What we’re reading (1/8)

“The Rise Of Personalised Stock Indices” (The Economist). “In 2001 Andrew Lo, a professor at the Massachusetts Institute of Technology, predicted that technological advances would one day allow investors to create their own personal indices designed to meet their financial aims, risk preferences and tax considerations. Such an idea ‘may well be science fiction today’, Mr Lo wrote, but ‘it is only a matter of time.’ More than 20 years later, that time may have come.”

“Rocket Grew Into America’s Biggest Mortgage Lender, But Now Comes The Hard Part” (Wall Street Journal). “No nonbank has grown as fast as Rocket. Its assembly-line method for making mortgages helps it handle lots of loans at once. The company spends aggressively on advertising, including Super Bowl ads in four of the past six years. But for Rocket to overcome the expected drop in refinancings, it will have to become something different. Like other nonbanks, it gets almost all of its revenue from mortgages, but it has been more aggressive about trying to expand beyond refinancings.”

“Fixed Mortgage Rates Hit 20-Month High As Long-Term Bond Yields Rise” (Washington Post). “What a difference a year makes. One year ago this week, the 30-year fixed mortgage rate sank to its lowest level in history. This week, fixed mortgage rates followed long-term bond yields and rose to their highest levels in 20 months.”

“The Athletic’s Sale Is Yet Another Sign That The Great Media Consolidation Is Upon Us” (Vanity Fair). “As a nearly two-year-old sports media start-up, The Athletic sold itself as a vulture hovering over the carcasses of local newspapers left to die in the digital age. The website’s cofounder Alex Mather went so far as to claim that The Athletic’s goal was to hasten the extinction of local news by poaching the most talented beat reporters from local sports sections—one of the few areas in which these antiquated publications continue to thrive.”

“The Background Level Of Stress” (Marginal Revolution). “That is a physiological or biological concept, or it may appear in the other sciences. It rarely plays a direct role in economics, though I think it is important for understanding regime shifts…I think a great deal about what the forthcoming level of background stress will be, but I am quite uncertain about any prediction. I do know I read a great number of people who either treat it as absurdly high (e.g., the climate doomsayers), or who are implicitly sure it will be quite low. I believe this concept of background stress, if nothing else, helps you to see what a lot of apparently reasonable predictions can end up being proven wrong.”

What we’re reading (1/7)

“The Best Investment For This Coming Crazy Year” (Wall Street Journal). “I think the best investment of 2022 is likely to be discipline. With the course of the coronavirus pandemic unclear, inflation expected to keep spiking and the Federal Reserve poised to raise interest rates, anything can happen—and probably will. What’s more, the things that feel most certain aren’t as obvious as they seem—so investors need to beware of taking drastic actions that, later on, they will wish they could undo.”

“How To Invest When There’s Nowhere To Hide” (Contrarian Edge). “I don’t know what straw will break the feeble back of this market or what will cause the music to stop (there, you got two analogies for the price of none). We are in an environment where there are very few good options. If you do nothing, your savings will be eaten away by inflation. If you do something, you find that most assets, including the stock market as a whole, are incredibly overvalued.”

“Is It Time To Fight The Fed? This Veteran Strategist Says The Central Bank Won’t Risk A 20% Drop In House Prices And A 30% Slide In Stocks.” (MarketWatch). “David Rosenberg, chief economist and strategist at Rosenberg Research and the former chief North American economist at Merrill Lynch, isn’t buying the tough talk from the Fed. ‘One should be skeptical of the Fed’s forecasts, given the poor track record, even though investors treat them (and the dot plots and FOMC minutes) as gospel,’ he says.”

“Layoffs Watch: Credit Suisse Prime Brokers” (Dealbreaker). “Luckily for those unlucky 69, they’ve gotten their walking papers at perhaps the most fortuitous moment in history for the laid off, a time when people are voluntarily leaving their jobs in droves, new jobs are springing up everywhere, and even Jamie Dimon finds himself forced to accept that the snowflakes these days just need more time at home.”

“Cities Whose Residents Make the Most Passive Income” (Chamber of Commerce). “At the regional level, households on the West Coast, Northeast, and Florida tend to earn more passive income. These differences vary based on total household income and other demographic factors. California and Florida residents earn the most, with median passive income of $7,000 and $6,000 per year, respectively. Whereas California has one of the highest median total household incomes of any state, Florida is home to a larger share of retirees who tend to depend on passive income to cover their living expenses.”

What we’re reading (1/6)

“Cathie Wood’s Flagship Ark ETF Off To A Rough Start In 2022 — Down 45% From Its Peak” (Yahoo!Finance). “With every new year comes a clean slate. For Cathie Wood’s Ark Invest, that doesn’t seem to be the case. The firm’s beaten-down Ark Innovation Fund has hit a new low in 2022 — already. After shedding 7% in Wednesday’s sell-off, the fund is down 9% this week so far and 45% from its peak in February 2021, with the decline marking its worst drawdown since inception in 2014.”

“Mortgage Rates Hit Highest Levels Since Spring 2020” (Wall Street Journal). “Ultralow interest rates have been a major force in the housing boom of the last two years. Households that kept their jobs and saved money during the pandemic seized on low borrowing costs to buy bigger homes that could accommodate working or schooling from home. Second-home purchases and investor demand for rental properties also surged.”

“Crypto Sell-Off Fuelled By Fed Worries Wipes Out Almost $900m Of Bets” (Financial Times). “Bitcoin traders suffered their worst day in a month after turbulence in traditional markets spilled into digital asset trading and caused almost $900m worth of bets to turn sour. The liquidations that hit leveraged traders come after the US Federal Reserve signalled that it could tighten monetary sooner than many investors had expected to combat rising inflation. The prospect of rising interest rates has caused prices to tumble in equity markets and pushed yields higher on government bonds.”

