What we’re reading (5/6)

“Wall Street Is Running Away From The Housing Market. But Why?” (Fortune). “[A]ccording to an analysis conducted by John Burns Research and Consulting, institutional investors—those owning over 1,000 homes—bought 90% fewer homes in January and February than they did in the first two months of 2022.”

“Berkshire Hathaway’s Operating Earnings Increase 12% In The First Quarter, Cash Hoard Tops $130 Billion” (CNBC). “Profit from insurance underwriting came in at $911 million, up sharply from $167 million a year prior. Insurance investment income also jumped 68% to $1.969 billion from $1.170 billion.”

“You May Never Eat Inside A Fast Food Restaurant Again” (Vox). “By the end of 2021, dine-in visits to fast food chains had fallen to just 14 percent of restaurant traffic, compared to 28 percent pre-pandemic, according to the market research firm NPD Group. When it comes to burgers and fries, people are increasingly scarfing them down in their homes, at their offices, in their cars — anywhere, really, but in the restaurant.”

“ChatGPT Can Pick Stocks Better Than Your Fund Manager” (CNN Business). “A survey of 2,000 UK adults conducted by Finder last week showed that 8% had already used ChatGPT for financial advice, while 19% said they would consider doing so.”

“Bank Turmoil Is Paving The Way For Even Bigger ‘Shadow Banks’” (DealBook). “Whipsaw trading in shares of regional banks this week made it clear the fallout from three federal bank seizures was far from over. Some investors are betting against even seemingly healthy banks like PacWest, and regulators are gearing up to tack on new capital constraints for small and medium-size lenders.”

What we’re reading (5/4)

“About Half In U.S. Worry About Their Money’s Safety In Banks” (Gallup). “Amid turbulence in the U.S. banking system, nearly half of Americans are anxious about the safety of the money they have in accounts at banks or other financial institutions. A total of 48% of U.S. adults say they are concerned about their money, including 19% who are ‘very’ and 29% who are ‘moderately’ worried. At the same time, 30% are ‘not too worried’ and 20% are ‘not worried at all.’”

“Apple Finds Strength In India As Overall Sales Fall For Second Straight Quarter” (Wall Street Journal). “This is the third time in a decade that the iPhone maker has posted back-to-back quarters of falling revenue. The tech giant’s revenue for the three months ended April 1 was $94.8 billion, down 3% from the year-earlier period. Net income dropped 3% year-over-year to $24.2 billion. Apple exceeded analyst expectations, according to FactSet, of $92.9 billion in sales and $22.6 billion in net income for its fiscal second quarter.”

“Lyft Stock Plunges Nearly 15% On Weaker Than Expected Revenue Forecast” (CNN Business). “The ride-hailing company reported revenue of $1 billion for the quarter ending in March, marking a 14% year-over-year increase and beating Wall Street estimate’s. But the company forecast weaker-than-expected revenue for the current quarter, which was enough to jitter investors.”

“ESG Is Digging A Deeper And Deeper Hole For Itself” (RealClear Markets). “Though more than $50 trillion has been committed to ESG and other sustainable investment strategies, the world is no closer to achieving its net zero objectives, nor is the global economy more socially inclusive than it would have been otherwise. These are not my findings, mind you; they are the conclusions of Professors Davidson Heath, Daniele Macciocchi, Roni Michaely, and Matthew C. Ringgenberg, who studied the behaviors of hundreds of firms over the past decade. ESG funds haven’t done much incremental good. Neither are they doing very well. As an asset class, ESG equity funds have underperformed broad market indices by hundreds of basis points in recent years.”

“How Can Active Stock Managers Improve Their Funds’ Performance? By Taking A Vacation—A Long One” (Morningstar). “The difference between the static portfolio’s hypothetical returns and the funds’ actual returns would approximate the value the funds’ active managers added to, or subtracted from, performance by trading stocks along the way…We found the Do Nothing Active Portfolio would have earned nearly the same return as the actual active large-cap funds did in aggregate.”

What we’re reading (5/3)

“Federal Reserve Raises Rates, Signals Potential Pause” (Wall Street Journal). “Federal Reserve officials signaled they might be done raising interest rates for now after approving another increase at their meeting that concluded Wednesday. ‘People did talk about pausing, but not so much at this meeting,’ Fed Chair Jerome Powell said at a news conference. ‘We feel like we’re getting closer or maybe even there.’”

“PacWest Falls More Than 50% After Hours On Report Bank Is Considering Strategic Options” (CNBC). “The regional bank is assessing options, including a possible sale, and bringing in advisors to evaluate longer-term plans for the business, CNBC confirmed, according to one person familiar with the matter. Piper Sandler and Stephens are the two firms advising PacWest, the person said.”

