What we’re reading (6/10)

“Port Of Seattle Closed Due To ILWU Labor Strife” (CNBC). “The West Coast ports have faced continuous worker slowdowns and stoppages all week where an estimated $5.2 billion of trade is floating off the Ports of Los Angeles, Long Beach, and Oakland.”

“The Great Decoupling: Macroeconomic Perceptions And COVID-19” (Darren Grant, Working Paper). “The American public’s perceptions of macroeconomic conditions changed dramatically during the Covid-19 pandemic, in seemingly-perplexing ways. To document this phenomenon and better understand it, this paper analyzes forty-six years of surveys on the state of the U.S. economy. The effect of inflation on these perceptions did not change during the pandemic, but the effect of unemployment fell significantly. The temporary provision of large income stabilizers generated an unusually mild response to increased unemployment in 2020, then negative real wage growth caused unusual pessimism in 2021-22, despite a tight labor market.”

“Railroads Offer Paid Sick Leave, Better Work Conditions After Yearslong Efficiency Push” (Wall Street Journal). “Major U.S. freight railroads are adopting labor-friendly policies such as paid sick leave and predictable shifts to help address long-running staffing shortages that nearly boiled over into a nationwide strike last year.”

“Turkey Turns To [Checks Notes Incredulously] Former First Republic CEO To Save Economy” (Dealbreaker). “[W]hile Washington looks askance at the NATO member’s cozying up to those who definitely wish the alliance ill, Wall Street stands astonished at Erdogan’s stubborn insistence that rock-bottom interest rates will tame inflation, even in the face of the 85% inflation his country faces as a result. Economically-speaking, things are so bad in Turkey that this otherwise quite desperate-looking pick for central bank governor is treated as tremendous news.”

“A.G. Sulzberger On The Battles Within And Against The New York Times” (The New Yorker). “With the collapse of so many local and second-tier newspapers, with the disappearance of once promising sites like BuzzFeed News, the Times occupies a nearly singular place in American journalism, a fact that makes honest scrutiny of the paper in all its forms even more necessary than ever.”

What we’re reading (6/9)

“Ben Bernanke Talks About Bank Runs, Inflation, A.I., Market Bubbles And More” (New York Times). “Mr. Bernanke said he still ‘monitors the Fed very carefully,’ and in a wide-ranging interview, he discussed many thorny issues, including bank runs, inflation and threats to financial stability.”

“How Can We Possibly Be In A Bull Market Right Now? Two Letters: AI” (CNN Business). “The bear market is over. But the bear economy isn’t. The eurozone has sunk into recession and some economists fear the United States is next. We’re worrying about rate hikes, inflation, lower spending, layoffs, surging mortgage costs and a war in Europe. That’s a strange place to find a bull market.”

“The Real-Estate Market Caught In A Tangled Web Of Ownership And Debt” (Wall Street Journal). “One of the world’s most overstretched real-estate markets has a knotty problem. Many of its top property tycoons own stakes in rival companies—and when one firm wobbles, others can feel the pain. The market is Sweden[.]”

“Does CNN’s Turmoil Mean There’s No Room On Cable For Independent News?” (New York Times). “The Warner Bros. Discovery chief, David Zaslav, was clear from the day he took control of CNN in 2022 about what he wanted for the cable news network. Publicly and privately he told associates, reporters and whoever else might care that he wanted to move the network away from what he viewed as left-leaning ‘advocacy’ and toward more ‘balance.’ His CNN would not be anti-Trump, and would be more welcoming for Republicans.”

“War Discourse And The Cross-Section Of Expected Stock Returns” (Hirshleifer, Mai, and Pukthuanthong, NBER Working Paper). “A war-related factor model derived from textual analysis of media news reports explains the

cross-section of expected asset returns. Using a semi-supervised topic model to extract discourse topics from 7,000,000 New York Times stories spanning 160 years, the war factor predicts the cross section of returns across test assets derived from both traditional and machine learning construction techniques, and spanning 138 anomalies. Our findings are consistent with assets that are good hedges for war risk receiving lower risk premia, or with assets that are more positively sensitive to war prospects being more overvalued. The return premium on the war factor is incremental to standard effects.”

What we’re reading (6/7)

“Eight Megacap Stocks Make For A Funny Sort Of Bull Market” (Wall Street Journal). “[T]he renaissance of megacapitalization companies matters. These stocks account for the shift from a bear to a tentative new bull market. And their resurgence comes alongside significant shifts in market behavior, especially when it comes to interest rates. In particular, the megacap stocks no longer seem to care what the Federal Reserve does.”

“A (Very Short) History Of Global Reserve Currencies” (Michael Pettis, Financial Times). “The US dollar, analysts often propose, is the latest in a 600-year history of global reserve currencies. Each of its predecessor currencies was eventually replaced by another, and in the same way the dollar will eventually be replaced by one or more currencies. The problem with this argument, however, is that there is no such history. The role of the US dollar in the global system of trade and capital flows is unprecedented, mainly because of the unprecedented role the US economy plays in global trade and capital imbalances. The fact that so many analysts base their claims on this putative history only shows just how confused the discussion has been.”

