What we’re reading (10/13)

“S&P 500 Closes Lower On Friday, But Notches Second Straight Positive Week” (CNBC). “Stocks came off their session highs after consumer sentiment data was released earlier Friday. According to the University of Michigan’s closely watched survey, preliminary consumer sentiment data slumped in October while inflation expectations spiked.”

“Hedge Funds Must Tell SEC Which Companies They Sell Short Under New Rules” (Wall Street Journal). “Traders will get a broader look at which public companies are being targeted by short sellers under rules the Securities and Exchange Commission adopted Friday as part of its response to the 2021. The final rules come more than two years after that drama, when thousands of investors coordinated on Reddit to buy shares of GameStop and others—and punish hedge funds that had bet against the stocks. The turmoil captured headlines and left some traders with huge gains while others lost eye-popping sums.”

“How A Billionaire-Backed Network Of AI Advisers Took Over Washington” (Politico). “In the high-stakes Washington debate over AI rules, Open Philanthropy has long been focused on one slice of the problem — the long-term threats that future AI systems might pose to human survival. Many AI thinkers see those as science-fiction concerns far removed from the current AI harms that Washington should address. And they worry that Open Philanthropy, in concert with its web of affiliated organizations and experts, is shifting the policy conversation away from more pressing issues — including topics some leading AI firms might prefer to keep off the policy agenda.”

“From LSD To I.P.O.” (New York Times). “‘Their popularity nowadays is pretty wild,” Ms. Steele added. “It’s not often that you see a total turnaround in public brand perception in the way we have with Birkenstock.’ Today, five core styles make up 76 percent of the business, the company said, with prices that start at 40 euros (about $42). For limited-edition luxury styles, that figure can be 40 times as much — up to $1,700. The company said that 30 million pairs of Birkenstock sandals were sold in 2022, with sales of 1.24 billion euros ($1.3 billion at current exchange rates), up from 292 million euros ($307 million) in 2014.”

“No, Low Interest Rates Did Not Justify Adding Trillions Of Dollars To The National Debt” (Reason). “In the end, the Forever Low believers were correct in their own transitory way. After all, interest rates did remain low for an extended period, catching many by surprise. Their main mistake, though, was tragic: concluding that there was no cost to trillions of dollars in additional debt.”

August/September Performance Update

Here with a performance update for the last two months, but I don’t have much of substance to report as the Prime and Select strategies’ performance, in combination, were not materially different from the market’s.

In August, Prime underperformed by about 100 bps; on the other hand, Select outperformed by over 160 bps. In September, Prime was almost exactly in line with the market, while Select gave back some of the prior month’s relative gains. In repeated samples (more than the two reported here) performance matching the market’s would support an inference that the factors Prime and Select index on don’t matter much. A subtly different inference would be that those factors don’t seem to matter much right now, perhaps because other systematic risk factors (rates, the resolution of macro growth uncertainty) are dominating the performance of all equities. Believers in the Halloween Effect would note that we are now entering the six months of the year where stocks tend to perform relatively better. Based on the market’s performance year-to-date, 2023 would seem to be another data point supporting that theory. Stay tuned!

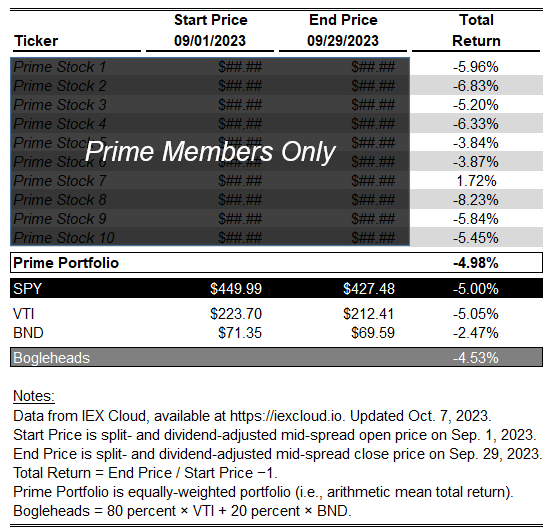

Prime: September Performance

Prime: August Performance

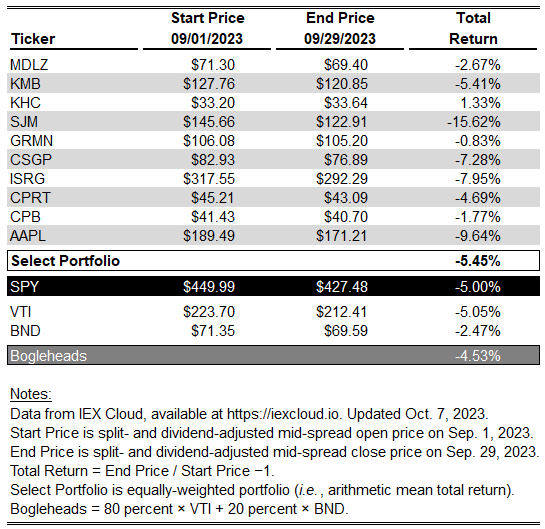

Select: September Performance

Select: August Performance

What we’re reading (10/7)

“The Oil Patch Is Primed For An Era Of Megadeals” (Wall Street Journal). “A wave of deals could reshape the U.S. oil-and-gas industry, ushering it from an era defined by relatively small drillers chasing growth to one dominated by the largest Western oil companies. The emerging order could resemble what came out of the industry’s megamergers that began in the late 1990s and included linkups between Exxon and Mobil, Chevron and Texaco, and BP and Amoco, among others.”

