What we’re reading (11/3)

“Fed Dials Back Bond Purchases, Plots End To Stimulus By June” (Wall Street Journal). “The Federal Reserve closed a chapter on its aggressive, pandemic-driven stimulus when it approved plans Wednesday to begin scaling back its bond-buying program this month amid concerns that inflationary pressures could last longer than officials expected earlier this year. Fed officials agreed to wind down their $120-billion-a-month asset-purchase program by $15 billion each in November and December, a pace that could phase out the purchases entirely by next June.”

“Wall Street Hits Highs Again After Fed Confirms Tapering Plans” (Financial Times). “The S&P 500, which had slipped slightly earlier in the day, swung to a gain after the Fed’s announcement and extended its gains as chair Jay Powell spoke to reporters. Powell said the Fed could adjust the pace of its tapering but stressed that ‘we wouldn’t want to surprise markets’ and would provide ample warning ahead of any change. He added that the central bank would not rush to raise interest rates.”

“Zillow Thought It Could Rule The Housing Market. It Was Very Wrong.” (MarketWatch). “Zillow Group had a wealth of data, access to millions of dollars in capital and executives with the hubris to believe they could use these tools to outsmart both a volatile housing market and startups specializing in buying and selling houses. They failed, and lost more than half a billion dollars in the process.”

“On Elon Musk And The Dangerous Power Of Insecure Billionaires” (Paul Krugman, New York Times). “Elon Musk doesn’t think visionaries like him should pay taxes the way little people do. After all, why hand over his money to dull bureaucrats? They’ll just squander it on pedestrian schemes like … bailing out Tesla at a crucial point in its development. Musk has his sights set on more important things, like getting humanity to Mars to ‘preserve the light of consciousness.’ Billionaires, you see, tend to be surrounded by people who tell them how wonderful they are and would never, ever suggest that they’re making fools of themselves.”

“The Uses And Abuses Of Green Finance” (The Economist). “In principle, [Green finance] has a huge role to play in slowing climate change. Shifting the economy from fossil fuels to clean sources of energy requires a vast reallocation of capital. By 2030, around $4trn of investment in clean energy will be needed each year, a tripling of current levels. And spending on fossil fuels must decline. In an ideal world the profit incentive of institutional investors would be aligned with reducing emissions, and these owners and financiers would control the global assets that create emissions. If so, asset owners would have both the motive and the means to reinvent the economy. But the reality of green investing falls short of this ideal.”

What we’re reading (11/2)

“A World Running On Empty” (Paul Krugman, New York Times). “Probably the best parallel is not with 1974 or 1979 but with the Korean War, when inflation spiked, hitting almost 10 percent at an annual rate, because supply couldn’t keep up with surging demand…[during the pandemic] the composition of demand has changed. During the worst of the pandemic, people were unable or unwilling to consume services like restaurant meals, and they compensated by buying more stuff…[s]omething similar seems to have happened around the world.”

“Money Talks: The Couple Who Used Lessons From 2008 To Navigate 2020” (Vox). “Krystal: We realized ownership was extremely valuable, especially in a market that was growing. Then, in this situation, we realized the people who were doing really well were the people who had ownership. It made sense that people who own property, people who have income sources that aren’t tied to employers, are doing okay.”

“Zillow Stock Dives After Analyst Highlights Two-Thirds Of Homes Bought Are Underwater” (MarketWatch). “Shares of Zillow Group Inc. took a dive Monday, after KeyBanc analyst Edward Yruma highlighted how most of the homes the real estate services company purchased, with an aim to flip them, were now worth less than what they paid for them…Yruma said it completed an analysis of 650 homes in Zillow’s inventory, or about one-fifth of the homes owned, and found that 66% are currently listed below the purchase price at an average discount of 4.5%.”

“Farewell Offshoring, Outsourcing. Pandemic Rewrites CEO Playbook.” (Wall Street Journal). “With the machinery of international trade slowed, business leaders are ditching, at least temporarily, overseas partners and the conventional wisdom of the global economy in favor of reliability, even if it costs more. Some are moving workers and production facilities closer to home and relocating plants closer to suppliers. Others are buying their suppliers or bringing former contract work in-house.”

“Of Course Trump’s SPAC Deal May Have Broken Securities Laws” (Vanity Fair). “Just days after Donald J. Trump left the White House, two former contestants on his reality show, The Apprentice, approached him with a pitch. Wes Moss and Andy Litinsky wanted to create a conservative media giant. Mr. Trump was taken with the idea. But he had to figure out how to pay for it…. To get his deal done, Mr. Trump ventured into an unregulated and sometimes shadowy corner of Wall Street, working with an unlikely cast of characters: the former Apprentice contestants, a small Chinese investment firm and a little-known Miami banker named Patrick Orlando.”

What we’re reading (11/1)

“G-20 Needs A ‘Sputnik Moment’ On The Global Economy” (Mohamed El-Erian, Washington Post). “central banks must now confront two policy requirements that would have been much easier to handle with better sequencing over a longer period: easing off the accelerator by reducing large-scale asset purchases (a QE taper) and tapping on the brakes through interest rate increases. The Bank of England has been the best at recognizing the underlying inflation dynamics and the urgent need to adjust its forward policy guidance. The Fed continues to notably lag behind, while the European Central Bank’s own sluggishness has a better economic rationale.”

“Even After A Weak Patch, America’s Economy Is Still In High Gear” (The Economist). “An end to stimulus would usually augur poorly for growth. Yet other factors could insulate the economy. The consumption of goods is about 15% higher than its trend level, partly because people have spent much less money than usual on holidays and restaurants and much more on sofas, exercise bikes and stay-at-home essentials. But with the pandemic now apparently petering out, people are buying experiences again—a fillip for growth, given that services account for nearly 80% of output[.]”

“How Robinhood Cashes In On The Options Boom” (Wall Street Journal). “In the 12 months through June, the 11 largest U.S. retail brokerages collected $2.2 billion for selling customers’ options orders, according to Larry Tabb, head of market-structure research at Bloomberg Intelligence. That was about 60% higher than their take from selling equities orders. During that period, major brokers were paid an average of about 16 cents for each 100 shares of their customers’ stock orders, compared with about 54 cents for equivalent-sized options orders, Mr. Tabb’s data show.”

