What we’re reading (11/12)

“Is The Stock Market Rally About To Rev Up?” (Wall Street Journal). “FOMO in the stock market is back. A lightning-fast rebound has driven the S&P 500 up in nine of the past 10 sessions and 7.2% over the past two weeks, the best such stretch of the year. Now, many investors are betting the rally has legs. Some have piled into funds tracking U.S. stocks, while others have abandoned trades that would profit in times of market turmoil. Many have slashed bearish wagers against the S&P 500 and tech-heavy Nasdaq-100 index, fearful of getting caught flat-footed if the big gains continue.”

“Welcome To Hochatown, The Town Created By Airbnb” (New York Times). “But the company’s [AirBnB’s] report also contained a data point that is reverberating through Airbnb boom towns like Hochatown: For the first time since the pandemic recovery, Airbnb’s supply of rental homes is outpacing demand, with supply increasing 19 percent year over year, compared to just 14 percent for demand. That gap can spell disaster for hosts, particularly those who bought houses at the peak of the market with the idea of renting them out. In extreme cases, they are being forced to sell at a loss.”

“Ray Dalio’s Response To ‘The Fund,’ A New Book That Dissects Bridgewater Associates” (Institutional Investor). “Dalio and Bridgewater, which threatened legal action against Copeland and his publisher before the book came out, blasted it Tuesday. In a LinkedIn post, Dalio said the book is ‘another one of those sensational and inaccurate tabloid books written to sell books to people who like gossip. The only thing that’s different about this one is that it’s about me and Bridgewater.’ The billionaire went on to say that Copeland applied for a job at Bridgewater and was rejected before he went on to become a reporter who ‘made a career of writing distorted stories about me and Bridgewater.’ Dalio has said similar things in the past about Copeland and his unfavorable reporting about the founder and the firm. Copeland is an award-winning investigative journalist for The New York Times, who previously spent 10 years covering hedge funds for The Wall Street Journal and worked at Institutional Investor.”

“Your 401(k) Is Falling Behind. Here’s What You Should Do.” (Wall Street Journal). “As tempting as it may be to meddle with your investments, history suggests most investors have a lousy record of timing the market. Financial advisers say the vast majority of Americans should stick to time-tested advice and simply do nothing.”

“36-Hour Shifts, 80-Hour Weeks: Workers Are Being Burned Out By Overtime” (NBC News). “From firehouses and police stations to hospitals and manufacturing plants, workers say they are being required to work increasing overtime hours to make up for post-pandemic worker shortages — leaving them sleep-deprived, scrambling to cover child care duties, and missing birthdays, holidays and vacations. While the extra hours can provide a financial boost, some workers say the trade-off is no longer worth it as they see no end in sight to a problem that has now lasted for several years.”

What we’re reading (11/11)

Happy Veterans Day!

“Claudia Sahm: ‘We Do Not Need A Recession, But We May Get One’” (Financial Times). “What I do know is that the US economy is leaving 2023 in a better place than when it came into it, and a better place than the vast majority of commentators thought it would be in. On balance, inflation is still higher than we had expected, but for almost two years running we’ve had unemployment below 4 per cent, [strong] inflation-adjusted GDP growth and real consumer spending, too. So if you take it all together, that’s really good. And the thing that happened this year that wasn’t supposed to happen was inflation came down markedly and unemployment stayed low. That opens up a conversation of whether we need to have a recession. I have said the whole time that we do not need a recession, but we may get one.”

“Bonds vs. Bond Funds: How Higher Rates Are Changing The Calculation” (Wall Street Journal). “During the yearslong period of near-zero interest rates, the answer seemed simple: Funds had low fees and were easy to buy and sell, and share values rose alongside bond prices. If any one bond defaulted, losses were minimal. The historic declines suffered by major bond funds last year highlighted the risks of that approach. Rising rates crushed funds’ share prices. That is because bond prices drop when new higher-yielding bonds come on the market and make older, lower-yielding bonds less attractive. Because funds’ share values are based on the market price of their bonds, someone who bought shares a few years ago could end up cashing out today with less money than they put in.”

“Google In-House Attys Joked About ‘Fake Privilege,’ Jury Told” (Law360). “Two in-house Google lawyers communicating on an internal company chat joked about ‘fake privilege’ — a practice of unnecessarily involving a lawyer in a matter to make it confidential — an attorney for Epic Games showed jurors in a California federal antitrust case against the tech giant.”

“Xi Jinping’s ‘Old Friends’ From Iowa Get A Dinner Invitation” (Bloomberg). “A group of Chinese President Xi Jinping’s “old friends” from Iowa have been invited to a dinner he will attend in California next week — 38 years after they welcomed the then-unknown party official for a hog roast, farm tours and a Mississippi River boat ride as they showed him how capitalists do agriculture.”

“Inside An OnlyFans Empire: Sex, Influence And The New American Dream” (Washington Post). “In the American creator economy, no platform is quite as direct or effective as OnlyFans. Since launching in 2016, the subscription site known primarily for its explicit videos has become one of the most methodical, cash-rich and least known layers of the online-influencer industry, touching every social platform and, for some creators, unlocking a once-unimaginable level of wealth…If OnlyFans’s creator earnings were taken as a whole, the company would rank around No. 90 on Forbes’s list of the biggest private companies in America by revenue, ahead of Twitter (now called X), Neiman Marcus Group, New Balance, Hard Rock International and Hallmark Cards.”

