March performance update

Here with a March performance update. The key numbers for the month are:

Prime: +8.52%

Select: +6.45%

SPY ETF: +2.77%

Bogleheads Portfolio (20% BND, 80% VTI): +2.36%

It was a fantastic month for SPC’s strategies. Prime and Select both produced monthly returns roughly commensurate with average historical annual returns for the market as a whole, and did that, notably, by indexing on relatively boring industrial companies amid a lot of continued hype of AI in the technology sector. Of course that wasn’t deliberate, that is just what the value ratios SPC’s models follow said to do. In particular, Prime and Select both had unusually large weights on oil and gas, and these were some of the biggest winners in the month across the two strategies. Within Prime, Valero, Phillips 66, and Marathon were up roughly 20 percent, 14 percent, and 18 percent, respectively (outside of oil and gas, but still in the “boring industrial” category, GM was also up 11 percent). Within Select, EOG Resources and Pioneer Natural Resources were up 10 percent and 12 percent respectively (homebuilders in Select also did well).

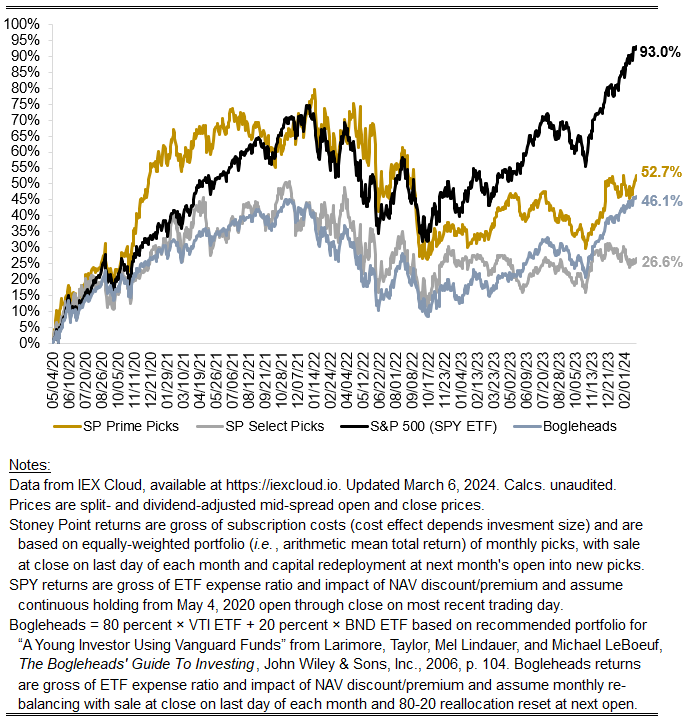

Stoney Point Total Performance History

April picks available now

The new Prime and Select picks for April are available starting now, based on a model run put through Today (March 31). As a note, I will be measuring the performance on these picks from the first trading day of the month, Monday, April 1, 2024 (at the mid-spread open price) through the last trading day of the month, Tuesday, April 30, 2024 (at the mid-spread closing price).

April picks available soon

I’ll be publishing the Prime and Select picks for the month of April before Monday, April 1 (the first trading day of the month). As always, SPC’s performance measurement for the month of March, as well as SPC’s cumulative performance, will assume the sale of the March picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Thursday, March 28). Performance tracking for the month of April will assume the April picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Monday, April 1).

Editorial Note: this page was corrected on 3/29/24. Previously, this page indicated that the last trading day of March 2024 would be Friday, March 29; however, U.S. markets are closed on Friday, March 29, in observance of Good Friday.

What we’re reading (3/27)

“A Historic And Clubby Group In London Could Face Billions In Claims From The Baltimore Bridge Collapse” (Business Insider). “Analysts with Barclays estimate insurance claims from the bridge itself could total $1.2 billion, with as much as $700 million in claims for wrongful deaths, plus additional costs from business interruptions related to the port closure and bridge reconstruction, Bloomberg reported.”

“The Fight For AI Talent: Pay Million-Dollar Packages And Buy Whole Teams” (Wall Street Journal). “Tech companies are serving up million-dollar-a-year compensation packages, accelerated stock-vesting schedules and offers to poach entire engineering teams to draw people with expertise and experience in the kind of generative AI that is powering ChatGPT and other humanlike bots. They are competing against each other and against startups vying to be the next big thing to unseat the giants.”

“The Fallout From A Credit Card Shake-Up” (Dealbreaker). “A long-running fight between the credit card giants Visa and Mastercard and retailers in the United States is nearing an end, with the promise of lower fees for merchants…Visa and Mastercard said on Tuesday that they had agreed to reduce swipe fees, costs associated with the use of a credit card, for about five years. Lawyers for merchants who had brought the case estimate that this could save about $30 billion worth of fees.”

