March picks available now

The new Prime and Select picks for March are available starting now, based on a model run put through today (February 29). As a note, I will be measuring the performance on these picks from the first trading day of the month, Friday, March 1, 2024 (at the mid-spread open price) through the last trading day of the month, Friday, March 29, 2024 (at the mid-spread closing price).

What we’re reading (2/26)

“Millions Of Fund Investors Are Getting A Voice” (New York Times). “[T]he relentless growth of index funds has come at a cost. One significant problem is that the most diversified funds own shares in every publicly traded company in the market, and if you don’t like a company, or its specific policies, you’re stuck. You couldn’t even exercise your vote on issues you thought were important because until recently, the fund managers insisted on doing that for you. Well, that’s been changing in a big way.”

“Zoom Shares Jump As Quarterly Results Beat On Top And Bottom Lines” (CNBC). “Revenue increased less than 3% from $1.12 billion a year earlier, according to a statement. The company reported net income of $298.8 million, or 98 cents per share, for the quarter that ended Jan. 31, compared with a net loss of $104.1 million, or 36 cents per share, in the year-ago quarter.”

“Supreme Court Questions State Efforts To Regulate Social-Media Content” (Wall Street Journal). “The Supreme Court sounded dubious Monday of state laws requiring online platforms such as Facebook and YouTube to publish nearly all user content, although several justices suggested that the ability to remove noxious social-media posts should not mean tech companies are free to block personal communications such as Gmail or chat messages.”

“J.P. Morgan Chase Is Once Again Global No. 1 for Sell-Side Research” (Institutional Investor). “J.P. Morgan extended its reign as the No. 1 global research provider to four years. The firm continued its upward trajectory by once again increasing its number of team positions from 280 to 289 across II’s eight surveys, which include the All-America Research Team; the Asia (ex-Japan) Research Team; the China Research Team; the Developed Europe Research Team; the Japan Research Team; the Emerging EMEA Research Team; the Latin America Research Team; and the Global Fixed-Income Research Team.”

“Empty Office Buildings Won’t Be The Solution To The US Housing Shortage” (Business Insider). “The pandemic ushered in a new era of remote work, and it's caused a structural decline in office demand that is set to worsen in the years ahead, Goldman Sachs said. Real estate experts have theorized that office-to-residential conversions could be a promising solution to the supply problem, but strategists at the bank caution that would be neither simple nor cheap.”

What we’re reading (2/24)

“The Cost Of Nuclear War In Space” (DealBook). “Putting a weapon into orbit is not just a military threat. It’s also a risk to the space economy — and the one on the ground. There is a little-known but fast-growing industry that insures satellites, but it doesn’t provide insurance against nuclear arms.”

“Indexing The Information Age” (Aeon). “One weekend in March 1995, a group of librarians and web technologists found themselves in Dublin, Ohio, arguing over what single label should be used to designate a person responsible for the intellectual content of any file that could be found on the world wide web. Many were in favour of using something generic and all-inclusive, such as ‘responsible agent’, but others argued for the label of ‘author’ as the most fundamental and intuitive way to describe the individual creating a document or work. The group then had to decide what to do about the roles of non-authors who also contributed to any given work, like editors and illustrators, without unnecessarily expanding the list. New labels were proposed, and the conversation started over.”

“Husband Who Eavesdropped On Wife’s Work Calls Pleads Guilty To Insider Trading” (Wall Street Journal). “Interruptions from young children and the neighbor’s noisy yard work are just some of the perils of remote work. For Tyler Loudon, it led to federal regulators charging him with securities fraud. The Houston resident pleaded guilty this week to insider trading after overhearing his wife, a former BP executive, discuss a planned acquisition while she was working from home. Loudon made $1.76 million trading shares based on the details he heard, according to charges filed Thursday by the Securities and Exchange Commission.”

“Material Non-Public Information About One Company Is Material Non-Public Information About All Companies” (Dealbreaker). “The debate over what, exactly, is insider trading rages on…Now, however, the SEC is making arguably its most avant-garde, boundary-bending insider-trading argument yet, arguably even more so than its recent failed attempt to show insider trading requires no evidence of having insider information: That trading one stock when in possession of inside dirt on another is insider-trading.”

“Why Don’t Nations Buy And Sell Territory More?” (Marginal Revolution). “Egypt has agreed to a $35bn deal with the United Arab Emirates to develop the town of Ras el-Hekma town on its northwestern coast, Egyptian Prime Minister Mostafa Madbouly announced on Friday after weeks of speculations. Madbouly said at a news conference, which was attended by Egyptian and Emirati officials, that Egypt will receive an advance amount of $15bn in the coming week, and another $20bn within two months. The deal is the largest foreign direct investment in an urban development project in the country’s modern history, the prime minister said. It is a partnership between the Egyptian government and an Emirati consortium led by ADQ, he said.”

March picks available soon

I’ll be publishing the Prime and Select picks for the month of March before Monday, March 4 (the first trading day of the month). As always, SPC’s performance measurement for the month of February, as well as SPC’s cumulative performance, will assume the sale of the February picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Friday, February 29). Performance tracking for the month of March will assume the March picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Monday, March 4).

