What we’re reading (10/25)

“The Stock Market Enters The Danger Zone” (Barron’s). “Investors were disappointed by a mixed week for the stock market. They could look back longingly on it if everything goes wrong over the next couple of weeks…Economically sensitive stocks took the worst hit. Retail, banking, and industrial stocks all fell between 2% and 3%, and it appeared that investors were simply taking profits after the S&P 500 entered this past week up 23% in 2024.”

“France’s Financial Morass Produces A Harsh Critique From Moody’s (New York Times). “France has become one of the most financially troubled countries in Europe, with a ballooning debt and deficit. The European Commission has threatened sanctions, including enforced limits on spending, for breaching the bloc’s fiscal discipline rules.”

“NASA Head: Matt Damon’s Potato Farm On Mars Isn’t ‘Too Far Off’” (Semafor). “Elon Musk isn’t the only one with Mars dreams. NASA Administrator Bill Nelson predicted that humans will travel to the planet for the first time in the 2040s. ‘We are getting everything we need to know about how to sustain human life in that very hostile atmosphere,’ Nelson said during Semafor’s World Economy Summit in Washington, DC on Friday, adding that while it takes humans less than a week to travel to the moon, it would take months to travel to Mars. ‘Matt Damon showed us that we can raise potatoes on Mars,’ he joked, referencing the actor’s hit 2015 film The Martian. ‘That’s not too far off, by the way. I have actually seen plants growing in lunar soil that we brought back a half a century ago.’”

“Silicon Valley’s Elite Pour Money Into Blotting Out The Sun” (Bloomberg). “Venture capitalists, startup founders and tech executives are funding studies, experiments and small deployments of controversial technology that could cool the planet.”

“JPMorgan Is Boosting Its Junior-Banker Ranks” (Business Insider). “JPMorgan Chase is amid an off-cycle hiring spree for junior investment bankers, according to people familiar with the bank's recruitment efforts and to its online jobs board. The bank recently rolled out parameters to protect its analysts and associates from burnout and reported a big jump in its dealmaking fees.”

What we’re reading (10/24)

“How Intel Got Left Behind In The A.I. Chip Boom” (New York Times). “In 2005, there was no inkling of the artificial intelligence boom that would come years later. But directors at Intel, whose chips served as electronic brains in most computers, faced a decision that might have altered how that transformative technology evolved. Paul Otellini, Intel’s chief executive at the time, presented the board with a startling idea: Buy Nvidia, a Silicon Valley upstart known for chips used for computer graphics. The price tag: as much as $20 billion…As [Intel’s’ valuation has sunk, some big tech companies and investment bankers have been considering what was once unthinkable: that Intel could be a potential acquisition target.”

“New ‘Call Of Duty’ Tests Microsoft’s $75 Billion Bet On Future Of Videogames” (Wall Street Journal). “The tech giant’s acquisition of Activision Blizzard, the biggest deal in its history, was a wager on the future of how people will access and pay for videogames. Microsoft sought to position itself as a disrupter, believing the streaming revolution would migrate from television and film toward a growing, interactive medium with billions of rabid fans.”

“Capri Stock Craters 46% After Judge Blocks $8.5 billion Tapestry Deal” (Yahoo Finance). “Tapestry and Capri had announced their proposed merger last year. The combination would have brought together six high-profile fashion brands under one roof: Tapestry’s Coach, Stuart Weitzman, and Kate Spade with Capri’s Versace, Jimmy Choo, and Michael Kors.”

“Paul Singer Settles For Torturing Southwest CEO Rather Than Firing Him” (Dealbreaker). “Unlike former Starbucks CEO Laxman Narasimhan (and his outgoing chairman, Gary Kelly, who’s now stepping down next month as opposed to next year), Southwest Airlines CEO Robert Jordan gets to keep his job. This is because his board of directors, faced with a do-or-die showdown with activist hedge fund Elliott Management in early December at which Elliott would seek to fire eight of its members, at last—like so many others before it—recognized the folly of playing chicken with Elliott chief Paul Singer and gave him five seats. Whether Jordan will ultimately want to keep that job is another matter. Elliott has accused him of presiding ‘over a period of stunning underperformance’ and being ‘incapable of delivering on Southwest’s potential’[.]”

“Painting By AI Robot Ai-Da Could Bring More Than $120,000 At Sotheby’s” (The Art Newspaper). “Sotheby’s will sell its first work credited to a humanoid robot using artificial intelligence (AI) later this month. A.I. God. Portrait of Alan Turing (2024) was created by Ai-Da Robot, the artist robot and brainchild of Oxford gallerist Aidan Meller. ‘What makes this work of art different from other AI-generated works is that with Ai-Da there is a physical manifestation, and this is the first time a work from a robot of this type has ever come to auction,’ Meller told CBS MoneyWatch, which first reported the sale.”

What we’re reading (10/23)

“Surge In Treasury ‘Term Premium’ Warns Of Rising Bond Risks” (Bloomberg). “The US Treasury market, already mired in one of its worst losing stretches of the year, is flashing a fresh warning sign of mounting risks as yields surge.”

“‘Back to Starbucks’ Could Have A Retro Feel—And Valuation” (Wall Street Journal). “A reset might help Starbucks get its mojo back but, even if it rights the ship, it probably can’t grow at that pace again, and that should be reflected in its share price. Back in 1998, Starbucks was already so ubiquitous that the Onion ran a satirical story with the headline ‘New Starbucks Opens in Restroom of Existing Starbucks.’ Yet it had fewer than 2,500 stores at the time. Today it has three times as many in China alone, a market it was just entering, and about 40,000 worldwide.”

“The US Is Facing A Drugstore Graveyard As Stores Close. Filling The Leftover Spaces Is The Next Challenge.” (Business Insider). “Thousands of drugstores are expected to close over the next several years, including CVS, Walgreens, and Rite Aid stores. Walgreens CEO Tim Wentworth said in June that the retail pharmacy industry was ‘largely overbuilt for where the future was going to be.’”

