What we’re reading (1/17)

“Investors Eye Inauguration Day, Netflix Earnings: What To Know In the Week Ahead” (Yahoo! Finance). “As traders return from the long holiday weekend on Tuesday and equity markets reopen, markets will turn their attention to the first days of the Biden administration and to another batch of corporate earnings results.”

“After Stock Surge, Investors Ask Companies What’s Ahead” (Wall Street Journal). “An epic stock rally faces a key test in coming weeks as investors learn what executives expect for profits and revenues in coming periods. Fourth-quarter earnings season kicked off in earnest Friday with better-than-expected profits from some of the nation’s largest banks. Despite a record quarterly profit at JPMorgan Chase & Co. and some bright spots at Citigroup Inc. and Wells Fargo & Co., shares of all three declined, with Wells and Citi each dropping more than 6%. The market reaction highlights the stakes as large firms begin sharing quarterly results and, more important, their outlooks for coming quarters. “

“Corporate Earnings Don’t Look Great. But The Drought May Be Over Soon” (CNN Business). “According to estimates from FactSet Research, companies in the S&P 500 are expected to report that their profits fell by about 7% in the final three months of 2020 compared to the fourth quarter of the previous year. That, however, should be the end of the earnings drought. FactSet senior earnings analyst John Butters told CNN Business that S&P 500 profits should rebound in the first quarter, with analysts forecasting a nearly 17% year-over-year jump in the first quarter and a more than 46% surge in the second quarter. For the full year, Butters said profits should rise more than 22%.”

“US Small-Cap Stocks Have Raced Ahead Of Their Bigger Peers In 2021. Experts Say A Number Of Factors Could Send Them Higher.” (Business Insider). “The stock market recovery from the coronavirus crash in the spring of 2020 was all about the biggest US names: Amazon, Apple, Facebook, Google, and Netflix. But the smaller, more unloved parts of the stock market come roaring back in the autumn and winter, and their momentum has continued in 2021. The Russell 2000 index of small-capitalization stocks has jumped 1.5%, for example.”

“How The Blenders Eyewear Founder Turned A $2,000 Loan Into A $90 Million Business In 7 Years” (CNBC). “Fisher borrowed $2,000 from his roommate and launched the sunglasses company Blenders Eyewear (named after Hornblend, the street he lived on). Fisher started to sell his product out of his backpack on the beach where he worked as a surf instructor. Within three years, Blenders made over $1 million in revenue. And in December 2019, Blenders was valued at $90 million after Italian eyewear company, the Safilo Group, announced it would acquire 70% of the company.”

What we’re reading (1/16)

“A Dollar Is a Dollar Is a Dollar. Except in Our Minds.” (Wall Street Journal).”We regularly divide our paychecks into pots. Sometimes they are tangible pots, such as checking accounts or glass jars. Sometimes they are virtual pots, such as Excel sheets or mental pots in our minds. We mark each pot with a label such as rent, food, entertainment, Christmas gifts or emergency funds, and refrain from dipping into pots other than designated ones. Of course, none of this is rational. Rent dollars aren’t any greener than entertainment dollars. Rationally, they should all be in one pot labeled ‘money.’”

“Bill Gates Becomes Top US Farmland Owner” (Fox Business). “Microsoft founder Bill Gates is now the owner of the most farmland in the United States, according to Land Report. The Land Report researchers concluded that Gates, now the fourth richest man in the world, and his wife, Melinda, own 242,000 acres of farmland…[a]ccording to Land Report's research, Gates and his wife had hired former Putnam Investments bond fund manager Michael Larson in 1994 to help them diversify their personal assets.”

“Massive Blackouts Have Hit Iran. The Government Is Blaming Bitcoin Mining.” (Washington Post). “Massive blackouts and smog have hit cities across Iran. It’s a toxic mix as the country, already under economic duress and suffocating U.S. sanctions, simultaneously battles the region’s worst coronavirus outbreak. Blackouts are not new in Iran, where an aging and subsidized electricity sector is plagued by alleged mismanagement. Only this time, government officials say that bitcoin mining at so-called cryptocurrency farms — the energy-intensive business of using large collections of computers to verify digital coin transactions — is partly to blame.”

“As Cookie Crumbles In Digital Advertising, Google And Apple May Benefit” (Investor’s Business Daily). “For years advertisers have feasted on cookies, those small data files that track your every click on the web. But in the name of improved consumer privacy, Google and Apple are forging ahead with plans to thwart online ad trackers. Now the stage is set for these internet giants, media publishers and digital advertisers to battle in the new cookie-free world.”

“The Most Concentrated Market In 40 Years” (Fortune Financial). “Back in the summer of 2017, I demonstrated that the weightings of the S&P 500’s top components were roughly in-line with the historical average, despite all the publicity and discussion the megacap stocks were getting. Fast forward to the beginning of 2021, and the story is very different; by just about any measure, the S&P 500 is the most top-heavy it has been in at least a generation. Consider, for example, the weighting of the top stock, Apple, which currently represents close to 7% of the S&P 500’s market capitalization[.]”

What we’re reading (1/15)

“Biden Outlines $1.9 Trillion Spending Package to Combat Virus and Downturn” (New York Times). “President-elect Joseph R. Biden Jr. on Thursday proposed a $1.9 trillion rescue package to combat the economic downturn and the Covid-19 crisis, outlining the type of sweeping aid that Democrats have demanded for months and signaling the shift in the federal government’s pandemic response as Mr. Biden prepares to take office.”

“Jeff Bezos’ Blue Origin Aims To Fly First Passengers On Its Space Tourism Rocket As Early As April” (CNBC). “After years in development, Jeff Bezos’ private space company Blue Origin aims to carry its first passengers on a ride to the edge of space in a few months. Blue Origin on Thursday completed the fourteenth test flight of its New Shepard rocket booster and capsule. Called NS-14, the successful test flight featured the debut of a new booster and an upgraded capsule.”

“James Simons Steps Down as Chairman of Renaissance Technologies” (Wall Street Journal). “James Simons, who helped lead a quantitative revolution that has swept the world of finance, is stepping back from his hedge fund on the heels of a terrible year for clients, but a terrific one for the firm’s employees. Mr. Simons, among the largest financial backers of Democractic candidates in recent years, told investors he was retiring as chairman of Renaissance Technologies LLC’s board of directors as of Jan. 1.”

