What we’re reading (1/6)

“Stress Test Looms For Financial System In 2021” (Financial Times). “Be warned. The global financial system in 2021 will face a gigantic stress test. This follows from one of the more important lessons that emerged from the coronavirus-induced market turmoil in March last year — a lesson that is worth revisiting. The so-called dash for cash was in part a reflection of how the big banks’ balance sheets had failed, since the 2008 financial crash, to keep pace with the growth in the stock of US Treasury securities that was spurred by the post-crisis surge in federal deficits.”

“Oil Soars Near $50 After OPEC And Russia Agree To Roll Over Production Cuts” (CNN Business). “A group of major oil producers have agreed to keep production broadly steady in February and March as the pandemic forces some economies back into lockdown and governments struggle to distribute vaccines. Russia and Kazakhstan will produce more oil over the coming months under the deal. Saudi Arabia, meanwhile, said it would voluntarily cut its production by 1 million barrels per day from January's levels.”

“China Hands Death Sentence To Former Asset-Management Head” (Wall Street Journal). “China sentenced the former chairman of one of the country’s biggest state-owned asset-management companies to death on bribery and corruption charges, a striking signal in Beijing’s campaign to rein in financial risk-taking. Lai Xiaomin, chairman of China Huarong Asset Management Co. from 2012 to 2018 when he was fired for graft, was accused by a local Chinese court in the northern city of Tianjin of taking bribes totaling a record high of more than 1.79 billion yuan, equivalent to $277 million.”

“Apple Adds New Section About Antitrust Risk To Its Annual Proxy Statement” (CNBC). “Apple’s board of directors regularly discusses antitrust risks, the company said on Tuesday in an annual filing. The language, which is new in this year’s proxy statement, highlights how regulatory pressure and antitrust issues have become a significant risk for Apple as policymakers increasingly scrutinize big technology companies.”

“The Lab-Leak Hypothesis” (New York Magazine). “There is no direct evidence for these zoonotic possibilities, just as there is no direct evidence for an experimental mishap — no written confession, no incriminating notebook, no official accident report. Certainty craves detail, and detail requires an investigation. It has been a full year, 80 million people have been infected, and, surprisingly, no public investigation has taken place. We still know very little about the origins of this disease.”

What we’re reading (1/5)

“NYSE No Longer Intends To Delist Chinese Firms Despite U.S. Executive Order” (Axios). “The New York Stock Exchange announced late Monday it no longer plans to delist three Chinese companies…[t]he NYSE said last Thursday it would suspend trading action from Jan. 7 for China Mobile Ltd., China Telecom Corp Ltd., China Unicom Hong Kong Ltd. following a Trump executive order that imposed restrictions on firms the U.S. identified as being affiliated with the Chinese military.”

“Where Is Jack Ma? Chinese Tycoon Not Seen Since October” (The Guardian). “Speculation is mounting over the whereabouts of the Chinese billionaire Jack Ma, who has not been seen or heard in public for more than two months. Ma, the co-founder and former chairman of the technology firm Alibaba, has fallen out of favour with China’s leadership. In late October, he stood alongside senior officials and delivered a blunt speech criticising national regulators, reportedly infuriating China’s president, Xi Jinping.”

“Low Taxes And High Temperatures Lure Finance Firms To Miami” (Wall Street Journal). “Private-equity giant Blackstone Group Inc. unveiled plans in October to open an office in the city to serve its internal technology needs that will eventually employ 215 people. Billionaire financier Carl Icahn moved his company to nearby Sunny Isles Beach earlier in 2020. Real-estate investor Starwood Capital Group is building a sleek new 144,000-square-foot headquarters in Miami Beach. Goldman Sachs Group Inc. is eyeing the region as a possible home for its asset-management arm, according to people familiar with the matter…A string of smaller tech and finance firms recently opened offices in the area, or said plans are in the works. Venture capitalists including Keith Rabois and Jon Oringer have moved here and hailed its emerging tech scene.”

“A Crypto Exchange Wants To List Futures Contracts Tied To The Outcome Of NFL Games To Help Sportsbooks Hedge Their Risks” (Business Insider). “In the vast US futures markets, traders can exchange derivatives on everything from cattle to crude oil, the S&P 500 Index, Treasury rates and bitcoin. The breadth of products is a reflection of the variety of American businesses, and futures are how these businesses, from a soybean farmer in Iowa to a hedge fund in New York City, hedge their exposure to future risks or speculate on the price of a given commodity or other benchmark. To date, however, traders have never had access to futures on the outcome of sports games, the results of which affect sportsbooks and stadium vendors and owners alike.”

“A Cure For Politician's’ Stock Trades” (New York Times). “[The SEC] could create a rule for broker-dealers that requires them to ask ‘politically exposed persons’ — lawmakers, their staff and relatives — to personally answer a questionnaire every time a stock trade is executed, even if a financial adviser instigated it. Those answers and details of the trades could then be forwarded to the S.E.C. and posted publicly on its website within 24 hours.”

2020 performance: a robustness check

If you’ve perused the FAQ section of this site, you know that I don’t directly hold the stocks recommended on this site in my personal account. That’s to avoid even the appearance of “front-running”—an unfortunately common (and also illegal) practice unsavory stock-selection newsletters have used that involves taking a position in a stock and then touting it and expecting to profit from others buying it up on your recommendation. But in the FAQs I note that, for a systematic trading strategy like Stoney Point’s, there’s an epistemological advantage to not buying the picks recommended here: I get to apply the exact same model to an entirely different universe of stocks, and therefore see if the model is robust “out-of-sample.” In data science, they call this “cross-validation.” Here’s what I wrote in the FAQs:

To the extent Stoney Point and its members use the models/strategies in investing company or personal funds, the models/strategies are applied to other stock universes, ensuring we never hold the same stocks in self-managed funds that we are publishing as our stock picks, but nevertheless allowing us to capitalize on our conviction in the strategy. Applying the Stoney Point strategies to other stock universes is intellectually useful as well: it allows us to cross-validate the strategy on what essentially amounts to a “holdout” sample, providing a test of the validity of the models.

