October performance update

Here with an update on last month’s performance:

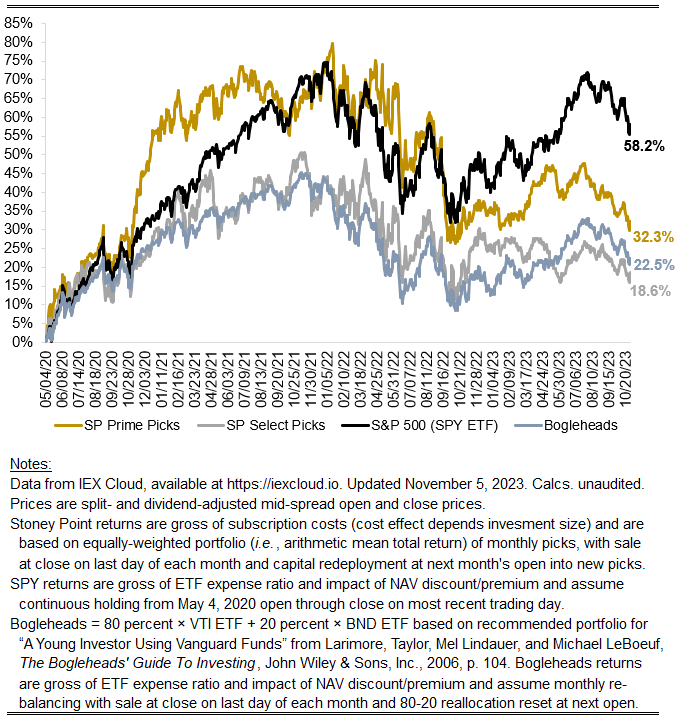

Prime: -1.22%

Select: -0.24%

SPY ETF: -1.97%

Bogleheads: -2.27%

A pretty bad month for the market overall, with the S&P 500-tracking ETF down nearly 200 basis points and the usually-pretty-steady Bogleheads portfolio down even more. SPC’s strategies held up better than the market, with Prime and Select down, but still outperforming by over 70 and 170 basis points, respectively. A cursory review of news last month reveals substantial risks arising from nearly all corners of the world: Ukraine, Israel, evidence of a slowing economic picture in the United States. All of these factors likely transmitted to large-cap U.S. equities through one channel or another (some obvious, some less so).

One technical note: one of my Select picks last month — ATVI — was acquired in the long-awaited Microsoft deal. ATVI’s last day of trading was October 12, and stockholders received $95.00/sh. in cash. The calculations shown below assume (I think quite reasonably) that a hypothetical ATVI stockholder following the Select strategy would immediately reinvest the proceeds in MSFT (the buyer) for the remainder of the month rather than, say, holding the proceeds in cash for a negative real return. This assumption is my general practice for cash deals, regardless of whether the buyer’s stock returns for the remainder of the month are positive or negative. In this instance, they were positive, with MSFT returning 2.10 percent from the close of trading on Oct. 12 through the close of trading on October 31.