“OpenAI Hires Former White House Official As Its Chief Economist” (New York Times). “The addition of a chief economist is indicative of OpenAI’s enormous ambition and where its executives see their company in the tech industry’s pecking order. Silicon Valley giants like Google and Facebook hired seasoned economists early in their transformations from promising start-ups into trillion-dollar companies whose technologies changed global markets.”

“Cash-Strapped Colleges Are Selling Their Prized Art And Mansions” (Bloomberg). “Selling cherished assets is a tricky calculus. While the funds generated can provide immediate relief, the effect of the disposals may hurt schools’ appeal, ultimately deepening their plight without even solving structural issues. After all, these sales don’t lead to a steady stream of revenue they can rely on, said Emily Raimes, a higher education analyst for Moody’s Ratings.”

What we’re reading (10/22)

“Peter Todd Was ‘Unmasked’ As Bitcoin Creator Satoshi Nakamoto. Now He’s In Hiding” (Wired). “When Canadian developer Peter Todd found out that a new HBO documentary, Money Electric: The Bitcoin Mystery, was set to identify him as Satoshi Nakamoto, the creator of Bitcoin, he was mostly just pissed. ‘This was clearly going to be a circus,’ Todd told WIRED in an email…The search for the creator of Bitcoin has dragged into its orbit a colorful cast of characters, among them Hal Finney, recipient of the first ever bitcoin transaction; Adam Back, designer of a precursor technology cited in the Bitcoin white paper; and cryptographer Nick Szabo, to name just a few. Journalists at Newsweek, the New York Times, and WIRED, among others, have all taken stabs at solving the Satoshi riddle. But irrefutable proof has never been unearthed.”

“The Quarter-Trillion Dollar Rush To Get Money Out Of China” (Wall Street Journal). “Chinese residents have been illicitly moving billions of dollars out of the country under authorities’ noses as a cratering property market and economic uncertainties push people to find safer places to park their wealth overseas.”

“Bed Bath & Beyond Stores Are Back From The Grave. Sort Of.” (Washington Post). “Bed Bath & Beyond seems to be the brand with more lives than an adventurous feline. Over the past 18 months, the retailer — once known for its sprawling stores stacked high with air fryers, trash cans and bedding — has gone through Chapter 11 bankruptcy, store closures, layoffs, liquidation, a new owner of its brand, a website relaunch and a new chief executive. Now the retailer is going back to its roots and opening a handful of small-format brick-and-mortar stores, according to parent company Beyond.”

“Inside The Bungled Bird Flu Response, Where Profits Collide With Public Health” (Vanity Fair). “When dairy cows in Texas began falling ill with H5N1, alarmed veterinarians expected a fierce response to contain an outbreak with pandemic-sparking potential. Then politics—and, critics says, a key agency’s mandate to protect dairy-industry revenues—intervened.”

“E. Coli Outbreak Linked To McDonald’s Quarter Pounders” (Centers for Disease Control and Prevention). “CDC, FDA, USDA FSIS, and public health officials in multiple states are investigating an outbreak of E. coli O157:H7 infections. Most people in this outbreak are reporting eating the Quarter Pounder hamburger at McDonald’s before becoming sick. It is not yet known which specific food ingredient is contaminated. McDonald’s is collaborating with investigation partners to determine what food ingredient in Quarter Pounders is making people sick. McDonald’s stopped using fresh slivered onions and quarter pound beef patties in several states while the investigation is ongoing to identify the ingredient causing illness.”

What we’re reading (10/21)

“The S&P 500’s Golden Decade Of Returns Is Over, Goldman Says” (Business Insider). “The stock market's decadelong golden age will soon be a thing of the past, Goldman Sachs said. A new report from the firm's portfolio-strategy research team forecast that the S&P 500 would see an annualized nominal return of 3% over the next 10 years. That would put it in the 7th percentile of performance since 1930. It would also badly lag the 13% annualized figure put up by the benchmark index over the prior decade, Goldman data showed…market concentration is near its highest level in 100 years, Goldman said.”

“Activist Urges Cheesecake Factory To Consider Breakup” (Wall Street Journal). “An activist investor has built a position in Cheesecake Factory and is urging the restaurant operator to spin off three of its smaller brands into a separate public company, according to people familiar with the matter.”

“Money Market Rates Are Lower, Yes. But Compared To What?” (New York Times). “Hundreds of billions of dollars flowed into the funds, which swelled in size month after month. Now that the Federal Reserve has begun cutting short-term interest rates — and money market funds have begun reducing their rates, too — you may expect that these funds would be less appealing. But nothing could be further from the truth. The “wall of cash” in money market funds isn’t flowing into the stock market or other risky investments. It is, for the most part, staying where it is — and growing larger.”

“Here’s One Economic Message From The Costco Gold Bar Craze” (Yahoo! Finance). “The wildly popular Costco bullion was introduced to warehouse club members last year via 24-karat 1 oz bars. The product has flown off the shelves, with Costco raking in a reported $200 million per month in gold bar sales. Demand has been so great that the retailer has begun to offer platinum bars.”

“Chick-Fil-A Is Releasing Its Own Entertainment App, With Family-Friendly Shows And Podcasts” (CNBC). “Chicken sandwiches, waffle fries, milkshakes – and now TV shows and podcasts? Chick-fil-A plans to launch a new app on Nov. 18, with a slate of original animated shows, scripted podcasts, games, recipes and e-books aimed at families. While it’s an unusual move for a restaurant company to wade into the crowded media world, Chick-fil-A has been expanding outside of food for years already — with the ultimate goal of directing more people to its over 3,000 restaurants.”

What we’re reading (10/20)

“They Are Basking In America’s Oil Boom—And Preparing For The Big Bust” (Wall Street Journal). “The history of oil is littered with cities that sprang up practically overnight and just as quickly crumbled. Scars from decades-old downturns are still etched into the collective memory of the mostly small towns speckling the Permian Basin that straddles West Texas and New Mexico.”

“Costco Has A Magazine And It’s Thriving” (New York Times). “Each month, 15.4 million copies of Costco Connection are mailed out to members. Another 300,000 are distributed via Costco warehouses. It is now the nation’s third largest magazine.”

