What we’re reading (10/27)

“S&P 500 Enters Correction” (Wall Street Journal). “The autumn pullback in the stock market worsened Friday, pushing the S&P 500 into a correction and to its worst two-week decline of the year. The broad stock-market gauge wavered for much of the day before turning lower and losing 0.5% for the session, bringing it down more than 10% from its recent high. A drop in shares of Chevron and JPMorgan Chase helped send the Dow Jones Industrial Average down 367 points, or 1.1%, to its lowest closing level since March.”

“Gold Is Officially Outperforming Stocks In 2023 As October Rally Continues” (MarketWatch). “It’s official: gold is officially outperforming the S&P 500 stock index in 2023 due to an October rally that has brought the price of an ounce of the yellow metal to the cusp of the $2,000 mark, a level it hasn’t seen since May. Metals traders attributed gold’s gains to a surge in demand for hedges and safety plays following Hamas’s Oct. 7 attack on Israel, which provoked a war between Israel and the group that is deemed a terrorist organization by the U.S. and European Union.”

“The Bond Market, A Sleeping Giant, Awakes” (New York Times). “The bond market is stirring. The business world and the Federal Reserve have been forced to take notice. Politicians in Washington may need to do so soon. After years of low interest rates, yields throughout the vast global bond market are soaring. Just this past week, the yield on the world’s most important fixed-income benchmark, the 10-year Treasury note, briefly exceeded 5 percent.”

“Wall Street Braces For Roughly $1.5 Trillion In Further Borrowing Needs By Treasury” (MarketWatch). “Treasury’s heavy borrowing is one of the most important factors behind the recent, steep run-up in long-term yields, which ended the New York session at their highest levels since 2007 last week. Since July, 10 and 30-year yields have each jumped by a full percentage point or more as traders fret over the onslaught of supply for Treasurys, the U.S. government’s fiscal trajectory, and the risks of holding long-dated government debt to maturity.”

“Sam Bankman-Fried Is Going To Talk Himself Right Into Jail” (The Verge). “Sam Bankman-Fried is so fucked. I have come to court every day since opening arguments thinking, Surely things cannot get worse for this man. Surely we have reached the bottom. Unfortunately, there is no bottom — in the prosecution’s telling, FTX and Alameda Research, his exchange and trading company, were matryoshka dolls of crime. Today, the defense started its case, which should theoretically present Bankman-Fried in a better light. But if what I saw of him on the stand is any indication, he may be more damning for himself than any of the prosecution’s witnesses.”

November picks available soon

I’ll be publishing the Prime and Select picks for the month of November before Wednesday, November 1 (the first trading day of the month). As always, SPC’s performance measurement for the month of October, as well as SPC’s cumulative performance, will assume the sale of the October picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Tuesday, October 31). Performance tracking for the month of November will assume the November picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Wednesday, November 1).

What we’re reading (10/25)

“Sam Bankman-Fried To Testify In FTX Fraud Trial, Attorney Says” (CNBC). “FTX founder Sam Bankman-Fried will take the stand to testify in his own defense, his attorney said in a conference call Wednesday. The decision by his legal team sets him up for a cross-examination by federal prosecutors, who will be able to press him on the collapse of his crypto exchange FTX.”

“UAW, Ford Expected To Announce New Tentative Labor Deal” (Wall Street Journal). “As part of the proposed contract, Ford has agreed to give factory workers a 25% wage increase over the life of the agreement, including a 11% bump in the first year, according to people familiar with the details. The wage increase would bump the top pay for assembly line workers from around $32 an hour to roughly $40 an hour.”

“Odey Asset Management Set To Shut Another Subsidiary” (Financial News). “Odey Asset Management is gearing up to close down another subsidiary, as it continues overhauling its business in the wake of sexual harassment allegations against founder Crispin Odey. A first Gazette notice has been filed for Brook Asset Management, alerting creditors that the company is set to be struck off Companies House records.”

“Morgan Stanley Names Ted Pick As Next Chief Executive” (Wall Street Journal). “Pick, who leads Morgan Stanley’s investment-banking and trading operations, was one of three finalists selected as possible successors for Gorman, who said in May he would step down from the CEO role he has held since 2010. At the company’s annual meeting in May, Gorman said he planned to step down as CEO within a year and noted the board had three internal candidates to replace him but didn’t name them. Gorman, who currently chairs the bank’s board, will become executive chairman.”

“The Startup Extinction Wave Is Rising And It’s beginning to wash Over The Cloud Industry” (Insider). “In June, we told you about a startup mass extinction event that was just beginning. Four months later, this wave of shutdowns is rising fast, and it's beginning to drag on the cloud sector. 212 startups went bankrupt or dissolved in some other way during the third quarter, according to data from Carta, which tracks startup shutdowns closely. This doesn't capture all the closures as not every startup is a client of Carta. But the rate of change is notable. So far this year, Carta has seen 543 startup shutdowns. That was by far the most of any year going back to 2019.”