What we’re reading (2/22)

“Nvidia Nears $2 Trillion Valuation On Insatiable AI Chip Demand” (Wall Street Journal). “The journey to become one of the three most-valuable U.S. companies might have started at a Denny’s in 1993, but it has been fast-tracked by Nvidia’s dominance of GPUs, or graphics processing units. These chips, worth tens of thousands of dollars each, have become a scarce, treasured commodity like Silicon Valley has seldom seen, and Nvidia is estimated to have more than 80% of the market.”

“Reddit Files To List IPO On NYSE Under The Ticker RDDT” (CNBC). “Social media company Reddit filed its IPO prospectus with the Securities and Exchange Commission on Thursday after a yearslong run-up. The company plans to trade on the New York Stock Exchange under the ticker symbol ‘RDDT.’ Its market debut, expected in March, will be the first major tech initial public offering of the year. It’s the first social media IPO since Pinterest went public in 2019.”

“Sam Altman Secretly Owned Way More Reddit stock Than We Thought” (Business Insider). “In preparation for its highly-anticipated IPO, the online social forum filed an S-1 form with the Securities and Exchange Commission on Thursday, detailing the company's financial background. The filing revealed that Altman, the CEO of OpenAI, owns an 8.7% stake in the company.”

“A U.S.-Built Spacecraft Lands On The Moon For The First Time Since 1972” (New York Times). “For the first time in a half-century, an American-built spacecraft has landed on the moon. The robotic lander was the first U.S. vehicle on the moon since Apollo 17 in 1972, the closing chapter in humanity’s astonishing achievement of sending people to the moon and bringing them all back alive. That is a feat that has not been repeated or even tried since.”

“A $150 Billion Question: What Will Warren Buffett Do With All That Cash?” (Wall Street Journal). “One tantalizing mystery: Berkshire wrote for a second consecutive quarter that it was requesting confidential treatment from the Securities and Exchange Commission for one or more holdings it omitted from its public 13F filing. One reason institutional investors can ask the SEC to keep a holding private is that disclosing it would reveal a continuing program of buying or selling a security. Investors can initially ask the SEC for confidentiality for up to one year.”

What we’re reading (2/21)

“Nvidia Posts Revenue Up 265% On Booming AI Business” (CNBC). “Nvidia reported fourth fiscal quarter earnings that beat Wall Street’s forecast for earnings and sales, and said revenue during the current quarter would be better than expected, even against elevated expectations for massive growth.”

“Fed Minutes Show Unease Over Premature Cuts” (Wall Street Journal). “More Federal Reserve officials signaled concern at their meeting last month with cutting interest rates too soon and allowing price pressures to grow entrenched as opposed to the risks of holding rates too high for too long. ‘Most participants noted the risks of moving too quickly to ease the stance of policy,’ said the minutes of the Jan. 30-31 meeting, released Wednesday with a customary three-week delay. Only two officials pointed to the risks ‘associated with maintaining an overly restrictive stance for too long.’”

“My Top 10 Peeves” (Cliff Asness, AQR). “Certain things said or done in our industry or said about our industry that have bugged me for years. These 10, which bother me the most, are held together by only three characteristics: (1) They are about investing or finance in general, (2) I believe they are commonly held and often-repeated beliefs, and (3) I think they are wrong or misleading and they hurt investors.”

“Leaked Files From Chinese Firm Show Vast International Hacking Effort” (Washington Post). “A trove of leaked documents from a Chinese state-linked hacking group shows that Beijing’s intelligence and military groups are carrying out large-scale, systematic cyber intrusions against foreign governments, companies and infrastructure — exploiting what the hackers claim are vulnerabilities in U.S. software from companies including Microsoft, Apple and Google.”

“Bukele’s Kingdom Of Dreams” (Compact). “Bukele has vowed to make his country the Singapore of the region, but even superfans I spoke to told me the economy had been only average in recent years, with high unemployment still driving a lot of people to migrate. Although many told me that the elimination of the gangs created better conditions for starting small businesses, growth and investment haven’t been particularly impressive. Unlike Singapore, El Salvador remains highly reliant on securing IMF loans to keep the government running, which includes the considerable expense of funding the police, military, and prisons. The issuance of a loan may require austerity measures that work against populist appeals.”

What we’re reading (2/20)

“Data Show The Economy Is Booming. Wall Street Thinks Otherwise.” (Wall Street Journal). “A handful of high-profile economic reports, covering the big topics of inflation, economic growth and the labor market, have leaned decidedly on the too-warm side. But many economists have minimized these surprises, pointing to other data that are less alarming and measurement challenges that are unique to the start of the year.”

“Steep Rate Cuts Are Coming As The Job Market Looks Poised To Weaken, Wells Fargo Strategist Says” (Insider). “Steep rate cuts from the Federal Reserve could be coming later this year thanks to weakening in the job market, which likely isn't as robust as some of the latest data has made it out to be, according to Wells Fargo strategist Erik Nelson.”