“BlackRock Now Has A Whopping $8.7 Trillion In Assets” (CNN Business). “The record stock market run is great news for BlackRock: The owner of the super popular iShares family of exchange-traded funds reported earnings and revenue for the fourth quarter Thursday that easily topped forecasts. BlackRock (BLK), the world's largest money management firm, ended the year with nearly $8.7 trillion in total assets -- an increase of 17% from a year ago.”

“How Law Enforcement Gets Around Your Smartphone's Encryption” (Wired). “Lawmakers and law enforcement agencies around the world, including in the United States, have increasingly called for backdoors in the encryption schemes that protect your data, arguing that national security is at stake. But new research indicates governments already have methods and tools that, for better or worse, let them access locked smartphones thanks to weaknesses in the security schemes of Android and iOS.”

What we’re reading (1/14)

“Americans Won’t Be Banned From Investing in Alibaba, Tencent and Baidu” (Wall Street Journal). “The U.S. government is expected to let Americans continue to invest in Chinese technology giants Alibaba Group Holding Ltd., Tencent Holdings Ltd. and Baidu Inc., after weighing the firms’ alleged ties to China’s military against the potential economic impact of banning them.”

“A Vastly Faster Vaccine Rollout” (World Spirit Sock Puppet). “When a traveler introduced smallpox to New York City in 1947, the city—and in particular its health commissioner, Israel Weinstein—apparently ran an epic vaccination campaign, reaching 5 million people in the first two weeks...[f]or covid, the first New York City vaccine was given on the 14th of December, and if I understand, by the 10th of January, twenty seven days later, 203,181 doses had reportedly been given…[t]hat’s around eight thousand doses per day. A factor of fifty fewer…[w]hy is New York fifty times slower at delivering covid vaccines in 2021 than it was at delivering smallpox vaccines in 1947?”

“J&J’s One-Shot Covid Vaccine Is Safe And Generates Promising Immune Response In Early Trial” (CNBC). “Most of the volunteers produced detectable neutralizing antibodies, which researchers believe play an important role in defending cells against the virus, after 28 days, according to the trial data. By day 57, all volunteers had detectable antibodies, regardless of vaccine dose or age group, and remained stable for at least 71 days in the 18-to-55 age group.”

“Twitter And Facebook Have Seen $51 Billion Of Combined Market Value Wiped Out Since Booting Trump From Their Platforms” (Business Insider). “Companies across sectors have responded to the president's rhetoric in recent days by pausing political donations, making statements decrying his inflammatory remarks, and pulling products with links to right-wing movements. Facebook and Twitter possibly took the biggest retaliatory steps when they indefinitely banned Trump from their platforms on Thursday and Friday, respectively.”

“SEC Charges Alleged Mastermind Of Made-Up Stuff With Fraud” (Dealbreaker). “Of course, if in spite of the names of Funds III and IV there were, in fact, no Funds I and II, no decade-long track record of overperformance, no $250 million balance sheet to cover losses…”

What we’re reading (1/13)

“Biden Is Expected to Name Gary Gensler for SEC Chairman” (Wall Street Journal). “President-elect Joe Biden is expected to choose Gary Gensler, a former financial regulator and Goldman Sachs Group Inc. executive, to head the Securities and Exchange Commission…Mr. Gensler’s nomination would please liberal Democrats who cheered the former regulator’s tough approach to rule-making during the Obama administration, when he spearheaded the overhaul of derivatives markets mandated by the 2010 Dodd-Frank Act and oversaw enforcement actions against investment banks accused of manipulating benchmark interest rates.”

“With Rates On The Rise, Investors Fearing Any Signs Of Inflation” (CNBC). “With the sharp move higher in interest rates, markets have been on the lookout for inflation creeping up. So Wednesday’s December CPI report will be important even if it still shows a muted rise in the consumer price index. According to Dow Jones, economists expect an increase of 0.4% month over month, and 1.3% year over year. Core CPI, less food and energy, is expected to be up 0.1% or 1.6% year over year, versus 0.2% and 1.6% in November.”

“Silver And Platinum Will Outperform Gold In 2021 As The Economy Recovers And Industrial Demand Supports Higher Metals Prices, Says UBS” (Business Insider). “2020 was one of the best years on record for gold, as investors piled into the safe-haven asset amid geopolitical and economic uncertainty. The precious metal even hit a record high of $2,075 on August 7, 202[0]. But UBS Global Wealth Management strategists don't see gold repeating its stellar performance in 2021. Instead, the firm sees other metals- including silver and platinum - outperforming gold during the year ahead.”

“Lost Passwords Lock Millionaires Out Of Their Bitcoin Fortunes” (New York Times). “Stefan Thomas, a German-born programmer living in San Francisco, has two guesses left to figure out a password that is worth, as of this week, about $220 million. The password will let him unlock a small hard drive, known as an IronKey, which contains the private keys to a digital wallet that holds 7,002 Bitcoin…[t]he problem is that Mr. Thomas years ago lost the paper where he wrote down the password for his IronKey, which gives users 10 guesses before it seizes up and encrypts its contents forever.”

“An Inside Look Into Cryptocurrency Exchanges” (Chan, et al., SSRN). An interesting new paper that lays out a list of 10 novel empirical observations about crypto investing. Among them: “institutional investors do not outperform individual investors [in crypto]….Individual investors' make good trading decisions, in the sense that the cryptocurrencies they buy outperform the ones they sell…[t]he same is not true for institutional investors.”

What we’re reading (1/12)

“The 2021 Tax Season Could Get Ugly. File Early And Electronically.” (Washington Post). “The surging pandemic. Confusion over who gets a stimulus payment. An overwhelmed IRS workforce still trying to catch up with last year’s delayed tax season. This is not the year to procrastinate. File your federal tax return early — and electronically.”

“Covid Vaccinations Offer CVS, Walgreens and Rite Aid A Chance To Showcase How Drugstores Have Changed” (CNBC). “he three drugstores have long been places where Americans stock up on shampoo, refill prescriptions and browse the aisles for a cold or flu remedy. During the pandemic, however, many of the driving forces behind drugstore trips faded. More purchases were made online. Fewer people have needed to buy over-the-counter cold and flu medications, as they wear face masks and social distance. Some have skipped doctor’s appointments, leading to fewer new prescriptions to fill. For the companies, Covid vaccines offer an opportunity to reach new customers.”