“Wall Street’s Scrappy Underdog Has An Ambitious Plan To Make It Big” (Wall Street Journal). “Many investment banks thinned their ranks as dealmaking sputtered in the past few years. Jefferies took the opposite approach. The bank is spending hundreds of millions of dollars to lure top bankers from competitors. The goal: become the world’s fifth-largest investment bank and maintain the spot year after year.”

“Halloween Could Taste Different This Year Thanks To Soaring Cocoa Prices” (CNN Business). “Everybody knows it’s not Halloween without candy, but trick-or-treaters might find less chocolate filling their buckets this year. That’s because cocoa prices have more than doubled since the start of the year and have remained at record highs, according to Wells Fargo data shared with CNN.”

“What It’s Like To Work On A Megayacht” (The Cut). “[N]ot that many celebrities own yachts, actually. Their net worth aren’t high enough. Yacht-owning money is next level. Yachts are so expensive that most of the owners are just businessmen you’ve never heard of. You couldn’t tell them apart from some other grandpa. I definitely had celebrity guests from time to time, but they were always friends of the owner or charter guest.”

What we’re reading (10/19)

“Boeing, Union Reach Wage Deal To End Strike” (Wall Street Journal). “The company is offering a 35% wage increase over four years in its latest proposal. That is up from its original offer of 25% that was overwhelmingly rejected by a union local representing machinists in the Pacific Northwest who build most of Boeing’s jets.”

“The Secretive Dynasty That Controls The Boar’s Head Brand” (New York Times). “In May 2022, the chief financial officer of Boar’s Head, the processed meat company, was asked a simple question under oath. ‘Who is the C.E.O. of Boar’s Head?’ ‘I’m not sure,’ he replied. ‘Who do you believe to be the C.E.O. of Boar’s Head?’ the lawyer persisted. The executive, Steve Kourelakos, who had worked at the company for more than two decades and was being deposed in a lawsuit between owners, repeated his answer: ‘I’m not sure.’ It is odd, to say the least, when a top executive of a company claims not to know who his boss is.”

“Global Government Debt To Surpass $100 Trillion For The First Time” (Semafor). “Global public debt will exceed $100 trillion this year for the first time, and will likely continue to rise from there. A new International Monetary Fund report showed that government borrowing will reach 93% of global GDP by the end of the year and near 100% by 2030 — exceeding a pandemic-era peak of 99%, and 10 percentage points up from 2019.”

“Netflix Keeps Getting Sued Over True-Crime Shows. It’s Thirsty For More.” (Business Insider). “Netflix's thirst for crime fare…shows no sign of letting up, according to Business Insider's interviews with agents and producers, as well as commissioning data from Ampere Analysis.”

“What’s In The Water? Long-Run Effects Of Fluoridation On Health And Economic Self-Sufficiency” (Adam Roberts, Journal of Health Economics). “Community water fluoridation has been named one of the 10 greatest public health achievements of the 20th century for its role in improving dental health. Fluoride has large negative effects at high doses, clear benefits at low levels, and an unclear optimal dosage level. I leverage county-level variation in the timing of fluoride adoption, combined with restricted U.S. Census data that link over 29 million individuals to their county of birth, to estimate the causal effects of childhood fluoride exposure. Children exposed to community water fluoridation from age zero to five are worse off as adults on indices of economic self-sufficiency (−1.9% of a SD) and physical ability and health (−1.2% of a SD). They are also significantly less likely to graduate high school (−1.5 percentage points) or serve in the military (−1.0 percentage points). These findings challenge existing conclusions about safe levels of fluoride exposure.”

What we’re reading (10/18)

“Are Reports Of Small-Cap Stocks’ Revival Prospects Premature?” (The Capital Spectator). “The rally in recent days of the Russell 2000 Index, a widely followed benchmark of small-cap shares, has revived hope anew that this slice of the equity market is finally set to recover after a long stretch of underperformance. But we’ve been here before, multiple times in recent years. Is this time different? Maybe, but the evidence is still a bit thin.”

“Would A Time Machine Make You A Great Investor?” (Wall Street Journal). “The latest is the ‘Crystal Ball Trading Game.’ Players are given $1 million in play money and are shown 15 Journal front pages following big economic news randomly selected over the past 15 years. With up to 50 times leverage, multiplying that pot of money sounds like shooting fish in a barrel. Yet it wasn’t, and many players instead shot themselves in the foot. Through Thursday, more than 8,000 mostly financially savvy players had taken a crack at the game. Their median ending wealth after 15 rounds was just $687,986 according to data provided by Elm. Many lost everything.”

“Wait, Are Millennials Suddenly The Wealthiest Generation?” (Washington Post). “For decades — dating back to when boomers themselves were hard(ish)-rocking, penniless rebels — the Fed, with the help of NORC at the University of Chicago, has asked Americans about their balance sheets, surveying anything from antique collections to gambling activities, from life insurance policies to home equity. In the past, this once-every-three-years survey held discouraging news for millennials. After adjusting for inflation, their wealth lagged behind where their Gen X and boomer parents had been at the same age. But when we incorporated the latest survey, conducted in 2022, we were shocked to see millennials had taken the lead. And home equity seems to have emerged as the wealth-creation hero. The eldest millennials — now in their early 40s, old enough to sue for age discrimination — boast about twice the median home equity a Gen Xer did at that age. They also enjoy a substantial lead over boomers.”

“Walmart Confirms Robots Will Run ‘Ghost Kitchens’ Inside ‘Test’ Locations And You Can Already Order Your Coffee” (The U.S. Sun). “The automated beverage system is projected to serve between 100 and 200 cups of coffee and tea each day. It is also set to appear in a new location in Peachtree, Georgia, opening this year. However, the new agreement between Richtech Robotics and Ghost Kitchens America extends its operations to 20 additional Walmart locations. Ghost Kitchens America CEO George Kottas said he hoped the decision would drive between $700,000 and $2 million in annual revenue at each location.”

“Electric Motors Are About to Get A Major Upgrade Thanks To Benjamin Franklin” (Wall Street Journal). “A handful of scientists and engineers—armed with materials and techniques unimaginable in the 1700s—are creating modern versions of Franklin’s ‘electrostatic motor,’ that are on the cusp of commercialization. It’s reminiscent of the early 1990s, when Sony began to produce and sell the first rechargeable lithium-ion batteries, a breakthrough that’s now ubiquitous.”

