What we’re reading (10/3)

“Stocks Kick Off October With A Huge Rally” (CNN Business). “The Dow rose 765 points, or 2.7%. That was its biggest gain since mid-July. The Nasdaq and S&P 500 gained 2.3% and 2.6%, respectively. Stocks ended September (and the third quarter) with a resounding thud on Friday.”

“Elon Musk’s Texts Shatter The Myth of the Tech Genius” (The Atlantic). “What is so illuminating about the Musk messages is just how unimpressive, unimaginative, and sycophantic the powerful men in Musk’s contacts appear to be. Whoever said there are no bad ideas in brainstorming never had access to Elon Musk’s phone.”

“Why Interest Rates Are Rising Everywhere—Except Your Savings Account” (Wall Street Journal). “‘The biggest reason consumers don’t seem to reoptimize their finances seems to be a belief that it will be a huge hassle,’ said Christopher Palmer, a professor of finance at MIT’s Sloan School of Management and a co-author of the study. The study also found that customers tend to overestimate how much of a hassle it actually is, and underestimate how much their interest rate might increase.”

“Advanced Economies Need To Change Course On Monetary Policy As Excessive Central Bank Tightening Risks Sparking A Global Recession, UN Trade Group Says” (Insider). “‘Excessive monetary tightening could usher in a period of stagnation and economic instability,’ the United Nations Conference on Trade and Development warned in a statement on Monday, shortly after releasing a report on growing recession risks.”

“Useless Meetings Waste Time And $100 Million A Year For Big Companies” (Bloomberg). “Unnecessary meetings are a $100 million mistake at big companies, according to a new survey that shows workers probably don’t need to be in nearly a third of the appointments they attend.”

September 2022 performance update

Hi friends, here with a performance update for the month. If you’ve been following the news, you probably understand it was a veritable nightmare of a month for capital asset prices. Currently, 30-year fixed rate mortgages are running about 7 percent in the U.S., the GBPUSD rate is near parity, and as of this writing there are rumors on Twitter that a major international investment bank is “on the brink.” As Matt Levine pointed out in Bloomberg this week, certain pension funds in the U.K. received margin calls receive, so it isn’t all that crazy to assume that most major pools of capital have experienced steep losses and, as a matter of sheer probability, some are probably having liquidity or even solvency problems.

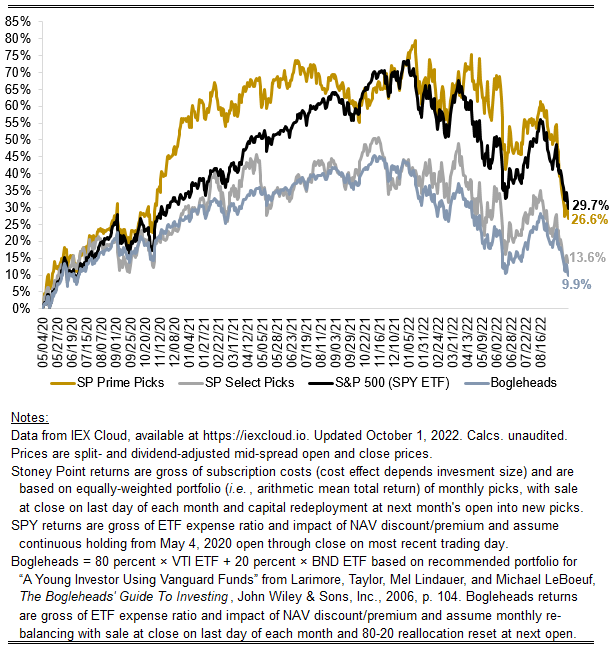

Stock markets were down big this month. Our Prime model was caught especially flat-footed, though Select outperformed the market. Here are the numbers:

Prime: -15.59%

Select: -7.11%

S&P 500 (SPY ETF): -8.72%

Bogleheads model (80% VTI + 20% BND): -7.69%

In terms of a post-mortem analysis, I think I have a pretty good understanding of why Prime was shredded last month. Less interesting (and, I think, controversial) than the “why” I will offer is whether it could have been foreseen. The why (perhaps one among others): Prime was unusually heavily concentrated in logistics providers last month. Careful readers may have noticed that among the Prime picks last month were UPS, Fedex, CH Robinson, and Expeditors International of Washington, all of which were hit hard and down more than the market overall. These aren’t exactly companies that one would expect to perform well heading into a recession—such as the recession that the market is now pricing and is being discussed daily in the media.

These stocks surely looked attractive to our algorithm because it extrapolates past profitability into the future and compares that to price (like any “value”-oriented approach). The upside to that strategy is that it aligns with the empirical observation that, historically, such “value” portfolios outperform. A natural downside is that it doesn’t reflect rapid shifts in sentiment, such as what markets experienced last month. In fact, it in a rapidly downshifting environment, the algo likely actually adversely selects worse-than-average stocks (focusing only on near-term performance). That is because prices, being market-based data points, adjust at a high frequency, unlike accounting data, which is reported at a low frequency. When prices for some stocks fall sharply, our model sees those stocks as “discounts” (assuming the infrequently reported accounting data still look good). But that begs the question of why did the prices go down in the first place? In an efficient market, the price declines can only be interpreted as the market seeing darkness on the horizon that isn’t quite picked up in earnings yet.

