technological change that could upend the business.”

“Housing Market Doesn’t Need Much For Buyers To Return” (Washington Post). “A better guess about where the housing market will stabilize would take into account the fact that housing activity was still just fine up until April, even though affordability was much worse than pre-pandemic. You also would need to account for the squiggles in the data as mortgage rates have moved up and down since then. And those measures suggest it wouldn’t take much for the housing market to get back into balance with more stable pricing and transactions. It might take as little as mortgage rates falling back to below 6%, or some additional modest declines in home prices combined with a little more wage growth for workers.”

“What The Fed Should Do Next On Inflation” (Larry Summers, Washington Post). “It is very unlikely that we will have a recession so severe as to drive the underlying inflation rate below the 2 percent target. Hence, overshooting on inflation reduction is not the primary risk, and the Fed is right to emphasize its inflation objective going forward. This judgment is supported by another consideration. There has been a transitory element in inflation’s recent deterioration caused by bottlenecks in sectors such as used cars. As these bottlenecks ease, and prices return to normal, there will be a transitory deflationary impact hitting the statistics. This must not be confused with enduring resolution of the inflation problem.”

“A Strong Signal That Recession Is Looming” (New York Times). “[G]oing back to 1968, every time the long-term rate was at least 0.07 percentage points higher than the short-term rate, the economy escaped recession. And every time the long-term rate became at least 0.07 percentage points lower than the short-term rate, the economy entered a recession within six to 17 months. The average gap so far in December is 0.81 percentage points, which is the biggest since 1981 and deep into recessionary territory.”

“Japan’s Consumer Inflation Hits Fresh 40-Year High” (CNN Business). “Japan’s core consumer inflation hit a fresh four-decade high as companies continued to pass on rising costs to households, data showed, a sign price hikes were broadening and could keep the central bank under pressure to whittle down massive stimulus.”

What we’re reading (12/21)

“How Much Have 401(k)s Lost In 2022?” (U.S. News & World Report). “If you’re concerned by dipping figures on your 401(k) financial statements, you’re not alone. Ongoing market swings have impacted retirement accounts, and the last 12 months indicate losses for many retirement savers. During the last year, 401(k) balances have dropped 22.9%, according to a Fidelity Investments analysis of 24,500 corporate retirement accounts.”

“Disney Stock On Its Way To Worst Year Since 1974 After ‘Avatar’ Sequel Disappoints” (MarketWatch). “Disney shares sank nearly 5% to their lowest level since March 2020 on Monday, after the blockbuster sequel and one of the priciest movies in Hollywood history fell short of the hype in its opening weekend. ‘Avatar: The Way of Water’ hauled in $134 million domestically and had the second-largest global opening of 2022, but fell short of tracking estimates based on advance U.S. ticket sales and disappointed in one of the biggest markets for the franchise, China.”

“Nike Raises Outlook After Making Progress With Inventory Woes” (Wall Street Journal). “Nike Inc. on Tuesday raised its revenue outlook and said that its inventory challenges are abating, signs that the sneaker giant’s efforts to use discounts to clear out excess merchandise are helping the business.”

“Tesla Stock Gets More Cautious Comments From Wall Street” (Yahoo!Finance). “EvercoreISI analyst Chris McNally slashed his price target on Tesla's stock to $200 from $300 on Tuesday, joining bearish takes in the past week from Goldman Sachs, Wedbush, and Oppenheimer.”

“Tech Bros Who Ran $800M Events Startup To Bankruptcy Spent Lavishly On Drug-Fueled Parties: Report” (New York Post). “Two British tech entrepreneurs who led an events and travel startup that was worth as much as $800 million spent hundreds of thousands of dollars on drug- and alcohol-fueled parties and ran a ‘frat boy’ culture rife with sexual harassment before the company imploded, according to a report.”

What we’re reading (12/19)

“Stocks Bulls Losing Support As $4 Trillion of Options Set To Expire” (Bloomberg). “Bulls reeling from the Federal Reserve’s still-hawkish tilt are about to lose a major force that helped tamp down turbulence in US stocks during this week’s macroeconomic drama.”