“This Is What the Government Strangling Crypto Looks Like” (Slate). “With the two lawsuits, the SEC has effectively said that the free-for-all era of crypto trading is over. Coinbase CEO Brian Armstrong nodded to the gravity of the moment even as he tried to downplay the news, tweeting on Tuesday that ‘the complaint filed against us is exclusively focused on what is or is not a security’ and that ‘we’re proud to represent the industry in court to finally get some clarity around crypto rules.’”

“Binance Lawyers Allege SEC Chair Gensler Offered To Serve As Advisor To Crypto Company In 2019” (CNBC). “Documents filed by the SEC on Wednesday indicate that attorneys from Gibson Dunn and Latham & Watkins, two of Binance’s law firms, allege that Gensler offered to serve as an advisor to the crypto exchange in several March 2019 conversations with Binance executives and Zhao. He eventually met Zhao in Japan for lunch later that month, the filing claims.”

“CNN’s Story On The Ouster Of Its CEO Is A Giant Middle Finger” (Insider). “In a story published Wednesday, CNN senior media reporter Oliver Darcy described Licht's one-year tenure as ‘stained by a series of severe missteps.’ He said the chairman and CEO alienated employees at all levels of the organization and effectively ‘lost the room.’”

What we’re reading (6/6)

“SEC Sues Coinbase, Alleges It Is Unregistered Broker” (Wall Street Journal). “The SEC alleged that Coinbase, the largest crypto exchange in the U.S., violated rules that require it to register as an exchange and be overseen by the federal agency. The case is the second in two days against a major crypto company. On Monday, the regulator sued the world’s largest crypto exchange, Binance, its founder Changpeng Zhao.”

“A First Try Of Apple’s $3,500 Vision Pro Headset” (New York Times). “[A]fter wearing the new headset to view photos and interact with a virtual dinosaur, I also felt there wasn’t much new to see here. And the experience elicited an “ick” factor I had never had before with an Apple product.”

“He Took Away The Country’s Top AAA Rating In 2011. He Ended Up Fearing For His Life” (NPR). “More than a decade ago, John B. Chambers and his colleagues at Standard & Poor's made a momentous decision: They were going to strip the United States of its cherished AAA credit rating. Going into it, Chambers, who led the powerful committee at S&P that rates the creditworthiness of more than 100 countries, knew it would be a huge deal.”

“Days Of Plunder” (The American Prospect). “PetSmart could not afford to treat or euthanize or even cremate its pets, even though sales jumped more than 60 percent and gross margins soared to unprecedented heights during the pandemic, because its owners had legally stolen $30 billion from the balance sheet, buying the company with a minuscule down payment, siphoning off cash and assets into its own pockets, and forcing the retailer to submit to a punishing payback plan that sucks every last penny the stores generate into usurious interest payments.”

“Why AI Will Save The World” (Marc Andreessen). “What AI offers us is the opportunity to profoundly augment human intelligence to make all of these outcomes of intelligence – and many others, from the creation of new medicines to ways to solve climate change to technologies to reach the stars – much, much better from here.”

What we’re reading (6/4)

“Bearish Bets Against S&P 500 Are Surging, Despite Love for Big Tech” (Wall Street Journal). “Wall Street hasn’t been this bearish on the stock market in more than a decade. Tech shares are a different story. Hedge funds and other speculative investors have built up a big bet that the S&P 500 will decline, marking their most bearish positioning since 2007. At the same time, they are preparing for a rally in the technology-focused Nasdaq-100, with net bullish wagers in recent weeks approaching the highest levels since late last year.”

“Want To Know Why Younger Generations Seem So Pissed? Look At The Housing Market.” (Insider). “You see it in survey results. You sense it in anti-capitalist TikTok videos. You hear about it when talking to your friends or colleagues, or if you're a parent of a 20-something or 30-something, from your kids. This economy has younger Americans on edge.”

“The S&P 500 Finally Broke Through A Key Level. Now What?” (CNN Business). “The S&P 500 index on Friday closed at its highest level in almost a year. But that doesn’t mean that stocks are poised for a bull run just yet. The broad-based index on May 26 closed above the 4,200 level for the first time since August 2022, when the market began to sell off and fell sharply to last year’s low of about 3,577 in October. The S&P 500 ended last week up 1.8% at about 4,282, marking its best weekly gain since late March.”

“Borrowers Brace For Student Loan Bills To Resume — ‘$600 A Month, Where Is That Going To Come From?’” (CNBC). “The more than three-year-long pause on federal student loan payments is slated to finally conclude within months. The Biden administration is preparing borrowers for their payments to resume by September, even while its loan forgiveness program is halted as the Supreme Court debates its validity. The debt ceiling deal passed by Congress also includes a provision officially terminating the pandemic-era relief policy and making it harder for the U.S. Department of Education to extend it.”

