What we’re reading (9/12)

“Sliding Earnings Forecasts Pose Next Test For Markets” (Wall Street Journal). “Analysts have cut their estimates for third-quarter earnings growth by 5.5 percentage points since June 30, according to John Butters, senior earnings analyst at FactSet. That is more than usual and marks the biggest cut since the second quarter of 2020, when the Covid-19 pandemic and ensuing lockdowns brought economic activity to a standstill.”

“Tuesday’s Inflation Report Could Show Prices Moderating As Gasoline And Travel Costs Fall” (CNBC). “The consumer price index will be released Tuesday at 8:30 a.m. ET, and the report could be a bit messy since headline inflation is expected to fall while core inflation, excluding energy and food, should rise. The report is also key because it is expected to influence the Federal Reserve’s decision on how much to raise interest rates next week — and more importantly, in the long term.”

“Is Physical Climate Risk Priced? Evidence From Regional Variation In Exposure To Heat Stress” (Viral Acharya, et al., NBER Working Paper). “We exploit regional variations in exposure to heat stress to study if physical climate risk is priced in municipal and corporate bonds as well as in equity markets. We find that local exposure to damages related to heat stress equaling 1% of GDP is associated with municipal bond yield spreads that are higher by around 15 basis points per annum (bps), the effect being larger for longer-term, revenue-only and lower-rated bonds, and arising mainly from the expected increase in energy expenditures and decrease in labor productivity. Among S&P 500 companies, one standard deviation increase in exposure to heat stress is associated with yield spreads that are higher by around 40 bps for sub-investment grade corporate bonds, with little effect for investment grade bond spreads, and with conditional expected returns on stocks that are higher by around 45 bps.”

“The Forthcoming Rate Of Economic Growth?” (Marginal Revolution). “As Brad DeLong stresses, the second Industrial Revolution starting about 1870 was the true one, and we woke up fifty years later to an entirely different world, based on electricity and consumer society and extreme physical mobility. Yet I am not aware of any extreme gdp or productivity stats during the intermediate period. In fact the numbers I have seen seem a little….mediocre. I say side with the reality, not with the numbers, but this is one of the questions I wish was studied much more. Is it simply the case that stringing together a series of qualitatively discrete changes inevitably will outrace our ability to measure it?”

“Goodbye, Globalization?” (Daniel Drezner, Reason). “To understand the intellectual roots of today's resistance to free markets, the book to examine is Karl Polanyi's The Great Transformation. Polanyi, writing in 1944, wanted to understand how the world had arrived at a low moment of depression, fascism, and war. Where writers like F.A. Hayek saw socialism's rise as a tragic result of state interference in free markets, Polanyi viewed it as the ineluctable backlash against those same markets' volatility.”

What we’re reading (9/11)

“Inflation Sets The Scene For The Fed: What To Know This Week” (Yahoo! Finance). “Tuesday morning will bring investors the closely-watched Consumer Price Index (CPI) for August, which will likely solidify in investors' minds whether the Federal Reserve raises interest rates by 0.50% or 0.75% at its policy meeting later this month. Economists surveyed by Bloomberg expected headline CPI rose 8.1% over the prior year in August, a moderation from from 8.5% increase seen in July. On a month-over-month basis, CPI is expected to show prices fell 0.1% from July to August, primarily due to continued easing in energy prices. If realized, this would mark the first monthly decline since May 2020.”

“Inflation Showed Signs Of Easing In Several Industries In August” (Wall Street Journal). “U.S. consumer-price inflation showed signs of moderating in August for the second straight month, though the decrease was uneven across sectors and it remains unclear whether the slowdown will continue.”

“What If We’re Fighting Inflation All Wrong? (Vox). “what if the prevailing wisdom is wrong, and workers don’t have to suffer? That’s what Nathan Tankus, research director of the Modern Money Network and publisher of the newsletter Notes on the Crises, thinks. Or, at the very least, he believes that leaving inflation up to a single body — the Fed — to try to find a balance between the prices people should pay and the jobs and incomes people should have is off. He also backs the notion of a federal jobs guarantee.”

“Equities Start Month In Deeply Undervalued Territory After Latest Pullback” (Morningstar). “Equities are now trading 15% below our fair value estimate, an even greater discount than the 11% they were at to the end of July. Prices initially rose after better-than-expected news around second-quarter earnings but ended the month in retreat following a hawkish speech on inflation from Federal Reserve Chairman Jerome Powell at the Jackson Hole Economic Symposium.”

“Wall Street’s Favorite Sport Is A Failing Business” (New York Times). “If it [tennis] were a company, activist shareholders would have already descended, calling for a restructuring. In fact, some are — raising the prospect of a turnaround effort or else the risk that a competitor could emerge to steal tennis players the same way LIV Golf has sought to upend the PGA Tour.”

What we’re reading (9/10)

“Simple Models Predict Behavior At Least As Well As Behavioral Scientists” (Dillon Bowen, Wharton). “How accurately can behavioral scientists predict behavior? To answer this question, we analyzed data from five studies in which 640 professional behavioral scientists predicted the results of one or more behavioral science experiments. We compared the behavioral scientists’ predictions to random chance, linear models, and simple heuristics like “behavioral interventions have no effect” and “all published psychology research is false.” We find that behavioral scientists are consistently no better than - and often worse than - these simple heuristics and models. Behavioral scientists’ predictions are not only noisy but also biased. They systematically overestimate how well behavioral science “works”: overestimating the effectiveness of behavioral interventions, the impact of psychological phenomena like time discounting, and the replicability of published psychology research[.]”