“Hedge Funds Are Selling Tech Shares At Their Fastest Pace In A Decade As Rates Spike” (CNBC). “The hedge fund community dumped tech stocks in the four sessions between Dec. 30 and Tuesday as interest rates spiked. The four-session tech unloading marked the biggest sale in dollar terms in more than 10 years, reaching a record since Goldman Sachs’ prime brokerage started tracking the data.”

“A Fed Official’s 2020 Trade Drew Outcry. It Went Further Than First Disclosed.” (New York Times). “Corrected disclosures show that Vice Chair Richard H. Clarida sold a stock fund, then swiftly repurchased it before a big Fed announcement…’It undermines the claim that this was portfolio rebalancing,’ said Peter Conti-Brown, a Fed historian at the University of Pennsylvania. ‘This is deeply problematic.’”

What we’re reading (1/5)

“Interest-Rate Worries Batter Stock Market” (Wall Street Journal). “Major U.S. stock indexes fell Wednesday as investors worried that the Federal Reserve might respond more aggressively to rising inflation than previously anticipated…The minutes of the Federal Reserve’s December policy meeting, released Wednesday afternoon, indicated that officials might lift short-term interest rates as soon as March. U.S. equities fell broadly after the minutes were released. Bond yields rose to their highest levels since early April.”

“Hedge Funds Struggle To Lure New Money As Performance Lags” (Financial Times). “Hedge funds gained 8.7 per cent on average from January to November 2021, according to data provider HFR…[h]edge fund managers argue their portfolios are not designed to match an index but rather to do well in all market conditions, but the size of the underperformance last year has nevertheless raised some concerns. Goldman Sachs analysts noted that while hedge funds did not necessarily aim to beat the S&P 500, last year’s returns were also ‘weak on an absolute basis’.”

“Oh, No: Adam Neumann Wants To Be A Landlord Again” (Curbed). “It seems safe to say that when Neumann himself eventually comes out of quasi seclusion to speak about his new venture, there will be lots of self-regarding over-the-top rhetoric (WeGrow once vowed to revolutionize elementary school via ‘elevating the collective consciousness of the world by expanding happiness and unleashing every human’s superpowers’).”

“The NFT Craze Has Stopped Being Funny” (The Week). “As an NFT skeptic, some guy getting scammed out of his collection of objectively hideous procedurally-generated ape cartoons was amusing. But it's all getting steadily less funny. Real non-rich people are putting a lot of money into these things, and there are good reasons to think sooner or later most of them are going to lose their shirts.”

“The Price Of Nails since 1695: A Window Into Economic Change” (Daniel Sichel, NBER). “First, from the late 1700s to the mid 20th century real nail prices fell by a factor of about 10 relative to overall consumer prices. These declines had important effects on downstream industries, most notably construction. Second, while declining materials prices contribute to reductions in nail prices, the largest proximate source of the decline during this period was multifactor productivity growth in nail manufacturing, highlighting the role of the specialization of labor and re-organization of production processes. Third, the share of nails in GDP dropped back from 0.4 percent of GDP in 1810—comparable to today’s share of household purchases of personal computers—to a de minimis share more recently; accordingly, nails played a bigger role in American life in that earlier period. Finally, real nail prices have increased since the mid 20th century, reflecting in part an upturn in materials prices and a shift toward specialty nails in the wake of import competition, though the introduction of nail guns partly offset these increases for the price of installed nails.”

What we’re reading (1/4)

“Don’t Tell Anyone, But 2021 Was Pretty Amazing” (Paul Krugman, New York Times). “[T]here’s a good chance that once time has passed and we’ve had a chance to regain perspective, we’ll consider 2021 to have been a very good year, at least in some ways. In particular, although nobody seemed to notice, it was a year of spectacular economic recovery — and one in which many dire warnings failed to come true.”

“10 Predictions For 2022” (The Irrelevant Investor). “Large value will outperform large growth by 20%. One of the stories that went under the radar last year was the return of small value. While small growth returned 2.5% in 2021, small value gained 28%. This same dynamic did not take place in large stocks. As the economy reopened over the first three months of last year, large value returned 11% while large growth fell 1%. It looked like the tide was changing, but the endzone dance was premature. Growth came roaring back, returning 29% through the rest of the year, while large value gained just 12% over the same time.”

“This Was The Year When Finance Jumped The Doge” (Wired). “When Lasse Heje Pedersen, a finance professor at Copenhagen Business School, researched the GameStop incident, he noticed something unexpected. A lot of those seemingly crusading investors were not dumping the stock at the end of the ride, as one would expect from predators ready to collect their loot; in fact, they were clinging to their GameStonks. ‘They didn’t just drive it up and then dump the stock: they were actually holding it for quite a long time,’ Pedersen says. ‘They didn’t seem to be buying it just to hurt somebody else.’ What happened in January 2021 was not simply a rebellion against Wall Street—it was something else. Call it, if you like, the rise of meme finance.”

“4 Charts On Apple's $3 Trillion Market Cap” (Morningstar). “Comparisons with fruit production and trips to Mars aside, Apple's size is massive even when measured against global stock markets. Apple's current market cap is greater than the market caps of entire countries. All public companies that operate in Canada, for example, added up to a total market cap of $2.64 trillion as of year-end 2020, $360 billion less than Apple.”

“The Verdict Is In On Elizabeth Holmes” (DealBook). “Elizabeth Holmes, the founder of the failed blood testing start-up Theranos, was found guilty of fraud yesterday, in a high-profile case that came to symbolize the perils of Silicon Valley hype and hubris. The case was not open-and-shut. Jurors, after a 15-week trial, returned a mixed verdict, finding Holmes guilty on four of 11 charges. All of the counts that she was convicted of related to defrauding investors. She was found not guilty of four counts of defrauding patients, and jurors were unable to agree on three counts related to financial fraud.”