“The New York Times’ Elizabeth Holmes Profile Is Causing Drama in the Newsroom: ‘What the Hell Happened Here?’” (Vanity Fair). “In the feature, ‘Liz Holmes Wants You to Forget About Elizabeth,’ the convicted fraudster was described by writer Amy Chozick as ‘an authentic and sympathetic person’ and a ‘devoted mother’ who has been ‘volunteering for a rape crisis hotline’ for the past year. ‘She didn’t seem like a hero or a villain. She seemed, like most people, somewhere in between,’ Chozick writes. The piece came under scrutiny for, among other things, being overly credulous, which Chozick acknowledges in the piece, admitting that her own editor—business editor Ellen Pollock—had called her out for getting ‘rolled.’”

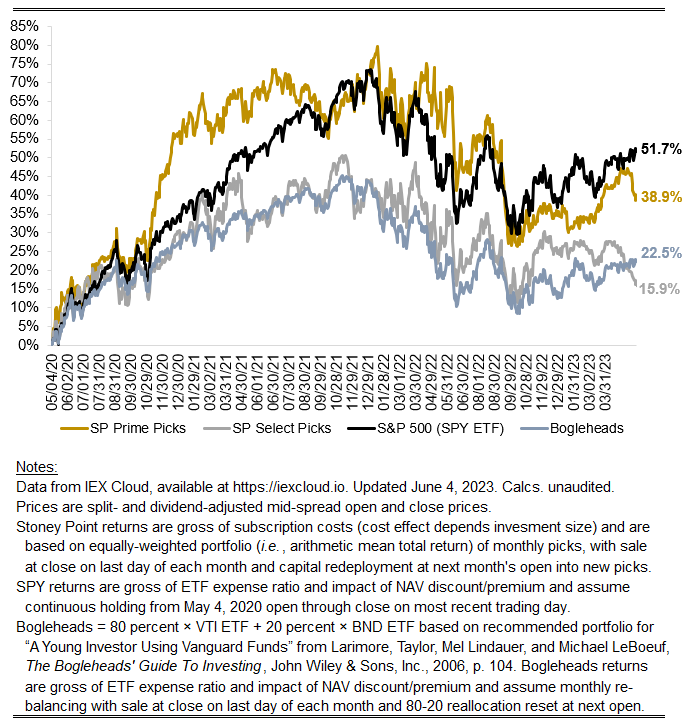

May 2023 performance update

Welp, that was a rough month.

Prime: -5.09%

Select: -7.42%

SPY ETF: +0.57%

Bogleheads Portfolio (80% VTI, 20% BND): +0.31%

Both my model portfolios got smoked in May. On both the Prime side and the Select side, there were some bad earnings results that surely could have been diversified away in a less concentrated portfolio. Widely diversified portfolios were flattish (note the SPY ETF and Bogleheads results above). That flattish-ness masks considerable variation among individual names under the hood. A few days ago I posted an article from Institutional Investor entitled “Is the Era of Large-Cap Growth Stocks Over?”, which observed the following:

Only 28 percent of companies in the S&P 500 have managed to outperform the index year-to-date, compared to 59 percent in 2022, 49 percent in 2021, and 36 percent in 2020, according to RBA’s latest research. Between 2007 and May 2023, the median percentage of stocks that have outperformed the S&P 500 index is 48 percent.

That stylized fact was equally true in May. Being a capitalization-weighted index, the returns of the largest constituent stocks dominate the S&P 500’s overall returns. At present, those stocks are generally the big tech stocks. As of May 4, Apple, Microsoft, Meta, Amazon, Nvidia, Google Class A, and Google Class C, represented 7.28%, 6.60%, 1.55%, 2.68%, 2.02%, 1.82%, and 1.60% of the index, respectively. In total, that means nearly a quarter of the S&P 500’s May return was determined by just these six stocks (or seven classes of stock). And these seven issues were on fire in may, up 5.00%, 7.45%, 10.94%, 14,89%, 35.90%, 15.00% and 14,53%, respectively. If you do the math, that means the remaining part of the index returned -2.72%. That is something of an odd result, suggesting significant divergence between large-cap tech, on the one hand, and everyone else. Those results make just being long Big Tech a seductive option, but a la the early 2000s a precarious one. Big trees fall hard, after all. A more defensible approach is to just “buy the haystack” (to make sure you get the needle even if you get a lot of hay) a la Vanguard, et al., but the goal here is to see if there is a way to beat the haystack, and that can only be reliably answered over long periods of time. I’m watching with bated breath to see if the rest of 2023 just turns out to be a big tech party, but we’ll see.

