What we’re reading (5/20)

“Will The U.S. Economy Pull Off A ‘Soft Landing’?” (Paul Krugman, New York Times). “[A]t this point policymakers are more or less expected to achieve results that would have seemed wildly unrealistic for most of the past 40 years: 2 percent inflation and unemployment in the mid-3s.”

“The Optimist’s Guide To Artificial Intelligence And Work” (DealBook). “David Autor, a professor of economics at the Massachusetts Institute of Technology, said that A.I. could potentially be used to deliver ‘expertise on tap’ in jobs like health care delivery, software development, law, and skilled repair. ‘That offers an opportunity to enable more workers to do valuable work that relies on some of that expertise,’ he said.”

“What The Debt Ceiling Debate Means For Your Finances” (The Week). “The ongoing showdown over raising the debt limit could have serious implications for Americans' finances. The U.S. has never defaulted on its debt obligations since the establishment of the U.S. Treasury in 1789. However, experts contend that even just nearing — let alone passing — the point of default could rock Americans’ retirement plans.”

“A New Class Of Executives On Wall Street Is Gaining A Ton Of Power” (Insider). “It's true major decisions about where to use AI will involve CEOs and heads of tech, but the day-to-day strategy is largely left to these behind-the-scenes players. That means these executives will be tasked with making choices that have the potential to impact thousands of jobs.”

“Young Investors In College Clubs Embrace Wild Market Ride” (Wall Street Journal). “Investment clubs might not be as ubiquitous as Greek life or intramural sports, but they are fixtures at colleges around the U.S.—big and small, public and private. Lafayette College’s club says it is the oldest student-run investment club in the country, established in 1946 with $3,000 and now managing roughly $1 million.”

What we’re reading (5/19)

“Fed Chair Powell Says Rates May Not Have To Rise As Much As Expected To Curb Inflation” (CNBC). “Powell spoke with markets mostly expecting the Fed at its June meeting to take a break from the series of rate hikes it began in March 2022. However, pricing has been volatile as Fed officials weigh the impact that policy has had and will have on inflation that in the summer of last year was running at a 41-year high. On balance, Powell said inflation is still too high.”

“Markets Continuously Project Lower Rates...Much Lower” (RealClear Markets). “Several serious questions remain yet to be answered in the aftermath of recent bank failures. While politicians wrestle over who might be to blame, they’ll never come up with a useful answer anyway and far more important is what this will all do to a global system already in rough shape. The possibility of at least recession was already high to begin with before anyone came to know the name Silicon Valley Bank.”

“Americans’ Views Of Federal Income Taxes Worsen” (Gallup). “The 60% of Americans who say the amount of federal income tax they pay is too high is up six percentage points from a year ago and 15 points from the recent low measured in 2018 and 2019. Meanwhile, 36% of Americans say their federal income tax payments are “about right,” while 3% say they are ‘too low.’”

“America’s Semiconductor Boom Faces A Challenge: Not Enough Workers” (New York Times). “Semiconductor manufacturers say they will need to attract more workers…to staff the plants that are being built across the United States. America is on the cusp of a semiconductor manufacturing boom, strengthened by billions of dollars that the federal government is funneling into the sector. President Biden had said the funding will create thousands of well-paying jobs, but one question looms large: Will there be enough workers to fill them?”

“Mutual Fund Manager May Not Have Meant To Lose Investors $20 Million, But He’s Going To Jail Anyway” (Dealbreaker). “Give Ofer Abarbanel this much: He understands that the point of mutual fund is to make, and not to lose, money. We know this because he said as much…emotionality notwithstanding, saying he didn’t mean to lose them money while asking for probation and community services doesn’t sound like accepting responsibility for his crime, which was not, after all, losing Mosaic money—which is not, after all and to the great relief of mediocre and worse mutual fund managers everywhere, illegal—but lying to it.”

What we’re reading (5/18)

“Crypto: New. Fraud: Old.” (Vox). “Crypto’s utopic vision can be an attractive one: a completely decentralized, egalitarian, anonymous ecosystem. It’s intended to be trustless, meaning that it runs without relying on the government or banks or any third party. It’s also, at least for now, not entirely a reality.”

“Home Prices Posted Largest Annual Drop In More Than 11 Years In April” (Wall Street Journal). “The national median existing-home price fell 1.7% in April from a year earlier to $388,800, the biggest year-over-year price decline since January 2012, NAR said.”

“A Secretive Annual Meeting Attended By The World’s Elite Has A.I. Top Of The Agenda” (CNBC). “The three-day event, which this year runs from Thursday to Sunday, is shrouded in mystery, with clandestine talks held behind closed doors and subject to Chatham House rules, meaning the identity and affiliation of speakers must not be disclosed.”

“Netflix Stock Jumps 9% As It Boasts Ad-Tier Growth” (CNBC). “The streaming service this week said it had five million monthly active users for its cheaper, ad-supported option and 25% of its new subscribers were signing up for the tier in areas where it’s available.”