What we’re reading (1/3)

“Apple Briefly Tops $3 Trillion Market Cap” (Wall Street Journal). “The move marked the latest milestone in a pandemic-era surge that carried shares of Apple and other large technology companies to unprecedented highs. Its share price has more than tripled since the pandemic lows of March 2020, adding around $2 trillion in market capitalization.”

“Wall Street Is Getting Greedy Again” (CNN Business). “The CNN Business Fear & Greed Index, which measures seven indicators of Wall Street's mood, is now showing signs of Greed, with three of the indicators at Extreme Greed levels. Just over a week ago, the index was flashing Fear warnings — and a month ago, it was in Extreme Fear territory.”

“Start The New Year By Asking For That Overdue Pay Raise” (New York Post). “The consensus among compensation experts is that this is the time to speak up.”

“FDIC Chair Intends To Resign In February, Giving Biden More Say Over Bank Regulation” (CNBC). “Jelena McWilliams, the head of the Federal Deposit Insurance Corporation and a holdover Trump appointee, said Friday she intends to leave her position in early 2022. In a surprise announcement, McWilliams said she is resigning effective Feb. 4. The move gives President Joe Biden another opportunity to strengthen his hand over bank regulation.”

“Will The Cloud Business Eat The 5G Telecoms Industry?” (The Economist). “Dish’s network is to be the first in America that would live almost entirely in a computing cloud. Except for antennas and cables, it is mostly a cluster of code that runs on Amazon Web Services (AWS), the e-commerce giant’s cloud-computing arm. As such, the roll-out is a test of the extent to which computing clouds will “eat” the telecoms industry, as software has eaten everything from taxis to Tinseltown.”

December 2021 performance update

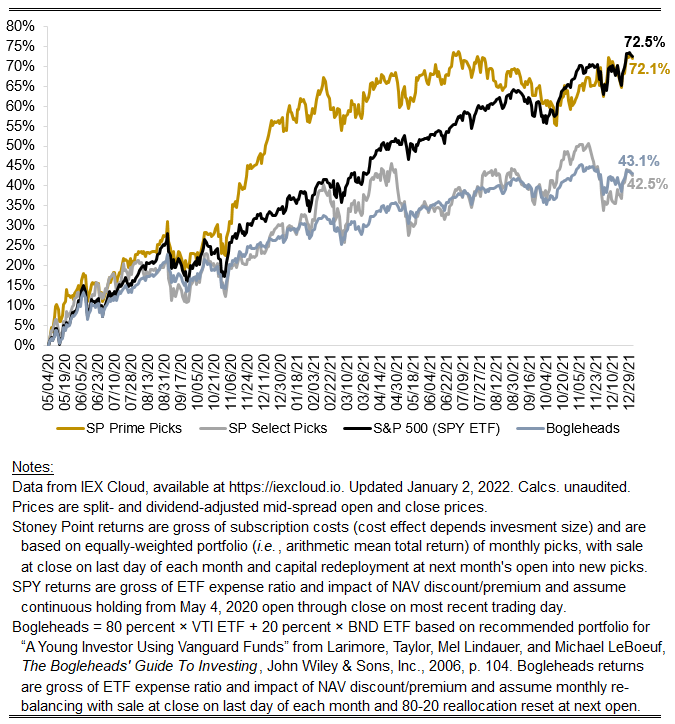

2021 has officially come to a close with December rounding out a generally solid year for U.S. equities. Here are the key numbers for the month:

Prime: +3.69 percent

Select: +3.19 percent

SPY ETF: +3.25 percent

Bogleheads (80 percent VTI, 20 percent BND): +1.67 percent

Over the whole year, our Prime and Select returns were good, at 9.55 and 9.17 percent, respectively, relative to the base historical U.S. equity rate of return of around 5-8 percent (7.98 percent since 1928 for the S&P 500 index, according to these data). Our returns dramatically underperformed the benchmark S&P 500 index in the year itself, however (as discussed yesterday, the median U.S. equity-focused fund reporting data to Bloomberg returned 13.05 percent for the year, before management and performance fees). Hence, we start 2022 at about parity with the market as a whole on a cumulative basis, with both the SPY ETF and our Prime strategy appreciating by about 72 percent since we began.

I think there is cause for optimism about a strategy like Stoney Point’s for the year ahead.

First, conditions are such that it is very unlikely the S&P 500’s high returns of late will persist long into the future. As mentioned above, the long-term historical total return for the S&P 500 is 7.98 percent since 1928. Annualized returns for the index in 2019, 2020, and 2021 were 28.88 percent, 16.26 percent, and 26.89 percent, respectively (according to these data, which I think do not incorporate dividends, by the way). Relative to history, cumulative returns for the index in the last three years have been a 1.9-standard deviation event (a very rare occurrence).

Notably, the largest five constituents—Apple, Microsoft, Amazon, Meta (f.k.a. Facebook), and Alphabet (owner and issuer of Google)—represented 23 percent of the index in market value terms as of Dec. 29. The next two—Tesla and Nvidia—represented an additional 6 percent. That is to say that nearly 30 cents of every dollar invested in proxies for the S&P 500 is a directional bet on seven technology-adjacent companies. While Amazon was flattish, Alphabet, Microsoft, Meta, and Apple returned 65 percent, 51 percent, 34 percent, and 23 percent in the year. Tesla was up 36 percent. Devotion to these names paid off handsomely in 2021, but they are now trading at arguably euphoric levels. In P/E terms, Apple, Microsoft, Amazon, Meta, Alphabet, Tesla, and Nvidia are trading at 31.65x, 37.62x, 65.25x, and 24.07x, 27.88x, 345.13x, and 90.69x. High multiples imply the market is anticipating a great deal of future growth, but mathematically it also renders these valuations relatively more sensitive to the potential for a disruption in expectations around discount rates. Surely, the market is rationally pricing its expectations of the path of future rate hikes, but that says nothing about the standard error, or certainty, around the market’s expectations and whether or not that standard error is larger today than it has been in the past. Reality will manifest in one form or another, and if it departs from expectations in an adverse way, the market’s valuation of these growthy names should rationally come down farther than others. Big trees fall hard.