“Tom Hayes Really Wishes He Did His LIBOR-Rigging In New York” (Dealbreaker). “Tom Hayes, the former Citigroup and UBS trader who bore the brunt of the backlash against banks rigging the still-just-breathing London Interbank Offered Rate, will not be going back to jail, where he spent more than five years. But he and his fellow LIBOR-fiddler and formerly imprisoned scapegoat, ex-Barlcays trader Carlo Palombo, won’t be getting their good names (or a load of money) back, either, such as they are…In addition to being weird and winding up in a job where essentially everyone was breaking the law, Hayes can now add to his list of misfortunes being British. After all, if he’d been American, he’d likely never have spent much more than a few hours behind bars, given that, all the sound and fury and convictions notwithstanding, manipulating interest rates isn’t illegal on this side of the pond.”

“Daniel Kahneman, Nobel Laureate Who Upended Economics, Dies At 90” (Washington Post). “Dr. Kahneman took a dim view of people’s ability to think their way through a problem. ‘Many people are overconfident, prone to place too much faith in their intuitions,’ he wrote in his popular 2011 book, ‘Thinking, Fast and Slow.’ ‘They apparently find cognitive effort at least mildly unpleasant and avoid it as much as possible.’”

What we’re reading (3/26)

“Baltimore Bridge Collapse Reverberates From Cars To Coal” (Bloomberg). “As much as 2.5 million tons of coal, hundreds of cars made by Ford Motor Co., and General Motors Co., and lumber and gypsum are threatened with disruption after the container ship Dali slammed into and brought down Baltimore’s Francis Scott Key Bridge in the early hours of Tuesday.”

“Is Private Equity’s Bet On Life Insurance Turning Sour?” (Financial Times). “The IMF is urging regulators to consider the risks to the financial system posed by insurers either owned by — or whose assets are managed by — private equity groups. It calls them ‘PE-influenced’ insurers. Such firms, it said, were “more vulnerable” to a credit downturn, due to their higher proportion of illiquid assets, a situation that could be “aggravated” by the embedded leverage in structured credit.”

“The Stock Market Is Seeing One Of The Strongest 1st Quarters Of The Postwar Era. What That May Hold For The Rest Of 2024.” (MarketWatch). “It’s the final week of the first quarter and the S&P 500 is on track for a price gain of nearly 10% — and has rallied nearly 30% off its Oct. 27 closing low — leaving investors to ponder just how much good news is already baked into the market.”

“Boeing’s Embattled CEO Is Poised To Walk Away With Millions” (CNN Business). “Exactly how much Calhoun will receive isn’t clear yet, as it depends on how Boeing’s stock performs. A Boeing spokesperson said that details of his compensation will be shared in company filings in the coming weeks. But we already know that Calhoun has made about $63 million over the past three years in total compensation, according to regulatory filings. That includes a $1.4 million base salary, plus millions in stock-based incentives.”

“Why Treasury Yields Are Rising Despite Rate-Cut Expectations” (Wall Street Journal). “Inflation readings for January and February came in firmer than expected, and economic growth has proved resilient, forcing investors to dial back their rate-cut bets. Now, traders expect rates to end the year between 4.5% and 4.75%.”

What we’re reading (3/25)

“Boeing’s Next CEO Will Have ‘Massive Job’ At Company In Crisis” (Wall Street Journal). “Federal probes, sloppy factories, angry airlines, tense union negotiations and supply-chain snarls. Boeing’s crisis won’t end when David Calhoun exits as chief executive. The next leader of the American manufacturing icon will have to address some of the same issues that Calhoun, a longtime Boeing director, was brought on to clean up four years ago when the board he led ousted his predecessor.”

“Adam Neumann Makes A $500 Million Bid For WeWork That Could Hit $900 Million If Financing And Diligence Firm Up” (CNBC). “Neumann’s financing was not immediately clear, although people familiar with the matter told CNBC that Dan Loeb’s Third Point was not involved in the offer. Neumann’s counsel had previously said that Loeb’s investment firm was backing the WeWork founder’s offer, but Third Point disputed that assertion in a prior statement.”

“Meta Pursues AI Talent With Quick Offers, Emails From Mark Zuckerberg” (The Information). “In a sign of how seriously the social media company is taking the competition for AI talent, CEO Mark Zuckerberg has personally written to researcher’s as Google’s DeepMind unit to recruit them, according to two people who viewed the emails.”

“Why Investors Think Reddit Is Worth $1 Billion More Than The New York Times” (Business Insider). “Reddit, which loses money, is currently worth about $8.15 billion. The New York Times, which makes money, is worth about $7.2 billion…if you're running a media business, you understand precisely why investors are more excited about Reddit than the Times: The Times spends lots of money to make the content that readers and advertisers pay for. Reddit gets all of it for free, from its users.”

“A Higher Bid, And National Security Concerns, For An Ammunition Maker” (DealBook). “A battle over Vista Outdoor, the company behind top ammunition brands like Remington and Camelbak water bottles, is escalating — and national security is becoming a bigger factor in the fight. The investment firm MNC Capital on Monday raised its bid for the company to $3 billion, DealBook is first to report, hoping that a more generous offer — and further uncertainty that a rival bidder, the Czechoslovak Group, can pass a U.S. national security review — will win over Vista’s shareholders.”