“January Was Awesome For Stock Pickers, But Can They Keep It Going?” (New York Times). “Over the last 20 years, stock pickers have had a dismal record. Most haven’t come close to beating the overall stock market. But occasionally, there are exceptions. In some periods, stock pickers rule, and the start of this year was one of those times. In fact, it was the best January for actively managed stock mutual funds since Bank of America began compiling data in 1991. It wasn’t just that they turned in handsome returns for investors. The entire stock market did that. The S&P 500 and other stock indexes set records during the month.”

“Nvidia Faces Stiff Test On Wall Street This Week After ‘Parabolic’ Stock Rally” (CNBC). “When Nvidia reports fiscal fourth-quarter earnings after the market close Wednesday, it will do so as the world’s third most valuable public company. Investors are giving the company little margin for error. Nvidia’s stock price has soared fivefold since the end of 2022, as demand has skyrocketed for its graphics processing units that sit at the heart of the artificial intelligence boom. Nvidia’s chips, such as the H100, are used by AI developers to create cutting-edge models like the ones OpenAI used to develop ChatGPT.”

“Unpacking The Washington Math For A Big Payment Deal” (DealBook). “Capital One’s $35.3 billion takeover to buy Discover Financial Services will create a colossus in the fast-growing credit card industry and a more powerful force in the payment networks that underpin the consumer economy. That will almost surely invite tough scrutiny from a Washington that is increasingly skeptical of big financial mergers. But continuing scrutiny of the two biggest payment networks in the U.S., Visa and Mastercard, may complicate the regulatory math.”

What we’re reading (2/8)

“Qube And Renaissance Have Started 2024 With A Bang. Here’s How Quant Funds Did In January.” (Business Insider). “The London-based manager run by CEO Pierre-Yves Morlat and CIO Laurent Laizet led the way in what was generally a strong month for quant funds. According to Hedge Fund Research, the average systematic fund betting on equities made 1.8% in January, besting the S&P 500 and the average hedge fund, which were up 1.6% and 0.2%, respectively.”

“S&P 500 Hits Intraday Record Of 5000” (Wall Street Journal). “The S&P 500 crossed 5000 for the first time in intraday trading, the latest milestone for a U.S. stock market powered by a resilient economy and subsiding inflation. The broad U.S. stock index popped over 5000 in the final minute of trading Thursday, according to Dow Jones Market Data, before settling slightly below the mark. The S&P 500’s daily advance of 0.1% was enough for another record close, its ninth of 2024.”

“Arm’s Post-Earnings Pop Leaves Stock Trading At Over 100% Premium To Nvidia” (CNBC). “Exactly two years ago, Nvidia’s attempt to purchase chip designer Arm from SoftBank came to an end due to ‘significant regulatory challenges.’ Masayoshi Son, SoftBank’s billionaire founder, has never been so lucky. That agreement would have involved selling Arm for $40 billion, or just $8 billion more than SoftBank paid in 2016. Instead, Arm went public last year, and the company is now worth over $116 billion after the stock soared 48% on Thursday.”

“He’s Lost His Marriage, His Followers And His Lamborghini” (New York Times). “BitBoy was one of the most popular figures in the wild, scam-ridden world of crypto influencers. Cultivating a persona as a straight-talking everyman, he filmed a livestream five days a week in which he lectured his hundreds of thousands of listeners on the virtues of experimental coins with names like Polkadot or XRP…Two years later, Mr. Armstrong, 41, has lost his production company and much of his wealth. His friends have turned on him, and his wife has filed for divorce. Over the last five months, across countless social media posts and videos, Mr. Armstrong has claimed to be the victim of a ‘criminal conspiracy’ by ‘terrorists’ who took over his YouTube channel. ‘BitBoy is dead,’ he recently declared.”

“Baltimore Orioles Sale To Avoid Capital Gains Taxes” (Dealbreaker). “Rubenstein and his group will initially purchase 40% of the team. The remaining 60% will be sold, reportedly for tax reasons, after 94-year-old Angelos passes away. Angelos purchased the team in 1993 for $173 million. If the sale were to take place now, Angelos would face an estimated $250 million capital gains tax on the approximately $1.5 billion profit. But by waiting until after his passing, the basis step-up rule would increase his cost basis to current market value instead of his original purchase price. If the team is sold immediately thereafter, there will be little to no capital gains tax on the sale.”

What we’re reading (2/6)

“Morningstar Calls Cathie Wood The Worst 'Wealth Destroyer’” (Investor’s Business Daily). “No one wants to be known as the largest wealth destroyer — especially when the S&P 500 is rising. But that's exactly what Morningstar is calling Cathie Wood's ARK Family of funds. ARK ETF Trust, which runs the popular ARK Innovation ETF (ARKK), has wiped out $14.3 billion in investors' wealth over the past 10 years, says a new analysis from Morningstar.”

“ESPN, Fox And Warner Team Up To Create Sports-Streaming Platform” (Wall Street Journal). “ESPN, Fox Corp. and Warner Bros. Discovery are teaming up to create a supersize sports-streaming service that will offer content from all major leagues, a deal that will reshape the sports and media landscape. The as-yet-unnamed service will be offered directly to consumers, who would be able to stream all of these companies’ sports content, the companies said in a statement, following a report in The Wall Street Journal about the new venture.”