What we’re reading (11/10)

“How Risky Is Private Credit? Analysts Are Piecing Together Clues” (Wall Street Journal). “‘If rates stay higher for longer—or higher forever—then these companies are not equipped,’ said Ramki Muthukrishnan, head of U.S. leveraged finance at S&P Global. He said companies would struggle to pay their debt. Just 46% of the companies in the analysis would generate positive cash flow from their business operations under S&P’s mildest stress scenario, in which earnings fell by 10% and the Fed’s benchmark rates increased by another 0.5 percentage point, the ratings firm said.”

“Citadel’s Ken Griffin Sees High Inflation Lasting For Decades” (MarketWatch). “…Ken Griffin, head of the Miami-based hedge-fund manager Citadel, said higher baseline inflation may go on for decades, caused by structural changes that are pushing the world toward de-globalization.”

“Moody’s Cuts U.S. Outlook To Negative, Citing Deficits And Political Polarization” (CNBC). “‘In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues,’ the agency said. ‘Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.’”

“Has IBM Built The Next Generation’s 401(k) Plan?” (Morningstar). “Whatever its name, the introduction of the RBA converts IBM’s employee-retirement plan into a hybrid scheme. It will now consist partially of a defined-contribution plan and partially of a defined-benefit plan. Such arrangements are not unique, but they are unusual—particularly when openly coupled with the decision to cancel the company’s 401(k) match program.”

“How To Hijack A Quarter Of A Million Dollars In Rare Japanese Kit Kats” (New York Times). “These particular Kit Kats would become the key players in an ultimately frustrating saga of shell email accounts, phantom truckers, supply-chain fraud and one seriously bewildered cargo freight broker. Interviews and emails shared with The New York Times tell the story of just one instance of ‘strategic theft,’ a growing corner of the criminal world that the F.B.I. has said accounts for some $30 billion in losses a year — with food being among the top targets.”

What we’re reading (11/9)

“Even If The Fed Stays On Hold, Jerome Powell Is Keeping His Options Open” (Wall Street Journal). “Fed Chair Jerome Powell indicated the central bank wouldn’t declare an end to its historic interest-rate increases until it had more evidence that inflation was cooling. Price and wage pressures have eased recently, leading more investors to think the Fed is done raising rates. Powell disappointed those investors in a speech Thursday by explaining why he thinks the Fed is more likely to tighten policy than ease it if any change is warranted.”

“What History Tells Us About The Feel-Bad Economy” (New York Times). “Here’s how I think about it: The supply chain disruptions caused by the pandemic made it inevitable that prices of some goods would rise sharply. The only way to have avoided overall inflation would have been to force major price cuts for other goods and services. And everything we know from history suggests that trying to impose deflation — falling prices — on large parts of the economy would have had disastrous effects on employment and output, something like the quiet depression Britain inflicted on itself after World War I when it tried to go back to the prewar gold standard.”

“Robinhood Misses Q3 Revenue Estimates On Muted Trading Activity” (Reuters). “Robinhood's transaction-based revenue decreased 11% year-over-year to $185 million amid a 13% decline in equities and a 55% decrease in cryptocurrencies. Monthly active users dropped 16% to 10.3 million from a year earlier.”

“Thousands Of AMC Shareholders Wanted The Board To Go, But Abstentions Carried The Day” (MarketWatch). “Tens of thousands of AMC Entertainment Holdings Inc. shareholders voted to, in essence, throw out the entertainment company’s board, but the proposal went nowhere because of no-shows and abstentions.”

“The Fight Over Return-To-Office Is Getting Dirty” (Insider). “As the return-to-office battle has heated up in the past six months, there has been a marked increase in declarations that remote work is less productive. But diving deeper into this evidence reveals flawed logic — and a media industry obsessed with proving bosses right.”

What we’re reading (11/8)

“Warner Bros. Discovery Stock Sinks 19% As Ad Revenue Falls, Zaslav Warns Of ‘Generational Disruption’” (CNBC). “Warner Bros. Discovery’s results reflected dire trends in the legacy media industry. Ad revenue in Warner Bros. Discovery’s TV networks segment fell 12% compared with a year earlier, reflecting a decline in audiences for general entertainment and news programming, as well as soft ad trends in the U.S., the company said.”

“In Regulating A.I., We May Be Doing Too Much. And Too Little.” (Tim Wu, New York Times). “To regulate speculative risks, rather than actual harms, would be unwise, for two reasons. First, overeager regulators can fixate shortsightedly on the wrong target of regulation. For example, to address the dangers of digital piracy, Congress in 1992 extensively regulated digital audio tape, a recording format now remembered only by audio nerds, thanks to the subsequent rise of the internet and MP3s. Similarly, today’s policymakers are preoccupied with large language models like ChatGPT, which could be the future of everything — or, given their gross unreliability stemming from chronic falsification and fabrication, may end up remembered as the Hula Hoop of the A.I. age…Second, pre-emptive regulation can erect barriers to entry for companies interested in breaking into an industry.”