“CES 2021: The World’s Largest Tech Show Trades Las Vegas for Cyberspace” (Wall Street Journal). “CES, the world’s largest tech show, is quite something to behold. Or it would be if you could actually behold it in person…This year, you actually can see it all—but only from the little screen through which you see pretty much everything else these days. Vegas and CES will be without each other for the first time in decades. No more blimp rides.”

“An Oral History Of The World’s Biggest Coupon” (New York Times). “The F.B.I. found one in the junk drawer at the Santa Monica hide-out of the notorious mobster Whitey Bulger, which goes to show that gangsters are just like everybody else. There’s probably one or two clipped to your car’s visor…God knows your mother-in-law has a folder full of them. The 20 percent off coupon from Bed Bath & Beyond — a homely and oversize mailer known as Big Blue — is omnipresent, unmistakable and a joy to deploy in the chain’s endless aisles.”

“The Fried Chicken Sandwich Wars Are Heating Up. Here Are The New Entrants” (CNN Business). “The fried chicken sandwich wars sparked by Popeyes in 2019 are still clucking along two years later -- and they're heating up again. This week, KFC, McDonald's, Shake Shack and even salad-chain Sweetgreen kicked off the new year with their own takes on the crispy concoction. Cheap, tasty and growing in sales, fried chicken sandwiches are becoming an attractive menu item for many fast food restaurants.”

What we’re reading (1/10)

“The Top Stock Funds Of 2020” (Wall Street Journal). “While the Dow climbed 7.2% in 2020 and the S&P 500 wrapped up the year with a gain of more than 16%, the average diversified U.S. stock fund rewarded investors with a 19.1% increase…[w]hile most top-performing mutual-fund managers oversaw relatively concentrated funds and could boast of being early investors in some of the pandemic’s biggest beneficiaries like Zoom or Spotify, they emphasize that their smaller-than-average portfolios are surprisingly diverse.”

“Robinhood Has Beefed Up Its Legal Firepower With These 11 Lawyers As It Eyes A Blockbuster IPO, Including SEC Veterans And A Goldman Sachs In-House Counsel” (Business Insider). “The fintech startup Robinhood has been growing like crazy amid the pandemic. The trading app's revenue from routing trades roughly doubled from the first quarter of 2020 to the second. And as its valuation skyrocketed, Robinhood has been hiring software engineers, data analysts, and product managers. And lawyers.”

“IRS Rushes To Fix Error That Sent Millions Of Stimulus Payments To Wrong Bank Accounts” (Washington Post). “The IRS says it is fixing an error that prevented millions of people who used tax preparers from getting the second round of $600 stimulus payments. The agency said it has direct-deposited about 100 million economic impact payments…[b]ut some taxpayers using the ‘Get My Payment’ tool on the IRS website to track their stimulus relief are seeing that the money was deposited in a bank account they don’t recognize.”

“The Other Tech Giant: Wikipedia Is 20, And Its Reputation Has Never Been Higher” (The Economist). “On January 15th Wikipedia—’the free encyclopedia that anyone can edit’—will celebrate its 20th anniversary. It will do so as the biggest and most-read reference work ever. Wikipedia hosts more than 55m articles in hundreds of languages, each written by volunteers. Its 6.2m English-language articles alone would fill some 2,800 volumes in print. Alexa Internet, a web-analysis firm, ranks Wikipedia as the 13th-most-popular site on the internet, ahead of Reddit, Netflix and Instagram.”

“He Created The Web. Now He’s Out To Remake The Digital World.” (New York Times). “Three decades ago, Tim Berners-Lee devised simple yet powerful standards for locating, linking and presenting multimedia documents online. He set them free into the world, unleashing the World Wide Web. Others became internet billionaires, while Mr. Berners-Lee became the steward of the technical norms intended to help the web flourish as an egalitarian tool of connection and information sharing. But now, Mr. Berners-Lee, 65, believes the online world has gone astray.”

What we’re reading (1/9)

“Today’s Markets Are In Uncharted Territory” (Morningstar). “[C]current interest rates are ‘literally unprecedented in human history.’ Per [CFA Institute Research Foundation director of research Laurence] Siegel’s sources, which date back 5,000 years (!), nominal interest rates in countries (or, for most of that history, empires) that were successful enough to be remembered have always been positive. Until the mid-19th century, they were almost always highly positive, at 8% or more. The lone exception was the height of the Roman Empire, where rates briefly hit 4%.”

“‘We’re In Nosebleed Territory’ — Three Market Market Analysts On Where Stocks Head In 2021” (CNBC). “Stocks are on track to end the first trading week of 2021 higher, despite an unexpected drop in jobs last month, turmoil in Washington and the ongoing Covid pandemic. Here are three experts with their market outlooks for 2021.”

“The Market’s Strange Disregard For The Chaos In Washington” (New York Times). “A rampaging mob in the halls of Congress wasn’t enough to stop the American stock market…[t]he rally continued as Congress resumed the counting of the electoral vote and certified the election of Joseph R. Biden Jr. as the nation’s 46th president. And the party was still going on Friday, despite a Labor Department report showing that employers cut 140,000 jobs in December…[i]t was, in addition, the worst stretch, to date, for coronavirus deaths in the United States.”

“CEO Arrested In Capitol Riot Calls It ‘Worst Personal Decision Of My Life’” (Wall Street Journal). “The chief executive of a small Chicago area marketing technology firm was arrested after breaching the U.S. Capitol in riots this week, one of multiple executives to have participated. Bradley Rukstales, CEO of Cogensia, based in Schaumburg, Ill., was placed on a leave of absence as the firm assesses the situation, the company said. Mr. Rukstales was arrested Wednesday for unlawful entry, according to U.S. Capitol police.”

“A New Study Has Found Being Angry Increases Your Vulnerability To Misinformation” (PsyPost). “Human memory is prone to error — and new research provides evidence that anger can increase these errors. The new findings have been published in the scientific journal Experimental Psychology.”

What we’re reading (1/8)

“Federal Investigators Probing AmEx Card Sales Practices” (Wall Street Journal). “Federal investigators are probing business-card sales practices at American Express Co., according to people familiar with the matter. The inspectors general offices of the Treasury Department, Federal Deposit Insurance Corp. and Federal Reserve are investigating whether AmEx used aggressive and misleading sales tactics to sell cards to business owners and whether customers were harmed, the people said.”

