What we’re reading (6/21)

“Nvidia’s Success Is The Stock Market’s Problem” (Wall Street Journal). “The Russell 2000 index of smaller companies is down 17% from its November 2021 peak and has made no progress at all this year. In the S&P 500, which includes the biggest companies, the average stock is about where it was at the start of 2022, and more than half of the current constituents are down since then. Worse still, only 198 have managed gains this month, even as the index reached new intraday highs on 11 out of 13 trading days.”

“OpenAI Competitor Anthropic Announces Its Most Powerful AI Yet” (CNBC). “OpenAI competitor Anthropic on Thursday announced Claude 3.5 Sonnet, its most powerful artificial intelligence model yet. Claude is one of the chatbots that, like OpenAI’s ChatGPT and Google’s Gemini, has exploded in popularity in the past year. Anthropic, which was founded by ex-OpenAI research executives, has backers including.”

“Transcendence: Generative Models Can Outperform The Experts That Train Them” (Zhang, et al.). “Generative models are trained with the simple objective of imitating the conditional probability distribution induced by the data they are trained on. Therefore, when trained on data generated by humans, we may not expect the artificial model to outperform the humans on their original objectives. In this work, we study the phenomenon of transcendence: when a generative model achieves capabilities that surpass the abilities of the experts generating its data. We demonstrate transcendence by training an autoregressive transformer to play chess from game transcripts, and show that the trained model can sometimes achieve better performance than all players in the dataset. We theoretically prove that transcendence is enabled by low-temperature sampling, and rigorously assess this experimentally. Finally, we discuss other sources of transcendence, laying the groundwork for future investigation of this phenomenon in a broader setting.”

“New York Governor Signs Bill Regulating Social Media Algorithms, In A US First” (CNN Business). “Big changes are coming for New York’s youngest social media users after Gov. Kathy Hochul signed two bills into law Thursday clamping down on digital platforms’ algorithms and use of children’s data. The unprecedented move makes New York the first state to pass a law regulating social media algorithms amid nationwide allegations that apps such as Instagram or TikTok have hooked users with addictive features. Hochul’s signature comes days after US Surgeon General Vivek Murthy called for warning labels to be applied to social media platforms, fueling a debate about social media’s potential impact on the mental health of users, particularly teens.”

“America's Middle Class Is Shrinking” (Newsweek). “America's middle class, traditionally considered the backbone of the nation and its economic engine, has been shrinking for the past 50 years, according to a recent Pew Research Center survey. A study based on government data released by the Washington-based nonpartisan fact tank in late May found that the share of Americans living in middle-class households dropped from 61 percent in 1971 to 51 percent in 2023. During the same time, the share of Americans living in lower income households rose from 27 percent to 30 percent, while that of individuals living in upper income households rose from 11 percent to 19 percent.”

What we’re reading (6/16)

“Investors Fear Long Stretch Of Calm in Markets Can’t Last” (Wall Street Journal). “Investors look sanguine, and analysts say they have good reason. The economy has remained stronger than almost anyone predicted after the Federal Reserve began raising interest rates. Corporate profits are rising again. Inflation cooled more than expected in last week’s consumer prices report, and Fed officials signaled that they expect to cut benchmark rates later this year.”

“What Is A ‘Zombie Mortgage’?” (New York Times). “For most buyers, mortgages are the cornerstone of purchasing a home. Sometimes a second mortgage is necessary, too, to cover the down payment, for instance. But what happens if that second mortgage seems to have been forgiven but actually still exists? Introducing: the ‘zombie mortgage.’ These aren’t creatures from the underworld, but mortgages that homeowners forgot about or lenders said they would write off, but didn’t, only to reappear years later, according to the Consumer Financial Protection Bureau.”

“The Media’s Role In Fracturing Sports” (Washington Post). “The pursuit of truth now competes with the desire for attention. It’s no contest, sadly. Instead of reporting, instead of wondering and scrutinizing, instead of building trust and gaining insight and providing context, we exhaust too many diminishing resources to facilitate screaming. There is seldom enough fresh information to react to, so we regurgitate arguments, only louder, all in the name of provocation.”

“Meta VPs Are Getting Squeezed Out Amid Mark Zuckerberg's ‘Permanent’ Efficiency Mode” (Business Insider). “As CEO Mark Zuckerberg makes what was a year of efficiency — in which more than 20,000 Meta employees were laid off — into a "permanent part" of how Meta operates, executives are not being shielded from tougher performance standards and ongoing reorganizations that are leading to incremental cuts to teams.”

“What Frank Lloyd Wright Tells Us About Late Bloomers” (Financial Times). “Many of Wright’s most significant buildings, including Fallingwater in Pennsylvania, the first Jacobs House in Wisconsin and the Guggenheim Museum, which still stands out futuristically in Manhattan, are the product of a late, unexpected period in his career. At 60, he was in decline; at 80, he was in the ascendant. He did more than half his work in the last quarter of his life. His final decade was his most productive. In other words, Wright was a late bloomer. Prior to his second act, he had been written off by an architecture establishment that could no longer see his potential. So many late bloomers hide in the open like this: among them Harry Truman, Margaret Thatcher and Katharine Graham. Jonathan Yeo, who produced the portrait of King Charles, only began to paint in his twenties. Penelope Fitzgerald wrote her first novel at 60. Young stars may be more visible, more celebrated, but late bloomers lurk among us.”

What we’re reading (6/15)

“The Good Economic News This Week Was Just That … Good News” (CNN Business). “When economic reports are released that are solid, they have all too often been clouded with concerns that good news for the economy actually means a longer wait before the Federal Reserve rolls out rate cuts. This week, a string of good news was actually good news: Closely watched inflation gauges showed prices had cooled more than anticipated; Americans’ financial outlooks were rosier than they have been in years while their inflation expectations dipped; and, on Friday, US import prices reversed course and fell sharply, adding fuel to the disinflationary fire.”