Stoney Point Total Performance History

What we’re reading (6/3)

“Online Banks Are Winning The Deposit War” (Wall Street Journal). “Deposits in the first quarter fell from December at regional-bank powerhouses such as U.S. Bank, Truist Financial and Citizens Financial. They were down more sharply at the smaller regional banks that have been under investor scrutiny, like Western Alliance and PacWest. But deposits were up quarter over quarter at Ally Financial and Goldman Sachs Group’s online bank Marcus, which don’t have branch networks. Deposits were also up at Capital One, which has far fewer branches than the other big regionals.”

“Markets Sense The Inflation ‘Clock Is Running’” (Deutsche Bank). “Over the past week or so, 5y5y breakevens and inflation swaps have risen, particularly relative to the levels implied by fundamental drivers like oil prices. Our models show the highest positive residuals for these market gauges versus oil – consistent with an inflation premium embedded in the former – in quite some time. Indeed, 5y5y inflation swaps are the furthest above levels implied by oil since 2017.”

“Will a Dollar General Ruin A Rural Crossroads?” (New York Times). “Anne Hartley’s brick house in Ebony, Va., overlooks windswept fields, a Methodist church, a general store and the intersection of two country roads, a pastoral setting that evokes an Edward Hopper painting or a faded postcard from the South. Now this scene is being threatened, Ms. Hartley said, by a plan to build what every small American town seems to have: a Dollar General.”

“‘It’s Like Watching A Snuff Film’: Media Elites Shocked By The Atlantic’s Surgical Dismantling Of CNN Boss Chris Licht” (Insider). “‘Let's get real. The problem isn't Licht, it’s his paymasters. The American billionaire class has convinced themselves that the way to save journalism is to make it as bland and as both-sidesy as possible. They chose Licht as their latest champion of harmless vanilla inoffensiveness. The problem is, no one wants vanilla. Not even a tasting spoon of it.’”

“Inside The Meltdown At CNN” (The Atlantic). “CEO Chris Licht felt he was on a mission to restore the network’s reputation for serious journalism. How did it all go wrong?”

What we’re reading (6/2)

“When Markets Melt Down, These Traders Cash In” (Wall Street Journal). “Statistically, the move was virtually unquantifiable, one that shouldn’t have occurred in the history of the universe, or 10 universes—in a normal world. As Taleb was learning, in finance things were often far from normal, and those who assumed they were normal would get them wrong again and again.”

“Former Google Exec Warns Of Global AI Catastrophe Within Two Years” (The Byte). “Former top Google exec Mo Gawdet, who once led the Silicon Valley behemoth's Google X ‘moonshot’ division, is very stressed about AI. ‘It is beyond an emergency,’ Gawdat said in a new interview on a podcast called ‘The Diary of a CEO,’ hosted by Stephen Bartlett. ‘It's the biggest thing we need to do today. It's bigger than climate change, believe it or not.’”

“We Just Got 2 Alarming Signals That An Economic Slowdown Is Upon Us” (Insider). “There are new signs the American consumer is pulling back on spending right now, reaffirming fears of an economic downturn widely expected to end in recession. The first of two jarring pieces of evidence comes in the form of first-quarter earnings from Dollar General. The discount retailer turned in a dismal report that included a cut to full-year sales and profit forecasts…a bit further up the affluence scale, Macy's turned in an earnings stinker of its own.”

“Airbnb Sues New York City Over Its Short-Term Rental Restrictions” (CNN Business). “In a lawsuit filed in state court Thursday, Airbnb said the ‘extreme and oppressive regulatory scheme’ operates as a ‘de facto ban against short-term rentals in New York City.’ The company also argued that the city’s restrictions around Airbnb hosting are overly complex.”

“How Winning (Or Losing) A Grammy Changes The Music Artists Make” (Behavioral Scientist). “[A]fter winning a Grammy, artists tend to release music that deviates stylistically from their own previous work, as well as from other artists in their genre. Nominees who lose do the opposite—their subsequent albums trend toward the mainstream. We think this happens because winning a Grammy grants an artist more leverage to pursue their personal artistic inclinations. Nonwinners, however, might interpret their loss as a negative signal about how their artistic choices deviated from the norm, and thus feel more bound to conventions of their genre.”

What we’re reading (6/1)

“Will Google’s AI Plans Destroy The Media?” (Intelligencer). “For publishers, however — of news, how-to content, reviews, recommendations, reference material, and a range of other content one might describe as existing to “distill complex information and multiple perspectives into easy-to-digest formats” — it [Google’s AI-augmented search engine] looked like nothing less than an existential crisis. Google was getting into content, automating the work of its partners, and dramatically altering the terms of its informal deal with publishers that has sustained digital media for years: You make content; we send traffic; everyone sells ads. If this wasn’t a threat to journalism directly, it was certainly a threat to the journalism business. Google, it seemed, was eager to cut the publishers out.”

