What we’re reading (4/6)

“S&P 500 Ends Thursday Higher, But Suffers Its First Down Week In Four: Live Updates” (CNBC). “Tech stocks lifted the S&P 500 into the green Thursday as the market wrapped up the short trading week on a high note despite signs of a weakening labor market.”

“Stocks Haven’t Looked This Unattractive Since 2007” (Wall Street Journal). “The equity risk premium—the gap between the S&P 500’s earnings yield and that of 10-year Treasurys—sits around 1.59 percentage points, a low not seen since October 2007.”

“Tim Cook On Shaping The Future Of Apple” (GQ). “As Apple CEO, he has defied his skeptics and refashioned the world’s most creative company on his own exacting terms. Now, in a frank conversation, he offers new insight into his leadership—explaining why he sees himself as an outsider, how he asserts Apple’s values, and what he does to keep from staring at his iPhone all day.”

“This Bank Proposal Will Damage Our Economy And Make Voters Even More Resentful” (New York Times). “The current [deposit insurance] limit, $250,000 per person, is more than adequate for any banking needs an individual might have. An unlimited guarantee to banks that their debts to depositors will always be 100 percent backed by the government is an invitation for the banks to print money with Uncle Sam’s credibility but for their private profit.”

“‘It’s An Especially Bad Time’: Tech Layoffs Are Hitting Ethics And Safety Teams” (CNN Business). “Big Tech companies brought on employees focused on election safety, misinformation and online extremism. Some also formed ethical AI teams and invested in oversight groups. These teams helped guide new safety features and policies. But over the past few months, large tech companies have slashed tens of thousands of jobs, and some of those same teams are seeing staff reductions.”

What we’re reading (4/5)

“Inflation’s Inventory Gluts Are Here To Stay And Will Hit The Bottom Line In Weaker Economy: CNBC Supply Chain Survey” (CNBC). “Bloated warehouse inventories are an expensive pressure eating away at the bottom line of many companies, and for many, the excess supply and associated costs of storage won’t abate this year, according to a new CNBC Supply Chain Survey.”

“Exxon Quits Drilling In Brazil After Failing To Find Oil” (Wall Street Journal). “Exxon Mobil Corp. has abandoned a multibillion-dollar wager on finding oil in the deep waters off Brazil after a series of disappointing wells left it with nothing to show for more than five years of work, according to people familiar with the matter.”

“Anyone Hoping To Make An Easy Buck Off Vacation Properties Must Contend With An ‘Airbnbust’ And A Growing Number Of Places Looking To Regulate Short-Term Rentals” (Insider). “[T]he industry sits at a crossroads. Some short-term rentals are doing better than ever, while other owners complain of dried-up bookings and an encroaching Airbnbust. Some experts note that localities with robust regulations of short-term rentals provide a solid environment for hosts by capping the number of permits and preserving the profits of existing Airbnb owners.”

“Reimagining Index Funds” (Research Affiliates). “We show that the indexing gold standard of cap-weighting can be improved upon when index construction uses a company’s fundamentals to choose stocks—and then cap-weights them. We propose just such an index, which we call the Research Affiliates Capitalization-Weighted Index, or RACWI.”

“These Are The Only Stocks That Matter Right Now” (CNN Business). “The rally that the S&P 500 has enjoyed since the beginning of the year has been driven by a small group of stocks — the market cap of the remaining 480 or so has basically remained the same. ‘This is not a broad-based rally where all stocks go up but instead a rally concentrated in a few of the largest stocks by market cap, mainly tech names,’ Torsten Slok, chief economist at Apollo Global Management, told CNN.”

What we’re reading (4/4)

“Jamie Dimon On Banking Turmoil: ‘This Wasn’t The Finest Hour For Many Players’” (Wall Street Journal). “Mr. Dimon used his annual letter to highlight JPMorgan’s performance and weigh in on political issues, bank regulation and the state of the economy. In his 43-page letter this year, Mr. Dimon repeated his mantra that the U.S. economy is strong but faces challenges. The fallout from the recent bank failures further clouds the outlook, he said.”