“Outlook for Tech Stocks Darkens After Rocky Stretch” (Wall Street Journal). “Investors are bailing out of technology-focused mutual and exchange-traded funds at the fastest clip since early February, when the tech selloff was first intensifying, according to data from Refinitiv Lipper. They yanked about $2.4 billion from such funds in the three weeks ended Wednesday.”

“Anyone Who Thinks We’re Not In A Recession Is ‘Crazy,’ Says RH CEO” (CNN Business). “Gary Friedman, the CEO of luxury home goods retailer RH, is often a colorful speaker who doesn't mince words. That was on full display during the company's earnings call Thursday night as he bemoaned New York City breakfasts, dunked on industry rivals and declared that anyone who thinks the United States isn't in a recession is ‘crazy.’ […] ‘I think the Fed finally really understands what they have to do. And it's not going to be pretty when interest rates go up the way they are,’ Friedman said.”

“Massive Rail Strike Next Week Could Deal Another Blow To America’s Economy” (CNN Business). “Freight railroads have been around since the 19th century, but you can't run a 21st century economy without them. The looming possibility of a strike by unions representing more than 90,000 workers at the nation's freight railroads has businesses nationwide worried. The unions are poised to go on strike on September 16, a move that could bring nearly 30% of the nation's freight to a grinding halt, according to data from the Bureau of Transportation Statistics.”

“The Obscure Economist Silicon Valley Billionaires Should Dump Ayn Rand For” (Vanity Fair). “[Henry] George’s masterwork, published in 1879, was Progress and Poverty, which set forth to explain how ‘increase of want’ could go hand in hand with ‘increase of wealth.’ Thus George took on precisely the question we face today: not the general question of poverty or inequity, but why specifically are middle-class incomes stagnating, and incomes of people at the bottom falling, while those at the top continue to rise?”

What we’re reading (9/9)

“Dow Jumps More Than 300 Points As US Stocks Break 3-Week Losing Streak After Dollar Falls From Recent Highs” (Insider). “The Dow Jones Industrial Average soared more than 300 points on Friday, cementing a three-day rally and breaking a three-week losing streak as both the US dollar and Treasury yields took a breather from their recent surges and moved lower.”

“Robinhood Unveils Index to Track Customers’ Favored Stocks” (Wall Street Journal). “Robinhood Markets Inc. is offering a peek into the favorite stocks of its millions of predominantly young, social-media-savvy customers. The brokerage firm’s new ‘Robinhood Investor Index,’ unveiled Friday, is designed to track the performance of the 100 investments most popular among its user base. Such an index could be of interest to financial professionals who monitor the activities of small investors as one of the underlying factors behind stock-market moves.”

“Behold Perhaps The Most Brazenly Incredible Investment Scam In History” (Dealbreaker). “Dear readers: There are damn-nigh undetectable scams. There are the sneaky ones, with claims that seem a bit too good to be true but with just enough trappings to make the claims believable. Then there is the whole universe of brow-raisers, head-slappers, whoppers; the incredible, the astounding, the chutzpah-laden, the literally unbelievable; in all shapes and sizes from the miniscule to the Madoffian." And then, friends, on a completely different order of magnitude, at least in respect of sheer gall and subsequent credulousness (and, of course, at the moment allegedly), there is this one[.]”

“Dissecting The Royal Family’s Wealth” (DealBook). “Dissecting the royal family’s financial empire isn’t straightforward. Last year, Forbes put the headline value of its holdings at $28 billion, theoretically making the Windsors one of the two richest clans in Britain. Among those holdings are instantly recognizable icons like Buckingham Palace and crown jewels. Also included are vast tracts of land, from office properties and a major cricket ground in London to farmland on Britain’s outer edges.”

“Confused About The Housing Market? Here’s What’s Happening Now – And What Could Happen Next” (CNBC). “The slowdown in the otherwise red-hot housing boom has been stunningly swift. The U.S. housing market surged during the pandemic as homebound people sought new places to live, boosted by record-low interest rates. Now, real estate agents who once reported lines of buyers outside open houses and bidding wars on the back deck say homes are sitting longer and sellers are being forced to lower their sights.”

What we’re reading (9/8)

“Fed Chair Powell Vows To Raise Rates To Fight Inflation ‘Until The Job Is Done’” (CNBC). “Federal Reserve Chair Jerome Powell in an appearance Thursday emphasized the importance of getting inflation down now before the public gets too used to higher prices and comes to expect them as the norm. In his latest comments underlining his commitment to the inflation fight, Powell said expectations play an important role and were a critical reason why inflation was so persistent in the 1970s and ’80s.”

“Steve Job’s Daughter Slams New iPhone 14 And Says Its ‘Same As Old Version’” (The Sun). “Eve posted an image of a man being gifted the same shirt he is wearing, implying the new iPhone 14 is the same as the last iPhone.”

“BlackRock Seeks To Defend Its Reputation Over E.S.G. Fight” (DealBook). “BlackRock says it’s looking to correct ‘misconceptions’ and ‘inaccurate statements’ about its climate position. In its letter, BlackRock says that the firm has never dictated specific emission targets to any company, and that it doesn’t coordinate its investment decisions or shareholder votes with others on climate issues, as the attorneys general claimed. Far from boycotting, BlackRock says it has invested ‘hundreds of billions of dollars’ in energy companies.”