“Billionaire George Soros’ 7 Top Stock Picks In 2023” (U.S. News & World Report). “Soros is considered one of the most successful investors in history. His Soros Fund Management currently manages $6.5 billion in assets, and Soros himself has an estimated net worth of $6.7 billion after donating more than $32 billion to philanthropic causes.”

What we’re reading (5/17)

“Can We Count On The Government To Do Something About AI?” (Vox). “Big Tech moves fast. DC doesn’t…Many federal lawmakers have learned that Big Tech and social media companies can operate recklessly when guardrails are self-imposed. But those lessons haven’t resulted in much by way of actual laws, even after the consequences of not having them became obvious and even when both parties say they want them.”

“Schwab Taps Credit Markets To Raise $2.5 Billion In Debt” (Wall Street Journal). “Schwab issued $1.2 billion of bonds due in 2029 and $1.3 billion of bonds due in 2034, according to a person familiar with the matter. The bonds due in 2029 were issued at a 5.643% yield, or 2.05 percentage point higher than U.S. Treasurys, while the notes due in 2034 were sold at a 5.853% yield or 2.27 percentage point spread.”

“Will The Fed Keep Interest Rates ‘Higher For Longer’?” (The Hill). “Given the muted transmission of Fed rate hikes via the interest rate, the asset-price, and the exchange-rate channels so far, a lot is riding on the credit and risk-taking channels. The ongoing banking sector turmoil is shrinking credit availability and raising lending standards.”

“JPMorgan Is Watching: How The Nation’s Largest Bank Keeps Tabs On Its Workforce — From Their Office Attendance To Emails And Zoom Calls” (Insider). “Last year, Insider correspondent Reed Alexander unearthed details about JPMorgan's monitoring systems by speaking to roughly a dozen people currently or recently employed by the bank. They explained how the bank tracks everything from office attendance to time spent on Zoom calls and composing emails. He documented what he learned in a series of stories, starting with the bank’s tracking of office attendance and culminating in a story about a proprietary system called the ‘Workforce Activity Data Utility,’ or WADU for short, that monitors the bank's computer laptops.”

“Toronto’s Proudly Anti-Capitalist Cafe Is Permanently Closing” (blogTO). “Sims-Fewer [the proprietor] uploaded a bittersweet message to the cafe’s website this week announcing the shop’s closure…‘Unfortunately, the lack of generational wealth/seed capital from ethically bankrupt sources left me unable to weather the quiet winter season, or to grow in the ways needed to be sustainable longer-term,’ the message continues.”

What we’re reading (5/16)

“Americans Curb Spending On Home Improvements” (Wall Street Journal). “Executives at Home Depot said such spending has cooled sharply this year, prompting the retailer to warn that its annual sales will decline for the first time since 2009. Homeowners are pinching pennies amid concerns about the economic outlook, and many people have completed most of the projects they wanted to accomplish during the pandemic.”

“Homebuilder Sentiment Pulls Out Of Negative Territory For The First Time In Nearly A Year” (CNBC). “Builder confidence in the market for newly built single-family homes rose 5 points in May to 50, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). It’s the fifth straight month of gains and the first reading of builder sentiment since July that wasn’t negative, which would be a reading below 50. Sentiment stood at 69 in May of last year.”

“Move Over, U.S. Dollar. China Wants To Make The Yuan The Global Currency.” (Washington Post). “The dollar’s widespread use makes it difficult to displace. Because it is widely used, it is easy to exchange, creating more incentive for countries to use it. This network effect encapsulates part of the challenge to adoption of the yuan, which is more expensive and inconvenient partly because there is less of it circulating outside China. But the recent flurry of settlements in yuan do constitute some progress toward Chinese leader Xi Jinping’s vision: with China at the helm of a global economic order that is insulated from the fluctuations of the dollar and Western sanctions.”

“Silicon Valley Bank Was Not Your Bank” (Slate). “Imagine that the government had left SVB deposits up to fate. In that event, why would anyone bank anywhere other than JPMorgan, Bank of America, Citigroup, Wells Fargo, and the like? There’s an extremely simple answer, which I am qualified to give, because I am a reasonably normal American person with a bank account, not a venture capital-funded startup or midsize company…Smaller banks offer higher rates to be competitive with the much better known, richer Goliaths of the industry. They can do it because they run leaner businesses with lower costs.”

“The “Return To The Office” Won’t Save The Office” (Vox). “The so-called “return to the office” has been underway for a while now, and it’s a bit of a mess. Sure, more people are going to the office more often than they were a year ago, but we’re still eons away from where we were before the pandemic. And despite the gains in office attendance, many office buildings themselves are in big trouble — some of which goes beyond remote work and started long before the pandemic. So despite what you’re hearing from some bosses, things will likely never go back to the way they were.”