“People Are Suing Elon Musk For $258 Billion Dollars Over Meme Money. I'd Want This Case Thrown Out, Too.” (Dealbreaker). “Like it or not, Elon Musk has a lot of influence. He’s the second richest man in the world, is the (bumbling) head of one of the largest public forums in the world, and — when he’s not actively creating them — has dedicated followers who watch his every move. Said watchers, much like Tesla and Facebook, often take losses for reasons that range from normal market fluctuations to Elon bullying his employees. And when that happens, lawsuits follow.”

“Why I Would Start An Enterprise Technology Company Today” (RealClearMarkets). “Incredible companies have been founded during down economic times; just look at Google, Salesforce, Dropbox, Uber and many more. Their founders were not deterred by the macroeconomic environment. The macro was irrelevant. The cycles were ON, and the dreamers were obsessed. They were committed to navigating challenges and remained undeterred. Founders today shouldn't be deterred, either.”

“You’re Fired!” (RiskHedge). “I think a lot of Nasdaq stocks—and perhaps the whole index—will surprise to the upside when the cost-saving effects of these layoffs start to show up in earnings results. I expect that to happen during Q3 and Q4 of this year.”

“How Cigna Saves Millions by Having Its Doctors Reject Claims Without Reading Them” (ProPublica). “[Cigna] has built a system that allows its doctors to instantly reject a claim on medical grounds without opening the patient file, leaving people with unexpected bills, according to corporate documents and interviews with former Cigna officials. Over a period of two months last year, Cigna doctors denied over 300,000 requests for payments using this method, spending an average of 1.2 seconds on each case, the documents show. The company has reported it covers or administers health care plans for 18 million people. Before health insurers reject claims for medical reasons, company doctors must review them, according to insurance laws and regulations in many states. Medical directors are expected to examine patient records, review coverage policies and use their expertise to decide whether to approve or deny claims, regulators said.”

What we’re reading (4/3)

“Wall Street Dealmaking Activity Dives In Q1” (Axios). “The further Wall Street gets from 2021, the more of an aberration it looks like…[t]he value of U.S. merger and acquisition activity fell 20% from the previous quarter — and is nearly halved from Q1 of last year.”

“McDonald’s Temporarily Shuts U.S. Offices As Chain Prepares For Layoff Notices And Begins Layoff Notices To Employees” (Wall Street Journal). “McDonald’s Corp. has temporarily closed its U.S. offices this week and has started informing corporate employees about layoffs being made by the burger giant as part of a broader company restructuring.”

“Oil Prices Soar As OPEC+ Shocks The Market” (OilPrice.Com). “OPEC+ on Sunday surprised oil markets with an announcement that it will reduce its output further, by some 1.66 million barrels daily…[t]he Financial Times reported that oil prices had gained 8% immediately after the announcement, noting Saudi Arabia’s share of the cuts would be almost half of the total, at 500,000 bpd.”

“How Mobile Phones Have Changed Our Brains” (BBC). “The mere proximity of a phone, it seems, contributes to ‘brain drain’. Our brains may be subconsciously hard at work in inhibiting the desire to check our phones, or constantly monitoring the environment to see if we should check our phone (eg, waiting for a notification). Either way, this diverted attention can make doing anything else more difficult. The only ‘fix’, the researchers found, was putting the device in a different room entirely.”

“A Hollywood Superagent Buys A Pro Wrestling Heavyweight” (New York Times). “Ari Emanuel’s media colossus Endeavor, whose properties include the Ultimate Fighting Championship, has agreed to buy World Wrestling Entertainment, creating a live event behemoth and cementing its status as a leader in combat sport competitions. The combination will create a new, publicly traded company that is 51 percent owned by Endeavor, with W.W.E. holding the remaining 49 percent. The new company will be worth more than $21 billion[.]”

