May 2023 performance update

Welp, that was a rough month.

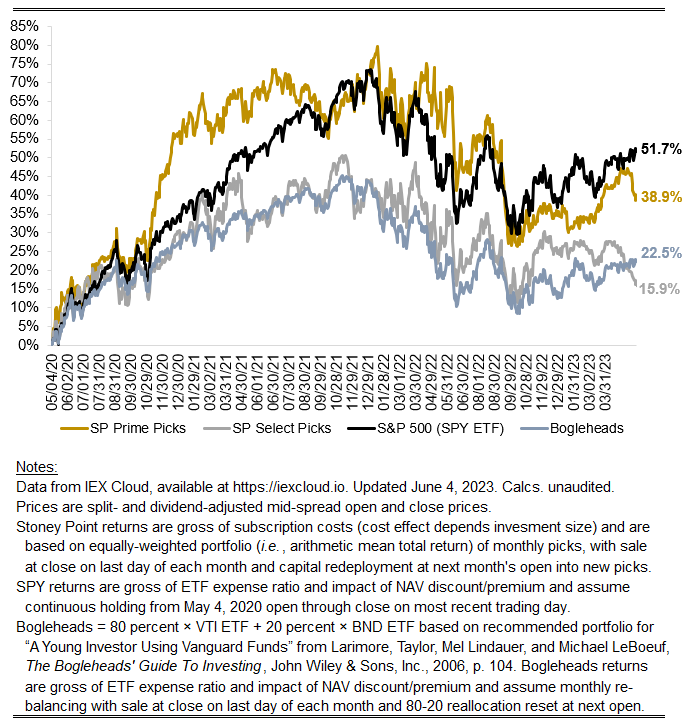

Prime: -5.09%

Select: -7.42%

SPY ETF: +0.57%

Bogleheads Portfolio (80% VTI, 20% BND): +0.31%

Both my model portfolios got smoked in May. On both the Prime side and the Select side, there were some bad earnings results that surely could have been diversified away in a less concentrated portfolio. Widely diversified portfolios were flattish (note the SPY ETF and Bogleheads results above). That flattish-ness masks considerable variation among individual names under the hood. A few days ago I posted an article from Institutional Investor entitled “Is the Era of Large-Cap Growth Stocks Over?”, which observed the following:

Only 28 percent of companies in the S&P 500 have managed to outperform the index year-to-date, compared to 59 percent in 2022, 49 percent in 2021, and 36 percent in 2020, according to RBA’s latest research. Between 2007 and May 2023, the median percentage of stocks that have outperformed the S&P 500 index is 48 percent.

That stylized fact was equally true in May. Being a capitalization-weighted index, the returns of the largest constituent stocks dominate the S&P 500’s overall returns. At present, those stocks are generally the big tech stocks. As of May 4, Apple, Microsoft, Meta, Amazon, Nvidia, Google Class A, and Google Class C, represented 7.28%, 6.60%, 1.55%, 2.68%, 2.02%, 1.82%, and 1.60% of the index, respectively. In total, that means nearly a quarter of the S&P 500’s May return was determined by just these six stocks (or seven classes of stock). And these seven issues were on fire in may, up 5.00%, 7.45%, 10.94%, 14,89%, 35.90%, 15.00% and 14,53%, respectively. If you do the math, that means the remaining part of the index returned -2.72%. That is something of an odd result, suggesting significant divergence between large-cap tech, on the one hand, and everyone else. Those results make just being long Big Tech a seductive option, but a la the early 2000s a precarious one. Big trees fall hard, after all. A more defensible approach is to just “buy the haystack” (to make sure you get the needle even if you get a lot of hay) a la Vanguard, et al., but the goal here is to see if there is a way to beat the haystack, and that can only be reliably answered over long periods of time. I’m watching with bated breath to see if the rest of 2023 just turns out to be a big tech party, but we’ll see.