Second, and relatedly, this seems like a fortuitous time to be long “value” strategies—strategies that are inherently skeptical of high valuation multiples like the P/E’s cited above (in essence, Stoney Point’s stock selection algorithm selects stocks on the basis of a relatively novel measure of “value”). To at least some degree, all value investors believe in the notion that valuation multiples should be stationary (not increasing or decreasing monotonically) over the long term, and therefore should mean-revert when they are too high or two low. This is so because the numerators of these multiples are economically linked to the denominators in some fundamental, inexorable way. Consider price/rent ratios in the residential real estate market. When price/rent multiples are high relative to history, buyers get a better deal by renting and, all else equal, demand should flow to rentable units, raising rents and lowering purchase prices. In the process, the price/rent multiple should come down until it is “right” or until it has overshot the right level to such an extent that the reverse process occurs. This story fits both common sense and historical observation across asset classes. In my view, believing in the story does not require believing there is some big “correction” coming. It merely requires believe that, in probabilistic terms, higher-multiple assets are more likely to underperform lower-multiples assets for some period in the future.

When valuation multiples are about at their historical level, whether one believes multiples should mean-revert probably matters less. But valuation multiples today are historically high. This is not only true of U.S. stocks, but also true across a range of assets. It is true of residential real estate, where median home prices have risen 30 percent in the last decade while incomes (the basic ingredient for buying houses) rose only 11 percent. It is likewise true in the earliest-stage corner of private equities, where startup valuations in 2021 nearly doubled their level in 2020. Choosing to invest in anything in this environment requires taking a stand (consciously or unconsciously) on whether you believe the basic premise of value investing is true.

Stoney Point Total Performance History

What we’re reading (1/2)

“Stocks Face Rockier Path In 2022 As Fed Rate Increases Loom” (Wall Street Journal). “[F]ew investors expect 2022 to go as well as 2021, with the Federal Reserve on the verge of raising interest rates, a new Covid-19 variant sweeping the country and government aid to families dwindling. Already, oil prices have slipped 11% since their highs in late October, reflecting traders’ concern about slowing demand for fuel. The S&P 500 spent much of the past two months trading sideways, while some speculative investments, such as shares of smaller, fast-growing tech companies, fell sharply—hurt by fears that they would be especially vulnerable to tighter monetary policies.”

“Among 2021's Best-Performing Hedge Funds: Citadel” (Crain’s). “Deep-pocketed investors have been flocking to private companies because stakes can be acquired relatively cheaply…[a] reliance on private investments should give investors pause, said Chris Walvoord, global head of alternatives research at Aon Plc. ‘Everybody needs to be careful shifting into this direction,’ he said, noting that funds more heavily weighted with illiquid private investments are at greater risk if something goes wrong. ‘If a quarter of your investors ask for their money back, you’re going to have to shut things down, because it’s going to completely unbalance the portfolio.’”

“Bitcoin Has Plunged 32% From Its All-Time High This Year. But Investors Can Take Advantage Of A Tax Loophole While They Wait For The Cryptocurrency's Comeback.” (Insider). “One advantage crypto has over stocks is that the wash sale rule doesn't apply to it. A wash sale is when a security is sold at a loss and repurchased shortly after. When this is done with securities, any losses incurred are not deductible. Some seasoned crypto traders purposely sell their digital assets below the purchase price and then buy them back at the same or similar price to take advantage of this tax-loss harvesting rule.”

“Fed Repo Facility Use Jumps To Record High On Final Day of 2021” (Yahoo!Finance). “More than 100 participants on Friday put a total of $1.905 trillion at the Fed’s overnight reverse repurchase agreement facility, in which counterparties like money-market funds can place cash with the central bank. The previous record, set on Dec. 20, was $1.758 trillion. Friday’s $208 billion leap was the biggest one-day increase in usage since June 17 after the central bank increased the offering yield to 0.05%. That compares to the last trading day of 2020 when a mere 15 counterparties tapped the facility for $9.65 billion.”

“A Booming Startup Market Prompts An Investment Rush For Ever-Younger Companies” (Wall Street Journal). “Blank Street has a simple business: It sells coffee—sometimes in carts, usually in small stores. It launched its first location 17 months ago, before it began dotting Manhattan and Brooklyn with baristas…in today’s booming market for early-stage startups, the New York-based company has received commitments for its third funding round in a year. The $35 million investment comes just three months after the still-fledgling company received $25 million, said Vinay Menda, Blank Street’s chief executive.”

What we’re reading (1/1)

“Money Has Never Felt More Fake” (Vox). “If NFTs and crypto, as a concept, prevail, it’s unlikely all of the current projects and fads will. Everybody’s hoping they’ve got a golden ticket, or at least a gold-plated ticket, that they can sell before everyone else realizes what they’ve got is a fraud. Some people in the industry acknowledge that most of this stuff is likely to implode.”

“An Engineer's Hype-Free Observations On Web3 (And Its Possibilities)” (PSL). “The history of the Internet is, in part, the history of the birth, adoption, and stewardship of distributed protocols by the broader community. Blockchains follow in this tradition, but also break radically from it: they are the first protocols to arrive with an asset class attached. Protocols like SMTP (1981; email), TCP (1983; reliable packet transmission), HTTP (1991; web), and XMPP (1999; chat) all created immense value while capturing little for their inventors. Blockchains upend this, allowing inventors to capture considerable value for themselves.”