What we’re reading (10/14)

“The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2024” (Royal Swedish Academy of Sciences). “This year’s laureates in the economic sciences – Daron Acemoglu, Simon Johnson and James Robinson – have demonstrated the importance of societal institutions for a country’s prosperity. Societies with a poor rule of law and institutions that exploit the population do not generate growth or change for the better. The laureates’ research helps us understand why.”

“Acemoglu, Johnson And Robinson Win Nobel Prize For Institutions And Prosperity” (Marginal Revolution). “One interesting aspect of this year’s Nobel is that almost all of AJRs Nobel work is accessible to the public because it has come primarily through popular books rather than papers. The Economic Origins of Dictatorship and Democracy, Why Nations Fail, and the The Narrow Corridor all by Acemoglu and Robinson and Power and Progress by Acemoglu and Johnson are all very readable books aimed squarely at the general public. The books are in many ways deeper and more subtle than the academic work which might have triggered the broader ideas (such as the famous Settler Mortality paper). Many of the key papers such as Reversal of Fortune are also very readable.”

“The Economist Whose Contrarian Streak Has Gotten Attention In Biden And Trump Camps” (Wall Street Journal). “Michael Pettis, a professor of finance at Peking University, has spent two decades in China observing its breakneck economic ascent and its impact around the world. Among his conclusions: He thinks former President Trump’s plan for across-the-board import tariffs isn’t a bad idea. He also says the U.S. should use capital controls to discourage China and other high-saving nations from snapping up treasuries, stocks and other American assets.”

“Anthropic CEO Goes Full Techno-Optimist In 15,000-Word Paean To AI” (TechCrunch). “In broad strokes, Amodei paints a picture of a world in which all AI risks are mitigated, and the tech delivers heretofore unrealized prosperity, social uplift, and abundance. He asserts this isn’t to minimize AI’s downsides — at the start, Amodei takes aim, without naming names, at AI companies overselling and generally propagandizing their tech’s capabilities. But one might argue that the essay leans too far in the techno-utopianist direction, making claims simply unsupported by fact.”

“Prince Harry Says The Smartphone Is ‘Stealing Young People’s Childhood’” (Vanity Fair). “For World Mental Health Day, Prince Harry interviewed a researcher who helped inspire Harry and Meghan Markle’s work on online safety.”

What we’re reading (10/13)

“The Market Has Been Fabulous, Maybe Excessively So” (New York Times). “Consider how powerful the U.S. stock market rally has been. The S&P 500, the most widely followed U.S. stock market benchmark, rose 5.9 percent for the quarter and 22 percent since the start of the year through September, including dividends. In the 12 months through September, it returned a sizzling 34.2 percent. That’s more than triple the average annualized return of 10.5 percent since 1926.”

“Fate Of Lina Khan’s Bid To Reshape Antitrust Comes Down To Election” (Wall Street Journal). “Whether Khan sticks around is more of an open question. Khan would be open to remaining atop the FTC if Harris wins, according to a person familiar with her thinking. Harris has ties to the country’s biggest corporate law firms, whose merger departments feed on the flow of deals brokered by investment banks. Some investors, such as Reid Hoffman, have also said Khan’s antimerger bent hurts innovation. Hoffman, the founder of LinkedIn and a major Democratic donor, said this summer that Khan should be replaced if Harris wins the White House.”

“OpenAI Must Scale A Massive Money Mountain” (Spyglass). “OpenAI is clearly very good at fundraising. Understatement of the century, thus far? But a lot can happen between now and 2028. An in AI, where the days feel more like months, even more is unknown. That's a massive risk, to put it lightly. Of course, they'll have levers they can pull to dial down burn, in particular with compute. But there's also a chance they'd have to dial it up as well. It's just a complete unknown at this point. It does feels like it will be hard for any other startup to compete with such cash needs – Anthropic, answer your phone, Amazon is calling – but OpenAI will be competing with Google, Meta, and all the rest of Big Tech. Maybe not Apple. But probably them too, eventually.”

“Just How Doomed Is Home Insurance?” (Vox). “Home insurance premiums are rising across the country. Florida homeowners already pay the highest rates, on average about $3,600 per year, according to the Florida Office of Insurance Regulation, well above the national average of around $2,400 per year. Across Florida’s 10 largest cities, rates are more than $10,000 per year, according to a report from Insurify. Last year, US home insurance rates jumped 11.3 percent on average, which has led some to drop their coverage altogether. Some Floridians have seen rate hikes as high as 400 percent over the past five years. That’s if they can find insurance at all. Hundreds of thousands of Americans have come home to a breakup letter from their private insurers, canceling their coverage.”

“America’s New Millionaire Class: Plumbers And HVAC Entrepreneurs” (Wall Street Journal). “Aaron Rice has two logos tattooed on his left leg: one from the plumbing business he co-founded more than a decade ago, and another from the private-equity-backed company that recently bought it. Few businesses are as vital to their customers as local plumbing, heating or air-conditioning companies—especially in places like Tucson, Ariz., where Rice works and residents sweltered in 100-degree heat most days this summer. For years, Rice, 43 years old, was skeptical when out-of-state investors offered to buy his company. He assumed most of them knew little about skilled-trade work or his customers. They were just looking to make a buck. But in 2022, when approached by a local HVAC company backed by private equity, he changed his mind, figuring that they knew the business.”

What we’re reading (10/12)

“OpenAI’s AI-Adjusted Earnings Numbers Have Echoes Of Groupon And WeWork” (Business Insider). “When Google was about five years old, the world saw its finances for the first time when it filed for an IPO. The company was wildly profitable, making over $100 million in net income in 2003. It never looked back. When Facebook was roughly seven years old, it shared financial data with prospective investors. I got a look at the document when I was a reporter at MarketWatch. It indicated that the company had already become remarkably profitable, too. Now, we've gotten the first peak at OpenAI's financials. It's almost 10 years old, and it's nothing like Google and Facebook.”

