What we’re reading (6/22)

“Bank Of England Hikes Interest Rates To 5%, Stoking Fears Of A ‘Mortgage Bomb’” (CNN Business). “The Bank of England raised interest rates by half a percentage point Thursday, after data this week revealed surprisingly stubborn inflation. The move will pile pain on people with mortgages and put more downward pressure on house prices. The decision in favor of a 13th consecutive hike takes the main borrowing cost for commercial banks in the United Kingdom to 5%, the highest since April 2008.”

“Warner Bros. Discovery Negotiating $500 Million Deal To Sell Film And TV Music Publishing Assets” (Variety). “Warner Bros. Discovery is negotiating to sell around half of the storied Warner studio’s film and TV music-publishing assets for approximately $500 million, three sources confirm to Variety.”

“How Michael Jordan Turned $25 Million Into $3 Billion By Buying The Charlotte Hornets For Pennies On The Dollar” (Huddle Up). “Michael Jordan shocked the sports world last week when he announced that he was selling his controlling stake in the Charlotte Hornets at a $3 billion valuation. So today's newsletter breaks down how Michael Jordan acquired the team for pennies on the dollar, why they have performed so poorly on the court, and how he's set to make more money on this one deal than his 40-year partnership with Nike.”

“‘Power And Progress’ Review: Technology And The New Leviathan” (Deirdre McCloskey in the Wall Street Journal). “Since the 1920s, economists from John Maynard Keynes to Paul Samuelson to Joseph Stiglitz have been claiming, with increasing self-assurance though with surprisingly little evidence beyond the blackboard, that (1) private arrangements work poorly, (2) the state knows better, and (3) we therefore need more state. Messrs. Acemoglu and Johnson have long believed in this anti-liberal syllogism.”

“Elon Musk And Mark Zuckerberg Agree To Hold Cage Fight” (BBC News). “Two of the world's most high-profile technology billionaires - Elon Musk and Mark Zuckerberg - have agreed to fight each other in a cage match.”

What we’re reading (6/21)

“401(k) Plans Have Never Been Hotter. That’s Changing The Stock Market” (CNN Business). “Participation is likely to continue to skyrocket in 2023 as the SECURE Act 2.0 goes into effect. The bill, signed into law late last year, requires employers to automatically enroll all eligible workers into their retirement plans at a savings rate of 3% of salary.”

“Vacant Offices Are Piling Up In Silicon Valley” (Wall Street Journal). “Silicon Valley companies are dumping office space at an accelerating pace, as tech leaders such as Google and Facebook parent Meta Platforms close locations and reassess their commitments to the workplace.”

“Return To Office Enters The Desperation Phase” (New York Times). “For tens of millions of office workers, it’s been three years of scattershot plans for returning to in-person work — summoning people in, not really meaning it, everybody pretty much working wherever they pleased. Now, for the umpteenth time, businesses are ready to get serious.”

“Handouts To Corporations Don’t Create Jobs” (The Hill). “Microchip manufacturers will soon be raking in federal subsidies for building plants in the United States, but there is also a handy ploy they will use to soak up bucks from state governments: They pretend they have jobs to sell.”

“Bitcoin Rallies To Touch Highest Level Since April As Traders Get Bullish On ETF News” (CNBC). “The price of the flagship cryptocurrency touched a high of $30,749.45, its highest level since April 14, according to CoinMetrics. At 6:39 p.m. ET, the price was $29,988.46. Investors are growing bullish about the prospects of BlackRock and other major institutional names getting involved in digital assets.”

What we’re reading (6/20)

“The Hottest New Perk In Tech Is Freedom” (Vox). “[Small technology companies] are much more likely than their larger peers to allow people to work fully remotely, with 81 percent of those with fewer than 5,000 employees either allowing remote work or only having remote options, according to new data from Scoop Technologies, a software firm that builds tech to help hybrid teams coordinate and also tracks the office policies at major companies. Meanwhile, just 26 percent of companies with more than 25,000 employees are fully flexible.”

“Where Housing Prices Have Crashed And Billions In Wealth Have Vanished” (New York Times). “The pandemic’s disruptions to jobs, wages and living conditions caused a yo-yo effect in housing markets in many countries, including Sweden, Britain, Canada and Australia. Few places have experienced as wild a swing as New Zealand, which last week slipped into a recession.”

“Inside The Escalating Feud At One Of Wall Street’s Biggest Hedge Funds” (Wall Street Journal). “Over the last 22 years, John Overdeck and David Siegel built Two Sigma Investments into a $60 billion quant-trading behemoth. But behind the scenes, the billionaire co-founders have clashed over the firm’s direction, succession planning and more, people familiar with the matter said.”

“Mark Zuckerberg goes In For The Kill As Elon Musk’s Twitter Bleeds Ad Dollars” (The Telegraph). “Zuckerberg’s company is already courting celebrities and influencers to test the [new] app. Meta has been negotiating with TV host Oprah Winfrey and Tibetan religious leader the Dalai Lama to open accounts, hoping that high-profile early users can help tempt the masses to join.”