What we’re reading (3/22)

“The New Normal For Mortgage Rates Will Be Higher Than Many Hope” (Wall Street Journal). “The extra yield over Treasurys—or spread—demanded by investors to own mortgage-backed securities issued by government-sponsored enterprises such as Fannie Mae or Freddie Mac, known as agency MBS,has come down a bitfrom the highs touched last year. But it still hasn’t narrowed back to historical levels. Wider spreads appear to be a new normal for the mortgage market. That in turn means homebuyers for now can expect to keep paying relatively higher rates.”

“The Trustbuster Who Has Apple And Google In His Sights” (New York Times). “Shortly after Jonathan Kanter took over the Justice Department’s antitrust division in November 2021, the agency secured an additional $50 million to investigate monopolies, bust criminal cartels and block mergers. To celebrate, Mr. Kanter bought a prop of a giant check, placed it outside his office and wrote on the check’s memo line: ‘Break ’Em Up.’ Mr. Kanter, 50, has pushed that philosophy ever since, becoming a lead architect of the most significant effort in decades to fight the concentration of power in corporate America. On Thursday, he took his biggest swing when the Justice Department filed an antitrust lawsuit against Apple.”

“Charts Show A Sharp Rise In The Rate Of Young Adults Getting Cancer Before Age 50” (Business Insider). “The rate of young adults being diagnosed with cancer has risen sharply in the past 30 years, particularly in high-income countries. Researchers aren't sure why.”

“Lawyering In The Age Of Artificial Intelligence” (Choi, Monahan, and Schwarcz). “We conducted the first randomized controlled trial to study the effect of AI assistance on human legal analysis. We randomly assigned law school students to complete realistic legal tasks either with or without the assistance of GPT-4. We tracked how long the students took on each task and blind-graded the results. We found that access to GPT-4 only slightly and inconsistently improved the quality of participants’ legal analysis but induced large and consistent increases in speed. AI assistance improved the quality of output unevenly—where it was useful at all, the lowest-skilled participants saw the largest improvements. On the other hand, AI assistance saved participants roughly the same amount of time regardless of their baseline speed.”

“Little League Scandal Roils Washington, D.C., Elite” (Wall Street Journal). “Emotions can run high in Little League, a touchstone of childhood for millions, and while blowouts sometimes raise suspicions of foul play, most parents keep the speculation to a whisper. That isn’t the case when the moms and dads of Little Leaguers are law-firm partners, lobbyists and other Beltway heavy-hitters.”

What we’re reading (3/20)

“Fed Meeting Recap: Everything Powell Said During Wednesday’s Market-Moving News Conference” (CNBC). “The Federal Reserve held steady on interest rates at the conclusion of its March meeting, and it’s sticking with its forecast for three interest rate cuts. During a news conference Fed Chair Jerome Powell noted that a strong jobs market wouldn’t deter the central bank from cutting rates.”

“The Era Of No-Brainer 5% Returns On Cash Is Ending” (Wall Street Journal). “It’s getting more complicated to hold cash. Certificates of deposit, money-market funds and various other cashlike investments have offered healthy returns, in many cases over 5%, since the Federal Reserve started lifting interest rates two years ago. But the central bank signaled Wednesday it expects to cut rates three times before the end of the year. Some cashlike investments are staying strong while others have begun to decline in yield.”

“The Private Equity Market Has Stalled — And There’s No Easy Fix” (Institutional Investor). “With $3.2 trillion in assets waiting for an exit plan sitting in their portfolios, private equity funds are facing market woes unlike anything since the financial crisis of 2008, according to the 2024 global private equity report by consultant Bain & Co. But this time around, the industry may not have the Federal Reserve coming to its rescue. ‘The word for this market is stalled,’ Hugh MacArthur, chairman of Bain’s global private equity practice, said in the report. ‘The culprit was the sharp and rapid increase in central bank rates.’”

“Reddit Is Going Public. Will Its Unruly User Base Revolt?” (Vox). “Reddit, the launchpad for many meme stocks, could now become one: The social media giant makes its debut on Wall Street this week in one of the most highly anticipated initial public offerings of the year. The nearly 20-year-old company is seeking to raise up to $748 million in its IPO on March 21, putting its valuation at about $6.4 billion. It’s the first time that a major social media company has gone public since Snap (i.e., Snapchat) in 2017. It will sell approximately 22 million shares priced at $31 to $34 each under the ticker symbol ‘RDDT.’”

“Harvard Has Halted Its Long-Planned Atmospheric Geoengineering Experiment” (MIT Technology Review). “Proponents of solar geoengineering research argue we should investigate the concept because it may significantly reduce the dangers of climate change. Further research could help scientists better understand the potential benefits, risks and tradeoffs between various approaches. But critics argue that even studying the possibility of solar geoengineering eases the societal pressure to cut greenhouse gas emissions.”