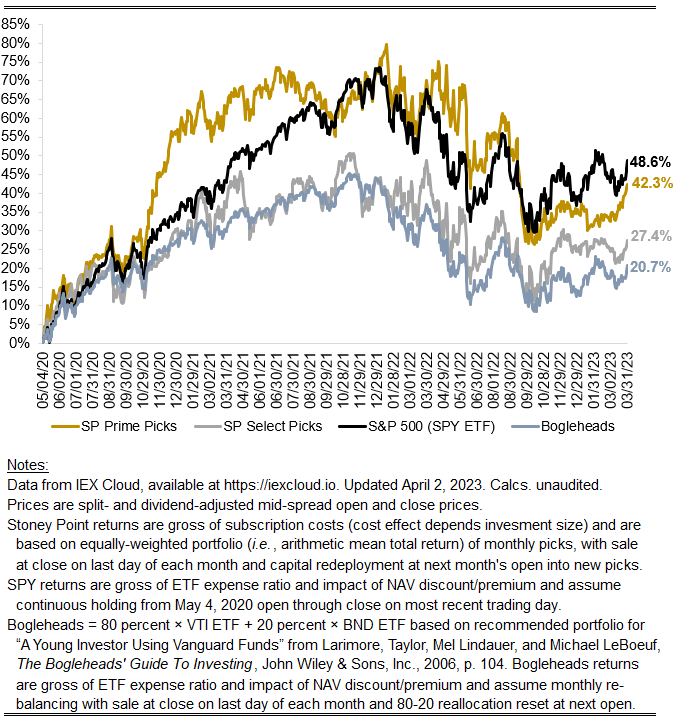

March 2023 performance update

Hi friends,

Here with an update for the month. Here are the key numbers:

Prime: +7.18%

Select: +1.75%

SPY ETF: +3.93%

Bogleheads Portfolio (80% VTI, 20% BND): 2.82%

Financial markets experienced a lot of excitement in March with the SVB blowup (and bailout), but those events did not ultimately bear much, it at all, on the performance of Prime and Select or the benchmarks listed above. Careful readers will recall that the model I use to choose stocks for Prime and Select filters out financial institutions from the universe of considered stocks. That is not because I think there is anything wrong with them, but rather because the economics of financial institutions tend to be sufficiently different from all other types of enterprises that they simply cannot be analyzed the same way, with the same ratios, etc. In the case of the benchmarks, the bank runs this month arguably did not matter much because their pricing impact was largely confined to the at-issue institutions, while the larger American banks’ stocks behaved more or less agnostically to the events.

Needless to say, Prime knocked it out of the park in March. Earlier this month, I posted an article discussing AQR’s recent strong performance and attributing it to its selection of “boring” so-called “value” stocks. If you are familiar with the composition of the Prime portfolio lately that should strike you as essentially the types of stocks currently in that portfolio. Cliff Asness, who runs AQR, insists “value” should return to prominence as general stock selection paradigm and value factors should perform better in the future than they have in the recent past. I agree.

Stoney Point Total Performance History

What we’re reading (3/31)

“Regulators Really Have Given Up Trying To Teach Wells Fargo A Lesson” (Dealbreaker). “It has become clear over the past decade that it does not matter how much or how often you fine Wells Fargo, it will find new ways to break the rules while continuing to break the other rules it’s already been taken to task over, often multiple times. Everyone—most especially Sen. Sherrod Brown and probably CEO Charles Scharf, like those CEOs who preceded him and those who will succeed him—is powerless to stop it, except perhaps for Federal Reserve Chairman Jay Powell, and he’s rather disinclined to do much of anything about it. So when he and his predecessor, Treasury Secretary Janet Yellen, found out that once again Wells had screwed up—and not in a minor way, either, allowing the likes of Iran, Syria and Sudan to illegally funnel a half-billion dollars their bloody ways—they just sort of shrugged.”

“The Fed Is Doing Too Much, All At Once” (New York Times). “Beating inflation is crucial for the Federal Reserve. But so is promoting full employment. And don’t forget about preserving the stability of the financial system. Each of these goals is exemplary on its own. Put them all together in the current environment, however, and you get head-spinning problems.”

“The $2.3 Trillion Fed Program Banks Hate” (Axios). “The year was 2013. The great concern among the Federal Reserve's leaders was that, with the world awash in dollars they had created, they wouldn't be able to raise rates even when they felt they needed to…[t]heir solution was a tool that has now swelled to massive size — $2.3 trillion as of Wednesday — and is making banks angry, as they see it as a major factor in their loss of deposits.”