“U.S.-Funded Scientist Among Three Chinese Researchers Who Fell Ill Amid Early Covid-19 Outbreak” (Wall Street Journal). “A prominent scientist who worked on coronavirus projects funded by the U.S. government is one of three Chinese researchers who became sick with an unspecified illness during the initial outbreak of Covid-19, according to current and former U.S. officials. The identity and role of the researchers is one piece of intelligence that has been cited by proponents of the judgment that the pandemic originated with a lab leak, though the nature of their illness hasn’t been conclusively established.”

What we’re reading (6/19)

“Tech-Stock Boom Pits AI Against The Fed” (Wall Street Journal). “Investors can’t agree on whether their recent run looks like the prelude to an eventual bust—like that of the dot-com era—or the start of a more durable rally. Hype around artificial intelligence has helped drive shares of technology companies to records this year. The rally has only intensified heading into the end of the quarter.”

“Norway Proposes 40% Gender Quota For Large And Mid-Size Unlisted Firms” (Reuters). “Large and mid-size private firms in Norway must have boards comprising at least 40% women, Norway's government proposed in a bill on Monday, in a further push to break the glass ceiling preventing women from reaching top positions. The Nordic country was the first in the world to introduce a 40% gender quota on the boards of listed companies, in 2005, kick-starting an international push to force companies to have more women on boards.”

“A Tiny Activist Takes On John Malone, Cerberus, And A Cable Giant” (Institutional Investor). “Behind a pizzeria in an alley off the main drag of a New Jersey suburb, a gruff, Lenin-quoting provocateur named Kevin Rendino is plotting an assault on corporate America. His boldfaced targets: cable czar John Malone of Liberty Media Corp., leveraged buyout mogul Steve Feinberg of Cerberus Capital Management, and Charter Communications, the second-largest U.S. cable company by subscribers. Each owns preferred stock in Comscore, an advertising analytics firm, and they have been sucking it dry, Rendino says. His fund, 180 Degree Capital Corp., owns 6 percent of Comscore’s common stock — and he is incensed.”

“Fully Grown - European Vacation!” (Economic Growth Blog). “For the United States I delineated between a relatively fast-growth 20th century and a slow-growth 21st century. GDP per capita in the US grew at about 2.25% per year in the 20th, and about 1% per year in the 21st. This slowdown appeared to predate the financial crisis, starting some time around the year 2000. Does this look the same for Europe? Basically, yes.”

“Mortgages: New Squeeze On Landlords Will Hit Renters Too” (BBC). “Landlords are making their lowest profits for 16 years as interest rates rise, leading some to look to leave the sector, estate agency Savills has said. Twelve consecutive increases in the Bank of England's base rate, matched by rising mortgage costs, were putting the squeeze on landlords' income, it said.”

What we’re reading (6/18)

“Lots Of Hiring, But Not So Much Working” (Wall Street Journal). “The hiring boom obscures what looks like a contradictory economic trend: Employees are working fewer hours. The average number of hours worked a week by private-sector employees declined to 34.3 in May, below the 2019 average and down from a peak of 35 hours in January 2021, according to the Labor Department.”

“He Went After Crypto Companies. Then Someone Came After Him.” (New York Times). “Kyle Roche was a rising star in the field of cryptocurrency law — until his career imploded. Who orchestrated his downfall?”

“Odey Asset Management Suspends Further Funds After Investor Flight- Website” (Reuters). “Odey Asset Management has suspended further funds after increased investor redemptions, letters posted on the fund's website showed. The hedge fund, once run by one of Britain's best known star managers, Crispin Odey, has grappled with investor flight after the founder became the focus of sexual misconduct allegations in media reports last week.”

“The Space Industry Is Taking Off. Space Law Is Still A Mystery.” (DealBook). “Virgin Galactic, the space tourism company founded by Mr. Branson, announced on Thursday that it would launch its first commercial spaceflight this month, joining Mr. Bezos’ Blue Origin, and Mr. Musk’s SpaceX in sending ticketed passengers to space. But travel is just one emerging corner of the industry, which is mostly fueled by U.S. and international government contracts. The sector includes companies in the fields of satellites and communications, solar power, manufacturing, and even mining. One, Orbital Assembly, hopes to open a luxury extraterrestrial hotel by 2025.”

“A Sydney Home That’s Been Abandoned For 7 Years And Is Completely Covered In Vines Is Going Up For Auction At $1.7 Million, And The Agent Says It’s ‘Not Habitable.’ Check It Out.” (Insider). “Located on a quiet back street in Redfern — an inner suburb of Sydney in Australia — the abandoned property has been completely reclaimed by nature, listing photos show.”

What we’re reading (6/16)

“A Bull Or A Bear Market? It Doesn’t Matter.” (New York Times). “Instead of focusing on where stocks may be heading over the summer, consider that over periods of 20 years or longer, the stock market has always risen. But remember that it’s frequently fallen sharply from time to time within those periods.”