“Treasury-Market Liquidity May Not Improve Under 2024 Buyback Plan, Jefferies Says” (MarketWatch). “The U.S. Treasury’s plan for a 2024 regular buyback program to help support liquidity in the government-debt market is drawing doubts from at least one important player: investment bank Jefferies Group. Since buybacks were first discussed in late 2022, Jefferies has ‘expressed extreme skepticism that such a program would have benefits that outweigh the costs and risks,’ said U.S. economist Thomas Simons. Jefferies is one of two dozen primary dealers that act as trading counterparties of the Federal Reserve’s New York branch, and help to implement monetary policy.”

“A Look Under The Hood Of U.S. Equity Markets” (RealClear Markets). “Be careful when reading the headlines or defining true market health as measured by potentially skewed data and indexes. For the U.S. equities markets to truly enter into the next bull market we will need more than the chosen few [big tech stocks] to rally and show demand outweighs supply.”

“You’ve Heard About Behavioral Finance. But What About Physical Finance?” (Institutional Investor). “[R]esearch has begun to map behavioral finance concepts directly to specific neural pathways. For instance, loss aversion — where the psychological pain of losing is greater than the pleasure of gaining the same amount — has now been linked to activity in the ventral striatum, an area of the brain involved in processing dopamine, a neurochemical associated with rewards and pleasure. This research has shown less neural activity in this section of the brain among individuals who were less loss averse.”

What we’re reading (5/2)

“Job Openings Near Two-Year Low As Layoffs Jump” (Wall Street Journal). “U.S. job openings dropped to their lowest level in nearly two years in March and layoffs rose sharply, in signs that demand for workers is cooling a year after the Federal Reserve began lifting interest rates to combat inflation.”

“Subway Comes Up With Debt Plan To Clinch $10 Billion-Plus Sale” (Reuters). “The bankers running the sale process for Subway have given the private equity firms vying for the sandwich chain a $5 billion acquisition financing plan, hoping to overcome a challenging environment for leveraged buyouts and fetch the company's asking price of more than $10 billion, people familiar with the matter said.”

“Michael Milken Says Recent Crisis Is The Same Mistake Banks Have Been Making For Decades” (CNBC). “Famed investor Michael Milken said Tuesday that the current banking crisis stemmed from a classic asset-liability mismatch that has played out miserably time and again in history. ‘You shouldn’t have borrowed short and lent long... Finance 101,’ Milken said on CNBC’s ‘Last Call.’ ‘How many times, how many decades are we going to learn this lesson of borrowing overnight and lending long? Whether it was the 1970s, the 1980s and 90s.’”

“What’s Driving Dollar Doomsaying?” (Paul Krugman, New York Times). “The point is that tugging on one or two strands of this web isn’t likely to cause it to unravel. Even if some governments express a desire to see payments conducted in other currencies, it’s not at all clear they can make that happen, since we’re mostly talking about private-sector decisions. And even if they can make partial de-dollarization stick, all the other advantages of the dollar as a banking and borrowing currency will remain. So ignore all the dollar doomers out there. Or better yet, consider what their hyping of a nonissue says about their own judgment.”

“‘Not My King’ Protests Are Now The Norm At King Charles III’s Events” (Washington Post). “A change of sovereign, … for the first time in seven decades, has energized the republican movement and prompted others in Britain, and the 14 other countries where Charles is king, to look at the monarchy anew and begin to question aspects of its role in modern times.”

What we’re reading (5/1)

“Jamie Dimon Wins Again In First Republic Bank Deal” (Wall Street Journal). “JPMorgan used its huge balance sheet to beat out smaller banks for First Republic, which was seized early Monday by the Federal Deposit Insurance Corp. First Republic collapsed after losing $100 billion in deposits in a March run that followed the implosion of fellow Bay Area lender Silicon Valley Bank.”

“First Republic Bank Collapse Spurs Fears For Banking System, Broader Economy” (The Hill). “Monday’s shutdown marks the nation’s second-largest bank failure — First Republic Bank had nearly $230 billion in assets last month — eclipsing the Silicon Valley Bank collapse. Three of the four largest bank failures in U.S. history have taken place over the last two months.”

“First Republic’s Pain Had A Lot To Do With Its Reliance On Wealthy Clientele” (CNN Business). “First Republic, which entered a death spiral six weeks ago and was seized by the Federal Deposit Insurance Corporation early Monday and taken over byJPMorgan Chase, is the third US lender to fail in two months — and the reason has a lot to do with its well-heeled client base.”

“Banks Are Finally Admitting They Have A Problem With Billions Of Dollars In Looming Real-Estate Defaults” (Insider). “The US's four largest banks, Wells Fargo, JPMorgan Chase, Bank of America, and Citibank, together now have $62.9 billion of such loss provisions, according to the debt-tracking firm Trepp's analysis of their recent first-quarter financial statements. That's a $12.6 billion increase in their reserves from six months ago…Some of the uptick is attributable to expected losses connected to commercial real estate.”