“Big Banks Steer Through ‘Treacherous’ Conditions” (New York Times). “In an early test of the effect the Federal Reserve’s big interest rate cut has had on the finance business, the verdict is: mixed. Profits were down at JPMorgan Chase and Wells Fargo, two of the nation’s biggest banks, they reported on Friday, yet their results largely surpassed expectations. The results suggested the economy was in solid shape, in keeping with recent data on jobs and inflation, although bank executives warned of looming risks.”

“France Freaks Out Over Proposed Sale Of Paracetamol-Maker To American Fund” (Politico). “French pharmaceutical giant Sanofi said on Friday that it was in talks to sell a majority stake of its subsidiary that produces over-the-counter drugs to an American private equity firm CD&R for €15 billion. The proposed takeover is already proving highly controversial in France, with politicians from across political spectrum voicing fears it could threaten manufacturing jobs in France and fall afoul of Europe's push to secure its supply chains for critical medicines.”

“Boeing To Cut 10% of Workers, Delay New Plane” (Wall Street Journal). “Boeing will cut 10% of its global workforce, or roughly 17,000 jobs, and warned of deeper losses in its operations as a machinist strike compounds problems brewing at the jet maker for years. Along with the job cuts, the manufacturing giant said it would further delay the launch of a new airplane, the 777X, that is already years behind schedule. It will also discontinue the 767 cargo plane. They are the biggest moves so far by Chief Executive Kelly Ortberg, who took over the company in August, to revamp an American company that has struggled with production issues and been burning through its cash.”

“This Texas Mom Charges Over $1,000 For Her Elaborate Pumpkin Displays Each Year — See Her Stunning Designs!” (People). “This Texas mom turned her passion for pumpkins into a thousand-dollar business! Heather Torres, the founder of Porch Pumpkins, opened up about her flourishing porch-scaping business in which she designs and sets up elaborate pumpkin displays outside of people’s homes while appearing on The Koerner Office podcast with Chris Koerner. During the interview, released on Wednesday, Oct. 2, Torres explains how it all started when she saw her friends paying thousands of dollars to have Christmas decorations installed at their homes.”

What we’re reading (10/10)

“The Endless Downfall Of A Crypto Power Couple” (New York Times). “He was a wealthy cryptocurrency executive with a shiny white Porsche and a luxury condo in the Bahamas. She was a crypto policy expert with political ambitions, advocating for the industry in Washington…Two years ago, the FTX executive Ryan Salame and the crypto advocate Michelle Bond were an industry power couple. Mr. Salame gave tens of millions of dollars to conservative politicians, who celebrated him as a “budding Republican megadonor,” while Ms. Bond ran for Congress, drawing support from Donald Trump Jr. But this tale of crypto boy meets crypto girl has turned into a legal nightmare. Mr. Salame, 31, once a top lieutenant to Mr. Bankman-Fried, is set to report to federal prison in Maryland on Friday to start a sentence of seven and a half years, after he pleaded guilty to campaign finance fraud. In August, Ms. Bond, 45, who lives with Mr. Salame and their infant son in Potomac, Md., was also charged with campaign finance violations linked to FTX.”

“Fed’s 2% Inflation Target Is ‘Sacrosanct’ — And Here” (Semafor). “[Austan Goolsbee on “how sacrosanct is the Fed’s 2% target?] When the Fed announced the 2% inflation target in 2012 and made it official, I was critical because I thought it was overly precise for a data series with a lot of noise in it. But that is now a sacred promise, and I will say that I’ve come — if not a full 180 degrees, maybe 178 degrees on this. The target was an anchor when inflation surged and kept things from spiraling.”

“Activist Accuses Pfizer Of Pressuring Former Executives” (Wall Street Journal). “The fight between Starboard Value and drug giant Pfizer took an unusual, bitter turn Thursday. Hours after two former top Pfizer executives said they would no longer participate in Starboard’s activist campaign, the investor accused the drugmaker of pressuring the executives to remain loyal to their longtime employer.”

“Elon Musk Is About To Reveal Tesla’s Robotaxi. Uber And Lyft Should Be Nervous.” (Business Insider). “Elon Musk's highly anticipated Robotaxi Day is finally happening Thursday evening in Hollywood — and it has the potential to shake up the ride-hailing industry. Musk has been touting Tesla's Full Self-Driving software and its potential to create a robotaxi network for years. Analysts have told Business Insider that Tesla's emergence in the ride-hailing industry could pose a long-term threat to Uber and Lyft. It may also force them to develop and expand their own autonomous-vehicle offerings or seek out a partnership with Musk's company, similar to Uber's partnership with Alphabet-owned Waymo.”

“The Conflict-Of-Interest Discount In The Marketplace Of Ideas” (Barrios, et al.). “We conduct a survey of economists and a representative sample of Americans to infer the reduction in the perceived value of a paper when its authors have conflicts of interest (CoI), i.e., they have financial, professional, or ideological stakes in the outcome of the results…We show that, on average, conflicted papers are worth less than half of non-conflicted ones, though this effect varies significantly depending on the nature of the conflict.”

What we’re reading (10/9)

“TD Bank Faces $3 Billion In Penalties And Growth Restrictions In U.S. Settlement” (Wall Street Journal). “As part of the agreement, the bank’s primary U.S. regulator, the Office of the Comptroller of the Currency, is expected to impose an asset cap barring the bank from growing above a certain level in the U.S., according to people familiar with the matter.”

“Fed Officials Were Divided On Whether To Cut Rates By Half A Point In September, Minutes Show” (CNBC). “Federal Reserve officials at their September meeting agreed to cut interest rates but were unsure how aggressive to get, ultimately deciding on a half percentage point move in an effort to balance confidence on inflation with worries over the labor market, according to minutes released Wednesday.”

“Venture Capital's ‘Crisis’” (Spyglass). “Without question, the past decade-plus has been an unprecedented build up and expansion of VC as an asset class. This was seemingly happening more naturally and then the pandemic came and threw the world into crisis. But channeling JFK, with the danger, many VCs also saw an opportunity. It seemed like there were suddenly new opportunities in a changed world – social voice networks, virtual conference software, 15-minute delivery apps, etc – but what really happened is that the pandemic just created this sort of temporary bubble, which rather quickly deflated. But it also impacted basically every other company, with most others that operate online in meaningful way seeing growth pulled forward by a couple of years or more. This was true of Amazon on down. But as the world normalized, it became clear that growth would return to the place where it was almost as if the pandemic hadn't happened – it was just a blip, a massive one. But this all was largely masked by both stimulus and zero interest rates that the government put in place to try to avoid economic collapse.”