“Why Value Investing Works” (Morningstar). “Per the academic research, buying stocks on the cheap has flourished for as long as the data has existed. Why? The common explanation is sentiment. What is now unloved will later receive its due. True enough. Value investing certainly does benefit when the unpopular becomes popular. But that is the icing rather than the cake. The happy secret of value investing is that it can succeed even if sentiment remains unchanged.”

“Disney Finance Chief Clashed With Top Executives Before Stepping Down” (Wall Street Journal). “[Disney CFO Christine] McCarthy has clashed with Disney Chief Executive Robert Iger and other top executives over strategy, including the amount of money Disney spends on content and a recent restructuring that she felt didn’t go far enough to streamline the company, a person familiar with the matter said.”

“The Housing Market Has About 40% Fewer Homes For Sale Than Before The Pandemic, And Listings Keep Falling” (Insider). “The issue is unlikely to ease anytime soon, as the total number of homes for sale dropped 6% year over year in the four weeks leading up to June 11, the report said, marking the largest drop in 13 months. And new home listings fell 23%, the 10th consecutive month of double-digit declines, amid a slump in homebuilding.”

“The Trust Crisis” (Commentary). “We have no shortage of conflicts and challenges in 2023. But is life in the United States worse than in 1973? Item by item, no. Not even close. American troops aren’t fighting in a foreign war; Ukrainians are. (And even in 1973, a total of 68 Americans were killed in Vietnam.) The 1973 oil shock was the largest in history. In 2023, oil prices are down almost 11 percent from a year earlier. Whatever unsavory business dealings may be swirling around the Biden family, the president is not facing resignation or removal because of them. And while the crime rate has risen significantly in the past few years, the crime spike of the immediate postwar decades makes our age look paradisiacal.”

What we’re reading (6/15)

“Stocks Close At Highest Levels Since 2022” (Wall Street Journal). “Markets have been buoyant in recent weeks, with the three major U.S. stock indexes closing Thursday at their highest levels since 2022. The S&P 500 on Thursday scored its sixth straight session of gains, its longest winning streak since an eight-session run in November 2021, according to Dow Jones Market Data.”

“Artificial Intelligence Already Being Used In Transactional Drafting: An Interview With The CEO Of Spellbook” (Dealbreaker). “Professors worried that no human being would ever bother to write a term paper again. A handful of nerds went all in with the doomsaying and warned that AI has a pretty good chance of killing us all. Probably most presciently, workers, particularly those who write or code or otherwise do things that AI has already demonstrated itself to have some proficiency at, fretted about their future job security. The legal industry has been far from immune.”

“New Report Flashes A Warning Light Over 401(k) Account Balances” (CNN Business). “The average balance in employer-sponsored savings plans last year was $112,572, well below the $141,542 recorded in 2021.”

“From Quiet Desperation to Quiet Quitting: On John Kaag and Jonathan van Belle’s ‘Henry at Work’” (Los Angeles Review of Books). “Long before ‘quiet quitting’ entered the lexicon, Henry David Thoreau concluded from the shore of Walden Pond that ‘the mass of men lead lives of quiet desperation.’ His contemporaries’ desperation was but another word for their resignation: not resignation from a life of unhappy, meaningless work ‘in shops, and offices, and fields,’ but resignation to it. In going to Walden Pond, Thoreau himself did the opposite, opting out of the rat race rather than ‘practi[cing] resignation’ and ‘liv[ing] what was not life.’”

“Corporate Discount Rates” (Niels Joachim Gormsen and Kilian Huber). “Standard theory implies that the discount rates used by firms in investment decisions (i.e., their required returns to capital) determine investment and transmit financial shocks to the real economy. However, there exists little evidence on how firms’ discount rates change over time and affect investment. We construct a new global database based on manual entry from conference calls. We show that, on average, firms move their discount rates with the cost of capital, but the relation is far below the one- to-one mapping assumed by standard theory, with substantial heterogeneity across firms.”

What we’re reading (6/14)

“Fed Holds Rates Steady But Expects More Increases” (Wall Street Journal). “Federal Reserve officials agreed to hold interest rates steady after 10 consecutive increases, but signaled they are leaning toward raising them next month if the economy and inflation don’t cool more.”

“Why Economists Say It’s A Near Certainty That Housing Inflation Will Soon Fall” (CNBC). “‘I know this with about as high a degree of confidence as one could have,’ Mark Zandi, chief economist at Moody’s Analytics, said of falling housing inflation being near at hand.”

“Twitter Hit With $250M Lawsuit From Music Publishers Over ‘Massive Copyright Infringement’ Claim” (The Hollywood Reporter). “The three major music conglomerates — Universal, Sony and Warner — joined by a host of other publishers, on Wednesday sued Twitter for at least $250 million over the alleged infringement of roughly 1,700 works for which it received hundreds of thousands of takedown notices. They allege the company “consistently and knowingly hosts and streams infringing copies of music compositions” to ‘fuel its business.’ Twitter has rebuffed calls for it to obtain the proper licenses, according to the suit.”