“Hyundai Motor Says It’s In Early Talks With Apple To Develop A Car, Sends Shares Soaring 23%” (CNBC). “Shares of Hyundai Motor surged 23% after the South Korean automaker said it was in early-stage talks with Apple over potentially working together to develop an electric car. ‘We understand that Apple is in discussion with a variety of global automakers, including Hyundai Motor. As the discussion is at its early stage, nothing has been decided,’ a representative from Hyundai Motor told CNBC’s Chery Kang.”

“BlackRock Is Leading A $120 Trillion Investment Boom That Is Upending Wall St.” (OilPrice.com). “Investing will never be the same again. The $120 trillion sustainability trend has left no sector untouched, and it is fueling one of the biggest transfers in capital the world has ever seen. Blackrock, the world’s largest asset manager with $7 trillion under management, has already said that its clients are looking to double their ESG investment in the next 5 years. And that is only the beginning.”

“'Don't Sell A Share': Billionaire Investor Chamath Palihapitiya Says Tesla's Stock Could Triple From Current Levels, Making Elon Musk The First Trillionaire” (Business Insider). “The billionaire investor Chamath Palihapitiya said Tesla's stock could be worth three times its current valuation, which would make CEO Elon Musk the first trillionaire…[Palihapitiya] told investors in a CNBC interview on Thursday. He advised investors to get behind Musk and other entrepreneurs who wouldn't bend to short-term profits and who were striving to make the world a better place.”

“What, Did Something Happen In Washington…? Because Wall Street Sure As Hell Didn’t Notice” (Dealbreaker). “Over the last four years, Wall Street has demonstrated a truly remarkable capacity to shake off whatever crimes and horrors are unfolding outside of its boardrooms and trading floors, up to and including a global pandemic that’s killed 2 million people and shuttered every developed economy in the world. So, you know, what’s a little armed invasion of the U.S. Capitol in service of a petty tyrant to overthrow the very stability and system of government that business leaders (many of them with no small amount of fealty to said tyrant, however transactional) insist are the very things that undergird American capitalism and prosperity?”

What we’re reading (1/7)

“Here’s Why Washington Mostly Ignored The Chaos In Washington” (CNN Business). “[W]hy did Wall Street reach new heights even as the President doubled down on false claims that election results were fraudulent and thousands of his supporters broke into government buildings? Quite simply this: Investors don't really look at what's happening right now. They look to the future and what it could bring for the companies they invest in, or the economy as a whole.”

“Business Leaders Condemn Violence On Capitol Hill: ‘This Is Sedition’” (New York Times). “Hours after supporters of President Trump forced lawmakers from the floors of the Senate and House of Representatives, the Business Roundtable, a group of chief executives from some of the nation’s largest companies, called on the president and other officials to ‘put an end to the chaos and facilitate the peaceful transition of power.’”

“‘Disgusted’: Companies, Business Groups Decry ‘Lawless’ Mob Violence At Capitol” (Washington Post). “The mob scenes at the Capitol attracted harsh and unusual criticism from business groups, including the chief executive of one of the nation’s largest banks saying he was ‘disgusted’ and a manufacturing trade group calling it ‘sedition’ and suggesting President Trump needed to be immediately removed from office.”

“Horrified By Trump Supporters Storming The US Capitol, VCs Are Calling On Others To Stop Doing Deals With Trump's Son-In-Law Jared Kushner” (Business Insider). “Homebrew's Hunter Walk wrote on Twitter ‘don't be putting Jared Kushner on cap tables when this is all said and done,’ a post that was retweeted over 100 times by the tech community.” [“cap tables” = capitalization tables that list equity holders in companies, usually put together when they’re being funded or acquired'].

“Covid-19 Case Studies Make Their Way Into M.B.A. Curricula” (Wall Street Journal). “The courses are aimed at analyzing management decisions—good and bad—made during the pandemic and gleaning what lessons can be taught, given the benefit of hindsight.”

What we’re reading (1/6)

“Stress Test Looms For Financial System In 2021” (Financial Times). “Be warned. The global financial system in 2021 will face a gigantic stress test. This follows from one of the more important lessons that emerged from the coronavirus-induced market turmoil in March last year — a lesson that is worth revisiting. The so-called dash for cash was in part a reflection of how the big banks’ balance sheets had failed, since the 2008 financial crash, to keep pace with the growth in the stock of US Treasury securities that was spurred by the post-crisis surge in federal deficits.”

“Oil Soars Near $50 After OPEC And Russia Agree To Roll Over Production Cuts” (CNN Business). “A group of major oil producers have agreed to keep production broadly steady in February and March as the pandemic forces some economies back into lockdown and governments struggle to distribute vaccines. Russia and Kazakhstan will produce more oil over the coming months under the deal. Saudi Arabia, meanwhile, said it would voluntarily cut its production by 1 million barrels per day from January's levels.”

“China Hands Death Sentence To Former Asset-Management Head” (Wall Street Journal). “China sentenced the former chairman of one of the country’s biggest state-owned asset-management companies to death on bribery and corruption charges, a striking signal in Beijing’s campaign to rein in financial risk-taking. Lai Xiaomin, chairman of China Huarong Asset Management Co. from 2012 to 2018 when he was fired for graft, was accused by a local Chinese court in the northern city of Tianjin of taking bribes totaling a record high of more than 1.79 billion yuan, equivalent to $277 million.”

“Apple Adds New Section About Antitrust Risk To Its Annual Proxy Statement” (CNBC). “Apple’s board of directors regularly discusses antitrust risks, the company said on Tuesday in an annual filing. The language, which is new in this year’s proxy statement, highlights how regulatory pressure and antitrust issues have become a significant risk for Apple as policymakers increasingly scrutinize big technology companies.”

“The Lab-Leak Hypothesis” (New York Magazine). “There is no direct evidence for these zoonotic possibilities, just as there is no direct evidence for an experimental mishap — no written confession, no incriminating notebook, no official accident report. Certainty craves detail, and detail requires an investigation. It has been a full year, 80 million people have been infected, and, surprisingly, no public investigation has taken place. We still know very little about the origins of this disease.”

