September performance update

Hi friends, here with a performance update for September.

Prime: +0.64%

Select: +3.51%

SPY ETF: +2.69%

Bogleheads Portfolio (80% VTI + 20% BND): +2.28%

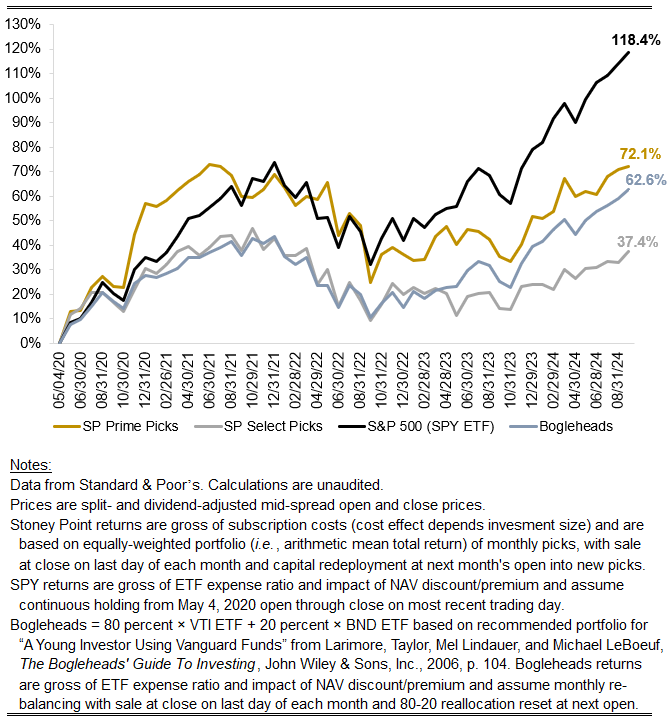

As is often the case, discussion about the stance of monetary policy and the health of the economy dominated market analysis in the month amid the onset of an expected rate-cutting cycle and a very good jobs report recently. Prime and Select’s returns bracketed another very strong monthly gain for the market overall (proxied by SPY). As the chart below makes clear, SPY’s performance has been stellar the last two years. I generally use “the market” and SPY interchangeably, but a careful look at the chart below calls the wisdom of that language into question, and elicits an observation that might inform whether it is reasonable to expect SPY’s outperformance to persist over time. Specifically, both SPC’s prime strategy and the Bogleheads portfolio overlap SPY’s holdings to an extent. The former reflects, by construction, a narrow subset of SPY’s constituents. The latter, in contrast, reflects a much broader universe of holdings. Yet both the narrow subset (Prime) and the broader universe (Bogleheads) have performed essentially in lockstep in the last two years, while SPY has dramatically outperformed both. One feature that Prime and the Bogleheads portfolio share in common that distinguishes each from SPY is a much lower weight (or indeed no weight) applied to largest, most salient technology stocks, including those at the forefront of the so-called AI revolution (Bogleheads’ VTI holding, for example, tracks the CRSP Total Market Index, rather than the S&P 500 index).

Reasonable minds can disagree on what that means going forward. Investors who are bullish on technology incumbents generally and AI in particular might see evidence corroborative of their bullishness in the recent historical data. Investors with the opposite view may well see the opposite under an assumption of mean reversion, given that SPY’s more-than-doubling in the last four and a half years represents annual returns far outpacing the long-term historical base rate, which itself is much higher than the academic consensus for equity returns over the long run going forward.