What we’re reading (10/17)

“The Dow Is On Track For Its Best October In 6 years And Third-Quarter Earnings Are Strong So Far. What Could Go Wrong?” (MarketWatch). “It is very early days, with only 8% of the S&P 500 index companies reporting third-quarter results thus far, but at least 80% of companies are beating expectations on earnings and revenue, according to John Butters, FactSet’s senior earnings analyst. Butters says that the blended growth rate (estimates and actual results) of reporting S&P 500 companies is 30%, which would, if it holds, represent the [best] [sic] earnings growth rate in over a decade.”

“A Bitcoin ETF Is Almost Here. What Does That Mean For Investors?” (Wall Street Journal). “ProShares filed plans Friday, laying the groundwork for the launch of its Bitcoin Strategy ETF. Other funds are expected to follow over the next two weeks as the Securities and Exchange Commission considers additional proposals made in August by asset managers Valkyrie Investments, Invesco and VanEck to sell bitcoin ETFs to investors. The companies don’t expect their proposals to be turned down, according to people familiar with them, though the SEC could approve, disapprove or defer any or all of the applications”

“Femtech Firms Are At Last Enjoying An Investment Boom” (The Economist). “Dame Jessica’s startup is part of a wave of “femtech” firms coming up with ways for women to overcome health problems specific to their sex. The market could more than double from $22.5bn last year to more than $65bn by 2027, reckons Global Market Insights, a research firm. Having ignored it for years—in 2020 femtech received only 3% of all health-tech funding, and a modest $14bn has been invested in it globally to date—venture capitalists are at last waking up to the opportunity. So far this year they have invested nearly $1.2bn in the industry, nearly half as much again as the annual record in 2019[.]”

“The United Nations Pension Fund Has Billions To Deploy In Private Markets” (Institutional Investor). “Pedro Guazo, the head of the $87 billion United Nations Joint Staff Pension Fund, revealed that the UNJSPF is poised to invest between $5 billion and $7 billion in the private markets in the coming years. Guazo, who spoke on the heels of the publication of the fund’s annual meeting report on October 5, said the new investments would be made possible by a shift in the organization’s asset allocation policy, among other changes.”

“Labor Flexes Its Muscle As Leverage Tips From Employers To Workers” (CNN Business). “Workers are saying enough is enough. And many of them are either hitting the picket lines or quitting their jobs as a result. The changing dynamics of the US labor market, which has put employees rather than employers in the driver's seat in a way not seen for decades, is allowing unions to flex their muscle.”

What we’re reading (10/16)

“Why Some People Invest And Others Don't” (Morningstar). “The research found that some obvious factors were at play in whether people invest or not, such as income and age. But what's different about this study was its examination of what's going on inside of people's heads, including their self-identity as an investor, the emotions they feel around investing, and their focus on preventing bad outcomes or achieving good ones.”

“Goldman Sachs Profit Rises On Deal Bonanza” (Wall Street Journal). “Goldman Sachs Group Inc. on Friday reported a 60% jump in profit and a 26% increase in revenue, beating analysts’ expectations. The Wall Street titan rounded out earnings season for the biggest U.S. banks, all of which reported double-digit profit gains. JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc. and Wells Fargo & Co. released some of the money they had set aside to deal with pandemic losses, a sign of their confidence in the bumpy economic recovery.”

“Why The IMF Is Intrinsically Conservative And Hard To Reform” (Marginal Revolution). “Successful international economic orders typically have been based on a fair degree of hegemony, whether it was the British-led gold standard of the 19th century, or the more recent post-World War II American dominance. Once you realize that, a lot of the current questions about the IMF answer themselves rather automatically. The real issue isn’t how to improve the IMF, but how we are going to cope as current hegemonies continue to lose their sway.”

“D.C. Mayor Muriel Bowser: ‘Bet On Cities’ Coming Out Of The Pandemic” (Fortune). “Washington, D.C., has been the site of multiple tumultuous events in the past year and a half, between a post-election insurrection on Jan. 6 at the U.S. Capitol and the economic fallout of the pandemic. D.C.'s mayor, Muriel Bowser (D), has dealt with it all as a working mother. But as the country strives to come out of the pandemic, she's also hopeful D.C. will be the site of something more positive: opportunity for business owners.”

“Rising Rents Are Fueling Inflation, Posing Trouble For The Fed” (New York Times). “As buyers bid up prices on single-family homes and condominiums, many people who would have otherwise moved toward homeownership found themselves unable to afford it, increasing demand for apartments and home leases. Rents have been further boosted by the large number of people searching for places with more space and home offices during the pandemic, and as millennials in their late 20s and early to mid-30s look for more autonomy.”

What we’re reading (10/15)

“Powell Says Fed Faces ‘Difficult Trade-Off’ If Inflation Doesn’t Moderate” (Wall Street Journal). “‘Almost all of the time, inflation is low when unemployment is high, so interest rates work on both problems,’ he said. That isn’t the case right now. Inflation is well above the Fed’s 2% target, and the economy is ‘far away, we think, from full employment,’ Mr. Powell said. “That’s the very difficult situation we find ourselves in.”

“Everything Is Getting More Expensive” (DealBook). “As the central bank prepares to remove emergency stimulus measures to support the economy, sustained inflation could force the Fed to move faster than it would like, before the labor market is fully healed. In newly released minutes from their latest policymaking meeting, Fed officials appear split, with ‘various’ members arguing that interest rates should stay near zero for a couple of years, while ‘a number’ said that rates would need to go up next year, with inflation most ‘likely to remain elevated in 2022 with risks to the upside.’ A recent Fed survey suggests that consumer expectations for inflation are running at historic highs.”

“Oil Spills” (Our World in Data). “Over the past four and half decades – the time for which we have data – oil spills from tankers decreased very substantially…[w]hile in the 1970s there were 24.5 large (> 700 tonnes) oil spills per year, in the 2010s the average number of large oil spills decreased to 1.7 oil spills per year. Both, large oil spills and medium sized oil spills (7-700 tonnes) are decreasing. This happened as the worldwide trade of petroleum and gas products increased.”

“China Has At Least 65 Million Empty Homes — Enough To House The Population Of France. It Offers A Glimpse Into The Country's Massive Housing-Market Problem.” (Insider). “If you drive an hour or two outside Shanghai or Beijing, you'll find something odd. The cities are still tall, and they're still modern. They're also, generally, in good condition. But unlike their bustling, Tier 1-city counterparts, they're basically empty. These are China's ghost cities.”