“Why Celebrities Are So Interested In The Unglamorous World Of Private Equity” (CNN Business). “‘It's [private equity] survived by being secretive and by perpetuating a myth that it's providing great returns to investors — it fundamentally is not.’ PE firms are often seen as vultures, swooping in to feast on dying entities. But more recently, according to a report from Mother Jones, the bulk of modern PE work is ‘not to finish off sick companies, but rather to stalk and gut the healthy ones.’”

“EY Leaders Green Light Split Plan” (Wall Street Journal). “Ernst & Young’s leaders fired the starting gun Thursday on a monthslong plan to split its consulting and auditing businesses, in a radical move that will generate windfalls for the firm’s partners and could upend the business model for accounting firms. ‘This is something that will change the industry,’ Carmine Di Sibio, EY’s global chairman and chief executive, said in an interview.”

What we’re reading (9/7)

“Dow Closes More Than 400 Points Higher, Nasdaq Snaps 7-Day Slump As Wall Street Shakes Off Rate Hike Concerns” (CNBC). “Stocks rose Wednesday — trying to shake off a three-week slide — as rates and oil prices eased, cooling investor concerns about continued high inflation. The Dow Jones Industrial Average gained 481 points, or 1.55%. The S&P 500 rose 1.99% and the Nasdaq Composite ticked up 2.33%, attempting to break a seven-day losing streak.”

“The Period Of Abundance Is Over” (Jupiter Asset Management). “According to his [Jeffrey Gundlach’s] view, one of the biggest risks right now is that the Federal Reserve is doing considerable damage to the economy with its aggressive rate hikes: ‘The next shock is that we’re having to put in a big overreaction to the inflation problem which we created from our initial reaction of excess stimulus,’ Mr. Gundlach says. ‘My guess is that we will end up creating momentum that’s more deflationary than a lot of people believe is even possible.’”

“Summer Is Over. And The Battle To Get Workers Back To The Office Is Heating Up” (CNN Business). “Many companies experimenting with a hybrid work schedule have said they want employees to be in the office a set number of days each week. But thus far, they have not done much to enforce those mandates, even as employees remain adamant in their desire to work remotely for more days than many CEOs want. But now that summer vacations and Labor Day are behind us, more employers may start taking a harder line.”

“Apple Event Recap — iPhone 14, Apple Watch 8, New AirPods Pro And More” (Tom’s Guide). “That's plenty of product news for one afternoon, and if there was a common theme to all the new features, it's that Apple wants to make its devices as indispensable as ever. The new iPhones and Apple Watches have a crash detection feature, for example, and your iPhone will be able to send emergency messages via satellite connectivity.”

“Kim Kardashian’s Newest Business Venture: Private Equity” (Wall Street Journal). “Kim Kardashian and a former partner at Carlyle Group Inc. are launching a new private-equity firm focused on investing in and building consumer and media businesses. Ms. Kardashian is teaming up with Jay Sammons, who ran consumer investing at Carlyle, to launch SKKY Partners, they said in separate interviews. SKKY will make investments in sectors including consumer products, hospitality, luxury, digital commerce and media as well as consumer-media and entertainment businesses.”

What we’re reading (9/6)

“Junk-Loan Defaults Worry Wall Street Investors” (Wall Street Journal). “Defaults on so-called leveraged loans hit $6 billion in August, the highest monthly total since October 2020, when pandemic shutdowns hobbled the U.S. economy, according to Fitch Ratings. The figure represents a fraction of the sprawling loan market, which doubled over the past decade to about $1.5 trillion. But more defaults are coming, analysts say.”

“One Of The Biggest Strikes In US History Is Brewing At UPS” (CNN Business). “Over the past year, the nascent labor movements at mighty corporations like Starbucks and Amazon have grabbed national attention. But less well-known is a looming high-stakes clash between one of America's oldest unions and the world's biggest package courier. Contract negotiations are set to begin in the spring between UPS and the Teamsters Union ahead of their current contract's expiration at the end of July, 2023. Already, before the talks have even started, labor experts are predicting that the drivers and package handlers will go on strike…If that happens, a strike at UPS would affect nearly every household in the country. An estimated 6% of the nation's gross domestic product is moved in UPS trucks every year.”

“How Passive Are Markets, Actually?” (Financial Times). “The harsh reality is that the investment industry as a whole makes a staggering amount of money — listed US asset managers had an average profit margin of almost 26 per cent in 2021, more than twice the S&P 500’s average — and yet do a bad job on average. Despite the march of passive over the decades, there are still more mutual and hedge fund managers than ever before, many of which in practice do little more than extract rents from the financial system.”

“The Other Doomsday Scenario Looming Over Markets” (Wall Street Journal). “The Fed doubles the pace of its bond runoff this month, aiming to reduce its Treasury holdings by $60 billion and its mortgage-backed securities by $35 billion monthly. Those concerned about the impact include hedge fund giant Bridgewater, which thinks markets will fall into a ‘liquidity hole’ as a result.”