Of course, I don’t interfere with the model and try to step in and make alterations to account for factors it may not pick up. I think my attempt to do so would be guesswork and I would be wrong as often or more than I would be right. More important, my belief is that the model should outperform over the long term (a multi-year horizon) without such interference, even if there are hiccups along the way. Empirically, that is true when backtesting historically, and in terms of performance assessment for posterity such interference would contaminate results and cause serious replicability issues and doubts about out-of-sample validity.

The results do bring questions to the fore and that I have raised in the past about whether it makes sense to incorporate automated sentiment indicates in the algorithm. Many quants do this (a simple example would be to have the model look at trends in the relationship between the recent simple moving average of price and a longer-term historical simple moving average, or to incorporate proxies for the well-established “momentum” concept). I’m working on some things on this front that I will plan to incorporate by year end. Results are promising so far, and a few of these sentiment indicia are things that theoretically make a lot of sense (unlike many “technical” indicators) but that few, if any, seem to be using (or least no one seems to be discussing).

Stoney Point Total Performance History

October picks available now

The new Prime and Select picks for October are available starting now, based on a model run put through today (October 1). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Monday, October 3, 2022 (at the mid-spread open price) through the last trading day of the month, Monday, October 31, 2022 (at the mid-spread closing price).

What we’re reading (9/30)

“Stocks Finish A Losing Week, Month And Quarter” (Wall Street Journal). “Major indexes have sustained deep losses this year as the Federal Reserve raises interest rates in an attempt to tame rising prices. The S&P 500, Dow Jones Industrial Average and Nasdaq Composite on Friday all recorded their worst first nine months of a calendar year since 2002, according to Dow Jones Market Data.”

“Bonds May Be Having Their Worst Year Yet” (New York Times). “It is a horrible time for stocks, which have spent the year in a bear market. But guess what? When you look at the historical record, bonds are worse. This year is the most devastating period for bonds since at least 1926, the numbers show. And, in the estimation of one bond maven, 2022 is shaping up to be the worst year for bonds since reliable record-keeping began in the late 18th century.”

“Wary Investors Struggle To Evade Market Tumult” (Wall Street Journal). “‘In 50 years we haven’t seen debt and equity markets fall this much in unison,’ said Rick Rieder, chief investment officer of global fixed income and head of the global allocation team at BlackRock Inc. ‘I’ve never spoken with clients so much in my life—everyone wants to know when this is going to be over.’”

“Barclays Fined $200 Million For Losing Itself $600 Million” (Dealbreaker). “You might think losing some $600 million because some back-office person forgot to keep track of how many structured notes you’ve sold and/or some lawyer forgot to file the boilerplate with the Securities and Exchange Commission informing it that you’d be selling some more would be enough to ensure that something like that never happens again. Certainly, a screw-up of similar magnitude at Citigroup seems to have done that trick. But when it comes to Barclays, well, the SEC [is] just not sure. So it has a little reinforcement to remind the Brits not to cross it again.”

“One Of The Hottest Trends In The World Of Investing Is A Sham” (Hans Taparia). “Wall Street’s current system for E.S.G. investing is designed almost entirely to maximize shareholder returns, falsely leading many investors to believe their portfolios are doing good for the world.”

What we’re reading (9/29)

“Apple Downgrade Sparks Tech Sell-Off, Sending Alphabet And Microsoft To One-Year Lows” (CNBC). “Shares of large technology companies suffered heavy losses on Thursday, dragging down many other U.S. stocks along with them, after analysts at Bank of America lowered Apple’s stock rating. Tech stocks have been pushed down all year as investors have rotated out of growth and flocked to more defensive assets to deal with higher interest rates and to get ahead of a possible recession.”

“Porsche Takes Off In Trading Debut” (DealBook). “Shares in Porsche rose in their trading debut this morning, after the sports car maker priced its initial public offering at the top end of its expected range last night. The long-awaited offering was an increasingly rare bright spot for I.P.O.s, but it may not be enough to revive the moribund market on its own.”

“Pension Strategy Left Funds Vulnerable To Rate Increases” (Wall Street Journal). “‘A vicious cycle kicks in and pension funds are selling and selling,’ said Calum Mackenzie, an investment partner at pension-fund adviser Aon PLC. ‘What you start to see is a death spiral.’”

“UK Pensions Got Margin Calls” (Bloomberg). “This all makes total sense, in its way. But notice that you now have borrowed short-term money to buy volatile financial assets. The thing that was so good about pension funds — their structural long-termism, the fact that you can’t have a run on a pension fund: You’ve ruined that! Now, if interest rates go up (gilts go down), your bank will call you up and say ‘you used our money to buy assets, and the assets went down, so you need to give us some money back.’ And then you have to sell a bunch of your assets[.]”

“Inside Supersonic Plane That Will Get You From London To New York In 80 Minutes At Speeds Of 2,486 Mph” (The U.S. Sun). “The plane would travel at a speed of 2,486mph – twice as fast as Concorde. Measuring 328 feet long with a 168-foot wingspan, the aircraft is also nearly twice its size.”