“Deepfake Scammer Walks Off With $25 Million In First-Of-Its-Kind AI Heist” (ars technica). “The scam featured a digitally recreated version of the company's chief financial officer, along with other employees, who appeared in a video conference call instructing an employee to transfer funds.”

“Fundraising Is Tough. Just Ask This Hedge-Fund Star.” (Semafor). “Money once flowed into funds founded by big name portfolio managers at big name funds striking out on their own, like Jain’s fellow Millennium defector Michael Gelband, who launched ExodusPoint Capital Management in 2018 with $8.5 billion under management. But things have changed. Investors pulled more than $100 billion out of hedge funds in both 2022 and 2023, and the average shop returned about half the S&P 500. And Jain is trying to hire in the shadow of established multi-manager giants — known as “pod shops” — like Millennium, Citadel, Point72 and ExodusPoint. Meanwhile, The Financial Times reported that Jain has cut his performance fees to 10% for investors looking to funnel more than $250 million, and has steadily lowered his fundraising goal.”

“Seaweed As A Resilient Food Solution After A Nuclear War” (Jehn, et al., Earth’s Future). “Abrupt sunlight reduction scenarios such as a nuclear winter caused by the burning of cities in a nuclear war, an asteroid/comet impact or an eruption of a large volcano inject large amounts of particles in the atmosphere, which limit sunlight. This could decimate agriculture as it is practiced today. We therefore need resilient food sources for such an event. One promising candidate is seaweed, as it can grow quickly in a wide range of environmental conditions. To explore the feasibility of seaweed after nuclear war, we simulate the growth of seaweed on a global scale using an empirical model based on Gracilaria tikvahiae forced by nuclear winter climate simulations.”

What we’re reading (2/5)

“Stocks Fall After Powell Says Caution Is Needed On Rate Cuts” (Wall Street Journal). “The S&P 500 backed off its record high and bond yields jumped Monday after investors’ hopes for a Federal Reserve interest-rate cut next month were all but dashed.”

“Palantir Stock Jumps 19% As AI Demand Drives Revenue Beat” (CNBC). “In a letter to shareholders, Palantir CEO Alex Karp said the company’s expansion and growth ‘have never been greater,’ especially as demand for large language models in the U.S. ‘continues to be unrelenting.’ Palantir has been rolling out its Artificial Intelligence Platform, or AIP, and Karp said the company carried out nearly 600 pilots with the technology in 2023, up from fewer than 100 in 2022.”

“How The U.S. Became The World’s Biggest Gas Supplier” (New York Times). “America’s gas export boom initially caught many policymakers by surprise. In the early 2000s, natural gas was relatively scarce at home, and companies were spending billions of dollars to build terminals to import gas from places like Qatar and Australia. Fracking changed all that.”

“Disentangling Demand And Supply Of Media Bias: The Case Of Newspaper Homepages” (Tin Cheuk Leung, Koleman Strumpf). “In this study, we propose a novel approach to detect supply-side media bias, independent of external factors like ownership or editors’ ideological leanings. Analyzing over 100,000 articles from The New York Times (NYT) and The Wall Street Journal (WSJ), complemented by data from 22 million tweets, we assess the factors influencing article duration on their digital homepages. By flexibly controlling for demand-side preferences, we attribute extended homepage presence of ideologically slanted articles to supply-side biases. Utilizing a machine learning model, we assign ‘pro-Democrat’ scores to articles, revealing that both tweets count and ideological orientation significantly impact homepage longevity. Our findings show that liberal articles tend to remain longer on the NYT homepage, while conservative ones persist on the WSJ. Further analysis into articles’ transition to print and podcasts suggests that increased competition may reduce media bias, indicating a potential direction for future theoretical exploration.”

“Real Identity Of Bitcoin Founder ‘Satoshi Nakamoto’ Could FINALLY Be Revealed In Court…And May Unlock £36billion Fortune” (The U.S. Sun). “A UK court will now decide if Craig Wright, 54, is the mysterious, anonymous crypto-king who disappeared from the internet over a decade ago. Wright, an Australian computer scientist who lives in London, has been arguing since 2016 that he is the real Nakamoto - a claim largely dismissed by the cryptocurrency world.”

What we’re reading (2/4)

“Powell Insists The Fed Will Move Carefully On Rate Cuts, With Probably Fewer Than The Market Expects” (CNBC). “Federal Reserve Chair Jerome Powell vowed in an interview aired Sunday that the central bank will proceed carefully with interest rate cuts this year and likely will move at a considerably slower pace than the market expects. In a wide-ranging interview with ‘60 Minutes’ after last week’s Federal Open Market Committee meeting, Powell expressed confidence in the economy, promised he wouldn’t be swayed by this year’s presidential election, and said the pain he feared from rate hikes never really materialized.”

“Our Economy Isn’t ‘Goldilocks.’ It’s Better.” (Paul Krugman New York Times). “I believe that the risk of an economic slowdown is much higher than that of resurgent inflation and that rate cuts should come sooner rather than later. But that’s not the kind of argument that’s going to be settled on the opinion pages. What I want to talk about, instead, is what the good economic news says about policy and politics.”