What we’re reading (5/15)

“The Great Yield Chase: Why A Trillion Has Fled Traditional Bank Accounts” (Forbes). “‘The opportunity cost of zero interest checking didn't really matter two years ago, whereas now you're leaving decent yield and cash flow on the table by not moving cash around and being really opportunistic and thoughtful about it,’ says Margaret Wright, a managing director and senior wealth advisor at Truist Wealth in Atlanta. ‘We've all been so yield starved,’ she adds. ‘All of a sudden you see these percentages and people are excited.’”

“Where Can You Put Your Cash Besides A Bank Account?” (The Week). “Alternatives to traditional savings accounts might be especially worth considering if you have funds in excess of the amount covered by FDIC insurance (or NCUA insurance, if your money is at a credit union), or if you're hoping to earn slightly better returns. Plus, ‘the insurance limit has not changed since 2008 and is not indexed to inflation,’ Kiplinger points out.”

“Consumer Debt Passes $17 Trillion For The First Time Despite Slide In Mortgage Demand” (CNBC). “That increase came even though new mortgage originations, including refinancings, totaled just $323.5 billion, the lowest level since the second quarter of 2014. The total was 35% lower than in the fourth quarter of 2022 and 62% below the same period a year ago.”

“Egg Prices Are Crashing. Here’s Why” (CNN Business). “As of last week, Midwest large eggs — the benchmark for eggs sold in their shells — cost just $0.94 per dozen in the wholesale market, according to Urner Barry, an independent price reporting agency. That’s a sharp fall from $5.46 per carton just six months ago. (In retail, prices are well above $1 per carton, though they too have been declining.)”

“The Forever Labor Shortage” (Insider). “By any objective measure, the balance of power in the job market should be tipping back to employers. Strangely, though, it isn't. Ask pretty much anyone who's hiring these days, and they'll tell you something curious: It remains incredibly hard to find and hire enough qualified people for the roles they're desperately trying to fill. Somehow, workers still hold the power — and a massive shift that's underway in the labor market could keep it that way forever. The shift boils down to demographics.”

What we’re reading (5/14)

“Investors Are Nervous—And That Could Support Stocks” (Wall Street Journal). “Turmoil in the banking sector has dragged fund managers’ enthusiasm for stocks to a 2023 ebb, according to Bank of America’s most recent monthly survey. The stress adds to worries including lingering inflation, higher interest rates and a slowing economy that have driven them to cut their stockholdings to their lowest levels relative to bonds since 2009.”

“The Greatest Wealth Transfer In History Is Here, With Familiar (Rich) Winners” (New York Times). “In 1989, total family wealth in the United States was about $38 trillion, adjusted for inflation. By 2022, that wealth had more than tripled, reaching $140 trillion. Of the $84 trillion projected to be passed down from older Americans to millennial and Gen X heirs through 2045, $16 trillion will be transferred within the next decade.”

“How Germany’s Hydrogen Boom Stalled” (Der Spiegel). “Welcome to the sobering hydrogen reality. While Germany hopes that it will soon be able to run basement gas heating systems on hydrogen, steel manufacturers are converting their production to the green gas at a cost of billions and energy companies are planning new power plants that will generate electricity from hydrogen, almost everything needed to make the climate-neutral dreams a reality in the near future is still lacking. The environmentally friendly hydrogen is missing, as are the pipeline networks to carry it across the country, not to mention reliable business models.”

“The Real Reasons Stores Such As Walmart And Starbucks Are Closing In Big Cities” (CNN Business). “Nordstrom. Walmart. Whole Foods. Starbucks. CVS. These big chains and others have closed stores in major US cities recently, raising alarm about the future of retail in some of the country’s most prominent downtowns and business districts.”

“Why China Doesn’t Have A Property Tax” (New York Times). “In China, where the government owns the land, localities almost never tax homeowners to support services like schools. Cities rely instead on selling long-term leases to real estate developers. Revenue from these land sales has plunged in the past year.”

What we’re reading (5/12)

“Google Just Showed How Big Tech Will Win Again In AI” (Insider). “After Google I/O this week, it's looking like AI will be another 80/20 situation where a few Big Tech companies benefit the most. The big takeaway from Google's annual conference was how the company is weaving the capabilities of its big AI model, PaLM 2, into so many of its existing – and very popular – products.”

“Meet Linda Yaccarino, Elon Musk’s New Twitter CEO And The Ad World’s ‘Velvet Hammer’” (Wall Street Journal). “The billionaire [Musk] on Friday named Ms. Yaccarino as Twitter’s new chief executive, putting her in charge of a social-media platform that has been stung by a large exodus of advertisers since Mr. Musk’s $44 billion takeover late last year.”

“I Bond Rates Dropped To 4.3 Percent. Are They Still Worth It?” (Washington Post). “[W]ith inflation waning, Treasury just announced a new rate of 4.3 percent for I bonds, down from the most recent 6.89 percent that ended in April. Still, that’s a good rate, but it’s not likely to see a mad rush like last year. The lower rate is yet another indication inflation has come down.”

“‘Vehicular Crime Wave’: Baltimore Suing Kia And Hyundai Over Lack Of Anti-Theft Tech” (WBALTV11). “Thefts of those vehicles continue to trend in Maryland. Baltimore City police said car thefts are up 95% compared to this time last year, with Kias and Hyundais making up more than 40% of those stolen vehicles.”