“Banks Raise Roadblocks To Small-Business Loans” (Wall Street Journal). “Some entrepreneurs are finding it more difficult to get a new loan or have had existing credit lines cut. Others report stricter terms, higher borrowing costs, longer waits and tougher questions from their bankers. ‘They are definitely being more conservative,’ said Brock Hutchinson, chief executive officer of Big Frig, a maker of coolers and drinkware in North Sioux City, S.D. ‘Things have tightened up.’”

“Short Selling Makes Markets Work Better. So Why Do Banks Want To Outlaw It?” (Los Angeles Times). “The very human instinct to seek scapegoats for every crisis is playing out again on Wall Street. As so often happens, this time the target is short selling, which supposedly is helping to drive banking stocks lower. As so often also happens, the loudest cries for relief are coming from the people most responsible for the stocks’ decline — in this case, banking executives themselves.”

“Do We Really Need An App For Everything?” (Vox). “It really does feel like there’s an app for everything these days — often for things where they’re not really needed. We all managed to do business with each other for years and years without having to pull out our phones at every corner.”

“Elon Musk Is Accused Of Insider Trading By Investors In Dogecoin Lawsuit” (Reuters). “In a Wednesday night filing in Manhattan federal court, investors said Musk used Twitter posts, paid online influencers, his 2021 appearance on NBC's ‘Saturday Night Live’ and other ‘publicity stunts’ to trade profitably at their expense through several Dogecoin wallets that he or Tesla controls.”

June picks available now

The new Prime and Select picks for June are available starting now, based on a model run put through today (May 31). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Thursday, June 1, 2023 (at the mid-spread open price) through the last trading day of the month, Friday, June 30, 2023 (at the mid-spread closing price).

What we’re reading (5/30)

“Twitter Is Now Worth Just 33% Of Elon Musk’s Purchase Price, Fidelity Says” (Bloomberg). “Musk has acknowledged he overpaid for Twitter, which he bought for $44 billion, including $33.5 billion in equity. More recently, he said Twitter is worth less than half what he paid for it. It’s unclear how Fidelity arrived at its new, lower valuation or whether it receives any non-public information from the company.”

“To Work Fewer Hours, They Put AI On The Job” (Wall Street Journal). “Numerous workers, especially freelancers and small-business owners who are free of the legal hurdles in large companies, have already started using generative AI tools to save time. They say they’ve been struck by how the new technologies, including image and text generators, allow them to expand and speed up what they do, freeing them to take on new projects and make more money.”

“Is The Era Of Large-Cap Growth Stocks Over?” (Institutional Investor). “Only 28 percent of companies in the S&P 500 have managed to outperform the index year-to-date, compared to 59 percent in 2022, 49 percent in 2021, and 36 percent in 2020, according to RBA’s latest research. Between 2007 and May 2023, the median percentage of stocks that have outperformed the S&P 500 index is 48 percent.”

“Tech Stock Hail Mary” (Smead Capital Management). “We are very late in one of the greatest growth stock investing games in history. Technology, an investment sector with a few huge winners and mostly flame-out startups, has been on a roll dominated by the largest companies in the sector. These largest wide-moat monopoly stocks have feasted on nearly uninterrupted momentum. However, this tech stock investing era included the cheapest interest rates in my lifetime, which came to a screeching halt in late 2021.”

“Why Don’t More Voters Care About The Debt Ceiling?” (Vox). “Though there are reports that an agreement is near, a lot could go wrong if congressional Republicans and the White House are unable to work out a deal to raise the debt ceiling by late next week. At some point in the next few weeks, checks from the federal government would stop going out since the country wouldn’t be able to pay its bills. Interest rates would rise, the stock market would fall, and the country would likely enter a recession potentially resulting in millions of job losses. But do most Americans know this? And who would they blame for the economic calamity that would ensue?”

June picks available soon

We’ll be publishing our Prime and Select picks for the month of June before Thursday, June 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of May, as well as SPC’s cumulative performance, assuming the sale of the May picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Wednesday, May 31). Performance tracking for the month of June will assume the June picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Thursday, June 1).

What we’re reading (5/28)

“Tech Stock Rally Leaves Small-Caps In The Dust” (Wall Street Journal). “The Russell 1000 index of large companies has gained 9.2% this year, beating the 0.7% advance of the small cap concentrated Russell 2000. That is the widest outperformance since 1997, when looking at years in which the Russell 1000 has been in positive territory through May 26, Dow Jones Market Data show.”

“The Tech Trade Is Back, Driven By A.I. Craze And Prospect Of A Less Aggressive Fed” (CNBC). “‘Being concentrated in these mega-cap tech stocks has been where to be in this market,’ said Victoria Greene, chief investment officer of G Squared Private Wealth, in an interview on CNBC’s ‘Worldwide Exchange’ Friday morning. ‘You cannot deny the potential in AI, you cannot deny the earnings prowess that these companies have.’”