What we’re reading (1/5)

“NYSE No Longer Intends To Delist Chinese Firms Despite U.S. Executive Order” (Axios). “The New York Stock Exchange announced late Monday it no longer plans to delist three Chinese companies…[t]he NYSE said last Thursday it would suspend trading action from Jan. 7 for China Mobile Ltd., China Telecom Corp Ltd., China Unicom Hong Kong Ltd. following a Trump executive order that imposed restrictions on firms the U.S. identified as being affiliated with the Chinese military.”

“Where Is Jack Ma? Chinese Tycoon Not Seen Since October” (The Guardian). “Speculation is mounting over the whereabouts of the Chinese billionaire Jack Ma, who has not been seen or heard in public for more than two months. Ma, the co-founder and former chairman of the technology firm Alibaba, has fallen out of favour with China’s leadership. In late October, he stood alongside senior officials and delivered a blunt speech criticising national regulators, reportedly infuriating China’s president, Xi Jinping.”

“Low Taxes And High Temperatures Lure Finance Firms To Miami” (Wall Street Journal). “Private-equity giant Blackstone Group Inc. unveiled plans in October to open an office in the city to serve its internal technology needs that will eventually employ 215 people. Billionaire financier Carl Icahn moved his company to nearby Sunny Isles Beach earlier in 2020. Real-estate investor Starwood Capital Group is building a sleek new 144,000-square-foot headquarters in Miami Beach. Goldman Sachs Group Inc. is eyeing the region as a possible home for its asset-management arm, according to people familiar with the matter…A string of smaller tech and finance firms recently opened offices in the area, or said plans are in the works. Venture capitalists including Keith Rabois and Jon Oringer have moved here and hailed its emerging tech scene.”

“A Crypto Exchange Wants To List Futures Contracts Tied To The Outcome Of NFL Games To Help Sportsbooks Hedge Their Risks” (Business Insider). “In the vast US futures markets, traders can exchange derivatives on everything from cattle to crude oil, the S&P 500 Index, Treasury rates and bitcoin. The breadth of products is a reflection of the variety of American businesses, and futures are how these businesses, from a soybean farmer in Iowa to a hedge fund in New York City, hedge their exposure to future risks or speculate on the price of a given commodity or other benchmark. To date, however, traders have never had access to futures on the outcome of sports games, the results of which affect sportsbooks and stadium vendors and owners alike.”

“A Cure For Politician's’ Stock Trades” (New York Times). “[The SEC] could create a rule for broker-dealers that requires them to ask ‘politically exposed persons’ — lawmakers, their staff and relatives — to personally answer a questionnaire every time a stock trade is executed, even if a financial adviser instigated it. Those answers and details of the trades could then be forwarded to the S.E.C. and posted publicly on its website within 24 hours.”

2020 performance: a robustness check

If you’ve perused the FAQ section of this site, you know that I don’t directly hold the stocks recommended on this site in my personal account. That’s to avoid even the appearance of “front-running”—an unfortunately common (and also illegal) practice unsavory stock-selection newsletters have used that involves taking a position in a stock and then touting it and expecting to profit from others buying it up on your recommendation. But in the FAQs I note that, for a systematic trading strategy like Stoney Point’s, there’s an epistemological advantage to not buying the picks recommended here: I get to apply the exact same model to an entirely different universe of stocks, and therefore see if the model is robust “out-of-sample.” In data science, they call this “cross-validation.” Here’s what I wrote in the FAQs:

To the extent Stoney Point and its members use the models/strategies in investing company or personal funds, the models/strategies are applied to other stock universes, ensuring we never hold the same stocks in self-managed funds that we are publishing as our stock picks, but nevertheless allowing us to capitalize on our conviction in the strategy. Applying the Stoney Point strategies to other stock universes is intellectually useful as well: it allows us to cross-validate the strategy on what essentially amounts to a “holdout” sample, providing a test of the validity of the models.

Now that calendar year 2020 has reached it’s natural conclusion, and now that I’ve published some unaudited performance results for Stoney Point’s public picks (see here) it makes sense to take a look at how Stoney Point’s strategy performed in my personal portfolio as a robustness check. Unlike the public picks I publish here, which I select from among the S&P 500 constituents (excluding financial sector stocks), I select the picks in my personal portfolio from among the constituents of the S&P 1500 (excluding both financial sector stocks and all S&P 500 stocks). First, a couple of computational details, and then the results.

The results below are adjusted to exclude the impact of inflows and outflows. Naturally, if you have a portfolio worth $100, and then you add $10 to it in the middle of the year, and it ends up at $110 at the end of the year, your investment return wasn’t 10 percent, it was 0 percent (you have to subtract the effect of the contribution). In formal language, these are “time-weighted” returns.

I started applying the Stoney Point strategy to S&P 1500 (ex. financial sector stocks and ex. S&P 500 stocks) in early May, when I first started publishing Stoney Point’s picks (again, to avoid any possibility of any appearance of front-running). So January through April in the chart below isn’t really that informative of the strategy.

Throughout the entire year, I had a pretty sizeable allocation to the SPY ETF, which underperformed my portfolio overall. I had a smaller allocation to DBO (an oil futures ETF), which was actually down over 20 percent in the year. What that means is that the results below actually significantly understate the performance of the portion of my portfolio that was actually implementing Stoney Point’s strategy. I haven’t done the math myself yet to figure out the magnitude of the understatement, but in case you want to get a rough estimate yourself, about 30 percent of my portfolio was in SPY at the start of 2020, and between 5-10 percent was in DBO. I also had a de minimis legacy position in QCOM.