“Owners Of ‘Catastrophe Bonds’ Are Staring Down Big Losses As Hurricane Milton Barrels Toward Florida” (Business Insider). “The back-to-back barrage of hurricanes Helene and Milton could trigger big losses for investors in catastrophe bonds. The fixed-income securities allow insurers and reinsurers to transfer risks associated with major weather events to investors. Investors who buy cat bonds can see big returns if it’s a relatively quiet year for hurricanes and other natural disasters. As long as there are few extreme weather events or damage from any event is mild, investors continue to collect the relatively high yield on the bonds.”

“Nobel Prize In Chemistry Awarded To Three Scientists For Work On Proteins” (Washington Post). “The discoveries by David Baker at the University of Washington and Demis Hassabis and John M. Jumper of Google DeepMind in the United Kingdom have rapidly transformed science. Hassabis and Jumper developed a powerful computational tool that gave researchers the long-sought ability to predict how proteins twist and fold to create complex 3D structures that can block viruses, build muscle or degrade plastic.”

What we’re reading (10/8)

“Nearly 1,500 Florida Gas Stations Have Run Out Of Fuel. Hurricane Milton Could Cause Even More Trouble” (CNN Business). “Demand for gas has surged as some residents in Milton’s path are trying to fuel up before they evacuate. Others who plan to stay put are trying to fill gas tanks so they’ll be able to power their generators should they lose electricity for an extended period.”

“Short Seller Hindenburg Goes After Roblox” (Wall Street Journal). “Hindenburg alleges that Roblox has been exaggerating daily user and engagement figures to investors since it went public in 2021. The firm also accuses Roblox of giving priority to growth over measures that would better protect children from pedophiles and mature content. The firm said its research is based in part on interviews it conducted with multiple former Roblox employees and firsthand experience on the platform.”

“The Profit-Obsessed Monster Destroying American Emergency Rooms” (Vox). “Under new private equity ownership, ERs adopted an assortment of unsavory practices. Firms not only pressured clinicians to see patients faster, as illustrated by John’s experience, but to recommend hospital admission for more patients. They also dramatically raised the price tags for a range of emergency services, resulting in back-breakingly large bills for patients nationwide, like ones charging thousands of dollars for glue applied to a half-inch wound. To avoid having to negotiate those astronomical bills with the expert hagglers at insurance companies, firms kept their ERs from participating in many insurance networks. It was easier to collect on a so-called balance bill — the portion of a medical bill not paid for by a patient’s insurer — if the care a patient had received wasn’t covered by their insurance at all.”

“To Tax Capital Or Not To Tax Capital? That Should Not Be The Question” (A Zibaldone). “The main takeaway I have come to is following: the extant theoretical and empirical literature does not support the idea that mildly increasing or decreasing capital taxes from current levels matters much for growth or welfare. If someone does believe to the contrary, the burden of proof is on them.”

“Rate Cuts Were Supposed To Push Mortgage Rates Lower. The Opposite Has Happened.” (Business Insider). “Since Fed Chair Jerome Powell lowered interest rates by 50 basis points on September 18, the average 30-year fixed mortgage rate has moved higher, not lower. According to data from Mortgage News Daily, the average 30-year fixed mortgage rate has jumped about 47 basis points since the Fed rate cut, to 6.62% from 6.15%.”

What we’re reading (10/7)

“Activist Starboard Value Takes $1 Billion Stake In Pfizer” (Wall Street Journal). “Pfizer had a market value of about $162 billion as of Friday. Its shares have been roughly cut in half from a record high notched in late 2021 after the company delivered the world’s first Covid-19 vaccine. They are little changed so far this year, compared with a 21% rise in the S&P 500.”

“New titans Of Wall Street: How Jane Street Rode The ETF Wave To ‘Obscene’ Riches” (Financial Times). “Last year was the fourth straight year that Jane Street generated net trading revenues of more than $10bn, according to investor documents seen by the Financial Times. Its gross trading revenues of $21.9bn were equivalent to roughly one-seventh of the combined equity, bond, currency and commodity trading revenues of all the dozen major global investment banks last year, according to Coalition Greenwich data. ‘The amount of money they make is almost obscene. And that comes from handling instruments that many other people don’t want to touch,’ said Larry Tabb, a longtime analyst of the industry who now works at Bloomberg Intelligence. ‘That’s where the greatest profits are, but also the greatest risks.’”

“Can AI Pick Stocks? 5 AI Investing Apps To Try” (U.S. News & World Report). “Artificial intelligence is helping companies run more efficiently and offer more choices for their customers. The technology can minimize human errors and reduce operating costs, leading to higher profits. It can make people's lives easier with personalized product recommendations, enhanced cybersecurity and quicker access to relevant information. Some investors are also turning to new AI tools for stock picks and advice on how to manage their portfolios.”

“Tennessee’s HPR Law And Its Transformation Of Nashville’s Housing Market: A Model For Other States” (Mercatus Center). “Since the mid-2000s, Nashville, Tennessee, has undergone a housing boom that created thousands of new homeownership opportunities in established urban districts. Among the nation’s 50 largest metropolitan areas, Nashville now ranks second for having the most recently built, single-family, attached and detached homes for sale within five miles of the central business district…Charles Gardner and Alex Pemberton examine the obscure state law that rejuvenated Nashville’s aging neighborhoods and show how passing similar legislation might boost housing supply in other cities and states as well.”

“Homeowners Hit By Helene Are In For An Insurance Claim Shock” (Wall Street Journal). “Helene is one of the deadliest and most destructive hurricanes to hit the U.S. in recent years, with property damage pegged at $15 billion to $26 billion by ratings firm Moody’s. The insured loss, however, will likely be at the lower end of initial forecasts, which ranged from around $5 billion to $15 billion, according to John Neal, chief executive of the Lloyd’s of London insurance marketplace. Much of the shortfall is because typical home insurance policies don’t cover flooding, and most people don’t have separate flood insurance. Another reason is an increase in coverage restrictions.”