“The S&P 500 Is Top-Heavy With Tech. Here’s What That Says About Future Stock-Market Returns.” (MarketWatch). “The S&P 500 is up more than 7% so far in 2023, after last year’s 19.4% slide. The top 10 stocks hold a 29% weight in the index, and are responsible for around 70% of year-to-date performance, said Ross Mayfield, investment strategy analyst at Baird, in a Thursday note.”

What we’re reading (5/11)

“What’s The Best-Performing Asset Type During A Recession?” (Morningstar). “The explanation for bonds’ strength during recessionary periods is twofold. The Federal Reserve often cuts interest rates during such periods, which boosts bond prices. Moreover, investors often retreat to safety, stability, and liquidity in periods of economic insecurity (high-quality bonds and cash) and away from assets they perceive to be higher risk (equities).”

“Tech’s New Business Model: ‘Do More With Less’” (CNBC). “Cost cuts that kicked into gear in late 2022 ramped up in the first quarter and are continuing into the second. Microsoft CEO Satya Nadella told staffers Wednesday there will be no salary increases for full-time employees, after the company announced 10,000 job cuts earlier this year.”

“26 Empire State Buildings Could Fit Into New York’s Empty Office Space. That’s a Sign.” (New York Times). “In downtowns from Chicago to Los Angeles, the physical layout of the 20th-century city is clashing with the new economy. Since the 1920s, single-use zoning has divided our cities into separate neighborhoods for home, work and play. Work-from-home and Netflix have made these distinctions irrelevant, but our partitioned urban fabric has yet to catch up.”

“SoftBank Says Goodbye To Alibaba, Hello To More AI Investments” (Wall Street Journal). “One of the world’s most influential tech investors, SoftBank has been in a defensive crouch for over a year, slashing its once profligate spending after many of its investments in startups went sour during the recent tech downturn.”

“The Greek Origins Of Modern Science” (Merchants and Mechanics). “The mathematical fact that we call Pythagoras’ theorem was known to the Babylonians at least 1200 years before Pythagoras was born. Why then do we call it Pythagoras’ theorem? Because facts and theorems are different. The mathematical fact antedates him, but the theorem is his. And herein lies the difference between Greek activities, which we are calling science, and what went before or elsewhere, which we do not call science. The Babylonians observed a mathematical regularity, and compiled or calculated tables of similar regularities. The Greeks…observed this mathematical regularity, and proved geometrically that it holds for all particular cases.”

What we’re reading (5/10)

“Repeat Bankruptcies Are Piling Up At Fastest Rate Since 2009” (Bloomberg). “The 11 repeat bankruptcies filed through April already tops the tally for all of 2021 or 2022 and the spate of Chapter 22 filings through the first four months of the year has been eclipsed only once since 2000, according to BankruptcyData…Ed Altman, a New York University finance professor and inventor of a popular default prediction metric, the Z-score, said firms too often leave Chapter 11 ‘looking like a failing company’ when it would be better for creditors to get paid in a liquidation. A second bankruptcy is a sign the first was a waste of capital, Altman said.”

“Icahn, Under Federal Investigation, Blasts Short Seller” (Wall Street Journal). “Icahn Enterprises IEP, the publicly traded firm controlled by Mr. Icahn, was targeted by short seller Hindenburg Research early this month. The next day, the U.S. Attorney’s Office for the Southern District of New York contacted Icahn Enterprises asking for information about the value of its assets, corporate governance, dividends and other topics, the firm said in a securities filing Wednesday.”

“Wealthy Americans Are Getting Hit Hardest By The Economy Slowing Down” (Yahoo! Finance). “Wealthier Americans aren't spending — or earning—like they used to. Data from Bank of America Institute out Wednesday reveals households making more than $125,000 have seen wage growth slow down faster than lower-income households while spending trends have followed a similar pattern. Higher-income households' discretionary spending on Bank of America credit and debit cards has slipped below lower- and middle-income groups since the start of this year.”

“DB Proxy Rate: Bank Lending Offsets Easing Financial Conditions” (Deutsche Bank). “There remains tremendous uncertainty about how recent bank stresses will evolve and how much they will tighten financial conditions. Based on our proxy rates, the further tightening in bank lending conditions has largely offset the easing from lower yields and other high-frequency variables but has not, on net, produced a further meaningful tightening. This update therefore raises some questions about whether tighter credit conditions will substitute for Fed rate increases as much as initially anticipated.”

“Electric Vehicle Illusions” (City Journal). “The rush to subsidize and mandate EVs is animated by a fatal conceit: the assumption that they will radically reduce CO2 emissions. That assumption is embedded orthodoxy not just among green pundits and administrators of the regulatory state but also among EV critics, who take issue with a forced transition mainly on grounds of lost freedoms, costs, and market distortions. But the truth is, because of the nature of uncertainties in global industrial ecosystems, no one really knows how much widespread adoption of EVs could reduce emissions, or whether they might even increase them.”