“Home Buyers Are Eager But Sellers Are Scarce, Creating ‘Real Gridlock’” (New York Times). “The housing market typically comes to life in spring, when buyers emerge in the warmer weather. This year, the market appears stuck in a deep freeze, and the biggest culprit is a lack of sellers, housing experts say.”

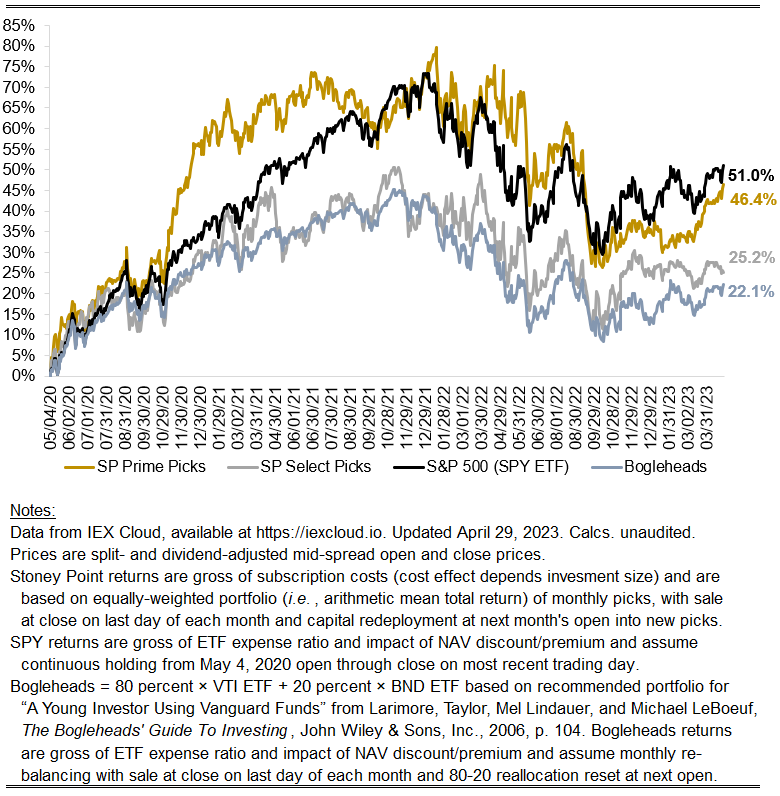

April performance update

Hi friends, here with a monthly performance update.

Prime: +2.88 percent

Select: -1.72 percent

SPY ETF: +1.73 percent

Bogleheads portfolio (80% VTI, 20% BND): +1.15 percent

Earlier this month, I highlighted commentary from an equities analyst describing current market conditions as the thinnest bull market in memory, meaning that good year-to-date returns for the S&P 500 overall have been dominated by the returns of just a few of the index’s largest constituents. That was certainly true in April. Notably, Microsoft’s stock price rose 7.24 percent this month, and Meta’s rose 15.07 percent. Given the large weight each of these stocks have in the index, those two surely drove much of the index’s positive return. The asynchrony between the performance of these stocks and hundreds of other constituents could reasonably give investors pause about the notion that we are in a bull market at all.

Notably, none of the index’s high-fliers were among the Prime picks this month, which makes the more than 100-basis-point outperformance of that strategy look all the better. On the other hand, the Select picks continue to be a drag. Considering the same algorithm is used to choose the Select as the Prime picks, one possibility is that the advantages the algorithm looks for drop off quickly after the top 10-or-so stocks. That is not what my backtesting suggest, but history does not always repeat.

Stoney Point Total Performance History

May picks available now

The new Prime and Select picks for May are available starting now, based on a model run put through today (April 29). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Monday, May 1, 2023 (at the mid-spread open price) through the last trading day of the month, Wednesday, May 31, 2023 (at the mid-spread closing price).

What we’re reading (4/27)

“GDP Report Shows Economic Growth Slowed In First Quarter” (Wall Street Journal). “U.S. gross domestic product, a measure of the value of all the goods and services produced in the country, rose at an inflation- and seasonally-adjusted 1.1% annual rate from January to March, a significant slowdown from 2.6% growth in the fourth quarter, the Commerce Department said Thursday.”

“Taylor Swift: Better Crypto Due Diligence Than The SEC, Plus Integrity In Wielding Influence” (Dealbreaker). “When Sam Bankman-Fried’s cryptocurrency exchange FTX melted down, a lot of celebrities were left looking foolish. FTX was known for its high-profile, high-dollar endorsement deals. Now some celebrities — including Tom Brady, Stephen Curry, Larry David, and Shaquille O’Neal — are facing a lawsuit accusing them of promoting an unregistered security. Not Taylor Swift. When the superstar was approached by FTX for a $100 million deal to sell her concert tickets as NFTs, her response was reportedly, ‘Can you tell me that these are not unregistered securities?’”