Now that calendar year 2020 has reached it’s natural conclusion, and now that I’ve published some unaudited performance results for Stoney Point’s public picks (see here) it makes sense to take a look at how Stoney Point’s strategy performed in my personal portfolio as a robustness check. Unlike the public picks I publish here, which I select from among the S&P 500 constituents (excluding financial sector stocks), I select the picks in my personal portfolio from among the constituents of the S&P 1500 (excluding both financial sector stocks and all S&P 500 stocks). First, a couple of computational details, and then the results.

The results below are adjusted to exclude the impact of inflows and outflows. Naturally, if you have a portfolio worth $100, and then you add $10 to it in the middle of the year, and it ends up at $110 at the end of the year, your investment return wasn’t 10 percent, it was 0 percent (you have to subtract the effect of the contribution). In formal language, these are “time-weighted” returns.

I started applying the Stoney Point strategy to S&P 1500 (ex. financial sector stocks and ex. S&P 500 stocks) in early May, when I first started publishing Stoney Point’s picks (again, to avoid any possibility of any appearance of front-running). So January through April in the chart below isn’t really that informative of the strategy.

Throughout the entire year, I had a pretty sizeable allocation to the SPY ETF, which underperformed my portfolio overall. I had a smaller allocation to DBO (an oil futures ETF), which was actually down over 20 percent in the year. What that means is that the results below actually significantly understate the performance of the portion of my portfolio that was actually implementing Stoney Point’s strategy. I haven’t done the math myself yet to figure out the magnitude of the understatement, but in case you want to get a rough estimate yourself, about 30 percent of my portfolio was in SPY at the start of 2020, and between 5-10 percent was in DBO. I also had a de minimis legacy position in QCOM.

I’ve included a few different comparators in the chart below. First, I show the results for SPY, since it’s the single most active ETF in the world by some measures and the S&P 500 is a widely followed measure of the performance of U.S. equities overall. Second, I show results for two “target-date” funds from Goldman Sachs, one designed for people retiring around 2060, and one designed for people retiring around 2040. I include these because these are the sorts of funds that many Americans invest in through their 401(k) funds through their employers. I suspect these options (SPY or target-date funds) are pretty good proxies for what the average person might expect to get on their own (without Stoney Point’s help).

The punchline: the personal portfolio partially applying Stoney Point’s strategy (out-of-sample!) beat SPY by over 10 percentage points over the entire year, and beat the two Goldman target-date funds resembling common 401(k) investments by about 20 percentage points. And that’s despite not even applying the strategy in the first four months, and despite lower-performing allocations to SPY and DBO throughout the whole year.

Stoney Point personal account performance

(selecting from S&P 1500 ex. fin. ex. S&P 500)

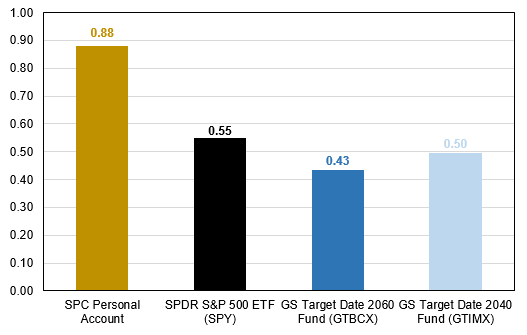

A natural question, given the returns above, is whether the outperformance in the year is just compensation for risk. The market itself (as proxied by SPY) was up for the year, so if the picks Stoney Point’s model would dictate are correlated with SPY, but also riskier, you’d expect them beat SPY (assuming risk and return are correlated in general, which is a bedrock principle of finance). We can bring that question to the data to gather some evidence.

The simplest way to do that is to compare the four comparators in the chart above in terms of a measure of returns that accounts for risk (or variance) of the returns each earned. I’ve done that in the chart below. Specifically, I took the standard deviation of daily returns for each of the comparators above and annualized each to get a measure of realized volatility in the year. I then took the total return from the chart above for each comparator, and divided it by its volatility to get a “reward-to-volatility” ratio. Conceptually, this is very similar to the Sharpe Ratio reported by mutual funds and hedge funds (and essentially identical when the risk-free rate of interest is approximately 0 percent, as it has been in 2020).

The chart below shows how the comparators above line up in terms of this risk-adjusted measure. As the chart details, the personal portfolio partially using Stoney Point’s model significantly outperformed both the market and the Goldman target-date funds not just in terms of gross performance, but also on a risk-adjusted basis. That is, for each unit of volatility borne, my personal portfolio using Stoney Point’s strategy out-of-sample generated considerably more return than either SPY or the Goldman target-date funds.

Reward-to-volatility ratios

One more note: these results are for my personal portfolio, but I’m pleased to announce I will likely have another out-of-sample robustness check in the future. That’s because Stoney Point’s company account started trading today, the first trading day of 2021.

What we’re reading (1/4)

“S&P 500 Has Only Been This Expensive One Other Time — At The Peak Of The Dot-Com Bubble” (Yahoo! Finance). “By at least one popular investing metric, U.S. stocks have only been this expensive one other time in history, and it didn’t end well the first time around. According to the cyclically adjusted price-to-earnings ratio — a measure of market value based on 10 years of smoothed earnings data — the S&P 500 is at its second most expensive point in history.”

“Carl Icahn Sells More Than Half Of His Herbalife Stake” (Wall Street Journal). “Carl Icahn sold over half his stake in Herbalife Nutrition Ltd. and is relinquishing his seats on the nutritional-supplements company’s board, taking a step back from a longtime investment he fiercely defended against an onslaught from rival activist investor William Ackman.”