“Jobs People Want — And Don't Want — After The Pandemic” (Axios). “Interest in IT and media jobs is surging, but no one wants to fill the sorely needed child care and home health roles…only around 37% of U.S. jobs can be done from home, per an analysis by economists at the University of Chicago. But more and more people are eager to secure those jobs for the flexibility they provide during the pandemic and beyond, says Indeed economist AnnElizabeth Konkel…Indeed's report shows that interest in loading and stocking jobs at warehouses has cratered 40%. Clicks for food service jobs are down 18%. And interest in personal care and home health jobs and child care jobs is down 33% and 15%, respectively.”

“Catastrophe Bonds Storm Into Mainstream As Climate Threat Grows” (Financial Times). “A cyclone that sweeps through Jamaica, a typhoon that hits China’s Greater Bay, an earthquake that damages Google’s facilities in California — just a few examples of the growing range of hypothetical events that investors are queueing up to underwrite. Catastrophe bonds were first created in the 1990s as a niche form of risk transfer from insurers to investors. They have expanded steadily to a market of more than $30bn in terms of debt outstanding.”

October 2021 performance update

Hi friends, here with a monthly performance update. Here are the monthly numbers:

Prime: -0.35%

Select: +6.54%

S&P 500-tracking “SPY” ETF: +6.56%

Bogleheads: +4.93%

It was a great month for U.S. stocks broadly — the best month year-to-date so far for the S&P 500 — and that played out in the performance of the S&P 500-tracking SPY ETF performance and in the performance of our Select picks, which basically performed in-line with the market as a whole. Prime was deeply disappointing. Basically our top picks (HPQ and HPE) turned out a fine month, but a few picks deeply enmeshed in supply chain issues related to the global chip shortage were hit hard (e.g., WDC and INTC, down 8.31 percent and 8.66 percent, respectively). Both of those companies reported quarterly earnings during the month and actually crushed EPS expectations, but the forward-looking outlook apparently left something to be desired. Our algo likely picked them up because their prices seemed low relative to real-time fundamentals, but it really is forward-looking fundamentals that matter, of course, and in turbulent times like this extrapolating trailing fundamentals into the future isn’t a safe bet. In repeated monthly samples over a multi-year hold period, one expects/hopes that base rates play out.

The month ahead should be interesting. There is a big Fed meeting this week that augurs potentially significant policy changes that should effect risk premia across all asset classes, including stocks. It could be a wild ride. Stay tuned.

Stoney Point Total Performance History

November Prime + Select picks available now

The new Prime and Select picks for November are available starting now, based on a model run put through yesterday (October 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Monday, November 1, 2021 (at the mid-spread open price) through the last trading day of the month, Tuesday, November 30, 2021 (at the mid-spread closing price).

What we’re reading (10/31)

“U.S. Prices, Wages Rise At Fastest Pace In Decades” (Wall Street Journal). “Consumer prices rose at the fastest pace in 30 years in September while workers saw their biggest compensation boosts in at least 20 years, according to new government data released Friday…[t]he reports point to a recovery caught between robust consumer demand and severe supply shortages, leading to a rapid uptick in inflation. They also put pressure on Federal Reserve officials as they prepare to meet next week.”

“Microsoft Surpasses Apple As The World's Most Valuable Company After The iPhone Maker's Stock Slips On Earnings Miss” (Insider). “The Windows software producer's market capitalization reached $2.46 trillion, higher than Apple's market cap of $2.43 trillion, making Microsoft the most valuable company. That title exchanged hands as Microsoft stock rose 1% to $327.50 Friday, while Apple dropped as much as 4% to $146.41 after the company late Thursday posted its first miss in quarterly revenue since 2018. Fiscal fourth-quarter sales of $83.4 billion were below expectations of $85 billion, hurt by supply-chain disruptions for semiconductors.”

“Slower S&P 500 Earnings Growth Is Not Bullish — No Matter What Some Stock Market ‘Experts’ Are Saying” (MarketWatch). “Some exuberant analysts are trying to put a bullish spin on the dramatic slowing in the S&P 500’s earnings per share growth rate projected for the next several quarters. They are wrong…the stock market is forward looking, its performance in a given quarter will to a far greater extent reflect projected earnings growth several quarters hence.”

“Merrick Garland Is Looking To Nail Some Corporate A**es To The Wall” (Dealbreaker). “We can’t be sure that Credit Suisse’s absolute inability to get out of its own way was the final straw. Maybe it was Deutsche Bank’s routine refusal to live up to its promises to stop breaking rules/laws/etc. Whatever it was, the Justice Department has had quite enough.”

“Women May Be Better Investors Than Men…” (New York Times). “Over a 10-year period, [Fidelity’s] female customers earned, on average, 0.4 percentage points more annually than their male counterparts. That may not seem like a lot, but over a few decades it can add up to tens of thousands of dollars or more…[t]he source of women’s superior returns is the way they trade. Or, rather, how they don’t. Female Fidelity customers bought and sold half as much as male customers. Vanguard saw similar patterns over the same decade-long period when examining workplace retirement accounts that it manages; at least 50 percent more men traded in them than women did every year during that time.”

What we’re reading (10/29)

“U.S. Economic Growth Lagged In The Third Quarter, But Hopeful Signs Abound For The Rest Of 2021” (Washington Post). “The U.S. economy grew at a disappointing 2.0 percent annual rate in the third quarter as the delta variant peaked, but promising signs suggest 2021 is on track to notch the fastest full-year growth in almost four decades.”

“Facebook Changes Company Name To Meta In Focus On Metaverse” (Wall Street Journal). “Facebook Inc. Chief Executive Officer Mark Zuckerberg said the company changed its name to Meta to reflect growth opportunities beyond its namesake social-media platform in online digital realms known as the metaverse. ‘Over time I hope our company will be seen as a metaverse company,’ Mr. Zuckerberg said Thursday.”