“Politico’s New German Owner Has A ‘Contrarian’ Plan For American Media” (Washington Post). “A newcomer to the community of billionaire media moguls, Döpfner is given to bold pronouncements and visionary prescriptions. He’s concerned that the American press has become too polarized — legacy brands like the New York Times and The Washington Post drifting to the left, in his view, while conservative media falls under the sway of Trumpian ‘alternative facts.’ So in Politico, the fast-growing Beltway political journal, he sees a grand opportunity.”

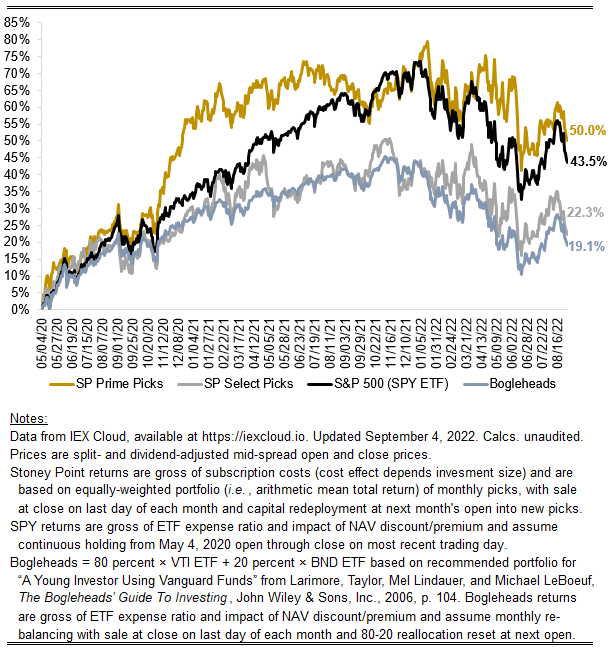

August 2022 performance update

Hi friends,

Here with a performance update for August:

Prime picks: -3.28%

Select picks: -5.70%

SPY ETF: -3.41%

Bogleheads (80% VTI, 20% BND): -3.10%

After a big July, the market was a little less sanguine about economic conditions in August. Jerome Powell’s Jackson Hole warning of “some pain” ahead apparently persuaded investors that the Fed means business when it comes to tamping down demand to break the back of inflation. Corroborative indicia of slowing demand seemed to be everywhere. Transaction volume is way down and inventories are way up in interest-rate sensitive industries (e.g., real estate). Consumer products companies have had some bad earnings reports—Walmart cut guidance at the end of July and Bed Bath and Beyond’s bad results have prompted store closures, layoffs, and, apparently, the suicide of its CFO. Asset prices have come down across most markets, including markets that purport to be uncorrelated to other asset classes (e.g., crypto), and U.S. stock funds are down nearly 20 percent this year. For us, it was a slight win for Prime and certainly a loss for Select. Let’s see how this plays out.

Stoney Point Total Performance History

What we’re reading (9/4)

“U.S.-Stock Funds Are Down 17.3% So Far In 2022” (Wall Street Journal). “The average U.S.-stock mutual fund or exchange-traded fund is down 17.3% for the year to date, through August, according to Refinitiv Lipper data. That includes a 3.5% average decline in August, reflecting the stock market’s reaction to Fed Chairman Jerome Powell’s comments that the central bank will keep raising interest rates to fight inflation, despite recession risk.”

“Flash Boys Face Fund Managers In Treasury-Market Feud Over Data” (Bloomberg Law). “There’s a battle raging in the $23 trillion US Treasury market, and it’s not over the trajectory of interest rates. Rather, it’s all about data. On one side, you have high-speed traders, hedge funds and electronic market makers. On the other, some of the biggest US banks and asset managers. At issue: whether the publication of real-time transaction figures will help or harm a market already suffering from faltering liquidity.”

“Car Companies Are Making A Deadly Mistake With Electric Vehicles” (Slate). “On Aug. 16, President Biden signed the Inflation Reduction Act, whose climate investments include a muscular effort to convince more Americans to purchase an electric vehicle. The new law offers $7,500 off many new electric or plug-in hybrid cars or trucks, without restricting the number of credits that a carmaker can receive. A day later the National Highway Traffic Safety Administration announced that American road deaths soared once again in the first quarter of 2022, rising 7 percent to 9,560 fatalities—the highest quarterly toll since 2002. The two news items may seem unrelated, but they are not.”

“The Family That Mined The Pentagon’s Data For Profit” (Wired). “What turned into a business opportunity for the Poseys began as a Cold War-era fight for government transparency. In 1947, President Harry Truman signed an executive order that gave the executive branch power to investigate and fire any federal employee who was deemed to be disloyal to the country, without having to supply evidence. The results of those investigations were held in secret FBI files. In the mid-1950s, the US government, and the Pentagon, in particular, hoarded information as compulsively as atom bombs. In the midst of the Red Scare, the design of a bow and arrow was deemed too sensitive for public release. The amount of peanut butter American soldiers consumed annually was a military secret. Shark attacks on sailors could neither be confirmed nor denied.”

“Jefferies CEO Pushes Return To Office, End To ‘Lonely Home Silos’” (New York Post). “Jefferies CEO Richard Handler signaled the firm will take a lighter approach than other firms by not tracking office attendance and allowing staffers to occasionally work from home.”