“Samsung To Launch Its Newest Galaxy Smartphones On Jan. 14, Earlier Than Usual” (CNBC). “Samsung said Monday its next smartphone announcement will be held on Jan. 14, where it is expected to launch the newest versions of its Galaxy flagship phones…The launch is set to take place the same week as the digital-only CES 2021 — the biggest tech show of the year, where major companies often show off their new products.”

“A History Of The 30-Year Feud Between Bill Gates And Steve Jobs, Whose Love-Hate Relationship Spurred The Success Of Microsoft And Apple” (Business Insider). “Bill Gates and Steve Jobs never quite got along. Over the course of 30-plus years, the two went from cautious allies to bitter rivals to something almost approaching friends — sometimes, they were all three at the same time. It seems unlikely that Apple would be where it is today without Microsoft, or Microsoft without Apple. Here's the history of the love-hate relationship between Steve Jobs and Bill Gates.”

“Wall Street Eyes Billions In The Colorado’s Water” (New York Times). “In the West, few issues carry the political charge of water. Access to it can make or break both cities and rural communities. It can decide the fate of every part of the economy, from almond orchards to ski resorts to semiconductor factories. And with the worst drought in 1,500 years parching the region, water anxiety is at an all-time high.”

What we’re reading (1/2/21)

“These Businesses Were The Surprise Winners of 2020” (CNN Business). “In a year of widespread and often devastating hardships, no business or industry came through 2020 untouched by the Covid-19 pandemic. But for some key sectors, the news wasn't all bad.”

“Is A Home Office Actually More Productive? Some Workers Think So.” (Wall Street Journal). “Some Americans have a new outlook on remote working: They prefer it. In June and July, a group of 1,388 people working from home were asked for their impressions of the experience by workplace consulting firm Global Workplace Analytics and video technology company Owl Labs. The new arrangement, it turns out, suited many of them.”

“VCs Say An Entirely New Category Of Startups Will Be Born In 2021 To Serve ‘Hybrid’ Employees” (Business Insider). “Tech investors say the shift to ‘hybrid work’ will create a new category of software to help companies keep track of people's schedules and preferences, as well as figure out their real estate needs in cities where their workers live.”

“Why American Telecoms Firms Are Splurging On 5G Spectrum” (The Economist). “It may be the most hyped technology since blockchain. But even sophisticated telecoms giants are now placing huge bets on 5G. In early December American regulators started the process of auctioning off radio-frequency bands needed to roll out superfast fifth-generation mobile networks. Industry experts had expected bids to come in at $25bn-30bn between them, less than the $45bn fetched in the last big 4G spectrum sale in 2015—but a tidy sum nonetheless.”

“IPOs in 2021: After A year Of Impressive Pandemic Offerings, These Tech Companies Expect To Keep It Rolling” (MarketWatch). “It is typical for companies to delay their initial public offerings when the market for them is weak, but the unprecedented year that is 2020 is ending with companies delaying IPOs because the market is too strong.”

December 2020 performance update

As we leap into 2021, it’s a natural time to look back on how things went in 2020.

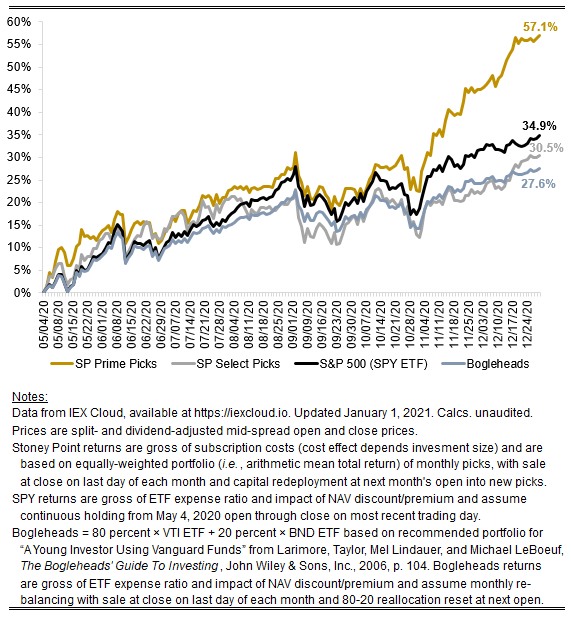

But first, a quick December update. Both Stoney Point’s Prime picks and Select picks demolished the market in December. The market (proxied by the SPY ETF) was up 2.71 percent (the Bogleheads’ “young investor” portfolio performed similarly, at 2.70 percent for the month). The Prime picks were up 8.74 percent. The Select picks were up 6.94 percent, and have now passed the Bogleheads portfolio on a cumulative basis. This isn’t just Nasdaq exposure: the Nasdaq-tracking QQQ ETF was only up 4.12 percent in the period (and our picks are selected from the S&P 500 universe, not that Nasdaq universe, although there is some overlap).

As for 2020 performance overall, Prime also demolished the market over the entire period since I published our first Stoney Point picks at the beginning of May. The market was substantially up over the period in its own right (+34.9 percent), so it is safe to safe that market-tracking index funds and mutual funds overall did pretty well this year. The Prime picks, however, were up 57.1 percent in the period. Not only that, but Prime beat the market in 6/8 months to-date, and the magnitude of underperformance in the two months where SPY won the race was considerably less than the magnitude of outperformance in the six months where Prime won. If you have a coin that comes up heads 75 percent of the time and you get to flip it over and over again, the smart bet is (obviously) to bet on heads.