What we’re reading (3/19)

“The Fed Is Playing A Waiting Game On Rate Cuts. The Rules Are Starting To Change.” (Wall Street Journal). “For investors, the big question hanging over this week’s meeting of the Federal Reserve is whether it will wait a little longer to cut interest rates because of recent, firm inflation readings. The Fed, though, has a different preoccupation: If it waits too long, will it inadvertently cause a recession? Officials won’t put recession risk front and center this week. Yet that risk is likely to drive its thinking over the remainder of the year, leaving it on track to cut rates at some point.”

“Here’s Everything To Expect From The Federal Reserve’s Policy Meeting Wednesday” (CNBC). “In addition to releasing its rate decision after the meeting wraps up Wednesday, the central bank will update its economic projections as well as its unofficial forecast for the direction of interest rates over the next several years. As expectations have swung sharply this year for where the Fed is headed, this week’s two-day session of the Federal Open Market Committee will draw careful scrutiny for any clues about the direction of interest rates.”

“Why Are Americans Still Down On The Economy? (Paul Krugman). “I’ve been struck by the results of swing-state polls being conducted by Quinnipiac University, which ask respondents about both the national economy and their personal financial situations. In the latest poll, of Michigan voters, only 35 percent of people said that the national economy was excellent or good, while 65 percent said it was not so good or bad. But when asked about their personal finances the proportions were basically reversed, with 61 percent saying that they were in excellent or good shape and 38 percent saying they were in not so good or bad shape.”

“The Era Of The AI Home Broker Approaches” (Axios). “An AI trained on the actions of very good brokers would be able to forward new listings to clients within seconds of them appearing; would be up to speed on the plethora of documents and payments that need to be brought to a closing; and could answer questions in an approachable, conversational style 24 hours a day.”

“Same Old Song: Private Equity Is Destroying Our Music Ecosystem” (New York Times). “Does that song on your phone or on the radio or in the movie theater sound familiar? Private equity — the industry responsible for bankrupting companies, slashing jobs and raising the mortality rates at the nursing homes it acquires — is making money by gobbling up the rights for old hits and pumping them back into our present. The result is a markedly blander music scene, as financiers cannibalize the past at the expense of the future and make it even harder for us to build those new artists whose contributions will enrich our entire culture.”

What we’re reading (3/18)

“Hedge Funds Ramp Up Leverage To Near Record Highs To Juice Returns” (Reuters). “Hedge funds' use of leverage in equities trading is near record levels after debt-fueled strategies ballooned in recent years and an upturn in financial markets prompted riskier bets, according to two banking sources and recent client notes from major banks. Fresh data compiled by Goldman Sachs, JPMorgan and Morgan Stanley, the three largest global prime brokerages, seen by Reuters in notes distributed to a restricted group of clients, show that leverage used to juice up returns is at or close to historical highs, depending on the bank.”

“Once America’s Hottest Housing Market, Austin Is Running In Reverse” (Wall Street Journal). “Austin was at the forefront of the U.S. housing boom, when rock-bottom borrowing costs near the start of the pandemic fueled robust sales and sent home prices to new highs. Austin prices soared more than 60% from 2020 to the spring of 2022. A surge in interest rates crushed the housing market nationwide, and existing-home sales fell to a nearly 30-year low in 2023. Despite that collapse, home prices remain near record levels thanks to tight supply. But in Austin, according to the Freddie Mac House Price Index, prices have fallen more than 11% since peaking in 2022, the biggest drop of any metro area in the country.”

“8 Incidents In 2 Weeks: What’s Going On With United’s Planes?” (New York Times). “An engine fire sparked by plastic packaging wrap, a tire lost shortly after takeoff and a plane veering off the runway: These are among the eight incidents that have occurred over the past two weeks on flights operated by United Airlines. While no injuries — or worse — have been reported, the mishaps have generated headlines and stoked rising anxiety about aviation safety among federal officials and passengers alike.”

“Musk Says His Ketamine Prescription Is In Investors’ Best Interests” (Bloomberg). “For Wall Street, ‘what matters is execution,’ Musk said in an interview with former CNN anchor Don Lemon streamed Monday on YouTube. ‘From an investor standpoint, if there is something I’m taking, I should keep taking it,’ he said referring to Tesla’s success.”

“Online Selling Platforms Amplify Consumer Preference For Local” (RealClear Markets). “The way Americans shop has radically changed over the last couple decades. The decline of traditional shopping malls and rise of online shopping followed by the COVID-19 pandemic ushered in an era of uncertainty for many retail small businesses. Yet, recent numbers suggest that American small businesses have finally found their footing when it comes to evolving with the way consumers shop. In fact, mom-and-pop shops across the country experienced a selling frenzy during the last holiday season. Much of that success is due to the full embrace of the digital era of retail.”

What we’re reading (3/17)

“Weekly Peak Office Attendance Is Still Nowhere Near Pre-Pandemic Levels” (Axios). “Office occupancy levels on the busiest day of the week are just 62% of their February 2020 average, according to Kastle Systems' office swipe data for 10 major metros…[w]hile occupancy is at 61.7% on those high-attendance days, it falls to around 35% on Fridays.”