“What Microsoft’s Activision Setback Means for Deal Making” (Dealbreaker). “A British regulator’s decision to reject Microsoft’s $69 billion takeover bid for Activision Blizzard stunned many who had expected the deal to go through. That’s especially because moves this month by the agency, the Competition and Markets Authority, suggested that the transaction might pass muster.”

“Will Office-To-Residential Conversions Save America’s Downtowns?” (The Week). “Can America's big cities solve two problems with one big idea? Downtowns have been decimated by the post-pandemic rise of hybrid work — and there's also a nationwide shortage of affordable housing. The solution? Turn all those empty offices into apartments. The Associated Press reports that in cities across the country, ‘office-to-housing conversions are being pursued as a potential lifeline for struggling downtown business districts.’”

“You Learn The Value Of A College Degree When You Live Without One” (New York Times). “Companies from Google to G.M. to Delta Air Lines are dropping college degree requirements for many roles, focusing instead on skills-based hiring, a philosophy that emphasizes people over pedigrees. Some high-profile chief executives, including Ryan Roslansky of LinkedIn, have been vocal about the benefits of a skills-based approach for companies looking to broaden their talent pipelines. And the Business Roundtable introduced its Multiple Pathways Initiative with the goal of improving diversity, equity and inclusion at all levels of corporate America by emphasizing ‘the value of skills’ in recruitment, retention and advancement. This movement is not new, but the tight labor market, along with some of the inequities that were made more apparent by the pandemic, has brought it to the fore.”

What we’re reading (4/26)

“This Awfully Fragile Narrow No-Good Rally” (Financial Times). “The S&P 500 is up nearly 8 per cent this year, but unease around the underlying strength of the rally is almost palpable. People really bloody hate it, basically. JPMorgan’s equity analysts are among the haters. They estimate that the breadth of the US equity rally is ‘by some measures is the weakest ever’, with the narrowest leadership in a rising stock market since the 1990s. Microsoft and Apple alone are behind about 2.3 per cent of the S&P 500’s gain this year and now account for a record 13.4 per cent of the index — the most ever for the top-two stocks.”

“The Problem With Apple’s Big Banking Push” (Vox). “Do you want the company that makes your phone to be your bank, too? That’s the question some people are surely asking themselves now that Apple has rolled out its new Apple Card savings account, which comes with a 4.15 percent interest rate — well above what most traditional banks are offering. It’s also not traditional because, unlike any other savings accounts out there, this one is baked into the operating system of your phone, as is the Apple Card, the credit card you must have in order to get the savings account.”

“SPACs Delivered Easy Money, But Now Companies Are Running Out” (Wall Street Journal). “Shares of many of these companies trade under $1, more than 90% below where they did when they went public, and are in danger of being delisted. Those that have raised cash typically have done it on onerous terms.”

“First Republic May Not Survive, Even After Two Multibillion-Dollar Bailouts” (CNN Business). “‘It’s becoming clearer each day’ that First Republic is “toast,” said Don Bilson at Gordon Haskett, in a note Wednesday. ‘The only question that really needs to be answered is whether the [Federal Deposit Insurance Corporation] moves in before the weekend or during the weekend, which is when it usually does its thing.’”

“Meta Stock Jumps Toward Highest Price In A Year As Facebook Parent Predicts Renewed Revenue Growth” (MarketWatch). “Meta Platforms Inc.’s stock soared 11.6% higher in extended trading Wednesday after the social networking company’s profit declined less than expected in the first three months of 2023, and a revenue forecast pointed toward reinvigorated sales growth.”

What we’re reading (4/25)

“Silicon Valley Startups Brace For A Summer Of Pain” (Bloomberg). “The startup world has had a tough year — plagued by mass layoffs, plummeting venture capital investment and the chaotic collapse of Silicon Valley Bank. But many in tech believe that the worst is yet to come…’We haven’t had a compression in values like this in more than 20 years. It’s an absolute bloodbath,’ said Cameron Lester, global co-head of technology media and telecom investment banking at Jefferies, adding that companies that are able to raise money, even at a lower valuation, are the lucky ones.”

“First Republic Bank Shares Sink 49% After Earnings Report” (Wall Street Journal). “First Republic Bank shares lost about half their value Tuesday, a day after the bank reported first-quarter results that showed a deposit hemorrhage in March that was worse than expected.”

