December 2020 performance update

As we leap into 2021, it’s a natural time to look back on how things went in 2020.

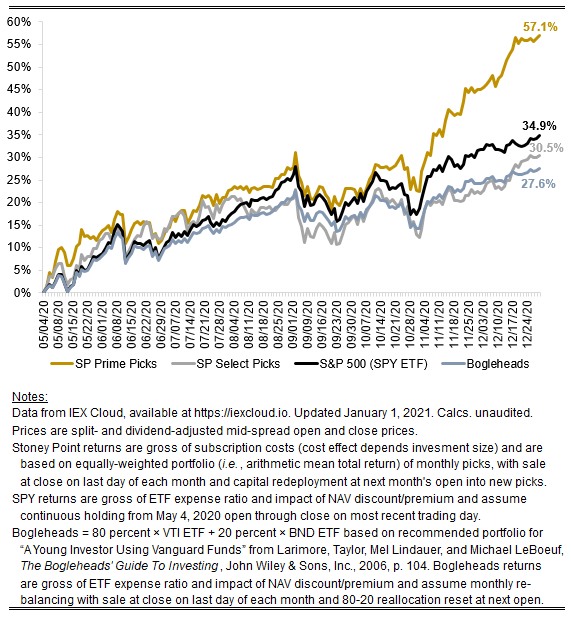

But first, a quick December update. Both Stoney Point’s Prime picks and Select picks demolished the market in December. The market (proxied by the SPY ETF) was up 2.71 percent (the Bogleheads’ “young investor” portfolio performed similarly, at 2.70 percent for the month). The Prime picks were up 8.74 percent. The Select picks were up 6.94 percent, and have now passed the Bogleheads portfolio on a cumulative basis. This isn’t just Nasdaq exposure: the Nasdaq-tracking QQQ ETF was only up 4.12 percent in the period (and our picks are selected from the S&P 500 universe, not that Nasdaq universe, although there is some overlap).

As for 2020 performance overall, Prime also demolished the market over the entire period since I published our first Stoney Point picks at the beginning of May. The market was substantially up over the period in its own right (+34.9 percent), so it is safe to safe that market-tracking index funds and mutual funds overall did pretty well this year. The Prime picks, however, were up 57.1 percent in the period. Not only that, but Prime beat the market in 6/8 months to-date, and the magnitude of underperformance in the two months where SPY won the race was considerably less than the magnitude of outperformance in the six months where Prime won. If you have a coin that comes up heads 75 percent of the time and you get to flip it over and over again, the smart bet is (obviously) to bet on heads.

The degree and consistency of outperformance is encouraging. We will inevitably learn more as time goes on, particularly when we confront a big correction at some point in the future and get to see how Prime performs against the market in a bona fide down market in real time. But so far at least, from my vantage point, the results are beginning to call into question the often-repeated advice to “main street” investors to just buy the proverbial index and let it stew for a few decades. The chorus singing that refrain has grown steadily louder since the 1970s when Jack Bogle created the first equity index mutual fund, reaching a fever pitch in recent years as index funds and exchange-traded products proliferated (to the point that passive U.S. equity funds recently surpassed active funds in assets under management).

It is not bad advice for a world where active fund managers generally don’t know what they doing. It is even better advice for a world where not only do active fund managers not know what they doing, but they also do not know that they do not know what they’re doing, which may in fact be the world in which we live. That may sound harsh, but it really is not. The reality is that we simply do not have a great understanding at this point in the development of our collective asset pricing knowledge about what factors explain the so-called cross-section of expected stock returns—that is, how to predict that one stock is likely to do better than another in the future.

We once had a grand “equilibrium” theory—the Capital Asset Pricing Model, or “CAPM”—about the determinants of expected stock returns. Developed in the 1960s, some folks were even awarded Nobel Prizes for creating it (except Jack Treynor, who was an MBA, not a PhD, and was arguably first to put the pieces together). So influential has been the CAPM that about 74 percent of CFOs use it, 75 percent of finance professors recommend it, nearly every finance course teaches, and investment analysts and bankers all over Wall Street use it.

The trouble is, the CAPM doesn’t work, and we have known it doesn’t work for quite some time. It ought to be obvious that it shouldn’t work from the implausible underlying assumptions required to make the math work in the first place. Consider just a few (see here for a more comprehensive list): (1) all investors are rational and risk-averse; (2) all investors are well-diversified; (3) all investors can lend and borrow unlimited amounts of money at the same interest rate as the U.S. Treasury; (4) information is perfect, everybody has all that perfect information, and everybody interprets it the same way. These are ludicrous assumptions. Take the second one, which might seem at least somewhat plausible at first. As it turns out, #2 isn’t even remotely true. In fact, we know that the average investor holds only a “handful” of stocks!

As with any model of anything, garbage-in yields garbage out, and so it is with the CAPM. Of course, we have other models that might help predict returns. Famously, we have the Fama-French Three-Factor Model, which is what gave rise to this notion of “value” stocks and “growth” stocks. More recently, we have the Fama-French Five-Factor Model. But the asset pricing factors used in these models to predict returns were identified empirically, not theoretically, meaning they came about for the simple fact that they seemed to work in the historical data, not because there is some grand logic suggesting that they should work that we can rely upon to give us comfort that they will work when we are extrapolating out of the historical sample space and into the future. That, of course, is what an investor really wants and needs. And, more to the point, for all the merits of these models (and there are many, in my view), the market doesn’t seem to be using them. Rather, investors, including putatively sophisticated investors and funds, still measure their performance with respect to CAPM (see, e.g., the discussion on “alpha” here).

This big digression is all just to reiterate that the old advice to buy the index and let it ride is not, on the whole, bad advice. Yet the whole point of Stoney Point is to suggest, humbly, that there may be a third option besides betting the farm on active managers throwing darts at a dart board, on the one hand, and accepting a modest spread above Treasury rates that the market as a whole gets in an *average* year. That option follows the simple logic that if you can choose only the best picks from the index and re-balance regularly, you can create a portfolio that looks and feels a lot like “passive” investing, but does better than the index average. Hopefully more of that in 2021. In any case, happy new year!

As usual, you can check out the position-level December performance for our Prime and Select picks on our performance page and our picks for January here. Of Follow Stoney Point on Twitter for the latest updates (@StoneyPointCap)