“Cities Aren’t The Innovation Incubators They Used To Be” (Works In Progress). “It’s time to reassess this idea [that innovation is accelerated when knowledge workers are located close to each other] in light of new evidence and new technologies for diffusing information. A steady stream of research suggests the importance of local knowledge is waning, because increased travel and online communication has facilitated the circulation of ideas across a much wider geographic domain.”

What we’re reading (10/14)

“Fed Worried About Inflation Risk As It Firmed Up Tapering Plan” (Wall Street Journal). “Minutes of their Sept. 21-22 Fed meeting, released Wednesday, revealed a stronger consensus over scaling back the $120 billion in monthly purchases of Treasury and mortgage securities amid signs that higher inflation and strong demand could call for tighter monetary policy next year. The bond purchases have been a key piece of the Fed’s effort to stimulate growth since the coronavirus pandemic disrupted the U.S. economy last year.”

“Wages Are Surging Across The Rich World” (The Economist). “When covid-19 first struck, most forecasters expected bosses to slash bonuses and yearly rises, or even to cut basic pay, as they did after the global financial crisis in 2007-09. Although wage growth did slow modestly early in the pandemic, that restraint has since been abandoned. Oxford Economics, a consultancy, finds that pay in the rich world is growing at a rate well north of its pre-pandemic average. The acceleration in compensation per employee across the OECD, a club of mostly rich countries, is equally arresting.”

“China Is Probably the Most Overvalued Property Market in the World. Evergrande is a Symptom of That” (The Market). “[E]conomically, it’s very hard to justify an economy that is two thirds of the size of the US, with having property that is worth twice as much as US property is worth. It’s not as if US property is cheap. It’s probably too expensive in the US too, which means it’s incredibly expensive in China. The amount of income it takes to buy an ordinary apartment in China is several times what it would take even in Switzerland.”

“Busting the Tech-Stock, Bond-Yield Connection Myth” (Morningstar). “It turns out that when the numbers are crunched, over the past 15 years there has only been a small inverse correlation between technology stocks and bond yields. In other words, when bond rates rise, there is a slight tendency for tech stocks to fall.”

“The Problem With America’s Semi-Rich” (Vox). “There are some defining characteristics of today’s American upper-middle class [between the proverbial 0.1 percent and the lower 90 percent.] They are hyper-focused on getting their kids into great schools and themselves into great jobs, at which they’re willing to work super-long hours. They want to live in great neighborhoods, even if that means keeping others out, and will pay what it takes to ensure their families’ fitness and health. They believe in meritocracy, that they’ve gained their positions in society by talent and hard work. They believe in markets. They’re rich, but they don’t feel like it — they’re always looking at someone else who’s richer.”

What we’re reading (10/13)

“Doing Economics As If Evidence Matters” (Paul Krugman, New York Times). A bold, provocative claim from a bold, provocative Nobel Laureate: “the political use of economic theory has tended to have a right-wing bias. But now we have evidence that can be used to check these arguments, and some don’t hold up. So the empirical revolution in economics undermines the right-leaning conventional wisdom that had dominated discourse. In that sense, evidence turns out to have a liberal bias.”

“BofA Warns The Fed Won’t Rush To Stock Market’s Rescue This Time” (Yahoo! Finance). “‘The Fed may be less willing to so easily deviate from tapering plans and talk the market back up as during the last cycle,’ BofA strategists including Riddhi Prasad and Benjamin Bowler said in a note. As reasons for their skepticism they cite equity valuations and returns accelerating to ‘extremes,’ and ‘increasingly real’ risks of inflation overshooting.”

“IMF Cuts Global Growth Forecast Amid Supply-Chain Disruptions, Pandemic Pressures” (Wall Street Journal). “Supply-chain disruptions and global health concerns spurred the International Monetary Fund to lower its 2021 growth forecast for the world economy, while the group raised its inflation outlook and warned of the risks of higher prices. In the IMF’s latest World Economic Outlook report, released Tuesday, economists cited the spread of the Covid-19 Delta variant and said the foremost policy priority is to vaccinate an adequate number of people in every country to prevent dangerous mutations of the virus.”

“Cathie Wood Says Exodus From High-Cost Cities Will Push Down Inflation As Ark Heads To St. Petersburg” (CNBC). “Wood has been vocal about her theory on deflation. While many market participants are concerned about rising prices, the Ark Invest founder expects deflation amid a breakdown in commodity prices, gridlock on tax policy in Washington and innovation trends taking off.”

“Loans Will Be The Key To Banks’ Future Fortunes” (DealBook). “Loan growth was way down at the beginning of the pandemic and has so far been slow to recover. Consumers and businesses benefited significantly from government stimulus efforts, which reduced demand for credit and helped them pay off their debts or amass more cash. But Richard Ramsden, an analyst at Goldman Sachs, wrote in a recent report that demand for loans was showing signs of increasing. ‘We believe that we have reached the inflection point,’ he wrote. “We see the outlook as increasingly encouraging.’”

What we’re reading (10/12)

“JPMorgan's Dimon Blasts Bitcoin As ‘Worthless’, Due For Regulation” (Reuters). “‘No matter what anyone thinks about it, government is going to regulate it. They are going to regulate it for (anti-money laundering) purposes, for (Bank Secrecy Act) purposes, for tax,’ Dimon said, referring to banking regulations in a conversation held virtually by the Institute of International Finance.”

“Thorstein Veblen’s Theory Of The Leisure Class—A Status Update” (Quillette). “In the past, people displayed their membership of the upper class with their material accoutrements. But today, luxury goods are more affordable than before. And people are less likely to receive validation for the material items they display. This is a problem for the affluent, who still want to broadcast their high social position. But they have come up with a clever solution. The affluent have decoupled social status from goods, and re-attached it to beliefs. “

“The Eviction Tsunami That Wasn't” (Reason). “When the U.S. Supreme Court struck down an eviction moratorium issued by the Centers for Disease Control and Prevention (CDC) in late August, housing activists, researchers, and politicians warned that an eviction tsunami would be the inevitable result…[e]conomic projections of how many evictions could be expected without a national moratorium painted an equally dire picture…Nevertheless, a month after the end of the federal eviction moratorium, these millions of evictions have yet to materialize. Indeed, while filings have increased, they remain well below historical averages almost everywhere in the country.”