What we’re reading (9/28)

“The Mysterious Ad Slump Of 2022” (Vox). “Not every truism is true, but there’s one for the ad industry that is pretty truthy: When the economy goes south, the ad market is the first thing to go. The idea behind this one is pretty straightforward. If a company needs to cut costs, it’s much easier to get rid of ad budgets than anything else, like workers. So people in media have been trained to expect ad dollars to disappear in the wake of economic shocks.”

“10-Year Yield Drops The Most Since 2020 After Touching 4%” (CNBC). “The benchmark 10-year Treasury yield dropped the most since 2020 on Wednesday, despite briefly topping 4% earlier in the session, after the Bank of England announced a bond-buying plan to stabilize the British pound. The yield on the 10-year Treasury fell 25 basis points or the most it’s declined since 2020. It yielded 3.705%.”

“Global Bonds Rally After 10-Year Treasury Yield Touches 4%” (Wall Street Journal). “A wild run for global government bonds took an unexpected turn on Wednesday after the Bank of England stepped in to stop a rout in the U.K. gilts market, spurring a furious rally on both sides of the Atlantic. The sharp move added to a stretch of highly volatile trading sessions and came just after the 10-year U.S. Treasury note had climbed above 4% for the first time in more than a decade—a significant milestone that was quickly swept away by the day’s events.”

“‘Act of Sabotage’ Hits Europe’s Energy And Stocks Markets” (DealBook). “There is still no official explanation for what caused the explosions that ruptured the Nord Stream 1 and 2 pipelines, sending natural gas gurgling to the surface of the Baltic Sea. But that hasn’t stopped some E.U. officials from calling the episode an “act of sabotage,” with Prime Minister Mateusz Morawiecki of Poland publicly blaming Russia. Then last night, the pipelines’ operator, Gazprom, threatened to shut down the only pipeline that’s still pumping Russian gas to Western Europe.”

“Make Sure To Delete That Incriminating Message About Deleting Potentially Incriminating Messages, Too” (Dealbreaker). “There are non-nefarious reasons bankers and the like might choose to use a messaging service such as WhatsApp or Signal (well, probably not Signal) on a personal device. Specifically, they’re a lot quicker, more convenient and interactive than the sort of modes of communication officially sanctioned by their employers, and those employers’ regulators, such as e-mail. Of course, there are also nefarious reasons, specifically that no one is looking at what you’re saying or doing on those devices. Allow one Bank of America trader explain: ‘We use WhatsApp all the time but we delete convos regularly.’”

What we’re reading (9/27)

“Dow Slips Again After Entering Bear Market” (Wall Street Journal). “All three indexes spent much of the morning in the green, but it didn’t last. The Dow Jones Industrial Average, which entered a bear market on Monday, fell 125.82 points, or 0.4%, to 29134.99. That marked its sixth consecutive day in the red.”

“The British Pound Is On Parity Watch” (New York Times). “Investors expect the pound to reach parity with the dollar. Even after the Bank of England said it was ready to keep raising interest rates to head off inflation and prop up sterling, the pound fell; it is currently holding steady at roughly $1.08. Meanwhile, the yield on British government bonds, known as gilts, continued a record-breaking climb — which will also most likely push up some British mortgage rates.”

“Companies Downplayed Their Earnings. Here’s Why.” (Institutional Investor). “According to the latest note from the research firm New Constructs, some of the nation’s largest companies purposely understated their earnings in the first half of 2022. New Constructs CEO David Trainer argues that many companies may have done so to avoid reporting significant losses in the second half of the year, where fears of recession are mounting due to deteriorating economic conditions.”

“Feds Sought To Jail Father Charged In $100 Million New Jersey Deli Scam With Hong Kong-Based Son At Large” (CNBC). “Hometown International, which only had the deli and its less than $40,000 in annual sales to its name, and E-Waste, which had no discernible business, both ended up with market values of about $100 million. Both companies merged with other firms. The deli’s new owner, Makamer Holdings, closed the shop earlier this year, selling its remaining inventory for $700.”

“‘We Are Going To Drag Our Editors Into This’: The New York Times’ Labor Fight Is Demoralizing The Newsroom” (Vanity Fair). “‘There’s a feeling among the staff who have paid attention to the negotiations that the company’s negotiating team is disrespectful and does not value journalism in a way that other parts of the company at least claim to,’ the reporter said.”

What we’re reading (9/26)

“S&P 500 Notches New Closing Low For 2022, Dow Falls Into Bear Market As Dollar Surges” (CNBC). “The S&P 500 notched a new closing low for 2022 and the Dow Jones Industrial Average slipped into a bear market as interest rates surged and turmoil rocked global currencies. The S&P 500 declined 1.03% to 3,655.04, falling below the June closing low of 3,666.77. At one point during the day, the index dipped to 3,644.76, less than eight points away from its intraday low of 2022: 3,636.87.”

“European Political Turmoil Roils Global Markets” (DealBook). “The pound briefly hit a decades-long low against the dollar, at $1.03, before recouping some of its losses. But that recovery appears largely tied to expectations that the Bank of England will make a rare extra hike in interest rates to head off inflation spurred by the government’s new fiscal policy. Markets are now pricing in a series of increases to bring the benchmark to 6 percent by next summer.”