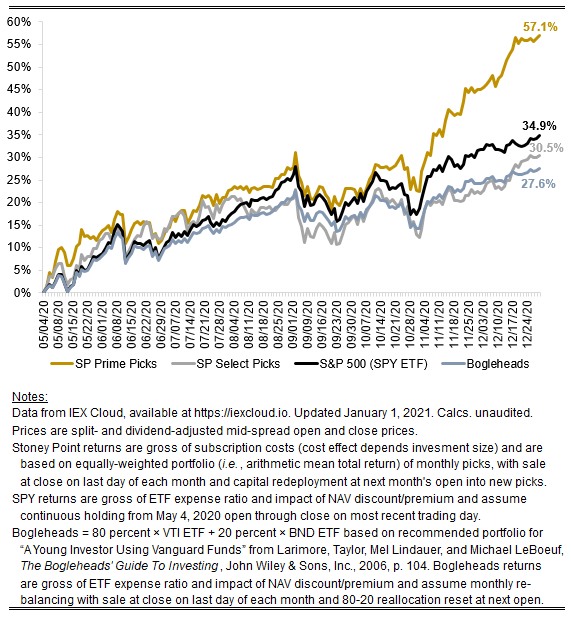

I’ve included a few different comparators in the chart below. First, I show the results for SPY, since it’s the single most active ETF in the world by some measures and the S&P 500 is a widely followed measure of the performance of U.S. equities overall. Second, I show results for two “target-date” funds from Goldman Sachs, one designed for people retiring around 2060, and one designed for people retiring around 2040. I include these because these are the sorts of funds that many Americans invest in through their 401(k) funds through their employers. I suspect these options (SPY or target-date funds) are pretty good proxies for what the average person might expect to get on their own (without Stoney Point’s help).

The punchline: the personal portfolio partially applying Stoney Point’s strategy (out-of-sample!) beat SPY by over 10 percentage points over the entire year, and beat the two Goldman target-date funds resembling common 401(k) investments by about 20 percentage points. And that’s despite not even applying the strategy in the first four months, and despite lower-performing allocations to SPY and DBO throughout the whole year.

Stoney Point personal account performance

(selecting from S&P 1500 ex. fin. ex. S&P 500)

A natural question, given the returns above, is whether the outperformance in the year is just compensation for risk. The market itself (as proxied by SPY) was up for the year, so if the picks Stoney Point’s model would dictate are correlated with SPY, but also riskier, you’d expect them beat SPY (assuming risk and return are correlated in general, which is a bedrock principle of finance). We can bring that question to the data to gather some evidence.

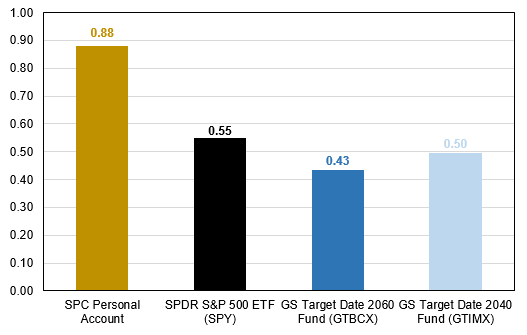

The simplest way to do that is to compare the four comparators in the chart above in terms of a measure of returns that accounts for risk (or variance) of the returns each earned. I’ve done that in the chart below. Specifically, I took the standard deviation of daily returns for each of the comparators above and annualized each to get a measure of realized volatility in the year. I then took the total return from the chart above for each comparator, and divided it by its volatility to get a “reward-to-volatility” ratio. Conceptually, this is very similar to the Sharpe Ratio reported by mutual funds and hedge funds (and essentially identical when the risk-free rate of interest is approximately 0 percent, as it has been in 2020).

The chart below shows how the comparators above line up in terms of this risk-adjusted measure. As the chart details, the personal portfolio partially using Stoney Point’s model significantly outperformed both the market and the Goldman target-date funds not just in terms of gross performance, but also on a risk-adjusted basis. That is, for each unit of volatility borne, my personal portfolio using Stoney Point’s strategy out-of-sample generated considerably more return than either SPY or the Goldman target-date funds.

Reward-to-volatility ratios

One more note: these results are for my personal portfolio, but I’m pleased to announce I will likely have another out-of-sample robustness check in the future. That’s because Stoney Point’s company account started trading today, the first trading day of 2021.

What we’re reading (1/4)

“S&P 500 Has Only Been This Expensive One Other Time — At The Peak Of The Dot-Com Bubble” (Yahoo! Finance). “By at least one popular investing metric, U.S. stocks have only been this expensive one other time in history, and it didn’t end well the first time around. According to the cyclically adjusted price-to-earnings ratio — a measure of market value based on 10 years of smoothed earnings data — the S&P 500 is at its second most expensive point in history.”

“Carl Icahn Sells More Than Half Of His Herbalife Stake” (Wall Street Journal). “Carl Icahn sold over half his stake in Herbalife Nutrition Ltd. and is relinquishing his seats on the nutritional-supplements company’s board, taking a step back from a longtime investment he fiercely defended against an onslaught from rival activist investor William Ackman.”

“Samsung To Launch Its Newest Galaxy Smartphones On Jan. 14, Earlier Than Usual” (CNBC). “Samsung said Monday its next smartphone announcement will be held on Jan. 14, where it is expected to launch the newest versions of its Galaxy flagship phones…The launch is set to take place the same week as the digital-only CES 2021 — the biggest tech show of the year, where major companies often show off their new products.”

“A History Of The 30-Year Feud Between Bill Gates And Steve Jobs, Whose Love-Hate Relationship Spurred The Success Of Microsoft And Apple” (Business Insider). “Bill Gates and Steve Jobs never quite got along. Over the course of 30-plus years, the two went from cautious allies to bitter rivals to something almost approaching friends — sometimes, they were all three at the same time. It seems unlikely that Apple would be where it is today without Microsoft, or Microsoft without Apple. Here's the history of the love-hate relationship between Steve Jobs and Bill Gates.”

“Wall Street Eyes Billions In The Colorado’s Water” (New York Times). “In the West, few issues carry the political charge of water. Access to it can make or break both cities and rural communities. It can decide the fate of every part of the economy, from almond orchards to ski resorts to semiconductor factories. And with the worst drought in 1,500 years parching the region, water anxiety is at an all-time high.”

What we’re reading (1/2/21)

“These Businesses Were The Surprise Winners of 2020” (CNN Business). “In a year of widespread and often devastating hardships, no business or industry came through 2020 untouched by the Covid-19 pandemic. But for some key sectors, the news wasn't all bad.”

“Is A Home Office Actually More Productive? Some Workers Think So.” (Wall Street Journal). “Some Americans have a new outlook on remote working: They prefer it. In June and July, a group of 1,388 people working from home were asked for their impressions of the experience by workplace consulting firm Global Workplace Analytics and video technology company Owl Labs. The new arrangement, it turns out, suited many of them.”