“As Debt Ceiling Negotiators Finalize Deal, The Nation Watches Anxiously” (Washington Post). “President Biden and House Speaker Kevin McCarthy (R-Calif.) announced late Saturday that they had reached an ‘agreement in principle’ to raise the debt ceiling and cap federal spending. But that deal still needs congressional approval to prevent a government default, and lawmakers in both parties have been raising objections over the past week.”

“Jeff Bezos Mid-Life Crisis Rumors Resurface After Lauren Sanchez Proposal” (New York Post). “Bezos now appears to be having a “mid-life crisis to end them all’[.]”

“Do Tax Increases Tame Inflation?” (Marginal Revolution). “Here is a new AER article by James Cloyne, Joseba Martinez, Haroon Mumtax, and Paolo Surico. After an extensive data analysis, they arrive at this conclusion: ‘Based on US federal tax changes post–World War II, our answer is ‘yes’ if personal income taxes are increased but ‘no’ if corporate income taxes are increased. Of course this is consistent with the view — no longer so commonly admitted — that higher corporate tax rates do have negative supply side effects.”

What we’re reading (5/25)

“A Beginner’s Guide To Getting Away With Accounting Fraud, Part Two” (Financial Times). “Bio-On’s billion-euro valuation largely hinged on its claim to have come up with a revolutionary new way of manufacturing a biodegradable plastic. The compound it planned on making had been around for about a century but Bio-On claimed it could produce it at something like a tenth of the cost anyone else had managed. Or maybe not, as it turned out.”

“Mark Zuckerberg Unveils ‘Scrappier’ Future At Meta After Layoffs” (Washington Post). “Meta chief executive Mark Zuckerberg attempted to rally the troops on Thursday, following multiple rounds of layoffs that have decimated the social media giant’s workforce. Zuckerberg told employees during a companywide meeting that he hopes the Facebook parent company will have more stability but less bureaucracy in the future, according to a recording of the call listened to by The Washington Post.”

“Gas Prices Give Drivers A Reprieve Heading Into Memorial Day Weekend” (Wall Street Journal). “The average price of unleaded gasoline in the U.S. was $3.57 a gallon on Thursday, down 22% from a year ago, according to OPIS, an energy-data and analytics provider.”

“‘Price Bubble’ In A.I. Stocks Will Wreck Rally, Economist David Rosenberg Predicts” (CNBC). “Investors piling into stocks with artificial intelligence exposure may pay a hefty price. Economist David Rosenberg, a bear known for his contrarian views, believes enthusiasm surrounding AI has become a major distraction from recession risks.”

“Elon Musk Can Now Put His Brain Implants In Humans” (Insider). “Elon Musk finally got approval from the Food and Drug Administration to start implanting his company's brain chips in humans, Neuralink announced Thursday.”

What we’re reading (5/24)

“Nvidia Barrels Toward Rare $1 Trillion Valuation After Putting A Dollar Figure On AI Boost” (MarketWatch). “Nvidia Corp. headed toward market-capitalization gains of nearly $200 billion in after-hours trading Wednesday, which could put the chip maker within sight of becoming only the seventh U.S. company to top a valuation of $1 trillion.

Nvidia shares jumped 25% in the extended session Wednesday, after executives predicted that revenue would exceed the company’s record by more than 30% in the current quarter.”“‘I Came To Kill The Banks.’ Meme-Stock Traders Find A New Passion.” (Wall Street Journal). “The sharp turns [for banks] have been exaggerated by the same forces that turbocharged GameStop and AMC a couple of years ago: the lightning-fast spread on social media of both fact and rumor, strong interest from individual investors and the use of options and other tools that can amplify the impact of trades.”

“First Republic Wealth Advisors Voted With Their Feet–And It Wasn’t For JPMorgan” (Forbes). “Depositors and shareholders weren’t the only ones fleeing San Francisco-based First Republic Bank before it was seized by regulators and sold to JPMorgan. As a crisis of confidence enveloped regional and specialized U.S. banks, especially those with significant levels of uninsured deposits, First Republic’s wealth-management advisors also headed for the exits”

“Do Americans Really Want “Unbiased” News?” (Vox). “Both companies [the Messenger and CNN] are trying to position themselves as an antidote to ‘biased media,’ and promise to deliver down-the-middle news. The problem is there’s not much evidence that people are clamoring for that, which makes it hard to envision a light at the end of the tunnel for either company.”

“Working From Home And Realizing What Matters” (Paul Krugman, New York Times). “[I]t’s not hard to make the case that the overall benefits from not commuting every day are equivalent to a gain in national income of at least one and maybe several percentage points. That’s a lot: There are very few policy proposals likely to produce gains on that scale. And yes, these are real benefits. C.E.O.s may rant about lazy or (per Musk) ‘immoral’ workers who don’t want to go back into their cubicles, but the purpose of an economy is not to make bosses happy.”