“Bitcoin Miners Are Gobbling Up U.S. Energy” (Gizmodo). “There’s a big new presence slurping up power from the U.S. grid, and it’s growing: bitcoin miners. New research shows that the U.S. has overtaken China as the top global destination for bitcoin mining and energy use is skyrocketing as a result.”

“Why Are Natural Gas Prices High? Because Fracking Isn’t Really Profitable.” (Barron’s). “Normally, a spike in prices induces energy companies to increase production, but not this time. Energy prices fell by as much as 70% early in the pandemic. According to a New York Times report, energy executives are not willing to increase production because they are still experiencing the trauma from the crash, and Wall Street is hesitant to fund exploration because of new pressures to meet climate and ESG (environmental, social, governance) goals. But the truth is actually less complex: even before the pandemic, shale oil and fracking had not been profitable.”

“Muddy Waters’ Carson Block Says Wall Street Is ‘Thoroughly Compromised by China Money’” (Institutional Investor). “‘The government of China has co-opted much of the U.S. financial services industry — from the exchanges to the asset managers, investment banks and index providers,’ wrote [Carson] Block, a short-seller who is one of the most vociferous critics of Chinese companies that he sees as frauds that have been perpetrated on U.S. investors with little consequence for the scofflaws.”

What we’re reading (10/28)

“Third Point Has Big Shell Stake, Urges Energy Giant To Break Up” (Wall Street Journal). “The activist is the latest to pressure a major oil company to change its strategic direction, as the firms face calls to reduce fossil fuel investments and pivot to renewable energy amid concerns about climate change. Upstart hedge fund Engine No. 1 waged a successful campaign to win seats on the board of Exxon Mobil Corp. in May.”

“This Movement Is Taking Money Away From Fossil Fuels, And It’s Working” (New York Times). “And by this point, divestment has spread way beyond colleges and universities. Enormous pension funds serving New York City and state employees have announced that they will sell stocks; earlier this year, the Maine legislature ordered the state’s retirement fund to divest; and just last month, Quebec’s big pension fund joined the tide. We’ve seen entire religious groups — the Episcopalians, the Unitarian Universalists, the U.S. Lutherans — join in the call; the Pope has become an outspoken proponent (and many high-profile Catholic institutions have announced they will divest).”

“Cathie Wood Just Dumped Another $100-Plus Million In Tesla — Here Are The ‘Bargain’ Stocks She Likes Now” (MoneyWise). “Cathie Wood is known for investing in high-flying tech stocks. But she isn’t opposed to buying low and selling high. The ace stock picker of Ark Investment Management has been bullish on Tesla for years. Yet she’s been taking some profits off the table recently as shares of the electric car maker have soared.”

“‘I Quit’ Is All The Rage. Blip Or Sea Change?” (Lawrence Katz, The Harvard Gazette). “The number of people who switch from one job to another is what you would predict given the great opportunities. It’s always been true that people who switch jobs tend to get higher wage growth than people who stay put, but it looks unusually high right now…[b]ut a second issue — we see a lot of anecdotal and survey data on this — is, I think we’ve really met a once-in-a-generation ‘take this job and shove it’ moment.”

“Marjorie Taylor Greene Invested As Much As $50,000 In The Trump SPAC Before Its Stock Plunged” (CNN Business). “Georgia Rep. Marjorie Taylor Greene bought as much as $50,000 worth of shares in a shell company that is merging with former President Donald Trump's new media venture, according to a financial disclosure form. Greene, a Republican and Trump supporter with a history of conspiracy theories, bought shares of Digital World Acquisition Corp. on Friday when they were skyrocketing to breathtaking levels. Days later, the Trump SPAC (Special Purpose Acquisition Company) plunged in value.”

What we’re reading (10/27)

“Buyout Firms Set Record For Loading Companies With Debt To Pay Themselves” (Wall Street Journal). Hence, my private-equity focused blog post a few weeks ago…“Private-equity firms are taking advantage of a frothy credit market to pay themselves record sums with borrowed money, a controversial practice that critics say benefits buyout-firm executives but can harm portfolio companies. Companies backed by U.S. private-equity firms have taken on $58.5 billion in dividend-recapitalization debt this year through Oct. 20, S&P Global Market Intelligence’s LCD unit said in response to a Wall Street Journal data request.”

“The Bond Market Is Waking Up” (Calafia Beach Pundit). “It looks like the bond market is beginning to wake up to the reality of higher inflation. Yields have moved significantly higher in recent days, and inflation expectations are rising. That the stock market is taking this in stride—so far—suggests that higher interest rates are not necessarily bad for the economy. I think we are still in the early innings of the adjustment to higher interest rates. There's a lot more to this story that will play out soon.”

“Tesla Joins An Exclusive Club” (DealBook). But! “It has a junk bond rating…[r]egulators had accused its C.E.O. of securities fraud…[i]ts sales and earnings are far lower than others.”

“Billionaire Tudor Jones: This Is The ‘Single Biggest Threat’ To Stocks And Society — Protect Yourself Now” (Yahoo! Finance). “The stock market has bounced back after a sluggish September, but a billionaire hedge fund manager says it would be a mistake to drop your guard. Paul Tudor Jones, who runs Tudor Investment Corporation, told CNBC last week that runaway inflation remains ‘the single biggest threat to financial markets and society in general.’ ‘If we don't immediately shift to attack it,’ Jones warns, ‘we run the risk of getting back into the '70s, where it was the single most important issue for multiple presidents, multiple Fed chairmen.’”

“3-D Printed Houses Are Sprouting Near Austin As Demand For Homes Grows” (Wall Street Journal). “A major home builder is teaming with a Texas startup to create a community of 100 3-D printed homes near Austin, gearing up for what would be by far the biggest development of this type of housing in the U.S. Lennar Corp. and construction-technology firm Icon are poised to start building next year at a site in the Austin metro area, the companies said.”