“The Great Zelle Pool Scam” (Insider). “Elizabeth Warren, the financial industry regulator banks most love to hate, has been petitioning Zelle to find out exactly how much fraud there is. And the data she's collected suggests there's probably, technically speaking, a whole fucking lot. According to Warren's office, US Bank — a single institution in the consortium — reported 45,000 incidents of Zelle scams last year. That's triple the number from 2021. It's certainly possible, if the criminals keep at it, work hard, and show some grit, they can triple the amount of fraud again by next year.”

“The Lifesaving, Nobel Prize-Winning Discovery That Almost Didn’t Happen” (Vox). “In hindsight, little medical research was of more importance than Karikó’s work at Weissman’s lab on making mRNA vaccines a reality. But at every stage, the research community that should have embraced this research instead stymied it, because of powerful incentives in science toward work that is more fundable and more publishable.”

“Active Success: Still Elusive” (Standard & Poor’s). “Anyone even vaguely conversant with our SPIVA® Scorecards will realize that most active managers underperform passive benchmarks most of the time. This result is robust across geographies and across time, and is reflected in our recently issued mid-year 2023 report for the U.S. market. Although the scorecard covers 39 categories of equity and fixed income managers, the largest and most closely watched comparison is that between large-cap U.S. equity managers and the S&P 500®. Exhibit 1 shows that 60% of large-cap managers underperformed the S&P 500 in the first six months of 2023; not since 2009 has a majority of large-cap managers outperformed.”

“In Provence, Winemakers Confront Climate Change” (New York Times). “The tastes of centuries-old varieties are being altered by spiking temperatures, scant rainfall, snap frosts and unpredictable bouts of extreme weather. The hellish summer was the latest reminder of how urgently the $333 billion global wine industry is being forced to adapt. Temperature records were set in Europe, the United States, China, North Africa and the Middle East as hail, drought, wildfires and floods on a biblical scale inflicted damage.”

What we’re reading (10/6)

“Surprisingly Strong Hiring Sends Bond Yields Higher” (Wall Street Journal). “Employers added 336,000 jobs in September, the strongest gain since January and up sharply from the prior month’s upwardly revised 227,000 gain, the Labor Department said Friday. Job growth was also stronger in July than previously estimated.”

“Investing Has Been Ugly. Stick With It Anyway.” (New York Times). “This is one of those stretches when you may want to avoid looking at your investments. Performance reports for the three months that ended in September are arriving now, and they are ugly. The vast majority of mutual funds and exchange-traded funds — the vehicles used by most Americans for their investments — fell. There were losses in most markets and in nearly all asset classes.”

“The Long Game: Why Patience And Perspective Matter In Investing” (Validea). “It’s tempting to toss in the towel and lock in the 5% that short-term treasuries are paying, and that could be a good or bad decision, but for long-term money earmarked toward growth I’d argue that type of decision has the ability to detract from returns more than enhance them. When we are in periods like this, it’s important for investors to take a longer-term view and not let recency bias and short-termism impact their decisions.”

“The Cure For High Prices That Weren't Actually Inflation” (RealClear Markets). “We are being caught in a tug-of-war pitting the world’s oil exporters and suppliers on the one side attempting to keep crude up under the ironic euphemism of “price stability” against global recession on the other. Last year’s surge already pushed much of the world into one and this year’s was merely an invitation to finish the job for everyone else.”

“Amazon Launches First Internet Satellite Prototypes” (CNBC). “More than four years since the tech giant announced its ambitious plan to invest heavily in building a global satellite internet network, Amazon on Friday saw the first pair of satellites for its Project Kuiper system launch into space.”

What we’re reading (10/5)

“GM Has At Least 20 Million Vehicles With Potentially Dangerous Air-Bag Parts” (Wall Street Journal). “The number of affected GM vehicles—a figure that hasn’t been disclosed publicly—makes the Detroit-based automaker among the most exposed in a push by U.S. auto-safety regulators to recall 52 million air-bag inflators designed by Tennessee-based auto supplier ARC Automotive, according to people familiar with the matter.”

“Fed’s Bid To Avoid Recession Tested By Yields Nearing 20-Year Highs” (Bloomberg). “The surge — 10-year Treasury yields rose more than half a percentage point the past month to surpass 4.7% — heightens the danger in the near-term of a financial blowup akin to the regional bank breakdown in March. Longer run, it threatens to undercut the economy by markedly raising borrowing costs for consumers and companies.”