“The Trillion-Dollar Coin Scheme, Explained By The Guy Who Invented It” (Vox). “In 2013, even former US Mint Director Philip Diehl agreed it would work, and over the years, influential voices like financial journalist Joe Weisenthal and New York Times columnist Paul Krugman have also promoted the idea. But all these people did not simply stumble upon this law. It was brought to their attention by Beowulf, a blog commenter and ‘reply guy’ better known as Atlanta-area attorney Carlos Mucha. Mucha conceived of the idea in a short comment on financier Warren Mosler’s blog posted on May 24, 2010, at 8:29 pm[.]”

“The Nobel Prize In Economics Celebrates An Empirical Revolution” (The Economist). “[T]heory [once] ruled the roost and empirical work was a poor second cousin. ‘Hardly anyone takes data analysis seriously,’ declared Edward Leamer of the University of California, Los Angeles, in a paper published in 1983. Yet within a decade, new and innovative work had altered the course of the profession, to such an extent that the lion’s share of notable new research today is empirical. For helping enable this transition David Card of the University of California at Berkeley shares this year’s economics Nobel prize, awarded on October 11th, with Joshua Angrist of the Massachusetts Institute of Technology and Guido Imbens of Stanford University.”

What we’re reading (10/11)

“A Nobel Prize For The Credibility Revolution” (Marginal Revolution). “The Nobel Prize goes to David Card, Joshua Angrist and Guido Imbens. If you seek their monuments look around you. Almost all of the empirical work in economics that you read in the popular press (and plenty that doesn’t make the popular press) is due to analyzing natural experiments using techniques such as difference in differences, instrumental variables and regression discontinuity. The techniques are powerful but the ideas behind them are also understandable by the person in the street which has given economists a tremendous advantage when talking with the public. Take, for example, the famous minimum wage study of Card and Krueger (1994) (and here). The study is well known because of its paradoxical finding that New Jersey’s increase in the minimum wage in 1992 didn’t reduce employment at fast food restaurants and may even have increased employment. But what really made the paper great was the clarity of the methods that Card and Krueger used to study the problem.”

“We May Have Reached Peak Earnings” (CNN Business). “Corporate profits soared in the first half of this year, largely because of favorable comparisons to last year's weak earnings. The Covid shutdown of the economy hit major companies hard in the first half of 2020. But as companies get set to report their third-quarter results in the next few weeks, some Wall Street analysts are concerned the rate of earnings increases will start to slow. This may be the peak for the foreseeable future.”

“There Is Shadow Inflation Taking Place All Around Us” (New York Times). “Many types of businesses facing supply disruptions and labor shortages have dealt with those problems not by raising prices (or not by only raising prices), but by taking steps that could give their customers a lesser experience. A hotel room might cost the same as a year ago — but no longer include daily cleaning services because of a shortage of housekeepers. Some restaurants are offering limited service, with waiters stretched thin. Would-be car buyers are being advised to be flexible on the color and even make and model, lest they face a long wait to get their new wheels.”

“San Francisco Fed's Daly: Too Soon To Say Job Market 'Stalling'“ (Reuters). “The U.S. job market will continue to feel the effects of COVID-19, but it is too soon to say it is ‘stalling,’ San Francisco Federal Reserve President Mary Daly said on Sunday. ‘It's going to have these ups and downs, especially with the Delta variant,’ Daly said on the CBS weekend news program ‘Face the Nation’ when asked about a second straight month of disappointing job growth in September.’

“Is It Time For A New Economics Curriculum?” (The New Yorker). “Jonathan Gruber, who teaches introductory economics at M.I.T., felt that core might introduce too much complexity for a foundational course. He worried that so much emphasis on the ethical and political dimensions of economics might make the subject feel like a different discipline altogether. ‘The question is, do you want the students to feel like they’re coming out of, you know, to be blunt, a sociology class or an economics class?’ Gruber said. Still, he welcomed the greater emphasis on the imperfections of markets. ‘Economics is a right-wing science,’ he told me. ‘We teach students that the market is always right. And that’s just wrong.’”

What we’re reading (10/10)

“Is The ‘Unicorn’ Boom Turning Into A Bubble?” (Fortune). “The number of pre-IPO startups worth more than $1 billion has skyrocketed globally…[a] total of 136 startups achieved unicorn status in Q2 of 2021 alone, more than in all of 2020. After the initial meeting with a founder, investment decisions are made "in a matter of days, or maybe even a week,” says Sumi Das, partner at Alphabet’s private equity arm, CapitalG. A couple years ago, that was typically a two- or three-week process. And it’s not just VCs sloshing money into startups: Hedge funds, mutual funds, and sovereign wealth funds are entering the private market, both inside and outside the U.S.”

“A Bunch Of Fitness Companies Have Jumped Into The IPO Market This Year. It’s Not Working Out.” (MarketWatch). “Has the U.S. IPO market reached peak fitness? It may have, based on Thursday’s market, which saw the latest fitness company to go public — Life Time Group Holdings — flounder in early trade, while another expected this week, iFit Health & Fitness, postponed its deal, citing adverse market conditions.”

“Cotton Prices Just Hit A 10-Year High. Here’s What That Means For Retailers And Consumers” (CNBC). “Cotton prices surged to a 10-year high on Friday, reaching $1.16 per pound and touching levels not seen since July 7, 2011. The price of the commodity rose roughly 6% this week, and is up 47% year to date. Analysts note that gains are being intensified further from traders rushing to cover their short positions.”

“An SEC Rule Was Meant To Protect Individual Investors. Chaos Ensued.” (Wall Street Journal). “ [A] rule from the Securities and Exchange Commission went into effect at the end of September, generally preventing brokers from providing public price quotations on securities issued by companies that don’t release current financial information…[u]nder the SEC rule, many brokers have stopped offering price quotes on…[thousands of] companies that don’t provide public information.”

“We Have No Theory Of Inflation” (Value Added). “Right now, the debate about how transitory or temporary the global spike in inflation will be is the hottest topic in macro. Between them, Goodhart and Rudd have done a good job of demonstrating that the best answer might be ‘we don’t know’. None of the existing models provide a solid basis for forecasting. Many of the people claiming that inflation is definitely staying high have been saying much the same thing for a decade or more, while many of those insisting that it is transitory failed to spot the coming spike.”