“Wild Quarter For Markets Might Foretell Further Turbulence” (Wall Street Journal). “In the face of significant uncertainty, markets proved to be more buoyant than many investors thought possible. The S&P 500 rose 7% in the first quarter, while the Dow Jones Industrial Average added 0.4%. The Nasdaq Composite soared. The technology-heavy index jumped 17%, outperforming the Dow industrials by the widest margin since 2001. Overall, it was Nasdaq’s best quarter since the second quarter of 2020.”

“Where Are The Missing Workers?” (Brookings Institution). “About 40% (nearly 1 million workers) of the persistent decline can be attributed to the continuation of pre-pandemic demographic trends, according to the authors. As the Baby Boomers reach retirement age, they are leaving the labor force. However, the population is becoming more educated, and at every age, more educated people are more likely to be working.”

April picks available now

The new Prime and Select picks for April are available starting now, based on a model run put through today (March 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Monday, April 3, 2023 (at the mid-spread open price) through the last trading day of the month, Friday, April 28, 2023 (at the mid-spread closing price).

What we’re reading (3/29)

“How To Beat The Market With Boring Stocks” (Forbes). “For a depressingly protracted period the value-conscious portfolio managers at AQR, which Asness, 56, cofounded in 1998, lost ground to competitors chasing hot growth stocks. Then came last year’s stock market rout. As the air exited inflated tech stocks, AQR funds became winners. This is how Asness describes what bubbles do to value players: ‘It starts out ugly and then it turns wonderful.’ Wonderful, that is, if you hang in there. Which some clients didn’t.”

“What’s Troubling Private Equity Executives, According To Their Personal Coaches” (Institutional Investor). “Fundraising is definitely a concern, according to Peter Feer, an executive coach to more than 25 clients who he meets weekly or monthly. About 80 percent of his clients are senior-level workers at private-equity firms ranging from $2 billion to almost $40 billion. ‘They are stressed that they are not going to be able to raise that successful next fund that’s larger than the prior fund. That definitely seeps into our conversations,’ Feer said.”

“A Rapid-Finance World Must Ready For A Slow-Motion Banking Crisis” (Wall Street Journal). “In recent decades financial crises have tended to be fast-moving and violent. They usually revolve around a handful of companies or countries, and often climax over a weekend, before Asian markets open…But another template is also possible: the corrosive, slow-motion crisis. SVB collapsed because of a confluence of structural factors that to a lesser extent afflict many institutions. That could force many banks in coming years to shrink or be acquired, a process that also hampers the supply of credit.”

“Is The Era Of Remote Work Over?” (The Week). “In terms of hybrid arrangements, under which employees spend part of the week at home and part of the week in the office, such plans ‘decreased in all measured industries in 2022 from 2021, declining 13.4 percentage points across the private sector.’ This change was ‘particularly stark’ in the finance sector, wherein the share of ‘establishments operating hybrid dropped by half, to 22 percent in 2022 from 44.9 percent in 2021.’ Where work-from-home did manage to remain relatively common was in ‘jobs that were traditionally done in an office,’ like tech and media positions or law and accounting roles.”

“The Search For Earth Look-Alikes Is Getting Serious” (The Atlantic). “Several years ago, astronomers pointed a telescope at another star and discovered something remarkable: seven planets, each one about the same size as Earth. The planets were quite close to their small star—all seven of their orbits would fit inside Mercury’s. And yet, because this star is smaller, cooler, and dimmer than our own, at least three of those rocky worlds are in the habitable zone, at the right temperature for liquid, flowing water. Earthlike size and sunniness don’t guarantee that you’ll find ET, but if you were looking for signs of alien life beyond this solar system, this corner of the universe would be a promising place to start.”

What we’re reading (3/28)

“Bank Regulators Eye Tougher Oversight After Silicon Valley Bank Collapse” (Washington Post). “Silicon Valley Bank’s failure was a ‘textbook case of mismanagement’ that shows that banks with more than $100 billion in assets may need tougher oversight, and the government will review the federal insurance program that protects deposits, regulators told a Senate committee looking into the crisis.”

“Investment Firms Have A New Bidding Opponent: Activist Home Flippers” (Wall Street Journal). “Activist flippers say they are leveling the playing field. Many home sellers prefer cash buyers because they are viewed as the fastest and most reliable purchaser. Nonprofits want to offer an alternative—and competitive—all-cash option.”