The degree and consistency of outperformance is encouraging. We will inevitably learn more as time goes on, particularly when we confront a big correction at some point in the future and get to see how Prime performs against the market in a bona fide down market in real time. But so far at least, from my vantage point, the results are beginning to call into question the often-repeated advice to “main street” investors to just buy the proverbial index and let it stew for a few decades. The chorus singing that refrain has grown steadily louder since the 1970s when Jack Bogle created the first equity index mutual fund, reaching a fever pitch in recent years as index funds and exchange-traded products proliferated (to the point that passive U.S. equity funds recently surpassed active funds in assets under management).

It is not bad advice for a world where active fund managers generally don’t know what they doing. It is even better advice for a world where not only do active fund managers not know what they doing, but they also do not know that they do not know what they’re doing, which may in fact be the world in which we live. That may sound harsh, but it really is not. The reality is that we simply do not have a great understanding at this point in the development of our collective asset pricing knowledge about what factors explain the so-called cross-section of expected stock returns—that is, how to predict that one stock is likely to do better than another in the future.

We once had a grand “equilibrium” theory—the Capital Asset Pricing Model, or “CAPM”—about the determinants of expected stock returns. Developed in the 1960s, some folks were even awarded Nobel Prizes for creating it (except Jack Treynor, who was an MBA, not a PhD, and was arguably first to put the pieces together). So influential has been the CAPM that about 74 percent of CFOs use it, 75 percent of finance professors recommend it, nearly every finance course teaches, and investment analysts and bankers all over Wall Street use it.

The trouble is, the CAPM doesn’t work, and we have known it doesn’t work for quite some time. It ought to be obvious that it shouldn’t work from the implausible underlying assumptions required to make the math work in the first place. Consider just a few (see here for a more comprehensive list): (1) all investors are rational and risk-averse; (2) all investors are well-diversified; (3) all investors can lend and borrow unlimited amounts of money at the same interest rate as the U.S. Treasury; (4) information is perfect, everybody has all that perfect information, and everybody interprets it the same way. These are ludicrous assumptions. Take the second one, which might seem at least somewhat plausible at first. As it turns out, #2 isn’t even remotely true. In fact, we know that the average investor holds only a “handful” of stocks!

As with any model of anything, garbage-in yields garbage out, and so it is with the CAPM. Of course, we have other models that might help predict returns. Famously, we have the Fama-French Three-Factor Model, which is what gave rise to this notion of “value” stocks and “growth” stocks. More recently, we have the Fama-French Five-Factor Model. But the asset pricing factors used in these models to predict returns were identified empirically, not theoretically, meaning they came about for the simple fact that they seemed to work in the historical data, not because there is some grand logic suggesting that they should work that we can rely upon to give us comfort that they will work when we are extrapolating out of the historical sample space and into the future. That, of course, is what an investor really wants and needs. And, more to the point, for all the merits of these models (and there are many, in my view), the market doesn’t seem to be using them. Rather, investors, including putatively sophisticated investors and funds, still measure their performance with respect to CAPM (see, e.g., the discussion on “alpha” here).

This big digression is all just to reiterate that the old advice to buy the index and let it ride is not, on the whole, bad advice. Yet the whole point of Stoney Point is to suggest, humbly, that there may be a third option besides betting the farm on active managers throwing darts at a dart board, on the one hand, and accepting a modest spread above Treasury rates that the market as a whole gets in an *average* year. That option follows the simple logic that if you can choose only the best picks from the index and re-balance regularly, you can create a portfolio that looks and feels a lot like “passive” investing, but does better than the index average. Hopefully more of that in 2021. In any case, happy new year!

As usual, you can check out the position-level December performance for our Prime and Select picks on our performance page and our picks for January here. Of Follow Stoney Point on Twitter for the latest updates (@StoneyPointCap)

Stoney Point performance since founding

What we’re reading (1/1/21)

Happy New Year!

“US Gas Prices End The Year Near A Pandemic-Era High” (CNN Business). “Gas prices are now close to their highest point since the pandemic prompted stay-at-home orders in March. The average price of a gallon of regular gas stood at $2.25 on Thursday, according to AAA, off only a penny from the nine-month highs reached last weekend but up 13 cents from a month ago.”

“Airlines Buckle Their Seat Belts For A Bumpy 2021” (Wall Street Journal).”Airlines are betting that coronavirus vaccines will reignite demand for travel this year. The question is when. Delta Air Lines Inc. Chief Executive Ed Bastian expects improvement starting this spring. Alaska Airlines President Ben Minicucci said he hopes to get back to 80% of pre-pandemic capacity by summer. United CEO Scott Kirby, however, said travel may not start getting back to normal until vaccines are widely distributed—in late 2021.”

“New York To Delist Chinese Telecom Firms In Symbolic Shift” (New York Times). “The New York Stock Exchange said it would delist China’s three big state-run telecommunications companies following an executive order from the Trump administration, in a symbolic severing of longstanding ties between the Chinese business world and Wall Street.”

“A Bitcoin ETF Could Finally Become A Reality In 2021 After An SEC Filing From VanEck” (Business Insider). “A bitcoin exchange-traded fund could go live in 2021 if an application from VanEck filed this week with the Securities and Exchange Commission proves successful. A bitcoin ETF operated by VanEck would follow the path of gold-trust ETFs in that it would hold the underlying bitcoin, the filing said. The VanEck Bitcoin Trust would reflect the performance of the MVIS CryptoCompare Bitcoin Benchmark Rate.”

“World’s Richest Men Added Billions To Their Fortunes Last Year As Others Struggled” (Washington Post). “The pandemic has forced untold hardships onto many Americans, with tens of millions of families now reporting that they don’t have enough to eat and millions more out of work on account of layoffs and lockdowns. America’s wealthiest, on the other hand, had a very different kind of year: Billionaires as a class have added about $1 trillion to their total net worth since the pandemic began. And roughly one-fifth of that haul flowed into the pockets of just two men: Jeff Bezos, chief executive of Amazon (and owner of The Washington Post), and Elon Musk of Tesla and SpaceX fame.”