“When Your Boss Is An Algorithm” (NPR). “University of California College of the Law professor Veena Dubal says…rideshare apps promote ‘algorithmic wage discrimination’ by personalizing wages for each driver based on data they gather from them. The algorithms are proprietary, so workers have no way of knowing how their data is being used, Dubal says.”

“Microsoft Reports Earnings Beat, Says A.I. Will Drive Revenue Growth” (CNBC). “Microsoft shares rose 9% in extended trading on Tuesday after the software maker issued fiscal third-quarter results and quarterly guidance that exceeded analysts’ predictions.”

“Insiders Say Tucker Carlson Overplayed His Hand At Fox But The ‘Whole Universe’ Of Right-Wing Media Is Courting Him Now” (Insider). “This person said Carlson's exit was not part of the Dominion settlement, but that Fox had found more damaging information during discovery than had been released to the public. Indeed, trying to decipher exactly why Carlson got the boot may be a fool's game.”

May picks available soon

We’ll be publishing our Prime and Select picks for the month of May before Monday, May 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of April, as well as SPC’s cumulative performance, assuming the sale of the April picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Friday, April 28). Performance tracking for the month of May will assume the May picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Monday, May 1).

What we’re reading (4/24)

“‘Nobody Knows When It’s Going To Happen’: Wall Street Wakes Up To Default Threat.” (Politico). “As the drop-dead date to raise the nation’s $31.4 trillion debt ceiling looms with no deal in sight, traders and executives are starting to get nervous that President Joe Biden and Republicans won’t resolve the impasse until it’s too late. That’s sparked increasing concern about a potential threat that could rock markets and tilt the world’s largest economy into recession.”

“The Fabulous Yields, And Lurking Risks, Of Money Market Funds” (New York Times). “[I]t’s been a glorious time for one part of the financial world: money market mutual funds. The biggest money funds tracked by Crane Data are paying more than 4.6 percent interest, and a handful have yields around 5 percent. Their gaudy interest rates closely follow the Fed funds rate, set by the central bank. The effective Fed funds rate is now about 4.83 percent. That’s onerous for people who need to borrow money, and deliberately so: The Fed is raising rates because it is trying to squelch inflation by slowing the economy.”

“‘Crypto Is Dead In America,’ Says Longtime Bitcoin Bull Chamath Palihapitiya” (CNBC). “Palihapitiya blamed crypto’s demise largely on regulators, who have gotten much more aggressive in their pursuit of bad actors in the industry. Securities and Exchange Commission Chairman Gary Gensler has said crypto trading platforms should abide by strict U.S. securities laws.”

“How Washington Allowed Bank CEOs To Pocket Huge Bonuses Amid Failures” (Washington Post). “Years of research showed that the existing structure for paying Wall Street executives led them to take much bigger gambles with their institutions because they benefited from stock price increases, Sanjai Bhagat, a finance professor at the University of Colorado at Boulder, warned Securities and Exchange Commission attorneys and economists in a closed-door meeting in November 2016. The best fix would be to require top bank officials to hold any stock until one to three years after they left their companies, Bhagat told them. The idea was one of dozens of ways to change how bank CEOs are compensated that federal authorities spent years discussing. But regulators never acted[.]”

“Everything You Don’t Actually Need To Know About The Economics Of Succession” (Financial Times). “Despite the sound, fury and personal drama, in a strictly business sense . . . not much has actually happened. Still, it has got a bit confusing, and even seasoned financial analysts or FT columnists could be forgiven for losing track of things. So FT Alphaville sat down for a fevered quasi-binge of the show and tried to make sense of Succession’s financial plotline(s).”

What we’re reading (4/23)

“Individual Investors Are Still Hungry for Stocks—While Shunning Risk” (Wall Street Journal). “Individual investors scooped up shares of single stocks and exchange-traded funds at a near-record clip in the first quarter. They appear to have learned some lessons in risk taking as well. Individuals bought a net $77.7 billion in equities and ETFs on U.S. exchanges in the first three months of the year, according to Vanda Research data, which excludes contributions to 401(k)s and other retirement accounts. That sum trails only the first quarters of 2021 and 2022, when they bought about $80 billion.”

“Perspective: Housing Prices Take Some Buyers Out Of The Market” (Washington Post). “There has been much debate over whether the economy will or will not suffer a recession this year. There is no debate that housing is in recession. Home sales, the construction of single family homes, and house prices are falling.”

“Fed Officials On Track To Hike Rates And Signal Potential Pause” (Bloomberg). “Federal Reserve officials are on track to raise interest rates a quarter percentage point next month and signal a potential pause from the steepest hiking campaign in decades.”

“Here’s a Better Way To Identify Quality Stocks” (Institutional Investor). “According to the research, the annual return on a portfolio of quality stocks can be enhanced by an average of .60 percent when investors include intangible assets in their definition of quality. Intangible assets include investments in research and development, software expenses, and costs associated with branding and human capital.”