What we’re reading (10/9)

“Wall Street Isn't Sweating The Mixed Jobs Report” (CNN Business). “America added far fewer jobs in September than expected, but investors didn't seem too disappointed: Stocks were mostly unchanged Friday as Wall Street took solace that the unemployment rate continues to drop after the pandemic-fueled spike last year.”

“Markets Are Telling The Fed To Start Tapering Now After Big Miss On September Jobs Report, Says Mohamed El-Erian” (Insider). “‘…[T]he message from the market to the Fed is: 'Go ahead and taper, we expect you to.’…El-Erian has been banging the drum for months on the need for the Fed to taper as soon as possible. Last month, he blamed the central bank for bond-market turmoil, saying markets would begin to question the Fed's judgment on inflation the longer it waited to taper.”

“Global Supply-Chain Problems Escalate, Threatening Economic Recovery” (Wall Street Journal). “Earlier this year it cost more than five times as much to ship goods from China to South America compared with last year’s pandemic low, according to U.N. Conference on Trade and Development data. Freight rates on the more heavily trafficked China-North America route more than doubled.”

“The Bretton Woods Credibility Crisis” (Project Syndicate). “[F]ollowing the 2018 report, there were complaints about the data that had been used, leading the World Bank to commission the highly regarded law firm WilmerHale to investigate. Its report, issued last month, found serious irregularities with respect to China’s ranking in the 2018 report. The investigators report that Kristalina Georgieva, the Bank’s then-CEO (second in command) who has since become managing director of the IMF, urged staff to reconsider the results for China, and then ‘explored … ways to change the methodology to raise China’s ranking.’ The report also points out that the Bank had an interest in placating China, because it was seeking Chinese support for a capital increase at the time.”

“Why Tesla Bought Bitcoin” (Works In Progress). “Bitcoin has weathered its fair share of theoretical criticisms over the years. It’s just like tulips. It’s insecure. It’s technically unsound. It’s on the wrong side of a global macroeconomic network effect. It’s economically unworkable. It’s wasteful. It’s dangerous. It’s stupid. Besides, if it does eventually overcome these problems, the government will shut it down. And yet, there Bitcoin stands—thriving.”

What we’re reading (10/8)

“America's CEOs Are Losing Confidence In The Economy” (CNN Business). “US business leaders are still upbeat about the economic recovery. But they're not as confident as they were just a few months ago, and they blame the Delta variant and a super tight labor market for the drop in sentiment. The Conference Board, a leading business research think tank, reported Thursday a steep slide in its CEO confidence index for the third quarter.”

“Builders Hunt For Alternatives To Materials In Short Supply” (Wall Street Journal). “Shortages of key construction materials are forcing some builders and contractors to turn to substitutes and hunt for alternative suppliers as they rush to meet high demand for new housing. Construction companies are looking for replacements and new sources for everything from wood paneling to ceiling joists to pipes, saying that potentially higher costs and added complications to design and construction can be preferable to putting a project on hold for months while waiting for planned supplies.”

“Banks Don’t Want Your Money Right Now” (Vox). “US interest rates and inflation are on the rise again, which means Americans can expect to pay higher rates for mortgages, auto loans, and credit cards. But don’t expect it to lead to higher interest on your savings account anytime soon. Banks don’t want your money. That’s why they’re offering such low rates.”

“Yet Another Covid Victim: Capitalism” (New York Times). “Professor Stiglitz — winner of the 2001 Nobel Memorial Prize in Economic Sciences, a former chief economist at the World Bank and a professor at Columbia University — said in a pre-conference interview that the private sector had proven incapable of responding alone to the global health challenge and that government had a big role to play.”

“Want to Pick the Best Stocks? Pick the Happiest Companies.” (Institutional Investor). “According to a paper published on October 1, a portfolio that includes companies with high employee-satisfaction ratings can measurably outperform a portfolio that doesn't feature such firms. And these returns were even better in crisis periods. Researchers Hamid Boustanifar and Young Dae Kang at EDHEC Business School in Nice, France, said the paper, entitled Employee Satisfaction and Long-run Stock Returns, 1984-2020, builds on a similar 2011 study by expanding the dataset and controlling for more variables.”

What we’re reading (10/7)

“Central Banks And The Looming Financial Reckoning” (Project Syndicate). “Across the advanced economies (and in many emerging markets), risk assets, notably equity and real estate, appear to be materially overvalued, despite recent minor corrections. The only way to avoid this conclusion is to believe that long-run real interest rates today (which are negative in many cases) are at or close to their fundamental values. I suspect that both the long-run real safe interest rate and assorted risk premia are being artificially depressed by distorted beliefs and enduring bubbles, respectively. If so, today’s risk-asset valuations are utterly detached from reality.”

“You Know Who Don’t Want To End Banking As We Know It? Banks.” (Dealbreaker). “You’d have thought Gary Gensler was bad enough. Rohit Chopra in Mick Mulvaney’s seat? Even worse. The decreasing likelihood that Jay Powell will at least be around to keep an eye on their interests? Tough to take. But this communist [Saule Omarova] who wants to “end banking as we know it” as head of the most important banking regulator in the country? That is simply too much for the banks to take.”

“Why Wall Street Cheers China, Despite Growing Business Unease” (The Economist). “This year has been unsettling for Chinese business. The ruling Communist Party has gone after the private sector industry by industry. The stock markets have taken a huge hit. The country’s biggest property developer is on the verge of collapse. But for some of the biggest names on Wall Street, China’s economic prospects look rosier than ever. BlackRock, the world’s biggest asset manager, urged investors to increase their exposure to China by as much as three times.”

“Do Pandemics Normally Lead To Rising Inflation?” (The Economist). “That covid-19 might usher in a prolonged spell of high inflation would buck a historical trend. A recent paper by Dennis Bonam and Andra Smadu, two economists at the Dutch central bank, looks at the effect of pandemics on inflation and concludes that they typically lead to lower, not higher, price pressures. Using data going baIck to the 14th century, covering six European countries and 19 pandemics, the authors find that such events have historically caused inflation to fall for more than a decade, on average, yielding an inflation rate about 0.6 percentage points lower than if the pandemic had not occurred. The more prolonged and severe the outbreak, the more pronounced and persistent the negative effects on trend inflation.”