“Tech Stocks Face Another 10% Drop or More as Strong Dollar Hits Profits” (Bloomberg). “More than two-thirds of 914 respondents in the MLIV Pulse survey think profits of the technology companies will disappoint the market throughout 2022. Firms including Alphabet Inc.’s Google are at risk of advertisers cutting spending as the global economy struggles, while streaming services including Netflix Inc. face an exodus of price-sensitive subscribers with consumers tightening their belts.”

“Traders Who ‘Just Want To Survive’ Sit On $5 Trillion Cash Pile” (Bloomberg). “Investors have $4.6 trillion stashed in US money-market mutual funds, while ultra-short bond funds currently hold about $150 billion. And the pile is growing. Cash saw inflows of $30 billion in the week through Sept. 21, according to figures from EPFR Global. Where once that stash yielded practically nothing, the vast bulk now earns upwards of 2%, with pockets paying 3%, 4% or more.”

“Inside Goldman Sachs’ ‘Tough Week’ As Pink Slips Were Handed Out From New York To San Francisco” (Insider). “It's been ‘a tough week,’ one Goldman insider said of the sackings. Among those given pink slips were a number of senior associates and vice presidents working for the technology, media, and telecommunications team in New York and San Francisco, according to a person with knowledge of the layoffs. At least some of the axed TMT employees worked on mergers and acquisitions, the person added.”

October picks coming soon

We’ll be publishing our Prime and Select picks for the month of October before Monday, October 3 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of September, as well as SPC’s cumulative performance, assuming the sale of the September picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Friday., September 30). Performance tracking for the month of October will assume the October picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Mon., October 3).

What we’re reading (9/24)

“Silicon Valley Had Its Heyday. Can Tech Ecosystems Now Grow Inland?” (DealBook). “Steve Case has long said tech ecosystems can — and should — expand beyond major coastal cities. In 2014, Mr. Case, a co-founder of AOL, started an initiative at his venture firm, Revolution, that focuses on investment outside tech hubs like Silicon Valley and New York. He has pushed for more venture capital to flow inland. But the landscapes of both the United States and business are shifting rapidly. The pandemic has given white-collar workers in states like California, New York and Massachusetts, which have received 75 percent of venture capital dollars in the past decade, an opportunity to work from wherever they want.”

“Never Mind Growth Vs. Value Stocks, Look To Beta” (Morningstar). “‘More than value versus growth, the factor that I prefer right now is beta, which represents risk and volatility,’ says Denise Chisholm, director of quantitative market strategy at Fidelity Investments. Investors must decide for themselves how much up-and-down portfolio risk they can stomach in the short term, even as high-beta stocks trade at low valuations. That's especially the case if the Federal Reserve needs to raise rates even more aggressively than is expected in order to contain inflation and the risk of serious recession increases.”

“The Fed Appears More Optimistic Than Some Investors. Here’s Why.” (New York Times). “Interest rate traders have been bruised this year as the Fed’s outlook for inflation and interest rates has repeatedly been upended by reality. The central bank raised interest rates this week by three-quarters of a percentage point — its third such increase since June. The Fed’s policy rate is now the highest it has been since 2008, well above forecasts at the start of the year. And policymakers predict it will move even higher as the central bank escalates its campaign to lower stubbornly high inflation.”

“Mandatory Overtime Is Garbage” (Vox). “Many American workers have very little control over their schedules. For some, that translates to too few hours, or a complete lack of control of when they’re expected to work week to week. For others, it means too many hours they can’t say no to. Often (but not always), mandatory overtime comes with a carrot of being paid time and a half for their labor. Sometimes, the carrot isn’t worth it, but workers have no choice. Their employer also has the stick and can fire them for refusing.”

“Wall Street’s Most Highly Regarded Titans Are Warning ‘The Worst Is Yet To Come’ For Stocks. Here’s Why People Like Ray Dalio, Jeremy Grantham, Carl Icahn, And Scott Minerd Are Bearish On The Market’s Near-Term Prospects.” (Insider). “Tom Lee, the top equity strategist at Fundstrat and the former chief US equity strategist at JPMorgan, said in a note to clients this week that he still sees the S&P 500 climbing to 5,100 in 2022, despite it currently sitting at 3,693. His reasoning is that inflation is falling and the Federal Reserve will be able to back off of their hawkish stance next year.”

What we’re reading (9/23)

“Dow Drops Nearly 500 Points To Close At New Low For 2022 On Rising Recession Fears” (CNBC). “Stocks tumbled Friday to cap a brutal week for financial markets, as surging interest rates and foreign currency turmoil heightened fears of a global recession…The major averages capped their fifth negative week in six, with the Dow giving up 4%. The S&P and Nasdaq shed 4.65% and 5.07%, respectively. It marked the fourth negative session in a row for stocks, as the Fed on Wednesday enacted another super-sized rate hike of 75 basis points and indicated it would do another at its November meeting.”

“Stock Market Continues Long Tumble As Economic Outlook Sours” (Washington Post). “Blue-chip stocks plunged to their lowest level since 2020 on Friday, continuing a bad slump that began in August as investors try to grapple with economic head winds in the United States and around the world that are only likely to worsen.”

“A Natural Gas Shortage Is Looming For The U.S.” (OilPrice.Com). “[N]atural gas prices fell by nearly a dollar per million British thermal units, helped by a respectable build in inventories. And yet, inventories remain below the seasonal average, exports are running at record rates, and producers are beginning to struggle to meet demand, both at home and abroad.”