“The Collapse In Treasury Bonds Now Ranks Among The Worst Market Crashes In History” (Insider). “Compared with previous bond-market meltdowns, long-term Treasurys are seeing one of the most extreme undoings in history. The losses are over twice as big as those seen in 1981 when 10-year yields neared 16%.”

“Copper’s Price Curve Hasn't Looked Like This In Decades” (OilPrice.com). “The copper market is in a state of extreme contango—a state of the futures curve where futures contracts trade at a premium to the spot price and signal weak prompt demand.”

“Negotiations Between The UAW And GM Are Showing Signs Of Progress” (CNN Business). “Three weeks into the United Auto Workers strike, signs of progress have emerged in talks between the union and General Motors. GM said it provided a counteroffer to the UAW’s most recent proposal, which it said is the sixth by the company since the start of negotiations.”

What we’re reading (10/4)

“Why Wall Street Investors Are Freaking Out” (CNN Business). “Several historic stock market crashes have haunted the autumnal month. Black Tuesday, the 1929 market plunge that led to the Great Depression, 1987’s Black Monday and the beginnings of the 2008 financial crisis all took place in October. October also marks the end of the fiscal year for many mutual funds in the United States. This sometimes leads to so-called “window dressing,” where fund managers sell poorly performing stocks and purchase better-performing alternatives to improve the appearance of their portfolios. These events have led investors to fear the cursed ‘October Effect,’ a perceived tendency for the stock market to decline through the month. Statistical evidence doesn’t quite support the phenomenon, but the level of superstitious caution on Wall Street is real.”

“Dow Adds 100 Points To Snap 3-Day Losing Streak As Treasury Yields Ease From 16-Year Highs” (CNBC). “The Dow Jones Industrial Average broke a three-day losing streak Wednesday as Treasury yields pulled back from multiyear highs following the release of much weaker-than-expected jobs data. The 30-stock index gained 127.17 points, or 0.39%, to close at 33,129.55. The S&P 500 added 0.81% and closed at 4,263.75. Meanwhile, the Nasdaq Composite gained 1.35% at 13,236.01. Within the S&P 500, consumer discretionary was the best-performing sector, rising about 2%. Tesla and Norwegian Cruise Line led the sector gains, adding 5.9% and 3.8%, respectively.”

“Is A College Degree No Longer A Good Investment? Walmart Plans To AX Degree Requirements From Hundreds Of Its Corporate Job Descriptions” (Daily Mail). “The retail giant said last week that it would get rid of 'unnecessary barriers' that prevent career advancement, and that job applicants would start seeing updated job descriptions next year. Walmart said it will waive the need for a university degree if candidates can show they have gained the necessary skills through alternative prior experience.”

“One In Eight US Households Saw Drop In Income Last Month” (Bloomberg). “The share of US adults with decreasing incomes has ticked higher in recent weeks, another sign that the labor market is slowly cooling. The increase — to 11.8% last month from 10.7% in August — was driven primarily by high- and middle-income households and the West region, according to a survey of the US labor market from data intelligence company Morning Consult. Among adults with an annual income of $100,000 or more, close to 20% say they expect their incomes to fall in the next four weeks.”

“Play it again, Sam” (Michael Lewis in the Washington Post). “‘Hey, this is Sam!’ said Sam, to his laptop, as his Zoom box opened. Onto his screen popped Anna Wintour, editor in chief of Vogue magazine. She wore a tight yellow dress and careful makeup and a bob cut so sharply that its fringes plunged and curved down around her face like the blades of two scythes. ‘I’m so happy to finally meet you!’ she said. ‘Hey, it’s great to meet you too!’ Sam replied. Sam didn’t really know who Anna Wintour was.”

What we’re reading (10/3)

“Wall Street Thinks America’s Homes Are Overvalued” (Wall Street Journal). “U.S. single-family properties are the only type of real estate that has increased in value since interest rates began to rise in March 2022. After a brief dip in the months after the Federal Reserve’s initial hikes, house prices resumed their climb. Residential property values reached a record in July, based on the latest numbers from the S&P CoreLogic Case-Shiller Home Price Index. Commercial real estate hasn’t fared as well, falling 16% in value since March last year, according to property research firm Green Street. Offices and malls face different pressures, but even U.S. apartment values are off more than 20% since last year’s peak.”

“How Treasury Market Upheaval Is Rippling Through Global Markets, In 4 Charts” (MarketWatch). “Signs of stress in the Treasury market abound. As prices across the bond-market have slumped, some long-dated Treasury securities have been trading below 50 cents on the dollar. Moreover, a popular exchange-traded fund tracking U.S. government debt that matures in 20 years or longer cemented its lowest close on Monday since 2007.”

“Dow Loses More Than 400 Points And Goes Negative For 2023 As Interest Rates Spike” (MarketWatch). “The 10-year Treasury yield touched 4.8%, reaching its highest level in 16 years. The benchmark yield has surged in the past month as the Federal Reserve pledged to keep interest rates at a higher level for longer. The 30-year Treasury yield hit 4.925%, also the highest since 2007. The average rate on a 30-year fixed mortgage neared 8%.”