“Week Of Whipsawing Treasurys Casts Doubt On Soft-Landing Trade” (Wall Street Journal). “The strongest U.S. jobs report in a year has dented investors’ hopes that the Federal Reserve will drastically slash interest rates this year, the latest reversal for those betting the economy is on track to achieve a soft landing.”

“Number Of Companies Going Bust Hits 30-Year High” (BBC). “The number of companies that went bust last year in England and Wales hit a 30-year high, according to the latest figures. More than 25,000 company insolvencies were registered in 2023, the highest number since 1993, as firms struggled with rising costs and interest rates. Companies faced higher energy bills, while consumer spending was squeezed by the cost of living crisis. The new figures show one in 186 active firms went bust in 2023.”

“This Ancient Material Is Displacing Plastics And Creating A Billion-Dollar Industry” (Washington Post). “[C]ork is experiencing a revival as more industries look for sustainable alternatives to plastic and other materials derived from fossil fuels. The bark is now used for flooring and furniture, to make shoes and clothes and as insulation in homes and electric cars. Portugal’s exports reached an all-time high of 670 million euro ($728 million) in the first half of 2023. But cork is more than a trendy green material. In addition to jobs, the forests where it grows provide food and shelter for animals, all while sequestering carbon dioxide. And unlike most trees grown commercially, cork oaks are never cut down, meaning their carbon storage capacity continues through the 200 years or more they live.”

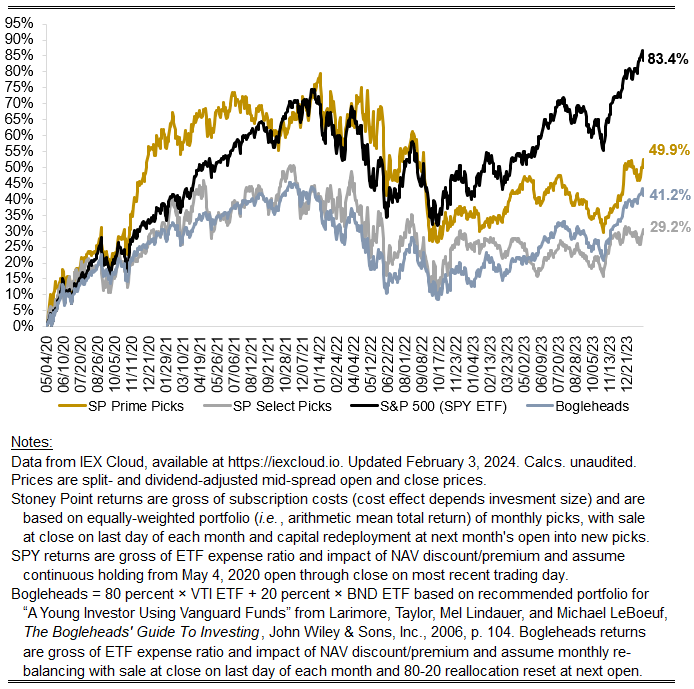

January performance update

Hi Friends, here with a performance update for January.

Prime: -0.35%

Select: -0.10%

SPY ETF: +2.27%

Bogleheads portfolio (80% VTI + 20% BND): +1.36%

It wasn’t a great month for value stocks, coming on the heels of a full-year 2023 where growth beat value by a substantial margin. That’s a pretty good description of the last decade or so, when growth consistently beat value, defying the observed “value premium” that is fairly robust in historical stock market returns data. I don’t expect the recent experience of growth beating value to persist forever, for sensible reasons (the question is for how long?) and I’m not alone.

To use one crude but common measure, value stocks tend to have low price-to-earnings (P/E) ratios while growth stocks tend to have high P/E ratios. There lots of other ratios, but they generically are trying to do the same thing: normalize a capitalized asset value by a proxy for the cash flows the asset throws off. No one would disagree that the value of an asset should be the risk-adjusted present value of its expected future cash flows. Assuming future cash flows are a function of current cash flows (e.g., earnings tomorrow = earnings today + growth in earnings between today and tomorrow), valuation ratios like P/E simply proxy for the reciprocal of expected returns. I say “proxy” because the the “E” is earnings, not cash flows, and is usually a measure of current earnings, not future, earnings; but these technicalities affect the measure for all companies, so when you look at the cross-section of P/E ratios you should get a ranking of companies that approximates an ordering of their expected returns, with a healthy dose of error.

A little more formally, say P = CF1/(1+r)^1 + CF2/(1+r)^2 + … CFN/(1+r)^n, where P = price today, CFi = cash flow for the ith year, r is the discount rate or the expected return on the stock, and n goes to infinity. In a simple model where r is assumed constant and cash flows grow at a constant rate, this all collapses to roughly P = CF0*(1+g)/(r - g). For a stock, dividends are the relevant measure of cash flows, and dividends equal earnings (E) - reinvested earnings, or earnings * (1 - IR) where IR is the investment rate. So the simple equation becomes P = E*(1+g)*(1-IR)/(r-g), and more complicated versions of it aren’t too different, at least not in ways that are important for this point. Factor out the E and divide both sides by it to get P/E = (1+g)(1-IR)/(r-g). That is, P/E is a function of growth, investment, and expected returns. All else equal (growth and investment), a relatively higher P/E (growth stocks) should be associated with a lower r in the cross-section of stocks, and a relatively lower P/E (value stocks) should be associated with a higher r in the cross-section of stocks, which is the historical empirical pattern — just not lately. That is a mechanical explanation, but a more intuitive one is something like the following: take the reciprocal of P/E (that is, E/P) and think about what it means for one company to have a higher E/P (value stocks) than others. All else equal, it means the market has bid down the price of that company, demanding higher returns (in expectation) to bear the risk of holding that stock, i.e., the stock price itself tells you something about the returns the market overall is demanding and therefore must expect to hold that stock, and you just need to normalize it appropriately to extract the signal the market is giving off about its returns expectations.