What we’re reading (10/26)

“David Tepper Shuns Stock Market: ‘Sometimes There’s Times To Make Money…Sometimes There’s Times Not To Lose Money’” (MarketWatch). “‘I don’t think it’s a great investment,’ Tepper [founder of Apaloosa Management] told the business network, referring to his view on the stock market, with the Dow Jones Industrial Average, and the S&P 500 index near record highs on Friday. ‘I just don’t know how interest rates are going to behave next year,’ Tepper added. ‘I don’t think there’s any great asset classes right now,’ said the owner of the National Football League’s Carolina Panthers. Tepper said that he didn’t ‘love stocks. I don’t love bonds. I don’t love junk bonds,’ referring to markets he felt were overvalued.”

“America Inc And The Shortage Economy” (The Economist). “If you look only at the scale of the profits cranked out by American businesses, they seem to be indestructible…[y]et as earnings season gets into full swing this week, bosses and investors are watching for signs that three related worries are biting: supply-chain tangles, inflation, and hints that a long era of profitable oligopolies is giving way to something more dynamic and risky.”

“Jeff Bezos’ Blue Origin Plans ‘Business Park’ In Space” (Financial Times). “Jeff Bezos’s space exploration company Blue Origin has announced plans to launch a commercial space station into low-earth orbit in the latter half of this decade…[a]ccording to a promotional website, the station, to be called Orbital Reef, will be an ideal location for a ‘space hotel’, ‘film-making in microgravity’ or ‘conducting cutting edge research’. Those on board would experience 32 sunsets and sunrises each day, the company said.”

“Billionaire Leon Black Is Being Investigated By The Manhattan D.A., Sources Say” (Vanity Fair). “Black’s personal and professional lives have been in a tailspin since January 2021, when the billionaire announced he was stepping down as CEO of private-equity giant Apollo following the emergence of his ties to Epstein. An investigation commissioned by Apollo’s board disclosed that Black had paid Epstein $158 million in fees between 2012 and 2017—after Epstein pleaded guilty to soliciting prostitution from a teenage girl. Black’s massive payments to Epstein for purported ‘tax advice’ and ‘estate planning’ struck many on Wall Street as amounting to a preposterously inflated sum for such services.”

“The Hostile Mediator Phenomenon: When Threatened, Rival Partisans Perceive Various Mediators As Biased Against Their Group” (Omer Yair, Public Opinion Quarterly). “Rival partisans tend to perceive ostensibly balanced news coverage as biased against their respective sides; this is known as the ‘hostile media phenomenon’ (HMP). Yet complaints of hostile bias are common in contexts besides the media (e.g., law enforcement and academia). Does a process similar to the HMP occur outside the context of news coverage?…[a]n additional study (N = 2,172) shows that both Democrats and Republicans perceived the social network Facebook to be biased against their side.”

November picks available soon

We’ll be publishing our Prime and Select picks for the month of November before Monday, November 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of October, as well as SPC’s cumulative performance, assuming the sale of the October picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Fri., October 29). Performance tracking for the month of November will assume the November picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Monday, November 1).

What we’re reading (10/25)

“Psychoanalyzing The Housing Frenzy With Redfin’s CEO” (Curbed). “[C]onstruction of new housing [after the Great Financial Crisis] slowed to a crawl and inventory continues to drop. By this time in 2019, Redfin had 1.1 million active listings; now it has little more than half that. This shortage is what primed the real-estate market for its current boom, but what touched things off was the Federal Reserve’s decision to stimulate the U.S. economy with near-zero interest rates last spring. ‘The beneficiaries of that were exclusively wealthy people,’ Kelman told me. ‘When you’re shoveling several hundred billion dollars into mortgage-backed securities, you have to keep interest rates below 3 percent[.]”

“Tesla Surpasses $1 Trillion In Market Value As Hertz Orders 100,000 Vehicles” (Wall Street Journal). “Tesla Inc. crossed $1 trillion in market value Monday…[i]nvestors pushed the electric-vehicle maker over the line after Hertz Global Holdings Inc. ordered 100,000 autos to be delivered to the rental-car company by the end of next year, a bulk purchase that promises to expose more mainstream drivers to Tesla’s technology…‘Wild $T1mes!’ Tesla Chief Executive Elon Musk tweeted Monday afternoon. He added, of the Hertz order: ‘Strange that moved valuation, as Tesla is very much a production ramp problem, not a demand problem.’”

“A Boston Beer Exec Explained That ‘Millions of Cases' Of Truly Will Be Destroyed Because Discounting Is ‘Just Not What We Do’” (Insider). “Jim Koch, the chairman of Boston Beer Company — which produces Truly, along with Samuel Adams, Dogfish Head, and Twisted Tea — told CNBC on Friday that the company overestimated the popularity of hard seltzers. Boston Beer got "aggressive" about buying raw materials like flavors and cans and adding extra capacity to produce Truly, Koch said during an interview on ‘Closing Bell.’”

“The New Billionaire Tax In Democrats’ Sights” (DealBook). “Billionaires could be taxed on unrealized capital gains on their liquid assets, Democratic officials said yesterday. It would affect people with $1 billion in assets or those who have reported at least $100 million in income for three consecutive years, according to news reports. That would ensnare perhaps 700 taxpayers — or the wealthiest 0.0002 percent — but Democrats hope it would generate at least $200 billion in revenue over a decade. It would cover not only stocks, but also other assets like real estate. (Individuals could claim deductions for annual losses in the value of their assets.)”

“PayPal Says It’s Not Looking To Buy Pinterest Right Now, Shares Jump 6%” (CNBC). “U.S. payments giant PayPal said it is not currently interested in buying social media platform Pinterest. Responding to what it called ‘market rumors,’ the financial technology company said Sunday in an update on its website that it is ‘not pursuing an acquisition of Pinterest at this time.’”

What we’re reading (10/24)

“Bull Market Okay Until Interest Rate Push Comes To Shove” (Briefing.com). “When the stock market's worst-performing sector is up 6.2% for the year in mid-October, it almost goes without saying that the stock market has had a good year…The stock market has shown that it can tolerate rising interest rates at these nominally low levels. What it has some difficulty with is a rapid rate of change in interest rates. When rates rise gradually, it is billed as an expression of confidence in the economic outlook. When rates rise quickly, it is viewed as a nervous expression of inflation pressures and the specter of the Fed being forced to raise rates to keep inflation in check.”