“Southwest Changed Flying. Now It Can’t Change Fast Enough.” (Wall Street Journal). “Elliott Investment Management, the influential New York hedge fund, says Southwest is stuck in the past. The activist investor says it has amassed a $1.9 billion stake, which amounts to an approximately 11% economic interest in the airline, making it one of Southwest’s biggest shareholders—and its most vocal critics. This past week it demanded Southwest oust its CEO, overhaul the board, and consider shaking up its business model. Southwest became the biggest U.S. airline by domestic passengers by doing things its own way. Trouble is, that’s no longer working so well.”

“The AI Bill That Has Big Tech Panicked” (Vox). “If I build a car that is far more dangerous than other cars, don’t do any safety testing, release it, and it ultimately leads to people getting killed, I will probably be held liable and have to pay damages, if not criminal penalties. If I build a search engine that (unlike Google) has as the first result for ‘how can I commit a mass murder’ detailed instructions on how best to carry out a spree killing, and someone uses my search engine and follows the instructions, I likely won’t be held liable, thanks largely to Section 230 of the Communications Decency Act of 1996. So here’s a question: Is an AI assistant more like a car, where we can expect manufacturers to do safety testing or be liable if they get people killed? Or is it more like a search engine?”

“How Jeff Bezos Is Trying To Fix The Washington Post” (New York Times). “Mr. Bezos, aware of the growing business problems, started paying more attention to his purchase last year. In June, the company announced that Fred Ryan, the chief executive since 2014, would be stepping down and that Patty Stonesifer, a veteran technology executive and a confidante of Mr. Bezos, would temporarily take over.”

“Wells Employees, So Adept At Forging Signatures And Altering Time Stamps Discover Power Automate” (Dealbreaker). “For years, Wells Fargo has been very clear: It does the screwing over of other people/places/things. It does not get screwed over itself! Not by its vendors, and certainly not by its employees. And yet those employees continue to (allegedly) find new ways to screw Wells Fargo over.”

What we’re reading (6/14)

“Hot Funds And The Curse Of ‘Self-Inflated Returns’” (Wall Street Journal). “What your exchange-traded fund owns is important. Who else owns your ETF might be even more important. That’s because a fund’s returns often don’t depend merely on the behavior of the investments it buys, but also on the behavior of the investors who buy the fund. Hot money—a sudden influx of cash from people trying to get rich quick—can overheat an ETF and create what new research calls ‘self-inflated returns.’ The result, sooner or later, is self-inflicted losses. Fortunately, you can protect yourself with some common sense.”

“Larry Summers Isn’t Second-Guessing The Government On Inflation” (New York Times). “Dissatisfaction with high interest rates and the unavailability of consumer credit explains why consumer sentiment is worse than would be expected given current levels of inflation and unemployment, Lawrence Summers, the former Treasury secretary and Harvard president, wrote in February in a working paper with three other economists…You might be surprised, then, that Summers is not arguing for the Bureau of Labor Statistics to put interest rates in the Consumer Price Index. ‘I don’t think the purpose of the C.P.I. is to predict people’s sentiment,’ he told me this week. ‘The purpose is to measure the cost of goods and services.’”

“Caught You Faking: Wells Fargo Firings Expose Workplace Surveillance Dilemma” (Axios). “Wells Fargo’s decision to fire more than a dozen employees for ‘simulation of keyboard activity’ points to a simmering tension in the post-pandemic workplace…Major employers are using surveillance tools to ensure that no matter where people work, they're at their computers — but polls suggest doing so is risky for morale…Wells Fargo didn't say whether the employees — from the company's wealth- and investment-management unit — were working remotely, or how they were faking the ‘impression of active work,’ Bloomberg reports.”

“Why The Stock Market Has Risen Even With No Fed Rate Cuts” (New York Times). “The Federal Reserve has disappointed investors this year, but no matter. The markets have adjusted. Even without any interest rate cuts so far in 2024 — and with the likelihood of just one meager rate reduction by the end of the year — the stock market has been purring along. That’s quite an achievement, given the expectation in January that the Fed would trim rates six or seven times in 2024 — and that interest rates throughout the economy would be much lower by now.”

“Roaring Kitty Becomes The 4th Largest GameStop Shareholder After Nearly Doubling His Position To 9 Million Shares” (Business Insider). “Keith Gill, better known as Roaring Kitty on social media, appears to have nearly doubled his position in GameStop stock. According to a screenshot of his E*Trade portfolio posted to Reddit on Thursday, Gill now owns nine million shares of GameStop. Gill had previously owned 5 million shares of GameStop and 120,000 call option contracts with a $20 strike price that were set to expire next week. With Gill's massive options position in the money, he partially sold the options and exercised some to acquire an additional 4 million shares at $20 each.”

What we’re reading (6/10)

“Apple Is Bringing One Of iPhone Owners’ ‘Most Requested’ Features To Text Messages” (Business Insider). “Apple’s iOS 18 update will come with the ability to schedule text messages to be sent at a later time, it announced Monday at its annual WWDC event. It’s among the ‘most requested’ features and can come in handy for things like sending a reminder or remembering to wish a friend happy birthday, Ronak Shah, Apple’s director of internet-technologies product marketing, said.”

“Gen Z Plumbers And Construction Workers Are Making #BlueCollar Cool” (Wall Street Journal). “Skepticism about the cost and value of four-year degrees is growing, and enrollment in vocational programs has risen as young people pursue well-paying jobs that don’t require desks or so much debt, and come with the potential to be your own boss. The number of students enrolled in vocational-focused community colleges rose 16% last year to its highest level since the National Student Clearinghouse began tracking such data in 2018.”

“A New Measure Shows C.E.O. Pay At Even More Astronomical Levels” (New York Times). “Twelve years after the enactment of Dodd-Frank, the Securities and Exchange Commission approved additional rules for assessing C.E.O. pay. Virtually all publicly traded companies have been subject to these ‘compensation actually paid’ rules this year. The new approach is supposed to help shareholders determine whether an executive’s compensation is aligned with their company’s stock market return. It emphasizes the annual changes in value of an executive’s current and potential stock holdings, in contrast with the traditional approach, which provides a snapshot of the estimated value of a pay package when it is granted.”