What we’re reading (10/24)

“Google’s Cloud Sales Disappoint As Advertising Rebounds” (Wall Street Journal). “Google reported its strongest business growth in more than a year but disappointed investors with relatively weak cloud-computing sales, delivering a mixed picture as it continues to wrestle with competitors developing artificial-intelligence tools.”

“Microsoft Ticks Up On Faster Cloud Growth And Hopeful Revenue Forecast” (CNBC). “Microsoft shares jumped as much as 6% in extended trading Tuesday after the software maker issued fiscal first-quarter results and quarterly revenue guidance that beat Wall Street estimates. The firm also reported a surge in profit due to a slower pace of operating expense growth.”

“How High Interest Rates Sting Bakers, Farmers and Consumers” (New York Times). “Over the past few weeks, investors have realized that even with the Federal Reserve nearing an end to its increases in short-term interest rates, market-based measures of long-term borrowing costs have continued rising. In short, the economy may no longer be able to avoid a sharper slowdown.”

“The Secret Of America’s Economic Success” (Paul Krugman). “My conjecture — and that’s all it is — is that the U.S. approach turned out to be the right one. Covid appears to have had lasting effects on what we buy and how we work — most obviously, working from home appears to be here to stay — while high labor force participation belies fears that laid-off workers would never come back. So America’s Covid response, even though it temporarily led to high measured unemployment, may have set the stage for a strong recovery.”

“The 4% Rule For Retirement Spending Is Now The 4.7% Rule” (MarketWatch). “Bengen’s new work says 4.7% is the new “SAFEMAX” withdrawal rate under poor conditions — his word for the most someone can take the first year with a low probability of depleting their nest egg. Take more than 4.7% from your nest egg the first year, according to the new adjustment, and you run the risk of outliving your money. Take less, and you may leave more on the table than you’d like.”

What we’re reading (10/23)

“Fresh Growth Numbers Are Set To Show US Remains Economic Powerhouse” (Bloomberg). “The world’s largest economy probably expanded at the quickest pace in nearly two years during the third quarter on the back of a steadfast US consumer, a challenge for Federal Reserve officials who are debating whether additional policy tightening is needed.”

“Who You Calling Dumb Money? Everyday Investors Do Just Fine” (Wall Street Journal). “The average individual-investor stock portfolio has risen about 150% since the beginning of 2014, according to investment research firm Vanda Research, which began tracking the data nine years ago. That beats the S&P 500’s roughly 140% during the same period. Vanda calculates the average portfolio by analyzing individual investors’ brokerage-account trading activity in U.S.-listed single stocks. The firm’s analysis excludes purchases of exchange-traded funds and mutual funds, along with transactions made through retirement accounts or investment advisers.”

“Treasury 10-Year Yield Breaches 5% For First Time Since 2007” (Bloomberg). “Treasuries rallied, bouncing back from a slide that took the 10-year Treasury yield beyond 5% for the first time in 16 years, as investors start to question whether the economy can withstand current interest rates.”

“Bill Ackman Covers Bet Against Treasurys, Says ‘Too Much Risk In The World’ To Bet Against Bonds” (CNBC). “The billionaire hedge fund manager first disclosed his bearish position on 30-year Treasurys in August, betting on elevated yields on the back of ‘higher levels of long-term inflation.’ The 30-year Treasury yield has risen more than 80 basis points since the end of August, making Ackman’s bet profitable.”

“ESG Investing Is Dying On Wall Street. Here’s Why” (CNN Business). “The market for environmental, social and corporate governance, or ESG, investing is fundamentally broken. The numbers speak for themselves. The cumulative flow of investments into US ESG funds has been flat to slightly negative since the first quarter of 2022, according to data shared exclusively with CNN by Lipper, a financial data provider.”

What we’re reading (10/22)

“There’s Never Been A Worse Time To Buy Instead Of Rent” (Wall Street Journal). “Getting on the property ladder has rarely been tougher for first-time buyers. But a tight housing market isn’t turning out to be a bonanza for landlords either. The cost of buying a home versus renting one is at its most extreme since at least 1996. The average monthly new mortgage payment is 52% higher than the average apartment rent, according to CBRE analysis. The last time the measure looked out of whack was before the 2008 housing crash. Even then, the premium peaked at 33% in the second quarter of 2006.”

“New Homeowners Won’t See A Profit For Over A Decade” (Axios). “Historically, experts have said you need to stay in your home at least five years to break even. But with mortgage rates inching toward 8%, new homeowners will need to stay put longer to avoid going underwater.”

“Car Owners Fall Behind On Payments At Highest Rate On Record” (Bloomberg). “Americans are falling behind on their auto loans at the highest rate in nearly three decades. With interest rate hikes making newer loans more expensive, millions of car owners are struggling to afford their payments.”

“This Land Isn’t For You Or Me. It’s For The Meat Industry.” (Vox). “The federal government’s livestock grazing program is just one part of America’s agricultural land use story. The other part is all the land used to grow crops to feed farmed cattle, chickens, pigs, and fish, which comes in at 127 million acres. All told, a staggering 41 percent of land in the continental US is used for meat, dairy, and egg production. Globally, it’s more than one-third of habitable land. Much of it was once forest that’s since been cut down to graze livestock and grow the corn and soy that feeds them.”