“‘I Found A Flaw In Your System, And I Took Advantage Of it.’ Florida Man Filed 745 Tax Returns In 4 Years, Collecting $235K In Bogus Refunds” (MarketWatch). “Most people dread having to file their taxes, but not Damian Barrett, authorities say. Over a four-year period, the Florida man filed 745 tax returns in 19 different states, according to the IRS. The payoff: $235,000 in tax refunds he wasn’t entitled to. Barrett, 40, who pleaded guilty in July to mail fraud, identity theft and filing false tax returns, was sentenced this week to 4 ½ years in federal prison, according to prosecutors in Oregon, where he had filed 348 returns alone.”

What we’re reading (10/6)

“Is The Stock Market Open At 3 a.m.? This Startup Says It Should Be” (Wall Street Journal). “Under decades-old conventions, the bulk of stock trading takes place between 9:30 a.m. and 4 p.m. ET on weekdays, and exchanges shut down for holidays, such as Good Friday and Washington’s Birthday. In contrast, 24 Exchange would operate like the foreign-exchange and cryptocurrency markets, which run continuously. The three-year-old startup already offers trading in FX and crypto. Its parent company, 24 Exchange Bermuda Ltd., is incorporated in Bermuda, but the proposed stock exchange would be run by a U.S. subsidiary.”

“The Fractionalization Of Everything” (Vox). “With emerging technologies such as blockchain, the increasing power and importance of retail traders, and a growing appetite for new assets, everything from shoes to artwork to classic cars is being broken up into pieces and offered to investors in bite-sized portions through a process called fractionalization…[o]ne interesting caveat to most fractional investments aimed at retail investors is that buyers don’t actually own the things they buy. They’re simply buying a stake in the asset, betting that it will rise in value and they’ll be able to sell their portion at a higher price than what they paid.”

“Bond Yields Are Disconnected From Economic Fundamentals. Investors Shouldn’t Expect That To Change.” (Institutional Investor). “Interest rates relative to inflation aren’t getting back to normal anytime soon. That’s because institutions, including sovereign reserve managers, commercial banks, and pension funds are buying bonds for regulatory reasons or to match their future liabilities, breaking the relationship between a bond’s price and the underlying fundamentals, according to the newly formed Strategic Investment Advisory Group of J.P. Morgan Asset Management.”

“Natural Gas Crisis Pushes U.S. Prices To Highest Since 2008” (Bloomberg). “Natural gas futures jumped to the highest settlement price in 12 years in New York as global gas supply shortages stoke concerns for U.S. shortages…As the northern hemisphere heads into winter-heating season, low U.S. auxiliary supplies have sparked concerns about potential shortages as demand for the furnace fuel ramps up. Gas futures rose 9.5% to close settle at $6.312 per million British thermal units on the New York Mercantile Exchange, the highest close since December 2008.”

“A Look At The Lavish Real Estate Revealed In The Pandora Papers” (Architectural Digest). “Unlike some other famed documents revealing the corruption encouraged by the world’s most prominent power players, this specific collection of 12 million confidential files centers on the financial secrets—luxury property machinations—of global political leaders. Everyone from Pakistani Prime Minister Imran Khan to former British Prime Minister Tony Blair appear in the report. Indeed, the Pandora Papers extend far beyond these public officials and heads of state; the Papers span their entire inner circle.”

What we’re reading (10/5)

“Stock, Bond And Real Estate Prices Are All Uncomfortably High” (Robert Shiller, New York Times). “The prices of stocks, bonds and real estate, the three major asset classes in the United States, are all extremely high. In fact, the three have never been this overpriced simultaneously in modern history. What we are experiencing isn’t caused by any single objective factor. It may be best explained as a result of a confluence of popular narratives that have together led to higher prices.”

“Do Inflation Expectations Matter For Inflation?” (Marginal Revolution). “Many people (NYT) are talking about the new paper by Jeremy Rudd on exactly this topic — Rudd is skeptical that they matter very much. So I went to read the paper, and I have to say I am baffled. It didn’t change my priors at all. I didn’t see new empirical estimates, or new theoretical arguments, and furthermore I didn’t see the most relevant factors discussed much. I did see a lot of pokes at Friedman, Phelps, and Lucas (and there is also an introductory assertion that, even given enough time, markets with flexible prices do not clear. Then he goes on to deny that the theory of household choice is sufficient to derive downward-sloping demand…why do that???).”

“The Age Of Fossil-Fuel Abundance Is Dead” (The Economist). “In recent weeks…it is a shortage of energy, rather than an abundance of it, that has caught the world’s attention. On the surface, its manifestations are mostly unconnected. Britain’s miffed motorists are suffering from a shortage of lorry drivers to deliver petrol. Power cuts in parts of China partly stem from the country’s attempts to curb emissions. Dwindling coal stocks at power stations in India are linked to a surge in the price of imports of the commodity. Yet an underlying factor is expected to make scarcity even worse in the next few years: a slump in investment in oil wells, natural-gas hubs and coal mines”

“Empty Buildings In China’s Provincial Cities Testify To Evergrande Debacle” (Wall Street Journal). “Rows of residential towers, some 26 stories high, stand unfinished in this provincial city about 350 miles west of Shanghai, their plastic tarps flapping in the wind. Elsewhere in Lu’an, golden Pegasus statues guard an uncompleted $9 billion theme park that was supposed to be bigger than Disneyland. A planned $4 billion electric-vehicle plant, central to local leaders’ economic dreams, remains a steel frame with overgrown vegetation spilling into the road.”

“‘Some Are Just Psychopaths’: Chinese Detective In Exile Reveals Extent Of Torture Against Uyghurs” (CNN Business). “The methods included shackling people to a metal or wooden ‘tiger chair’ -- chairs designed to immobilize suspects -- hanging people from the ceiling, sexual violence, electrocutions, and waterboarding. Inmates were often forced to stay awake for days, and denied food and water, he said.”

What we’re reading (10/4)

“Wonking Out: Biden Should Ignore The Debt Limit And Mint a $1 Trillion Coin” (Paul Krugman, New York Times). Caveat emptor—not sure this kind of devaluation is advisable, but worth reading nonetheless: “there’s a strange provision in U.S. law that empowers the Treasury secretary to mint and issue platinum coins in any quantity and denomination she chooses. Presumably the purpose of this provision was to allow the creation of coins celebrating people or events. But the language doesn’t say that. So on the face of it, Janet Yellen could mint a platinum coin with a face value of $1 trillion — no, it needn’t include $1 trillion worth of platinum — deposit it at the Federal Reserve and draw on that account to keep paying the government’s bills without borrowing.”