“OpenAI Hires New CFO And Product Chief, Announces Apple Deal To Integrate ChatGPT” (CNBC). “OpenAI on Monday hired two top executives and announced a partnership with Apple that includes a ChatGPT-Siri integration, the company announced in two blog posts. The company said Sarah Friar, previously CEO of Nextdoor and finance chief at Square, is joining as chief financial officer. Friar co-chairs the Stanford Digital Economy Lab. ‘She will lead a finance team that supports our mission by providing continued investment in our core research capabilities, and ensuring that we can scale to meet the needs of our growing customer base and the complex and global environment in which we are operating,’ OpenAI wrote in a blog post. OpenAI also hired Kevin Weil, an ex-president at Planet Labs, as its new chief product officer, according to the blog post.”

“Walmart Store Closures Are A Warning Sign Of Retail Apocalypse With Other Chains Also Facing Threat, Expert Says” (The U.S. Sun). “Walmart, which operates 5,000 stores in the US, is also reportedly laying off hundreds of corporate employees as the company urges remote workers to come into work. Retail analyst Neil Saunders told Yahoo that Walmart's closures in 2016, captured by retail photographer Nicholas Eckhart, were the beginning of a pattern in store cuts. ‘The blunt truth is that while stores remain a vital part of the retail mix, they are not quite as relevant as they used to be,’ the expert told the outlet.”

What we’re reading (6/9)

“A Crypto Bull’s Big Tax Settlement” (DealBook). “The attorney general for the District of Columbia has reached a $40 million settlement with the billionaire Bitcoin investor Michael Saylor and MicroStrategy, the software company he founded, over tax fraud, DealBook’s Lauren Hirsch is first to report. Officials say the agreement is the biggest-ever income tax fraud recovery in the district. It’s also the first lawsuit under the district’s amended False Claims Act, which encourages whistle-blowers to file claims of tax evasion against residents who they say are concealing where they actually live.”

“Colorado’s Weed Market Is Coming Down Hard And It’s Making Other States Nervous” (Politico). “What once was a success story has now left a trail of failed businesses and cash-strapped entrepreneurs in its wake. Regulatory burdens, an oversaturated market and increasing competition from nearby states have all landed major blows, leaving other states with newer marijuana markets scrambling to avoid the same mistakes.”

“A Researcher Fired By OpenAI Published A 165-Page Essay On What To Expect From AI In The Next Decade. We Asked GPT-4 To Summarize It.” (Business Insider). “Leopold Aschenbrenner, a researcher fired from OpenAI in April, published his thoughts on the AI revolution in an epic 165-page treatise…Aschenbrenner's essay doesn't appear to include sensitive details about OpenAI. Instead, as Aschenbrenner writes on the dedication page, it’s based on ‘publicly available information, my own ideas, general field knowledge, or SF gossip.’”

“Why You Shouldn’t Obsess About The National Debt” (Paul Krugman). “First, while $34 trillion is a very large figure, it’s a lot less scary than many imagine if you put it in historical and international context. Second, to the extent debt is a concern, making debt sustainable wouldn’t be at all hard in terms of the straight economics; it’s almost entirely a political problem. Finally, people who claim to be deeply concerned about debt are, all too often, hypocrites — the level of their hypocrisy often reaches the surreal.”

“Gold Is Getting Harder To Find As Miners Struggle To Excavate More, World Gold Council Says” (CNBC). “The gold mining industry is struggling to sustain production growth as deposits of the yellow metal become harder to find, according to the World Gold Council. ‘We’ve seen record first quarter mine production in 2024 up 4% year on year. But the bigger picture, I think about mine production is that, effectively, it plateaued around 2016, 2018 and we’ve seen no growth since then,’ WGC Chief Market Strategist John Reade said.”

What we’re reading (6/8)

“Why The Pandemic Probably Started In A Lab, In 5 Key Points” (New York Times). “[A] growing volume of evidence — gleaned from public records released under the Freedom of Information Act, digital sleuthing through online databases, scientific papers analyzing the virus and its spread, and leaks from within the U.S. government — suggests that the pandemic most likely occurred because a virus escaped from a research lab in Wuhan, China. If so, it would be the most costly accident in the history of science.”

“The Unexpected Origins Of A Modern Finance Tool” (MIT News). “Discounting calculations are ubiquitous today — thanks partly to the English clergy who spread them amid turmoil in the 1600s, an MIT scholar shows.”

“Beneath The Calm Market, Stocks Are Going Haywire” (Wall Street Journal). “It is easy to look at the piddling daily moves in the S&P 500 and think the market has been oh-so-boring recently. There hasn’t been a 2% move since February and the VIX gauge of expected volatility is only up a bit from the postpandemic low reached last month. Under the calm surface, however, there is furious paddling. Only once in the past 25 years have stocks swung about like this while the overall market stayed so placid. Traders in the options markets are betting on its continuing: Prices indicate the biggest swings in stocks for at least 10 years relative to the prevailing calm for the S&P 500.”

“Zombies: Ranks Of World’s Most Debt-Hobbled Companies Are Soaring, And Not All Will Survive” (Associated Press). “They are called zombies, companies so laden with debt that they are just stumbling by on the brink of survival, barely able to pay even the interest on their loans and often just a bad business hit away from dying off for good. An Associated Press analysis found their numbers have soared to nearly 7,000 publicly traded companies around the world — 2,000 in the United States alone — whiplashed by years of piling up cheap debt followed by stubborn inflation that has pushed borrowing costs to decade highs. And now many of these mostly small and mid-sized walking wounded could soon be facing their day of reckoning, with due dates looming on hundreds of billions of dollars of loans they may not be able to pay back.”

“Celebrating The Glamorous Heyday Of The Department Store” (Washington Post). “Convinced that top-notch service was key to their success, department stores offered their employees handsome salaries and often provided their staff with in-house health care and even resorts. They could take free courses in interior design and merchandising at New York University. The stores were, Satow posits in several compelling ways, a way for women to get ahead when few professional avenues were available to them.”