“Why The Fed Shouldn’t Get Credit For The Fall In Inflation” (Wall Street Journal). “Does the Federal Reserve deserve credit for the decline in inflation? The economic evidence is clear: No, not a lot. On the face of it, inflation plummeted after the Fed, flat-footed at first, finally caught up by imposing a rapid series of rate increases. Dig into what actually happened, and there is no obvious link between the Fed action and the slowdown in inflation.”

“Inside Google Billionaire’s Airship That’s Just Been Cleared For Flight And Can Carry 200 Tons Of Humanitarian Cargo” (The U.S. Sun). “Once it flies, the Pathfinder 1 will be the largest aircraft to take to the skies since the tragic Hindenberg disaster in 1937, when Zeppelins were largely abandoned. On the second of its scheduled 1937 transatlantic crossings, the Hindenburg burst into flames over Lakehurst, New Jersey, killing 35 out of 96 passengers and one member of ground crew. The incident triggered a reflexive fear of hydrogen based, in what has come to be known as ‘Hindenberg syndrome’. To combat this paranoia, the Pathfinder 1 will use only non-flammable helium, as opposed to explosive hydrogen.”

“Will We See Less Comovement In Global Economic Growth?” (Marginal Revolution). “In this new world, with these major common shocks neutered, a country’s prosperity will be more dependent on national policies than on global trends. Culture and social trust will matter more too, as will openness to innovation — and, as fertility rates remain low or decline, so will a country’s ability to handle immigration. A country that cannot repopulate itself with peaceful and productive immigrants is going to see its economy shrink in relative terms, and probably experience a lot of bumps on the way down. At the same time, excuses for a lack of prosperity will be harder to come by. The world will not be deglobalized, but it will be somewhat de-risked. Dare we hope that these new arrangements will produce better results than the old?”

What we’re reading (11/6)

“Why Household Wealth Took Off During The Pandemic” (The Week). “The median net worth of American families grew 37% from 2019 to 2022, according to the survey. Not only is this a huge jump considering the economic uncertainties of the pandemic, it's also "the largest since the Fed started its modern survey in 1989," CNBC reported. The Covid-19-era wealth bump is more than double the prior growth record of 18% between 2004 and 2007.”

“These Funds Offer A Way To Lock In High Bond Yields” (Wall Street Journal). “Investors looking to lock in higher yields are turning to a lesser known type of bond fund. Defined-maturity exchange-traded funds have surged in popularity recently. As their name suggests, the bond funds mature and liquidate on a specific date, similar to how an individual bond pays back its principal.”

“Injured By Chicken Nuggets: What’s Known About The Tyson Recall” (Washington Post). “The U.S. Department of Agriculture is recalling about 30,000 pounds of ‘Tyson fully-cooked fun nuggets breaded shaped chicken patties.'‘ The chicken is pressed into dinosaur shapes. Consumers reported finding small metal pieces in the product that caused at least one minor injury. The recall is considered a ‘Class I’ recall and is considered the most serious of three classifications. According to a USDA spokesperson, Class I recalls happen if there is a reasonable probability that using the product presents a health hazard that could cause serious harm or even death.”

“OpenAI Unveils Latest AI Model, Customizable GPTs And Digital Store” (CNN Business). “During its first developer conference held in San Francisco on Monday, OpenAI unveiled a series of artificial intelligence tool updates, including the ability for developers to create custom versions of ChatGPT. It is also launching a digital store and cutting base prices for developers while also pledging to pay some who use OpenAI products on their platforms.”

“Ray Dalio Once Interrogated His Pregnant Protégé In Front Of His Top Execs Until She Cried” (Insider). “Dalio announced to the room that he would first "probe" and then deliver what he called a ‘diagnosis.’ In the probe he asked her to confirm that she had fallen short in his assignment. The diagnosis was that she was an idiot, a point he made over and over. ‘You're a dumb shit!’ Dalio spat. ‘You don't even know what you don't know.’”

October performance update

Here with an update on last month’s performance:

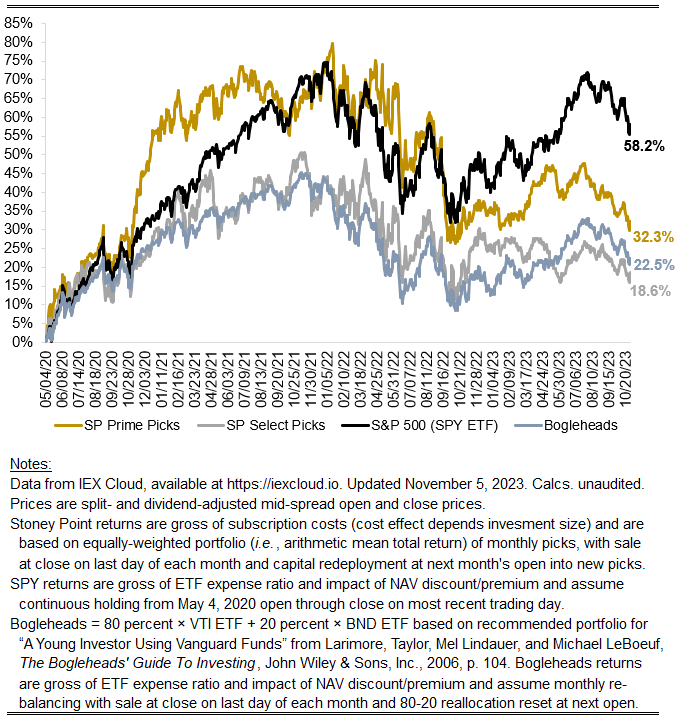

Prime: -1.22%

Select: -0.24%

SPY ETF: -1.97%

Bogleheads: -2.27%

A pretty bad month for the market overall, with the S&P 500-tracking ETF down nearly 200 basis points and the usually-pretty-steady Bogleheads portfolio down even more. SPC’s strategies held up better than the market, with Prime and Select down, but still outperforming by over 70 and 170 basis points, respectively. A cursory review of news last month reveals substantial risks arising from nearly all corners of the world: Ukraine, Israel, evidence of a slowing economic picture in the United States. All of these factors likely transmitted to large-cap U.S. equities through one channel or another (some obvious, some less so).

One technical note: one of my Select picks last month — ATVI — was acquired in the long-awaited Microsoft deal. ATVI’s last day of trading was October 12, and stockholders received $95.00/sh. in cash. The calculations shown below assume (I think quite reasonably) that a hypothetical ATVI stockholder following the Select strategy would immediately reinvest the proceeds in MSFT (the buyer) for the remainder of the month rather than, say, holding the proceeds in cash for a negative real return. This assumption is my general practice for cash deals, regardless of whether the buyer’s stock returns for the remainder of the month are positive or negative. In this instance, they were positive, with MSFT returning 2.10 percent from the close of trading on Oct. 12 through the close of trading on October 31.

Stoney Point Total Performance History

What we’re reading (11/4)

“Stock Market Falling Deeper Into Undervalued Territory” (Morningstar). “The pullback in October has been relatively broad-based as each of the style categories has fallen by similar amounts. As such, based on our valuations, we continue to advocate for an overweight position in value, underweight in core/blend, and market weight in growth. By market capitalization, large-cap stocks fared better to the downside whereas mid-cap and small-cap took the brunt of the selloff, making those categories even more undervalued compared with our valuations.”

“Warren Buffett’s Berkshire Hathaway Sits On Record $157 Billion Cash Pile” (Wall Street Journal). “The stash leaves Berkshire equipped to pounce if Buffett, the company’s chief executive and chairman, finds an attractive opportunity to buy a business. Charlie Munger, Berkshire’s vice chairman and Buffett’s longtime business partner, told the Wall Street Journal in a recent interview that the odds of another big acquisition under the pair were ‘at least 50/50.’”

“What Happened To Airbnb?” (Vox). “What started as a scrappy idea offering an affordable alternative to hotels has now made Airbnb a target for lawmakers and a magnet for critics. Airbnb may not be collapsing, as some doomsayers are predicting, but it is facing a reckoning — an existential questioning of what it offers and where it will go from here.”

“New York City Is Enforcing A ‘De Facto Ban’ On Airbnb. Will Travelers Be Better Off Without It?” (Insider). “‘In just the first two months since the rules have gone into effect, the negative consequences are clear — visitors to New York City now have fewer accommodation options in fewer neighborhoods, hotels have increased their nightly rates, and, predictably, activity has gone underground with a myriad of unregistered listings popping up on unregulated third-party websites,’ an Airbnb spokesperson said in an email to Insider Tuesday.”

“How The Real Estate Broker Business Could Change” (New York Times). “Real estate experts say the current system won’t stand. Right now, home sellers essentially pay fees for both their own agent and the buyers’ agent, with a typical commission around 5 to 6 percent, split between the two brokers. That structure is largely enforced by the National Association of Realtors, which has about 1.5 million dues-paying members. If a seller doesn’t agree to those terms, the listing isn’t shown on the multiple listing services that underpin most home sales.”

What we’re reading (11/3)

“US Employers Pulled Back On Hiring In October, Adding 150,000 Jobs In Face Of Higher Borrowing Rates” (Associated Press). “The nation’s employers slowed their hiring in October, adding a modest but still decent 150,000 jobs, a sign that the labor market may be cooling but remains resilient despite high interest rates that have made borrowing much costlier for companies and consumers.”

“S&P 500 Clinches Best Week Since November 2022” (Wall Street Journal). “The S&P 500 rallied Friday, capping its best weekly performance since November 2022, after the latest monthly jobs report suggested the Federal Reserve’s interest-rate raising campaign is working. The broad index gained 0.9%, bringing its gains for the week to 5.9%. The index is up 14% this year. The Dow Jones Industrial Average added about 200 points, or 0.7%, on Friday, while the Nasdaq Composite rose 1.4%. Those indexes also recorded their biggest weekly percentage gains of the year.”

“Shipping Giant Laying Off 10,000 As Pandemic Boom Turns To Bust” (CNN Business). “Shipping giant Maersk is laying off thousands more workers as weak demand and lower freight prices pummel its revenues — a sign the pandemic-driven boom in shipping is turning to bust. One of the world’s biggest shipping firms said in its third-quarter results Friday that its revenues had almost halved to $12 billion compared with the same period last year.”