“The Job Market For Remote Workers Is Shrinking” (Wall Street Journal). “After remote work surged during the pandemic, fewer employers now feel the need to lure talent with the promise of working from home. Remote jobs made up 13.2% of postings advertised on LinkedIn last month—down from 20.6% in March. Other job sites such as Indeed.com and ZipRecruiter also report declines in remote listings.”

“The Great Paradox Of The U.S. Market!” (Jeremy Grantham). “Well, the U.S. is really enjoying itself if you go by stock prices. A Shiller P/E of 34 (as of March 1st) is in the top 1% of history. Total profits (as a percent of almost anything) are at near-record levels as well. Remember, if margins and multiples are both at record levels at the same time, it really is double counting and double jeopardy – for waiting somewhere in the future is another July 1982 or March 2009 with simultaneous record low multiples and badly depressed margins.”

“Is PE Ready For College Sports?” (Institutional Investor). “PE firms have the potential to clash with nonprofit colleges and universities. Managers will have to navigate controversial issues regarding student-athletes, including whether they’ll be employees, and marketing rights. (Players on the men’s basketball team at Dartmouth College voted earlier this month to unionize.) The reshuffling of sports conferences, including the Big Ten and Pac-12, may bring uncertainty to finances. Managers may even face issues under Title IX rules, as they go after football and men’s basketball, the two most popular college sports.”

“EU Approves Landmark AI Law, Leapfrogging US To Regulate Critical But Worrying New Technology” (CNN Business). “The first-of-its-kind law is poised to reshape how businesses and organizations in Europe use AI for everything from health care decisions to policing. It imposes blanket bans on some ‘unacceptable’ uses of the technology while enacting stiff guardrails for other applications deemed ‘high-risk.’”

What we’re reading (3/16)

“Middle Managers Are On The Chopping Block, Accounting For Almost A Third Of Layoffs Last Year” (Insider). “Times are tough for the middle managers of corporate America. Job cuts for middle managers — those below the executive ranks who still have direct reports — increased to 31.5% of total layoffs in 2023, according to a data analysis by Live Data Technologies for Bloomberg. That's up from a little under 20% in 2018.”

“Americans Invested Billions In Chinese Companies. Now Their Money Is Stuck.” (DealBook). “As recently as 2021, venture investors were pouring nearly $47 billion into Chinese companies, according to PitchBook. It’s not just venture capital at risk. U.S. public pensions and university endowments invested about $146 billion from 2018 to 2022, according to Future Union, an advocacy group focused on exploring U.S. investments abroad.”

“A 15-Year Problem That Has Plagued Corporate America Is Finally Turning Around” (Yahoo! Finance). “American workers are becoming more productive. Recent analysis from Bank of America showed the average revenue per worker for companies in the S&P 500 hit an all-time high in February after 15 years of no gains. This is one of several signs that labor productivity is rebounding after slumping during 2022. Some on Wall Street think the developments in labor productivity could help the stock market survive stickier-than-expected inflation that has emerged as a concern in recent weeks.”

“How I Got Hooked On The Hottest Trade In Markets—And Bagged A 2,000% Return” (Wall Street Journal). “There’s a hot new trade on Wall Street, blurring the line between investing and gambling like never before. It involves contracts known as short-dated options, bets on everything from individual stocks to indexes that run for just a few days, or in some cases mere hours. Part of their appeal, and risk, is that the contracts can be like placing chips at a roulette table, or buying a scratch-off lottery ticket. There is the potential for huge, nearly instantaneous gains, or the loss of everything you put down.”

“Could An AI Replace All Music Ever Recorded With Taylor Swift Covers?” (New Scientist). “A rogue artificial intelligence obsessed with Taylor Swift could supplant all recorded music with artificially generated cover versions by her, say researchers. History would show the American singer-songwriter as being responsible for everything from Für Elise to Paperback Writer, leaving no evidence that Ludwig van Beethoven or The Beatles ever existed. Nick Collins at Durham University, UK, and Mick Grierson at the University of the Arts London give the unusual warning in a paper that says humanity must think of methods of resistance ‘now, rather than when it is too late’.”

What we’re reading (3/15)

“Powerful Realtor Group Agrees To Slash Commissions To Settle Lawsuits” (New York Times). “American homeowners could see a significant drop in the cost of selling their homes after a real estate trade group agreed to a landmark deal that will eliminate a bedrock of the industry, the standard 6 percent sales commission.vThe National Association of Realtors, a powerful organization that has set the guidelines for home sales for decades, has agreed to settle a series of lawsuits by paying $418 million in damages and by eliminating its rules on commissions. Legal counsel for N.A.R. approved the agreement early Friday morning, and The New York Times obtained a copy of the signed document.”

“Consultants Are Paid To Fix Businesses. Why Can’t They Fix Their Own?” (Wall Street Journal). “Slower promotions, partner layoffs and fewer office snacks as big firms grapple with a slowdown. Recruits wait months to start, ‘Here I am…doing Uber Eats.’”