“I Would Love To Have Enough Time And Money To Go To An Office To Work All Day” (Slate). “Growing prosperity? A choice? Now, that’s interesting. It’s true that most Americans live in a world of material abundance relative to, say, the bog people, but it’s questionable whether their ‘rewards’ for working are ‘growing,’ or whether the United States’ prosperity, as described by measures like gross domestic product, is being made available to them in a way that affords real choices about how to spend time.”

“Sam Bankman-Fried Paid Over $40 Million To Bribe At Least One Official In China, DOJ Alleges In New Indictment” (CNBC). “FTX co-founder Sam Bankman-Fried paid out tens of millions of dollars worth of bribes to at least one Chinese government official, federal prosecutors alleged in a new indictment Tuesday.”

“When Can Waffle House Raise Its Prices?” (American Institute of Economic Research). “If market power were a big deal, companies wouldn’t need the cover of inflation to raise prices. Monopolies can pass on their cost increases and customers can’t flee to other sellers. Under competition — under supply and demand — firms can only raise prices when other firms’ costs rise. With competition, firms will raise prices together, seemingly “under the cover of inflation.” Instead of being evidence that markets are “no longer controlled by competition,” firms raising prices together is evidence of supply and demand at work.”

What we’re reading (3/27)

“Markets May Be Entering A ‘Lost Decade' For Global Economic Growth Amid Financial Instability And High Inflation, World Bank Says” (Insider). “In a Monday report, World Bank economists estimated that the global economy's potential growth rate could average 2.2% for the rest of the decade. By comparison, in the early 2000s, that measure was 3.5%, and it was 2.6% for the most recent decade.”

“How China Keeps Putting Off Its Lehman Moment” (New York Times). “[I]nstead of introducing reforms to establish a healthy market-based economy in which inefficient businesses are allowed to fail, China’s Evergrande-style fixes — while defusing short-term crises — reward irresponsible behavior and perpetuate the excessive borrowing and wasteful use of funding that leads to recurring financial distress.”

“A Tale Of Two Housing Markets: Prices Fall In The West While The East Booms” (Wall Street Journal). “In all of the 12 major housing markets west of Texas, plus Austin, home prices fell in January on an annual basis, according to mortgage-data firm Black Knight Inc.’s home-price index. In the 37 biggest metro areas east of Colorado, except Austin, home prices rose year-over-year.”

“American Cities With The Highest Property Taxes” (Construction Coverage). Rochester, NY is #1 on the list for large metros.

“A Simple Heuristic For Distinguishing Lie From Truth” (Verschuere, et al., Nature Human Behaviour). “One of the reasons that people perform poorly when trying to detect deception is the difficulty of integrating multiple cues into a binary judgement. A simple heuristic of only judging the level of detail in the message consistently allowed people to discriminate lies from truths.”

What we’re reading (3/26)

“Cathie Wood Suffers Double Blow As Drama Hits Coinbase And Block” (Bloomberg). “An activist short seller attack on one US firm and the threat of regulatory action against another have conspired to deal a double blow to Cathie Wood and ARK Investment Management, as both shares are among her top holdings.”

“How Options-Hedging Turbocharged Oil Volatility” (Wall Street Journal). “The economic fears gripping Wall Street have sparked outsize swings in oil prices, exacerbated by trading that investors and analysts say has little to do with the fundamental value of crude. One culprit is an arcane area of trading known on Wall Street as delta hedging, aimed at reducing the risks tied to directional price moves.”

“Deutsche Bank, UBS Stocks Sink As Fear Of European Banking Crisis Returns” (CNN Business). “Europe’s banking stocks tumbled Friday as investors acted on their lingering worries that the recent crises at some banks could spill over into the wider sector. Europe’s Stoxx Europe 600 Banks index, which tracks 42 big EU and UK banks, closed 3.8% lower. The index is down 18% from its high in late February. London’s bank-heavy FTSE 100 index closed down 1.3%. Shares in Germany’s biggest bank, Deutsche Bank (DB), plunged as much as 14.5% before paring its losses to close 8.5% lower. Shares in UBS (UBS) and Credit Suisse (CS) were 3.6% and 5.2% down respectively.”