“The Great Social Media–News Collapse” (The Atlantic). “Over the past decade, Silicon Valley has learned that news is a messy, expensive, low-margin business—the kind that, if you’re not careful, can turn a milquetoast CEO into an international villain and get you dragged in front of Congress. No surprise, then, that Big Tech has decided it’s done with the enterprise altogether.”

“Over 75% Of U.S. Workers Say They Could Complete The Same Amount Of Work In 4 Days Rather Than 5” (CNBC). “Among US workers, over 75% say they could complete their current workload in a four-day workweek rather than five, according to a recent report from Fiverr. Millennials, who make up around 35% of today’s workforce, were the most passionate about the four-day workweek with 87% agreeing.”

What we’re reading (11/2)

“Sam Bankman-Fried Found Guilty On All Seven Counts” (TechCrunch). “The decision was handed down on Thursday, following a five-week trial that dug deep into how one of the biggest crypto exchanges and its sister trading company collapsed about a year ago. The U.S. Department of Justice charged 31-year-old Bankman-Fried about 11 months ago. The jury took about four hours to come to a verdict on six counts relating to fraud and one count relating to money laundering.”

“How Does The World’s Largest Hedge Fund Really Make Its Money?” (New York Times). “With the hope of turning around the firm’s investment performance, members of the Circle of Trust put together a study of Mr. Dalio’s trades. They trawled deep into the Bridgewater archives for a history of Mr. Dalio’s individual investment ideas. The team ran the numbers once, then again, and again. The data had to be perfect. Then they sat down with Mr. Dalio, according to current and former employees who were present. (Lawyers for Mr. Dalio and Bridgewater said that no study was commissioned of Mr. Dalio’s trades and that no meeting took place to discuss them.) One young employee, hands shaking, handed over the results: The study showed that Mr. Dalio had been wrong as much as he had been right. Trading on his ideas lately was often akin to a coin flip. The group sat quietly, nervously waiting for the Bridgewater founder’s response. Mr. Dalio picked up the piece of paper, crumpled it into a ball and tossed it.”

“Private Equity: Higher Rates Start To Pummel Dealmakers” (Financial Times). “‘Many of the reasons these guys outperformed had nothing to do with skill,’ says Patrick Dwyer, a managing director at NewEdge Wealth, an advisory firm whose clients invest in private equity funds. ‘Borrowing costs were cheap and the liquidity was there. Now, it’s not there,’ he adds. ‘Private equity is going to have a really hard time for a while . . . The wind is blowing in your face today, not at your back.’”

“Artificial (Stock Market) Life Support” (Smead Capital Management). “The whole thing [AI] looks very disingenuous to us at Smead Capital Management. First, AI is not new, and they have all been working on it and using it in the last ten years. Second, interest rates have risen substantially and make futuristic earnings on exciting technology less valuable by discounting those earnings back to today. Third, this group of companies has been famous for having a lack of forthrightness (just ask the Justice Department). Lastly, the Magnificent 7 has been the only thing keeping the rally in the S&P 500 Index alive this year. The success of this narrow group of stocks has defended the massive amount of capital stuck in the passive index and prevented it from fleeing.”

“Apple Stock Dips After Weak Outlook For December Quarter Revenue” (CNBC). “Apple reported fiscal fourth-quarter earnings on Thursday that beat analyst expectations for sales and earnings per share, but revealed that overall sales fell for the fourth quarter in a row. Every hardware business outside of the iPhone declined year over year, with big drops in the iPad and Mac segments.”

November picks available now

The new Prime and Select picks for November are available starting now, based on a model run put through today (October 31). As a note, I will be measuring the performance on these picks from the first trading day of the month, Wednesday, November 1, 2023 (at the mid-spread open price) through the last trading day of the month, Thursday, November 30, 2023 (at the mid-spread closing price).

Happy Halloween!

What we’re reading (10/30)

“Why Nuveen Is Cautiously Optimistic About Markets” (Institutional Investor). “Nuveen’s private credit teams are cautiously optimistic about where the markets are heading next. Rising interest rates, inflation, and geopolitical pressures have not undermined the private credit markets. Executives at Churchill Asset Management and Arcmont Asset Management, Nuveen’s private credit shops, say they’re raising plenty of money from investors.”

“Treasury To Borrow $776 Billion In The Final Three Months Of The Year” (CNBC). “The U.S. government’s borrowing needs will decline slightly in the final three months of 2023 from the prior quarter, a potentially important development during a turbulent time for the global bond market. In a closely watched announcement Monday afternoon, the U.S. Department of the Treasury said it will be looking to borrow $776 billion, which is below the $1.01 trillion in privately held marketable debt the department borrowed in the July-through-September period, the highest ever for that particular quarter.”

“The National Debt Is Finally A Real-World Problem” (Yahoo! Finance). “We’re now beginning to see the real-life effects of an unsustainable federal debt load. To finance trillions of dollars in spending beyond what incoming revenue can support, the US Treasury is now issuing more debt in the form of Treasury securities than global financial markets can readily absorb. That forces the borrower—the US government—to pay higher interest rates, which in turn pushes up borrowing costs for consumers and businesses in much of the Western world.”

“Fliers Can’t Get Enough Of The ‘Upper-Middle Class’ Section Of The Plane” (Wall Street Journal). “Not quite business class and definitely not coach, premium-economy cabins are hooking travelers willing to treat themselves to extra comfort for about double the price of a coach seat on some flights.”