“The Gems Hiding In Plain Sight In The Treasury Market” (New York Times). “You didn’t have to be a financial wizard to get a safe return of more than 7 percent on your money for decades to come. All you had to do was buy a 30-year U.S. Treasury bond in the last nine months of 1994. And if you were especially lucky with your timing and bought that bond in early November 1994, you could have gotten more than 8 percent interest annually.”

What we’re reading (10/20)

“What Is ‘Normal’ For Interest Rates?” (Morningstar). “For many investors, it may seem like the current environment is an aberration. Instead, bond watchers say the rate landscape we’d known since the 2008 financial crisis was the true anomaly. That means investors may need to get used to these conditions. ‘We’re in a more normal period of interest rates,’ explains Kristy Akullian, iShares senior investment strategist at BlackRock. ‘The last 15 years were the exception rather than the norm.’ She notes that over the past 60 years, 10-year Treasury yields have averaged about 5.9%.”

“Amazon Confronts A New Rival: TikTok” (Wall Street Journal). “TikTok made a name for itself in the U.S. as a viral video-sharing sensation. Now it’s trying to get its 150 million U.S. users to think of it as a shopping destination. Amazon, meanwhile, is trying new tactics to maintain its dominance in e-commerce. It has added social elements to its app to entice younger shoppers, and it is building up a network of influencers who hawk items on and off its website.”

“Tyson Foods, One Of The Biggest Meat Producers, Is Investing In Insect Protein” (CNN Business). “The meat processor said on Tuesday that it has invested in Protix, a Netherlands-based insect ingredients maker. Tyson is not only taking a minority stake in the company, but is working alongside it to build a US factory. That facility will use animal waste to feed black soldier flies, which will then be turned into food for pets, poultry and fish. Tyson did not disclose the financial specifics of the deal.”

“America Needs A Grand Strategy For Outer Space” (The Hill). “Of all the areas that demand our attention in U.S.-China competition, outer space is uniquely important. Space has tremendous untapped economic potential and is becoming increasingly accessible. In the next five years, the global space economy is projected to grow to $800 billion.”

“Nonprofit Hospitals Skimp On Charity While CEOs Reap Millions, Report Finds” (ars technica). “Nonprofit hospitals are under increasing scrutiny for skimping on charity care, relentlessly pursuing payments from low-income patients, and paying executives massive multi-million-dollar salaries—all while earning tax breaks totaling billions.”

What we’re reading (10/19)

“Home Sales Slide To Lowest Pace Since 2010 As High Rates Squeeze Market” (Wall Street Journal). “Home sales fell in September to the lowest rate in 13 years, showing the corner of the economy most weakened by high interest rates remains in decline.”

“Silicon Valley Ditches News, Shaking An Unstable Industry” (New York Times). “Campbell Brown, Facebook’s top news executive, said this month that she was leaving the company. Twitter, now known as X, removed headlines from the platform days later. The head of Instagram’s Threads app, an X competitor, reiterated that his social network would not amplify news. Even Google — the strongest partner to news organizations over the past 10 years — has become less dependable, making publishers more wary of their reliance on the search giant. The company has laid off news employees in two recent team reorganizations, and some publishers say traffic from Google has tapered off.”

“CEOs Are Leaving Their Jobs In Record Numbers In What Is The Executive Suite Version Of The Great Resignation” (Fortune). “For most workers, the so-called Great Resignation is over. For CEOs, it’s just ramping up. More than 1,400 chief executives have left their positions so far this year through September, according to a report by executive coaching firm Challenger, Gray & Christmas. That’s up almost 50% from the same period last year and the highest on record over that period since the firm began tracking in 2002.”

“Why Carlyle Is Making Big Private Credit Investments In Hollywood Companies Like ‘Bohemian Rhapsody’ Producer New Regency” (Insider). “[B]acking companies with rich troves of library content is one way to access the entertainment economy while hedging risk as streamers continue to lean on library content to bulk up their offerings and keep subscribers from churning out.”

“Stanford Scientist, After Decades Of Study, Concludes: We Don’t Have Free Will” (Los Angeles Times). “Before epilepsy was understood to be a neurological condition, people believed it was caused by the moon, or by phlegm in the brain. They condemned seizures as evidence of witchcraft or demonic possession, and killed or castrated sufferers to prevent them from passing tainted blood to a new generation. Today we know epilepsy is a disease. By and large, it’s accepted that a person who causes a fatal traffic accident while in the grip of a seizure should not be charged with murder. That’s good, says Stanford University neurobiologist Robert Sapolsky. That’s progress. But there's still a long way to go.”

What we’re reading (10/19)

“10-Year U.S. Treasury Yield Tops 4.9%” (Wall Street Journal). “Long-term bond yields hit a fresh 16-year high Wednesday, weighing on stocks already pressured by the conflict in Gaza and corporate earnings results. The 10-year U.S. Treasury yield rose to 4.902%, the highest closing level since July 2007. The S&P 500 fell 1.3%. The Dow Jones Industrial Average shed 332.57 points, or 1%. The Nasdaq Composite lost 1.6%.”