“VCs Say An Entirely New Category Of Startups Will Be Born In 2021 To Serve ‘Hybrid’ Employees” (Business Insider). “Tech investors say the shift to ‘hybrid work’ will create a new category of software to help companies keep track of people's schedules and preferences, as well as figure out their real estate needs in cities where their workers live.”

“Why American Telecoms Firms Are Splurging On 5G Spectrum” (The Economist). “It may be the most hyped technology since blockchain. But even sophisticated telecoms giants are now placing huge bets on 5G. In early December American regulators started the process of auctioning off radio-frequency bands needed to roll out superfast fifth-generation mobile networks. Industry experts had expected bids to come in at $25bn-30bn between them, less than the $45bn fetched in the last big 4G spectrum sale in 2015—but a tidy sum nonetheless.”

“IPOs in 2021: After A year Of Impressive Pandemic Offerings, These Tech Companies Expect To Keep It Rolling” (MarketWatch). “It is typical for companies to delay their initial public offerings when the market for them is weak, but the unprecedented year that is 2020 is ending with companies delaying IPOs because the market is too strong.”

December 2020 performance update

As we leap into 2021, it’s a natural time to look back on how things went in 2020.

But first, a quick December update. Both Stoney Point’s Prime picks and Select picks demolished the market in December. The market (proxied by the SPY ETF) was up 2.71 percent (the Bogleheads’ “young investor” portfolio performed similarly, at 2.70 percent for the month). The Prime picks were up 8.74 percent. The Select picks were up 6.94 percent, and have now passed the Bogleheads portfolio on a cumulative basis. This isn’t just Nasdaq exposure: the Nasdaq-tracking QQQ ETF was only up 4.12 percent in the period (and our picks are selected from the S&P 500 universe, not that Nasdaq universe, although there is some overlap).

As for 2020 performance overall, Prime also demolished the market over the entire period since I published our first Stoney Point picks at the beginning of May. The market was substantially up over the period in its own right (+34.9 percent), so it is safe to safe that market-tracking index funds and mutual funds overall did pretty well this year. The Prime picks, however, were up 57.1 percent in the period. Not only that, but Prime beat the market in 6/8 months to-date, and the magnitude of underperformance in the two months where SPY won the race was considerably less than the magnitude of outperformance in the six months where Prime won. If you have a coin that comes up heads 75 percent of the time and you get to flip it over and over again, the smart bet is (obviously) to bet on heads.

The degree and consistency of outperformance is encouraging. We will inevitably learn more as time goes on, particularly when we confront a big correction at some point in the future and get to see how Prime performs against the market in a bona fide down market in real time. But so far at least, from my vantage point, the results are beginning to call into question the often-repeated advice to “main street” investors to just buy the proverbial index and let it stew for a few decades. The chorus singing that refrain has grown steadily louder since the 1970s when Jack Bogle created the first equity index mutual fund, reaching a fever pitch in recent years as index funds and exchange-traded products proliferated (to the point that passive U.S. equity funds recently surpassed active funds in assets under management).

It is not bad advice for a world where active fund managers generally don’t know what they doing. It is even better advice for a world where not only do active fund managers not know what they doing, but they also do not know that they do not know what they’re doing, which may in fact be the world in which we live. That may sound harsh, but it really is not. The reality is that we simply do not have a great understanding at this point in the development of our collective asset pricing knowledge about what factors explain the so-called cross-section of expected stock returns—that is, how to predict that one stock is likely to do better than another in the future.

We once had a grand “equilibrium” theory—the Capital Asset Pricing Model, or “CAPM”—about the determinants of expected stock returns. Developed in the 1960s, some folks were even awarded Nobel Prizes for creating it (except Jack Treynor, who was an MBA, not a PhD, and was arguably first to put the pieces together). So influential has been the CAPM that about 74 percent of CFOs use it, 75 percent of finance professors recommend it, nearly every finance course teaches, and investment analysts and bankers all over Wall Street use it.

The trouble is, the CAPM doesn’t work, and we have known it doesn’t work for quite some time. It ought to be obvious that it shouldn’t work from the implausible underlying assumptions required to make the math work in the first place. Consider just a few (see here for a more comprehensive list): (1) all investors are rational and risk-averse; (2) all investors are well-diversified; (3) all investors can lend and borrow unlimited amounts of money at the same interest rate as the U.S. Treasury; (4) information is perfect, everybody has all that perfect information, and everybody interprets it the same way. These are ludicrous assumptions. Take the second one, which might seem at least somewhat plausible at first. As it turns out, #2 isn’t even remotely true. In fact, we know that the average investor holds only a “handful” of stocks!

As with any model of anything, garbage-in yields garbage out, and so it is with the CAPM. Of course, we have other models that might help predict returns. Famously, we have the Fama-French Three-Factor Model, which is what gave rise to this notion of “value” stocks and “growth” stocks. More recently, we have the Fama-French Five-Factor Model. But the asset pricing factors used in these models to predict returns were identified empirically, not theoretically, meaning they came about for the simple fact that they seemed to work in the historical data, not because there is some grand logic suggesting that they should work that we can rely upon to give us comfort that they will work when we are extrapolating out of the historical sample space and into the future. That, of course, is what an investor really wants and needs. And, more to the point, for all the merits of these models (and there are many, in my view), the market doesn’t seem to be using them. Rather, investors, including putatively sophisticated investors and funds, still measure their performance with respect to CAPM (see, e.g., the discussion on “alpha” here).

This big digression is all just to reiterate that the old advice to buy the index and let it ride is not, on the whole, bad advice. Yet the whole point of Stoney Point is to suggest, humbly, that there may be a third option besides betting the farm on active managers throwing darts at a dart board, on the one hand, and accepting a modest spread above Treasury rates that the market as a whole gets in an *average* year. That option follows the simple logic that if you can choose only the best picks from the index and re-balance regularly, you can create a portfolio that looks and feels a lot like “passive” investing, but does better than the index average. Hopefully more of that in 2021. In any case, happy new year!

As usual, you can check out the position-level December performance for our Prime and Select picks on our performance page and our picks for January here. Of Follow Stoney Point on Twitter for the latest updates (@StoneyPointCap)

Stoney Point performance since founding

What we’re reading (1/1/21)

Happy New Year!

“US Gas Prices End The Year Near A Pandemic-Era High” (CNN Business). “Gas prices are now close to their highest point since the pandemic prompted stay-at-home orders in March. The average price of a gallon of regular gas stood at $2.25 on Thursday, according to AAA, off only a penny from the nine-month highs reached last weekend but up 13 cents from a month ago.”