“Is The Hyperloop Doomed?” (New York Times). “[W]hile companies have raised hundreds of millions of dollars to design and construct hyperloop systems — with projects in India, the Netherlands, Saudi Arabia and the United States — the technology remains an aspiration.”

“When Bad Things Happen To Good Stocks” (Wall Street Journal). “In this year’s market bloodbath, you might think funds with “quality” in their name—and in their holdings—would lose less money. You’d be wrong…Over the past few years, exchange-traded funds specializing in quality stocks have grown to more than $60 billion. With the S&P 500 down 20% this year, several of these ETFs have fallen even harder, losing as much as 25%.”

What we’re reading (9/22)

“‘The Party Is Over’: How Meta And Google Are Using Recession Fears To Clean House” (Vox). “As Google’s parent company Alphabet and Meta have grown into corporate giants worth $1 trillion and $385 billion, respectively, they’ve swelled their staffing to over 150,000 and 80,000. Now, economic circumstances are giving management an opportunity to reset expectations, pressure staff to start working harder with smaller budgets, and show some workers the door.”

“Treasury Yields Surge As Global Central Banks Scramble To Respond To Fed, Inflation” (Wall Street Journal). “U.S. government bond yields surged Thursday, after foreign governments and central banks rushed to raise interest rates or otherwise support local currencies pressured by the dollar’s strongest rally in a generation.”

“In The Dollar We Trust” (Jeffrey Frankel, The Financial Express). “In a sense, the dollar’s recent rally may seem puzzling. After all, surging inflation and the ongoing economic slowdown should have hurt demand for dollars. But the greenback’s current strength can be explained by the relative resiliency of the US economy and the Federal Reserve’s ongoing commitment to raising interest rates.”

“Bad News From the Fed? We’ve Been Here Before.” (New York Times). “The outlook is gloomy, but it has been worse before. The last time severe inflation tested the mettle of the Federal Reserve was the era of Paul A. Volcker, who became Fed chair in August 1979, when inflation was already 11 percent and still rising. He managed to bring it below 4 percent by 1983, but at the cost of two recessions, sky-high unemployment and horrendous volatility in financial markets.”

“Quiet Quitting Is A Fake Trend” (The Atlantic). “What people are now calling “quiet quitting” was, in previous decades, simply known as ‘having a job.’”

What we’re reading (9/21)

“Incentives: The Most Powerful Force In The World” (Morgan Housel). “[P]eople are not calculators; they are storytellers. There’s too much information and too many blind spots for people to calculate exactly how the world works. Stories are the only realistic solution, simplifying complex problems into a few simple sentences. And the best story always wins – not the best idea or the right idea, but just whatever sounds the best and gets people nodding their head the most. Ben Franklin once wrote, “If you are to persuade, appeal to interest and not to reason.” Incentives fuel stories that justify people’s actions and beliefs, offering comfort even when they’re doing things they know are wrong and believe things they know aren’t true.”

“Inflation Is High. How Will Rate Increases Fix That?” (New York Times). “[T]ime is of the essence when it comes to controlling inflation. If price increases run fast for months or years on end, people could start to adjust their lives accordingly. Workers might ask for higher wages to cover their climbing expenses, pushing up labor costs and prompting businesses to charge more. Companies might begin to believe that consumers will accept price increases, making them less vigilant about avoiding them.”

“Some WFH Employees Have A Secret: They Now Live In Another Country” (Vice). “Even more than the average person, Daniel dislikes video calls with the boss. That’s understandable, because Daniel is hiding a big, complicated secret: He doesn’t live in Birmingham, England, like his entire company believes that he does. In reality, for the past two years, he has been living 5,600 miles away—in Chiangmai, Thailand.”

“Why Index Funds Could Fade” (Barron’s). “Index funds have had a spectacular run. They collected $8.5 trillion in retail investment dollars by the end of the first quarter of this year, according to Morningstar, more than all active strategies together. Along the way, they became the dominant investment idea. Yet the stock market’s recent dip into bear-market territory raises new questions for these popular funds. Will indexing recover and go on to scale new heights? Or has the time come to consider its defects as well as its virtues?”

“Fed Raises Interest Rates By 0.75 Percentage Point For Third Straight Meeting” (Wall Street Journal). “Fed officials voted unanimously to lift their benchmark federal-funds rate to a range between 3% and 3.25%, a level last seen in early 2008. Nearly all of them expect to raise rates to between 4% and 4.5% by the end of this year, according to new projections released Wednesday, which would call for sizable rate increases at policy meetings in November and December.”

What we’re reading (9/19)

“10-Year Treasury Yield Jumps To 3.51%, The Highest Level Since 2011” (CNBC). “The benchmark 10-year Treasury yield gained 6 basis points to 3.518%, hitting its highest level since April 2011, and was last up 4 basis points to 3.49%. The yield on the 2-year Treasury bond rose 9 basis points to trade at 3.949%, trading around levels not seen since 2007.”

“Rising Bond Yields Change The Calculus For Stocks” (Wall Street Journal). “After several Fed interest-rate increases, yields across the Treasurys market are trading at multiyear highs. Now, fewer than 16% of S&P 500 stocks have dividend yields greater than the yield of the two-year U.S. Treasury note, which is approaching 4%. Fewer than 20% have dividend yields greater than the yield of the 10-year note, according to Strategas. Those numbers mark the lowest share since 2006.”