What we’re reading (12/31)

“How The Pandemic Drove Massive Stock Market Gains, And What Happens Next” (CNBC). “The pandemic turned 2020 into a year of unprecedented events — not the least of which was the swift crash and then record-fast recovery of the stock market…the market has powered higher, fueled by expectations of a period of strong growth after vaccines are widely distributed and the economy fully reopens. Those same expectations have helped draw in a different cohort of investors, many of them young and new to investing. JMP estimates the brokerage industry added more than 10 million new accounts in 2020, with Robinhood alone likely representing about 6 million.”

“The Future Is Already Here” (Quillette). “We are, I argue, not in some era of fantastical innovation, nor are we really on the cusp of another. Rather, we have reached the end of one long and thrilling ride up the steep part of an S-shaped curve of technological development that kicked off with the steam engine and ended, surprisingly, jarringly, with the proliferation of the global Internet.”

“Finance Executives Look To Advance LIBOR Transition In 2021” (Wall Street Journal). “Efforts to skip the London interbank offered rate for new transactions by end of next year are forcing finance executives to take stock of their contracts, communicate with banks and investors and adjust their interest-rate cost calculations.”

“Here Are 9 Fascinating Facts To Know About BlackRock, The World’s Largest Asset Manager Popping Up In The Biden Administration” (Business Insider). “BlackRock, the world's largest investment manager, has become an increasingly influential Wall Street player in Washington, DC as a poster child of the revolving door between finance and politics.”

“Watch Boston Dynamics Robots Dance To ‘Do You Love Me’” (CNN Business). “Boston Dynamics' robots are back to let you know they can really shake 'em down. In a stunning dance video that's part celebration of an incredible engineering achievement and part advertisement for the robotics company, Boston Dynamics showed four of its robots performing fully choreographed dance moves to The Contours' hit ‘Do you love me.’”

January Prime + Select picks available now

The new Prime and Select picks for January are available starting now, based on a model run put through today (December 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Monday, January 4, 2020 (at the mid-spread open price) through the last trading day of the month, Friday, January 29 (at the mid-spread closing price). If you’re following the strategy perfectly, you’d want to close out your December positions by end-of-trading tomorrow (Friday, December 31), and re-balance at the start of trading in the new year.

You can check out the latest picks here, and stay tuned for a performance update for December.

What we’re reading (12/30)

“Wall Street Will Soon Have To Take Millennial Investors Seriously” (The Economist). Quick summary: Millennials are entering their peak earning years and are likely to be on the receiving end of one of the greatest transfers of wealth in human history in the next few decades (as of Q2 2020, U.S. Baby Boomers’ total assets stood at an astounding +$60 trillion, including property, pensions, equities, and other assets—over 6x Millennials’ total assets at the same point in time).

“Sears Is Dying A Quiet, Invisible Death” (CNN Business). “Sears has made it through another holiday shopping season. Just barely…But the fact that Sears isn't in bankruptcy is not a sign of health, according to experts. The company has made little effort to reinvigorate stores, grow sales or turn its failing business around.”

“Intel Stock Surges As Activist Daniel Loeb Pushes It To Explore Deals” (Barron’s). “Intel shares caught a bid in Tuesday’s trading after news emerged that activist investor Daniel Loeb of Third Point had acquired a significant stake in the chip maker and was pushing it to explore strategic alternatives. Shares were up as much as 5.7% in afternoon trading after Reuters reported that Loeb’s hedge fund has a nearly $1 billion stake in the $200 billion company.”

“In 2020, We Reached Peak Internet. Here’s What Worked—And What Flopped.” (Washington Post). “The pandemic put Silicon Valley’s boldest ideas for an app-operated life to the test, quickly and at scale. Now it’s time for an accounting of what worked, what flopped — and what’s the new normal.”

“IAC Enters The Spin Cycle” (Dealbreaker). “Internet holding company IAC, chaired by media mogul Barry Diller, announced yesterday it will spin-off its Vimeo video unit to shareholders…[Vimeo was] scooped-up by IAC in 2006 as part of a larger acquisition…[t]he pandemic has driven a surge in demand for software-as-a-service (SaaS) companies like Vimeo, which now boasts 1.5 million paying subscribers. That includes over 3,500 enterprise customers like Amazon, Starbucks and Rite Aid.”

What we’re reading (12/29)

“The Coming Tech-Driven Productivity Leap” (Axios). “The coronavirus pandemic hit the global economy hard in 2020, but the economy may be close to consolidating years of technological advances — and ready to take off in a burst of productivity growth.”

“‘You Checked Tesla The Most’: Robinhood Recaps From A Volatile Year” (New York Times). “In 2020, wild fluctuations in the stock market caused by the pandemic turned millions of people into opportunistic investors. After stocks plunged in March, experienced traders and Nasdaq novices poured their dollars into buzzy tech companies like Tesla and Zoom, as well as businesses bludgeoned by Covid restrictions, including airlines, restaurants and cruises. To reflect a year of volatility and impulsive investments, Robinhood, the popular trading app that has spurred controversy by marketing itself to young people, released a year-end data dump for its users.”

“As 2021 Approaches, Watch Out For A Y2K-Style Stock-Market Correction, Says Strategist” (MarketWatch). “With just a handful of trading days before the year finishes, our call of the day says investors need to brace for a bumpy start to 2021 if we close out the year with stock-market records.”

“JPMorgan Is Acquiring A Major Credit Card Rewards Business In A Bet That Travel Will Rebound Next Year” (CNBC). “JPMorgan Chase has agreed to purchase one of the biggest third-party credit card loyalty operators in a bet that pleasure travel will rebound sharply after the coronavirus pandemic subsides, CNBC has learned.”