“Big Tech Stocks Are The Market’s Superstars But Rising Rates Could Bring Them Down” (MarketWatch). A nice summary of some recent research on the differential impact of rate changes across not just different sectors, but across companies of different sizes. Much of the media commentary about the impact of rates (including the article title here) posits that tech companies are particularly sensitive because they are long-duration stocks (i.e., the contribution of extra long-term cash flows to their current prices is comparably high). The research here apparently shows it isn’t just tech, but rather the top 5% in almost any industry is more sensitivity to rates.

“Congressional Democrats Take Aim At Private Equity” (Axios). “Congressional Democrats are again taking aim at private equity, but they don't have much more firepower than the last time around…the big differences between 2019 and 2021 is that Democrats control both the Senate and the White House, and that they aren't distracted by presidential primaries. But there's no reason to think the Stop Wall Street Looting Act will meet a different fate, particularly as Democrats continue to squabble over their signature legislation.”

“Maybe The Metaverse Can Save Facebook. Maybe.” (Insider). “Next week, the company is expected to announce a huge rebrand, which will focus on its expansion into the so-called metaverse. It's a "genius" and "classic" move in the world of branding strategy that could help Facebook, experts told Insider, but ultimately it may not be enough to save the company's reputation.”

“Trump’s Tech SPAC Could Make Him Billions With Meme-Stock Frenzy” (Bloomberg). “News late Wednesday that the former president’s nascent media enterprise, Trump Media & Technology Group, is planning to go public via a special purpose acquisition company has sent retail investors into a frenzy, even with few details released. The stock gain drove the implied value of the new venture to more than $8.2 billion.”

What we’re reading (10/23)

“Notes On A Statistical Scandal” (Financial Times). “Even a spreadsheet can become a victim of its own success. Just ask the World Bank’s Doing Business report. While many worthy publications from the World Bank are never downloaded, Doing Business has been a smash hit for years. No longer. Amid an ugly scandal about data manipulation that has left the head of the IMF, Kristalina Georgieva, fighting for her career, Doing Business has been cancelled.”

“WeWork Hits The Stock Markets” (WeWork). “After two years, a failed I.P.O., a plunging valuation and a pandemic that reset many workers’ relationships with the office, the co-working company WeWork [began] a new life [yesterday] as a publicly traded company. WeWork argues it’s a better company now. It has renegotiated or exited some 500 leases this year, saving over $400 million, according to its C.E.O., Sandeep Mathrani. And its deal to go public via a merger with a SPAC, BowX, will provide $1.3 billion in new capital.”

“Housing Is The Economy’s Energizer Bunny: It Keeps Going And Going” (CNN Business). “Even as some sectors of the economy remain muted, the housing boom keeps going and going. That's obviously good for builders, but it could also be great news for the broader economy and stock market — especially since this strength appears to be nationwide. ‘Residential is still pretty hot. Remodeling activity is good. Housing starts are good,’ said Mark Sheahan, CEO of Graco, which makes paint sprayers for home owners and contractors, on an earnings call Thursday. ‘I don't see any real negatives in the future. No storm clouds on the horizon, I would say, from our viewpoint,’ Sheahan added.”

“The Coming Electric Car Disruption That Nobody’s Talking About” (Bloomberg). “Making the massive batteries that line the bottom of electric cars promises to employ thousands. But where a conventional car’s engine and transmission have hundreds of parts, some electric-vehicle powertrains have as few as 17, according to the Congressional Research Service. That doesn’t take into account the radiators, fuel tanks or exhaust systems that electric vehicles don’t need. Once operating, an electric car has no spark plugs or oil that need changing or mufflers that wear out. And with so few moving parts, service stations could be relegated to changing tires and windshield wipers.”

“Powell Says Supply-Side Constraints Have Worsened, Creating More Inflation Risk” (Wall Street Journal). “Federal Reserve Chairman Jerome Powell indicated he is now somewhat more concerned about higher inflation and said that the central bank would watch carefully for signs that households and businesses were expecting sustained price pressures to continue. ‘Supply-side constraints have gotten worse,’ Mr. Powell said Friday at a virtual conference. ‘The risks are clearly now to longer and more-persistent bottlenecks, and thus to higher inflation.’”

What we’re reading (10/22)

“Just How High Could The Dow Go?” (New York Times). “It can be simultaneously true that capital has enjoyed an enviable position and that markets going up is not a sign of a rigged system. There are now about 4,000 publicly traded companies on the major exchanges in the United States — 20 years ago, there were around 7,000. Capital markets reward those that excel in eking out double-digit growth in a single-digit world. Only the strongest companies survive.”

“It’s Time For Americans To Buy Less Stuff” (Vox). “When the stuff we want is so hard to get ahold of, why go to such great lengths to buy it? Consumers have the option to not order items manufactured overseas, to source things locally from small businesses or artisans. We also have a choice that eliminates the potential for shipping or supply chain mishaps: We can just buy less.”

“Chipotle Earnings Crush Estimates As Sales Jump 22%, Higher Menu Prices Offset Rising Costs” (CNBC). “Chipotle Mexican Grill on Thursday reported quarterly earnings that crushed Wall Street’s estimates as its menu price increases helped the chain weather higher costs. Shares of the company rose more than 1% in extended trading…Chipotle is still experiencing some staffing challenges amid the labor crunch that’s hitting the broader industry. But Chief Technology Officer Curt Garner said in an interview that Chipotle was able to keep that from hitting its sales for the most part by keeping its restaurants open.”

“Deutsche Bank Whistleblower Gets $200 Million Bounty For Tip On Libor Misconduct” (Wall Street Journal). “A whistleblower whose information helped U.S. and U.K. regulators investigate manipulation of global interest-rate benchmarks by Deutsche Bank AG was awarded nearly $200 million for assisting the probe, according to people familiar with the matter. The payout is the largest ever by the Commodity Futures Trading Commission, which along with the Justice Department and U.K. Financial Conduct Authority settled enforcement actions against Deutsche Bank in 2015.”