“A Higher Monthly Payment, But Less Square Footage” (New York Times). “The American home is shrinking. With interest rates rising and mortgage costs with them, homebuilders are pulling in yards, tightening living rooms and lopping off bedrooms in an attempt to keep the monthly payment in line with what families can afford. The result is that new home buyers are paying more and getting less, while far-flung developments where people move for size and space are now being reimagined as higher-density communities where single-family houses have apartment-size proportions.”

“Real-Estate Commissions Could Be The Next Fee On The Chopping Block” (Wall Street Journal). “In recent years, technology has made a host of consumer transactions cheaper—from booking a vacation to buying stocks—but commission rates for selling a home haven’t really budged. That could soon change. A pair of class-action lawsuits challenging real-estate industry rules—including one that went to trial beginning this week—and continued pressure from U.S. antitrust officials are threatening to disrupt a compensation model that hasn’t meaningfully changed in decades.”

“The Author Michael Lewis On The Lessons Of Sam Bankman-Fried” (Vox). “What the tech geniuses do, in my experience, is say a lot of words and they don’t make a lot of sense, or to put it more politely, they’re too smart for me to understand. It’s mostly jargon and acronyms. They don’t want me to understand. They want me to be impressed. Sam was not like that. He was very good at explaining and making sure you understood and allowing you to ask the simple questions. He wasn’t off-putting. I’m with you on the tech genius stuff. I’ve dipped into Silicon Valley and I’ve never really wanted to write about that crowd. He wasn’t that way.”

“The Techno-Optimist Manifesto” (Marc Andreesen). “We believe free markets are the most effective way to organize a technological economy. Willing buyer meets willing seller, a price is struck, both sides benefit from the exchange or it doesn’t happen. Profits are the incentive for producing supply that fulfills demand. Prices encode information about supply and demand. Markets cause entrepreneurs to seek out high prices as a signal of opportunity to create new wealth by driving those prices down.”

What we’re reading (10/15)

“A Recession Is No Longer The Consensus” (Wall Street Journal). “Economists are turning optimistic on the U.S. economy. They now think it will skirt a recession, the Federal Reserve is done raising interest rates and inflation will continue to ease.”

“Bonds Have Been Awful. It’s A Good Time To Buy.” (New York Times). “Fixed-income investors have been experiencing calamitous price declines in the bond market since summer 2020. Some 30-year U.S. Treasuries have lost 50 percent of their value, the Bank of America team noted. In parts of the international market, losses have been worse. An extremely long-term Austrian bond — one with a 100-year maturity — plummeted 75 percent in value. As interest rates have risen over the past few years, breathtaking price movements have been occurring with dismaying frequency. And as losses have mounted, it’s been easy to give up on bonds.”

“Despite Big Losses, Investors Flock To Long-Term Bond ETFs” (Morningstar). “The iShares 20+ Year Treasury ETF TLT is down nearly 15% this year, but the exchange-traded fund’s poor performance hasn’t deterred investors. Instead, the high yields brought on by the bond market’s sell-off seem to have attracted them. Investors have poured $17.2 billion into the $40.7 billion fund this year, making it the third most popular ETF in terms of flows so far in 2023.”

“Workers With In-Person Jobs Spend About $51 A Day That They Wouldn’t Remotely, Survey Finds” (USA Today). “From getting stuck in traffic and the extra effort put into getting dressed, many employees would much rather clock in from home. However, a recent survey found that one of the biggest reasons could simply be how costly it is to make money. Owl Lab’s 2023 ‘State of Work’ report found 66% of U.S. employees who returned to the office to work five days a week or full time, spend an average of $51 every workday.”

“Will the United States Be the Next Israel?” (Politico). “What’s happening in Israel now is a disturbing example of what can happen when elected officials use partisan and personal motivations to warp national security. For years, Republicans in Congress have attempted to sabotage what they call the ‘Deep State.’ This includes placing holds on political nominees and castigating diplomats, officers and analysts employed in the government as captives to ‘Big Woke.’ They might see it as political theater, necessary to boosting profiles and fundraising. But as this week shows, there can be a price.”

What we’re reading (10/13)

“S&P 500 Closes Lower On Friday, But Notches Second Straight Positive Week” (CNBC). “Stocks came off their session highs after consumer sentiment data was released earlier Friday. According to the University of Michigan’s closely watched survey, preliminary consumer sentiment data slumped in October while inflation expectations spiked.”

“Hedge Funds Must Tell SEC Which Companies They Sell Short Under New Rules” (Wall Street Journal). “Traders will get a broader look at which public companies are being targeted by short sellers under rules the Securities and Exchange Commission adopted Friday as part of its response to the 2021. The final rules come more than two years after that drama, when thousands of investors coordinated on Reddit to buy shares of GameStop and others—and punish hedge funds that had bet against the stocks. The turmoil captured headlines and left some traders with huge gains while others lost eye-popping sums.”