“Apple Enjoys ‘Symbiotic’ Relationship With China, Cook Says” (AFP). “Apple enjoys a ‘symbiotic’ relationship with China, CEO Tim Cook said on Saturday, as the iPhone giant looks to move production out of the country. Cook, who is in China to attend the high-profile China Development Forum, said ‘Apple and China grew together,’ during an interview on the role of technology in education. ‘This has been a symbiotic kind of relationship that I think we both enjoyed,’ he said at the state-run event attended by top government officials and corporate leaders.”

“Accenture Slashes 19,000 Jobs Worldwide” (CNN Business). “Accenture (ACN), which has 738,000 employees globally, said in its latest quarterly report to the Securities and Exchange Commission that it continues to hire, but had ‘initiated actions to streamline [its] operations and transform our non-billable corporate functions to reduce costs.’”

What we’re reading (3/26)

“Commercial Real Estate Is The Next Shoe To Drop For Regional Banks And The Stock Market” (Business Insider). “A potential credit crunch in the sector, sparked by a wave of upcoming refinancings of commercial real estate loans at much higher interest rates than in the past, could send stocks spiraling and the economy into a recession.”

“Welcome To The Superprime Banking Crisis” (Wall Street Journal). “Banking’s last crisis featured subprime borrowers, specifically people with troubled credit who were given mortgages by bankers who ignored the risk that the borrowers wouldn’t realistically be able to afford them. Banks that got into trouble were ones that churned out such loans or gorged on them in securitized form. The current emerging turmoil is, so far, featuring the opposite. Banks such as Silicon Valley Bank and Signature Bank that catered to some of the wealthiest, most creditworthy clients—those with superprime credit scores—are the ones running into the biggest problems.”

“Interpol Confirms Arrest Of Crypto Fugitive Do Kwon In Montenegro” (CNN Business). “Interpol says a man arrested in Montenegro is Kwon Do-hyeong, also known as Do Kwon, the disgraced founder of a collapsed crypto company who is wanted in South Korea and the United States on fraud and other charges…Kwon’s identity was confirmed through a fingerprint match, Interpol’s national central bureau in Seoul told CNN on Friday.”

“Funding Unprofitable Growth” (Smead Capital Management). “The current tribulation is closely associated with a myriad of startup companies in everything from tech to clean energy. The Federal Reserve tightened credit by taking short-term rates to 4.75% from nearly zero. In the process, we are now learning that the regional banks most closely associated with new technologies have severe problems and a few have been shut down by the government. The flow of funds to venture capital investments and profit-less growth businesses could possibly come to a halt.”

“Ford CEO On EV transition: ‘Batteries Are The constraint’” (Yahoo! Finance). “Companies such as Ford (F) are collectively pouring hundreds of billions of dollars into electric vehicles (EVs). But as the industry transitions toward zero carbon emissions, battery supply chains could stand in the way of those ambitions.”

April picks available soon

We’ll be publishing our Prime and Select picks for the month of March before Monday, April 3 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of March, as well as SPC’s cumulative performance, assuming the sale of the March picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Friday, March 31). Performance tracking for the month of April will assume the April picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Monday, April 3).

What we’re reading (3/23)

“Charles Schwab Says It Could Ride Out A Deposit Flight” (Wall Street Journal). “Charles Schwab Corp., one of a host of financial firms that have taken a drubbing since the collapse of several regional banks this month, is pushing back against fears that it could face some of the same problems as paper losses on its bondholdings mount. In an interview with The Wall Street Journal, Schwab’s chief executive said the brokerage giant could continue to operate even if it lost most of its deposits over the next year.”

“Moody’s Sees Risk That U.S. Banking ‘Turmoil’ Can’t Be Contained” (MarketWatch). “Despite quick action by regulators and policy makers, there’s a rising risk that banking-system stress will spill over into other sectors and the U.S. economy, ‘unleashing greater financial and economic damage than we anticipated,’ said Moody’s Investors Service, one of the Big Three credit-ratings firms.”