“A Real-Time Revolution Will Up-End The Practice Of Macroeconomics” (The Economist). “[T]he age of bewilderment is starting to give way to greater enlightenment. The world is on the brink of a real-time revolution in economics, as the quality and timeliness of information are transformed. Big firms from Amazon to Netflix already use instant data to monitor grocery deliveries and how many people are glued to “Squid Game”. The pandemic has led governments and central banks to experiment, from monitoring restaurant bookings to tracking card payments. The results are still rudimentary, but as digital devices, sensors and fast payments become ubiquitous, the ability to observe the economy accurately and speedily will improve. That holds open the promise of better public-sector decision-making—as well as the temptation for governments to meddle.”

What we’re reading (10/21)

“Lessons From Oil On The New Crypto Futures Fund” (Fisher Investments). “Every investment decision is a tradeoff. When you buy stocks, you accept the risk of short-term volatility in exchange for the likelihood of high long-term returns. With a bitcoin futures ETF, we surmise you are accepting the risk of tracking error in exchange for the transparency and investor protections that come with owning a regulated fund. Some investors might think the tradeoff is worthwhile. Some might not. Some might want to avoid bitcoin entirely, concluding that speculating conflicts with their long-term goals.”

“The Great Resignation Is Accelerating” (The Atlantic). “Before the pandemic, the office served for many as the last physical community left, especially as church attendance and association membership declined. But now even our office relationships are being dispersed. The Great Resignation is speeding up, and it’s created a centrifugal moment in American economic history.”

“The Revenge Of The Essential Worker” (The New Republic). “Of all the images coming out of the current strike wave…the apparent chaos at the John Deere plants is among the most viscerally satisfying. Last week, more than 10,000 workers across 14 plants went on strike after rejecting the tractor maker’s contract offer, an offer that included a 4 percent increase in pay the year after its CEO made $15.6 million himself. To keep its business running, the company told The Washington Post, it ‘activated a continuity plan,’ which sounded reasonable until it became clear that the plan took salaried office workers, gave them punchy new titles like ‘tractor driver’ and ‘general repair,’ and put them on the shop floor.”

“PayPal Is In Late-Stage Talks To Acquire Pinterest” (CNBC). “PayPal has discussed acquiring the company for a potential price of around $70 a share, which would value Pinterest at about $39 billion, according to Bloomberg. Pinterest stock closed at $55.58 per share on Tuesday. PayPal and Pinterest declined to comment.”

“The S.E.C. Weighs In On Meme-Stock Mania” (DealBook). “ [A] long-awaited S.E.C. report about those events, released yesterday, concluded that the markets operated largely as intended, debunking conspiracy theories. The report proposed no policy changes…[t]he 45-page report was simply meant to describe events, a senior S.E.C. official told reporters. But many observers anticipated much more, considering that the S.E.C. chairman, Gary Gensler, has hinted at big changes to the way markets work.”

What we’re reading (10/20)

“The Wealthiest 10% Of Americans Own A Record 89% Of All U.S. Stocks” (CNBC). “The top 1% gained more than $6.5 trillion in corporate equities and mutual fund wealth during the Covid-19 pandemic, while the bottom 90% added $1.2 trillion, according to the latest data from the Federal Reserve. The share of corporate equities and mutual funds owned by the top 10% reached the record high in the second quarter, while the bottom 90% of Americans held about 11% of individually held stocks, down from 12% before the pandemic.”

“Credit Suisse To Pay $475 Million, Admits Defrauding Investors To Settle Mozambique Charges” (Wall Street Journal). “A subsidiary of the Swiss bank pleaded guilty to wire fraud conspiracy charges in New York federal court Tuesday. Credit Suisse, which previously had maintained it was a victim of rogue employees, admitted to defrauding investors who bought some of the debt and agreed to pay $275 million to resolve both a criminal probe by the Justice Department and a civil investigation by the Securities and Exchange Commission.”

“The $5 Trillion Insurance Industry Faces A Reckoning. Blame Climate Change.” (Vox). “The water has receded and the embers have died down from many of the disasters in the United States this year — leaving insurance companies that cover floods, fires, hail, and extreme cold on the hook for staggering losses. If current trends continue, they could suffer one of the costliest years in recent memory.”

“For Uber And Lyft, The Rideshare Bubble Bursts” (New York Times). “Underwritten by venture capital, Uber and Lyft hooked users by offering artificially cheap rides that often undercut traditional yellow cabs. But labor shortages and a desperate need to find some path to a profitable future have caused rideshare prices to skyrocket, perhaps to a more rational level. After burning through billions of venture capital dollars, Uber said it was on a path to profitability last year, using an accounting metric that ignores many of the costs that actually make it unprofitable. By the same measure, chief executive Dara Khosrowshahi is projecting this quarter could be profitable. That remains to be seen.”

“Long-Term NAEP Scores For 13-Year-Olds Drop For First Time Since Testing Began In 1970s — ‘A Matter for National Concern,’ Experts Say” (The 74). “Thirteen-year-olds saw unprecedented declines in both reading and math between 2012 and 2020, according to scores released this morning from the National Assessment of Educational Progress (NAEP). Consistent with several years of previous data, the results point to a clear and widening cleavage between America’s highest- and lowest-performing students and raise urgent questions about how to reverse prolonged academic stagnation.”

What we’re reading (10/19)

“Why The ‘Big Short’ Guys Think Bitcoin Is A Bubble” (The Intelligencer). “Hedge-fund mogul John Paulson, who was behind the ‘the greatest trade ever’ — in 2007, he personally made $4 billion on his short of subprime mortgages — thinks cryptocurrencies are a bubble that will prove to be ‘worthless.’ Michael Burry, the quirky hedge-fund manager made famous in The Big Short movie (played by Christian Bale), complains that no one is paying attention to crypto’s leverage. For months, he has been suggesting that bitcoin is on the precipice of collapse. And NYU professor Nassim Taleb, whose now-canonical book The Black Swan warned about the dangers of unpredictable events just ahead of the subprime crash, argues that bitcoin is functionally a Ponzi scheme.”