“American Debt Stings Like Never Before In New Era For Households” (Bloomberg). “Two years after the Federal Reserve began hiking interest rates to tame prices, delinquency rates on credit cards and auto loans are the highest in more than a decade. For the first time on record, interest payments on those and other non-mortgage debts are as big a financial burden for US households as mortgage interest payments.”

“Knives Out” (Business Insider). “Michelin-starred restaurant Quince says a startup stole its name and is ruining its reputation.”

“Laid-Off Techies Face ‘Sense Of Impending Doom’ With Job Cuts At Highest Since Dot-Com Crash” (CNBC). “Allison Croisant, a data scientist with about a decade of experience in technology, was laid off by PayPal earlier this year, joining the masses of unemployed across her industry. Croisant has one word to describe the process of looking for a job right now: ‘Insane.’ ‘Everybody else is also getting laid off,’ said Croisant, who lives in Omaha, Nebraska, where she worked remotely for PayPal. Her sentiment is reflected in the numbers. Since the start of the year, more than 50,000 workers have been laid off from over 200 tech companies, according to tracking website Layoffs.fyi. It’s a continuation of the predominant theme of 2023, when more than 260,000 workers across nearly 1,200 tech companies lost their jobs.”

What we’re reading (3/14)

“Dealmaking Slowdown Leaves Private Equity With Record Unsold Assets” (Financial Times). “Private equity groups globally are sitting on a record 28,000 unsold companies worth more than $3tn, as a sharp slowdown in dealmaking creates a crunch for investors looking to sell assets…[l]ast year, the combined value of companies that the industry sold privately or on public markets fell 44 per cent on 2022 to its lowest level in a decade…[t]he decline in value was even bigger where private equity groups sold portfolio companies to rivals, a practice that makes the industry look like a potential ‘pyramid scheme’, according to one critical investor.”

“Apollo Partner Did The OK Kind Of Fraud” (Matt Levine, Money Stuff). “Here, on appeal in a garden-variety six-figure SEC fraud case, the court just casually accused Apollo of a much bigger fraud, “improperly billing” all of its expenses to its funds, when it was supposed to pay them itself.”

“It’s Hard To Beat That 7% Mortgage Rate. These Charts Show Why.” (Wall Street Journal). “Home buyers are going to have to settle for a 7% mortgage. The cost of a home loan has soared in recent years, in part thanks to a series of rate increases by the Federal Reserve. The average rate on a 30-year fixed mortgage was 6.74% this week, the mortgage giant Freddie Mac said. It rose to as high as 7.79% last fall. With rates this high, buyers are running through the full playbook of ways to shave a bit off the cost of borrowing money. These include paying the lender more upfront or choosing an adjustable-rate loan. But these popular strategies are no longer doing buyers much good.”

“Come On, Everyone, Let’s Buy TikTok!” (Business Insider). “That's what Steven Mnuchin and everyone else who wants to buy TikTok are planning to do. That's why Mnuchin made his announcement on CNBC this morning — to let every investor on the planet who might give him money to buy TikTok know that he's raising money to buy TikTok. He saved himself a lot of emails and phone calls.”

“Tesla Is The Worst Performing Stock In The S&P 500. Analysts Say It Has Further To Fall” (CNN Business). “The once red-hot electric vehicle maker — heralded as part of the so-called Magnificent Seven behemoth tech stocks — is currently the worst performer in the S&P 500 this year, down nearly 32% since January.”

February performance update

Here with a performance update for February. For the key numbers:

Prime: +1.90%

Select: -1.99%

SPY ETF: 4.84%

Bogleheads portfolio (80% VTI + 20% BND): +3.47%

February was a repeat of a common theme lately: a great month (for the Prime model anyway) that nevertheless compares unfavorably to a blisteringly good month for the S&P 500 overall. SPY’s February return of almost 5 percent contributed to a year-to-date return for the ETF of 7.61%, which is in the zip code of what the market overall typically earns for an entire year. Followers of financial media will likely know well that truly obscene returns for Nvidia — the chip maker, which has benefited from increasing public conviction around the value of AI and which is now the third most valuable company in the index — have been materially influencing the S&P 500’s overall performance. Year-to-date, NVDA is up more than 60% and in February was up fully 27%. Needless to say, Nvidia is not a “value” stock and as such is not likely to show up in my models.

Observations like this drive anxious investors toward so-called “growth” strategies (better deemed “high-multiple” strategies) that have been profitable lately. For my part, I continue to think there are good reasons (theoretical and empirical reasons alike) to believe markets should reward value investing in the long term. Alas, factors can underperform for long stretches — much longer than the couple of years since Prime dominated the S&P 500 — so patience is required. And it’s not just factor-based strategies that require patience. Long-S&P 500-only “buy the haystack” strategies can also underperform relevant benchmarks for long periods of time. It wasn’t until 2013, roughly five years after the Great Financial Crisis, that SPY regained its pre-crisis high.