“Problem Gambling Is On The Rise Among Young Men” (Wall Street Journal). “Gaming and gambling problems are surfacing among young men, and increasingly, teen boys, say counselors, therapists and addiction experts. They cite the rise in time spent online during the pandemic, the legalization of sports betting in a growing number of states, and the increasing presence of gambling-like elements in videogames.”

“‘Big Short’ Investor Michael Burry Says Crypto Reserve Reviews Like Binance’s Are ‘Essentially Meaningless’” (Insider). “Michael Burry, the legendary investor who foresaw the subprime mortgage crisis, is wary of so-called proof of reserves that crypto exchanges have touted since FTX crashed. The ‘Big Short’ former hedge fund manager tweeted on Friday that such reviews on a firm's digital holdings are “essentially meaningless.”

“Tesla Gets Downgraded On Wall Street Over Elon Musk’s Twitter Antics, Banning Of Journalists” (CNN Business). “Oppenheimer & Co. downgraded its rating on Tesla, where Musk is the CEO, solely because of risks posed by the billionaire’s ownership and management of Twitter. ‘We believe Mr. Musk is increasingly isolated as the steward of Twitter’s finances with his user management on the platform. We see potential for a negative feedback loop from departure of Twitter advertisers and users,’ Oppenheimer analyst Colin Rusch wrote to clients.”

“Rising Production Cost – And Rising Resentment” (Inside Higher Ed). “Understanding the rising cost of producing higher education starts with the fact that the wealthiest, most elite colleges and universities, which set the norms in higher education, are admitted "cookie monsters," whose insatiable and competitive need for revenue has long been viewed as beneficial -- until recent decades.”

What we’re reading (12/18)

“Forget Stock Predictions For Next Year. Focus On The Next Decade.” (New York Times). “Consider how bad Wall Street forecasts have been. In 2020…the median Wall Street forecast since 2000 had missed its target by an average 12.9 percentage points a year. That error over two decades was astonishing: more than double the actual average annual performance of the stock market! Imagine a weather forecast as bad as that. A meteorologist says the high temperature the next day will be 25 degrees Fahrenheit and it will snow, so you dress for a winter storm. Actually, the temperature turns out to be 60 degrees and the skies are clear. That’s about the level of accuracy for Wall Street strategists through 2020.”

“Will Investors Care If The Fed Lessens Its Commitment To 2 Percent Inflation?” (The Hill). “The key issue for many economists is that raising the target rate could undermine the Fed’s credibility. As Dudley states: ‘Moving the goal posts would be interpreted as a failure, making it more difficult to anchor expectations around the new objective.’ This begs an important question: Will investors care if the Fed tolerates inflation of 3 percent to 4 percent if the economy slips into recession?”

“Holiday Discounts Are Already Hard To Resist. The Best Bargains Are Yet To Come” (CNN Business). “Stores are drowning in a glut of merchandise this holiday season, keeping the discounts fast and furious in the runup to Christmas. And the deals are only getting juicier. So if you have the patience and the willpower to wait to grab a few bargains for yourself, you’ll be richly rewarded.”

“Mortgage Buydowns Are Making A Comeback” (Wall Street Journal). “Scores of lenders including Rocket Mortgage and United Wholesale Mortgage are touting temporary buydowns as a way to soften the blow of rates that have roughly doubled over the past year. Home builders are also using them to entice buyers. About 75% of builders surveyed in early December by John Burns Real Estate Consulting said they were paying to reduce buyers’ mortgage rates, either for the full mortgage term or for a shorter period.”

“A New EU Rule Can Expose Greenwashers” (Wired). “In 2023, all companies listed on regulated markets in the European Union will begin applying the Corporate Sustainability Reporting Directive (CSRD), a new rule that will require them to publish, from 2024, detailed information about how they relate to the environment, the treatment of employees, human rights, anti-corruption, bribery, and boardroom diversity.”

What we’re reading (12/16)

“The Big Story On The Market Downturn: The Wealth Bubble Is Popping” (The Hill). “Before 1990 in the U.S., asset price inflation and income followed similar trajectories. The aggregate value of all households’ net assets, including homes and retirement accounts, grew in line with economic output. That connection was long ago broken through a combination of loose fiscal and monetary policy and a worldwide glut of savings. In the 1947 to 1990 period, the net worth of all households and nonprofit institutions on average equaled about four times the annual economic output; at the end of 2021, the ratio equaled about six and a half times an output of $23 trillion.”