“How A Billionaire-Backed Network Of AI Advisers Took Over Washington” (Politico). “In the high-stakes Washington debate over AI rules, Open Philanthropy has long been focused on one slice of the problem — the long-term threats that future AI systems might pose to human survival. Many AI thinkers see those as science-fiction concerns far removed from the current AI harms that Washington should address. And they worry that Open Philanthropy, in concert with its web of affiliated organizations and experts, is shifting the policy conversation away from more pressing issues — including topics some leading AI firms might prefer to keep off the policy agenda.”

“From LSD To I.P.O.” (New York Times). “‘Their popularity nowadays is pretty wild,” Ms. Steele added. “It’s not often that you see a total turnaround in public brand perception in the way we have with Birkenstock.’ Today, five core styles make up 76 percent of the business, the company said, with prices that start at 40 euros (about $42). For limited-edition luxury styles, that figure can be 40 times as much — up to $1,700. The company said that 30 million pairs of Birkenstock sandals were sold in 2022, with sales of 1.24 billion euros ($1.3 billion at current exchange rates), up from 292 million euros ($307 million) in 2014.”

“No, Low Interest Rates Did Not Justify Adding Trillions Of Dollars To The National Debt” (Reason). “In the end, the Forever Low believers were correct in their own transitory way. After all, interest rates did remain low for an extended period, catching many by surprise. Their main mistake, though, was tragic: concluding that there was no cost to trillions of dollars in additional debt.”

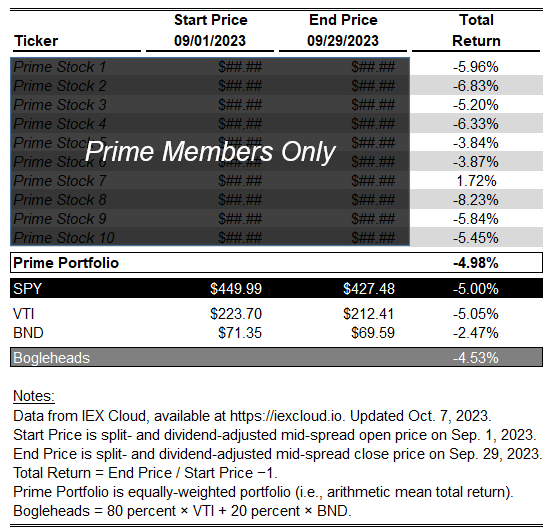

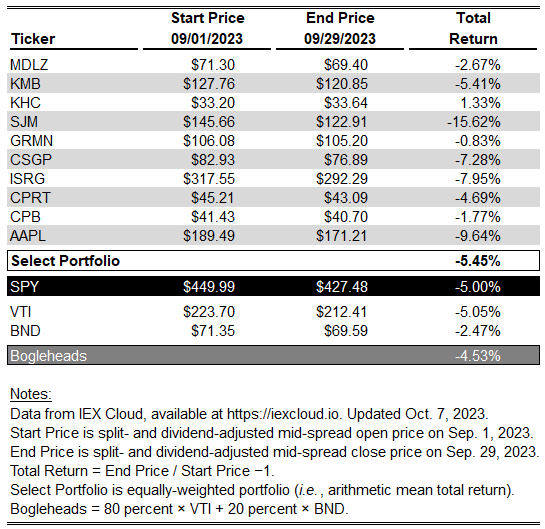

August/September Performance Update

Here with a performance update for the last two months, but I don’t have much of substance to report as the Prime and Select strategies’ performance, in combination, were not materially different from the market’s.

In August, Prime underperformed by about 100 bps; on the other hand, Select outperformed by over 160 bps. In September, Prime was almost exactly in line with the market, while Select gave back some of the prior month’s relative gains. In repeated samples (more than the two reported here) performance matching the market’s would support an inference that the factors Prime and Select index on don’t matter much. A subtly different inference would be that those factors don’t seem to matter much right now, perhaps because other systematic risk factors (rates, the resolution of macro growth uncertainty) are dominating the performance of all equities. Believers in the Halloween Effect would note that we are now entering the six months of the year where stocks tend to perform relatively better. Based on the market’s performance year-to-date, 2023 would seem to be another data point supporting that theory. Stay tuned!

Prime: September Performance

Prime: August Performance

Select: September Performance

Select: August Performance

What we’re reading (10/7)

“The Oil Patch Is Primed For An Era Of Megadeals” (Wall Street Journal). “A wave of deals could reshape the U.S. oil-and-gas industry, ushering it from an era defined by relatively small drillers chasing growth to one dominated by the largest Western oil companies. The emerging order could resemble what came out of the industry’s megamergers that began in the late 1990s and included linkups between Exxon and Mobil, Chevron and Texaco, and BP and Amoco, among others.”

“The Great Zelle Pool Scam” (Insider). “Elizabeth Warren, the financial industry regulator banks most love to hate, has been petitioning Zelle to find out exactly how much fraud there is. And the data she's collected suggests there's probably, technically speaking, a whole fucking lot. According to Warren's office, US Bank — a single institution in the consortium — reported 45,000 incidents of Zelle scams last year. That's triple the number from 2021. It's certainly possible, if the criminals keep at it, work hard, and show some grit, they can triple the amount of fraud again by next year.”