What we’re reading (5/9)

“ChatGPT Is Causing A Stock-Market Ruckus” (Wall Street Journal). “Investors are gauging the extent to which AI’s arrival will upend companies, industries and contemporary business practices—and placing bets accordingly. That has sent stocks swinging wildly in both directions: Chip maker Nvidia’s shares are surging, while shares of study-materials company Chegg have plummeted. Enthusiasm for the potential of AI is one reason big tech companies are among this year’s strongest performers.”

“Generative AI And Firm Values” (Eisfeldt, Schubert, and Zhang, NBER). “Using Artificial Minus Human portfolios that are long firms with higher exposures and short firms with lower exposures, we show that higher-exposure firms earned excess returns that are 0.4% higher on a daily basis than returns of firms with lower exposures following the release of ChatGPT. Although this release was generally received by investors as good news for more exposed firms, there is wide variation across and within industries, consistent with the substantive disruptive potential of Generative AI technologies.”

“Banking Stress Emerges As Major Concern For Financial Stability” (Washington Post). “Banking sector stress has shot up as a concern for stability in the financial system, according to the latest Federal Reserve survey on major risks to the economy.”

“Paramount Cuts 25 Percent Of Staff From TV Networks, MTV News Shutting Down” (The Hollywood Reporter). “Chris McCarthy’s swath of Paramount Global is laying off 25 percent of its domestic team today. The reduction comes on the heels of integrating Showtime into his cable and streaming purview, which will be consolidated into two functions going forward. There are ‘studios,’ which now combine Showtime with MTV Entertainment Studios, and ‘networks,’ which will merge nine separate teams into one portfolio group. The majority of the cuts are being felt by the latter group, with certain units, including MTV News, being shut down altogether.”

“Home Prices Fell In Third Of The U.S. During First Quarter” (Wall Street Journal). “Home prices fell in more parts of the U.S. than they have in over a decade during the first quarter, when nearly a third of metro areas posted annual price declines, the National Association of Realtors said Tuesday.”

What we’re reading (5/8)

“ChatGPT Fever Has Investors Pouring Billions Into AI Startups, No Business Plan Required” (Wall Street Journal). “While most of Silicon Valley’s venture-capital ecosystem remains in the doldrums, investors this year have been pouring funds into companies like Essential specializing in generative AI systems that can create humanlike conversation, imagery and computer code. Many of the companies getting backing are new and unproven.”

“Liz Holmes Wants You To Forget About Elizabeth” (New York Times). “Ms. Holmes has not spoken to the media since 2016, when her legal team advised she go quiet. And, as the adage goes, if you don’t feed the press, we feed on you. In Elizabeth Holmes, we found an all-you-can-eat buffet. It had everything: The black turtlenecks, the Kabuki red lipstick, the green juices, the dancing to Lil Wayne. Somewhere along the way, Ms. Holmes says that the person (whoever that is) got lost. At one point, I tell her that I heard Jennifer Lawrence had pulled out of portraying her in a movie. She replied, almost reflectively, ‘They’re not playing me. They’re playing a character I created.’”

“RIP Metaverse (Insider). “The Metaverse, the once-buzzy technology that promised to allow users to hang out awkwardly in a disorientating video-game-like world, has died after being abandoned by the business world. It was three years old.”

“Fed Survey: Banks Are Tightening Up Their Lending Standards After Rate Hikes, Turmoil” (CNN Business). “More lenders have stiffened their standards in the wake of increasing turmoil within the banking sector, according to the Federal Reserve’s quarterly Senior Loan Officer Opinion Survey (SLOOS) released Monday.”

“Why Journalists Have More Freedom Than Professors” (Ross Douthat, New York Times). “[Matt] Yglesias absorbed a set of personal and professional costs by being somewhat unwoke, but he then found compensations elsewhere in the media ecosystem, while also retaining his connection to the world of practical liberal politics — precisely because politicians have to be practical to win. Crucially, he did not cease to be a journalist in this process; he merely changed his journalistic identity, and his position within the profession changed but didn’t fall apart.”

What we’re reading (5/7)

“Tech Workers Aren’t As Rich As They Used To Be” (Wall Street Journal). “For years, tech jobs were a ticket to riches. Much of that wealth has evaporated along with tech companies’ boom-time gains. Stock typically makes up a large portion of tech workers’ generous pay. Compensation soared when a pivot to remote everything made tech companies the market’s darlings. The reverse, in turn, sent tech shares down sharply. While they have recovered some this year, they are still well below their 2021 heights.”

“Short Selling Comes Under Fire As Regional Banks Sell Off” (U.S. News & World Report). “The practice of short selling is coming under increased scrutiny as shares of regional banks remain under pressure, with some calls for more regulatory oversight of the practice. Short sellers, who borrow shares they expect to fall and hope to repay the loan for less later to pocket the difference, have profited from the banking crisis. They gained $1.2 billion in the first two days of May, analytics firm Ortex said.”