“Amazon Used Secret ‘Project Nessie’ Algorithm To Raise Prices” (Wall Street Journal). “The algorithm helped Amazon improve its profit on items across shopping categories, and because of the power the company has in e-commerce, led competitors to raise their prices and charge customers more, according to people familiar with the allegations in the complaint. In instances where competitors didn’t raise their prices to Amazon’s level, the algorithm—which is no longer in use—automatically returned the item to its normal price point.”

“‘Dumb Money’ Exposes The Baffling Allure Of Bad Investment Advice” (New York Times). “Much as we enjoyed the movie, we are economists, not movie critics. And as practitioners of the dismal science, we worry that some viewers will continue to be inspired to copy the heroes’ investment strategies, which is about as smart as driving home at 100 miles per hour after seeing ‘The Fast and the Furious.’”

What we’re reading (10/2)

“Americans Are Still Spending Like There’s No Tomorrow” (Wall Street Journal). “Interest rates are up. Inflation remains high. Pandemic savings have shrunk. And the labor market is cooling. Yet household spending, the primary driver of the nation’s economic growth, remains robust. Americans spent 5.8% more in August than a year earlier, well outstripping less than 4% inflation. And the experience economy boomed this summer, with Delta Air Lines reporting record revenue in the second quarter and Ticketmaster selling over 295 million event tickets in the first six months of 2023, up nearly 18% year-over-year. Economists and financial advisers say consumers putting short-term needs and goals above long-term ones is normal. Still, this moment is different, they say.”

“JPMorgan Boss Jamie Dimon Says AI Will Enable A 3.5-Day Workweek As He Reveals The Technology Is ‘Already Doing All The Equity Hedging’ For His Bank” (The Daily Mail). “Jamie Dimon said artificial intelligence is already being used in most parts of JPMorgan and that it will eventually likely shorten the work week to 3.5 days. In a Monday interview with Bloomberg TV, the Wall Street titan spoke about the development of AI is impacting his bank and what sorts of effects it will likely have on the working world in the future.”

“Why Stocks Are Likely To Be Especially Volatile This October” (MarketWatch). “You might think October’s historical volatility can be traced to the U.S. market crashes that occurred in 1929 and 1987, each of which occurred during that month. But you’d be wrong: October remains at the top of the volatility rankings even if those two years are removed from the sample. Nor is there any trend over time in October’s place in those rankings: If we divide the period since the Dow Jones Industrial Average DJIA was created in 1896 into two periods, October is the most volatile in both the first and second halves.”

“Microsoft C.E.O. Testifies That Google’s Power In Search Is Ubiquitous” (New York Times). “Satya Nadella, Microsoft’s chief executive, testified on Monday that Google’s power in online search was so ubiquitous that even his company found it difficult to compete on the internet, becoming the government’s highest-profile witness in its landmark antitrust trial against the search giant. In more than three hours of testimony in federal court in Washington, Mr. Nadella was often direct and sometimes combative as he laid out how Microsoft could not overcome Google’s use of multibillion-dollar deals to be the default search engine on smartphones and web browsers.”

“How 10-year Treasurys Could Produce 20% Returns, According To UBS” (MarketWatch). “Owners of 10-year Treasury notes at recent yields of around 4.5% could reap up to 20% in total returns in a year if the U.S. economy stumbles into a recession, according to UBS Global Wealth Management. The key would be for U.S. debt to rally significantly as investors scramble for safety in the roughly $25 trillion treasury market.”

October picks available now

The new Prime and Select picks for October are available starting now, based on a model run put through yesterday (September 30). As a note, I will be measuring the performance on these picks from the first trading day of the month, Monday, October 2, 2023 (at the mid-spread open price) through the last trading day of the month, Tuesday, October 31, 2023 (at the mid-spread closing price).

What we’re reading (9/9)

“Xi Jinping Is Done With The Established World Order” (The Atlantic). “The world’s most powerful leaders gathered in New Delhi for the year’s premier diplomatic event—the G20 summit—but China’s Xi Jinping deemed it not worth his time. His absence sends a stark signal: China is done with the established world order. Ditching the summit marks a dramatic turn in China’s foreign policy. For the past several years, Xi has apparently sought to make China an alternative to the West. Now Xi is positioning his country as a full-on opponent—ready to align its own bloc against the United States, its partners, and the international institutions they support.”

“U.S., India, Saudi, EU Unveil A Massive Rail And Ports Deal On G20 Sidelines” (CNBC). “Global leaders announced a multinational rail and ports deal linking the Middle East and South Asia on Saturday on the sidelines of the G20 summit in New Delhi. The pact comes at a critical time as U.S. President Joe Biden seeks to counter China’s Belt and Road push on global infrastructure by pitching Washington as an alternative partner and investor for developing countries at the G20 grouping.”

“'The World Is Rapidly Evolving’: How Gen Z Is Rethinking The Idea Of College” (Insider). “Four million fewer teenagers enrolled at a college in 2022 than in 2012. For many, the price tag has simply grown too exorbitant to justify the cost. From 2010 to 2022, college tuition rose an average of 12% a year, while overall inflation only increased an average of 2.6% each year. Today it costs at least $104,108 on average to attend four years of public university — and $223,360 for a private university.”