What we’re reading (5/23)

“A Housing Bust Comes For Thousands Of Small-Time Investors” (Wall Street Journal). “Over the past four years, Gajavelli built his real-estate empire using funds from dozens of small investors who wanted a chance to earn a landlord’s riches without any of the work. He pitched double-your-money returns in ebullient, can-do talks at investor conferences and on YouTube videos…In April, Gajavelli’s company lost more than 3,000 apartments at four rental complexes taken in foreclosure, one of the biggest commercial real-estate blowups since the financial crisis. Investors lost millions. Gajavelli didn’t respond to requests for comment.”

“It’s About To Get Incredibly Expensive To Watch Sports” (Intelligencer). “For years, all of you non-sports fans have been subsidizing us: By paying your hidden eight bucks a month for a channel you didn’t watch, you allowed us to pay the same amount for channels we watched obsessively. But if ESPN, the unquestioned T.Rex of the sports media world, is separating from the cable model, that eight bucks a month will have to be made up from somewhere. The plan appears to be charging me, and my fellow sports addicts, a lot more.”

“The Surprising Reason Luxury Goods Are Booming” (Vox). “The pandemic was a period of mass unemployment and economic hardship for many Americans. It was also a riotously popular time for buying luxury goods. ‘2021 and 2022 were blockbuster years for the luxury industry,’ says Lauren Sherman, fashion correspondent at Puck News. ‘The biggest years they’ve ever had — ever.’”

“Why Inflation Erupted: Two Top Economists Have The Answer” (Wall Street Journal). “Now two of the country’s top economists have an answer: It’s both. Pandemic-related supply shocks explain why inflation shot up in 2021. An economy overheated by fiscal stimulus and low interest rates explain why it has stayed high ever since. The conclusion: For inflation to fade, the economy has to cool off, which means a weaker labor market.”

“Former Fed Chair Ben Bernanke Says There’s More Work Ahead To Control Inflation” (CNBC). “Former Federal Reserve Chair Ben Bernanke, who guided the central bank and the U.S. economy through the Great Recession, thinks central bankers still have work to do to bring down inflation. That work, he and economist Olivier Blanchard argue in an academic paper released Tuesday, will entail slowing down what has been a phenomenally resilient labor market.”

What we’re reading (5/22)

“What It Would Mean For The Global Economy If The US Defaults On Its Debt” (Associated Press). “The repercussions of a first-ever default on the federal debt would quickly reverberate around the world. Orders for Chinese factories that sell electronics to the United States could dry up. Swiss investors who own U.S. Treasurys would suffer losses. Sri Lankan companies could no longer deploy dollars as an alternative to their own dodgy currency.”

“Slow Return To Work Pummels Office Stocks” (Wall Street Journal). “Both Vornado and SL Green shares are down more than 30% so far this year, while the broader stock market is higher.”

“Office Workers Don’t Hate The Office. They Hate The Commute.” (New York Times). “For many, the pandemic-era shift to remote work proved that all the schlepping was unnecessary. They can’t unsee all the wasted time, and questioning their morality isn’t going to change that. They aren’t taking a moral stance; they’re just making a rational calculation: They can get a lot more done — in their work lives and in the rest of their lives — if they skip the commute.”

“Employees Say Returning To The Office Is Breaking The Bank. Here’s What's Costing Them So Much” (Insider). “Frustrated workers are sounding off that cost of office clothes, daily lunches, commuting, and more are all adding up as they start going into the office multiple times per week. Jessica Chou of the Wall Street Journal reported spending between 20% and 30% of her paycheck when asked to report for work at the office.”

“Rigor, Not Speed, Should Define The Silicon Valley Of The Future” (RealClear Markets). “[I]n March 2023, the company [HP] found itself in a British court. At the heart of the case was the 2011 sale by British tech entrepreneur Mike Lynch of Autonomy, the company he founded, to HP for $11.7 billion…Now U.S. authorities are seeking the extradition of Mr. Lynch to the United States. The Justice Department alleges that he misled HP and its shareholders about Autonomy’s financial condition ahead of the sale…[t]his transaction continues to resonate because HP acquired Autonomy at a steep premium, one that many HP shareholders deemed excessive at the time. Later, when HP came to realize the shambolic state of Autonomy, the company had to take a nearly $9 billion write-down…HP’s then-CEO Léo Apotheker admitted in court that he did not read KPMG’s due-diligence reports on Autonomy, or even the company’s quarterly financial statements, before purchasing it. Its then-Chief Financial Officer admitted that she did not read the documents either.”

What we’re reading (5/20)

“Will The U.S. Economy Pull Off A ‘Soft Landing’?” (Paul Krugman, New York Times). “[A]t this point policymakers are more or less expected to achieve results that would have seemed wildly unrealistic for most of the past 40 years: 2 percent inflation and unemployment in the mid-3s.”