Stoney Point Total Performance History

What we’re reading (3/5)

“Target Aims For Turnaround After First Sales Decline Since 2016” (Wall Street Journal). “The Minneapolis retailer said Tuesday it would open more than 300 new stores and invest in the majority of its locations over the next decade. It also announced a paid membership program, Target Circle 360, that offers free same-day delivery on orders over $35 and free two-day shipping. ‘Our goal is to recapture profitable sales, traffic and market share gains by expanding what makes Target different and better for our guests,’ Chief Executive Brian Cornell told analysts during an investor presentation. Shares in the company rose 12% to $168.58 as it also reported stronger-than-expected profits in the holiday quarter. Target’s stock was the S&P 500’s best performer Tuesday.”

“Bitcoin Hits Record, Breaking Pandemic-Fueled 2021 Mark” (Washington Post). “Bitcoin rose to a record price of more than $69,000 Tuesday, months after federal regulators allowed the asset class to enter the mainstream via exchange-traded funds, or ETFs.”

“The ZIP Code Shift: Why Many Americans No Longer Live Where They Work” (New York Times). “Many Americans now live roughly twice as far from their offices as they did prepandemic. That’s according to a new study, set to be released this week, from economists at Stanford and Gusto, a payroll provider, using data from Gusto. The economists studied employee and employer address data from nearly 6,000 employers across the country and found that the average distance between people’s homes and workplaces rose to 27 miles in 2023 from 10 miles in 2019, more than doubling.”

“A Matter Of Strategy In Argentina” (Manuel’s Substack). “The only instance of instantaneous stabilization in Argentina's history is the introduction of the Convertibility Plan under the presidency of Carlos Menem. The Convertibility plan established a rule for the Central Bank: it could print money only when selling pesos for dollars at a perpetually fixed exchange rate (which was one-to-one). Period. Thus, there would be a dollar in reserves in the Central Bank for every peso in circulation. If the rules are followed, this system produces results similar to dollarization because it removes the discretion to create money from the Central Bank. The domestic currency increases only when dollars are brought from abroad.”

“Wisdom Of The Silicon Crowd: LLM Ensemble Prediction Capabilities Match Human Crowd Accuracy” (Schoenegger, et al.). “Human forecasting accuracy in practice relies on the ‘wisdom of the crowd’ effect, in which predictions about future events are significantly improved by aggregating across a crowd of individual forecasters. Past work on the forecasting ability of large language models (LLMs) suggests that frontier LLMs, as individual forecasters, underperform compared to the gold standard of a human crowd forecasting tournament aggregate. In Study 1, we expand this research by using an LLM ensemble approach consisting of a crowd of twelve LLMs. We compare the aggregated LLM predictions on 31 binary questions to that of a crowd of 925 human forecasters from a three-month forecasting tournament. Our main analysis shows that the LLM crowd outperforms a simple no-information benchmark and is statistically equivalent to the human crowd.”

What we’re reading (3/4)

“Nvidia’s Surge Stokes Talk Of A Bubble” (Wall Street Journal). “The stock has risen more than sevenfold since Oct. 14, 2022, and Nvidia is now the third-most-valuable U.S. company, with a market value above $2 trillion. The chip maker added nearly $280 billion in value in just two trading sessions after reporting blowout fourth-quarter results on Feb. 21. It took just 180 trading days for Nvidia’s value to rise to $2 trillion from $1 trillion; it took more than 500 trading days for both Apple and Microsoft to reach that milestone.”

“A Frothy Market Misses Vital Bubble Ingredients” (Wall Street Journal). “Valuations don’t suggest a lot of speculative buying…The Nasdaq peaked at over 100 times predicted earnings for 12 months ahead in the late-1990s dot-com bubble because buyers didn’t think valuations mattered any more. At the moment the Nasdaq’s at 27 times forecast earnings, much lower than the 35 times it traded at in late 2020. Nvidia’s stunning rise hasn’t been about higher valuations, either—its profits and forecast profits have been rising faster than the share price, so it trades at a lower valuation than before the AI boom started with the release of ChatGPT.”

“Why We Expect Inflation To Fall In 2024” (Morningstar). “In our latest Economic Outlook, we detail that the drop in inflation has been driven principally by the unwinding of price spikes owing to supply chain resolutions and by the slowing pace of economic growth because of the Fed’s tightening.”

“JetBlue, Spirit End Bid To Merge After Antitrust Objections” (Washington Post). “JetBlue Airways and Spirit Airlines announced Monday they have dropped plans to merge, a transaction that would have created the nation’s fifth-largest carrier. In a statement, JetBlue said that while the two companies still believe in the ‘procompetitive benefits of the combination,’ it was unlikely they would be able to reach the necessary legal and regulatory approvals by July 24 as called for in their agreement.”

“The Core Of The Tax Code Will Change, But We Don’t Know How” (New York Times). “On Dec. 31, 2025, critical parts of the 2017 federal tax law are scheduled to expire. After that sunset, they would revert to what they would have been if that sweeping tax legislation, passed in the first year of the Trump administration, had never taken effect.”