What we’re reading (6/7)

“Keith Gill’s Riotous Return To YouTube Had Beer, Charts And A GameStop Pep Talk” (Wall Street Journal). “Keith Gill’s livestream Friday had many of the same ingredients as the 2021 videos that made him a legend to scores of everyday investors eager to strike it big in the stock market. He donned sunglasses. He spoke from his signature red gaming chair. He poured a beer, cracked jokes and cheered on the Celtics. He even had a few props, including his Magic 8 Ball. ‘It’s five o’clock somewhere,’ Gill said. The crowd loved it.”

“Roaring Kitty Rambled About Memes, Guzzled A Beer, And Revealed His E-Trade Account In A Long-Awaited Livestream. It Couldn’t Reverse A 41% Decline In The Stock.” (Business Insider). “Gill also revealed his portfolio, which was worth $350 million as of 1 p.m. ET on Friday. Apart from talking about GameStop, Gill confirmed that he's behind all of his social-media accounts and that he did not sell any, as some on the internet had speculated. Gill told viewers that only his money was behind his $350 million position in GameStop and that he's not working with anyone else.”

“‘Everything Is Not Going to Be OK’ In Private Equity, Apollo’s Co-President Says” (Bloomberg). “‘I’m here to tell you everything is not going to be ok,’ the Apollo co-president said in a session at the SuperReturn International conference in Berlin on Wednesday. ‘The types of PE returns it enjoyed for many years, you know, up to 2022, you’re not going to see that until the pig moves through the python. And that is just the reality of where we are.’ Private equity firms didn’t take significant markdowns during the recent period of rapid rate hikes which means that ‘investors of all sorts are going to have swallow the lump moving through the system,’ he said, referring to assets that private equity firms bought up until 2022. Funds are now holding on to these companies and will eventually have to refinance at higher rates.”

“The Slow Death Of A Fabled Media Empire” (New York Times). “Because Paramount Global’s ownership structure gives all power to its largest voting shareholder, the company’s future comes down to the whims of just one person: the 70-year-old heiress Shari Redstone. She chose to put Paramount on the block, and she alone is deciding between a buyer whose strategy could very well further weaken, or kill, these cultural icons — and one that at least allows for some hope of a creative revival. She could, of course, reject both options, and try to maintain what’s left of the status quo. Is this how we want our cultural future to be decided?”

“Procyclical Stocks Earn Higher Returns” (William Goetzmann, Akiko Watanabe, and Masahiro Watanabe). “We find that procyclical stocks, whose returns comove with business cycles, earn higher average returns than countercyclical stocks. We use almost a three-quarter century of real GDP growth expectations from economists’ surveys to determine forecasted economic states. This approach largely avoids the confounding effects of econometric forecasting model error. The loading on the expected real GDP growth rate is a priced risk measure. A fully tradable, ex-ante portfolio formed on this loading generates a procyclicality premium that is statistically significant, economically large, long-lasting over a few years, and independent of the size, book-to-market, and momentum effects.”

What we’re reading (6/3)

“NYSE Says Technical Issue That Caused Berkshire Hathaway To Be Displayed Down 99% Is Fixed” (CNBC). “A technical issue on Monday caused the A-class shares of Warren Buffett’s Berkshire Hathaway to appear to be down nearly 100% on the New York Stock Exchange for most of the morning trading period. Trading was halted in those shares, as well as in Barrick Gold and Nuscale Power, which had also seen dramatic falls. All three stocks have since resumed trading.”

“‘Roaring Kitty’ Post Seems To Show Trader Held Onto Giant GameStop Stake After Monday’s Rally” (CNBC). “Gill, whose handle is ‘DeepF------Value’ on Reddit and ‘Roaring Kitty’ on YouTube and X, posted another screenshot of his portfolio showing the same common stock and call option holdings Monday after the stock market closed as those he shared Sunday evening. He still owned 5 million shares of GameStop and 120,000 call options with a strike price of $20 that expire on June 21, the screenshot showed. The post on Reddit’s r/SuperStonk forum could not be independently verified by CNBC. “

“E*Trade Considers Kicking Meme-Stock Leader Keith Gill Off Platform” (Wall Street Journal). “Shortly before Gill reignited a meme-stock craze in May, he bought a large volume of GameStop options on E*Trade, the people said. This week, Gill posted screenshots of an E*Trade account showing he owns GameStop shares now valued at $140 million and a new set of options that expire later this month. His total gains on the positions were at $85.5 million, he posted late Monday, showing his account remained in operation. The stock of GameStop surged again on his posts, showing the power Gill, also known as Roaring Kitty and DeepF—Value, has as an influencer. GameStop shares, up 21% on Monday, have risen more than 60% since he reappeared.”

“Oil And Gas Companies Are Trying to Rig The Marketplace” (New York Times). “[Y]ou might reasonably conclude that the market is pivoting, and the end for fossil fuels is near. But it’s not. Instead, fossil fuel interests — including think tanks, trade associations and dark money groups — are often preventing the market from shifting to the lowest cost energy.”

“Wealth Inequality In A Low Rate Environment” (Matthieu Gomez, Econometrica). “We study the effect of interest rates on wealth inequality. While lower rates decrease the growth rate of rentiers, they also increase the growth rate of entrepreneurs by making it cheaper to raise capital. To understand which effect dominates, we derive a sufficient statistic for the effect of interest rates on the Pareto exponent of the wealth distribution: it depends on the lifetime equity and debt issuance rate of individuals in the right tail of the wealth distribution. We estimate this sufficient statistic using new data on the trajectory of top fortunes in the U.S. Overall, we find that the secular decline in interest rates (or more generally of required rates of returns) can account for about 40% of the rise in Pareto inequality; that is, the degree to which the super rich pulled ahead relative to the rich.”