“Bank Turmoil Is Paving the Way For Even Bigger ‘Shadow Banks’” (DealBook). “Whipsaw trading in shares of regional banks this week made it clear the fallout from three federal bank seizures was far from over. Some investors are betting against even seemingly healthy banks like PacWest, and regulators are gearing up to tack on new capital constraints for small and medium-size lenders.”

“Private Jet Travel Is Booming. And Shameful. And We’re All Paying For It.” (New York Times). “Last year the marketing company Yard used data from @Celebjets, a Twitter account that tracked celebrities’ private flights (and has since been suspended by Twitter), to calculate how much time some luminaries spent aboard their planes. Yard’s top-flying celeb was Taylor Swift, whose jet spent nearly 23,000 minutes — about 16 days — in the air in the first half of last year, spewing more than 1,000 times more carbon into the atmosphere than the average person does in a year. (Swift’s representative disputed the numbers, explaining that the jet is often lent out to others.)”

“College Quality As Revealed By Willingness-To-Pay For College Graduates” (Education Economics). “This study measures college quality by the amount by which the college adds to the salary of its students above what the median market value would be for the same majors and student quality. Commonly used national rankings of colleges such as U.S. News and World Report or Forbes are heavily biased by a college’s average salaries and the quality of the students it enrolls, and not by the actual value-added by the colleges. Once student quality and mix of majors are controlled, salary differences between elite and nonelite schools largely disappear.”

What we’re reading (5/6)

“Wall Street Is Running Away From The Housing Market. But Why?” (Fortune). “[A]ccording to an analysis conducted by John Burns Research and Consulting, institutional investors—those owning over 1,000 homes—bought 90% fewer homes in January and February than they did in the first two months of 2022.”

“Berkshire Hathaway’s Operating Earnings Increase 12% In The First Quarter, Cash Hoard Tops $130 Billion” (CNBC). “Profit from insurance underwriting came in at $911 million, up sharply from $167 million a year prior. Insurance investment income also jumped 68% to $1.969 billion from $1.170 billion.”

“You May Never Eat Inside A Fast Food Restaurant Again” (Vox). “By the end of 2021, dine-in visits to fast food chains had fallen to just 14 percent of restaurant traffic, compared to 28 percent pre-pandemic, according to the market research firm NPD Group. When it comes to burgers and fries, people are increasingly scarfing them down in their homes, at their offices, in their cars — anywhere, really, but in the restaurant.”

“ChatGPT Can Pick Stocks Better Than Your Fund Manager” (CNN Business). “A survey of 2,000 UK adults conducted by Finder last week showed that 8% had already used ChatGPT for financial advice, while 19% said they would consider doing so.”

“Bank Turmoil Is Paving The Way For Even Bigger ‘Shadow Banks’” (DealBook). “Whipsaw trading in shares of regional banks this week made it clear the fallout from three federal bank seizures was far from over. Some investors are betting against even seemingly healthy banks like PacWest, and regulators are gearing up to tack on new capital constraints for small and medium-size lenders.”

What we’re reading (5/4)

“About Half In U.S. Worry About Their Money’s Safety In Banks” (Gallup). “Amid turbulence in the U.S. banking system, nearly half of Americans are anxious about the safety of the money they have in accounts at banks or other financial institutions. A total of 48% of U.S. adults say they are concerned about their money, including 19% who are ‘very’ and 29% who are ‘moderately’ worried. At the same time, 30% are ‘not too worried’ and 20% are ‘not worried at all.’”

“Apple Finds Strength In India As Overall Sales Fall For Second Straight Quarter” (Wall Street Journal). “This is the third time in a decade that the iPhone maker has posted back-to-back quarters of falling revenue. The tech giant’s revenue for the three months ended April 1 was $94.8 billion, down 3% from the year-earlier period. Net income dropped 3% year-over-year to $24.2 billion. Apple exceeded analyst expectations, according to FactSet, of $92.9 billion in sales and $22.6 billion in net income for its fiscal second quarter.”

“Lyft Stock Plunges Nearly 15% On Weaker Than Expected Revenue Forecast” (CNN Business). “The ride-hailing company reported revenue of $1 billion for the quarter ending in March, marking a 14% year-over-year increase and beating Wall Street estimate’s. But the company forecast weaker-than-expected revenue for the current quarter, which was enough to jitter investors.”

“ESG Is Digging A Deeper And Deeper Hole For Itself” (RealClear Markets). “Though more than $50 trillion has been committed to ESG and other sustainable investment strategies, the world is no closer to achieving its net zero objectives, nor is the global economy more socially inclusive than it would have been otherwise. These are not my findings, mind you; they are the conclusions of Professors Davidson Heath, Daniele Macciocchi, Roni Michaely, and Matthew C. Ringgenberg, who studied the behaviors of hundreds of firms over the past decade. ESG funds haven’t done much incremental good. Neither are they doing very well. As an asset class, ESG equity funds have underperformed broad market indices by hundreds of basis points in recent years.”