“Airlines Buckle Their Seat Belts For A Bumpy 2021” (Wall Street Journal).”Airlines are betting that coronavirus vaccines will reignite demand for travel this year. The question is when. Delta Air Lines Inc. Chief Executive Ed Bastian expects improvement starting this spring. Alaska Airlines President Ben Minicucci said he hopes to get back to 80% of pre-pandemic capacity by summer. United CEO Scott Kirby, however, said travel may not start getting back to normal until vaccines are widely distributed—in late 2021.”

“New York To Delist Chinese Telecom Firms In Symbolic Shift” (New York Times). “The New York Stock Exchange said it would delist China’s three big state-run telecommunications companies following an executive order from the Trump administration, in a symbolic severing of longstanding ties between the Chinese business world and Wall Street.”

“A Bitcoin ETF Could Finally Become A Reality In 2021 After An SEC Filing From VanEck” (Business Insider). “A bitcoin exchange-traded fund could go live in 2021 if an application from VanEck filed this week with the Securities and Exchange Commission proves successful. A bitcoin ETF operated by VanEck would follow the path of gold-trust ETFs in that it would hold the underlying bitcoin, the filing said. The VanEck Bitcoin Trust would reflect the performance of the MVIS CryptoCompare Bitcoin Benchmark Rate.”

“World’s Richest Men Added Billions To Their Fortunes Last Year As Others Struggled” (Washington Post). “The pandemic has forced untold hardships onto many Americans, with tens of millions of families now reporting that they don’t have enough to eat and millions more out of work on account of layoffs and lockdowns. America’s wealthiest, on the other hand, had a very different kind of year: Billionaires as a class have added about $1 trillion to their total net worth since the pandemic began. And roughly one-fifth of that haul flowed into the pockets of just two men: Jeff Bezos, chief executive of Amazon (and owner of The Washington Post), and Elon Musk of Tesla and SpaceX fame.”

What we’re reading (12/31)

“How The Pandemic Drove Massive Stock Market Gains, And What Happens Next” (CNBC). “The pandemic turned 2020 into a year of unprecedented events — not the least of which was the swift crash and then record-fast recovery of the stock market…the market has powered higher, fueled by expectations of a period of strong growth after vaccines are widely distributed and the economy fully reopens. Those same expectations have helped draw in a different cohort of investors, many of them young and new to investing. JMP estimates the brokerage industry added more than 10 million new accounts in 2020, with Robinhood alone likely representing about 6 million.”

“The Future Is Already Here” (Quillette). “We are, I argue, not in some era of fantastical innovation, nor are we really on the cusp of another. Rather, we have reached the end of one long and thrilling ride up the steep part of an S-shaped curve of technological development that kicked off with the steam engine and ended, surprisingly, jarringly, with the proliferation of the global Internet.”

“Finance Executives Look To Advance LIBOR Transition In 2021” (Wall Street Journal). “Efforts to skip the London interbank offered rate for new transactions by end of next year are forcing finance executives to take stock of their contracts, communicate with banks and investors and adjust their interest-rate cost calculations.”

“Here Are 9 Fascinating Facts To Know About BlackRock, The World’s Largest Asset Manager Popping Up In The Biden Administration” (Business Insider). “BlackRock, the world's largest investment manager, has become an increasingly influential Wall Street player in Washington, DC as a poster child of the revolving door between finance and politics.”

“Watch Boston Dynamics Robots Dance To ‘Do You Love Me’” (CNN Business). “Boston Dynamics' robots are back to let you know they can really shake 'em down. In a stunning dance video that's part celebration of an incredible engineering achievement and part advertisement for the robotics company, Boston Dynamics showed four of its robots performing fully choreographed dance moves to The Contours' hit ‘Do you love me.’”

January Prime + Select picks available now

The new Prime and Select picks for January are available starting now, based on a model run put through today (December 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Monday, January 4, 2020 (at the mid-spread open price) through the last trading day of the month, Friday, January 29 (at the mid-spread closing price). If you’re following the strategy perfectly, you’d want to close out your December positions by end-of-trading tomorrow (Friday, December 31), and re-balance at the start of trading in the new year.

You can check out the latest picks here, and stay tuned for a performance update for December.

What we’re reading (12/30)

“Wall Street Will Soon Have To Take Millennial Investors Seriously” (The Economist). Quick summary: Millennials are entering their peak earning years and are likely to be on the receiving end of one of the greatest transfers of wealth in human history in the next few decades (as of Q2 2020, U.S. Baby Boomers’ total assets stood at an astounding +$60 trillion, including property, pensions, equities, and other assets—over 6x Millennials’ total assets at the same point in time).

“Sears Is Dying A Quiet, Invisible Death” (CNN Business). “Sears has made it through another holiday shopping season. Just barely…But the fact that Sears isn't in bankruptcy is not a sign of health, according to experts. The company has made little effort to reinvigorate stores, grow sales or turn its failing business around.”

“Intel Stock Surges As Activist Daniel Loeb Pushes It To Explore Deals” (Barron’s). “Intel shares caught a bid in Tuesday’s trading after news emerged that activist investor Daniel Loeb of Third Point had acquired a significant stake in the chip maker and was pushing it to explore strategic alternatives. Shares were up as much as 5.7% in afternoon trading after Reuters reported that Loeb’s hedge fund has a nearly $1 billion stake in the $200 billion company.”

“In 2020, We Reached Peak Internet. Here’s What Worked—And What Flopped.” (Washington Post). “The pandemic put Silicon Valley’s boldest ideas for an app-operated life to the test, quickly and at scale. Now it’s time for an accounting of what worked, what flopped — and what’s the new normal.”

“IAC Enters The Spin Cycle” (Dealbreaker). “Internet holding company IAC, chaired by media mogul Barry Diller, announced yesterday it will spin-off its Vimeo video unit to shareholders…[Vimeo was] scooped-up by IAC in 2006 as part of a larger acquisition…[t]he pandemic has driven a surge in demand for software-as-a-service (SaaS) companies like Vimeo, which now boasts 1.5 million paying subscribers. That includes over 3,500 enterprise customers like Amazon, Starbucks and Rite Aid.”