What we’re reading (9/3)

“Entering The Superbubble’s Final Act” (GMO). “The U.S. stock market remains very expensive and an increase in inflation like the one this year has always hurt multiples, although more slowly than normal this time. But now the fundamentals have also started to deteriorate enormously and surprisingly: between COVID in China, war in Europe, food and energy crises, record fiscal tightening, and more, the outlook is far grimmer than could have been foreseen in January. Longer term, a broad and permanent food and resource shortage is threatening, all made worse by accelerating climate damage.”

“Enough, Bosses Say: This Fall, It Really Is Time To Get Back To The Office” (Wall Street Journal). “After months of encouraging white-collar employees to return, or attempting to coax them back with free pizza, warm cookies and catered lunches, many executives now say they feel emboldened to take a tougher stance. No longer can workers merely come to the office if they so choose; this fall, executives say, attendance is expected and the office resisters will be put on notice.”

“Interview: Vitalik Buterin, Creator Of Ethereum” (Noahpinion). Per Vitalik: “I was surprised that the crash did not happen earlier. Normally crypto bubbles last around 6-9 months after surpassing the previous top, after which the rapid drop comes pretty quickly. This time, the bull market lasted nearly one and a half years. People seemed to adjust into the mentality that the higher prices are a new normal. The whole time, I knew that eventually the bull market will end and we’re going to get the drop, but I just did not know when. Today, it feels like people are reading too much into what is ultimately cyclical dynamics that crypto has always had and probably will continue to have for a long time. When the prices are rising, lots of people say that it's the new paradigm and the future, and when prices are falling people say that it's doomed and fundamentally flawed. The reality is always a more complicated picture somewhere between the two extremes.”

“1 In 5 Home Sellers Are Now Dropping Their Asking Price As The Housing Market Cools” (CNBC). “Homes are simply not selling at the breakneck pace they were six months ago, when strong demand butted up against tight supply, bidding wars were the norm, and a seller could often get a signed contract in under a weekend. Homes in August sat on the market an average five days longer than they did a year ago — the first annual increase in time on the market in more than two years.”

“The Optimal Amount Of Fraud Is Non-Zero” (Bits About Money). “This fraud [payments fraud] is possible by design. The very best minds in government, the financial industry, the payments industry, and business have gotten together and decided that they want this fraud to be possible. That probably strikes you as an extraordinary claim, and yet it is true.”

What we’re reading (9/2)

“Recession Or Not, There Will Be Pain” (Morningstar). “When is a recession not really a recession? When it’s a ‘rolling’ recession. A rolling recession occurs when different segments of the economy slump at different times, resulting in very low overall growth in gross domestic product output. By maintaining the barest minimum of growth and avoiding a sharp and prolonged economic contraction, rolling recessions sidestep being labeled as official recessions. Rolling recessions are also referred to frequently as ‘growth’ recessions.”

“Meet Starbucks’s New Chief Executive” (DealBook). “He’s a veteran of American and British companies. Born in Pune, India, Narasimhan studied engineering and moved to the U.S. to attend the University of Pennsylvania’s Wharton School. He then joined McKinsey & Company, becoming a senior partner, before shifting in 2012 to PepsiCo, where he oversaw operations in regions including Latin America and Europe. In 2019, he was hired to lead Reckitt Benckiser, the British conglomerate that makes Lysol disinfectant and Durex condoms.”

“CVS Is In Advanced Talks To Buy Signify Health For Around $8 Billion” (Wall Street Journal). “CVS Health Corp. is in advanced talks to acquire the home-healthcare company Signify Health Inc. for around $8 billion, according to people familiar with the matter. CVS appears to have beat out other heavy hitters including Amazon.com Inc. and UnitedHealth Group Inc., which had been circling Signify for a deal that could be announced soon. UnitedHealth never submitted an official bid, one of the people said. There is still no guarantee that CVS will reach a deal for Signify, which has been exploring strategic alternatives since earlier this summer.”

“The Fed’s Hawkishness Dents Pershing Square’s Turnaround” (Institutional Investor). “Until recently, Bill Ackman had been browbeating the Federal Reserve to raise interest rates aggressively. But the Fed’s recent signals that it plans to keep doing so isn’t helping the stock market as the hedge fund manager hoped. Nor is it helping Ackman’s Pershing Square Capital hedge funds.”

“This Remote Mine Could Foretell The Future Of America’s Electric Car Industry” (New York Times). “mines that extract metal from sulfide ore, as this one would, have a poor environmental record in the United States, and an even more checkered footprint globally. While some in the area argue the mine could bring good jobs to a sparsely populated region, others are deeply fearful that it could spoil local lakes and streams that feed into the Mississippi River. There is also concern that it could endanger the livelihoods and culture of Ojibwe tribes whose members live just over a mile from Talon’s land and have gathered wild rice here for generations.”

What we’re reading (9/1)

“Benchmarking A Fed Pivot” (Deutsche Bank). “[A]t some point, slower growth will take its toll on inflation and the outlook will justify a Fed pivot. The quit rate could be useful in that context. It is well documented that the quit rate is the most reliable predictor of real wages. The quit rate peaked at 3.4% a few months ago and has recently been stable around 3.1%. Prior to covid, the quit rate never exceeded 2.7% (on a 3m moving average basis). Thus, allowing for the fact that the labour market lags and the downward momentum, a quit rate at 2.7% could open the door to a Fed pivot.”