“The Lifesaving, Nobel Prize-Winning Discovery That Almost Didn’t Happen” (Vox). “In hindsight, little medical research was of more importance than Karikó’s work at Weissman’s lab on making mRNA vaccines a reality. But at every stage, the research community that should have embraced this research instead stymied it, because of powerful incentives in science toward work that is more fundable and more publishable.”

“Active Success: Still Elusive” (Standard & Poor’s). “Anyone even vaguely conversant with our SPIVA® Scorecards will realize that most active managers underperform passive benchmarks most of the time. This result is robust across geographies and across time, and is reflected in our recently issued mid-year 2023 report for the U.S. market. Although the scorecard covers 39 categories of equity and fixed income managers, the largest and most closely watched comparison is that between large-cap U.S. equity managers and the S&P 500®. Exhibit 1 shows that 60% of large-cap managers underperformed the S&P 500 in the first six months of 2023; not since 2009 has a majority of large-cap managers outperformed.”

“In Provence, Winemakers Confront Climate Change” (New York Times). “The tastes of centuries-old varieties are being altered by spiking temperatures, scant rainfall, snap frosts and unpredictable bouts of extreme weather. The hellish summer was the latest reminder of how urgently the $333 billion global wine industry is being forced to adapt. Temperature records were set in Europe, the United States, China, North Africa and the Middle East as hail, drought, wildfires and floods on a biblical scale inflicted damage.”

What we’re reading (10/6)

“Surprisingly Strong Hiring Sends Bond Yields Higher” (Wall Street Journal). “Employers added 336,000 jobs in September, the strongest gain since January and up sharply from the prior month’s upwardly revised 227,000 gain, the Labor Department said Friday. Job growth was also stronger in July than previously estimated.”

“Investing Has Been Ugly. Stick With It Anyway.” (New York Times). “This is one of those stretches when you may want to avoid looking at your investments. Performance reports for the three months that ended in September are arriving now, and they are ugly. The vast majority of mutual funds and exchange-traded funds — the vehicles used by most Americans for their investments — fell. There were losses in most markets and in nearly all asset classes.”

“The Long Game: Why Patience And Perspective Matter In Investing” (Validea). “It’s tempting to toss in the towel and lock in the 5% that short-term treasuries are paying, and that could be a good or bad decision, but for long-term money earmarked toward growth I’d argue that type of decision has the ability to detract from returns more than enhance them. When we are in periods like this, it’s important for investors to take a longer-term view and not let recency bias and short-termism impact their decisions.”

“The Cure For High Prices That Weren't Actually Inflation” (RealClear Markets). “We are being caught in a tug-of-war pitting the world’s oil exporters and suppliers on the one side attempting to keep crude up under the ironic euphemism of “price stability” against global recession on the other. Last year’s surge already pushed much of the world into one and this year’s was merely an invitation to finish the job for everyone else.”

“Amazon Launches First Internet Satellite Prototypes” (CNBC). “More than four years since the tech giant announced its ambitious plan to invest heavily in building a global satellite internet network, Amazon on Friday saw the first pair of satellites for its Project Kuiper system launch into space.”

What we’re reading (10/5)

“GM Has At Least 20 Million Vehicles With Potentially Dangerous Air-Bag Parts” (Wall Street Journal). “The number of affected GM vehicles—a figure that hasn’t been disclosed publicly—makes the Detroit-based automaker among the most exposed in a push by U.S. auto-safety regulators to recall 52 million air-bag inflators designed by Tennessee-based auto supplier ARC Automotive, according to people familiar with the matter.”

“Fed’s Bid To Avoid Recession Tested By Yields Nearing 20-Year Highs” (Bloomberg). “The surge — 10-year Treasury yields rose more than half a percentage point the past month to surpass 4.7% — heightens the danger in the near-term of a financial blowup akin to the regional bank breakdown in March. Longer run, it threatens to undercut the economy by markedly raising borrowing costs for consumers and companies.”

“The Collapse In Treasury Bonds Now Ranks Among The Worst Market Crashes In History” (Insider). “Compared with previous bond-market meltdowns, long-term Treasurys are seeing one of the most extreme undoings in history. The losses are over twice as big as those seen in 1981 when 10-year yields neared 16%.”

“Copper’s Price Curve Hasn't Looked Like This In Decades” (OilPrice.com). “The copper market is in a state of extreme contango—a state of the futures curve where futures contracts trade at a premium to the spot price and signal weak prompt demand.”

“Negotiations Between The UAW And GM Are Showing Signs Of Progress” (CNN Business). “Three weeks into the United Auto Workers strike, signs of progress have emerged in talks between the union and General Motors. GM said it provided a counteroffer to the UAW’s most recent proposal, which it said is the sixth by the company since the start of negotiations.”