“SEC Accuses 23-Year-Old Crypto Hedge Fund Founder Of Fraud” (Reuters). “The U.S. Securities and Exchange Commission has sued a 23-year-old Australian hedge fund founder in Manhattan federal court for allegedly defrauding investors in his $92.4 million cryptocurrency arbitrage fund.”

What we’re reading (12/28)

“Investors Double Down On Stocks, Pushing Margin Debt To Record” (Wall Street Journal). “[As the market soared during the pandemic,] [s]ome investors have been tempted to chase bigger gains—and have exposed themselves to potentially devastating losses—through riskier plays, such as concentrated positions, trading options and leveraged exchange-traded funds. Others are borrowing against their investment portfolios, pushing margin balances to the first record in more than two years, to buy even more stock.”

“Dreading Or Dreaming Of A Return To The Office In 2021” (Washington Post). “The country is deep in the bleakest period of the pandemic, with thousands of Americans dying each day. That reality is not lost on affluent remote workers, who are quick to express gratitude for their own good fortune. They feel guilty complaining about Zoom fatigue and social isolation when they are working in relative safety and comfort. Yet with the Food and Drug Administration’s approval of two coronavirus vaccines, many of these remote employees find themselves imagining the new shape of their work lives in a post-pandemic America. Some glimpse a proverbial light at the end of the tunnel; others see an oncoming train.”

“Does Working From Home Make Employees More Productive?” (The Economist). “Both employers and employees have grumbled that the shift to home-working has been disruptive. But according to new research by Natalia Emanuel and Emma Harrington, two doctoral students in economics at Harvard, firms may be better off.”

“Equities Likely To Grow, But Finding Yield Remains Difficult” (CNBC). “Bottom-scraping interest rates in 2020 were a major factor fueling a stock market that, after plummeting in March from the pandemic, rallied to post a banner year. Low interest rates also vexed investors seeking yield from bonds purchased to diversify portfolios and reduce risk. But while bond yields likely will remain paltry in 2021, much higher yields are available from alternative fixed-income investments that individual investors typically overlook.”

“This Japanese Shop Is 1,020 Years Old. It Knows A Bit About Surviving Crises.” (New York Times). “Naomi Hasegawa’s family sells toasted mochi out of a small, cedar-timbered shop next to a rambling old shrine in Kyoto. The family started the business to provide refreshments to weary travelers coming from across Japan to pray for pandemic relief — in the year 1000. Now, more than a millennium later, a new disease has devastated the economy in the ancient capital, as its once reliable stream of tourists has evaporated. But Ms. Hasegawa is not concerned about her enterprise’s finances.”

January picks available soon

Reminder: we’ll be publishing our Prime and Select picks for the month of January on or before 12/31. As always, we’ll be measuring SPC’s performance for the month of December, as well as SPC’s cumulative performance, assuming the sale of the December picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Thursday, December 31). Likewise, performance tracking for the month of January will assume the January picks are bought at the open price (at the mid-point of the opening bid and ask prices) the first trading day of the month (Monday, January 4).

Stay tuned for the new picks and the performance updates and be sure to follow us on Twitter (@StoneyPointCap).

What we’re reading (12/17)

“Trump Signs COVID-19 Relief Package After Threatening To Derail It” (NPR). “President Trump has signed a coronavirus relief and spending package after threatening to derail the bill by calling for changes after it had passed Congress. The White House announced the signature Sunday night. The move puts an end to the uncertainty over when millions of Americans will receive the desperately needed economic relief provided by the massive package. The legislation includes more than $900 billion in aid for individuals and small businesses.”

“Search Engine Start-ups Try To Take On Google” (Financial Times). “A new batch of search engine start-ups positioning themselves as potential rivals to Google is hoping that growing regulatory pressure will finally reverse two decades of the search giant’s dominance. The latest challengers include Neeva, launched by two former Google executives, and You.com, founded by Salesforce.com’s former chief scientist, as well as Mojeek, a UK-based start-up with growing ambitions to build its own index of billions of web pages.”

“Insiders Cash Out Via IPOs As Investor Optimism Becomes Excessive, NDR Says” (Business Insider). “Company insiders are taking advantage of ‘excessive optimism’ among investors and cashing out via IPOs and secondary offerings, according to a note from Ned Davis Research. A survey conducted by the National Association of Active Investment Managers has registered above 100% invested for five weeks in a row. The survey suggests that optimism is high and active managers are fully invested.”

“New York Healthcare Provider May Have Fraudulently Obtained Vaccine Doses” (CNBC). “Doses of the coronavirus vaccine may have been wrongfully obtained and distributed throughout parts of New York, the state’s top doctor said Saturday…[t]he vaccine doses allegedly diverted for ‘members of the public’ circumvent the state’s plan to prioritize the inoculation of frontline healthcare professionals and residents of long-term care facilities, Zucker said. New York’s initial rollout of the vaccine it still limited to hospitals and nursing homes.”

“Washington’s Secret To The Perfect Zoom Bookshelf? Buy It Wholesale.” (Politico). “Books by the Foot, a service run by the Maryland-based bookseller Wonder Book, has become a go-to curator of Washington bookshelves, offering precisely what its name sounds like it does…[w]hen the coronavirus pandemic arrived, Books by the Foot had to adapt to a downturn in office- and hotel-decor business—and an uptick in home-office Zoom backdrops for the talking-head class.”

What we’re reading (12/25)

Merry Christmas!

“Are You Sure You Want To Go Back To The Office?” (New York Times). “When I talked to dozens of analysts, H.R. experts, architects, consultants, real estate agents and office furniture designers, the consensus was clear: The future of office work is flexibility. At one end of that flexibility spectrum, there will be fully ‘distributed’ companies like the software maker GitLab, with no headquarters and employees scattered across the world. At the other, there’ll be more old-fashioned organizations that demand face time in the office, but whose belief in the infeasibility of remote work has been permanently undercut. And then there’s the vast, corporate in between.”