With all that in mind, the “growth premium” lately is sort of puzzling. But it makes a little more sense when you consider that, collectively, the stock of just six companies has a weight of almost 1/3 of the entire S&P 500. Those are Microsoft, Apple, Nvidia, Amazon, Meta, and Alphabet (Class A and Class C). Nvidia alone (~4% weight in the overall index) was up 25% in January and has been explosive over the last year. Together, the six companies contributed 1.68% to the index’s roughly 2% gain on the month (or roughly 3/4 of the SPY ETF’s return). The prospects of those companies may merit the returns they’ve experienced, but being so richly valued from a P/E standpoint and then subsequently experiencing relatively high returns, as we have seen over and over again with these companies in recent years, sort of implies their high returns of late aren’t manifesting for reasons that were obvious a priori. Otherwise, they probably would have had lower P/E ratios, say, a year ago, than they did. Rather, that fact pattern suggests to me that their prospects have continued to surprise to the upside. It’s worth asking if it is reasonable to expect not just good results to persist, but for results to continue to be better than everyone currently expects.

Stoney Point Total Performance History

What we’re reading (2/2)

“Should ESG Investing Be Criminalized?” (Morningstar). “What is the outlook for ESG investing?”

“Invest In America, Live In Europe—A Mantra Some Just Can’t Shake” (Wall Street Journal). “Even Europeans are starting to wonder why they bother to invest in their own region. The economy is stuttering while the U.S. booms. It’s an also-ran in a world dividing into blocs led by the U.S. and China. And its biggest companies wouldn’t even make the top 10 in the S&P 500. The ‘Magnificent Seven’ big U.S. stocks are, as of two weeks ago, collectively worth more than all western European listed stocks together. What’s the point? There are three answers. European stocks aren’t the European economy. The European economy may not be as bad as it seems. And European stocks are cheap, so as bad as it is, much is already priced in. There’s one pushback: Since the end of 2021, the region’s stocks have actually been pretty good.”

“Why Is It So Hard To Find A Job Right Now Despite Low Unemployment?” (Business Insider). “Lynne Vargas calls it ghost hiring. Vargas, a special education instructor, has been mired for months in various stages of interviews for three teaching jobs. The processes have dragged on so long that sometimes she wonders whether the roles are real. With one position, she waited three months after an interview. Then she got fed up.”

“Mark Zuckerberg Made More Than $28 Billion This Morning After Meta Stock Makes Record Surge” (CNN Business). “On Friday, shares of Meta (META) jumped more than 20% on the news of a quarterly dividend of $0.50 per share to be paid out on March 26 to shareholders of record as of February 22.”

“U.S. Strikes More Than 85 Targets In Iraq And Syria In Initial Barrage Of Retaliatory Attacks” (CNBC). “The United States launched attacks against Iran-backed militias in Iraq and Syria on Friday, its first retaliatory strikes for the killing of three American soldiers in Jordan last weekend, according to an official at the Department of Defense.”

What we’re reading (2/1)

“Why Tim Cook Is Going All In On The Apple Vision Pro” (Vanity Fair). “Inside Apple Park, the tech giant’s CEO talks about the genesis of a “mind-blowing” new device that could change the way we live and work. A-list directors are already on board—’My experience was religious,’ says James Cameron—but will your average iPhone user drop $3,500 on a headset?”

“McKinsey’s Leader Survives, But Voting Reveals Cracks At Elite Consulting Firm” (Wall Street Journal). “The voting laid bare dissatisfaction within one of the world’s most lucrative partnerships. It also exposed the potential drawbacks of an unusual governance structure that gives McKinsey’s partners the power to choose their leader every three years. The structure works when business is booming as partners who bring in millions have little reason to agitate for change. The past few years have been anything but stable.”

“The Fed Is Taking It Slow. But The Markets Want More.” (New York Times). “U.S. economic reports have been sparkling. The economy appears to be booming, the labor market looks strong and inflation seems to be on the decline. Yet this seemingly propitious combination has locked the Federal Reserve into inaction. At its policymaking meeting this week, the Fed decided to do precisely nothing. It held the main policy rate, known as the federal funds rate, steady at about 5.3 percent, where it has stood since August.”

“U.S. Winning World Economic War” (Axios). “The United States economy grew faster than any other large advanced economy last year — by a wide margin — and is on track to do so again in 2024…America’s outperformance is rooted in its distinctive structural strengths, policy choices, and some luck. It reflects a fundamental resilience in the world's largest economy that is easy to overlook amid the nation's problems.”