“The Job Market Boom Is Over. Here’s Why And What It Means” (Wall Street Journal). “Overall job openings, a reflection of labor demand, peaked at 12 million in March 2022, about double the number of unemployed people looking for work the same month. That gap has since narrowed. Openings in July were much lower at 8.8 million compared with 5.8 million unemployed—showing easing but still elevated demand for labor.”

“How Safe Is Gold?” (Insider). “In short, the decision to invest in gold comes down to 1) the probability that an investor assigns to the prospect of international catastrophe and 2) the investor’s comfort level in ignoring that possibility. As an optimist, I find that an easy call: Forge ahead without it! However, I appreciate that others have different views. For them, a dollop of bullion may provide comfort worth its weight in...well, gold.”

What we’re reading (9/8)

“The Problem With Economic Data Is Getting Worse” (Wall Street Journal). “Revisions to economic data are widespread and normal. But occasionally the revisions are so big that they upend our shared understanding of what’s going on. The latest example comes from the U.K., where it turns out the economy grew much more than previously estimated. Rather than being the sick man of Europe with GDP still smaller than before the pandemic, and the weakest recovery in the Group of Seven industrialized nations, it has beaten Germany and grown in line with France (at least until their figures are revised).”

“Apple Could Be About To Make The Biggest Change To The iPhone In 11 years” (CNN Business). “Apple is set to unveil the iPhone 15 in just a few days, and it’s widely expected to come with a significant change. The iPhone 15 is heavily rumored to ditch Apple’s proprietary Lightning charger in favor of USB-C charging, marking a milestone for the company by adopting universal charging. The change could ultimately streamline the charging process across various devices — and brands.”

“‘I’m OK, But Things Are Terrible’” (Paul Krugman, New York Times). “[H]ere’s the funny thing: There’s substantial evidence that people don’t feel that they personally are doing badly. Both surveys and consumer behavior suggest, on the contrary, that while most Americans feel that they’re doing OK, they believe that the economy is doing badly, where “the economy” presumably means other people.”

“Why A Global Recession Is Unlikely” (Project Syndicate). “[T]hough the US Federal Reserve and the European Central Bank have been pursuing monetary tightening, demand has not collapsed, and supply is not piling up. Instead, recent recession forecasts were derived largely from statistical analyses of past data – analyses that did not adequately account for the impact and legacy of the COVID-19 pandemic.”

“Mattel’s Windfall From ‘Barbie’” (New York Times). “‘Barbie’ is close to grossing $1.4 billion and passed one of the “Harry Potter” movies as the top-grossing Warner Bros. film of all time. It could end up near the $2 billion mark. (The record-holder is 2009’s “Avatar,” at $2.9 billion.)”

What we’re reading (9/7)

“Health-Insurance Costs Are Taking Biggest Jumps In Years” (Wall Street Journal). “Costs for employer coverage are expected to surge around 6.5% for 2024, according to major benefits consulting firms Mercer and Willis Towers Watson , which provided their survey results exclusively to The Wall Street Journal.”

“Huawei Phone Is Latest Shot Fired In The U.S.-China Tech War” (New York Times). “In the midst of the U.S. commerce secretary’s good will tour to China last week, Huawei, the telecom giant that faces stiff U.S. trade restrictions, unveiled a smartphone that illustrated just how hard it has been for the United States to clamp down on China’s tech prowess. The new phone is powered by a chip that appears to be the most advanced version of China’s homegrown technology to date — a kind of achievement that the United States has been trying to prevent China from reaching.”

“Labor’s Message To Corporate America: Time To Pay Up” (The Hill). “The return to 1928 inequality levels did not happen by accident, and its correlation with the unionization rate is no coincidence. There has been a war on workers and their unions since the 1970s. Along the way, greed spun out of control and our country’s riches, which might have gone to workers, increasingly went to corporate America and Wall Street.”

“In-N-Out, Weirdly, Is A Climate Change Indicator” (Slate). “Aesthetically, In-N-Out Burger is all-in. Iris Apfel has her bug glasses; In-N-Out has its palms. ‘It’s kind of their thing,’ Vonderheide agreed when I spoke with him. Tiny red palms dot the restaurants’ wallpaper. Palms adorn wrappers, awnings, paper hats—and, usually, parking lots. Scan California’s freeways and you’ll see them everywhere: a pair of palms swaying in the breeze, standing sentry over your beloved animal-style fries.”

“Small Cap Value: Waiting For The Jumpstart” (Validea). “Things are even more compelling in the small-cap value universe. Using Validea’s Market Valuation tool, I’ve looked at the absolute valuation of small and mid-cap value stocks through various valuation ratios. As you can see, small/mid-cap value has rarely been so cheap (our data goes back to 2006). The other periods of this level of cheapness came mostly during the Great Financial Crisis (2008/2009) and during the COVID crash (2020).”