“NYT Tech Workers To Walk Out In Protest Of Return-To-Office Policies” (Axios). “The guild has argued that new remote-work policies violate the terms and conditions set when their union was ratified in 2022.”

What we’re reading (10/29)

“Hedge Fund Two Sigma Is Hit By Trading Scandal” (Wall Street Journal). “A researcher at Two Sigma Investments adjusted the hedge fund’s investing models without authorization, the firm has told clients, leading to losses in some funds, big gains in others and fresh regulatory scrutiny. The researcher, Jian Wu, a senior vice president at New York-based Two Sigma, was trying to boost his compensation, Two Sigma has told clients, without identifying Wu. He made changes over the past year that resulted in a total of $620 million in unexpected gains and losses, according to people close to the matter and investor letters. Two Sigma has placed Wu on administrative leave.”

“Spiking Treasury Yields Are Triggering Pain In Stocks. 3 Experts Discuss The Renewed Threat Of Bond Vigilantes And What Else Could Move Markets.” (Insider). “Forget about the technical charts, he [Gordon Johnson, of GLJ Research] says — they are not driving the bond market right now. Investors have their eyes on macroeconomic and geopolitical trends. And for Johnson, the recent spike in yields indicates the return of bond vigilantes, a term coined by the longtime economist Ed Yardeni to reference how some investors can sell bonds to protest certain government policies, thereby pushing up yields.”

“We All Know Social Media Is Bad For Mental Health. But Is It Go To Court Bad?” (Dealbreaker). “As interesting as the suit is, it is hard to know what law(s) Meta and its subsidiaries have broken. What are the causes of action — is causing depression in kids tortious? Is not doing “enough” to prevent online bullying a breach of contract? One of the more salient parts of the suit accuses Meta of collecting the data of children under 13, but the rest of the suit seems pretty nebulous.”

“What Ford’s Labor Deal Might Mean For The Auto Industry” (New York Times). “The new contract could cost Ford up to $2 billion annually over four years, according to Barclays analysts, or about 1 percent of sales. The company said it would look to offset those costs elsewhere. Employees were jubilant about the preliminary deal, which includes a 25 percent pay increase over the life of the contract and improvements on job security, pensions and more. ‘This is the best contract I have seen in my 30 years with Ford,’ one worker, Robert Carter, told The Times.”

“What Returns Should You Expect In The Stock Market?” (A Wealth of Common Sense). “My thinking here is there is a case to be made that stock market returns can and should be lower going forward but it’s not really based on valuations per se. Instead, it’s based on the idea that accessing the stock market was much harder in the past. Costs were higher and the financial system was more unstable. Thus, investors rightly demanded higher returns on a gross basis. But net returns in the past were likely much lower since trading costs, fees and expense ratios were so much higher. Even if gross returns are lower going forward, it’s much easier to earn market returns on a net basis through index funds, ETFs and zero-commission trading. Plus, there were no tax-deferred retirement accounts before 1980 or so.”

What we’re reading (10/27)

“S&P 500 Enters Correction” (Wall Street Journal). “The autumn pullback in the stock market worsened Friday, pushing the S&P 500 into a correction and to its worst two-week decline of the year. The broad stock-market gauge wavered for much of the day before turning lower and losing 0.5% for the session, bringing it down more than 10% from its recent high. A drop in shares of Chevron and JPMorgan Chase helped send the Dow Jones Industrial Average down 367 points, or 1.1%, to its lowest closing level since March.”

“Gold Is Officially Outperforming Stocks In 2023 As October Rally Continues” (MarketWatch). “It’s official: gold is officially outperforming the S&P 500 stock index in 2023 due to an October rally that has brought the price of an ounce of the yellow metal to the cusp of the $2,000 mark, a level it hasn’t seen since May. Metals traders attributed gold’s gains to a surge in demand for hedges and safety plays following Hamas’s Oct. 7 attack on Israel, which provoked a war between Israel and the group that is deemed a terrorist organization by the U.S. and European Union.”

“The Bond Market, A Sleeping Giant, Awakes” (New York Times). “The bond market is stirring. The business world and the Federal Reserve have been forced to take notice. Politicians in Washington may need to do so soon. After years of low interest rates, yields throughout the vast global bond market are soaring. Just this past week, the yield on the world’s most important fixed-income benchmark, the 10-year Treasury note, briefly exceeded 5 percent.”

“Wall Street Braces For Roughly $1.5 Trillion In Further Borrowing Needs By Treasury” (MarketWatch). “Treasury’s heavy borrowing is one of the most important factors behind the recent, steep run-up in long-term yields, which ended the New York session at their highest levels since 2007 last week. Since July, 10 and 30-year yields have each jumped by a full percentage point or more as traders fret over the onslaught of supply for Treasurys, the U.S. government’s fiscal trajectory, and the risks of holding long-dated government debt to maturity.”