“Microsoft Activision Deal Could Lessen Competition, UK Watchdog Finds” (BBC). “[T]he UK's Competition and Markets Authority (CMA) says its concerns mean it may now carry out an in-depth probe. Microsoft said it was ready to work with the CMA on the ‘next steps’. If the deal goes through it will be the Xbox maker's largest ever acquisition. The games Activision Blizzard make are some of the most popular in the world. But it has previously faced accusations of permitting a toxic and sexist work-place culture.”

“Firm Selling Hot Pre-IPO Shares Didn’t Actually Own Those Pre-IPO Shares, Per Se” (Dealbreaker). “Remember StraightPath Venture Partners? The “boutique private equity firm” accused of overselling the extremely hot and hotly-desired pre-IPO shares it flogged to its 2,200 investors, thereby necessitating—according to the Securities and Exchange Commission, anyway—a bit of fund commingling and Ponzi schemery? Well, a court-appointed receiver has had a bit of a look around. It turns out that saying StraightPath sometimes sold more of those shares than it actually had in its possession—a fact that StraightPath itself acknowledges—may have been a rather generous interpretation.”

“As The U.S. Dollar Surges, American Buyers Splurge On European Homes” (Wall Street Journal). “Laetitia Laurent, a South Florida interior designer, has long had her heart set on a Parisian pied-à-terre. This summer, with the dollar soaring and Parisian real-estate prices holding steady, she took the leap. The 42-year-old, who lives in Boca Raton, paid 758,000 euros, or $758,606, for a 460-square-foot, one-bedroom in the Golden Triangle—the prime residential and commercial area between the Seine and the Champs-Élysées, in the French capital’s pricey 8th arrondissement.”

“British Pound Could Near Parity With The US Dollar Next Year As Energy Crisis Sends Economy Into Recession, Analyst Says” (Insider). “Europe’s energy crisis will push the both the eurozone and UK into recession while the US experiences a milder slowdown, Capital Economics chief UK economist Paul Dales wrote in a report Wednesday. That sets up the euro and British pound to weaken further against the dollar, he added. The euro has already fallen below parity against the dollar, with one euro trading at $0.9938 on Thursday. And by next year, the pound could get close to parity too.”

What we’re reading (8/31)

“Fed Expects To Launch Long-Awaited Faster Payments System By 2023” (forkast). “The new payments system will allow faster payments of bills, paychecks and other transfers around-the-clock instead of days. The U.S. Federal Reserve expects to launch the payments system between May and July of 2023, after a testing phase beginning next month.”

“Oil Posts Third Straight Month Of Declines” (Wall Street Journal). “Benchmark U.S. oil futures ended Wednesday at $89.55 a barrel, down from Monday’s closing price of $97.01. Brent crude, the main international price, fell 12% in August to $96.49 a barrel.”

“How Quitting a Job Changed My Relationships” (New York Times). “Faced with choosing between their careers and their loved ones, many opted to put their professional dreams on hold after enduring the stresses brought on by the pandemic.”

“How Unions Are Winning Again, In 4 Charts” (Vox). “Workers are organizing at some of the most well-known companies in America and in industries previously thought un-unionizable. They’re also doing so against the tide of a decades-long decline in union membership, which led to eviscerated benefits and wages that haven’t kept pace with the cost of living. Lately, the news has been filled with stories of everyone from baristas to warehouse workers voting for unions and bargaining for contracts — a trend that makes it look like unions are at last on the rise again.”

“Meet The Newest Member Of Morgan Stanley’s Block-Trading Desk” (Dealbreaker). “It must have been a rude surprise for those manning Morgan Stanley’s block-trading desk (and, of course, their customers) to learn that their conversations were being monitored, retrospectively, by the Justice Department and Securities and Exchange Commission. (Although exactly when that surprise came is open to interpretation.) Seems the Feds had gotten it into their heads that block-trading, as much a cornerstone of what investment banks do as anything, is just a big old square fig leaf for a whole lot of insider-trading.”

September picks available now

The new Prime and Select picks for September are available starting now, based on a model run put through today (August 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Thursday, September 1, 2022 (at the mid-spread open price) through the last trading day of the month, Friday, September 30, 2022 (at the mid-spread closing price).

What we’re reading (8/29)

“Stocks End Lower, Yields Rise After Powell’s Hawkish Remarks” (Wall Street Journal). “U.S. Treasury yields climbed Monday as a selloff in government bonds gathered pace, highlighting investor unease at the likely impact of the Federal Reserve’s promise to hold the line against inflation. The yield on the two-year Treasury note, which is more sensitive to near-term Fed policy expectations, rose to 3.427% from 3.391% Friday.”

“Dollar Sags Below 20-Year Peak As Euro Lifted By ECB Bets” (Reuters). “The dollar languished on Tuesday after being beaten back from a two-decade high versus major peers by a reinvigorated euro. The tables turned for the two currencies as traders began ramping up bets for a super-sized 75 basis-point rate hike by the European Central Bank, while paring the odds for one by the U.S. Federal Reserve.”

“You Want An Electric Car With A 300-Mile Range? When Was The Last Time You Drove 300 Miles?” (New York Times). “Rather than unleashing a mass market of affordable E.V.s, more than a decade of subsidies favoring large batteries has created an overheated market for premium E.V.s. A serious electrification policy will have to be tailored to the way we actually drive, not the way we think we do.”