“Covid-19 Caused Chaos For Investors In 2020. These Hedge Funds Earned Billions.” (Wall Street Journal). “For the year through November, stock picking hedge funds posted their best performance relative to the total-return of the S&P 500 since 2010, according to data provider HFR, earning 11.9%. Their strong showing in 2020 partly reversed their underperformance relative to a portfolio of stocks and bonds over a one, three, five and 10-year period, according to Goldman Sachs Group Inc.”

“Some NYSE Operations To Return To Remote Work Amid Case Surge” (NBC News). “Some New York Stock Exchange workers will return to remote working amid a surge in Covid-19 cases in the largest city in the U.S. ‘On Monday, December 28, 2020, in response to changes in the NYC-area public health conditions, NYSE Designated Market Makers (DMMs) will temporarily return to remote operations (with limited exceptions),’ the NYSE said in a statement on Tuesday.”

“Biden’s Post-Election Stock Market Bump Is Easily Beating Trump’s” (CNN Business). “The Biden era is off to a roaring start on Wall Street, even surpassing the euphoria following President Donald Trump's upset victory in 2016. The S&P 500 has surged 10% since Election Day to all-time highs. That nearly doubles the 5.5% rally during the same post-election period in 2016.”

“Michael Jackson’s Neverland Ranch Sold To Billionaire” (ABC News). “Michael Jackson’s Neverland Ranch in California has found a new owner in billionaire businessman Ron Burkle. Burkle views the 2,700-acre property in Los Olivos, near Santa Barbara, as a land banking opportunity, his spokesman said Thursday in an email. The Wall Street Journal reports the property was sold for $22 million to Burkle, an associate of the late pop star and co-founder of the investment firm Yucaipa Companies. The asking price of the property was $100 million in 2016 then dropped to $67 million a year later.”

What we’re reading (12/24)

Merry Christmas Eve!

“Stocks Pare Gains; What The Santa Claus Rally Says About The Stock Market” (Investor’s Business Daily). “The Russell 2000 jumped to a 0.9% lead in Thursday's early market but reversed lower and was off 0.4% at midday. The small-cap benchmark is still up about 10% this month, adding to a record 18% surge in November. For the year, the Russell 2000 is up nearly 20%, beating the S&P 500's 14.3% increase. The Nasdaq composite and S&P 500 had only a sliver of a gain left, trading less than 0.1% higher at midday. The Dow Jones Industrial Average was flat.”

“Britain And E.U. Reach Landmark Deal On Brexit” (New York Times). “Britain and the European Union struck a hard-fought trade agreement on Thursday, settling a bitter divorce that stretched over more than four years and setting the terms for a post-Brexit future as close neighbors living apart. The deal, which must be ratified by the British and European Parliaments, came together in Brussels after 11 months of grinding negotiations, culminating in a last-minute haggle over fishing rights that stretched into Christmas Eve, just a week before a year-end deadline.”

“Stocks Ready To Close Out Powerful 2020 As Risks Loom In January” (CNBC). “At the close of trading next Thursday, the bull market will be ready to run into 2021 but probably at a slower pace. January is the month that Wall Street tradition says sets the tone for the year—‘so goes January, so goes the year,’ as the saynig goes. This January could be challenging, with the spreading pandemic slowing the economy and the important Georgia Senate run off elections on Jan. 5.”

“States Are Doing Battle For Your Tax Dollars” (Dealbreaker). “If you've seen The Sopranos, you know it's not feasible to ‘tax’ someone outside of your jurisdiction. With work-from-home becoming a reality in 2020 (and states desperate for tax revenue) a fight is brewing in the Supreme Court over which state has the right to tax remote workers' pay.”

“Covid-19 Stimulus Package Delivers A Christmas Haul For Loggers” (Wall Street Journal). “[T]ucked inside the new $900 billion coronavirus relief package passed by Congress, but facing an uncertain fate with President Trump, is $200 million in aid for the loggers and the trucking companies that transport their wares to paper mills and other processing facilities. The reason: an only-in-Washington tale of the importance of lobbying and political connections.”

What we’re reading (12/22)

“How Amazon Wins: By Steamrolling Rivals And Partners” (Wall Street Journal). “Jeff Bezos built Amazon.com Inc. from his garage with an underdog’s ambition to take on the establishment. He imbued staff with an obsession to grow fast by grabbing customers using the biggest selection and lowest prices. Today, he has more than 1.1 million employees and a market valuation around $1.6 trillion. But Amazon never really grew up. Mr. Bezos still runs it with the drive of a startup trying to survive.”

“Goldman Sachs, Once Reserved For The Rich, Is Close To Offering Wealth Management For The Masses” (CNBC). “Goldman Sachs has for decades set its sights on the global elite when it comes to wealth management. Now, it’s opening up to everyone else. The bank has begun internal testing of a new automated investment service ahead of a broader rollout early next year, according to an email obtained exclusively by CNBC. Employees who sign on to the digital service, called Marcus Invest, will pay an annual management fee of 0.15%, according to the company memo.”

“The Stimulus Deal: What’s In It For You” (New York Times). “Another dose of relief is finally on the way for the millions of Americans facing financial distress because of the coronavirus pandemic. Congress on Monday night passed an economic relief package that will provide a round of $600 stimulus payments to most Americans and partly restore the enhanced federal unemployment benefit, offering $300 for 11 weeks. The agreement also contains provisions related to student loans, rental assistance and medical bills. The legislation, which is 5,600 pages long, would provide welcome, albeit temporary, assistance to many. How quickly the money reaches your pocket will depend on several factors, though.”

“Apple’s Market Value Grows By $102 Billion After Report Says The Company Aims To Produce Electric Cars By 2024” (Business Insider). “Apple gained 4.7% on Tuesday following a Reuters report on Monday that said the iPhone maker planned to produce electric cars by 2024. The tech giant aims to compete in the rapidly expanding electric-car market with new battery technologies to improve vehicles' safety and range, according to the report. That could ‘radically’ cut down on battery costs, a source familiar with the plans told Reuters.”

