February performance update

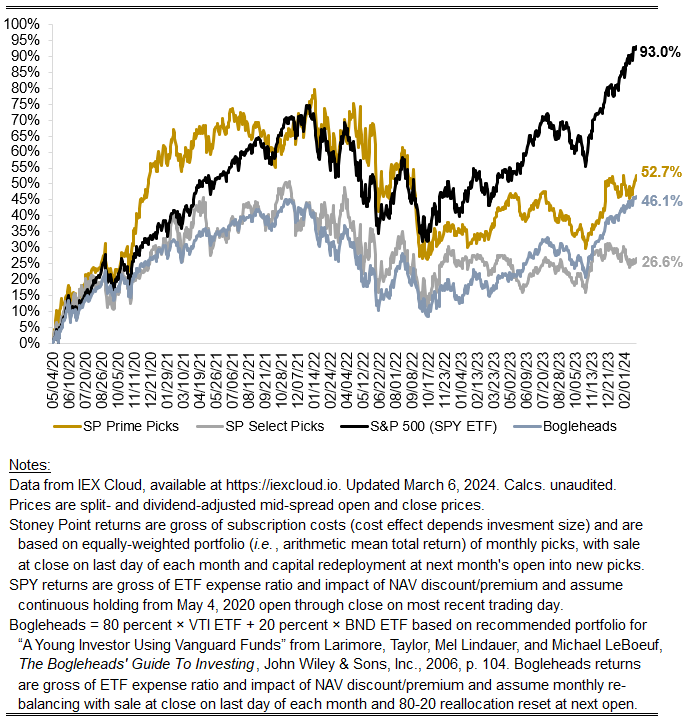

Here with a performance update for February. For the key numbers:

Prime: +1.90%

Select: -1.99%

SPY ETF: 4.84%

Bogleheads portfolio (80% VTI + 20% BND): +3.47%

February was a repeat of a common theme lately: a great month (for the Prime model anyway) that nevertheless compares unfavorably to a blisteringly good month for the S&P 500 overall. SPY’s February return of almost 5 percent contributed to a year-to-date return for the ETF of 7.61%, which is in the zip code of what the market overall typically earns for an entire year. Followers of financial media will likely know well that truly obscene returns for Nvidia — the chip maker, which has benefited from increasing public conviction around the value of AI and which is now the third most valuable company in the index — have been materially influencing the S&P 500’s overall performance. Year-to-date, NVDA is up more than 60% and in February was up fully 27%. Needless to say, Nvidia is not a “value” stock and as such is not likely to show up in my models.

Observations like this drive anxious investors toward so-called “growth” strategies (better deemed “high-multiple” strategies) that have been profitable lately. For my part, I continue to think there are good reasons (theoretical and empirical reasons alike) to believe markets should reward value investing in the long term. Alas, factors can underperform for long stretches — much longer than the couple of years since Prime dominated the S&P 500 — so patience is required. And it’s not just factor-based strategies that require patience. Long-S&P 500-only “buy the haystack” strategies can also underperform relevant benchmarks for long periods of time. It wasn’t until 2013, roughly five years after the Great Financial Crisis, that SPY regained its pre-crisis high.