“Home Sale Cancellations Rise In ‘Remarkably Uncertain Time’ For Market: Redfin CEO” (New York Post). “RedFin CEO Glenn Kelman noted housing demand plummeted because buyers were ‘absolutely freaked out’ in May and June as the Federal Reserve’s sharp interest rate hikes prompted an increase in mortgage rates.”

“Boomerang College Kids: Unemployment, Job Mismatch And Coresidence” (Albanesi, et al., NBER Working Paper). “Labor market outcomes for young college graduates have deteriorated substantially in the last twenty five years…Our hypothesis is that the declining availability of ‘matched jobs’ that require a college degree is a key factor behind these developments. Using a structurally estimated model of child-parent decisions, in which coresidence improves college graduates' quality of job matches, we find that lower matched job arrival rates explain two thirds of the rise in unemployment and coresidence between the 2013 and 1996 graduation cohorts.”

What we’re reading (8/28)

“When Private Equity Takes Over A Nursing Home” (The New Yorker). “Within two weeks, management laid out plans to significantly cut back nurse staffing. Some mornings, there were only two nursing aides working at the seventy-two-bed facility. A nurse at the home, who spoke on condition of anonymity for fear of retribution, told me, ‘It takes two people just to take some residents to the bathroom.’ (When reached by e-mail, a Portopiccolo [Group] spokesperson said, ‘We never made any staffing cuts during the transition.’) The home was renamed Karolwood Gardens, and the new management filed for a license to admit higher-needs residents, who can be billed at higher rates through Medicare. The aquarium on the second floor disappeared. So, too, did the aviary. Residents’ crafts were removed from the gift shop. No longer did the kitchen serve an eclectic variety of main dishes: turkey tetrazzini, salmon with lobster sauce, or Reuben sandwiches. Now residents were commonly given an option of ground beef. Some days, the kitchen was so short-staffed that the dining hall wasn’t set up, and residents took meals alone in their rooms.”

“For Private Equity Firms, Buying New Companies And Laying Off Employees Isn’t Cutting It Anymore” (Institutional Investor). “One reason is that the M&A market is getting more competitive, with more capital chasing a shrinking pool of quality companies. ‘Prices are going up, and that’s putting pressure on returns,’ Mooney said. For this reason, PE firms have begun to contemplate generating cash flows by transforming businesses, instead of acquiring new ones.” [An observation: “transforming businesses” is a stunning, albeit seemingly accurate, euphemism for the nursing home story above, to the extent that is an example of what Institutional Investor is talking about.]

“Investors Ramp Up Bets Against Stock Market As Summer Rally Fizzles” (Wall Street Journal). “Net short positions against S&P 500 futures have grown in the past couple months, reaching levels not seen in two years. That means traders are increasing their bets that the index will fall, or at least hedging against that risk. Meanwhile, short interest has picked up in the fund tracking popular technology shares, whose recent declines have signaled that a strong summer rally is stalling out.”

“Why Investors Went Bananas Over AMC Stock” (Wall Street Journal). “Forget about EMH, or the efficient market hypothesis. What we need is SMH: the simian market hypothesis. Under the EMH, market prices of assets like stocks and bonds reflect all available information. Under the SMH, market prices reflect whatever homo mercans—the ape who trades—happens to feel like paying attention to.”

“Half Cows, Entire Pigs: Families Are Buying Meat In Bulk To Save Money” (Washington Post). “Inflation has been at or near 40-year highs since the spring, but families have been pinched by higher food prices for two years. Meat prices in particular have surged 17 percent since July 2020, spurring families around the country to change their purchasing patterns and eating habits.”

What we’re reading (8/27)

“Shorting Zillow Is Your Best Bet In Housing This Year” (Zillow). “U.S. home seekers are desperately eyeing an expected turn in housing prices, but the best near-term deal in real estate could come from yet another price cut to Zillow’s stock. Having lost two-thirds of its value over the past 12 months on the heels of its home-flipping implosion, Zillow Group has already fallen to a market capitalization of barely $8 billion, despite the fact that virtually every U.S. adult is still “surfing” its namesake site monthly.”

“Is America On The Verge Of A House Price Collapse? Prices Could Crash By Up To 20% And Homes Are Overvalued By As Much As 72%, Expert Warns” (The Daily Mail). “housing inventory is at its highest level since April 2009, as sellers struggle to get rid of their property because mortgages have become more expensive, and other financial pressures - high gas prices, soaring costs of groceries - continue to be felt.”

“The Rent Crisis On Main Street Just Took A Turn For The Worse” (CNBC). “Nationally, apartment rental prices, which have soared, are among the inflation indicators that may have recently peaked. But the Alignable data shows that the rent inflation crisis for small businesses is actually getting worse. Forty percent of small business said they could not pay their rent in full this month, up 6% month over month and setting a record for 2022.”

“Get Used To Startups Trying To Reinvent Housing” (Wired). “For the past two decades, a confluence of factors has caused young Americans to give up on buying houses, a pattern also seen in the UK and some other European countries. New construction has stalled, existing supply has remained tied up, and population booms in urban areas have driven up housing costs. Nearly one in five homes in the US is now bought by institutional investors—not individuals—adding further competition. As a result, the share of first-time home buyers has shrunk, leading more millennials to rent well into their thirties and forties.”