May performance update

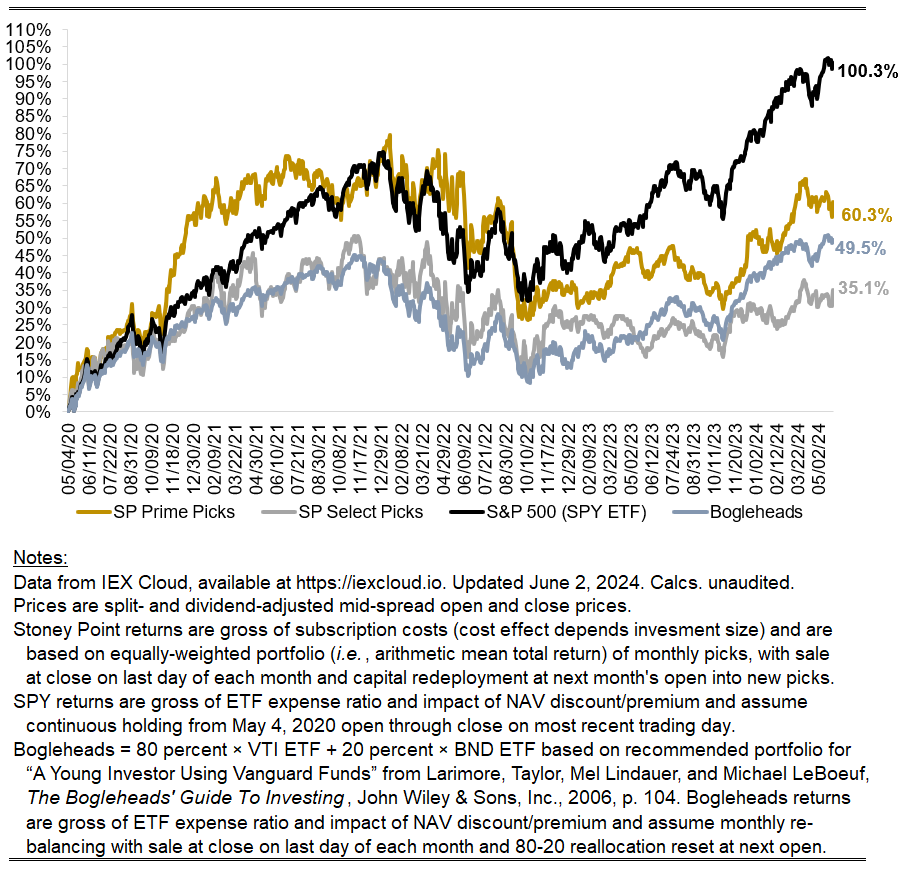

Here with a May performance update:

Prime: +1.33%

Select: +3.38%

SPY ETF: +5.18%

Bogleheads portfolio (80% VTI, 20% BND): 4.15%

A fine month overall for the Stoney Point strategies, and one that historically would be considered quite strong. But the market overall continues to perform even better, with an extraordinarily good month. Qualitatively, AI hopes appear to continue to power the S&P higher. I posted an article a few days ago highlighting that four companies now represent nearly 40% of the S&P index. Unsurprisingly, these are all AI giants. Time will tell whether the commercial opportunity for that will live up to the hype, but so far it seems to be a good bet.

Stoney Point Total Performance History

June picks available now

The new Prime and Select picks for June are available starting now, based on a model run put through Today (May 31). As a note, I will be measuring the performance on these picks from the first trading day of the month, Monday, June 3, 2024 (at the mid-spread open price) through the last trading day of the month, Friday, June 28, 2024 (at the mid-spread closing price).

What we’re reading (5/30)

“This Record Stock Market Is Riding On Questionable AI Assumptions” (Wall Street Journal). “Nvidia’s profits are rising about as fast as its share price, so if there is a bubble, it’s a bubble in demand for chips, not a pure stock bubble. To the extent there is a mispricing, it’s more like the banks in 2007—when profits were unsustainably high—than it is to the profitless dot-coms of the 2000 bubble. The threat to Nvidia’s share price is therefore about threats to its earnings. There are four risks: 1) Demand falls because AI is overhyped […] 2) Competition reduces prices […] 3) Nvidia’s biggest supplier, Taiwan Semiconductor Manufacturing, might want a bigger slice […] 4) What if scale doesn’t matter?”

“Lazy Work, Good Work” (Collab Fund). “John D. Rockefeller was the most successful businessman of all time. He was also a recluse, spending most of his time by himself. He rarely spoke, deliberately making himself inaccessible and staying quiet when you caught his attention.”

“Yes, Walmart Store Managers Really Can Make $500,000 A Year” (Bloomberg). “The world’s largest retailer is rethinking one of its most important roles after falling behind the competition. A couple of years ago, Walmart’s attrition rate for store managers spiked to almost double that of other big-box retailers such as Home Depot Inc. and Target Corp., according to data from human resources analytics company Revelio Labs Inc. Departures first ticked up when Walmart cut management ranks in the late 2010s, saddling those who remained with more work and longer hours, according to two former managers who declined to be named. At the time, the company was more focused on improving conditions for its hourly workers, investing billions in upgrading their wages.”

“You Can Thank Private Equity For That Enormous Doctor’s Bill” (Wall Street Journal). “Years of dealmaking has led to sprawling hospital systems, vertically integrated health insurance companies, and highly concentrated private equity-owned practices resulting in diminished competition and even the closure of vital health facilities. As this three-part Heard on the Street series will show, the rich rewards and lax oversight ultimately create pain for both patients and the doctors who treat them.”

“Home Insurance Was Once A ‘Must.’ Now More Homeowners Are Going Without.” (Washington Post). “Most uninsured homeowners are those who have paid off their mortgage and are no longer required to have insurance. Among those who own their home outright, the CFA estimates roughly 14 percent are uninsured, with low-income and minority homeowners especially at risk. Among mortgage holders, only 2 percent opt to go without coverage. Experts say this trend is driven by the escalating threat of climate change — which has forced insurers to make larger and larger payouts — and skyrocketing housing prices. Both trends are pushing the cost of policies up. On average, home insurance policies rose 11.3 percent in 2023, according to S&P Global.”