“The 60/40 Portfolio Is Back! *After Not Going Away” (The Big Picture). “One outlier year every 4 decades or so makes for a pretty reliable investment strategy. The academic evidence that this sort of investing outperforms all others over a long enough timeline is overwhelming.”

What we’re reading (4/22)

“Alphabet CEO’s Pay Soars To $226 Million On Huge Stock Award” (Bloomberg). “The pay package awarded to Alphabet Inc. Chief Executive Officer Sundar Pichai soared to $226 million in 2022, boosted by a triennial stock grant, making him one of the world’s highest-paid corporate leaders.”

“Americans Escaping Pricey Cities Bring Higher Housing Costs, Inflation With Them” (Wall Street Journal). “Tampa, Fla., residents face some of the hottest inflation in the country, but when excluding sizzling housing costs, price increases are nearly as cool as in Minneapolis. The disparity shows regional inflation is heavily influenced by home prices and rent costs.”

“Why BuzzFeed Is Closing Its News Division” (DealBook). “BuzzFeed’s decision to shut its news division — an innovator in digital journalism that published both prizewinning investigations and listicles designed to get clicks — drew many bittersweet tributes online. But its closure is the latest reminder that digital media start-ups, which deep-pocketed investors once valued at astronomical sums, are facing headwinds.”

“IPO Market Shows Signs Of Life Even As Recession Fears Persist” (Bloomberg). “The global market for initial public offerings is showing signs of life as a rebound in the stock market has emboldened companies to test investor appetite for new listings, particularly in Asia. But a full-fledged recovery looks distant.”

“Testing Political Antitrust” (New York University Law Review). “Our findings do not support the political antitrust movement’s central hypothesis that there is an association between economic concentration and the concentration of lobbying power. We do not find a strong relationship between economic concentration and the concentration of lobbying expenditure at the industry level. Nor do we find a significant difference between top firms’ and other firms’ allocation of additional revenues to lobbying.”

What we’re reading (4/21)

“Double-Digit Price Increases Bolster Profits At Procter & Gamble” (New York Times). “Another round of price increases on household products like Gillette razors, Dawn dish soap and Swiffer dusters bolstered Procter & Gamble’s bottom line last quarter, the company said on Friday, a sign that stubborn inflation may linger as companies defend their profit margins.”

“Billion-Dollar Hedge Fund Startups Rise To Pre-Pandemic Levels” (Bloomberg). “The biggest new hedge funds are raising more money, at levels not seen since before the pandemic, and the 2024 crop could include one of the largest startups in years. At least four new firms are poised to eclipse $1 billion by year-end, collectively bringing in at least $6.5 billion from investors, according to people with knowledge of the fundraising activities.”

“Gen Z Is Buying Up Homes. How They Got So Lucky — And Millennials Got Screwed.” (Insider). “Gen Zers may be the new kids on the block, but when it comes to home buying they are coming out on top. That's according to a report from Redfin that has found the generation has surpassed their peers in homeownership at the earliest stages of their adulthood. In 2022, 30% of 25-year olds owned their home, slightly higher than the 28% rate for millennials and 27% rate Gen Xers when they were that age, data from the real estate brokerage shows. So how did Gen Z gain the competitive edge? It all comes down to a healthy labor market, Daryl Fairweather, the chief economist at Redfin, told Insider.”

“The Economics Of Dating During High Inflation” (The Hustle). “The recent bout of inflation has impacted nearly every component of dating life — food, drinks, transportation — and has added additional financial pressure to courtship.”

“Miller High Life Cans Destroyed In Europe Over ‘Champagne of Beers’ Logo” (Wall Street Journal). “Comité Champagne, a trade organization that oversees which bubbly can call itself Champagne, was told about the beer and ‘requested the destruction of these illicit goods,’ a statement by Belgian customs authorities and Comité Champagne said. Only sparkling wines made in France’s Champagne region can use the name on their labels, according to French laws.”

What we’re reading (4/20)

“Blackstone Is The Latest Victim Of The Weakening Commercial Real Estate Market” (CNN Business). “The ongoing commercial real estate slowdown has a new victim: Blackstone, the largest owner of commercial real estate globally. The company saw its distributable earnings — the profit distributed to shareholders after expenses — plunge 36% since last year. That’s raising eyebrows on Wall Street as investors assess the fallout from last month’s regional banking crisis.”

“Making Manufacturing Greater Again” (Paul Krugman, New York Times). “Instead of offering corporations broad tax cuts, they [Biden administration policies] provide incentives for the transition to an economy that runs on renewable energy: tax credits for production of or investment in clean energy, for consumers who purchase electric vehicles or energy-efficient appliances, and so on. Combined with Buy American provisions, these incentives will create increased demand for a wide range of U.S.-produced manufactured goods, from batteries to electric motors.”