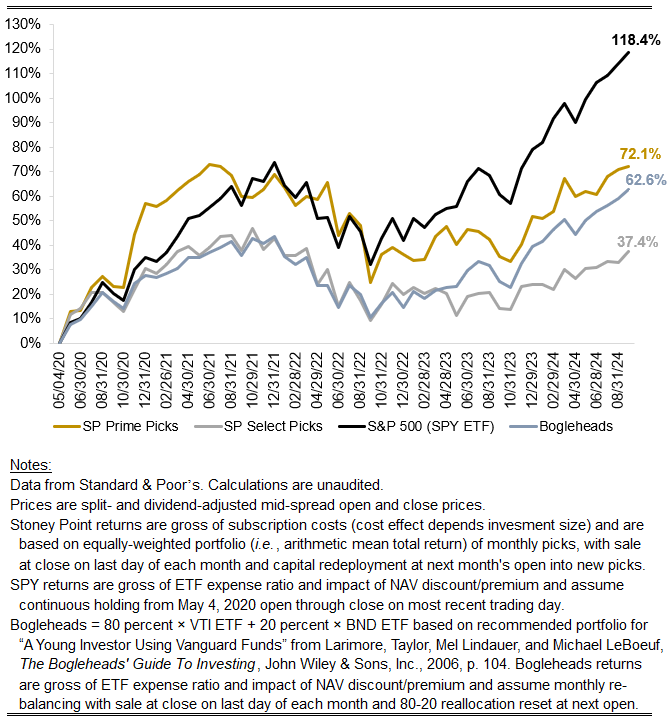

September performance update

Hi friends, here with a performance update for September.

Prime: +0.64%

Select: +3.51%

SPY ETF: +2.69%

Bogleheads Portfolio (80% VTI + 20% BND): +2.28%

As is often the case, discussion about the stance of monetary policy and the health of the economy dominated market analysis in the month amid the onset of an expected rate-cutting cycle and a very good jobs report recently. Prime and Select’s returns bracketed another very strong monthly gain for the market overall (proxied by SPY). As the chart below makes clear, SPY’s performance has been stellar the last two years. I generally use “the market” and SPY interchangeably, but a careful look at the chart below calls the wisdom of that language into question, and elicits an observation that might inform whether it is reasonable to expect SPY’s outperformance to persist over time. Specifically, both SPC’s prime strategy and the Bogleheads portfolio overlap SPY’s holdings to an extent. The former reflects, by construction, a narrow subset of SPY’s constituents. The latter, in contrast, reflects a much broader universe of holdings. Yet both the narrow subset (Prime) and the broader universe (Bogleheads) have performed essentially in lockstep in the last two years, while SPY has dramatically outperformed both. One feature that Prime and the Bogleheads portfolio share in common that distinguishes each from SPY is a much lower weight (or indeed no weight) applied to largest, most salient technology stocks, including those at the forefront of the so-called AI revolution (Bogleheads’ VTI holding, for example, tracks the CRSP Total Market Index, rather than the S&P 500 index).

Reasonable minds can disagree on what that means going forward. Investors who are bullish on technology incumbents generally and AI in particular might see evidence corroborative of their bullishness in the recent historical data. Investors with the opposite view may well see the opposite under an assumption of mean reversion, given that SPY’s more-than-doubling in the last four and a half years represents annual returns far outpacing the long-term historical base rate, which itself is much higher than the academic consensus for equity returns over the long run going forward.

Stoney Point Total Performance History

What we’re reading (10/5)

“U.S. Job Creation Roared Higher In September As Payrolls Surged By 254,000” (CNBC). “The U.S. economy added far more jobs than expected in September, pointing to a vital employment picture as the unemployment rate edged lower, the Labor Department reported Friday. Nonfarm payrolls surged by 254,000 for the month, up from a revised 159,000 in August and better than the 150,000 Dow Jones consensus forecast. The unemployment rate fell to 4.1%, down 0.1 percentage point.”

“Rock-Star Law Firms Are Billing Up To $2,500 Per Hour. Clients Are Indignant.” (Wall Street Journal). “Lawyers’ pay is skyrocketing. Brutal poaching wars for talent are now common, and top lawyers expect to be paid like investment bankers and private-equity principals. ‘You don’t negotiate with those guys. You aren’t going to bet the company,’ said Matthew Lepore, general counsel for chemical giant BASF. ‘Clients aren’t doing as well as the law firms are doing, and it’s not sustainable.’”

“Everyone Is Getting The Dockworkers Strike All Wrong” (Slate). “[T]o focus this story on just the so-far-hypothetical economic and political repercussions is to overlook what’s really at the heart of the ILA fight. Yes, it’s a story about modern-day labor anxieties and union leverage—but it’s also about something far more complex than your typical workers-vs.-bosses toss-up.”

“Why Is The Speed Of Light So Fast? (Part 1)” (Of Particular Significance). “It’s true that the speed of light does seem fast — light can travel from your cell phone to your eyes in a billionth of a second, and in a full second and a half it can travel from the Earth to the Moon. And indeed the energy stored in your body is comparable to the Earth’s most explosive volcanic eruptions and to the most violent nuclear bombs ever tested — enormously greater than the energy you use to walk across the room or even to lift a heavy suitcase. What in the name of physics — and chemistry and biology — is responsible for these bewildering features of reality?”

“The Nobel-, Emmy-Winning Genius Who Became Google’s Star Antitrust Witness” (Semafor). “During the Google antitrust trial, Milgrom picked apart the government’s assertions that the company had abused its power, essentially arguing that the prosecution had misinterpreted changes Google made to its advertising auctions over the course of many years. Rather than anticompetitive, Milgrom argued, they were the right choices at the time, given the current technology, to avoid abuse of the system.”

What we’re reading (10/3)

“Dockworkers On The East And Gulf Coasts Have Agreed To Suspend The Strike After Reaching A Deal For Better Pay” (Business Insider). “More than 45,000 striking port workers at docks from Maine to Texas have suspended their strike until January 15, 2025, and will return to work on Friday while contract negotiations continue, the union and organization that represents the ports said in a Thursday statement.”