“The Optimist’s Guide To Artificial Intelligence And Work” (DealBook). “David Autor, a professor of economics at the Massachusetts Institute of Technology, said that A.I. could potentially be used to deliver ‘expertise on tap’ in jobs like health care delivery, software development, law, and skilled repair. ‘That offers an opportunity to enable more workers to do valuable work that relies on some of that expertise,’ he said.”

“What The Debt Ceiling Debate Means For Your Finances” (The Week). “The ongoing showdown over raising the debt limit could have serious implications for Americans' finances. The U.S. has never defaulted on its debt obligations since the establishment of the U.S. Treasury in 1789. However, experts contend that even just nearing — let alone passing — the point of default could rock Americans’ retirement plans.”

“A New Class Of Executives On Wall Street Is Gaining A Ton Of Power” (Insider). “It's true major decisions about where to use AI will involve CEOs and heads of tech, but the day-to-day strategy is largely left to these behind-the-scenes players. That means these executives will be tasked with making choices that have the potential to impact thousands of jobs.”

“Young Investors In College Clubs Embrace Wild Market Ride” (Wall Street Journal). “Investment clubs might not be as ubiquitous as Greek life or intramural sports, but they are fixtures at colleges around the U.S.—big and small, public and private. Lafayette College’s club says it is the oldest student-run investment club in the country, established in 1946 with $3,000 and now managing roughly $1 million.”

What we’re reading (5/19)

“Fed Chair Powell Says Rates May Not Have To Rise As Much As Expected To Curb Inflation” (CNBC). “Powell spoke with markets mostly expecting the Fed at its June meeting to take a break from the series of rate hikes it began in March 2022. However, pricing has been volatile as Fed officials weigh the impact that policy has had and will have on inflation that in the summer of last year was running at a 41-year high. On balance, Powell said inflation is still too high.”

“Markets Continuously Project Lower Rates...Much Lower” (RealClear Markets). “Several serious questions remain yet to be answered in the aftermath of recent bank failures. While politicians wrestle over who might be to blame, they’ll never come up with a useful answer anyway and far more important is what this will all do to a global system already in rough shape. The possibility of at least recession was already high to begin with before anyone came to know the name Silicon Valley Bank.”

“Americans’ Views Of Federal Income Taxes Worsen” (Gallup). “The 60% of Americans who say the amount of federal income tax they pay is too high is up six percentage points from a year ago and 15 points from the recent low measured in 2018 and 2019. Meanwhile, 36% of Americans say their federal income tax payments are “about right,” while 3% say they are ‘too low.’”

“America’s Semiconductor Boom Faces A Challenge: Not Enough Workers” (New York Times). “Semiconductor manufacturers say they will need to attract more workers…to staff the plants that are being built across the United States. America is on the cusp of a semiconductor manufacturing boom, strengthened by billions of dollars that the federal government is funneling into the sector. President Biden had said the funding will create thousands of well-paying jobs, but one question looms large: Will there be enough workers to fill them?”

“Mutual Fund Manager May Not Have Meant To Lose Investors $20 Million, But He’s Going To Jail Anyway” (Dealbreaker). “Give Ofer Abarbanel this much: He understands that the point of mutual fund is to make, and not to lose, money. We know this because he said as much…emotionality notwithstanding, saying he didn’t mean to lose them money while asking for probation and community services doesn’t sound like accepting responsibility for his crime, which was not, after all, losing Mosaic money—which is not, after all and to the great relief of mediocre and worse mutual fund managers everywhere, illegal—but lying to it.”

What we’re reading (5/18)

“Crypto: New. Fraud: Old.” (Vox). “Crypto’s utopic vision can be an attractive one: a completely decentralized, egalitarian, anonymous ecosystem. It’s intended to be trustless, meaning that it runs without relying on the government or banks or any third party. It’s also, at least for now, not entirely a reality.”

“Home Prices Posted Largest Annual Drop In More Than 11 Years In April” (Wall Street Journal). “The national median existing-home price fell 1.7% in April from a year earlier to $388,800, the biggest year-over-year price decline since January 2012, NAR said.”

“A Secretive Annual Meeting Attended By The World’s Elite Has A.I. Top Of The Agenda” (CNBC). “The three-day event, which this year runs from Thursday to Sunday, is shrouded in mystery, with clandestine talks held behind closed doors and subject to Chatham House rules, meaning the identity and affiliation of speakers must not be disclosed.”

“Netflix Stock Jumps 9% As It Boasts Ad-Tier Growth” (CNBC). “The streaming service this week said it had five million monthly active users for its cheaper, ad-supported option and 25% of its new subscribers were signing up for the tier in areas where it’s available.”

“Billionaire George Soros’ 7 Top Stock Picks In 2023” (U.S. News & World Report). “Soros is considered one of the most successful investors in history. His Soros Fund Management currently manages $6.5 billion in assets, and Soros himself has an estimated net worth of $6.7 billion after donating more than $32 billion to philanthropic causes.”