“Quant Hedge Funds Post Historic Returns In Ugly Year For Wall Street” (Bloomberg). “The math wizards of Wall Street are notching dream returns in this nightmare year for global markets. Famous quant firms like AQR Capital Management, Man Group and Aspect Capital are riding high as inflation-fueled turmoil trashes many of their human counterparts in the stock and bond world.”

“Quant Hedge Funds Are Back. Here’s Why.” (Institutional Investor). “Hedge funds that use quantitative techniques to spot opportunities, even those focused on equities, have generated some envious returns in a year marked by huge losses in both stocks and bonds. Take equity quant strategies, which are up 5.1 percent year-to-date through November, according to PivotalPath’s index tracking these funds. ‘Anything touching equities being up at all — and up more than 5 percent — is going to feel pretty good for investors,’ said Jon Caplis, CEO of PivotalPath.”

“Goldman Sachs Plans Thousands Of Layoffs, Expects To Eliminate Some Bonuses” (Wall Street Journal). “Like other Wall Street banks, Goldman hired aggressively throughout 2020 and 2021, bringing in new employees to help it keep up with an M&A boom. This year was a different story: An economic slowdown, war in Europe and rising interest rates triggered a bear market for stocks and a slump in deal making. Morgan Stanley also laid off workers this month, and similar cutbacks have swept through American companies.”

“Who Gains And Loses From The New AI?” (Marginal Revolution). “One striking feature of the new AI systems is that you have to sit down to use them. Think of ChatGPT, Stable Diffusion, and related services as individualized tutors, among their other functions. They can teach you mathematics, history, how to write better and much more. But none of this knowledge is imparted automatically. There is a relative gain for people who are good at sitting down in the chair and staying focused on something. Initiative will become more important as a quality behind success.”

What we’re reading (12/16)

“Dow Tumbles On Recession Fears. So Much For A Santa Claus Rally” (CNN Business). “Christmas is just 10 days away, and investors hoping for a Santa Claus rally have found little holiday cheer on Wall Street this month – especially Thursday. The Dow plummeted nearly 765 points, or 2.3%, Thursday, and it is down 4% in December following solid gains the previous two months. Verizon (VZ) was the only one of the 30 Dow stocks in positive territory.”

“Wall Street Fears the Fed Could Cause ‘Some Damage’” (DealBook). “[I]nvestors grow concerned about just how far central banks will push up interest rates to tame inflation. The Bank of England on Thursday raised its prime lending rate by 0.5 percentage points, and the European Central Bank is expected to follow suit with a similar increase. The market volatility was on full display on Wednesday in the U.S. Stocks jumped at the open as investors anticipated that Jay Powell, the Fed chair, would signal that the central bank would soon pull back on its policy of aggressive rate increases. But he did the opposite, and stocks slumped.”

“Services Prices Should Cool In Time, Too” (Fisher Investments). “Services are simply a few links further down the supply chain, so they felt the effect at more of a delay, hence why services inflation has lagged goods inflation…[b]ut just as spiking commodity prices are busy working through the goods side of the economy, so should they soon work their way through services.”

“Everyone Wants to Know What Private Assets Are Really Worth. The Truth: It’s Complicated.” (Institutional Investor). “Private equity valuations have become a lightning rod for investors over the past year, as many have pointed out the lag in performance reporting: Private equity firms don’t report returns to their limited partners until 45 to 90 days after a quarter ends. This practice, coupled with the fact that these firms are not subject to the whims of a public market, has made it seem like the asset class has posted better returns with less volatility than its public equity peers. The truth, though, is much more complicated than that.”

“Is That Co-Worker Really ‘Off To A New Adventure’?” (Wall Street Journal). “Vague, euphemistic announcements about chief executive officers’ departures are practically an art form…nonbosses are carefully managing [their] farewell messages too…Controlling the narrative can feel especially important when many businesses are cutting staff, and as economists are warning of a looming recession.”

What we’re reading (12/14)

“Americans Are Draining The Money They Saved During The Pandemic” (Vox). “Many Americans piled up their savings during the pandemic after lawmakers passed rounds of stimulus measures to prop up the economy, and as households spent less on travel and other in-person events. But with many stimulus programs over, excess savings are quickly dwindling as inflation has spiked and stretched people’s budgets. And even though a strong labor market has led to fast wage growth, inflation has outpaced those gains.”