“Home Prices In March Posted Biggest Annual Decline In 11 Years” (Wall Street Journal). “Home sales fell across the U.S. in March, a sluggish start to the crucial spring selling season as higher mortgage rates squashed momentum from the previous month. U.S. existing-home sales decreased 2.4% in March from the prior month to a seasonally adjusted annual rate of 4.44 million, the National Association of Realtors said Thursday. March sales fell 22% from a year earlier.”

“BuzzFeed News, A Digital Media Pioneer, To Shut Down” (Washington Post). “BuzzFeed News, a pioneering digital news site that won a Pulitzer Prize and stirred controversy by publishing the Steele dossier, said Thursday it will close after 12 years. The news was broken to dismayed employees in an email from the site’s co-founder and chief executive, Jonah Peretti, who wrote the company couldn’t maintain a stand-alone news organization and cited “more challenges than I can count,” including the pandemic, declining advertising and ‘a tech recession.’”

“CEO Says Many Of His Remote Workers Didn't Open Their Laptops For A Month, And ‘Only The Rarest Of Full-Time Caregivers’ Can Be Productive Employees” (Insider). “Clearlink's CEO James Clarke reportedly told employees that he believed many remote workers have ‘quietly quit’ and become so brazen that dozens at his company ‘didn't even open’ their laptops for a month.”

What we’re reading (4/19)

“Bed Bath & Beyond Preparing For Bankruptcy Filing Within Days” (Wall Street Journal). “The embattled retailer recently said it needed to raise $300 million from share sales by April 26 to stay out of chapter 11. The company will have to stop selling stock by that date, when it would lose eligibility to continue under its share registration documents. Given the stock’s closing price on Wednesday of 46 cents, Bed Bath & Beyond faces long odds to raise that amount of money within that time.”

“The Plan To Get Rupert Murdoch To Pay Up” (DealBook). “The game plan revolved around getting damaging evidence out in public, Hootan Yaghoobzadeh of Staple Street Capital, which owns Dominion, said on CNBC today. That contributed heavily to what was a stacked deck against Fox News, with the broadcaster facing what one legal expert told The New York Times was ‘unquestionably the strongest defamation case we’ve ever seen against a major media company.’”

“What Beat The S&P 500 Over The Past Three Decades? Doing Nothing” (Morningstar). “A strategy of buying a basket of stocks and leaving them untouched outperformed the index, not to mention scores of active managers.”

“Crypto-Influencers Give Poor Investment Advice — And The SEC Is Taking Notice” (ProMarket). “The new research study Crypto-Influencers, that I co-authored with Ken Merkley, Mark Piorkowski, and Brian Williams, finds that, on average, following the advice of crypto-influencers generated significant negative returns depending on the holding period. In addition, the more expert the adviser claimed to be, the steeper the loss.”

“America’s Richest Banker Quadrupled His Firm’s Assets Last Year By Making A Massive Bet That Inflation Would Spike” (Insider). “While many of America's regional banks were making risky investments to generate yield during a prolonged period of low interest rates, Andy Beal, the founder and chairman of Beal Bank, was on the sidelines waiting to capitalize on a trade that would ultimately quadruple his firm's assets in a year.”

What we’re reading (4/18)

“Commercial Real Estate Is Bruised But Not Broken” (Financial Times). “Commercial real estate is facing a trifecta of challenges. Rising interest rates have reduced the net present value of properties and have pushed up mortgage costs. According to the RCA CPPI National All-Property Index, US commercial property prices have fallen 9 per cent over the past seven consecutive months. This drop, when annualised, is the biggest since 2010. According to Trepp, $270bn in commercial mortgages held by banks are set to mature this year, the highest on record. Higher interest rates mean rolling that debt over will be costly. Consequently, sales volumes have dropped to levels not seen in a decade (excluding the depths of the pandemic). And finally rents in CRE have been soft as a shift to working from home has sapped demand for office space.”

“Banks’ Bond Losses Caused the Crisis. Now the Crisis Is Reversing the Losses.” (Wall Street Journal). “The ripple effects of the banking crisis are reversing one of the problems that sparked it. Rising rates over the past year saddled banks with losses on their massive portfolios of bonds. Those losses helped sink Silicon Valley Bank last month. But since that failure sparked turmoil across the banking sector, falling bond yields have narrowed those losses.”

“Public Pessimism On The Economy Hits A New High, CNBC Survey Shows” (CNBC). “Amid persistent inflation, higher interest rates and recession worries, Americans have never been more negative about the economy, according to the latest CNBC All-America Economic Survey. A record 69% of the public holds negative views about the economy both now and in the future, the highest percentage in the survey’s 17-year history.”