“Workers Are Historically Stressed Out And Disengaged” (CNN Business). “A new Gallup poll released Tuesday revealed that workers around the world are historically stressed, disengaged with their work and increasingly fighting with their bosses. Gallup’s ‘State of the Global Workplace 2023’ examined how ‘employees feel about their work and their lives, an important predictor of organizational resilience and performance.’”

“Deep Value Moments” (Smead Capital Management). “The value factor has outperformed the stock market over long stretches of time because when you are wrong, these kinds of stocks go down less than growth stocks. A dollar saved is more valuable than a dollar earned in the world of compounding. [Co-head of asset allocation at Grantham Mayo Van Otterloo Ben] Inker points out that recessions have not been more damaging to deep value stocks than the rest of the stock market.”

What we’re reading (6/13)

“Inflation Rose At A 4% Annual Rate In May, The Lowest In 2 Years” (CNBC). “The inflation rate cooled in May to its lowest annual rate in more than two years, likely taking pressure off the Federal Reserve to continue raising interest rates, the Labor Department reported Tuesday.”

“Goldman Sachs Is At War With Itself” (Wall Street Journal). “Blankfein, holding court at the hotel bar before a gathering of Goldman partners, groused about his successor, according to people familiar with the matter. David Solomon, Blankfein said, was spending too much time away from his day job, jetting around on Goldman’s private planes and DJing at nightclubs and festivals.”

“Google’s Return-To-Office Crackdown Gets Backlash From Some Employees: ‘Check My Work, Not My Badge’” (CNBC). “Based on CNBC’s discussions with some employees and posts to an internal site called Memegen, Google faces growing concern among staffers that management is overreaching in its oversight of physical attendance. Staffers say they’re being treated like schoolchildren. There’s also increased uncertainty about what the future holds for people who moved to different cities and states after they were cleared to work from remote locations.”

“Record Number Of Media Job Cuts So Far In 2023” (Axios). “The media industry has announced at least 17,436 job cuts so far this year, marking the highest year-to-date level of cuts on record, according to a new report from Challenger, Gray & Christmas.”

“Their Crypto Company Collapsed. They Went to Bali.” (New York Times). “Not long after his cryptocurrency hedge fund collapsed last year, spawning a market meltdown that devastated the industry, Kyle Davies got on a plane and left his troubles behind. He flew to Bali. As his company was liquidated and law enforcement authorities opened investigations on two continents, Mr. Davies spent his days painting in cafes and reading Hemingway on the beach.”

What we’re reading (6/11)

“ETF Flows Sputter As Investors Favor Defensive Strategies” (Wall Street Journal). “Money typically chases performance in the $7 trillion exchange-traded fund market. This year, it is sitting on the sidelines. Despite a 12% rally for the S&P 500 so far in 2023, ETF flows paint a picture of a cautious investor base, reluctant to wade back into equities after a rough 2022.”

“Thematic Investing: Just Say No” (Morningstar). “That you have not heard of such funds, save perhaps for Steadman, suggests all one needs to know about high-concept sector funds: They fizzle. Those from our grandparents’ generation did, as did those from our parents’ time. So will the current incarnation. Over time, the sectors—sorry, ‘themes’—change, but the story does not. Buying the current headlines was, is, and always will be a mug’s game. As somebody once said, ‘If the bozos know about it, it won’t work anymore.’”

“The Rebalancing Bonus” (A Wealth of Common Sense). “My view on this is that it’s horseshoes and hand grenades — close enough does the trick. The most important thing with rebalancing is that you have a plan of attack, stick to that plan and automate it if you can to take yourself out of the equation.”

“A Startup ‘Mass Extinction Event’ Has Begun. You Can’t See It Clearly Yet, But It’s Going To Be Bad.” (Insider). “Venture capitalists love to talk about how failure is essential to innovation. They will have a LOT to discuss soon.”

“Every Investor Needs to Worry About the Risks Piling Up In Private Equity” (Institutional Investor). “As more allocators built larger positions in private markets, Allspring’s Kevin Kneafsey set out to learn if there were hidden risks to the entire market ecosystem.”

What we’re reading (6/10)

“Port Of Seattle Closed Due To ILWU Labor Strife” (CNBC). “The West Coast ports have faced continuous worker slowdowns and stoppages all week where an estimated $5.2 billion of trade is floating off the Ports of Los Angeles, Long Beach, and Oakland.”

“The Great Decoupling: Macroeconomic Perceptions And COVID-19” (Darren Grant, Working Paper). “The American public’s perceptions of macroeconomic conditions changed dramatically during the Covid-19 pandemic, in seemingly-perplexing ways. To document this phenomenon and better understand it, this paper analyzes forty-six years of surveys on the state of the U.S. economy. The effect of inflation on these perceptions did not change during the pandemic, but the effect of unemployment fell significantly. The temporary provision of large income stabilizers generated an unusually mild response to increased unemployment in 2020, then negative real wage growth caused unusual pessimism in 2021-22, despite a tight labor market.”