What we’re reading (10/4)

“Why Wall Street Investors Are Freaking Out” (CNN Business). “Several historic stock market crashes have haunted the autumnal month. Black Tuesday, the 1929 market plunge that led to the Great Depression, 1987’s Black Monday and the beginnings of the 2008 financial crisis all took place in October. October also marks the end of the fiscal year for many mutual funds in the United States. This sometimes leads to so-called “window dressing,” where fund managers sell poorly performing stocks and purchase better-performing alternatives to improve the appearance of their portfolios. These events have led investors to fear the cursed ‘October Effect,’ a perceived tendency for the stock market to decline through the month. Statistical evidence doesn’t quite support the phenomenon, but the level of superstitious caution on Wall Street is real.”

“Dow Adds 100 Points To Snap 3-Day Losing Streak As Treasury Yields Ease From 16-Year Highs” (CNBC). “The Dow Jones Industrial Average broke a three-day losing streak Wednesday as Treasury yields pulled back from multiyear highs following the release of much weaker-than-expected jobs data. The 30-stock index gained 127.17 points, or 0.39%, to close at 33,129.55. The S&P 500 added 0.81% and closed at 4,263.75. Meanwhile, the Nasdaq Composite gained 1.35% at 13,236.01. Within the S&P 500, consumer discretionary was the best-performing sector, rising about 2%. Tesla and Norwegian Cruise Line led the sector gains, adding 5.9% and 3.8%, respectively.”

“Is A College Degree No Longer A Good Investment? Walmart Plans To AX Degree Requirements From Hundreds Of Its Corporate Job Descriptions” (Daily Mail). “The retail giant said last week that it would get rid of 'unnecessary barriers' that prevent career advancement, and that job applicants would start seeing updated job descriptions next year. Walmart said it will waive the need for a university degree if candidates can show they have gained the necessary skills through alternative prior experience.”

“One In Eight US Households Saw Drop In Income Last Month” (Bloomberg). “The share of US adults with decreasing incomes has ticked higher in recent weeks, another sign that the labor market is slowly cooling. The increase — to 11.8% last month from 10.7% in August — was driven primarily by high- and middle-income households and the West region, according to a survey of the US labor market from data intelligence company Morning Consult. Among adults with an annual income of $100,000 or more, close to 20% say they expect their incomes to fall in the next four weeks.”

“Play it again, Sam” (Michael Lewis in the Washington Post). “‘Hey, this is Sam!’ said Sam, to his laptop, as his Zoom box opened. Onto his screen popped Anna Wintour, editor in chief of Vogue magazine. She wore a tight yellow dress and careful makeup and a bob cut so sharply that its fringes plunged and curved down around her face like the blades of two scythes. ‘I’m so happy to finally meet you!’ she said. ‘Hey, it’s great to meet you too!’ Sam replied. Sam didn’t really know who Anna Wintour was.”

What we’re reading (10/3)

“Wall Street Thinks America’s Homes Are Overvalued” (Wall Street Journal). “U.S. single-family properties are the only type of real estate that has increased in value since interest rates began to rise in March 2022. After a brief dip in the months after the Federal Reserve’s initial hikes, house prices resumed their climb. Residential property values reached a record in July, based on the latest numbers from the S&P CoreLogic Case-Shiller Home Price Index. Commercial real estate hasn’t fared as well, falling 16% in value since March last year, according to property research firm Green Street. Offices and malls face different pressures, but even U.S. apartment values are off more than 20% since last year’s peak.”

“How Treasury Market Upheaval Is Rippling Through Global Markets, In 4 Charts” (MarketWatch). “Signs of stress in the Treasury market abound. As prices across the bond-market have slumped, some long-dated Treasury securities have been trading below 50 cents on the dollar. Moreover, a popular exchange-traded fund tracking U.S. government debt that matures in 20 years or longer cemented its lowest close on Monday since 2007.”

“Dow Loses More Than 400 Points And Goes Negative For 2023 As Interest Rates Spike” (MarketWatch). “The 10-year Treasury yield touched 4.8%, reaching its highest level in 16 years. The benchmark yield has surged in the past month as the Federal Reserve pledged to keep interest rates at a higher level for longer. The 30-year Treasury yield hit 4.925%, also the highest since 2007. The average rate on a 30-year fixed mortgage neared 8%.”

“Amazon Used Secret ‘Project Nessie’ Algorithm To Raise Prices” (Wall Street Journal). “The algorithm helped Amazon improve its profit on items across shopping categories, and because of the power the company has in e-commerce, led competitors to raise their prices and charge customers more, according to people familiar with the allegations in the complaint. In instances where competitors didn’t raise their prices to Amazon’s level, the algorithm—which is no longer in use—automatically returned the item to its normal price point.”

“‘Dumb Money’ Exposes The Baffling Allure Of Bad Investment Advice” (New York Times). “Much as we enjoyed the movie, we are economists, not movie critics. And as practitioners of the dismal science, we worry that some viewers will continue to be inspired to copy the heroes’ investment strategies, which is about as smart as driving home at 100 miles per hour after seeing ‘The Fast and the Furious.’”