“Warnings Signs Multiply Ahead Of Pivotal Fed Meeting” (DealBook). “All eyes will be on the Fed this Wednesday. The consensus estimate is for a 75-basis-point increase, bringing the benchmark interest rate to between 3 and 3.25 percent — up from near zero at the start of the year. Higher interest rates generally slow lending and economic activity, and with it the forces that push prices higher. So far, it’s not going to plan. Last week, the government reported that consumer prices rose 8.3 percent in the past year, through the end of August.”

“Need Your Money Now? The Markets Aren’t Helping.” (New York Times). “The stock market has been painful if you have been looking at it closely. So don’t look. Set up your investments, then take a deep breath. After that, what should you do? In a word: nothing. Get on with your life.”

“The Rational Case For Monarchy” (Wrong Side of History). “The upside risk on republicanism is pretty small, since among developed liberal democracies both forms of government can be found. The downside risk, however, is gigantic. If you were to opt for a monarchy, you’d be unlucky to land in Saudi Arabia, for its repression, or Swaziland, for its poverty and ill heath. But there are far worse places to live than Saudi, for the depths of human depravity afforded by the absence of a monarch is essentially endless; just in that neighbourhood you could instead get Syria or Iran or Iraq, Libya or Yemen, and across the world everything from surveillance capitalism to anarcho-clannism to the eccentric last holdouts of Marx’s followers. If you were to go back over the past couple of centuries, the vast majority of the most appalling regimes would be republics.”

What we’re reading (9/18)

“Lower Prices Mean Higher Expected Returns” (Servo Wealth Management). “The 10-year period from November 2007 through October 2017 was predictably low, just +6.3% per year. What was the annualized return starting instead in October 2008 through October 2017, after the first stage of the decline? It was much higher, +10.7% per year. Of course, the index declined violently for another five months before bottoming out, and expected returns at that point, in March 2009, were higher still: +17.3% per year annually through October 2017.”

“Do Wages Drive Prices, Or Vice Versa? The Answer Matters For Interest Rates” (Wall Street Journal). “[S]ome economists say…the lesson of the past few decades is that while higher prices lead to higher wages, as workers try to claw back lost purchasing power, the reverse isn’t true. If so, high wage growth won’t stand in the way of getting inflation down.”

“Cracking Down On A Wall Street Trend: E.S.G. Makeovers” (DealBook). “E.S.G.-fund makeovers have become the trend du jour on Wall Street: BlackRock, J.P. Morgan, Morgan Stanley, HSBC, WisdomTree, Putnam and MassMutual have all done it. Over the past five years, about 90 mutual funds and E.T.F.s have undertaken similar revamps, according to the mutual fund rating firm Morningstar. And Wall Street firms have started up hundreds of brand-new E.S.G. dedicated funds — seeking to cash in on growing investor demand for such investments…But what may have seemed like a harmless marketing move is now causing some eyebrow raising: Securities regulators are starting to question whether their do-gooder claims are real or fraudulent, at the same time that regulators are seeking to enact new rules and guidelines for what constitutes an E.S.G. investment product or strategy.”

“The Congressional Stock Trading Ban, Explained” (The Week). “A recent in-depth analysis completed by The New York Times revealed that at least 97 members of Congress have engaged in buying or selling stock, bonds, and other financial assets that were directly affected by the committees they served on. Some of those transactions were completed by the representative, while others were reportedly the work of their spouse or a dependent child.”

“Volkswagen Targets $70.1 Billion To $75.1 Billion Valuation In Planned Porsche IPO” (CNBC). “A stock exchange prospectus is expected to be published on Monday, after which institutional and private investors can subscribe to Porsche shares.”

What we’re reading (9/17)

“Death On A Train: A Tragedy That Helped Fuel The Railroad Showdown” (Washington Post). “[D]iscontent among rail workers is still brewing. They say few details have been made available about the agreement, which leaves the points-based attendance policy in place for other types of emergencies. And some say they doubt the deal will address their fundamental concerns about quality of life amid painful labor shortages and the continued spread of covid-19.”

“Parsing Pessimism On Retail Sales” (Fisher Investments). “Whenever the economic outlook gets shaky, headlines dwell on retail discounts as evidence households are having a tough time—today’s reaction is a very well-trod one. In our experience, it is more of a sociological observation than anything else, as why and where people are shopping matters less to the economic data than the simple question of how much. Heck, people often tend to get more bang for their buck early in economic recoveries—not unlike businesses’ continuing cost-cutting for a while after economic output hits its low. Doing more with less is a big recovery hallmark.”

“Who Will Inherit The Family Business? Often, It’s Private Equity” (Wall Street Journal). “Family businesses hold particular appeal for buyout firms, and they are throwing out the traditional private-equity playbook to attract them. Management is often left intact. Owners keep big stakes. Buyout firms pledge to retain employees and plow more money into the businesses. Still, some buyout targets end up carrying heavy debt burdens that can turn a once-profitable company into a money-losing one. Families might ultimately cede control when the business is later sold so their private-equity owners can realize gains. Communities and workers, by extension, can lose their personal ties to a company’s ownership.”