“China’s Overextended Real Estate Sector Is A Systemic Problem” (Michael Pettis, Carnegie Endowment for International Peace). “[W]hat happened in Henan was not the first adverse credit event to hit the Chinese financial system. It was just the most recent in the country’s latest string of notable financial events, which can be said to have started back in May 2019 with the intervention in Baoshang Bank. A little over a year later, Baoshang became the first Chinese bank to be shut down since Shantou Commercial Bank closed shop in 2001.”

September picks available soon

We’ll be publishing our Prime and Select picks for the month of August before Thursday, September 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of August, as well as SPC’s cumulative performance, assuming the sale of the August picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Wed., August 31). Performance tracking for the month of September will assume the September picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Thurs., September 1).

What we’re reading (8/25)

“US Stocks Rise As Investors Await Policy Clues From Fed Chair Powell At Jackson Hole” (Insider). “US stocks rose Thursday as investors embraced some risk before Federal Reserve Chair Jerome Powell grabs the attention of global financial markets with a speech on monetary policy at the central bank's marquee annual conference in Jackson Hole, Wyoming.”

“Why Does The WeWork Guy Get To Fail Up?” (Vox). “In a blog post, a16z co-founder Marc Andreessen wrote that Neumann is returning to ‘the theme of connecting people through transforming their physical spaces and building communities where people spend the most time: their homes.’ Andreessen added that solving housing problems ‘requires combining community-driven, experience-centric service with the latest technology in a way that has never been done before to create a system where renters receive the benefits of owners.’ What any of that means is not exactly clear.”

“IRS To Start Spending Its $80 Billion Budget By Hiring People To Answer The Phone” (Wall Street Journal). “The Internal Revenue Service is planning to spend the first big chunk of its $80 billion expanded budget to hire people who will answer taxpayers’ telephone calls during the 2023 tax-filing season.”

“Twitter’s Whistleblower Problem Is Way Bigger Than Elon Musk’s Bot Complaints” (Vox). “When Peiter Zatko, the famous hacker best known as Mudge, got the job heading up Twitter’s security in November 2020, internet archivist Jason Scott tweeted, ‘you have my full support to walk away after setting the place on fire.’ Zatko may have done just that, if not quite in that order. Several months after he was fired by CEO Parag Agrawal, Zatko blew the whistle on the company, telling the Securities and Exchange Commission (SEC) that Twitter did basically nothing to improve its terrible security — the reason for Zatko’s hiring in the first place — and that the company has a pattern of lying to or misleading the government, investors, and Elon Musk.”

“California E.V. Mandate Finds A Receptive Auto Industry” (New York Times). “The automakers are hurrying to close deals with mining companies and other suppliers that can meet the escalating demand for battery materials. Some are teaming up with smaller companies to expedite the build-out of a nationwide charging network. And they are breaking up their own corporate structures and refashioning them to ensure that the electric vehicle transition is not held back by the conventions of making gasoline-powered products.”

What we’re reading (8/24)

“Is Value Just An Interest Rate Bet?” (Cliff Asness, AQR). “It seems obvious to so many that interest rates drive the value trade. After all, growth stocks have much longer-dated cash flows than value stocks and thus should be a “longer duration” asset and move more with longer-term interest rates, right? “Growth (or often just 'tech') stocks soar on plunging interest rates” (or vice versa) has become a common wise-sounding observation in the last few years. In fact, this is all taken as an axiomatic given in countless pundit and press observations. However it’s not nearly that simple, and mostly it’s just not true.”

“What Wall Street Hopes To Hear From The Federal Reserve At Jackson Hole” (CNN Business). “Whether the market will get the feel-good story it wants, or remarks that throw cold water on those hopes, is an open — and hotly debated — question. ‘What they are hoping to hear from Jay Powell is that the Fed will move to reduce inflation, but will be sufficiently confident that it can reverse course early next year. I don't think they're going to hear that,’ said Randall Kroszner, a former Fed governor and deputy dean for executive programs and economics professor at the University of Chicago Booth School of Business.”

“Jerome Powell’s Dilemma: What If The Drivers Of Inflation Are Here To Stay?” (Wall Street Journal). “Central bankers worry that the recent surge in inflation may represent not a temporary phenomenon but a transition to a new, lasting reality. To counter the impact of a decline in global commerce and persistent shortages of labor, commodities and energy, central bankers might lift interest rates higher and for longer than in recent decades—which could result in weaker economic growth, higher unemployment and more frequent recessions…This new era would mark an abrupt about-face after a decade in which central bankers worried more about the prospects of anemic economic growth and too-low inflation, and used monetary policy to spur expansions. It also would be a reversal for investors accustomed to low interest rates.”

“America’s Growth Challenge” (City Journal). “What explains the combination of a robust labor market and a slow-growing economy? Part of the answer lies in long-term developments in the U.S. labor force…A growth rate of around 2 percent per year, or less than half the rate of the 1960s, appears to be the new normal. If the economy had kept growing over the decades at those earlier rates, then real GDP in 2022 would be more than double its current level. Lackluster growth goes a long way to explain income inequality, stagnant wages, and perhaps even the sour mood of the American electorate.”

“What’s Hollowing Out the US Workforce?” (Michael Strain, Project Syndicate). “[U]nfavorable demographics do not explain the entire drop. People in their early twenties are 3% less likely to be in the workforce now than they were when the pandemic began. And for people in their ‘prime working years’ – ages 25 to 54, when they are generally too old to be in school but too young to be retired – the rate is 0.7 percentage points lower than it was in February 2020.”