“Sam Bankman-Fried Is Going To Talk Himself Right Into Jail” (The Verge). “Sam Bankman-Fried is so fucked. I have come to court every day since opening arguments thinking, Surely things cannot get worse for this man. Surely we have reached the bottom. Unfortunately, there is no bottom — in the prosecution’s telling, FTX and Alameda Research, his exchange and trading company, were matryoshka dolls of crime. Today, the defense started its case, which should theoretically present Bankman-Fried in a better light. But if what I saw of him on the stand is any indication, he may be more damning for himself than any of the prosecution’s witnesses.”

November picks available soon

I’ll be publishing the Prime and Select picks for the month of November before Wednesday, November 1 (the first trading day of the month). As always, SPC’s performance measurement for the month of October, as well as SPC’s cumulative performance, will assume the sale of the October picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Tuesday, October 31). Performance tracking for the month of November will assume the November picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Wednesday, November 1).

What we’re reading (10/25)

“Sam Bankman-Fried To Testify In FTX Fraud Trial, Attorney Says” (CNBC). “FTX founder Sam Bankman-Fried will take the stand to testify in his own defense, his attorney said in a conference call Wednesday. The decision by his legal team sets him up for a cross-examination by federal prosecutors, who will be able to press him on the collapse of his crypto exchange FTX.”

“UAW, Ford Expected To Announce New Tentative Labor Deal” (Wall Street Journal). “As part of the proposed contract, Ford has agreed to give factory workers a 25% wage increase over the life of the agreement, including a 11% bump in the first year, according to people familiar with the details. The wage increase would bump the top pay for assembly line workers from around $32 an hour to roughly $40 an hour.”

“Odey Asset Management Set To Shut Another Subsidiary” (Financial News). “Odey Asset Management is gearing up to close down another subsidiary, as it continues overhauling its business in the wake of sexual harassment allegations against founder Crispin Odey. A first Gazette notice has been filed for Brook Asset Management, alerting creditors that the company is set to be struck off Companies House records.”

“Morgan Stanley Names Ted Pick As Next Chief Executive” (Wall Street Journal). “Pick, who leads Morgan Stanley’s investment-banking and trading operations, was one of three finalists selected as possible successors for Gorman, who said in May he would step down from the CEO role he has held since 2010. At the company’s annual meeting in May, Gorman said he planned to step down as CEO within a year and noted the board had three internal candidates to replace him but didn’t name them. Gorman, who currently chairs the bank’s board, will become executive chairman.”

“The Startup Extinction Wave Is Rising And It’s beginning to wash Over The Cloud Industry” (Insider). “In June, we told you about a startup mass extinction event that was just beginning. Four months later, this wave of shutdowns is rising fast, and it's beginning to drag on the cloud sector. 212 startups went bankrupt or dissolved in some other way during the third quarter, according to data from Carta, which tracks startup shutdowns closely. This doesn't capture all the closures as not every startup is a client of Carta. But the rate of change is notable. So far this year, Carta has seen 543 startup shutdowns. That was by far the most of any year going back to 2019.”

What we’re reading (10/24)

“Google’s Cloud Sales Disappoint As Advertising Rebounds” (Wall Street Journal). “Google reported its strongest business growth in more than a year but disappointed investors with relatively weak cloud-computing sales, delivering a mixed picture as it continues to wrestle with competitors developing artificial-intelligence tools.”

“Microsoft Ticks Up On Faster Cloud Growth And Hopeful Revenue Forecast” (CNBC). “Microsoft shares jumped as much as 6% in extended trading Tuesday after the software maker issued fiscal first-quarter results and quarterly revenue guidance that beat Wall Street estimates. The firm also reported a surge in profit due to a slower pace of operating expense growth.”

“How High Interest Rates Sting Bakers, Farmers and Consumers” (New York Times). “Over the past few weeks, investors have realized that even with the Federal Reserve nearing an end to its increases in short-term interest rates, market-based measures of long-term borrowing costs have continued rising. In short, the economy may no longer be able to avoid a sharper slowdown.”

“The Secret Of America’s Economic Success” (Paul Krugman). “My conjecture — and that’s all it is — is that the U.S. approach turned out to be the right one. Covid appears to have had lasting effects on what we buy and how we work — most obviously, working from home appears to be here to stay — while high labor force participation belies fears that laid-off workers would never come back. So America’s Covid response, even though it temporarily led to high measured unemployment, may have set the stage for a strong recovery.”

“The 4% Rule For Retirement Spending Is Now The 4.7% Rule” (MarketWatch). “Bengen’s new work says 4.7% is the new “SAFEMAX” withdrawal rate under poor conditions — his word for the most someone can take the first year with a low probability of depleting their nest egg. Take more than 4.7% from your nest egg the first year, according to the new adjustment, and you run the risk of outliving your money. Take less, and you may leave more on the table than you’d like.”

What we’re reading (10/23)

“Fresh Growth Numbers Are Set To Show US Remains Economic Powerhouse” (Bloomberg). “The world’s largest economy probably expanded at the quickest pace in nearly two years during the third quarter on the back of a steadfast US consumer, a challenge for Federal Reserve officials who are debating whether additional policy tightening is needed.”

“Who You Calling Dumb Money? Everyday Investors Do Just Fine” (Wall Street Journal). “The average individual-investor stock portfolio has risen about 150% since the beginning of 2014, according to investment research firm Vanda Research, which began tracking the data nine years ago. That beats the S&P 500’s roughly 140% during the same period. Vanda calculates the average portfolio by analyzing individual investors’ brokerage-account trading activity in U.S.-listed single stocks. The firm’s analysis excludes purchases of exchange-traded funds and mutual funds, along with transactions made through retirement accounts or investment advisers.”