“Guy Who Founded Social Network Ruining The World Also Allegedly Founded Company Facilitating Fraud, Money-Laundering, Other Social Ills” (Dealbreaker). “You might think that Nate Anderson’s got enough on his plate. He and other short-sellers are fighting an existential battle against Washington. He’s still (probably) making plenty betting against aspiring electric-vehicle maker Nikola. Oh yea, and he’s busy shaking the markets of the second-largest country on earth to their core, wiping some $135 billion from the market value of one of India’s biggest conglomerates, Adani Group, which Anderson’s Hindenburg Group says is as filled with fraud as his own firm’s namesake was with highly-combustible hydrogen. But no: The one-time Ponzi-seeking hobbyist is always on the lookout for scams big and small; ‘there are just so many outrageous companies,’ he once said excitedly. And one of them just happens to have been founded by the same guy who launched Twitter—and both are about equally good for the world, sayeth Hindenburg.”

“Smaller PE Funds Struggled To Raise Money In 2022” (Institutional Investor). “The fundraising environment was even more difficult for the smallest group of funds, which are defined by McKinsey as those with less than $250 million in assets. According to the report, only 1,500 of these funds reached their fundraising targets in 2022, down 51 percent from the year before. That’s the lowest level since 2015.”

“Get Ready: More Blackouts Are Coming” (Insider). “[M]ass blackouts are starting to become a more regular feature of modern American life. Power outages have increased 64% from the early 2000s, and weather-related outages — many driven by the worsening climate crisis — have increased 78%. But it's not just nature making our grid shakier: A system that was once largely controlled by localized public entities has been handed over to layers of regional authorities and private companies whose goal is maximizing profits — not reliability.”

What we’re reading (3/22)

“Credit Suisse’s Investment Bank Is Slowly Disappearing” (DealBook). “[I]t now looks like the investment bank will largely be dissolved, as UBS makes clear that it’s only interested in bits of the business, and as the Swiss government moves to bar some promised payouts to Credit Suisse’s bankers. What was once a top-flight shop of corporate advisers now appears to be a melting ice cube.”

“It Wasn’t Just Credit Suisse. Switzerland Itself Needed Rescuing.” (Wall Street Journal). “It is still far from clear whether the Swiss have fully contained the damage. Having two world-class banks was seen as a fail-safe to maintain Switzerland’s position in world markets. The forced marriage has left it with one and has shaken ordinary Swiss people and their faith in the country’s economic and political model.”

“The End Of Silicon Valley” (RiskHedge). “The collapse of SVB is an extinction-level event for Silicon Valley. The friendly “startup” bank that extended an olive branch during tough times is gone. And Wall Street giants like JPMorgan aren’t writing checks to money-losing startups. My VC contact told me, ‘Firms are clinging to their capital. Everyone I know is in survival mode. The bar is very high for new companies.’ Silicon Valley startups are now starved for funding. Many need to raise money. Most won’t be able to. Get ready for a ‘culling of the herd.’ Only the strongest will survive.”

“What Elizabeth Warren, Larry Summers, And Paul Krugman All Got Wrong About SVB” (The Nation). “SVB’s growth was indeed rapid, but much of that was back in 2021, the pandemic recovery year. The return on deposits was sweet, and the ad said, in a way that is not now reassuring, that SVB is ‘fundamentally different from other banks.’ It’s also true that SVB lobbied successfully for relief from some regulations on the ground that it d”id not pose a systemic risk. That looks bad, but SVB wasn’t a systemic risk—its peak deposits of $300 billion were a tiny fraction of US bank deposits.”

“Inadequate Capital And Unrestricted Executive Compensation Took Down SVB” (The Hill). “In the aftermath of the 2008 banking and financial crisis, I studied its causes and concluded that if banks were financed with a significantly greater proportion of equity capital, a banking crisis would be much less likely. The proposal has two components. First, bank capital should be calibrated to the ratio of tangible common equity to total assets (i.e., to total assets independent of risk) not the risk-weighted capital approach that is at the core of Europe’s Basel Committee for Banking Supervision’s regulatory standards. Second, bank capital should be at least 20 percent of its total assets. Finally, total assets should include both on-balance sheet and off-balance sheet items; this would mitigate concerns regarding business lending spilling over to the shadow banking sector.”