“In 60 Seconds Before CPI Hit, Heavy Trading Drove Mystery Rally” (Bloomberg). “Karine Jean-Pierre, the press secretary for President Joe Biden, quickly brushed off the question when it came in toward the end of her daily press conference Tuesday. No, she said, there was no chance that anyone in the White House leaked the November inflation report before its 8:30 a.m. publication. Too much fuss was being made, as she saw it, over what were just ‘minor market movements.’ But there was nothing minor about the rally that took hold in the seconds before the better-than-expected inflation number hit the Labor Department’s website.”

“Fusion Industry Suddenly White-Hot After U.S. Lab Breakthrough” (Wall Street Journal). “Michl Binderbauer is chief executive of a southern California firm that aims to create almost limitless energy through nuclear fusion, a starry goal that at times struck some prospective investors as futuristic. That all changed this week.”

“Hold The Nuclear Fusion Hype” (Wall Street Journal Editorial Board)). “The news Tuesday that U.S. scientists have performed the world’s first controlled nuclear fusion reaction that generates a net energy gain is a refutation of American declinism. But don’t believe the hype that a fossil-fuel free world is near if only the government spends more.”

“The Microchip Renaissance Needs More Than Money” (The Hill). “The United States is pouring money into microchips, but will this fix the supply chain problem? The newly-passed CHIPS Act provides more than $75 billion for advanced fabrication of microchips in the U.S. and is the centerpiece of a strategic effort to boost domestic high-tech manufacturing.”

What we’re reading (12/13)

“Sam Bankman-Fried’s ‘House Of Cards’ Teeters” (DealBook). “The spectacular rise and fall of Sam Bankman-Fried, the founder of the failed crypto exchange FTX, came full circle on Monday, with his arrest in the Bahamas at the request of U.S. authorities, followed by the S.E.C. filing its own charges on Tuesday.”

“FTX’s Sam Bankman-Fried Charged With Criminal Fraud, Conspiracy” (Wall Street Journal). “FTX founder Sam Bankman-Fried oversaw one of the biggest financial frauds in American history, a top federal prosecutor said in charging that the former chief executive stole billions of dollars from the crypto exchange’s customers while misleading investors and lenders.”

“FTX ‘One Of The Biggest Financial Frauds’ In History, SDNY Says” (Axios). “Federal prosecutors on Tuesday called the stunning collapse of FTX ‘one of the biggest financial frauds in American history,’ charging that founder and former CEO Sam Bankman-Fried (SBF) defrauded investors while enriching himself.”

“FTX Founder Sam Bankman-Fried Made Political Contributions Under Other People’s Names, US Authorities Allege” (Insider). “US authorities allege that former FTX CEO and co-founder Sam Bankman-Fried violated multiple campaign finance laws, including by sending donations to politicians ‘in the names of other persons.’”

“‘Depressed’ Sam Bankman-Fried Hugs His Parents As He Is DENIED Bail And Sent To Overcrowded Hellhole Bahamas Jail As Prosecutors Say He Hid $300m In Brazilian Firm Before Collapse Of FTX Exchange” (The Daily Mail). “Disgraced FTX founder Sam Bankman-Fried has been denied bail as he fights extradition to the United States in the Bahamas after being charged with one of the ‘biggest financial frauds in American history’.”

What we’re reading (12/12)

“Daily Crunch: Thoma Bravo Buys Coupa Software For $8B, But Will That Price Satisfy Shareholders?” (TechCrunch). “Ron and Alex wrote last week about Coupa’s investors warning that a sale to private equity would not be good for the company. Well, today we learned that Thoma Bravo is acquiring Coupa as the private equity firm continues its M&A rampage. It should make for some interesting investor opinion: Ron reports that the company is being acquired for $81 a share, or $8 billion. Some investors were pushing for $95 a share.”

