April performance update

Hi friends, here with a monthly performance update.

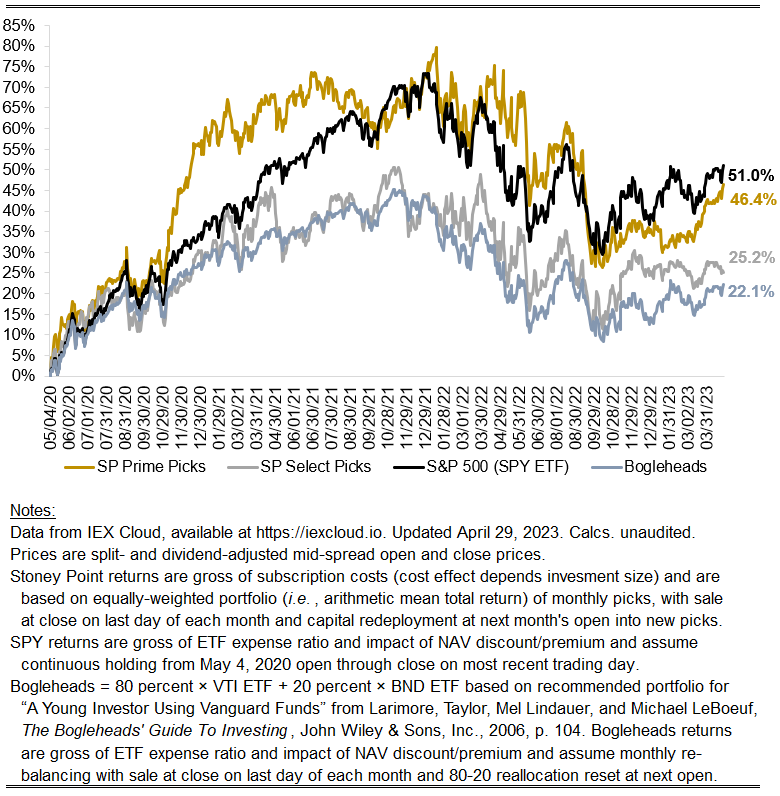

Prime: +2.88 percent

Select: -1.72 percent

SPY ETF: +1.73 percent

Bogleheads portfolio (80% VTI, 20% BND): +1.15 percent

Earlier this month, I highlighted commentary from an equities analyst describing current market conditions as the thinnest bull market in memory, meaning that good year-to-date returns for the S&P 500 overall have been dominated by the returns of just a few of the index’s largest constituents. That was certainly true in April. Notably, Microsoft’s stock price rose 7.24 percent this month, and Meta’s rose 15.07 percent. Given the large weight each of these stocks have in the index, those two surely drove much of the index’s positive return. The asynchrony between the performance of these stocks and hundreds of other constituents could reasonably give investors pause about the notion that we are in a bull market at all.

Notably, none of the index’s high-fliers were among the Prime picks this month, which makes the more than 100-basis-point outperformance of that strategy look all the better. On the other hand, the Select picks continue to be a drag. Considering the same algorithm is used to choose the Select as the Prime picks, one possibility is that the advantages the algorithm looks for drop off quickly after the top 10-or-so stocks. That is not what my backtesting suggest, but history does not always repeat.