June picks available soon

I’ll be publishing the Prime and Select picks for the month of June before Monday, June 3 (the first trading day of the month). As always, SPC’s performance measurement for the month of May, as well as SPC’s cumulative performance, will assume the sale of the May picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Friday, May 31). Performance tracking for the month of June will assume the June picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Monday, June 3).

What we’re reading (5/26)

“How An Ex-Teacher Turned A Tiny Pension Into A Giant-Killer” (Wall Street Journal). “Plymouth County is known for Pilgrims, cranberries—and a top-performing pension fund run by a 65-year-old former schoolteacher. After a decade of mostly ho-hum performance, the $1.4 billion Plymouth County Retirement Association ranked in the top 10% of U.S. pensions over the past three years. Key to that success was an early—and prescient—bet that interest rates would rise. That buoyed the fund through big chunks of the past two years, when climbing rates hammered both stocks and bonds.”

“Tesla Shareholders Advised To Reject Musk’s $56 Billion Pay” (CNBC). “Proxy advisory firm Glass Lewis said on Saturday it has urged Tesla shareholders to reject a $56 billion pay package for Chief Executive Officer Elon Musk, which if passed would be the largest pay package for a CEO in corporate America.”

“What Do Students At Elite Colleges Really Want?” (New York Times). “Over the last five years or so, ‘the idea of thinking about your professional path has moved much earlier in the undergraduate experience,’ Ms. Ciesil said. She said the banks first began talking to students earlier, and it was the entrance of Big Tech onto the scene, asking for junior summer applications by the end of sophomore year, that accelerated recruitment timelines. ‘At first, we tried to fight back by saying, ‘No, no, no, no, no, sophomores aren’t ready, and what does a sophomore know about financial modeling?’’ said Mr. Woolsey at Union College. But, he added, schools ‘don’t want to push back too much, because then you’re going to lose revenue,’ since firms often pay to recruit on campus.”

“How To Build 300,000 Airplanes In Five Years” (Construction Physics). “One of the most important elements in the ‘Arsenal of Democracy’ [during WWII] was aircraft. Over the course of the war the U.S. produced around 325,000 airplanes valued at roughly $46 billion ($800 billion in 2024 dollars). Not only is this more aircraft than what Germany, Japan, and Italy combined produced during the war — it’s also more aircraft than have been built for commercial transport in the entire history of aviation.”

“The Chuck E. Cheese Band Delays Retirement With An Encore At 3 More Stores” (Washington Post). “More of Chuck E. Cheese’s animatronics bands are here to stay at five locations as the pizza-and-arcade chain tries to lean into fans’ nostalgia while endearing Chuck to today’s children. The brand announced last year that it would retire its Munch’s Make-Believe Bands except one ‘permanent residency’ in Northridge, Calif., which the company says has become a destination for wistful parents. In addition to the full-stage band in Northridge — and a previously announced solo-Chuck set at a ‘100% retro store’ in Nanuet, N.Y. — bands will remain in Springfield, Ill., Hicksville, N.Y., and Charlotte, N.C. Everywhere else, though, will shed the once-ubiquitous American icons in a matter of months.”

What we’re reading (5/25)

“Q1 2024 Household Debt And Credit: Rising Delinquency Rates Raising Concerns” (Regions). “The overall delinquency rate on household debt rose to 3.25 percent in Q1 from 3.13 percent in Q4 2023, with a particularly large increase in severely derogatory accounts, i.e., those accounts in some stage of delinquency on which there has been either a report of repossession, a charge-off to bad debt, or a foreclosure action. Though having moved higher over recent quarters, early-stage and overall delinquency rates remain below pre-pandemic norms.”

“Inside The Rockefeller Clan’s Intensifying Feud With Exxon” (Wall Street Journal). “The Rockefeller Family Fund, the charity she [Rockefeller heir Miranda Kaiser] is president of, is funding litigation and other support for more than 30 lawsuits around the U.S. against the fossil fuel industry. Exxon is a defendant in all of them. Fund staffers also consult with state attorneys general, nine of whom have brought cases against Exxon. The cases aim to collect billions of dollars from Exxon and its peers for their contributions to climate change and the damages caused by it.”

“How A Global Seafood Giant Broke Red Lobster” (CNN Business). “Thai Union’s damaging decisions drove the pioneering chain’s fall, according to 13 former Red Lobster executives and senior leaders in various areas of the business as well as analysts. All but two of the former Red Lobster employees spoke to CNN under the condition of anonymity because of either non-disclosure agreements with Thai Union; fear that speaking out would harm their careers; or because they don’t want to jeopardize deferred compensation from Red Lobster.”

“Instagram’s Desperate Move” (Business Insider). “Ultimately, the Instagram badges aren't the end of the world. At best, they're a nothingburger. At worst, they seem a bit lame and add to the vibe that Instagram is becoming a platform for olds.”

“Meta Walked Away From News. Now The Company’s Using It For AI Content.” (Washington Post). “After years of Meta steadily walking away from news on its platforms, the company’s new AI tool is now using the work of those outlets for content.”

What we’re reading (5/24)

“What Our Brains Know About Stocks—But Won’t Tell Us” (Wall Street Journal). “In the past few years, researchers have been investigating “neuroforecasting.” That’s the apparent ability of activity in the brain to forecast outcomes—even when people are unaware of it. Neuroscientists have asked participants to predict which requests for microlending will raise the most money online, which ventures will receive the most crowdfunding, how popular video clips or songs will be, or whether a stock would go up or down. Consistently, people’s conscious choices when confronted with these sorts of questions aren’t significantly better than chance. But the intensity of activation in their nucleus accumbens, an area of the brain that subconsciously processes anticipation of reward, turns out to be a good predictor of what people will collectively decide they like.”