“Treasury 10-Year Yield Breaches 5% For First Time Since 2007” (Bloomberg). “Treasuries rallied, bouncing back from a slide that took the 10-year Treasury yield beyond 5% for the first time in 16 years, as investors start to question whether the economy can withstand current interest rates.”

“Bill Ackman Covers Bet Against Treasurys, Says ‘Too Much Risk In The World’ To Bet Against Bonds” (CNBC). “The billionaire hedge fund manager first disclosed his bearish position on 30-year Treasurys in August, betting on elevated yields on the back of ‘higher levels of long-term inflation.’ The 30-year Treasury yield has risen more than 80 basis points since the end of August, making Ackman’s bet profitable.”

“ESG Investing Is Dying On Wall Street. Here’s Why” (CNN Business). “The market for environmental, social and corporate governance, or ESG, investing is fundamentally broken. The numbers speak for themselves. The cumulative flow of investments into US ESG funds has been flat to slightly negative since the first quarter of 2022, according to data shared exclusively with CNN by Lipper, a financial data provider.”

What we’re reading (10/22)

“There’s Never Been A Worse Time To Buy Instead Of Rent” (Wall Street Journal). “Getting on the property ladder has rarely been tougher for first-time buyers. But a tight housing market isn’t turning out to be a bonanza for landlords either. The cost of buying a home versus renting one is at its most extreme since at least 1996. The average monthly new mortgage payment is 52% higher than the average apartment rent, according to CBRE analysis. The last time the measure looked out of whack was before the 2008 housing crash. Even then, the premium peaked at 33% in the second quarter of 2006.”

“New Homeowners Won’t See A Profit For Over A Decade” (Axios). “Historically, experts have said you need to stay in your home at least five years to break even. But with mortgage rates inching toward 8%, new homeowners will need to stay put longer to avoid going underwater.”

“Car Owners Fall Behind On Payments At Highest Rate On Record” (Bloomberg). “Americans are falling behind on their auto loans at the highest rate in nearly three decades. With interest rate hikes making newer loans more expensive, millions of car owners are struggling to afford their payments.”

“This Land Isn’t For You Or Me. It’s For The Meat Industry.” (Vox). “The federal government’s livestock grazing program is just one part of America’s agricultural land use story. The other part is all the land used to grow crops to feed farmed cattle, chickens, pigs, and fish, which comes in at 127 million acres. All told, a staggering 41 percent of land in the continental US is used for meat, dairy, and egg production. Globally, it’s more than one-third of habitable land. Much of it was once forest that’s since been cut down to graze livestock and grow the corn and soy that feeds them.”

“The Gems Hiding In Plain Sight In The Treasury Market” (New York Times). “You didn’t have to be a financial wizard to get a safe return of more than 7 percent on your money for decades to come. All you had to do was buy a 30-year U.S. Treasury bond in the last nine months of 1994. And if you were especially lucky with your timing and bought that bond in early November 1994, you could have gotten more than 8 percent interest annually.”

What we’re reading (10/20)

“What Is ‘Normal’ For Interest Rates?” (Morningstar). “For many investors, it may seem like the current environment is an aberration. Instead, bond watchers say the rate landscape we’d known since the 2008 financial crisis was the true anomaly. That means investors may need to get used to these conditions. ‘We’re in a more normal period of interest rates,’ explains Kristy Akullian, iShares senior investment strategist at BlackRock. ‘The last 15 years were the exception rather than the norm.’ She notes that over the past 60 years, 10-year Treasury yields have averaged about 5.9%.”

“Amazon Confronts A New Rival: TikTok” (Wall Street Journal). “TikTok made a name for itself in the U.S. as a viral video-sharing sensation. Now it’s trying to get its 150 million U.S. users to think of it as a shopping destination. Amazon, meanwhile, is trying new tactics to maintain its dominance in e-commerce. It has added social elements to its app to entice younger shoppers, and it is building up a network of influencers who hawk items on and off its website.”

“Tyson Foods, One Of The Biggest Meat Producers, Is Investing In Insect Protein” (CNN Business). “The meat processor said on Tuesday that it has invested in Protix, a Netherlands-based insect ingredients maker. Tyson is not only taking a minority stake in the company, but is working alongside it to build a US factory. That facility will use animal waste to feed black soldier flies, which will then be turned into food for pets, poultry and fish. Tyson did not disclose the financial specifics of the deal.”

“America Needs A Grand Strategy For Outer Space” (The Hill). “Of all the areas that demand our attention in U.S.-China competition, outer space is uniquely important. Space has tremendous untapped economic potential and is becoming increasingly accessible. In the next five years, the global space economy is projected to grow to $800 billion.”

“Nonprofit Hospitals Skimp On Charity While CEOs Reap Millions, Report Finds” (ars technica). “Nonprofit hospitals are under increasing scrutiny for skimping on charity care, relentlessly pursuing payments from low-income patients, and paying executives massive multi-million-dollar salaries—all while earning tax breaks totaling billions.”