“71 Years Of Stock Market Data Reveals Investors May Be Happy In The New Year” (Yahoo!Finance). “Truist Advisory Services co-chief investment officer Keith Lerner found that going back to 1950, when the S&P 500 had a total return of at least 25% in a year, stocks usually rose in the following year. The outcome during that 71 year stretch: stocks advanced 82% of the time, or 14 out of 17 instances. “

“The Impact Of The COVID-19 Vaccine Distribution On Mental Health Outcomes” (Agrawal, et. al, NBER Working Paper). “While vaccines are primarily aimed at reducing COVID-19 transmission and mortality risks, they may have important secondary benefits…[w]e estimate that COVID-19 vaccination reduces anxiety and depression symptoms by nearly 30%. Nearly all the benefits are private benefits, and we find little evidence of spillover effects, that is, increases in community vaccination rates are not associated with improved anxiety or depression symptoms among the unvaccinated. We find that COVID-19 vaccination is associated with larger reductions in anxiety or depression symptoms among individuals with lower education levels, who rent their housing, who are not able to telework, and who have children in their household.”

“Who Won in Afghanistan? Private Contractors” (Wall Street Journal). “Since the Sept. 11, 2001 attacks, military outsourcing helped push up Pentagon spending to $14 trillion, creating opportunities for profit as the wars in Afghanistan and Iraq stretched on…[t]he Pentagon spent $6 million on a project that imported nine Italian goats to boost Afghanistan’s cashmere market. The project never reached scale. The U.S. Agency for International Development gave $270 million to a company to build 1,200 miles of gravel road in Afghanistan. The USAID said it canceled the project after the company built 100 miles of road in three years of work that left more than 125 people dead in insurgent attacks…[b]y the time President Donald Trump left office four years later, 18,000 contractors remained in Afghanistan, along with 2,500 troops.”

What we’re reading (12/31)

“In A Wild Year For Markets, Stocks Pull Off Big Gains” (Wall Street Journal). “Even with the recent turbulence from the Omicron coronavirus variant, the S&P 500 saw a 27% advance for 2021 and has hit 70 highs. It is the third straight year of double-digit gains for the broad index, and the second in the midst of the Covid-19 pandemic. The Dow Jones Industrial Average and Nasdaq Composite have gained 19% and 21%, respectively, this year, helping send the major indexes to their best three-year performance since 1999.”

“Stocks Surged in 2021, As Wall Street Rolled Its Eyes At Covid” (CNN Business). “It was an incredibly resilient year for the market, with stocks continuing to rally despite an alarming uptick in cases of the Omicron variant of Covid-19 around the globe. Optimism about the effectiveness of vaccines helped fuel investor enthusiasm though, as did the steady hand of the Federal Reserve and other central banks, which have mostly pledged to tread cautiously as they look to normalize monetary policy and slowly begin raising interest rates.”

“The Fed’s Moves Pumped Up Stocks. In 2022, It May Pull The Plug.” (New York Times). “‘The nightmare scenario is: The Fed tightens and it doesn’t help,’ said Aaron Brown, a former risk manager of AQR Capital Management who now manages his own money and teaches math at New York University’s Courant Institute of Mathematical Sciences. Mr. Brown said that if the Fed could not orchestrate a ‘soft landing’ for the economy, things could start to get ugly — fast. And then, he said, the Fed may have to take ‘very aggressive action like a rate hike to 15 percent, or wage and price controls, like we tried in the ’70s.’”

“Billionaire Chamath Palihapitiya Says Visa And Mastercard Will Be The Biggest Business Failures In 2022, Losing Out To Altcoin-Linked Projects” (Insider). “‘Be short these companies and anybody that basically lives off of this 2 or 3% (transaction) tax, and be long well-thought-out, Web3 crypto projects that are rebuilding payments infrastructure in a completely decentralized way,’ he said.”

“The Hidden ‘Replication Crisis’ Of Finance” (Financial Times). “It may sound like a low-budget Blade Runner rip-off, but over the past decade the scientific world has been gripped by a ‘replication crisis’ — the findings of many seminal studies cannot be repeated, with huge implications. Is investing suffering from something similar? That is the incendiary argument of Campbell Harvey, professor of finance at Duke university. He reckons that at least half of the 400 supposedly market-beating strategies identified in top financial journals over the years are bogus. Worse, he worries that many fellow academics are in denial about this.”

January Prime + Select picks available now

The new Prime and Select picks for January are available starting now, based on a model run put through today (December 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Monday, January 3, 2022 (at the mid-spread open price) through the last trading day of the month, Monday, January, 31, 2022 (at the mid-spread closing price).

What we’re reading (12/30)

“Stock Pickers Are Struggling To Beat The Market” (Wall Street Journal). “[A]s 2021 draws to a close, most professional stock pickers find themselves in familiar territory: trailing the benchmark S&P 500 index…[s]ome 85% of active U.S. stock funds were on pace to underperform the S&P 500 this year as of Nov. 30, according to Morningstar Direct. In the same period a year ago, 64% of such funds were running behind the S&P 500, according to Morningstar.”

“Ivy Zelman Called The Housing Market's Peak Before The 2008 Crash. She Told Us Why Home Prices Will Tank Far Sooner Than Buyers, Sellers, And Wall Street Think.” (Insider). “[S]he says the seller's market is living on borrowed time. One reason, in her view, is that people are underestimating the enormous amount of construction being planned. In November, Zelman estimated that national demand for single-family homes sat at about 900,000 units a year, but 1.1 million units were planned — a difference of about 20%.”

“Mortgage Rates End Year About Where They Have Been” (Washington Post). “According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average rose to 3.11 percent with an average 0.7 point. (A point is a fee paid to a lender equal to 1 percent of the loan amount. It is in addition to the interest rate.) It was 3.05 percent a week ago and 2.67 percent a year ago.”