“A Lender To Consumer Start-Ups Falters, Rattling Its Clients” (New York Times). “A popular lender backed by venture capital firms is struggling financially, sending shock waves through the small clothing and home furnishing companies that count on its financing. The lender, Ampla, spent years courting small direct-to-consumer brands with low rates and a pitch that it understood their needs. In recent weeks, its top executives have been searching for a buyer, two people familiar with the firm’s finances said. Last week, Ampla, which is based in New York, said it would lay off half its 62 workers.”

“America Is Still Having A ‘Vibecession’” (Paul Krugman, New York Times). “The gold standard for assessing economic perceptions is the Federal Reserve’s annual survey of economic well-being of American households. The results of the latest survey, taken in October, have just been released, and while there’s a lot of information in the report — notably, families with children appear to have been hit hard by the end of pandemic-era financial aid — the key finding hasn’t changed much. Most Americans continue to say that they’re doing OK financially, but they think the national economy is doing badly — while they’re being considerably more positive about their local economy. Wasn’t it always thus? No. As the report notes, ‘the gap between people’s perceptions of their own financial well-being and their perception of the national economy has nearly doubled since 2019.’”

“The Rise And Fall Of Simon Sadler's Segantii, One Of Asia's Most Successful Hedge Funds” (Bloomberg). “The legal heat became too much for Simon Sadler. The founder of Segantii Capital Management has told investors that it’s winding down and returning their money, marking the end of a 16-year run for one of the largest and most successful hedge funds[.]”

“Welcome To The WFH Friday Economy: It’s A Time For Hair Masks, Spas, Day Drinking, And No-Camera Meetings” (Business Insider). “Friday was the most popular day for spa and salon appointments booked on ClassPass in 2023, according to data the company provided to BI. The top time for fitness classes on Fridays in 2023 was 12 p.m. — perhaps indicating a rush of lunchtime exercisers. The top time to hit the salon or spa was 5 p.m. on the dot. Upticks in foot traffic at Starbucks, Sweetgreen, and Panera Bread shown by Placer.ai could suggest people are more frequently treating themselves to lunch or coffee out, working at coffee shops, or signing off earlier from work on Fridays. Indeed, an ActivTrak analysis of 75,000 workers found that whether or not they were going into the office on Friday, they were signing off at about 4 p.m. that day, compared with 5 p.m. on Mondays through Thursdays.”

What we’re reading (5/23)

“Stocks Slide, Dow Suffers Worst Day In A Year As Nvidia Fails To Spur Market Rally” (Yahoo! Finance). “Stocks slid from record levels on Thursday as interest rate worries dominated investor sentiment after Nvidia's (NVDA) blockbuster earnings failed to spur a broader market rally.”

“FTC Chair: AI Models Could Violate Antitrust Laws” (The Hill). “‘The FTC Act prohibits unfair methods of competition and unfair or deceptive acts or practices,’ Khan said at the event. ‘So, you can imagine, if somebody’s content or information is being scraped that they have produced, and then is being used in ways to compete with them and to dislodge them from the market and divert businesses, in some cases, that could be an unfair method of competition.’”

“Top PE Funds See Mediocre Returns As Exits Slow” (Institutional Investor). “For funds between seven and nine years old, ‘half of the stated asset value consists of unsold deals that are ‘marked to market’ by the private equity managers,’ according to a study by Jeffrey Hooke, a senior finance lecturer at Johns Hopkins Carey Business School who focuses on the alternative asset class.”

“Redefining The Scientific Method: As The Use Of Sophisticated Scientific Methods That Extend Our Mind” (PNAS Nexus). “Scientific, medical, and technological knowledge has transformed our world, but we still poorly understand the nature of scientific methodology. Science textbooks, science dictionaries, and science institutions often state that scientists follow, and should follow, the universal scientific method of testing hypotheses using observation and experimentation. Yet, scientific methodology has not been systematically analyzed using large-scale data and scientific methods themselves as it is viewed as not easily amenable to scientific study. Using data on all major discoveries across science including all Nobel Prize and major non-Nobel Prize discoveries, we can address the question of the extent to which ‘the scientific method’ is actually applied in making science's groundbreaking research and whether we need to expand this central concept of science. This study reveals that 25% of all discoveries since 1900 did not apply the common scientific method (all three features)[.]”

“Should Governments Crack Down On Fake Job Postings?” (Dealbreaker). “While the details vary, ghost jobs fall into one of two categories. The first are advertised job openings although employers have no intention of actually hiring anyone. Companies do this to project an image that they are growing, to placate overworked employees, gauge salary demands in order to determine whether to give existing employees raises, or to have a list of people who may be available in the future. The second type of ghost jobs are those that have requirements that are so strict and specific that only a few people will be eligible. Usually this is the case where the company has already selected who they want to hire internally but is required to make the job opening public due to legal requirements (although this requirement only seems to apply for federal contracting jobs) or contractual requirements such as a collective bargaining agreement. These job postings are also suspected to automatically reject unemployed candidates and instead target people who are already employed and want to leave their current job.”

What we’re reading (5/22)

“Fed Officials Saw Longer Wait For Rate Cuts After Inflation Setbacks” (Wall Street Journal). “Federal Reserve officials concluded at their most recent meeting they would need to hold interest rates at their current level for longer than they previously anticipated after a third straight disappointing inflation reading last month.”

“The Second Great Bailout” (The Grumpy Economist). “After 2008, politicians and regulators promised the Dodd-Frank Act would stop bailouts. They failed. We document the massive bailouts of 2020-2023. But this time nobody is even promising to do anything about it. Too big to fail has spread everywhere. The basic architecture of allowing highly leveraged finance but promise that regulators will stop risks has failed. We have now tried everything else, it’s time for equity-financed banking and narrow deposit taking.”

“Tracing OpenAI CEO Sam Altman’s Love for Scarlett Johansson’s AI Romance Her” (Vanity Fair). “In September 2003, OpenAI cofounder and CEO Sam Altman was asked to name his favorite movie about artificial intelligence. It was two months before Altman would be pushed out of his company because, according to his board of directors, Altman was ‘not consistently candid in his communications’ with the board….onstage at Dreamforce 2023 in San Francisco, with a fake waterfall backdrop frozen behind him, Altman said that Spike Jonze’s 2013 film Her resonated with him more than other sci-fi films about AI.”