“How Can Active Stock Managers Improve Their Funds’ Performance? By Taking A Vacation—A Long One” (Morningstar). “The difference between the static portfolio’s hypothetical returns and the funds’ actual returns would approximate the value the funds’ active managers added to, or subtracted from, performance by trading stocks along the way…We found the Do Nothing Active Portfolio would have earned nearly the same return as the actual active large-cap funds did in aggregate.”

What we’re reading (5/3)

“Federal Reserve Raises Rates, Signals Potential Pause” (Wall Street Journal). “Federal Reserve officials signaled they might be done raising interest rates for now after approving another increase at their meeting that concluded Wednesday. ‘People did talk about pausing, but not so much at this meeting,’ Fed Chair Jerome Powell said at a news conference. ‘We feel like we’re getting closer or maybe even there.’”

“PacWest Falls More Than 50% After Hours On Report Bank Is Considering Strategic Options” (CNBC). “The regional bank is assessing options, including a possible sale, and bringing in advisors to evaluate longer-term plans for the business, CNBC confirmed, according to one person familiar with the matter. Piper Sandler and Stephens are the two firms advising PacWest, the person said.”

“Treasury-Market Liquidity May Not Improve Under 2024 Buyback Plan, Jefferies Says” (MarketWatch). “The U.S. Treasury’s plan for a 2024 regular buyback program to help support liquidity in the government-debt market is drawing doubts from at least one important player: investment bank Jefferies Group. Since buybacks were first discussed in late 2022, Jefferies has ‘expressed extreme skepticism that such a program would have benefits that outweigh the costs and risks,’ said U.S. economist Thomas Simons. Jefferies is one of two dozen primary dealers that act as trading counterparties of the Federal Reserve’s New York branch, and help to implement monetary policy.”

“A Look Under The Hood Of U.S. Equity Markets” (RealClear Markets). “Be careful when reading the headlines or defining true market health as measured by potentially skewed data and indexes. For the U.S. equities markets to truly enter into the next bull market we will need more than the chosen few [big tech stocks] to rally and show demand outweighs supply.”

“You’ve Heard About Behavioral Finance. But What About Physical Finance?” (Institutional Investor). “[R]esearch has begun to map behavioral finance concepts directly to specific neural pathways. For instance, loss aversion — where the psychological pain of losing is greater than the pleasure of gaining the same amount — has now been linked to activity in the ventral striatum, an area of the brain involved in processing dopamine, a neurochemical associated with rewards and pleasure. This research has shown less neural activity in this section of the brain among individuals who were less loss averse.”

What we’re reading (5/2)

“Job Openings Near Two-Year Low As Layoffs Jump” (Wall Street Journal). “U.S. job openings dropped to their lowest level in nearly two years in March and layoffs rose sharply, in signs that demand for workers is cooling a year after the Federal Reserve began lifting interest rates to combat inflation.”

“Subway Comes Up With Debt Plan To Clinch $10 Billion-Plus Sale” (Reuters). “The bankers running the sale process for Subway have given the private equity firms vying for the sandwich chain a $5 billion acquisition financing plan, hoping to overcome a challenging environment for leveraged buyouts and fetch the company's asking price of more than $10 billion, people familiar with the matter said.”

“Michael Milken Says Recent Crisis Is The Same Mistake Banks Have Been Making For Decades” (CNBC). “Famed investor Michael Milken said Tuesday that the current banking crisis stemmed from a classic asset-liability mismatch that has played out miserably time and again in history. ‘You shouldn’t have borrowed short and lent long... Finance 101,’ Milken said on CNBC’s ‘Last Call.’ ‘How many times, how many decades are we going to learn this lesson of borrowing overnight and lending long? Whether it was the 1970s, the 1980s and 90s.’”

“What’s Driving Dollar Doomsaying?” (Paul Krugman, New York Times). “The point is that tugging on one or two strands of this web isn’t likely to cause it to unravel. Even if some governments express a desire to see payments conducted in other currencies, it’s not at all clear they can make that happen, since we’re mostly talking about private-sector decisions. And even if they can make partial de-dollarization stick, all the other advantages of the dollar as a banking and borrowing currency will remain. So ignore all the dollar doomers out there. Or better yet, consider what their hyping of a nonissue says about their own judgment.”

“‘Not My King’ Protests Are Now The Norm At King Charles III’s Events” (Washington Post). “A change of sovereign, … for the first time in seven decades, has energized the republican movement and prompted others in Britain, and the 14 other countries where Charles is king, to look at the monarchy anew and begin to question aspects of its role in modern times.”

What we’re reading (5/1)

“Jamie Dimon Wins Again In First Republic Bank Deal” (Wall Street Journal). “JPMorgan used its huge balance sheet to beat out smaller banks for First Republic, which was seized early Monday by the Federal Deposit Insurance Corp. First Republic collapsed after losing $100 billion in deposits in a March run that followed the implosion of fellow Bay Area lender Silicon Valley Bank.”