“Car Sales Plunge As Chip Shortages Choke Off Supply” (CNN Business). “New car sales plunged over the last three months in the United States despite strong demand, as the shortage of computer chips and other supply chain issues caused shutdowns at auto factories and choked off the supply of vehicles. General Motors reported sales fell a third from a year-ago last quarter, and they were off 40% from the same quarter of 2019 before the pandemic roiled the car market. Sales at Stellantis, the company formed by the merger of Fiat Chrysler and France's PSA Group, fell 19% from a year ago, and 27% from the pre-pandemic period.”

“Balancing Honesty And Optimism In Silicon Valley” (DealBook). “‘It’s a thin line between a start-up and a Ponzi scheme,’ Mr. Ries [an entrepreneur] said. ‘Generally speaking, you are asking people to invest in something that doesn’t yet exist on the basis that you will bring it into existence.’ That requires a certain amount of bravado, optimism and experimentation, a combination that has often been rewarded: Zappos bought shoes from a shoe store before it shipped them from its warehouse, Apple announced its first iPhone before it had figured out how to mass-produce its prototypes, and Reddit populated its site with fake users to demonstrate desired behavior.”

“Powell Said The Fed Has No Plans To Ban Crypto. Here Is What Experts Say May Lie Ahead For Crypto Regulation As Authorities Tighten Their Grip.” (Insider). “When Federal Reserve Chair Jerome Powell said he has no intentions of banning cryptocurrency during a Congress testimony just days after China intensified its crackdown by banning all related transactions, many in the digital asset space were pleased but not surprised. ‘It's hard for me to believe that US regulators would decide that was the best course of action given the role that cryptocurrencies are playing in so many citizens' lives,’ Bobby Zagotta, US CEO of crypto exchange Bitstamp, told Insider. ‘I think doing that would be incredibly disruptive and it would really put the US and the economy in a compromised situation.’”

“Pandora Papers: Biggest Ever Leak Of Offshore Data Exposes Financial Secrets Of Rich And Powerful” (The Guardian). “The secret deals and hidden assets of some of the world’s richest and most powerful people have been revealed in the biggest trove of leaked offshore data in history. Branded the Pandora papers, the cache includes 11.9m files from companies hired by wealthy clients to create offshore structures and trusts in tax havens such as Panama, Dubai, Monaco, Switzerland and the Cayman Islands.”

What we’re reading (10/3)

“The Market Is Right To Be Spooked By Rising Bond Yields” (Wall Street Journal). “Why, you might reasonably ask, are stocks suddenly spooked by bond yields? In the boom up to March, stocks and yields marched higher together, and for the past two decades higher yields have generally been better for stocks. The difference is that investors see the central banks turning hawkish, even as economic growth slows, because they can’t ignore high inflation.”

“El-Erian Sees Fed Risking Disorderly Taper Without Quick Action” (Bloomberg). “Mohammed El-Erian has some advice for Federal Reserve Chairman Jerome Powell about tapering: Get going. The bond-market influencer has for months urged the Fed to reduce its asset purchases before inflation runs rampant and batters financial markets. A week ago, Powell said the U.S. central bank could begin scaling back in November and complete the process by mid-2022. ‘When it comes to an orderly taper, the window is closing,’ El-Erian, the chief economic adviser at Allianz SE and president of Queens’ College, Cambridge, said Friday on Bloomberg TV’s The Open.”

“Wall St Week Ahead Bruised Market Eyes Treasury Yields To Gauge Stocks' Path” (Reuters). “Investors are focusing on Treasury yields as a key factor in determining how stocks will fare the rest of the year, after a month in which equities notched their steepest losses since the coronavirus pandemic began. The S&P 500 index posted its biggest monthly drop since March 2020 in September, while pulling back as much as 5% below its all-time high for the first time this year.”

“Ozy Media Is Shutting Down After Reports About Misconduct And Lies At The Company” (CNBC). “Ozy Media CEO Carlos Watson informed employees Friday that the board had voted to shut down the company, according to a person familiar with the matter. In a five minute phone call late in the afternoon, Watson informed Ozy’s staff of the decision, said the person, who asked not to be named because the conversation was private. A dejected-sounding Watson did not take any questions, the person said.”

“Romanov Wedding Is A Royal Russian Flashback” (Vanity Fair). “It’s been over a century since the last one, but Russia still knows how to do a royal wedding. Grand Duke George Mikhailovich Romanov, a Spanish-born, Oxford-educated 40-year-old, is the Tsesarevich, meaning “heir apparent” to the Russian Empire … if such a monarchy still existed. On Thursday, he wed Victoria Romanovna Bettarini, an Italian national who converted to the Russian Orthodox Church (hence the Romanovna middle name). It was like nothing Russia has seen in a long time.The groom’s family, the Romanovs, first came to power in 1613, and include names you may recall from history class or Hulu such as Peter the Great, and, through marriage, Catherine the Great.”

September 2021 Performance Update

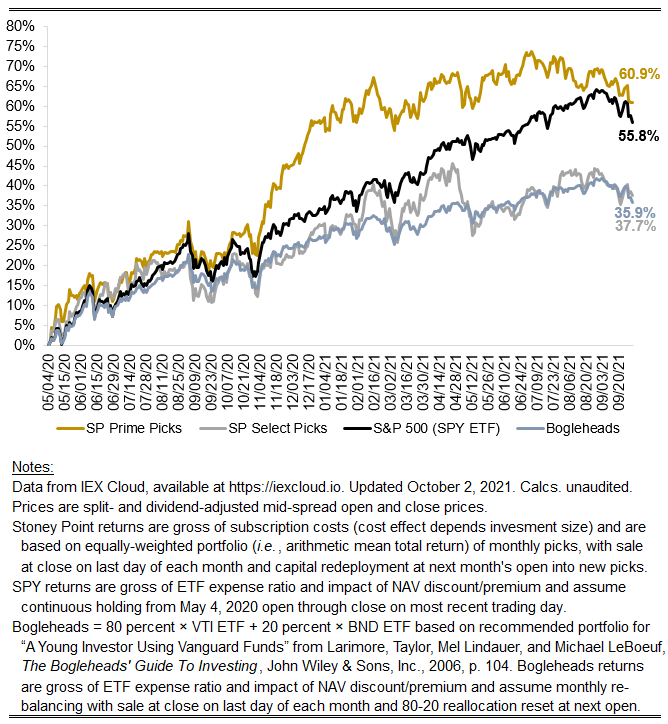

Hi friends, here with a monthly performance update. If you paid attention to U.S. equities in September, you already know the market was bad. A little less bad for both of our strategies, however. Here are the key numbers:

