December 2022 performance update

Hi Friends, wrapping up 2022 with December’s performance:

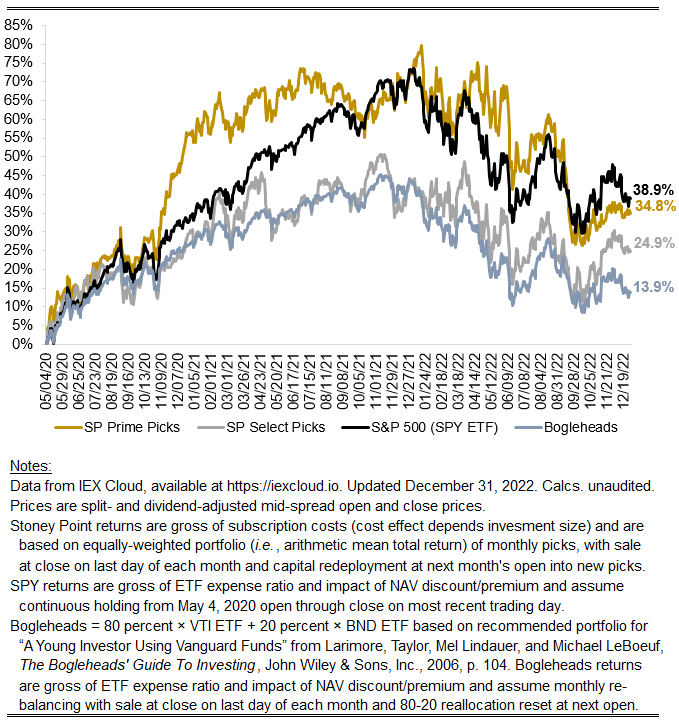

Prime: -2.16%

Select: -3.53%

SPY ETF: -6.01%

Bogleheads Portfolio (80% VTI + 20% BND): -5.17%

It was strong December with both Stoney Point portfolios significantly outperforming the market (by nearly 4 percentage points for Prime and roughly 2.5 percentage point for Select). Volatility remains elevated and, qualitatively, “fear” seems to be the predominant sentiment, at least among outspoken institutional market participants.

The headline for 2022 overall was that it was a bad year for equities. The market (as proxied by the SPY ETF) was down roughly 19.5 percent, the biggest calendar-year evaporation in aggregate corporate net worth since 2008. Prime’s performance broadly mirrored that although a bit worse, being down roughly 21.7 percent. Encouragingly after a slow few years, the drawdown in equities allocated to the Select strategy was considerably more muted, with that portfolio being down only 12.4 percent for the year.

The story in 2022 was mostly about rate hikes. More recently, on the back of the rate hikes, concerns are growing about a steep deceleration or decline in corporate earnings in 2023. Everyone seems to agree that a recession is coming. Alas, consensus on something like that is usually a good indicator that the valuation consequences of the presenting event have already been impounded into asset prices. I continue to believe “value”-oriented strategies will re-emerge as big winners in the years ahead after a long hiatus. While value has underperformed for a long time recently, it is noteworthy that the samples used in early studies quantifying the strong, positively predictive power of value ratios (e.g., Fama and French 1992) generally included the rate-hiking cycle of the early 80s and long period of elevated rates thereafter.

Some months ago I mentioned changes I anticipated putting through to the algorithm that guides my selection of securities for the Prime and Select portfolios. I am happy to say those edits—which are the first I have made to the algorithm since the start of this endeavor in May 2020—have now been fully incorporated. I am excited to see if and how they affect performance in 2023. The strategy (or system used to rank particular stocks against one another in the cross section) now reflects a weighted average of three factors:

The original Stoney Point value factor: until recently, this was the sole factor used to rank stocks for both Prime and Select. It is a proprietary value ratio that attempts to merge the insights of more traditional value factors (e.g., book-to-market ratios) and a less-famous literature on what scholars call the “implied cost of capital.” The essential logic of the latter literature is that the market’s expectation of returns for various securities can be extracted from current prices and various cash flow forecasts.

A new risk factor: this uses extensions of Merton’s (1974) famous structural credit risk model based on options pricing techniques to construct a novel risk factor. Statistical tests performed by yours truly suggest it relates to returns in a way that is not already captured by the most common extant asset pricing models.

Sentiment: I mentioned this before, but an intuitive flaw in any fundamentals-based algorithmic stock selection strategy is that reported fundamentals are inherently backward looking. This can be avoided somewhat by looking at things like analyst forecasts, but documented bias in analyst forecasts casts serious doubt on the reliability of their estimates as forward-looking measures (the analysts were basically the last to pick up on Enron’s frauds, after all). I use information from the analyst community in this new sentiment factor, but not in isolation. Market prices themselves, and other market data, provided alternative close-to-real-time measures of changes in sentiment with respect to particular stocks.

Let’s see what 2023 has in store.