“The US Is Moving One Step Closer To Letting Americans File Their Taxes Online For Free Directly To The IRS, Cutting Out Private Companies Like TurboTax And H&R Block” (Insider). “Filing your taxes could soon be free and relatively painless. The US is inching closer to modernizing how Americans file their taxes and breaking the grip that private tax-prep companies, like TurboTax and H&R Block, have over the process. In the future, tax filing may require only a few clicks — or even simply replying to a text message, as is done in some European countries like Estonia.”

“What Is The Average American Net Worth By Age?” (U.S. News & World Report). “Both median and average family net worth increased between 2016 and 2019, according to the U.S. Federal Reserve. Average net worth increased by 2% to $748,800 between 2016 and 2019, the bank reported in September 2020, the most recent year it publicized such data. Median net worth, however, rose 18% over that same time period to $121,700.”

What we’re reading (9/16)

“US Yield Curve Set To Invert By Most In 40 Years, Allspring Says” (Bloomberg). “Two-year yields are likely to surge in the next six months, increasing the inversion with 10-year yields to at least 100 basis points, said Brian Jacobsen, senior investment strategist at the firm [Allspring Global Investments]. The yield gap at that part of the curve stood at minus 44 basis points on Friday, the deepest in a month, data compiled by Bloomberg show.”

“FedEx CEO Says He Expects The Economy To Enter A ‘Worldwide Recession’” (CNBC). “The chief executive, who assumed the position earlier this year, said that weakening global shipment volumes drove FedEx’s disappointing results. While the company anticipated demand to increase after factories shuttered in China due to Covid opened back up, it actually fell, he said.”

“Redfin Predicts Sharpest Turn In Housing Market Since 2008 Crash” (Fox New York). “‘Buyers just don't have the 40% extra money to put towards housing every month,’ [Daryl] Fairweather [Redfin Chief Economist] said. ‘A lot of homebuyers had to drop out and go to the rental market instead or choose not to buy that second home or investment property.’”

“As Mortgage Rates Top 6%, More Borrowers Choose Adjustable-Rate Loans” (Wall Street Journal). “The average rate on a 5/1 ARM, one of the most popular adjustable-rate loans, was 4.93% this week, more than a full percentage point lower than the 6.02% average rate for a 30-year-fixed loan, according to Freddie Mac. A 5/1 ARM has a lower fixed rate for the first five years and a variable rate, based on one of several market indexes, for each of the remaining years of the loan.”

“Spare The Bear: The Inflation Debate That Should Be Happening” (BlackRock). “[Central bankers] are mostly silent about the collateral damage. For hikes to reduce inflation, they need to hurt growth. There is no way around this. How much they will hurt needs to be part of the equation. We estimate it would require a deep recession in the U.S., with around as much as a 2% hit to growth in the U.S. and 3 million more unemployed, and an even deeper recession in Europe.”

What we’re reading (9/15)

“The Illusion of Knowledge” (Howard Marks, Oaktree Capital). “Most forecasts consist of extrapolation of past performance. Because macro developments usually don’t diverge from prior trends, extrapolation is usually successful. Thus, most forecasts are correct. But since extrapolation is usually anticipated by security prices, those who follow expectations based on extrapolation don’t enjoy unusual profits when it holds. Once in a while, the behavior of the economy does deviate materially from past patterns. Since this deviation comes as a surprise to most investors, its occurrence moves markets, meaning an accurate prediction of the deviation would be highly profitable. However, since the economy doesn’t diverge from past performance very often, correct forecasts of deviation are rarely made and most forecasts of deviation turn out to be incorrect. Thus, we have (a) extrapolation forecasts, most of which are correct but unprofitable, and (b) potentially profitable forecasts of deviation, which are rarely correct and thus are generally unprofitable. Q.E.D.: Most forecasts don’t add to returns.”

“Mortgage Rates Top 6% For The First Time Since The 2008 Financial Crisis” (Wall Street Journal). “The jump in mortgage rates is one of the most pronounced effects of the Federal Reserve’s campaign to curb inflation by lifting the cost of borrowing for consumers and businesses. Already, it has ushered in a sea change in the housing market by adding hundreds of dollars or more to the monthly cost of a potential buyer’s mortgage payment, slowing what was a red-hot market not so long ago.”

“$20 Billion Figma Deal Is A Historic Coup For Startup Investors In An Otherwise Miserable Year” (CNBC). “In a year that’s featured exactly zero high-profile tech IPOs and far more headlines about mass layoffs than big funding rounds, Adobe’s $20 billion acquisition of Figma on Thursday is what some might call a narrative violation. There was no other bidder out there driving up the price, according to a person familiar with the matter who asked not to be named because the details are confidential.”

“Bridgewater's Ray Dalio Expects Stocks To Fall 20% If Rates Rise To 4.5%” (U.S. News & World Report). “Billionaire Ray Dalio, founder of one of the world's biggest hedge funds, has predicted a sharp plunge in stock markets as the U.S. Federal Reserve raises interest rates aggressively to tame inflation. ‘I estimate that a rise in rates from where they are to about 4.5 percent will produce about a 20 percent negative impact on equity prices,’ Bridgewater Associates' founder Dalio wrote in a LinkedIn post on Tuesday.”