What we’re reading (9/6)

“Real-Estate Doom Loop Threatens America’s Banks” (Wall Street Journal). “With the commercial real-estate market now in meltdown…trillions of dollars in loans and investments are a looming threat for the banking industry—and potentially the broader economy. Banks’ exposure is even bigger than commonly reported. The banks are in danger of setting off a doom-loop scenario where losses on the loans trigger banks to cut lending, which leads to further drops in property prices and yet more losses.”

“The Mistake-Prone Federal Reserve Could Be Sending Us Into Recession” (New York Post). “Milton Friedman famously taught that inflation is always and everywhere a monetary phenomenon. Had the Fed heeded this teaching, it wouldn’t have paved the way for multi-decade-high inflation in 2022 by allowing the broad money supply to balloon by a staggering 40% between the beginning of 2020 and the end of 2021. Despite that experience, the Fed is now letting the money supply contract at a pace unprecedented in the post-war period. That could be setting us up for the opposite problem of great economic weakness and another period of flirting with inflation. At this year’s start, a number of regional banks, including most notably Silicon Valley Bank, failed as a result of large interest-rate-induced losses on their bond portfolios.”

“Markets Brief: Will The Fed Really Cut Rates 5 Times Next Year?” (Morningstar). “As of Sept. 1, futures prices indicate that traders anticipate about 1.2 percentage points of rate cuts next year, according to Bank of America rates strategist Meghan Swiber. If the Fed lowers rates a quarter-point at a time, that would mean roughly five cuts over the course of the year. In contrast, strategists at Bank of America are anticipating just 0.75 percentage points of cuts in 2024. Swiber attributes the difference to the risk baked into futures markets.”

“Even Charter Thinks That Cable TV Sucks Now” (Insider). “Just how broken is cable TV? So broken that Charter, the second-biggest cable company in the US with nearly 15 million subscribers, says it's willing to walk away from the business entirely. Charter is currently locked in an ugly dispute with Disney over what are called carriage fees, or how much it pays to give its subscribers access to channels like ESPN. That's led to a blackout of Disney-owned channels that's taken the US Open, among other programming, off the air.”

“Five Steps To Navigating Fiduciary Duties In The ESG Era” (Dealbreaker). “The landscape of fiduciary duties is evolving rapidly, and ESG (Environmental, Social, and Governance) considerations are at the forefront of this transformation. Corporate boards find themselves under the scrutiny of various stakeholders, including investors, politicians, regulators, clients, and activists, each with strong opinions on how ESG should be integrated into corporate decision-making. Strong corporate governance is essential in this context. Fiduciary duties are the bedrock upon which responsible corporate governance is built.”

What we’re reading (9/5)

“Goldman Cuts US Recession Chances To 15% On Improved Inflation” (Bloomberg). “Goldman Sachs Group Inc. now sees a 15% chance the US will slide into recession, down from 20% previously as cooling inflation and a still-resilient labor market suggest the Federal Reserve may not need to raise interest rates any further.”

“The Fed’s Inflation Fight Will Push The 10-Year Treasury Yield To 5%” (MarketWatch). “All Federal Reserve Chairman Jerome Powell has to do now to finish the job is to artfully maneuver U.S. monetary policy so inflation slides to 2% without derailing economic growth. Easier said than done. After a long decline, real wages are rising and indicators of consumer sentiment have improved. The Chips and Science Act and the Inflation Reduction Act, along with enthusiasm for artificial intelligence, have triggered booms in factory construction for semiconductors, electric vehicles, green industries, cloud infrastructure and software development. To finance federal incentives and more health-care spending, the federal deficit for the fiscal year ending in September will likely hit $1.85 trillion. That’s 6.9% of GDP and well-above the average for advanced industrialized economies.”

“Elon Musk Blames The ADL For 60% Ad Sales Decline At X, Threatens To Sue” (CNN Business). “X owner Elon Musk is threatening to sue the Anti-Defamation League for defamation, claiming that the nonprofit organization’s statements about rising hate speech on the social media platform have torpedoed X’s advertising revenue. In a post on X, formerly known as Twitter, Musk said US advertising revenue is ‘still down 60%, primarily due to pressure on advertisers by @ADL (that’s what advertisers tell us), so they almost succeeded in killing X/Twitter!’”

“FTC Antitrust Suit Against Amazon Set For Later This Month After Meeting Fails To Resolve Impasse” (Wall Street Journal). “Top members of Amazon’s legal team had a video call with FTC officials on Aug. 15. The so-called last-rites meeting, which is often a final step before a court battle, was a chance for the technology giant to make its case to the regulator to head off a possible lawsuit that officials have been working on for many months. During such meetings, companies have the opportunity to offer to pre-emptively change their business practices in order to avoid a lawsuit. But, Amazon’s lawyers didn’t offer specific concessions, the people said.”

“TikTok Has Transformed The Concert Experience” (Vox). “The age of streaming media has brought with it increased access to concert footage, front-row fancams, and highly mobilized fanbases who approach everything about the concert season like it’s their job. From buying tickets (good luck) to prepping for the big night by carefully planning the perfect concert outfit, these fans do it all — and many of them do it on camera, sharing the whole experience with other die-hards online.”