“A Triple Shock Slows China’s Growth” (The Economist). “When supply is tight, prices are supposed to rise, obliging customers to economise on their consumption. But as the price of coal shot up, power stations were unable to pass their higher costs on. The price they could charge the grid company that buys the bulk of their power could only fluctuate up to 10% above a regulated price, which was changed infrequently. And the tariff paid by end-users was based on a provincial catalogue of prices that was similarly inflexible. Some power stations simply stopped operating, refusing to generate power at a loss.”

“Apple Cements Break From Intel With Laptops Powered By Own Computer Chips” (Financial Times). “Apple cemented its move away from Intel on Monday, unveiling two new high-end laptop computers powered by its own ‘Apple Silicon’ chips. The new 14-inch and 16-inch MacBook Pro notebooks, which start at $1,999 and $2,499 each, respectively, both feature the ‘M1 Pro’ chip, an iteration on the first Apple-designed M1 processors introduced a year ago.”

“Rent The Runway Targets Valuation Of Up to $1.5 Billion In IPO” (Wall Street Journal). “Rent the Runway Inc. is seeking a valuation of as much as $1.5 billion in its initial public offering next week, in what would cap a comeback for the clothing-rental business. The New York company is aiming to sell shares at between $18 and $21 apiece for a fully diluted valuation of $1.24 billion to $1.46 billion, it said in a securities filing Monday. The roadshow for company management and their underwriters to pitch the shares to potential investors begins Tuesday and the shares are to start trading on the Nasdaq Stock Market next Wednesday.”

“Colin Powell’s Greatest Legacy Is In The People He Inspired” (Condoleeze Rice, Washington Post). “In 2003, sitting in Buckingham Palace during President George W. Bush’s state visit to Britain, Alma, Colin and I drank a toast to our ancestors. ‘They would never have believed it,’ I said. ‘No, but they are smiling now,’ he said. Colin believed that his life and all that he achieved were an affirmation of America’s possibilities. He didn’t take his success for granted and recounted stories of people he knew who never got out of his modest South Bronx neighborhood. He knew that he was talented — but he was humble enough to believe that he was also lucky.”

What we’re reading (10/18)

“Inflation: Persistently Transitory” (Charles Schwab). “If the global economy persistently goes from one transitory source of inflation to the next, it may keep inflation elevated for longer than markets currently anticipate. Following this year’s supply disruptions and recent climb in energy prices, markets may begin to price another potential source of inflation: workers demanding higher wages as strikes blanket the news. Yet, central banks’ attitude toward inflation has changed. This may mean that the lift to earnings from inflation could more than offset any compression on stock valuations from tighter financial conditions.”

“The Revolt Of The American Worker” (Paul Krugman, New York Times). “[s]omething…fundamental and lasting may be happening in the labor market. Long-suffering American workers, who have been underpaid and overworked for years, may have hit their breaking point…[w]hat seems to be happening instead is that the pandemic led many U.S. workers to rethink their lives and ask whether it was worth staying in the lousy jobs too many of them had.”

“A Secretive Hedge Fund Is Gutting Newsrooms” (The Atlantic). “In May, the [Chicago] Tribune was acquired by Alden Global Capital, a secretive hedge fund that has quickly, and with remarkable ease, become one of the largest newspaper operators in the country. The new owners did not fly to Chicago to address the staff, nor did they bother with paeans to the vital civic role of journalism. Instead, they gutted the place.”

“Rising Mortgage Rates Shift Lenders’ Focus To Home Buyers” (Wall Street Journal). “Lenders still packaged up hundreds of billions of dollars of refinance loans last quarter. But business is harder to come by these days, Mr. Menatian said. Instead of taking inbound calls, he has been phoning clients whose home values have risen enough that they can refinance out of their mortgage insurance policies.”

“China Tests New Space Capability With Hypersonic Missile” (Financial Times). “China tested a nuclear-capable hypersonic missile in August that circled the globe before speeding towards its target, demonstrating an advanced space capability that caught US intelligence by surprise. Five people familiar with the test said the Chinese military launched a rocket that carried a hypersonic glide vehicle which flew through low-orbit space before cruising down towards its target.”

A private equity puzzle

Private equity occupies a special place in the universe of investment alternatives. A nascent asset class only decades ago—at which point public equities had existed in their modern form since at least 1602*—the industry has grown substantially in size over time. Simple anecdotes illustrate the incredible stature the industry has achieved since its early days:

Today, pension funds around the world scramble to ‘get an allocation’ to the most highly regarded funds;

Scions of the industry regularly wax philosophical to a very friendly business press about ‘what it takes’ to be a great entrepreneur (and are listened to), or even have their own programs discussing their views on the world with notables like Secretaries of State and are held out as “peers” of said notable people;

Other former scions have run for high office, with at least one running for the highest office, with his experience in private equity occupying a central place in the narrative around his competence as a leader, and the central focal point of attack for his opposition;

Like clockwork, many of the best and brightest young minds at the world’s best collegiate institutions are motivated by (among other more innocuous things, like learning, etc., it should be said) the chance to eventually land in private equity in making a Faustian Bargain in which they will first spend 1-2 years enduring a job that in certain instances has been so unnecessarily stressful (M&A investment banking) that a non-negligible number of those in its employ die either from acts of self-harm or exhaustion;

There are now eager start-up private equity funds aiming to bring private equity investment opportunities to retail investors. Here is one such exemplar fund that, ironically, is funded by private equity.

But is this stature deserved? And, if it ever was, is it still today?

At the outset, it’s worth noting that many credible people have long said “no” to that question. Take Nobel Laureate Joseph Stiglitz, for example. His main qualm about the industry, reportedly, is that it is full of rent-seeking, e.g., the extraction of wealth from the economy to the benefit of the funds without an equal creation of incremental economic value. The steady stream of stockholder litigation involving private equity funds as defendants would seem—at a minimum—consistent with that assertion, even if you think many of these suits are frivolous efforts at rent-seeking in and of themselves.

Another relevant economic question is whether the industry’s returns are even that good.