“The Party Animal And The Island-Hopping Hermit” (Insider). “Sometimes in the course of human events, two people join forces to bring forth something greater than the sum of their parts. Lennon and McCartney. Ben and Jerry. Fred Astaire and Ginger Rogers. But, perhaps, never have two partners created as much wealth, or so radically transformed the global flow of information, as Page and Brin. Like their predecessors — Bill Gates and Paul Allen at Microsoft, Steve Jobs and Steve Wozniak at Apple — the Google visionaries were once the most iconic duo in tech. But they stayed together far longer — almost two decades — and managed to end their partnership without an acrimonious split.”

“Pop Goes The Antitrust Bubble” (The Hill). “[S]harp declines in the stock prices and revenues of many leading platforms cast doubt on the worldwide regulatory consensus that favors “moving fast and breaking things” in antitrust enforcement. Those market shifts have identified cracks in the purportedly invincible armor of network effects and switching costs that had appeared to shield some platforms against competitive threats.”

“Microsoft Buys Near 4% Stake In London Stock Exchange Group As Part Of 10-Year Cloud Deal” (CNBC). “U.S. tech giant Microsoft on Monday announced a 10-year partnership with the London Stock Exchange Group and took a near 4% stake in the U.K. bourse operator. The partnership involves next-generation data and analytics, as well as cloud computing products, according to a statement by the LSEG. It includes a new data infrastructure for the London exchange and analytics and modelling solutions with Microsoft Azure, AI, and Microsoft Teams.”

“Investors Are Losing Faith In Cathie Wood’s ARK Innovation” (Wall Street Journal). “Shares of the fund, a pandemic-era favorite largely made up of unprofitable, growth-oriented technology companies, are down 63% this year. While the S&P 500 index has rallied 12% since mid-October to cut its 2022 losses to 16%, Ms. Wood’s flagship fund is hovering near a five-year low.”

What we’re reading (12/11)

“Investors Grow More Confident Fed Will Pull Off A Soft Landing” (Wall Street Journal). “Mutual funds and hedge funds managing roughly $4.8 trillion in assets have been putting money into stocks that stand to benefit from inflation cooling, interest rates going down and the U.S. economy avoiding a recession, according to an analysis by Goldman Sachs Group Inc.”

“Third Point Struggles In November” (Institutional Investor). “Third Point suffered another monthly loss—and this time, the multistrategy fund can blame its private investment strategy. According to the firm’s monthly report, which was seen by Institutional Investor, Dan Loeb’s Third Point Offshore lost 0.5 percent in November[.]”

“I Cried Every Day Working In An Amazon Warehouse In The Run-Up To Christmas. It’s Physically And Mentally Exhausting.” (Insider). “I had sore muscles, aches and pains. A ten-hour shift is like being in the gym for ten hours because bins and pods are huge, which means you're going up and down a step ladder to reach the top. I was exhausted. I had no life outside of work and was constantly physically and mentally exhausted. I felt depressed. I didn't want to see anyone, including my husband and son.”

“Why Is Howard Schultz Taking This So Personally?” (New York Times). “friends and longtime colleagues say Mr. Schultz’s opposition to the union isn’t primarily about the bottom line. It’s emotional. A union clashes with his image of Starbucks as a model employer. “It’s a sore for him, I guarantee you,” said Willard Hay, a former senior vice president at the company. (Mr. Schultz declined to comment for this article.)”

“Meta Staff Are Hitting Out At Mark Zuckerberg In Blind Reviews Because They Think His Metaverse Obsession Will ‘Single-Handedly Kill’ The Company” (Insider). “‘The Metaverse will be our slow death,’ one user, who called themselves a senior software developer, posted on Wednesday. They added: ‘Mark Zuckerberg will single-handedly kill a company with the meta-verse.’”

What we’re reading (12/10)

“The Housing Slowdown Is Wreaking Havoc On The Short-Term Rental Market” (Wall Street Journal). “[W]hile the absolute number of bookings has risen, there has also been a sharp rise in supply of available short-term rental listings in the U.S., up 23.3% in October 2022 compared with October 2021.”

“Nearly 25% Of U.S. Homebuyers Want To Move — This State Is The Top Destination” (CNBC). “With escalating housing costs squeezing out buyers, more people are looking to relocate from big cities to Sun Belt states where homes are cheaper — particularly Florida.”