“When It Comes To Inflation, I’m Still On Team Transitory” (Alan Blinder, Wall Street Journal). “Several factors point to lower inflation rates ahead. First, the price of crude oil, which more than doubled between November 2020 and October 2021, has begun to fall. Second, normal consumption patterns will re-emerge as pandemic fears subside. Consumers will start buying more restaurant meals, hotel rooms and movie tickets—and fewer things that are shipped in boxes. Omicron may delay the return to normalcy, but it will happen. Third, capitalism is on our side. Shortages raise prices, but high prices create opportunities for profit, which attract capitalists to alleviate the shortages. They don’t do this out of altruism, but out of self-interest.”

“South Africa Lifts Curfew As It Says Covid Omicron Peak Has Passed” (CNBC). “South Africa lifted a midnight to 4 a.m. curfew on movement with immediate effect as it believes the country has passed the peak of its fourth Covid-19 wave driven by the Omicron variant, a cabinet statement said on Thursday.”

What we’re reading (12/29)

“Hedge Funds Bet Against Market Pessimism On US Economic Outlook” (Financial Times). “[T]raders and strategists say that some hedge funds are wagering that the yield curve will not flatten much more. Instead, they are once again betting that yields on long-term US government bonds will eventually rise, and rise more than yields on shorter-term debt.”

“IPOs Had A Record 2021. Now They Are Selling Off Like Crazy.” (Wall Street Journal). “Looming behind a record-breaking run for IPOs in 2021 is a darker truth: After a selloff in high-growth stocks during the waning days of the year, two-thirds of the companies that went public in the U.S. this year are now trading below their IPO prices.”

“The Inside Story Of How ETFs Weathered The March 2020 Storm” (Financial Times). “At the New York Stock Exchange, level 1 circuit breakers, triggered when there is a 7 per cent decline in the S&P 500, activated four times in eight trading days between March 9 and March 18, halting trading for 15 minutes each time. Douglas Yones, head of exchange traded products at NYSE, recalls a huge effort to ensure everything ran smoothly and to ensure participants were ready for the vast trading volume that would hit the markets as soon as the circuit breakers came off.”

“What’s Behind Value And Growth’s Odd Behavior Last Month? Confusion And Mixed Signals.” (Institutional Investor). “‘It’s not often that we see most value, growth, and quality sub-factors all outperform the markets, but in November they did just that,’ according to Investment Metrics.”

“Taxi Medallion Lender Bought Glowing News Stories To Pump Up Its Stock Price, SEC Alleges” (CNN Business). “According to a complaint filed on Wednesday in Manhattan federal court, Medallion [Financial] and COO Andrew Murstein paid a California media strategist to place positive stories about Medallion on various websites and create fake identities to make the opinion pieces appear credible to investors.”

What we’re reading (12/28)

“The Peanut Butter Secret: A Lavish Tax Dodge for the Ultrawealthy” (DNYUZ). “Thanks to the ingenuity of the tax-avoidance industry, investors in hot tech companies are exponentially enlarging the [Qualified Small Business Stock, or “Q.S.B.S.”] tax break. The trick is to give shares in those companies [initially obtained by investing when they were small and speculative ]to friends or relatives. Even though these recipients didn’t put their money into the companies, they nonetheless inherit the tax break, and a further $10 million or more in profits becomes tax-free.”

“Why Capital Will Become Scarcer In The 2020s” (The Economist). “[L]et us shelve the immediate outlook and ask instead how things might change over the next decade or so. Today capital is abundant. A middle-aged global workforce has lots of savings to put to work. Low long-term interest rates and expensive assets point to a scarcity of worthwhile ways to deploy those savings. New businesses are often ideas-based and do not need a lot of capital. It can be hard to imagine this state of affairs ending. But over time capital is bound to become less abundant. Greater demand for it will come from three sources in particular: economic populism; shorter supply-chains; and the energy transition.”

“Reflections On Greenspan’s ‘Irrational Exuberance’ Speech After 25 Years” (Cato Institute). “Greenspan clearly recognized that monetary policy is a blunt tool for achieving long‐run economic growth, which depends on increasing real factors—such as labor, capital, and technology—as well safeguarding private property and the rule of law. Activist monetary policy may spur economic growth in the short run, but cannot do so in the long run. If it could, then all that need be done to increase the wealth of nations would be to drop money from helicopters.”

“Jimmy Cayne, Who Led Bear Stearns Before It Imploded, Dies At 87” (Wall Street Journal). The most brutal obit I’ve ever read: “Mr. Cayne, a blunt, competitive, cigar-smoking executive, remained an archetype of a Wall Street boss now rarely seen. He once told an associate, after meeting her son, ‘that kid’s got a rotten handshake. He’s going nowhere in life.’”

“Confessions Of A Loan Shark” (City Journal). “It was Labor Day weekend, 1961. Georgie McLaughlin, stewed to the gills, insulted and likely assaulted the girlfriend of one of McLean’s many friends. What happened next was the mandatory minimum for that kind of conduct in that kind of crowd. Georgie was beaten senseless and ended up in a hospital. Predictably, his two brothers sought vengeance—they crossed the border into Somerville and demanded that McLean hand over those responsible. McLean knew what that meant. He refused.”

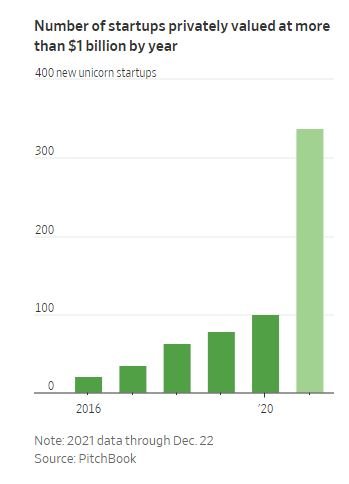

A bubble in private markets?