What we’re reading (9/4)

“Investors Head Into Fall With Jitters After Summer Rally” (Wall Street Journal). “The S&P 500 is up 18% so far this year, even after falling in August for its first monthly decline since February. The benchmark index rallied in the final week of the month, finishing near its monthly highs for the sixth consecutive month. Now investors are questioning whether stocks can continue defying expectations and hang onto this year’s gains.”

“Empty Office Buildings Are Blank Slates To Improve Cities” (The Week). “It's been three years since the Covid-19 pandemic prompted many to begin working from home, but the trend has continued to show its staying power even as other aspects of society have returned to pre-pandemic conditions. Because of this, many office buildings in cities have remained empty, leaving city planners and officials scrambling to figure out what to do about the empty spaces.”

“Column: Businesses Keep Complaining About Shoplifting, But Wage Theft Is A Bigger Crime” (Los Angeles). “Former Home Depot Chief Executive Bob Nardelli went on Fox Business the other day to warn that a surge in shoplifting by organized gangs showed that America was descending into ‘a lawless society.’ ‘We’ve got to get this back under control,’ Nardelli intoned gloomily, after videos of smash-and-grab teams in retail stores had spooled behind him. ‘I fear where this is headed.’ There isn’t much to say about Nardelli’s sepulchral comments, other than that he has a hell of a nerve. Back in June, Nardelli’s former company settled a class-action lawsuit with workers alleging widespread wage theft for $72.5 million.”

“Silicon Valley’s Elites Can’t Be Trusted With The Future Of AI. We Must Break Their Dominance–And Dangerous God Complex” (Fortune). “We can take Silicon Valley’s open-source technology and build something that benefits the masses. Altman surely believes that his company is doing good for the world and is uniquely positioned to deliver advanced AI, but even one of OpenAI’s top funders, Elon Musk, has distanced himself from this project due to concerns over its profit-seeking motives.”

“The Discredited Phillips Curve Cannot Be Discredited Enough” (Forbes). “Despite the obvious correlation between growth and falling prices, economists still stick to the belief that rising unemployment and business failure are essential ingredients to what they imagine is a ‘low-inflation’ environment. And it’s not ideological. While one guesses much of the Fed is populated with Democrats, the American Enterprise Institute is a prominent think tank largely populated by Republicans. Yet AEI’s lead economist in Michael Strain recently observed to the New York Times that the ‘more that good news becomes good news, the higher the likelihood of a recession.’ Imagine a growth-focused Republican associating job loss and bankruptcy with ‘good news’ as is, but where it gets worse is in it vivifying Strain’s embrace of the discredited Phillips Curve.”

What we’re reading (9/3)

“The Disappointing Bet That Could Turn Into The Biggest IPO Of The Year” (Wall Street Journal). “An AI boom is considered likely to boost demand for chips that go in servers, rather than in smartphones and home computers, where Arm is biggest. Still, Arm pitches itself as a likely beneficiary, saying growth in AI-enabled systems, such as self-driving cars, could mean more demand for chips using Arm designs. ‘Arm will be central to this transition,’ the IPO prospectus says.”

“Avoid Trendy Economics” (Econlib). “With the rise of social media (especially Twitter), it has becomes easier to observe changes in the zeitgeist. Over the past few years, I’ve seen the following trends: 1. Claims that increases in the minimum wage do not have negative side effects. 2. Claims that we don’t have to worry about big budget deficits when the interest rate is low. 3. Claims that changes in the money supply don’t impact inflation. 4. Claims that neoliberalism no longer works, and that we need an industrial policy. In each case, trendy pundits rejected long established economic principles. And now the chickens are coming home to roost.”

“The Myths We Tell Ourselves About American Farming” (Vox). “‘These factory farms operate like sewerless cities,’ said Tarah Heinzen, legal director of environmental nonprofit Food and Water Watch. Animal waste is ‘running off into waterways, it’s leaching into people’s drinking water, it’s harming wildlife, and threatening public health.’ Yet in practice, the Environmental Protection Agency appears to be largely fine with all that.”

“A S.A.D. Story: What Can We Learn From The 1970s?” (Paul Krugman, New York Times). “[T]he mechanism behind the Biden disinflation has been fundamentally different from the mechanism behind the Ford disinflation. The story that most easily fits the facts is long transitory — the gradual resolution of economic disruption caused by Covid and its aftermath.”

“Cash Piling Up On The Sidelines” (LPL Research). “Higher rates this year have created a high bar for cash coming off the sidelines. Assets in money market funds have climbed to nearly $5.6 trillion, a record-high and a notable 18% increase year to date. For reference, money market funds invest in short-term, high-quality debt or cash equivalents and are intended to provide investors with low-risk income generation and stable liquidity. It is important to note that money market funds are not considered ‘risk-free’ like U.S. Treasuries and are not protected by the Federal Deposit Insurance Corporation (FDIC), which generally insures deposits up to $250,000 per bank.”