“Americans’ Wealth Slips Further After Massive Loss In The Spring” (CNN Business). “Americans’ wealth continued to slide in the third quarter as stock prices plunged over the summer — but many Americans still have a healthy financial cushion, compared to pre-pandemic times. That’s according to data from the Federal Reserve released Friday, which showed that the net worth of households and nonprofit organizations dropped by $400 billion to $143.3 trillion in the third quarter. The value of households’ stocks declined by $1.9 trillion, while their real estate holdings increased in value by $700 billion.”

“Bond Investors Swap Mutual Funds For ETFs At Record Pace” (Wall Street Journal). “Worn down from record losses, investors have fled bond mutual funds en masse. But many aren’t quitting on bonds—they are just turning to exchange-traded funds. One main reason: taxes. Some investors sell beaten-down positions in bond funds to harvest tax losses. In many cases this year, investors have opted to put cash into similar ETFs to maintain bond exposure in their portfolios. As long as the securities within the ETF aren’t nearly identical to those in the mutual fund, swapping the so-called wrapper around the holdings allows investors to stay invested, while capitalizing on tax benefits.”

“Dan Loeb Thinks Bath & Body Works’ Board Could Use Some Serious Exfoliation” (Dealbreaker). “Incredible though this may seem, it has been more than four years since Third Point mounted its last proxy fight. Oh, sure, founder Dan Loeb has sent quite a few of his famous barbed letters in the interim, but has shied away from battle, in spite of how well the last one—against Campbell Soup—went. Has he been cured of the need for open combat by the bitter taste of his own medicine? So afflicted by indecisiveness—as demonstrated by his flip-flopping on Disney—that he can’t choose a target, or what he’d like it to do? Oh, no: He’s just been biding his time, for something sweet-smelling but somewhat bloated.”

What we’re reading (12/8)

“BlackRock Says Get Ready For A Recession Unlike Any Other And ‘What Worked In The Past Won’t Work Now’” (Insider). “The global economy has already exited a four-decade era of stable growth and inflation to enter a period of heightened instability — and the new regime of increased unpredictability is here to stay, according to the world's biggest asset manager.”

“FTC Sues To Block Microsoft’s Acquisition Of Activision Blizzard” (CNBC). “The Federal Trade Commission said on Thursday it has filed an antitrust case against Microsoft to challenge the software maker’s attempt to acquire video game publisher Activision Blizzard, claiming it would violate U.S. law.”

“Wall Street Boom Ends As Goldman Cuts Bonuses” (Semafor). “Goldman Sachs’ bonus pool for senior employees is expected to shrink by as much as half, people familiar with the matter said, as CEO David Solomon tries to boost flagging shareholder returns in a tough year across Wall Street.”

“The U.S. Chip Boom Is Just Beginning” (Axios). “Chip giant Taiwan Semiconductor Manufacturing Co.'s decision to triple its investment in Arizona is part of a national rush to re-shore key inputs for the American economy…TSMC says the plants will create more than 10,000 high-paying tech jobs, including 4,500 directly at the plants themselves.”

“The $42 Billion Question: Why Aren’t Americans Ditching Big Banks?” (Wall Street Journal). “In theory, savers could have earned $42 billion more in interest in the third quarter if they moved their money out of the five largest U.S. banks by deposits to the five highest-yield savings accounts—none of which are offered by the big banks—according to a Wall Street Journal analysis of S&P Global Market Intelligence data.”

What we’re reading (12/7)

“‘There Is A Slowdown Happening’ – Wells Fargo, BofA CEOs Point To Cooling Consumer Amid Fed Hikes” (CNBC). “After two years of pandemic-fueled, double-digit growth in Bank of America card volume, ‘the rate of growth is slowing,’ CEO Brian Moynihan said Tuesday at a financial conference. While retail payments surged 11% so far this year to nearly $4 trillion, that increase obscures a slowdown that began in recent weeks: November spending rose just 5%, he said.”

“What’s Going On With The Housing Market?” (Wall Street Journal). “Contradictory signals abound. Demand has tumbled, but the supply of homes is still low. Prices have fallen but are well above their pre-pandemic levels. Interest rates are sky-high compared with a year ago, but below where they stood in the decades when many older Americans bought their first homes. ‘When prices are rising, people can’t believe housing will ever go down, and then once prices fall, they can’t believe it will ever go up,’ said Glenn Kelman, chief executive at real-estate brokerage Redfin Corp.”