Prime: -5.05%

Select: -4.41%

S&P 500-tracking “SPY” ETF: -5.18%

Bogleheads: -4.25%

September’s results are basically in line with my general goal for Stoney Point’s performance: when the market is down, try not to be more down, and then when the market is up, try to be more up. That’s a pretty good recipe for substantial outperformance over a three-to-five-year (or longer) hold. But it’s shockingly hard to do. If you want to outperform when the market is up, one way to do it is through leverage, which for retail traders can be accomplished through (1) buying options, which have “embedded” leverage mathematically, on the stocks you like instead of the underlying stocks themselves, (2) buying the stock of highly leveraged companies, or (3) putting debt on your own balance sheet to buy the stocks you like (caution: you might get margin called!). The problem with leverage is that it works in both directions: when the market is down, you’re going to be more down. If, for example, you maxed out the margin financing allowable at retail brokerages under prevailing regulatory limitations (Regulation T), which is 1:1 debt-to-equity, and invested all that capital on buying SPY last month, you would’ve been down 10.36% instead of just the 5.18% you would be down if you simply used your own capital for 100% of the investment (the math: equity return = asset return*(1+debt/equity ratio), i.e., for SPY, last month if maxing out margin limits, 10.36% = 5.18%*(1+1/1)). And that’s before accounting for interest, which for margin financing can be between 5-10% annually).

Since leverage isn’t a good option, avoiding the market downs requires, basically, timing the market downs. That is, knowing when to bet the farm on SPY puts or when to go 100% cash or, in the case of last month, 100% oil futures or something. It’s possible to get that right once in a while, but very difficult to do consistently. Better—in my view—to put yourself in a position to have a relatively medium to long-term hold, accept the months when the market is down, and have confidence your strategy will play out when the market is up.

In that light, I’m quite please with Select’s performance last month, as it substantially outperformed the market (to me, the market is “SPY”) and hence is making relative progress in closing that gap. Prime also outperformed, but I’m not sure the result was different from the market’s performance in the statistical (i.e., true) sense.

An aside about September:

Stock market lore holds that September tends to be bad for the market as a whole.

“Why is September so bad? No one knows. Here’s one theory, though: Because it’s the end of summer, and it’s depressing.”

-Joe Weisenthal, Business Insider, September 9, 2009

This sounds like nonsense to me without some sound theoretical but basis for why September should be bad. I guess the psychological effect Joe Weisenthal suggests in the quote above could in fact meet that standard, though I’m not sure September is depressing—it’s beautiful here in the mid-Atlantic. Anyway, September really is replete with terrible events in market history! As the Weisenthal article above points out, all of the following happened in September:

September 4, 1929 was the market peak before the crash in 1929

There was unprecedent volatility in September 1987 preceding Black Monday in October

September 16, 1992 was the day the UK devalued the pound and exited the European Exchange Rate Mechanism (netting George Soros a solid billion)

September 2000 was the peak of the tech bubble

September 11, 2001 was the worst attack on U.S. soil in history (market was down 7% in response)

In September 2008, Lehman went bust (and so did AIG and Fannie and Freddie!)

The “September Effect” is, in fact, a statistical anomaly treated seriously by investment practitioners and academics.

It all reminds me of the multi-century-old adage I discussed in a prior post describing the so-called “Halloween Anomaly”: “Sell in may and go away. But remember to come back in September” (an alternative response is “but buy back on St. Leger Day”, that is, the date of a famous horse race in Doncaster in England in September).

It all very well might be nonsense, but September 2021 certainly won’t disabuse any true believers of the notion.

Stoney Point Total Performance History

What we’re reading (10/2)

“Private Equity is Notoriously Opaque. Researchers and Investors Say This is No Longer OK.” (Institutional Investor). “Measuring performance with internal rates of return…makes it difficult for investors to compare the returns of different private equity funds and to contrast the strategy with what they would have earned in the public markets. Monk and his co-authors argue that the measure is heavily influenced by returns earned early in a fund's life. As an example, the report cites private equity funds from the 1970s and 1980s, whose returns earned since inception are exceptional because of this property.”

“Employees’ Online Comments Can Predict Corporate Misconduct, Study Says” (Wall Street Journal). “A study from researchers at Harvard Business School and the Netherlands’ Tilburg University found that information extracted from employee reviews left on company-review site Glassdoor.com was useful in predicting misconduct beyond other readily observable factors, such as a firm’s performance, press coverage, industry risk and prior violations.”

“Climate Change Is The New Dot-Com Bubble” (Wired). “There are good VCs being venturesome with their capital. There are funds that are investing in green things. But—and God help me for wishing it—there's no Google, no Apple or Microsoft, no monster in the middle taking its cut. There isn't one carbon market; there isn't one set of standards to follow; there are dozens of options, which means there isn't really anything at all. Whole careers are dedicated, wonderful people, great science, online carbon calculators, but for right now it rounds to nothing. Amazon Web Services hosts open climate data, but I wish there were an AWS for climate. I wish I could tell you what it should do.”

“China's Housing Conundrum” (Project Syndicate). “[E]ngineering a slow, controlled deflation of China’s real estate bubble will not be easy. With the banking sector having lent heavily to residential projects (Evergrande alone has borrowed from almost 300 banks and financial firms), a sharp drop in housing prices could prove painful and cascade catastrophically into other sectors. In principle, banks are protected by substantial down payments, often amounting to 30% or more of the purchase price. But given China’s epic house-price boom in the twenty-first century, 30% may prove not nearly enough when a collapse comes. (After the 2008 financial crisis, US housing prices dropped by 36%, and by significantly more in some regions.)”

“Only 35% Pass Wall St.’s Toughest Test. How Much Does That Matter?” (New York Times). “Over time, the C.F.A. curriculum came to be seen as foundational knowledge for analysts and portfolio managers who were willing to plow through the material to gain an edge. But as the designation became more popular, pass rates dropped. The number of candidates peaked above 270,000 in 2019, and an average of 44.2 percent passed.”