I will go out on a limb and say that if there is one thing upon which the esteemed minds of empirical asset pricing agree, it might be that high ratios of market value to earnings (or cash flow, or book value, etc.) predict relatively lower subsequent returns (see, e.g., here). High valuation ratios don’t prove a bubble, of course, but they do offer a good place to look.

With that in mind, I was struck by the chart below from todays WSJ. Keep in mind, so-called “unicorns” often have de minimis earnings and cash flows, so the chart below may well be showing undefined or infinite valuation ratios, increasing higher still this year.

Are startups this year really worth that much more than they were last year? And if so, why startups? I haven’t put together a comparable chart examining public equities, but I suspect it wouldn’t look like this, with about 3.5x as many firms worth more than $1 billion than last year.

Is it more likely that the valuations captioned below reflect a rational pricing of expected cash flows and risk, or that some combination of chicanery and irrationality has funneled a ton of money into “growthy,” “tech-enabled” companies?

Anecdotally, I’ve been shocked at the amount of money I’ve seen raised (by people I know firsthand, no less!) for what seem like, at best, “OK” business plans. A relatively well-known venture capitalist active in this market once told me, “there’s no shortage of ideas [in Silicon Valley]. There’s just not enough execution.” One wonders if that might explain the chart below: there is a lot of money out there, and the money follows and prices the available “execution talent” in circulation. But good execution is hard to find, and when there is too much money chasing scarce good execution, the price of execution in general should rise, provided there is uncertainty about who the “good executors” are (or what the good “ideas” are). This is really just basic inflation dynamics, but with the pernicious influence of extra uncertainty: payoffs a long time in the future, obscure valuations not marked-to-market on a minute-by-minute basis (unlike public equities), and the promise of accessing investments “ordinary” investors can’t.

If this reasoning sounds fanciful, just recall that WeWork raised $13 billion from the most sophisticated investors on the planet on the back of its “community-adjusted EBITDA” before its valuation completely fell apart ahead of its initial stab at a public offering.

From Ramkumar, Amrith, and Eliot Brown, “The $900 Billion Cash Pile Inflating Startup Valuations,” Wall Street Journal, Dec. 27, 2021.

What we’re reading (12/27)

“The $900 Billion Cash Pile Inflating Startup Valuations” (Wall Street Journal). “The cash committed to venture-capital firms and private-equity firms focused on rapidly growing companies but not yet spent also is ballooning. So-called dry powder hit about $440 billion for venture capitalists and roughly $310 billion for growth-focused PE firms earlier this month, according to Preqin.”

“The Groundhog Day Stock Market Anomaly” (Shanaev, et al., Finance Research Letters). “This paper discovers a distinct calendar anomaly on the US stock market associated with the Groundhog Day prognostication tradition across 1928–2021. There are significant positive abnormal returns around the “prediction” of an early spring, while buy-and-hold returns around the “prediction” of a long winter are 2.78% lower. The results are robust in subsamples, to a set of placebo tests for international stock indices, and cannot be explained by January effect, the ‘halloween Indicator’, turn-of-the-month effect, or other seasonalities. The findings imply major and persistent irrational optimism of US investors revolving around Groundhog Day early spring prognostications.”

“Pandemic Migration Spurs Maine’s Biggest Population Growth In 2 Decades” (Bangor Daily News). “Maine saw more migration during the COVID-19 pandemic than almost all other states during the COVID-19 pandemic, leading to the greatest population growth here in nearly two decades. The sharp rise in population over the past two years comes on the heels of mostly anemic growth over the past decade, as Maine’s overall population rose just 2.6 percent between 2010 and 2020, compared with 7.4 percent growth nationally.”

“Tens Of Thousands Leave The Old Smoke In Biggest Exodus For A Generation” (The Times). “More than 90,000 Londoners quit the capital this year, the largest exodus for ‘at least a generation’, according to research published today by the estate agency Hamptons. A further 21,000 Londoners bought a second home, or a buy-to-let property, outside the M25.”

“Mick Jagger, Financial Planner Extraordinaire” (Wall Street Journal). “For more than half a century, as anyone even vaguely familiar with the history of rock ’n’ roll knows, the Stones have written and performed songs that provide sage investment advice for their fans. Bear in mind that Mick Jagger briefly attended the London School of Economics and was an early proponent of moving the Stones’ income to localities where they could escape the tax man.”

January picks available soon

We’ll be publishing our Prime and Select picks for the month of January before Monday, January 3 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of December, as well as SPC’s cumulative performance, assuming the sale of the December picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Fri., December 31). Performance tracking for the month of January will assume the January picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Monday, January 3).

What we’re reading (12/26)

“Wall Street Bets S&P 500 Will Say Goodbye To Outsize Stock Gains In 2022” (Wall Street Journal). “U.S. stocks are on track to end 2021 with another year of outsize gains. Many investors aren’t expecting a repeat in 2022. The S&P 500 has climbed 26% so far in 2021, after rising 16% in 2020. Rip-roaring corporate profits and easy monetary policy have fueled the run. Earnings growth is expected to moderate next year, and the Federal Reserve is pursuing plans to raise interest rates, chipping away at key supports for the stock market’s rally.”

“Debranding Is The New Branding” (Bloomberg). “In recent years many major brands have taken a long, hard look in the mirror and hit reverse — discarding detail and depth to debrand. Burger King returned to a simpler, flatter identity…Rolling Stone shed its character stroke and drop shadow for a cleaner edge…[a]s much as brands aspire to be sui generis, branding has fashions that ebb and flow like skirt lengths or collar widths. This was as true of “jazz age” and “flower power” brands as of the recent effusion of “hipster” brands[.]”