“Big Question With Dollar Under Fire From Rival Countries And Currencies: What Happens To Markets If The Greenback Loses Its Dominance?” (MarketWatch). “Is “King Dollar” in danger of losing its crown? Probably not yet, but the rapid unwinding of last year’s torrid rally in the U.S. dollar, combined with efforts in Beijing and beyond to ease dependence on the buck, have helped to reinvigorate speculation that the greenback’s dominance over international trade and finance may be moving toward its twilight.”

“De-Dollarization Is Happening At A ‘Stunning’ Pace, Jen Says” (Bloomberg). “The greenback’s share in global reserves slid last year at 10 times the average speed of the past two decades as a number of countries looked for alternatives after Russia’s invasion of Ukraine triggered sanctions, Jen and his Eurizon SLJ Capital Ltd. colleague Joana Freire wrote in a note. Adjusting for exchange rate movements, the dollar has lost about 11% of its market share since 2016 and double that amount since 2008, they said.”

What we’re reading (4/17)

“Alphabet Shares Dip On Report Samsung Phones May Switch To Microsoft Bing Search” (CNBC). “Google pays billions of dollars every year to phone manufacturers, including a reported $20 billion annually to Apple, to serve as the default search engine. In return, the search company reaps billions of dollars worth of advertising, which has long been a profit center for Google. Samsung and Google’s deal is up for renewal soon, the Times reported, and is worth an estimated $3 billion in revenue to Google. Samsung is a major Android manufacturer, and the news that Samsung would consider a switch reportedly surprised Google employees.”

“How To Recession-Proof Your Portfolio” (The Week). “Diversification — which ‘doesn't just mean allocating your money across different forms of investments like stocks or bonds,’ Nerdwallet points out, but also "across industries, geographic locations, and companies of various sizes" — is always important to mitigate portfolio risk. But during a recession, diversification becomes especially important. After all, you don't want to put all of your eggs into one basket that sinks with the market.”

“Fox Could Likely Survive A Nine-Figure Loss To Dominion, Media Analysts Say” (NBC News). “In the event Dominion wins its case, said Lyrissa Lidsky, a constitutional law professor at the University of Florida, the jury is highly unlikely to award Dominion all the money it’s seeking for what it says is the reputational damage exacted by Fox News’ broadcasts.”

“State Street, Schwab See Deposits Drop” (Wall Street Journal). “At Schwab, the brokerage giant, deposits fell 11% to $326 billion from the previous quarter and were down 30% from a year earlier. State Street, one of the largest custody banks, said Monday that deposits totaled about $224 billion at the end of the first quarter, down 5% from December and 11% from a year ago.”

“Life Insurers Could Face Liquidity Crunch Next” (Institutional Investor). “Insurers have faced liquidity problems in the past for a variety of reasons: poor product management, such as writing policies that allowed large-scale, immediate policyholder cash-outs; inadequate liquidity in investment portfolios to fund redemptions; and poorly anticipated disintermediation risk due to changing economic conditions.”

What we’re reading (4/16)

“The End of Faking It in Silicon Valley” (New York Times). “Not only has funding dried up for cash-burning start-ups over the last year, but now, fraud is also in the air, as investors scrutinize start-up claims more closely and a tech downturn reveals who has been taking the industry’s ‘fake it till you make it’ ethos too far.”

“Tech Bros Are Destroying Weird Austin” (UnHerd). “Not so long ago, Silicon Valley was a magical land where unicorns flourished; anybody with an idea, seed capital and a little luck could become richer than all the kings of folklore. These days, things aren’t so rosy. Silicon Valley’s own bank recently collapsed, some unicorns have turned out to be donkeys, and, depending on your point of view, the Valley is now either Ground Zero for a plague of disinformation or the epicentre of a sinister private-public surveillance regime.”

“Yellen Says U.S. Banks May Tighten Lending And Negate Need For More Fed Rate Hikes” (CNBC). “U.S. Treasury Secretary Janet Yellen said banks are likely to become more cautious and may tighten lending further in the wake of recent bank failures, possibly negating the need for further Federal Reserve interest rate hikes.”

“With The Odds On Their Side, They Still Couldn’t Beat The Market” (New York Times). “It’s awfully hard to beat the stock market consistently. In 2022, despite many advantages, most mutual funds couldn’t do it. There are important lessons in that failure for this year and beyond.”

“Christine Lagarde Says She Has ‘Huge Confidence’ That The US Won’t Default On Its Own Debt” (CNN Business). “Christine Lagarde, president of the European Central Bank, said she has “huge confidence” the US will not allow the country to default on its own debt during an interview on CBS’ ‘Face the Nation’ Sunday.”