“The Whiskey Industry Is Bracing For A Trade War If Trump Wins. It’s Not Alone.” (New York Times). “For the whiskey industry, the stakes are particularly high. In March, a 50 percent tariff on American whiskey exports to Europe will snap into effect unless the European Union and the United States can come to an agreement to stop the levies. The outcome may depend on who is in office.”

“Revenge Of The Office” (The Atlantic). “When [Andy] Jassy spoke last year about the company’s [Amazon’s] decision to move from a remote policy to a hybrid one, he said that it was based on a ‘judgment’ by the leadership team but wasn’t informed by specific findings.”

“This Teenage Hacker Became a Legend Attacking Companies. Then His Rivals Attacked Him.” (Wall Street Journal). “Arion Kurtaj, now 19 years old, is the most notorious name that has emerged from a sprawling set of online communities called the Com. They are gamers and hackers and online con artists who are native English speakers, able to talk their way into sensitive networks—social engineers in cybersecurity parlance. They have become one of the top cybersecurity threats in the world, and they are mostly boys and young men.”

“Before Brita: A Brief History Of Water Filtration” (JSTOR). “Early depictions of water purification techniques appear in Egyptian tombs from the fifteenth and thirteenth centuries BCE: In The Manners and Customs of the Ancient Egyptians, Sir John Gardner Wilkinson sketches a reproduction of water filtration from a tomb at Thebes.”

What we’re reading (10/2)

“Aperol Sales Pop In Summer. Its Owner Wants That To Happen All Year.” (Wall Street Journal). “Almost all alcohol brands grapple with seasonality, or the idea that some drinks are best suited for warming up in cold weather and others for cooling off in the sunshine. Now Davide Campari-Milano, which trades as Campari Group, is trying to “deseasonalize” Aperol, its distinctively orange, bitter aperitif from Northern Italy typically mixed with prosecco and soda to make a cooling, summertime spritz.”

“Silicon Valley Has A Plan To Save Humanity: Just Flip On The Nuclear Reactors” (CNN Business). “AI hasn’t quite delivered the job-killing, cancer-curing utopia that the technology’s evangelists are peddling. So far, artificial intelligence has proven more capable of generating stock market enthusiasm than, like, tangibly great things for humanity. Unless you count Shrimp Jesus. But that’s all going to change, the AI bulls tell us. Because the only thing standing in the way of an AI-powered idyll is heaps upon heaps of computing power to train and operate these nascent AI models. And don’t worry, fellow members of the public who never asked for any of this — that power won’t come from fossil fuels. I mean, imagine the PR headaches. No, the tech that’s going to save humanity will be powered by the tech that very nearly destroyed it.”

“Bank Of America Customers Shocked By Zero Balances In Online Account Glitch” (International Business Times). “Thousands of Bank of America customers were horrified Wednesday when they checked their online accounts and discovered zero balances due to a glitch in the banking giant's system. Reports of the outage began flowing into Downdetector around noon ET Wednesday, with thousands of customers complaining that they were unable to access their online accounts.”

“The Investors Behind OpenAI’s Historic $6.6 Billion Funding Round” (Business Insider). “Sam Altman has taken his share of bumps and bruises over the last year, but he proved yet again that he can convince investors to pour hundreds of millions into OpenAI. The latest funding round appeared to be the hottest ticket in Silicon Valley, drawing a who's who of investors looking to get in on the buzzy AI startup's latest capital raise. The $6.6 billion round gave OpenAI a $157 billion post-money valuation and minted it into one of the most valuable startups in the world. The startup's valuation is now in the same neighborhood of publicly traded companies like Uber or AT&T.”

“The Economic Cost Of A New War In The Middle East” (DealBook). “Markets are on edge about the risk of another oil shock. The price of crude has been relatively stable over the past year, apart from brief spikes, including after the Oct. 7 Hamas-led attacks on Israel. When Iran fired a well-telegraphed wave of missiles at Israel in April, it didn’t lead to prolonged price increases either. (Saudi Arabia’s oil minister has even reportedly warned that prices could drop to as low as $50 a barrel.)”

What we’re reading (10/1)

“Auto Sales Are Idling As Prices Remain High” (Wall Street Journal). “High new-vehicle prices and borrowing costs are keeping some shoppers on the sidelines, pointing to what is expected to be another lackluster sales year for automakers. Industrywide third-quarter U.S. vehicle sales fell 1.9% compared with a year earlier, according to an estimate from research firm Wards Intelligence. Most major automakers reported results for the July-to-September period on Tuesday.”

“Nike Withdraws Guidance, Postpones Investor Day As It Gears Up For CEO Change” (CNBC). “Nike on Tuesday said it was withdrawing its full-year guidance and postponing its investor day as it gears up for a new CEO to take the helm. Last month, the company announced that CEO John Donahoe would be stepping down in October and replaced with longtime company veteran Elliott Hill, effective Oct. 14. Given the impending CEO change, the company has decided to withdraw its full-year guidance and intends to provide quarterly guidance for the balance of the year, executives said.”

“Apollo Just Set A Goal To Manage $1.2 Trillion In Private Loans By 2029. These 7 Slides Show How It Will Get There.” (Business Insider). “The biggest player in non-bank loans has set a massive new goal for itself: more than doubling its $562 billion private lending business to $1.2 trillion in five years. The trillion-dollar goal has become a high watermark for asset managers generally. Blackstone became the first private-equity firm to manage $1 trillion in assets last year, while KKR set its own trillion-dollar goal this year.”

“How Chicken Tenders Conquered America” (New York Times). “Despite their local fame, fried chicken tenders were almost unknown outside New Hampshire for at least a decade. That changed for good in the 1980s, when Burger King, jealous of the McNugget, introduced its own hand-held morsels of fried chicken. A $20 million advertising campaign for the chain’s new Chicken Tenders worked too well. When locations around the country ran out of chicken, Burger King had to pull the ads.”

“Private Equity Is Taking Your Calls” (The American Prospect). “Two firms control the market for telecommunications assistance for deaf people. They have extracted higher rates for this government-funded service, while denying workers a union.”