“There Is At Least One Law Danske Bank Hasn’t Broken” (Dealbreaker). “Danske Bank has certainly done a great number of things wrong. Laundering money, mostly, and lots of it, for lots of people on a list of people for whom it should most especially not been laundering money. It was also, predictably and necessarily, given the above, pretty bad at detecting money laundering or listening to those who did. And, of course, it did business with Deutsche Bank, a serious enough lapse in judgement in and of itself, even before you realize that most of that business was—you guessed it—laundering money. But one thing it does not seem to have done wrong is violate U.S. sanctions while doing all of that money laundering.”

Prime and Select crushing it again this month

A little mid-month performance update (through Friday’s close). Happy Winter Solstice!

Prime Picks v. SPY (12/1-12/18)

Select Picks v. SPY (12/1-12/18)

What we’re reading (12/21)

“Stimulus Deal Provides Economic Relief, For Now” (New York Times). “The congressional agreement on a $900 billion dose of aid to fuel the slowing economic recovery has probably spared millions of Americans from a winter of poverty and kept the country from falling back into recession…[but] [t]he injection of money comes months too late for tens of thousands of failed businesses, however, and it may not be enough to sustain unemployed workers until the labor market rebounds. Moreover, it could be the last help from Washington the economy gets anytime soon.”

“Stocks Around The World Slump As Virus Mutation Hits Economy” (ABC News). “Stocks are slumping Monday as a new, potentially more infectious strain of the coronavirus has countries around the world restricting travel from the United Kingdom, raising worries that the economy is about to take even worse punishment. The S&P 500 was 1.9% lower in morning trading, putting it on track to fall for a second day from its record set on Thursday. The Dow Jones Industrial Average was down 379 points, or 1.3%, at 29,799, as of 10:23 a.m. Eastern time, and the Nasdaq composite was 1.7% lower.”

“Wall Street Analysts Make A Big S&P 500 Call For 2021. Market History Says Ignore Them” (CNBC). “[Equity research] [a]nalysts have overestimated the year-end price for the S&P 500 in 12 of the past 15 years, according to a recent analysis from FactSet. Based on the average overestimation, the S&P 500 could actually end 2021 below its current levels.”

“Walmart Is Attempting To Solve One Of The Biggest Pain-Points Of Online Shopping” (CNN Business). “Walmart is attempting to solve one of the biggest pain-points of online shopping — the dreaded return — with a new service. The retailer announced Monday that it will pick up items shipped and sold by Walmart.com from customers' homes through a new partnership with FedEx (FDX). Walmart said the ‘incredibly convenient’ option is free and will remain in place beyond the busy holiday shopping season.”

“The Journalist And The Pharma Bro” (Elle). “Over the course of nine months, beginning in July 2018, [reporter Christie] Smythe quit her job, moved out of the apartment, and divorced her husband. What could cause the sensible Smythe to turn her life upside down? She fell in love with a defendant whose case she not only covered, but broke the news of his arrest. It was a scoop that ignited the Internet, because her love interest, now life partner, is not just any defendant, but Martin Shkreli: the so-called ‘Pharma Bro’ and online provocateur, who increased the price of a lifesaving drug by 5,000 percent overnight and made headlines for buying a one-off Wu-Tang Clan album for a reported $2 million. Shkreli, convicted of fraud in 2017, is now serving seven years in prison.”

What we’re reading (12/20)

“Here’s A Market Forecast: 2021 Will Be Hard To Predict” (Wall Street Journal). “By their nature, once-in-100-year events are hard to predict. But the real lesson of 2020 is that even correctly predicting fundamentals just isn’t enough. What mattered this year wasn’t earnings, but the speed and scale of the response by central banks and governments, alongside a recognition that the U.S. stock market doesn’t reflect the economy.”

“Are We On The Verge Of Another Financial Crisis?” (Harvard Business Review). “John Macomber, a senior lecturer in the finance unit at Harvard Business School, believes we may be on the verge of a collapse in housing prices and an ensuing financial crisis — this time caused by our failure to acknowledge and confront climate change. In a phone interview and a written email exchange, he shared his reasoning and what the incoming Biden administration can do to prevent this scenario.”

“Trump Signs Bill That Could Lead To Delisting Of Chinese Stocks Including Nio, Li, Xpeng, Alibaba” (Benzinga). “U.S. President Donald Trump has signed a bill calling for the delisting of foreign companies that don't adhere to the same accounting transparency standards that securities regulators impose on public U.S. firms…The Holding Foreign Companies Accountable Act takes aim at Chinese companies and drew rare strong bipartisan support in the U.S. Congress before arriving on Trump's desk. The act says delisting could happen if a given company doesn't comply with audit inspections three years in a row.”

“Pain, Despair And Poverty Reach Fever Pitch For Unemployed Workers” (CNBC). “It has been nine months since the coronavirus pandemic began its assault on American livelihoods. Since then, financial desperation has steadily grown for jobless Americans across the country. Almost 8 million people have fallen into poverty since the summer. Savings for many, especially the lowest earners, are either dwindling or gone. Millions of households owe thousands in back rent and utilities — and face a renewed threat of eviction in the new year. A growing share of unemployed individuals say their households don’t have enough to eat.”

“Paul McCartney As A Management Study” (Marginal Revolution). “His vocal range once spanned over four octaves, he is sometimes considered the greatest bass player in the history of rock and roll, and he was the first popular musician to truly master the recording studio, again with zero initial technical or musical education of any sort. He is perhaps the quickest learner the music world ever has seen…[h]e was a very keen businessman in buying up the rights to music IP at just the right time, making him a billionaire.”