“Matt Levine’s Money Stuff: Texas Tempts Tesla” (Money Stuff). “[T]he bet here for Elon Musk is reasonable: If he moves Tesla to Texas, and then demands that Tesla’s board pay him $100 billion to keep a reasonable fraction of his time and attention on Tesla, and Tesla’s extremely accommodating board says ‘sure whatever you want,’ and a majority of shareholders approve the pay package, and one disgruntled shareholder sues, and the case goes to Texas business court, and the complaining shareholder comes into court citing conflicts of interest and the board’s lack of independence and the Delaware cases on ‘entire fairness,’ and Elon Musk comes into court saying ‘well that may all be true but what you are missing is that I am Elon Musk,’ and Texas Governor Greg Abbott is in the first row of spectators with a big sign saying ‘TX <3 U ELON,’ is the Texas business court, in its first real high-profile case, going to say ‘actually it’s illegal to pay Elon Musk that much’? It absolutely is not. That much is pretty predictable.”

What we’re reading (1/31)

“Fed Signals Cuts Are Possible But Not Imminent As It Holds Rates Steady” (Wall Street Journal). “The Federal Reserve signaled it was thinking about when to lower interest rates but hinted a cut wasn’t imminent when it held rates steady at its first policy meeting of the year on Wednesday. The central bank held its benchmark federal-funds rate steady in a range between 5.25% and 5.5%, the highest level in more than two decades, as it awaits more convincing evidence that a sharp downturn in inflation at the end of last year will endure.”

“Why Cut Rates In An Economy This Strong? A Big Question Confronts The Fed.” (New York Times). “Right now, officials think that the neutral rate is in the neighborhood of 2.5 percent. The Fed funds rate is around 5.4 percent, which is well above neutral even after being adjusted for inflation. In short, interest rates are high enough that officials would expect them to seriously weigh on the economy. So why isn’t growth slowing more markedly? It takes interest rates time to have their full effect, and those lags could be part of the answer. And the economy has slowed by some important measures. The number of job openings, for instance, has been steadily declining.”

“Beta Is Back” (Morningstar). A a big, bold controversial take that beta now works as it should.

“The Great American Natural Gas Reckoning Is Upon Us” (Vox). “The Biden administration last week announced that it was pausing the permitting process for some new natural gas export projects, including a facility that would be the second-largest gas export terminal in the United States. It’s a move the White House said will help the US meet its climate change goals, but it’s not clear how it will affect the economy, energy markets, or the environment.”

“The Nurture Of Nature And The Nature of Nurture: How Genes And Investments Interact In The Formation Of Skills” (Houmark, Ronda, and Rosholm, American Economic Review). “This paper studies the interplay between genetics and family investments in the process of skill formation. We model and estimate the joint evolution of skills and parental investments throughout early childhood. We document three genetic mechanisms: the direct effect of child genes on skills, the indirect effect of child genes via parental investments, and family genetic influences captured by parental genes. We show that genetic effects are dynamic, increase over time, and operate via environmental channels. Our paper highlights the value of integrating biological and social perspectives into a single unified framework.”

February picks available now

The new Prime and Select picks for February are available starting now, based on a model run put through today (January 30). As a note, I will be measuring the performance on these picks from the first trading day of the month, Thursday, February 1, 2024 (at the mid-spread open price) through the last trading day of the month, Thursday, February 29, 2024 (at the mid-spread closing price).

What we’re reading (1/29)

“Why Oil Prices Rose After Shrugging Off A Crisis” (Wall Street Journal). “Futures on Brent crude gained more than 6% last week to settle at $83.55 a barrel Friday, their highest level since early November. The rise came after winter storms slammed U.S. oil production and new data showed the country’s economy has remained resilient, suggesting robust demand for fuel ahead. The jump roused an oil market that has been surprisingly sleepy, given the growing threat that the Israel-Hamas war will spread into a wider conflict. On Monday, Brent crude retreated 1.4% despite another attack by Yemen’s Houthi rebels on an oil-carrying vessel over the weekend.”

“What Evergrande’s Collapse Might Mean For Global Business” (DealBook). “A Hong Kong court on Monday ordered the liquidation of Evergrande, the heavily indebted Chinese property giant. The decision comes two years after the company defaulted, setting off a financial crisis at other developers and adding to the challenges facing the world’s second-largest economy.”

“What About Gradualism?” (EconLib). “[W]hat did we learn from the 1982 experience? Did this show that gradualism doesn’t work? Not exactly, as a necessary precursor for gradualism never occurred. The 1982 recession showed that gradualism is not easy to implement, but it provided no evidence on whether it would work if implemented. So what is the necessary precondition for gradualism to work? The central bank must engineer a gradual slowdown in the growth rate of NGDP. That’s the only reliable method for achieving a ‘soft landing’.”

“Big Tech Is Thriving Despite The Layoffs” (Axios). “Microsoft announced this past week that it would cut 1,900 workers from its gaming division. Microsoft recently closed its acquisition of Activision Blizzard, which is where most of the cuts — representing about 8% of the company's total gaming workforce of 22,000 — are landing. Google also announced a smaller round of layoffs earlier this month and said some cuts would continue to be made throughout the year. Google and Microsoft's stocks both hit record highs this week.”