“First Republic Bank Collapse Spurs Fears For Banking System, Broader Economy” (The Hill). “Monday’s shutdown marks the nation’s second-largest bank failure — First Republic Bank had nearly $230 billion in assets last month — eclipsing the Silicon Valley Bank collapse. Three of the four largest bank failures in U.S. history have taken place over the last two months.”

“First Republic’s Pain Had A Lot To Do With Its Reliance On Wealthy Clientele” (CNN Business). “First Republic, which entered a death spiral six weeks ago and was seized by the Federal Deposit Insurance Corporation early Monday and taken over byJPMorgan Chase, is the third US lender to fail in two months — and the reason has a lot to do with its well-heeled client base.”

“Banks Are Finally Admitting They Have A Problem With Billions Of Dollars In Looming Real-Estate Defaults” (Insider). “The US's four largest banks, Wells Fargo, JPMorgan Chase, Bank of America, and Citibank, together now have $62.9 billion of such loss provisions, according to the debt-tracking firm Trepp's analysis of their recent first-quarter financial statements. That's a $12.6 billion increase in their reserves from six months ago…Some of the uptick is attributable to expected losses connected to commercial real estate.”

“Home Buyers Are Eager But Sellers Are Scarce, Creating ‘Real Gridlock’” (New York Times). “The housing market typically comes to life in spring, when buyers emerge in the warmer weather. This year, the market appears stuck in a deep freeze, and the biggest culprit is a lack of sellers, housing experts say.”

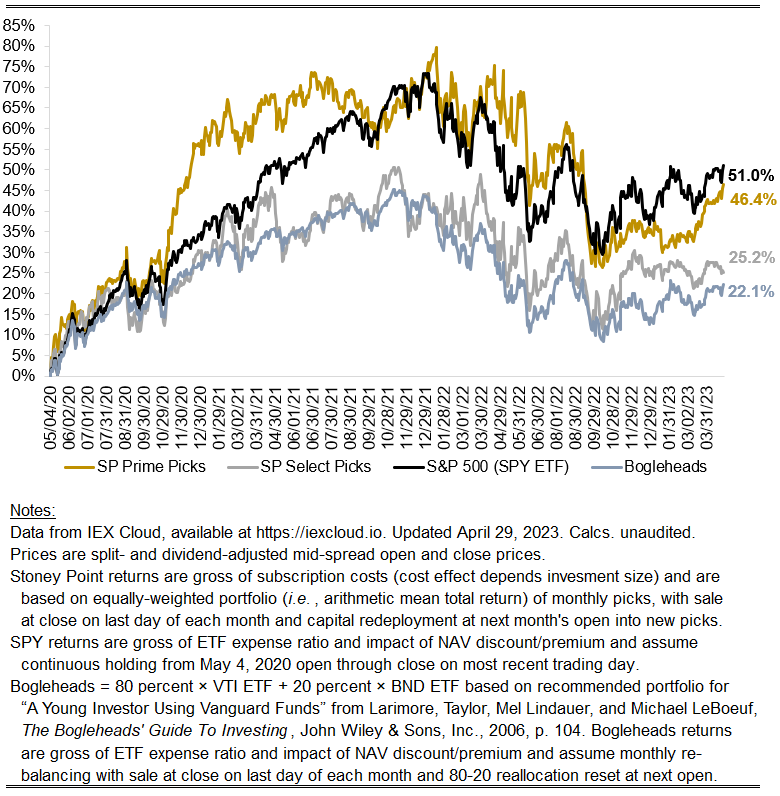

April performance update

Hi friends, here with a monthly performance update.

Prime: +2.88 percent

Select: -1.72 percent

SPY ETF: +1.73 percent

Bogleheads portfolio (80% VTI, 20% BND): +1.15 percent

Earlier this month, I highlighted commentary from an equities analyst describing current market conditions as the thinnest bull market in memory, meaning that good year-to-date returns for the S&P 500 overall have been dominated by the returns of just a few of the index’s largest constituents. That was certainly true in April. Notably, Microsoft’s stock price rose 7.24 percent this month, and Meta’s rose 15.07 percent. Given the large weight each of these stocks have in the index, those two surely drove much of the index’s positive return. The asynchrony between the performance of these stocks and hundreds of other constituents could reasonably give investors pause about the notion that we are in a bull market at all.

Notably, none of the index’s high-fliers were among the Prime picks this month, which makes the more than 100-basis-point outperformance of that strategy look all the better. On the other hand, the Select picks continue to be a drag. Considering the same algorithm is used to choose the Select as the Prime picks, one possibility is that the advantages the algorithm looks for drop off quickly after the top 10-or-so stocks. That is not what my backtesting suggest, but history does not always repeat.

Stoney Point Total Performance History

May picks available now

The new Prime and Select picks for May are available starting now, based on a model run put through today (April 29). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Monday, May 1, 2023 (at the mid-spread open price) through the last trading day of the month, Wednesday, May 31, 2023 (at the mid-spread closing price).