“Railroads Offer Paid Sick Leave, Better Work Conditions After Yearslong Efficiency Push” (Wall Street Journal). “Major U.S. freight railroads are adopting labor-friendly policies such as paid sick leave and predictable shifts to help address long-running staffing shortages that nearly boiled over into a nationwide strike last year.”

“Turkey Turns To [Checks Notes Incredulously] Former First Republic CEO To Save Economy” (Dealbreaker). “[W]hile Washington looks askance at the NATO member’s cozying up to those who definitely wish the alliance ill, Wall Street stands astonished at Erdogan’s stubborn insistence that rock-bottom interest rates will tame inflation, even in the face of the 85% inflation his country faces as a result. Economically-speaking, things are so bad in Turkey that this otherwise quite desperate-looking pick for central bank governor is treated as tremendous news.”

“A.G. Sulzberger On The Battles Within And Against The New York Times” (The New Yorker). “With the collapse of so many local and second-tier newspapers, with the disappearance of once promising sites like BuzzFeed News, the Times occupies a nearly singular place in American journalism, a fact that makes honest scrutiny of the paper in all its forms even more necessary than ever.”

What we’re reading (6/9)

“Ben Bernanke Talks About Bank Runs, Inflation, A.I., Market Bubbles And More” (New York Times). “Mr. Bernanke said he still ‘monitors the Fed very carefully,’ and in a wide-ranging interview, he discussed many thorny issues, including bank runs, inflation and threats to financial stability.”

“How Can We Possibly Be In A Bull Market Right Now? Two Letters: AI” (CNN Business). “The bear market is over. But the bear economy isn’t. The eurozone has sunk into recession and some economists fear the United States is next. We’re worrying about rate hikes, inflation, lower spending, layoffs, surging mortgage costs and a war in Europe. That’s a strange place to find a bull market.”

“The Real-Estate Market Caught In A Tangled Web Of Ownership And Debt” (Wall Street Journal). “One of the world’s most overstretched real-estate markets has a knotty problem. Many of its top property tycoons own stakes in rival companies—and when one firm wobbles, others can feel the pain. The market is Sweden[.]”

“Does CNN’s Turmoil Mean There’s No Room On Cable For Independent News?” (New York Times). “The Warner Bros. Discovery chief, David Zaslav, was clear from the day he took control of CNN in 2022 about what he wanted for the cable news network. Publicly and privately he told associates, reporters and whoever else might care that he wanted to move the network away from what he viewed as left-leaning ‘advocacy’ and toward more ‘balance.’ His CNN would not be anti-Trump, and would be more welcoming for Republicans.”

“War Discourse And The Cross-Section Of Expected Stock Returns” (Hirshleifer, Mai, and Pukthuanthong, NBER Working Paper). “A war-related factor model derived from textual analysis of media news reports explains the

cross-section of expected asset returns. Using a semi-supervised topic model to extract discourse topics from 7,000,000 New York Times stories spanning 160 years, the war factor predicts the cross section of returns across test assets derived from both traditional and machine learning construction techniques, and spanning 138 anomalies. Our findings are consistent with assets that are good hedges for war risk receiving lower risk premia, or with assets that are more positively sensitive to war prospects being more overvalued. The return premium on the war factor is incremental to standard effects.”

What we’re reading (6/7)

“Eight Megacap Stocks Make For A Funny Sort Of Bull Market” (Wall Street Journal). “[T]he renaissance of megacapitalization companies matters. These stocks account for the shift from a bear to a tentative new bull market. And their resurgence comes alongside significant shifts in market behavior, especially when it comes to interest rates. In particular, the megacap stocks no longer seem to care what the Federal Reserve does.”

“A (Very Short) History Of Global Reserve Currencies” (Michael Pettis, Financial Times). “The US dollar, analysts often propose, is the latest in a 600-year history of global reserve currencies. Each of its predecessor currencies was eventually replaced by another, and in the same way the dollar will eventually be replaced by one or more currencies. The problem with this argument, however, is that there is no such history. The role of the US dollar in the global system of trade and capital flows is unprecedented, mainly because of the unprecedented role the US economy plays in global trade and capital imbalances. The fact that so many analysts base their claims on this putative history only shows just how confused the discussion has been.”

“This Is What the Government Strangling Crypto Looks Like” (Slate). “With the two lawsuits, the SEC has effectively said that the free-for-all era of crypto trading is over. Coinbase CEO Brian Armstrong nodded to the gravity of the moment even as he tried to downplay the news, tweeting on Tuesday that ‘the complaint filed against us is exclusively focused on what is or is not a security’ and that ‘we’re proud to represent the industry in court to finally get some clarity around crypto rules.’”

“Binance Lawyers Allege SEC Chair Gensler Offered To Serve As Advisor To Crypto Company In 2019” (CNBC). “Documents filed by the SEC on Wednesday indicate that attorneys from Gibson Dunn and Latham & Watkins, two of Binance’s law firms, allege that Gensler offered to serve as an advisor to the crypto exchange in several March 2019 conversations with Binance executives and Zhao. He eventually met Zhao in Japan for lunch later that month, the filing claims.”