“This Man Did Not Invent Bitcoin” (New York Times). “The mystery of Satoshi’s identity has long obsessed crypto experts, who analyze every record of his communications with the reverence of Talmudic scholars. Various candidates have been proposed as possible Satoshis, only for them to deny any role in Bitcoin’s creation. Dr. Wright, by contrast, has gone to extraordinary lengths to prove that he is Satoshi. He has presented himself as Bitcoin’s inventor in interviews and social media posts, laying out evidence for virtually anyone who would listen. In lawsuits tried in three countries, he has testified that he wrote the original white paper. After a small-time crypto personality challenged his claims in 2019, Dr. Wright sued for defamation in England. He followed that up with an aggressive suit against software developers working to improve Bitcoin’s code, accusing them of violating his intellectual property rights.”

“100-Hour Weeks And Heart Palpitations: Inside Wall Street’s Brutal Work Culture” (New York Post). “The tragic death of former Green Beret and Bank of America employee Leo Lukenas III has become a flashpoint of anger over allegedly unrealistic work expectations on Wall Street — partly because some bankers say Lukenas’ experience is so similar to their own. While there is no evidence that job-related stress caused the blood clot that killed 35-year-old Lukenas on May 2, a recent Reuters report that he was talking with a recruiter to find a job with better hours has put a glaring spotlight on the 100-hour work weeks he was said to be juggling before his death.”

What we’re reading (5/21)

“Red Lobster Superfans Desperately Want A Piece Of The Bankrupt Chain” (Business Insider). “At the time the auctions closed, TAGeX's website showed that the entire contents of each location sold for between $10,000 and $35,000. That included everything from upright refrigerators and microwaves to fish tanks, furniture, and, in some cases, decor.”

“The High-Class Problem That Comes With Home Equity” (New York Times). “[R]everse mortgages or something like them seem inevitable in a nation where individuals are entirely responsible for their own retirement savings.”

“The Growing Importance Of Desalination” (Contrary). “[M]odern desalination plants are capable of converting roughly 80% of the saline water piped into potable water. The remainder is so heavily concentrated with salt that filtering it even further would be economically inefficient. This remainder is called brine and needs to be disposed of appropriately. An additional consideration for modern plants is that the filtration membranes need to be maintained and cleaned periodically as molecular compounds and minerals can get stuck in the membrane, decreasing its efficiency.”

“East Coast Has A Giant Offshore Freshwater Aquifer—How Did It Get There?” (ars technica). “For decades, scientists have known about an aquifer off the US East Coast. It stretches from Martha’s Vineyard to New Jersey and holds almost as much water as two Lake Ontarios. Research presented at the American Geophysical Union conference in December attempted to explain where the water came from—a key step in finding out where other undersea aquifers lie hidden around the world.”

“Private Equity Is No Place For Your Nest Egg” (Bloomberg). “Retirement is expensive. If you’re lucky, yours will last a few decades, and you’ll be earning no or very little income. So if you want to have enough money when you retire, you basically have three options: Save more, take more risk with your investments, or work longer. Many people find the first and third options undesirable or impossible. That leaves the second option. And despite what people such as Marc Rowan might lead you to believe, there’s really no way to get a higher return without taking more risk.”

What we’re reading (5/20)

“What Does The Dow Hitting 40,000 Tell Us?” (Paul Krugman, New York Times). “Unlike many right-wing commentators, I don’t consider the stock market the best indicator of the economy’s health, or even a good indicator. But it is an indicator. And given the state of American politics, with hyperpartisanship and conspiracy theorizing running rampant, I’d argue that this market milestone deserves more attention than it has been getting.”

“ChatGPT Can Talk, But OpenAI Employees Sure Can’t” (Vox). “what has really stirred speculation was the radio silence from former employees. [Ilya] Sutskever posted a pretty typical resignation message, saying ‘I’m confident that OpenAI will build AGI that is both safe and beneficial…I am excited for what comes next.’ [Jan] Leike ... didn’t. His resignation message was simply: ‘I resigned.’ After several days of fervent speculation, he expanded on this on Friday morning, explaining that he was worried OpenAI had shifted away from a safety-focused culture.”

“Press Pause On The Silicon Valley Hype Machine” (New York Times). “It’s a little hard to believe that just over a year ago, a group of leading researchers asked for a six-month pause in the development of larger systems of artificial intelligence, fearing that the systems would become too powerful. ‘Should we risk loss of control of our civilization?’ they asked. There was no pause. But now, a year later, the question isn’t really whether A.I. is too smart and will take over the world. It’s whether A.I. is too stupid and unreliable to be useful.”

“Oracle’s Deadly Gamble” (Business Insider). “Cerner was a total mess. While Ellison was fixated on the wildly exciting possibilities of marrying Cerner's medical records with Oracle's technology, Cerner was failing at even the most elementary tasks of data management. The company's rollout at the VA, which serves 9 million vets, had been a slow-moving catastrophe. One feature of its electronic records system had caused more than 11,000 orders for medical care to disappear into an ‘unknown queue.’ As a result, thousands of patients didn't receive the treatment their doctors had ordered. VA staffers were left in what one hospital leader called ‘a constant state of hypervigilance and distress’ as they scrambled to retrieve and reenter the missing orders, which wound up harming 149 patients. Even worse, errors in the system's underlying design were contributing factors in three deaths.”

“Ivan Boesky, Convicted In 1980s Insider-Trading Scandals, Dies At 87” (Wall Street Journal). “Ivan Boesky, who went to prison and paid a record $100 million fine for a sprawling insider-trading scandal, becoming a symbol of extravagance and corruption on Wall Street, has died at the age of 87…Boesky’s 1986 guilty plea and his cooperation with federal authorities led to the collapse of Michael Milken’s junk-bond empire and the end of the frenzied debt-fueled takeovers of the era that upended many industries. Boesky’s dramatic rise and fall marked a decade that became synonymous with unbridled ambition and even greed.”