“An Activist Investor Takes On BlackRock Over E.S.G.” (DealBook). “[Bluebell Capital Partners] said that ‘it is not BlackRock’s role to direct the public debate on climate and energy policies or to impose ideological beliefs on the corporate world.’ The hedge fund said BlackRock’s E.S.G. push had become politicized and a distraction, as several Republican state officials have moved to withdraw funds from BlackRock in protest.”

“If There Is A ‘Male Malaise’ With Work, Could One Answer Be At Sea?” (New York Times). “Though the gender split in the industry is more even for onshore office roles, workers and applicants for jobs on the water are predominantly male. Centerline says it has roughly 220 offshore crew members and about 35 openings. Captains and company managers agree that changing attitudes toward work among young men play a part in the labor shortage. But the strongest consensus opinion is that structural demographic shifts are against them. ‘We’re seeing a gray wave of retirement,’ said Mr. Harvey, who is 38.”

“We Forgot To Fix Unemployment Insurance Yet Again” (Vox). “‘This is literally what always happens every time there is an economic downturn,’ said Michele Evermore, the former deputy director of policy at the Office of Unemployment Insurance Modernization at the Department of Labor who is now a senior fellow at the Century Foundation, a progressive think tank. ‘At the very start of it, people are pretty sympathetic to people who suddenly became unemployed, so we temporarily add benefits and add temporary fixes, and then as the economic crisis rolls on, everybody gets sick of the unemployed people and starts blaming them.’”

What we’re reading (12/6)

“Doesn’t Anyone Do Due Diligence Any More?” (Financial Times). “Doesn’t anyone do due diligence any more? The boring process of checking that potential investments can live up to their promises has fallen completely by the wayside. Due diligence once meant sending bankers to check that a mining company really had a working gold mine, hiring accountants to scour the books and asking lawyers to identify contracts that could prove troublesome in a bankruptcy.”

“Small-Cap Stocks Are Really Cheap” (Morningstar). “For smaller-company stocks, price/earnings ratios—a widely used measure for determining the value of a stock relative to its earnings—have reached their lowest levels in two decades. Lower ratios generally represent more attractive values and with a greater potential for price gains.”

“9 Dividend Aristocrat Stocks To Buy Now” (U.S. News & World Report). “[T]here's a special breed of dividend stock that takes reliability, consistency and dependability to another level. The ‘dividend aristocrats’ are a group of 65 S&P 500 stocks that have somehow managed to raise their dividend payments each year for at least 25 consecutive years.”

“Europe Can’t Count On U.S. Shale To Make Up For Russian Crude” (OilPrice.com). “U.S. oil production growth is slowing down. The shale revolution, as we knew it until a few years ago, is no longer in full-growth mode. And it may never return to it.”

“Major League Baseball Used Two Balls Again This Year, And Evidence Points To A Third” (Insider). MLB has some questions to answer: “according to a new analysis of more than 200 balls used in games during the 2022 season conducted by Dr. Meredith Wills, a Society for American Baseball Research award-winning astrophysicist, that's [MLB’s claim that all balls used in 2022 were produced under the new manufacturing process] not true. Major League Baseball did not settle into using a single, more consistent ball last season, Wills' research suggests: It used three.”

What we’re reading (12/5)

“Mutual Funds That Consistently Beat The Market? Not One Of 2,132.” (New York Times). “Over the last five years, not a single mutual fund has beaten the market regularly, using the definition that S&P Dow Jones Indices has employed for two decades. The S&P Dow Jones team looked at all the 2,132 broad, actively managed domestic stock mutual funds that had been operating for at least 12 months as of June 2018.”

“How A Basket of ETFs Mimicked The Performance Of Top Hedge Funds” (Institutional Investor). “If the performance of the best hedge fund managers can be mimicked by a cheaper fund, why invest in less liquid and more complex products?”

“PepsiCo To Lay Off Hundreds Of Workers In Headquarters Roles” (Wall Street Journal). “Hundreds of jobs will be eliminated, one of the people said. The cuts affect the company’s North America beverage business, which is based in Purchase, N.Y., and its North America snacks and packaged-foods business, which has headquarters in Chicago and Plano, Texas, the people said.”