“CNN’s Story On The Ouster Of Its CEO Is A Giant Middle Finger” (Insider). “In a story published Wednesday, CNN senior media reporter Oliver Darcy described Licht's one-year tenure as ‘stained by a series of severe missteps.’ He said the chairman and CEO alienated employees at all levels of the organization and effectively ‘lost the room.’”

What we’re reading (6/6)

“SEC Sues Coinbase, Alleges It Is Unregistered Broker” (Wall Street Journal). “The SEC alleged that Coinbase, the largest crypto exchange in the U.S., violated rules that require it to register as an exchange and be overseen by the federal agency. The case is the second in two days against a major crypto company. On Monday, the regulator sued the world’s largest crypto exchange, Binance, its founder Changpeng Zhao.”

“A First Try Of Apple’s $3,500 Vision Pro Headset” (New York Times). “[A]fter wearing the new headset to view photos and interact with a virtual dinosaur, I also felt there wasn’t much new to see here. And the experience elicited an “ick” factor I had never had before with an Apple product.”

“He Took Away The Country’s Top AAA Rating In 2011. He Ended Up Fearing For His Life” (NPR). “More than a decade ago, John B. Chambers and his colleagues at Standard & Poor's made a momentous decision: They were going to strip the United States of its cherished AAA credit rating. Going into it, Chambers, who led the powerful committee at S&P that rates the creditworthiness of more than 100 countries, knew it would be a huge deal.”

“Days Of Plunder” (The American Prospect). “PetSmart could not afford to treat or euthanize or even cremate its pets, even though sales jumped more than 60 percent and gross margins soared to unprecedented heights during the pandemic, because its owners had legally stolen $30 billion from the balance sheet, buying the company with a minuscule down payment, siphoning off cash and assets into its own pockets, and forcing the retailer to submit to a punishing payback plan that sucks every last penny the stores generate into usurious interest payments.”

“Why AI Will Save The World” (Marc Andreessen). “What AI offers us is the opportunity to profoundly augment human intelligence to make all of these outcomes of intelligence – and many others, from the creation of new medicines to ways to solve climate change to technologies to reach the stars – much, much better from here.”

What we’re reading (6/4)

“Bearish Bets Against S&P 500 Are Surging, Despite Love for Big Tech” (Wall Street Journal). “Wall Street hasn’t been this bearish on the stock market in more than a decade. Tech shares are a different story. Hedge funds and other speculative investors have built up a big bet that the S&P 500 will decline, marking their most bearish positioning since 2007. At the same time, they are preparing for a rally in the technology-focused Nasdaq-100, with net bullish wagers in recent weeks approaching the highest levels since late last year.”

“Want To Know Why Younger Generations Seem So Pissed? Look At The Housing Market.” (Insider). “You see it in survey results. You sense it in anti-capitalist TikTok videos. You hear about it when talking to your friends or colleagues, or if you're a parent of a 20-something or 30-something, from your kids. This economy has younger Americans on edge.”

“The S&P 500 Finally Broke Through A Key Level. Now What?” (CNN Business). “The S&P 500 index on Friday closed at its highest level in almost a year. But that doesn’t mean that stocks are poised for a bull run just yet. The broad-based index on May 26 closed above the 4,200 level for the first time since August 2022, when the market began to sell off and fell sharply to last year’s low of about 3,577 in October. The S&P 500 ended last week up 1.8% at about 4,282, marking its best weekly gain since late March.”

“Borrowers Brace For Student Loan Bills To Resume — ‘$600 A Month, Where Is That Going To Come From?’” (CNBC). “The more than three-year-long pause on federal student loan payments is slated to finally conclude within months. The Biden administration is preparing borrowers for their payments to resume by September, even while its loan forgiveness program is halted as the Supreme Court debates its validity. The debt ceiling deal passed by Congress also includes a provision officially terminating the pandemic-era relief policy and making it harder for the U.S. Department of Education to extend it.”

“The New York Times’ Elizabeth Holmes Profile Is Causing Drama in the Newsroom: ‘What the Hell Happened Here?’” (Vanity Fair). “In the feature, ‘Liz Holmes Wants You to Forget About Elizabeth,’ the convicted fraudster was described by writer Amy Chozick as ‘an authentic and sympathetic person’ and a ‘devoted mother’ who has been ‘volunteering for a rape crisis hotline’ for the past year. ‘She didn’t seem like a hero or a villain. She seemed, like most people, somewhere in between,’ Chozick writes. The piece came under scrutiny for, among other things, being overly credulous, which Chozick acknowledges in the piece, admitting that her own editor—business editor Ellen Pollock—had called her out for getting ‘rolled.’”