“T Rowe Price Chief Warns Of ‘Free-Form Risk-Taking’ In Buoyant Markets” (Financial Times). “The outgoing head of one of the largest active US fund managers warned that investors should ‘step away from risk’ to avoid being burnt in an increasingly speculative market. Investors should not be overexposed to what has worked in the past year, or even three years, said Bill Stromberg, the chief executive of T Rowe Price, who will retire at the end of this year. ‘Even if they are a year too early. Because when the market unwinds, it will be areas of risk that unwind the most.’”

“Some Simple Game Theory Of Omicron” (Marginal Revolution). “Let’s say that everyone is totally reckless, and they go to Christmas Eve ‘Omicron parties.’ A week or two from now the virus has cleared their systems and I, who stay at home and blog, can then go out and frolic. Even if they stay sick, or if they die, they are removed as sources of potential infections for others (see below for new variants, possibly from the immunocompromised). If I know that is happening, I find it easy to stay at home for a week. I look forward to my pending freedom. In other words, right now my behavior becomes safer. I engage in intertemporal substitution.”

“Moving In Stereo: Churn And Rotations Causing Swings In Sentiment” (Charles Schwab). “This year has been a strong one for most major stock market averages; but with ample churn and sector volatility under the surface. Instead of trying to get ahead of these short-term swings, use them to your advantage via diversification, but also volatility/portfolio-based rebalancing in the interest of trimming into strength and adding into weakness. Keep a close eye on sentiment conditions, especially if they move back toward euphoria—and if not accompanied by breadth improvement.”

What we’re reading (12/25)

“Generation Z Is Lost In An Age When Nothing Matters” (Real Clear Markets). “How then can they think? The answer, of course, is that many do not. They feel - and react, based upon those feelings. Without thinking - the thinking being done for them, by those who have learned the value of thoughtlessness and passivity.”

“Almost One-Third Of Young Workers Are Making A Huge Retirement Mistake” (USA Today). “According to Goldman Sachs' recent report, 30% of workers under the age of 40 believe they will have to replace just 60% of their pre-retirement income -- or less -- after they've left the workforce for good. This means if they were making $70,000 when they left the workforce, they are assuming they'll only require a total of $42,000 at most once they've quit their jobs for good.”

“‘Mad Max,’ Crooked Insiders And A Wolf: Here’s What Some Of Wall Street’s Most Audacious Fraudsters Are Up To” (CNBC). “That can make the Street a fertile ground for fraud. Some of the most notorious financial crimes of all time have ties to the corner of Wall and Broad, and their impact — on victims, law enforcement, and future would-be crooks — lasts to this day. Let’s catch up with some of Wall Street’s most audacious fraudsters.”

“Commodities: Inflation Hedge Or Fool's Gold?” (Morningstar). “Investing in commodities always gains interest when the specter of inflation rears its ugly head. Research shows that commodities tend to be one of the asset classes that is most positively correlated with inflation, as calculated by the Consumer Price Index.”

“Travel Woes Deepen As Omicron Variant Hits Pilots And Flight Attendants” (Wall Street Journal). “Airlines have canceled more than 600 U.S. flights so far Friday, calling off hundreds more scheduled for Saturday, according to FlightAware, a flight-tracking site. Some European airlines and rail operators are also grappling with higher rates of illness among employees, in the latest sign of how the rapidly spreading Omicron variant is upending business even in industries with heavily vaccinated workforces.”

What we’re reading (12/23)

“What We’re Looking Forward To In 2022” (DealBook). “Americans are starting new businesses at the fastest pace in years. The pandemic helped end a multidecade slump in new start-ups that had both stumped and worried economists. This year, business applications in the U.S. are on track to surpass 5.4 million, up from 4.3 million last year. Why? Perhaps the pandemic gave people more time to think, and because the economic upheaval it wrought created opportunities for small new businesses. Technology has also made it easier to become an entrepreneur, and access to capital has expanded.”

“'Backdoor' Roth Restrictions Have Been Put On hold -- For Now” (CNN Business). “If you're a high earner who was scrambling to take advantage of a so-called backdoor Roth IRA or Roth 401(k) before new rules go into effect prohibiting you to do so, you just got a reprieve. Senator Joe Manchin's refusal to vote for the Build Back Better bill puts the future of that legislation in jeopardy. And, as a result, it also puts in jeopardy a revenue-raising provision in the bill that would restrict the ability of high-income savers to put money into Roth IRAs and Roth 401(k)s using a backdoor conversion method.”

“Wall Street Is So Desperate For Talent Some Firms Are Offering To Pay Out Rival Bankers' Year-End Bonuses” (Insider). “Wall Street's war for talent isn't letting up as the year winds down, as some investment banks are willing to pony up big money to poach bankers ahead of their year-end bonus payouts. It's a change from previous years, when hiring normally came to a standstill in the fourth quarter before talks resumed in January, recruiters said. ‘This year, people are giving out offers today in order to buy them out in 2022,’ Kevin Mahoney, a partner at Bay Street Advisors who leads the investment banking, private equity, and private credit practices, told Insider.”

“Should You Add Real Estate To Your Retirement Portfolio?” (Wall Street Journal). “Whether it is a physical property, such as an apartment building, or an investment in a real-estate investment trust or mutual fund, many financial-planning professionals say that income-producing real estate is an essential part of a well-performing retirement portfolio. However, while 75% of retirees have their money parked in bank accounts or CDs, just 12% own real estate other than their primary residence for investment, according to a survey conducted by the Transamerica Center for Retirement Studies between November 2020 and December 2020.”

“What Jack Dorsey’s Attack On Web3 Is Really About” (Slate). “Dorsey is essentially arguing that Web3 is doomed to break its promise of a more egalitarian and individualistic internet. Deep-pocketed venture capitalists, tech companies, and hedge funds are collectively pouring tens of billions of dollars into developing Web3 services and infrastructure. Just this month, a crypto firm called Hashed raised $200 million, Kraken Ventures Fund raised $65 million, and venture accelerator Brinc raised $130 million, all for Web3 investments.”