“What is ‘Shrinkflation’?” (The Week). “Switching between brands, or to a more generic product, is a good way to circumvent shrinkflation, CNBC suggests. Consumers can also try and submit a complaint with the manufacturer, which may be enough to score some coupons and save some money (though not enough to stop shrinkflation in its tracks, of course), Dworsky told CNBC. Financial advice website SmartAsset recommends planning your meals, avoiding impulse purchases, shopping the sale items, and using credit card rewards to save money while shrinkflation is rampant.”

“From Chicken Wings To Used Cars, Inflation Begins To Ease Its Grip” (Washington Post). “After more than a year of high inflation, many consumers are finally starting to catch a break. Even apartment rents and car prices, two items that hammered millions of household budgets this year, are no longer spiraling out of control.”

November 2022 performance results

Hi friends,

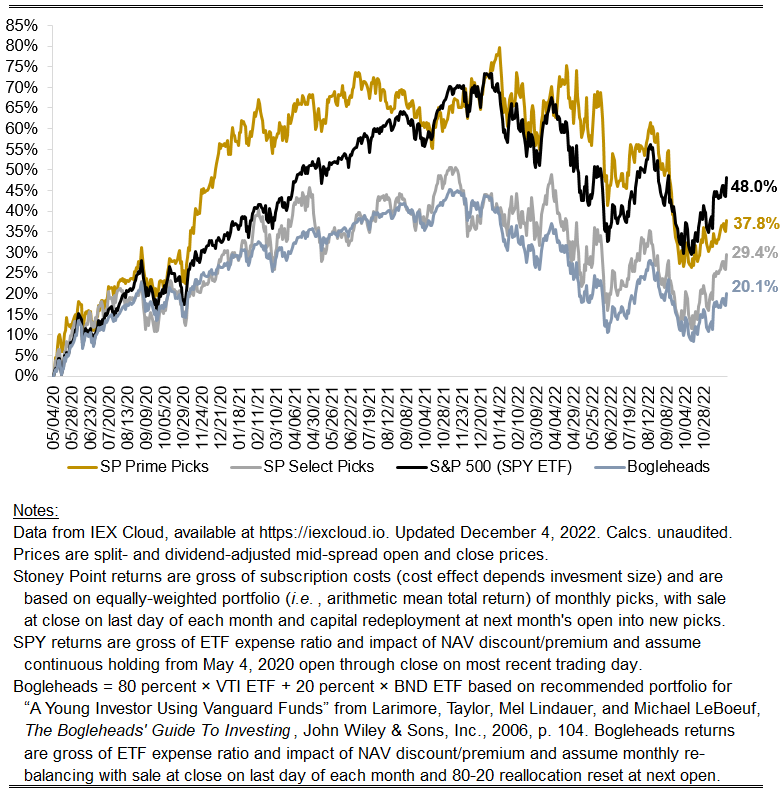

Here with a monthly performance update. Here are the numbers:

Prime: +2.02%

Select: +7.46%

SPY ETF: 4.5%

Bogleheads Portfolio (80% VTI + 20% BND): 3.91%

A solid month overall, with gains across both our portfolios outpacing the rise in consumer prices on an annualized basis. Prime underperformed the broad market, while Select significantly bettered it. Investors are paying close attention to corporate earnings and the slow-moving economic data. I am optimistic we are seeing the peak of inflation in real time and in fact are perhaps past the peak.

The de-pricing of crypto was a big story in the month, with the obliteration of FTX precipitating a noticeably different crisis of confidence for the entire asset class than we have seen before. Paul Krugman continues asking “what is the point [of crypto]?” and no one seems to have a compelling answer.

More consequentially, it seems clear at this point the recession many have been forecasting for corporates overall is most certainly manifesting in tech. All of them seem to be laying folks off, VC money has apparently completely dried up, and the usual tech “finfluencers” on Twitter seem a little quieter than they used to be.

These events strike me as bullish indicators for value-focused strategies overall. Everyone will likely end 2022 down to a significant extent, but who lifts off most strongly in the next year or so will be telling.

A quick reminder that I will be implementing some changes to the algorithm at year end to better capture changes in investor “sentiment” not readily picked up in trailing financial and market data. I will explain what I am doing in greater detail at some point in the relatively near future.