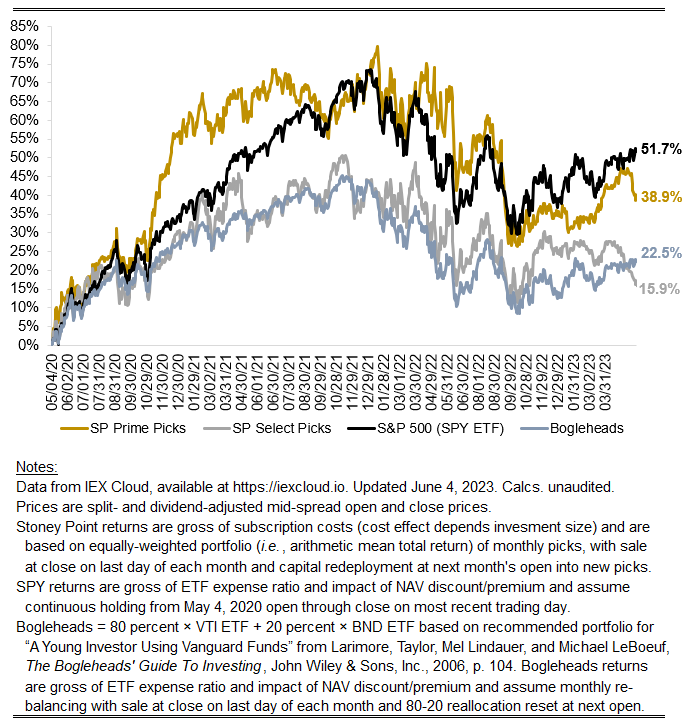

May 2023 performance update

Welp, that was a rough month.

Prime: -5.09%

Select: -7.42%

SPY ETF: +0.57%

Bogleheads Portfolio (80% VTI, 20% BND): +0.31%

Both my model portfolios got smoked in May. On both the Prime side and the Select side, there were some bad earnings results that surely could have been diversified away in a less concentrated portfolio. Widely diversified portfolios were flattish (note the SPY ETF and Bogleheads results above). That flattish-ness masks considerable variation among individual names under the hood. A few days ago I posted an article from Institutional Investor entitled “Is the Era of Large-Cap Growth Stocks Over?”, which observed the following:

Only 28 percent of companies in the S&P 500 have managed to outperform the index year-to-date, compared to 59 percent in 2022, 49 percent in 2021, and 36 percent in 2020, according to RBA’s latest research. Between 2007 and May 2023, the median percentage of stocks that have outperformed the S&P 500 index is 48 percent.

That stylized fact was equally true in May. Being a capitalization-weighted index, the returns of the largest constituent stocks dominate the S&P 500’s overall returns. At present, those stocks are generally the big tech stocks. As of May 4, Apple, Microsoft, Meta, Amazon, Nvidia, Google Class A, and Google Class C, represented 7.28%, 6.60%, 1.55%, 2.68%, 2.02%, 1.82%, and 1.60% of the index, respectively. In total, that means nearly a quarter of the S&P 500’s May return was determined by just these six stocks (or seven classes of stock). And these seven issues were on fire in may, up 5.00%, 7.45%, 10.94%, 14,89%, 35.90%, 15.00% and 14,53%, respectively. If you do the math, that means the remaining part of the index returned -2.72%. That is something of an odd result, suggesting significant divergence between large-cap tech, on the one hand, and everyone else. Those results make just being long Big Tech a seductive option, but a la the early 2000s a precarious one. Big trees fall hard, after all. A more defensible approach is to just “buy the haystack” (to make sure you get the needle even if you get a lot of hay) a la Vanguard, et al., but the goal here is to see if there is a way to beat the haystack, and that can only be reliably answered over long periods of time. I’m watching with bated breath to see if the rest of 2023 just turns out to be a big tech party, but we’ll see.

Stoney Point Total Performance History

What we’re reading (6/3)

“Online Banks Are Winning The Deposit War” (Wall Street Journal). “Deposits in the first quarter fell from December at regional-bank powerhouses such as U.S. Bank, Truist Financial and Citizens Financial. They were down more sharply at the smaller regional banks that have been under investor scrutiny, like Western Alliance and PacWest. But deposits were up quarter over quarter at Ally Financial and Goldman Sachs Group’s online bank Marcus, which don’t have branch networks. Deposits were also up at Capital One, which has far fewer branches than the other big regionals.”

“Markets Sense The Inflation ‘Clock Is Running’” (Deutsche Bank). “Over the past week or so, 5y5y breakevens and inflation swaps have risen, particularly relative to the levels implied by fundamental drivers like oil prices. Our models show the highest positive residuals for these market gauges versus oil – consistent with an inflation premium embedded in the former – in quite some time. Indeed, 5y5y inflation swaps are the furthest above levels implied by oil since 2017.”

“Will a Dollar General Ruin A Rural Crossroads?” (New York Times). “Anne Hartley’s brick house in Ebony, Va., overlooks windswept fields, a Methodist church, a general store and the intersection of two country roads, a pastoral setting that evokes an Edward Hopper painting or a faded postcard from the South. Now this scene is being threatened, Ms. Hartley said, by a plan to build what every small American town seems to have: a Dollar General.”