“Meet The Young People Working For The World's Most Evil Companies” (Vice). “Answering the question of what you do for work is just draining. Who wants to be reminded of their inbox, the sad Tupperware lunch from Tuesday or the latest brain-numbing lingo handed down from corporate? But for others who work in controversial – arguably unethical – industries like fossil fuels, tobacco and nuclear arms, this question can be deeply uncomfortable to answer, and can leave the listener wishing they’d never asked in the first place.”

What we’re reading (9/14)

“The Fed Could Crash The Housing Market” (CNN Business). “One area of growing concern: housing. Interest rate hikes can lead to higher mortgage rates, which could cause people to think twice about buying a home. So far, sales are slipping, while prices are holding steady. But some economists warn continued historic rate hikes by the Fed could risk crashing the housing market, underscoring the difficult task ahead for the central bank.”

“U.S. Mortgage Interest Rates Top 6% For First Time Since 2008” (Reuters). “The average interest rate on the most popular U.S. home loan rose above 6% for the first time since 2008 and is now more than double the level it was one year ago, Mortgage Bankers Association (MBA) data showed on Wednesday.”

“Crypto Investors Step Up Bets Against Ether As ‘Merge’ Looms” (Wall Street Journal). “Investors ramped up their bets against ether, the second-largest cryptocurrency, on the eve of the Ethereum network’s big software upgrade slated for early Thursday morning. The cost of holding a short position—a bet that ether’s value will fall—in the perpetual futures market has risen ahead of the upgrade, a sign that investors are increasingly hedging their risk going into the network update. So-called funding rates for ether perpetual futures, a kind of futures contract that doesn’t have an expiry date, have been negative for more than a month, meaning that traders are paying a premium for pessimistic bets.”

“Google Cancels Half The Projects At Its Internal R&D Group Area 120” (TechCrunch). “The company on Tuesday informed staff of a ‘reduction in force’ that will see the incubator halved in size, as half the teams working on new product innovations heard their projects were being canceled. Previously, there were 14 projects housed in Area 120, and this has been cut down to just seven. Employees whose projects will not continue were told they’ll need to find a new job within Google by the end of January 2023, or they’ll be terminated. It’s not clear that everyone will be able to do so.”

“Billionaire No More: Patagonia Founder Gives Away The Company” (New York Times). “In mid-2020, Mr. Chouinard began telling his closest advisers, including Ryan Gellert, the company’s chief executive, that if they couldn’t find a good alternative, he was prepared to sell the company. ‘One day he said to me, ‘Ryan, I swear to God, if you guys don’t start moving on this, I’m going to go get the Fortune magazine list of billionaires and start cold calling people,’’ Mr. Gellert said. ‘At that point we realized he was serious.’ […] ‘I don’t respect the stock market at all,’ he [Mr. Chouinard] said. ‘Once you’re public, you’ve lost control over the company, and you have to maximize profits for the shareholder, and then you become one of these irresponsible companies.’ They also considered simply leaving the company to Fletcher and Claire. But even that option didn’t work, because the children didn’t want the company.”

What we’re reading (9/13)

“Stocks Suffer Worst Day Since June 2020” (Wall Street Journal). “Stocks suffered their worst day in more than two years after hotter-than-expected inflation data dashed investors’ hopes that cooling price pressures would prompt the Federal Reserve to moderate its campaign of interest-rate increases. Investors sold everything from stocks and bonds to oil and gold. All 30 stocks in the Dow Jones Industrial Average declined, as did all 11 sectors in the S&P 500. Only five stocks in the broad benchmark finished the session in the green. Facebook parent Meta Platforms dropped 9.4%, BlackRock declined 7.5% and Boeing fell 7.2%.”

“Investors Have Begun Pricing In Odds Of A 100 Basis Points Rate Hike At This Month’s Fed Meeting After The Hotter-Than-Expected August Inflation Report” (Insider). “The CME FedWatch tool showed a 34% probability of a rate increase of 100 basis points at the September 20-21 meeting after showing zero probability over the past month.”

“Who Are America’s Missing Workers?” (New York Times). “People at retirement age, who had been staying in the work force longer as longevity increased before the pandemic, dropped out at disproportionate rates and haven’t returned. More puzzlingly, men in their prime working years, from 25 to 54, have retreated from the work force relative to February 2020, while women have bounced back. Magnifying those disparities are two crosscutting factors: the long-term health complications from Covid-19, and a lagging return for workers without college degrees.”

“What The High-Profile Layoffs At Snap, Netflix, And Other Companies Could Mean For The Economy” (Vox). “Julia Pollak, the chief economist at ZipRecruiter, said the layoffs clearly signaled a slowdown in the tech industry, but she didn’t expect that to necessarily be a leading indicator for hiring trends in the broader labor market.”

“King Charles Will Not Pay Tax On Inheritance From The Queen” (The Guardian). “King Charles will not pay tax on the fortune he has inherited from the late Queen, although he has volunteered to follow his mother’s lead in paying income tax. Under a clause agreed in 1993 by the then prime minister, John Major, any inheritance passed “sovereign to sovereign” avoids the 40% levy applied to assets valued at more than £325,000. The crown estate has an estimated £15.2bn in assets, of which 25% of the profits are given to the royal family as the sovereign grant. The estate includes the royal archives and the royal collection of paintings, which are held by the monarch ‘in right of the crown’.”