What we’re reading (10/1)

“Yellen Lends Support For Effort To Remove The Debt Ceiling Altogether” (CNBC). “With a potential default looming for the U.S. in October, Treasury Secretary Janet Yellen said Thursday she would just as soon see the power over debt limits taken away from Congress. A bill introduced in May would repeal the national debt ceiling, and Yellen said ‘yes, I would’ when asked during a House hearing if she backs the effort. She noted Congress makes the decisions on taxes and spending, and should provide the ability to pay those obligations.”

“Mail Delivery Slowdown: USPS To Slow Delivery Starting October 1” (CBS News). “Mail delivery for many Americans will slow starting on Friday, part of Postmaster General Louis DeJoy's blueprint for overhauling the U.S. Postal Service in order to slash costs. But critics say the slower delivery standards could cause problems such as late bill delivery while more broadly undermining the public's faith in the USPS…[s]tarting [today], the postal service's current three-day delivery standard for first-class mail — letters, bills, tax documents and the like — will drop to delivery anywhere within the U.S. within five days. “

“Boy, Robinhood And Citadel Securities Sure Were Chatty During That Whole GameStop Thing” (Dealbreaker). “More or less from the moment Robinhood and others began to place limits on retail customers’ trading of GameStop and other meme shares, those thereby blocked from doing so have presumed nefarious motives. The degenerates and diamond hands looked at the relationship between, say Robinhood and Citadel Securities, a company which contributes it share of 80% of Robinhood’s revenue, and whose sister hedge fund had rather a vested interest in seeing the short-squeeze crushing founder Ken Griffin’s buddy end, and concluded that the fix was in. Well, the internal communications over at Robinhood in the run-up to the trading restrictions isn’t likely to disabuse them of that notion.”

“Inside America’s Broken Supply Chain” (Washington Post). “The commercial pipeline that each year brings $1 trillion worth of toys, clothing, electronics and furniture from Asia to the United States is clogged and no one knows how to unclog it. This month, the median cost of shipping a standard rectangular metal container from China to the West Coast of the United States hit a record $20,586, almost twice what it cost in July, which was twice what it cost in January, according to the Freightos index. Essential freight-handling equipment too often is not where it’s needed, and when it is, there aren’t enough truckers or warehouse workers to operate it.”

“Review Analysis: Stanford Students Are More Likely To Wear Masks On Bicycles Than Helmets” (Stanford Review). “On Wednesday, September 22nd, in the 1:00 pm hour, I observed 400 Stanford cyclists on Lasuen Mall, a popular campus street for bicycles. I simply noted whether each cyclist wore a mask, a helmet, neither, or both. Here are the final tallies: Total cyclists: 400 - (100%)[;] No mask, no helmet: 195 - (49%)[;] Mask, no helmet: 134 - (34%)[;] Helmet, no mask: 42 - (10%)[;] Mask and helmet: 29 - (7%)[.] That works out to a masking rate of 41% and helmet-wearing rate of 17%. So, Stanford students are about twice as likely to wear a mask on a bicycle as a helmet…at one of America’s leading research universities, students wear masks on bicycles at a higher rate than they wear helmets.”

October Prime + Select picks available now

The new Prime and Select picks for October are available starting now, based on a model run put through today (September 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Friday, October 1, 2021 (at the mid-spread open price) through the last trading day of the month, Friday, October 29, 2021 (at the mid-spread closing price).

What we’re reading (9/30)

“‘Most Americans Today Believe The Stock Market Is Rigged, And They’re Right’” (Bloomberg). “New research shows insider trading is everywhere. So far, no one seems to care…[i]n theory, the law governing insider trading is clear-cut: Under the Securities Exchange Act of 1934, executives who abuse their access to nonpublic information, either by trading on it themselves or passing it along to someone else, can be charged with fraud and sent to jail. But regulators and lawyers say identifying and prosecuting the offense is deceptively difficult, and lawmakers…have been calling for reform.”

“We Asked 3 Major Investors What Happens Next In The Market — None Of Them See Big Returns” (CNBC). “In response to bonds that offer negative real returns, big investors are seeking alternative investments that provide a yield and that aren’t correlated to stocks, according to Ashbel Williams, executive director and CIO of the Florida State Board of Administration. He manages more than $195 billion in assets for one of the largest U.S. pension funds. He invests in assets including planes, trains, timber, and music and TV rights, he said. Bonds now make up a smaller percentage of his holdings, down to 18% or 19% from about 25% a decade ago, Williams said.”

“Jerome Powell's Week From Hell” (CNN Business). “Everything is going wrong for one of the world's most powerful figures. Jerome Powell's chances of getting another four-year term as head of the Federal Reserve took a hit Tuesday after Senator Elizabeth Warren called him a ‘dangerous man’ for being too soft on Wall Street banks. That blow came on the heels of two Fed officials stepping down amid a trading scandal that even Powell acknowledged is ‘obviously unacceptable.’ Meanwhile, the Treasury Department moved up the timeline for when it will run out of cash, raising the specter of a calamitous US default come October 18.”

“Real-Estate Investors Are Less Optimistic About The U.S. Housing Market — Here’s Why” (MarketWatch). “Small scale real-estate investors are less enthusiastic about the state of the U.S. housing market — and their reasons for worry largely mirror those of the average home buyer today, according to a new survey. Real-estate data company RealtyTrac reported that 48% of individual real-estate investors view the investment market as being worse or much worse than it was a year ago, based on the results of a survey the company conducted. That’s up from 45% of investors in last year’s edition of the same survey. RealtyTrac polled mom-and-pop investors who purchase between one to 10 properties a year — including both investors who flip the homes and those who hold onto them as rental units. These investors own most of the single-family rental properties in the country.”

“Massive Pension Investors Are Betting Big Bucks That The Office Isn't Dead In NYC And San Francisco. Here's Why They're Ignoring The Narrative And Going Bargain Hunting Instead.” (Insider). “Just under $17 billion of commercial real-estate sales took place in New York in the first half of 2021, according to data from CBRE, putting the year on track for even less dollar volume than the $36 billion sold in 2020, when the pandemic inflicted its worst damage on the economy. In 2019, almost $61 billion of commercial real estate was sold in NYC, according to CBRE.”