A review of the returns of at least one of the most well-respected and prestigious private equity firms over the past several decades suggests the glory days might be over. In the case of that firm (who shall go nameless here), annual equity returns over the last 40+ years were about 50 percent, but only about 30 percent over the last decade+ or so, implying a near halving of annualized returns from its first three decades (when returns must have averaged a little over 57 percent) to the most recent decade for which I have data (which actually ended a few years ago). If you do a simple monthly trendline through these numbers using the exact dates in the data, it would suggest annual returns for the period ending this month are probably about 18 percent. Now, 18 percent per year sounds pretty good, but keep in mind that typical private equity investments are super leveraged, and leverage creates mechanical volatility. There is nothing all that special about that, because anybody can do it. De-levering the illustrative 18 percent equity return assuming 60-80 percent leverage implies the asset return for the firm is only about 4-7 percent. Nominal US GDP growth isn’t too far below that (~3 percent/year for 1948 to 2021) and easily-constructed portfolios of public equities commonly achieve growth at that level on a leverage-free basis.

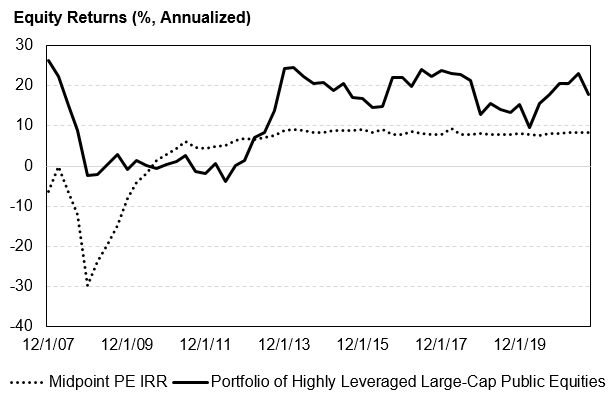

This is just one example, so it’s probably worth looking at the data more comprehensively. The chart below is a stab at that. I put this together pretty quickly, so take it with a grain of salt and as simply a conversation-starter (like everything else on this blog/site). The dotted line is the mid-point of the 2nd- and 3rd-quartile internal rates of return (IRR, or annualized equity return) of private equity funds in Bloomberg’s database. The solid line is the trailing five-year compound annual return of a portfolio of the 20 S&P 500-constituent stocks with the highest total debt/market capitalization, re-balanced monthly (i.e., it assumes that, each month, you re-rank the stocks in the S&P 500 index on the basis of total debt/market capitalization and select the top 20, selling any that have fallen out of the top 20 from the prior month and buying any that have entered the top 20). For the solid line, I’ve excluded financial institutions, since many of these have higher-than-even-private equity-level leverage and casual observation suggests they typically aren’t a focus for most private equity investments. I’ve used a five-year trailing return for the solid line as that is commonly suggested as a target holding period for private equity investments. The data for the solid line are from FactSet.

Both lines in the figure have the same general shape—there is a big decline in the aftermath of the financial crisis, followed by a strong improvement and subsequent consistency in returns. It is striking, however, how much higher the returns of the public equity portfolio are at most points in time. Over the whole period, the average is 3.7 percent for the private equity IRRs and 12.7 percent for the public equity portfolio. The implied annualized Sharpe ratio is 0.4 for the private equity line and 1.3 for the public equity line.**

Just to make sure my half-baked analysis isn’t directionally wrong even if is lacking in perfect rigor, I did a brief scan of the relevant literature and, sure enough, others who have studied this have said much the same thing. Bain & Co, along with HBS professor Josh Lerner, for example, recently found that “US buyout [i.e., private equity] returns have converged with public equity returns over the current cycle, closing a three-decade gap in performance[.]”

So what is going on? Surely, many things are, but I suspect one basic economic factor is key: competition. In the long run, competitive markets eliminate persistent abnormal excess profits such that the expected return on invested capital equals the cost of capital. There is nothing controversial about this concept. When a business arises that appears to crush it, new entrants soon follow, and competition whittles away the “excess” profits. After Uber came Lyft, after VRBO came AirBnB. The history of commerce is replete with easy-to-come-by examples. There is a hard constraint at 0 percent “excess” returns, because if the return on capital persistently falls below the cost of capital, competitors simply exit that line of business, so there is convergence toward the level of returns that is “just high enough” to fairly compensate the production inputs (labor, capital).

As it relates to private equity, stylized facts support this story. It was probably easier to find stable, cash-generating businesses whose owners were ready to cash out at less-than-full price back in the hey dey when there weren’t 200 other funds knocking down the door and investment bankers calling the owners every day and pitching their sell-side services. Since that time, private equity has grown a ton, with hundreds (thousands?) of new firms. Annual investor commitments to private equity funds in aggregate swelled from a rounding error in 1980 to almost $250 billion in 2019, with private equity assets under management in the same period rising from probably something less than $50 billion to over $1.4 trillion. As that happened, the average multiples paid in private equity buyouts rose from ~8x (enterprise value/EBITDA) in 1990 to something closer to 12x on average in 2019, according to Morgan Stanley. All of this is consistent with an increasingly competitive market, where the modal player really isn’t adding any value, even if there is still room for the best-of-the-best to outperform.

If that’s true, the obvious question is why do investors pay pretty substantial management and performance fees for exposure private equity if it’s not that much better on average than much cheaper-to-access public stocks. It’s not all that clear to me, but the theory of “conspicuous consumption” comes to mind. Private equity holds itself out as pretty prestigious and pretty smart. To date, we have all kind of accepted that story as true unquestioningly, and people want to be a part of that probably for the same reason people buy luxury goods in general. Perhaps we need a new theory of conspicuous investment.

Notes:

*Of course, private equity in the literal sense of private ownership of businesses existed long before even the 17th century and probably has always been the dominant legal form for commercial entities. Here, I am focused on “private equity” as the term is popularly used today, referring to private investment funds (as defined by the SEC) under an institutional arrangement that typically involves general partners managing day-to-day operations and investment decision-making and limited partners that contribute additional capital.

**Caveat emptor for the data nerds: these time series averages and Sharpe ratios are contaminated a bit by the fact that they embed overlapping periods. I also haven’t measured the Sharpe ratio in terms of excess returns above the risk-free rate, so it’s not theoretically perfect, but the risk-free rate was ~0% in most periods shown in the chart.