September picks available now

The new Prime and Select picks for September are available starting now, based on a model run put through today (August 31). As a note, I will be measuring the performance on these picks from the first trading day of the month, Friday, September 1, 2023 (at the mid-spread open price) through the last trading day of the month, Friday, September 29, 2023 (at the mid-spread closing price).

What we’re reading (8/29)

“Expensive Drugs Targeted For First U.S. Price Negotiations” (Wall Street Journal). “The U.S. government named 10 drugs that will be subject to the first ever price negotiations by Medicare, taking aim at some of the most widely used and costliest medicines in America. At stake is arguably the government’s strongest effort to date to tackle high drug costs—if drugmakers can’t persuade courts to scuttle the negotiating powers that Medicare was granted last year.”

“US Job Openings Decline To 8.83 Million, Lowest Since Early 2021” (Bloomberg). “US job openings fell in July by more than expected to a more than two-year low, offering fresh evidence that labor demand is cooling. The number of available positions decreased to 8.83 million from 9.17 million in June, the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey, or JOLTS, showed Tuesday. It marked the sixth decline in the last seven months.”

“While The Mall Food Court Struggles To Survive, Costco Thrives” (Salon). “Mall food courts are struggling to survive, there's no doubt about it. But elsewhere, one food court is managing to do the exact opposite. In fact, it's been staying strong for years. And it doesn't look like it's going out of business anytime soon. That's, of course, the one-and-only Costco food court, the beloved addition to the wholesale warehouse.”

“Is The US Economy Seeing An Upsurge Of New Firms?” (Conversable Economist). “I have written from time to time over the years about concerns that the number of start-up firms in the US economy has been stagnant (for example, here, here and here). This is a matter of general concern, because start-up firms are often the ones providing a jolt of new goods and services, new jobs, new competition, and new energy in a dynamic economy. However, there are some preliminary sources of data which suggest that since the end of the pandemic, the rate of new US business start-ups may be on the rise.”

“You Are A Morale-Driven Machine” (Alexey Guzey). “1. To have high morale is to believe that you are able to do the things you want to do; to have low morale is to believe the opposite. 2. Either state is stable, and your brain will act to reinforce it, so that reality matches its expectation. 3. Everything - everything - either increases or decreases morale. Morale is your motive force, and you live or die by its maintenance.”

What we’re reading (8/26)

“The Recession Should Probably Be Here By Now” (Axios). “According to Wall Street's most talked-about recession indicator, the long-awaited economic downturn should be nearly upon us…And yet, there's virtually no evidence the U.S. economy is contracting, putting this indicator's run of correctly predicting recessions — it's called every one since 1955 — in peril.”

“Why The Stock Market’s Summer Doldrums Are Not A Problem” (New York Times). “By bidding down bond prices and raising yields (prices and yields move in opposite directions, as a matter of basic bond-market math), traders have indicated that they consider the economy to be stronger and inflation to be more persistent than had been expected a few months ago. The downgrade of U.S. Treasury debt by the Fitch Ratings agency also contributed to the run-up in rates on Treasury securities. And because Treasuries serve as benchmarks for virtually every other bond and, indeed, for every other investment in the global economy, higher rates have made stocks less appealing in comparison.”

“Despite What Powell Says, The Fed Is Likely Done” (Wall Street Journal). “Speaking at the Kansas City Fed’s annual symposium in Jackson Hole, Wyo., Powell on Friday provided a classic on-the-one-hand, on-the-other-hand speech. On the one hand, the unwinding of pandemic distortions and the Fed’s rate increases ‘are now working together to bring down inflation.’ On the other hand, “the process still has a long way to go.’ Bank lending standards ‘have tightened’ and ‘growth in industrial production has slowed,’ but gross domestic product growth ‘has come in above expectations’ and ‘the housing sector is showing signs of picking back up.’”

“China Is On Edge As Fallout From Its Real Estate Crisis Spreads” (New York Times). “A model Chinese real estate developer in a sector replete with risk takers is teetering on the edge of default. Short of cash, one of China’s biggest asset managers has missed payments to investors. And billions of dollars have flowed out of the country’s stock markets. In China, August has been a dizzying ride.”

“Are We Ready For A $100 Billion Catastrophe? How About $200 Billion?” (Wall Street Journal). “Now, industry estimates peg a replay of Andrew today at two or even three times the inflation-adjusted number, potentially adding up to a $90 billion or even $100 billion insurance loss. And that is before considering what might have happened had Andrew—or Hurricane Irma in 2017, if it had continued on an early course and intensity—actually hit Miami directly, with modeling firm Karen Clark & Co. estimating that insured losses in such a scenario could be $200 billion.”

September picks available soon

I’ll be publishing the Prime and Select picks for the month of August before Friday, September 1 (the first trading day of the month). As always, SPC’s performance measurement for the month of August, as well as SPC’s cumulative performance, will assume the sale of the August picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Thursday, August 31). Performance tracking for the month of September will assume the September picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Friday, September 1).