March picks available now

The new Prime and Select picks for March are available starting now, based on a model run put through today (February 29). As a note, I will be measuring the performance on these picks from the first trading day of the month, Friday, March 1, 2024 (at the mid-spread open price) through the last trading day of the month, Friday, March 29, 2024 (at the mid-spread closing price).

What we’re reading (2/26)

“Millions Of Fund Investors Are Getting A Voice” (New York Times). “[T]he relentless growth of index funds has come at a cost. One significant problem is that the most diversified funds own shares in every publicly traded company in the market, and if you don’t like a company, or its specific policies, you’re stuck. You couldn’t even exercise your vote on issues you thought were important because until recently, the fund managers insisted on doing that for you. Well, that’s been changing in a big way.”

“Zoom Shares Jump As Quarterly Results Beat On Top And Bottom Lines” (CNBC). “Revenue increased less than 3% from $1.12 billion a year earlier, according to a statement. The company reported net income of $298.8 million, or 98 cents per share, for the quarter that ended Jan. 31, compared with a net loss of $104.1 million, or 36 cents per share, in the year-ago quarter.”

“Supreme Court Questions State Efforts To Regulate Social-Media Content” (Wall Street Journal). “The Supreme Court sounded dubious Monday of state laws requiring online platforms such as Facebook and YouTube to publish nearly all user content, although several justices suggested that the ability to remove noxious social-media posts should not mean tech companies are free to block personal communications such as Gmail or chat messages.”

“J.P. Morgan Chase Is Once Again Global No. 1 for Sell-Side Research” (Institutional Investor). “J.P. Morgan extended its reign as the No. 1 global research provider to four years. The firm continued its upward trajectory by once again increasing its number of team positions from 280 to 289 across II’s eight surveys, which include the All-America Research Team; the Asia (ex-Japan) Research Team; the China Research Team; the Developed Europe Research Team; the Japan Research Team; the Emerging EMEA Research Team; the Latin America Research Team; and the Global Fixed-Income Research Team.”

“Empty Office Buildings Won’t Be The Solution To The US Housing Shortage” (Business Insider). “The pandemic ushered in a new era of remote work, and it's caused a structural decline in office demand that is set to worsen in the years ahead, Goldman Sachs said. Real estate experts have theorized that office-to-residential conversions could be a promising solution to the supply problem, but strategists at the bank caution that would be neither simple nor cheap.”

What we’re reading (2/24)

“The Cost Of Nuclear War In Space” (DealBook). “Putting a weapon into orbit is not just a military threat. It’s also a risk to the space economy — and the one on the ground. There is a little-known but fast-growing industry that insures satellites, but it doesn’t provide insurance against nuclear arms.”

“Indexing The Information Age” (Aeon). “One weekend in March 1995, a group of librarians and web technologists found themselves in Dublin, Ohio, arguing over what single label should be used to designate a person responsible for the intellectual content of any file that could be found on the world wide web. Many were in favour of using something generic and all-inclusive, such as ‘responsible agent’, but others argued for the label of ‘author’ as the most fundamental and intuitive way to describe the individual creating a document or work. The group then had to decide what to do about the roles of non-authors who also contributed to any given work, like editors and illustrators, without unnecessarily expanding the list. New labels were proposed, and the conversation started over.”

“Husband Who Eavesdropped On Wife’s Work Calls Pleads Guilty To Insider Trading” (Wall Street Journal). “Interruptions from young children and the neighbor’s noisy yard work are just some of the perils of remote work. For Tyler Loudon, it led to federal regulators charging him with securities fraud. The Houston resident pleaded guilty this week to insider trading after overhearing his wife, a former BP executive, discuss a planned acquisition while she was working from home. Loudon made $1.76 million trading shares based on the details he heard, according to charges filed Thursday by the Securities and Exchange Commission.”

“Material Non-Public Information About One Company Is Material Non-Public Information About All Companies” (Dealbreaker). “The debate over what, exactly, is insider trading rages on…Now, however, the SEC is making arguably its most avant-garde, boundary-bending insider-trading argument yet, arguably even more so than its recent failed attempt to show insider trading requires no evidence of having insider information: That trading one stock when in possession of inside dirt on another is insider-trading.”

“Why Don’t Nations Buy And Sell Territory More?” (Marginal Revolution). “Egypt has agreed to a $35bn deal with the United Arab Emirates to develop the town of Ras el-Hekma town on its northwestern coast, Egyptian Prime Minister Mostafa Madbouly announced on Friday after weeks of speculations. Madbouly said at a news conference, which was attended by Egyptian and Emirati officials, that Egypt will receive an advance amount of $15bn in the coming week, and another $20bn within two months. The deal is the largest foreign direct investment in an urban development project in the country’s modern history, the prime minister said. It is a partnership between the Egyptian government and an Emirati consortium led by ADQ, he said.”