“FanDuel Parent Flutter Lists On The NYSE, Challenging DraftKings As Sports-Betting Pure Play” (CNBC). “FanDuel parent Flutter listed on the New York Stock Exchange on Monday, offering U.S. investors an alternative to the biggest pure play in sports betting, DraftKings. It’s a secondary listing for the international sportsbook, which will retain its primary listing on the London Stock Exchange and inclusion in the FTSE 100 index. But Flutter’s most important market for revenue and growth is the United States, where FanDuel is the market share leader. In the fourth quarter, FanDuel had 43% market share based on gross revenue and 51% based on net revenue.”

What we’re reading (1/28)

“Plummeting Inflation Raises New Risk For Fed: Rising Real Interest Rates” (Wall Street Journal). “Federal Reserve officials start the year with a problem they would ordinarily love to have: Inflation has fallen much faster than expected. It does, nonetheless, pose a conundrum. The reason: If inflation has sustainably returned to the Fed’s 2% target, then real rates—nominal rates adjusted for inflation—have risen and might be restricting economic activity too much. This means the Fed needs to cut interest rates. The question is, when and by how much?”

“Why Strip Malls Are Having A Revival” (WBBM Newsradio). “As shopping malls across America struggle to attract customers, fill floor space and ultimately stay open, strip malls are apparently seeing a surge in value and popularity. And it's basically thanks to the COVID-19 pandemic.”

“Falling Inflation, Rising Growth Give U.S. The World’s Best Recovery” (Washington Post). “The European economy, hobbled by unfamiliar weakness in Germany, is barely growing. China is struggling to recapture its sizzle. And Japan continues to disappoint. But in the United States, it’s a different story. Here, despite lingering consumer angst over inflation, the surprisingly strong economy is outperforming all of its major trading partners.”

“‘We’re All Climate Economists Now’” (New York Times). “Nearly every block of time at the Allied Social Science Associations conference — a gathering of dozens of economics-adjacent academic organizations recognized by the American Economic Association — had multiple climate-related presentations to choose from, and most appeared similarly popular. For those who have long focused on environmental issues, the proliferation of climate-related papers was a welcome development. ‘It’s so nice to not be the crazy people in the room with the last session,’ said Avis Devine, an associate professor of real estate finance and sustainability at York University in Toronto, emerging after a lively discussion.”

“What Prevents & What Drives Gendered Ideological Polarisation?” (The Great Gender Divergence). “Across much of the world, men and women think alike. However, in countries that are economically developed and culturally liberal, young men and women are polarising. As chronicled by John Burn-Murdoch, young women are increasingly likely to identify as ‘progressives’ and vote for leftists, while young men remain more conservative. What explains this global heterogeneity?”

February picks available soon

I’ll be publishing the Prime and Select picks for the month of February before Thursday, February 1 (the first trading day of the month). As always, SPC’s performance measurement for the month of January, as well as SPC’s cumulative performance, will assume the sale of the January picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Wednesday, January 31). Performance tracking for the month of February will assume the February picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Thursday, February 1).

What we’re reading (1/26)

“Economists Predicted A Recession. So Far They’ve Been Wrong.” (New York Times). “Many economists spent early 2023 predicting a painful downturn, a view so widely held that some commentators started to treat it as a given. Inflation had spiked to the highest level in decades, and a range of forecasters thought that it would take a drop in demand and a prolonged jump in unemployment to wrestle it down.”

“Cooler Inflation Keeps Door Open For Rate Cuts This Year” (Wall Street Journal). “The U.S. economy notched another month of mild inflation in December, keeping the Federal Reserve on track to deliberate when and how quickly to reduce interest rates later this year. The Fed’s preferred inflation measure, the personal-consumption expenditures price index, rose 2.6% in December from a year earlier, the Commerce Department said Friday, well below the 5.4% increase at the end of 2022.”

“Fed’s Preferred Inflation Gauge Falls Below 3% For First Time Since March 2021” (Yahoo! Finance). “The inflation data could fuel expectations that the central bank will soon start cutting interest rates after two years of hikes. During the December Fed press conference, Powell told Yahoo Finance's Jennifer Schonberger that the Fed would want to be "reducing restriction on the economy" well before inflation hits 2%.”

“FTX Was Never Really Bankrupt” (Project Syndicate). “The prosecution in Sam Bankman-Fried’s criminal trial drilled into the jurors’ heads that FTX customer losses exceeded $8 billion, but never substantiated that claim. In reality, the crypto exchange had sufficient assets to make creditors whole all along – a fact that would likely change the public’s perception of its founder.”

“The Media Is Melting Down, And Neither Billionaires Nor Journalists Can Seem To Stop It” (The Hollywood Reporter). “The media sector is facing a crisis unlike anything seen since the 2008 financial mess, with layoffs and cost-cutting at every turn. The cuts have all occurred in the backdrop of declining web readership at many major publishers over the past year, as tech giants like Meta (Instagram, Facebook) and Google try to keep consumers on their own platforms while old standby referrers like Twitter/X no longer deliver as many readers and the social media landscape fractures.”