What we’re reading (10/2)

“Americans Are Still Spending Like There’s No Tomorrow” (Wall Street Journal). “Interest rates are up. Inflation remains high. Pandemic savings have shrunk. And the labor market is cooling. Yet household spending, the primary driver of the nation’s economic growth, remains robust. Americans spent 5.8% more in August than a year earlier, well outstripping less than 4% inflation. And the experience economy boomed this summer, with Delta Air Lines reporting record revenue in the second quarter and Ticketmaster selling over 295 million event tickets in the first six months of 2023, up nearly 18% year-over-year. Economists and financial advisers say consumers putting short-term needs and goals above long-term ones is normal. Still, this moment is different, they say.”

“JPMorgan Boss Jamie Dimon Says AI Will Enable A 3.5-Day Workweek As He Reveals The Technology Is ‘Already Doing All The Equity Hedging’ For His Bank” (The Daily Mail). “Jamie Dimon said artificial intelligence is already being used in most parts of JPMorgan and that it will eventually likely shorten the work week to 3.5 days. In a Monday interview with Bloomberg TV, the Wall Street titan spoke about the development of AI is impacting his bank and what sorts of effects it will likely have on the working world in the future.”

“Why Stocks Are Likely To Be Especially Volatile This October” (MarketWatch). “You might think October’s historical volatility can be traced to the U.S. market crashes that occurred in 1929 and 1987, each of which occurred during that month. But you’d be wrong: October remains at the top of the volatility rankings even if those two years are removed from the sample. Nor is there any trend over time in October’s place in those rankings: If we divide the period since the Dow Jones Industrial Average DJIA was created in 1896 into two periods, October is the most volatile in both the first and second halves.”

“Microsoft C.E.O. Testifies That Google’s Power In Search Is Ubiquitous” (New York Times). “Satya Nadella, Microsoft’s chief executive, testified on Monday that Google’s power in online search was so ubiquitous that even his company found it difficult to compete on the internet, becoming the government’s highest-profile witness in its landmark antitrust trial against the search giant. In more than three hours of testimony in federal court in Washington, Mr. Nadella was often direct and sometimes combative as he laid out how Microsoft could not overcome Google’s use of multibillion-dollar deals to be the default search engine on smartphones and web browsers.”

“How 10-year Treasurys Could Produce 20% Returns, According To UBS” (MarketWatch). “Owners of 10-year Treasury notes at recent yields of around 4.5% could reap up to 20% in total returns in a year if the U.S. economy stumbles into a recession, according to UBS Global Wealth Management. The key would be for U.S. debt to rally significantly as investors scramble for safety in the roughly $25 trillion treasury market.”

October picks available now

The new Prime and Select picks for October are available starting now, based on a model run put through yesterday (September 30). As a note, I will be measuring the performance on these picks from the first trading day of the month, Monday, October 2, 2023 (at the mid-spread open price) through the last trading day of the month, Tuesday, October 31, 2023 (at the mid-spread closing price).

What we’re reading (9/9)

“Xi Jinping Is Done With The Established World Order” (The Atlantic). “The world’s most powerful leaders gathered in New Delhi for the year’s premier diplomatic event—the G20 summit—but China’s Xi Jinping deemed it not worth his time. His absence sends a stark signal: China is done with the established world order. Ditching the summit marks a dramatic turn in China’s foreign policy. For the past several years, Xi has apparently sought to make China an alternative to the West. Now Xi is positioning his country as a full-on opponent—ready to align its own bloc against the United States, its partners, and the international institutions they support.”

“U.S., India, Saudi, EU Unveil A Massive Rail And Ports Deal On G20 Sidelines” (CNBC). “Global leaders announced a multinational rail and ports deal linking the Middle East and South Asia on Saturday on the sidelines of the G20 summit in New Delhi. The pact comes at a critical time as U.S. President Joe Biden seeks to counter China’s Belt and Road push on global infrastructure by pitching Washington as an alternative partner and investor for developing countries at the G20 grouping.”

“'The World Is Rapidly Evolving’: How Gen Z Is Rethinking The Idea Of College” (Insider). “Four million fewer teenagers enrolled at a college in 2022 than in 2012. For many, the price tag has simply grown too exorbitant to justify the cost. From 2010 to 2022, college tuition rose an average of 12% a year, while overall inflation only increased an average of 2.6% each year. Today it costs at least $104,108 on average to attend four years of public university — and $223,360 for a private university.”

“The Job Market Boom Is Over. Here’s Why And What It Means” (Wall Street Journal). “Overall job openings, a reflection of labor demand, peaked at 12 million in March 2022, about double the number of unemployed people looking for work the same month. That gap has since narrowed. Openings in July were much lower at 8.8 million compared with 5.8 million unemployed—showing easing but still elevated demand for labor.”

“How Safe Is Gold?” (Insider). “In short, the decision to invest in gold comes down to 1) the probability that an investor assigns to the prospect of international catastrophe and 2) the investor’s comfort level in ignoring that possibility. As an optimist, I find that an easy call: Forge ahead without it! However, I appreciate that others have different views. For them, a dollop of bullion may provide comfort worth its weight in...well, gold.”