“‘It’s Like Watching A Snuff Film’: Media Elites Shocked By The Atlantic’s Surgical Dismantling Of CNN Boss Chris Licht” (Insider). “‘Let's get real. The problem isn't Licht, it’s his paymasters. The American billionaire class has convinced themselves that the way to save journalism is to make it as bland and as both-sidesy as possible. They chose Licht as their latest champion of harmless vanilla inoffensiveness. The problem is, no one wants vanilla. Not even a tasting spoon of it.’”

“Inside The Meltdown At CNN” (The Atlantic). “CEO Chris Licht felt he was on a mission to restore the network’s reputation for serious journalism. How did it all go wrong?”

What we’re reading (6/2)

“When Markets Melt Down, These Traders Cash In” (Wall Street Journal). “Statistically, the move was virtually unquantifiable, one that shouldn’t have occurred in the history of the universe, or 10 universes—in a normal world. As Taleb was learning, in finance things were often far from normal, and those who assumed they were normal would get them wrong again and again.”

“Former Google Exec Warns Of Global AI Catastrophe Within Two Years” (The Byte). “Former top Google exec Mo Gawdet, who once led the Silicon Valley behemoth's Google X ‘moonshot’ division, is very stressed about AI. ‘It is beyond an emergency,’ Gawdat said in a new interview on a podcast called ‘The Diary of a CEO,’ hosted by Stephen Bartlett. ‘It's the biggest thing we need to do today. It's bigger than climate change, believe it or not.’”

“We Just Got 2 Alarming Signals That An Economic Slowdown Is Upon Us” (Insider). “There are new signs the American consumer is pulling back on spending right now, reaffirming fears of an economic downturn widely expected to end in recession. The first of two jarring pieces of evidence comes in the form of first-quarter earnings from Dollar General. The discount retailer turned in a dismal report that included a cut to full-year sales and profit forecasts…a bit further up the affluence scale, Macy's turned in an earnings stinker of its own.”

“Airbnb Sues New York City Over Its Short-Term Rental Restrictions” (CNN Business). “In a lawsuit filed in state court Thursday, Airbnb said the ‘extreme and oppressive regulatory scheme’ operates as a ‘de facto ban against short-term rentals in New York City.’ The company also argued that the city’s restrictions around Airbnb hosting are overly complex.”

“How Winning (Or Losing) A Grammy Changes The Music Artists Make” (Behavioral Scientist). “[A]fter winning a Grammy, artists tend to release music that deviates stylistically from their own previous work, as well as from other artists in their genre. Nominees who lose do the opposite—their subsequent albums trend toward the mainstream. We think this happens because winning a Grammy grants an artist more leverage to pursue their personal artistic inclinations. Nonwinners, however, might interpret their loss as a negative signal about how their artistic choices deviated from the norm, and thus feel more bound to conventions of their genre.”

What we’re reading (6/1)

“Will Google’s AI Plans Destroy The Media?” (Intelligencer). “For publishers, however — of news, how-to content, reviews, recommendations, reference material, and a range of other content one might describe as existing to “distill complex information and multiple perspectives into easy-to-digest formats” — it [Google’s AI-augmented search engine] looked like nothing less than an existential crisis. Google was getting into content, automating the work of its partners, and dramatically altering the terms of its informal deal with publishers that has sustained digital media for years: You make content; we send traffic; everyone sells ads. If this wasn’t a threat to journalism directly, it was certainly a threat to the journalism business. Google, it seemed, was eager to cut the publishers out.”

“Banks Raise Roadblocks To Small-Business Loans” (Wall Street Journal). “Some entrepreneurs are finding it more difficult to get a new loan or have had existing credit lines cut. Others report stricter terms, higher borrowing costs, longer waits and tougher questions from their bankers. ‘They are definitely being more conservative,’ said Brock Hutchinson, chief executive officer of Big Frig, a maker of coolers and drinkware in North Sioux City, S.D. ‘Things have tightened up.’”

“Short Selling Makes Markets Work Better. So Why Do Banks Want To Outlaw It?” (Los Angeles Times). “The very human instinct to seek scapegoats for every crisis is playing out again on Wall Street. As so often happens, this time the target is short selling, which supposedly is helping to drive banking stocks lower. As so often also happens, the loudest cries for relief are coming from the people most responsible for the stocks’ decline — in this case, banking executives themselves.”

“Do We Really Need An App For Everything?” (Vox). “It really does feel like there’s an app for everything these days — often for things where they’re not really needed. We all managed to do business with each other for years and years without having to pull out our phones at every corner.”

“Elon Musk Is Accused Of Insider Trading By Investors In Dogecoin Lawsuit” (Reuters). “In a Wednesday night filing in Manhattan federal court, investors said Musk used Twitter posts, paid online influencers, his 2021 appearance on NBC's ‘Saturday Night Live’ and other ‘publicity stunts’ to trade profitably at their expense through several Dogecoin wallets that he or Tesla controls.”

June picks available now

The new Prime and Select picks for June are available starting now, based on a model run put through today (May 31). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Thursday, June 1, 2023 (at the mid-spread open price) through the last trading day of the month, Friday, June 30, 2023 (at the mid-spread closing price).