What we’re reading (3/21)

“Anxiety Strikes $8 Trillion Mortgage-Debt Market After SVB Collapse” (Wall Street Journal). “Last week, the risk premium on a widely followed Bloomberg index of agency MBS hit its highest level since October, when climbing interest rates turned global markets topsy-turvy. The move reflected fears that other regional banks might have to sell their holdings, bond-fund managers said.”

“Home Prices Just Broke A Decade-Long Streak” (CNN Business). “The median price of a US home was lower this February than it was in February 2022, ending more than a decade of year-over-year increases, the longest on record, according to a National Association of Realtors report released Tuesday.”

“An Insider Deconstructs ESG” (Law & Liberty). “Debates about business’s proper ends and responsibilities are not new. Many in the financial sector have been persuaded that ESG will allow business to continue generating wealth while also playing a positive role in society in ways that go far beyond the world of supply and demand. The problem, [former BlackRock Managing Director Terrence] Keeley says, is that ESG simply does not deliver.”

“Investigate The Bank Failures” (Luigi Zingales in City Journal). “In a speech last week, President Biden reassured the public that those responsible for the failure of Silicon Valley Bank (SVB) and Signature Bank will be held accountable. In the 2008–09 Financial Crisis, this did not happen. For Biden’s promise to be more than rhetoric, his administration must take a proactive role. As the last crisis showed, the normal mechanisms of accountability are broken. Banks paid billions of dollars in fees, but no CEO, board member, auditor, or regulator went to jail. Aside from a few CEOs, nobody even paid a fine out of his own pocket.”

“First Republic Bank Taps Lazard For Help With Review Of Strategic Options” (Wall Street Journal). “Lazard and McKinsey have been brought in alongside JPMorgan Chase & Co., which had already been hired by First Republic to advise on moves the bank could make to regain its footing after the failure of two other lenders caused its depositors to flee.”

What we’re reading (3/20)

“When Headlines Worry You, Bank On Investment Principles” (Dimensional Fund Advisors). “Nobel laureate Merton Miller famously used to say, ‘Diversification is your buddy.’ Thanks to financial innovations over the last century in the form of mutual funds, and later ETFs, most investors can access broadly diversified investment strategies at very low costs. While not all risks—including a systemic risk such as an economic recession—can be diversified away […], diversification is still an incredibly effective tool for reducing many risks investors face. In particular, diversification can reduce the potential pain caused by the poor performance of a single company, industry, or country”

“Federal Reserve Faces Tough Decision On Rate Increase” (Wall Street Journal). “The Fed has tried over the past year to telegraph its rate moves to avoid surprises and minimize volatility. Until now, it hasn’t confronted an abrupt and fluid crisis on the eve of a policy meeting. On Monday, investors anticipated the Fed would likely proceed with a rate rise, with interest-rate futures markets at midday implying a roughly three-in-four chance of a quarter-point increase, according to CME Group.”

“Google Was Beloved As An Employer For Years. Then It Laid Off Thousands By Email” (CNN Business). “Google (GOOGL), which for years ranked as the top company to work for in the United States, laid off thousands of workers by e-mail. And not just any employees: Decades-long veterans of the company, at least one employee on health leave, and even an employee in labor with her second child were all cut, with little explanation. Employees were left scrambling to determine who had been let go and those affected had no opportunity to say goodbye to colleagues or pack up their desks, former workers told CNN.”

“Can We Slow This All Down, Please?” (New York Times). “Over the past week, an observation by Matt Klein, a financial journalist, has gotten passed around quite a bit. ‘This was more a case of a ‘bank-run by idiots’ rather than a ‘bank run by idiots,’’ he wrote, referring to the collapse of Silicon Valley Bank. But why choose? Everyone involved in this looks terrible.”

“America’s New Class War” (UnHerd). “Taken together, then, we can see that affluent, college-educated voters and the donors in both parties are skewing American politics to the Left on social issues and to the Right on economics. This has left a substantial part of the American public unrepresented in our two-party system.”

What we’re reading (3/19)

“UBS Agrees To Buy Credit Suisse For More Than $3 Billion” (Wall Street Journal). “The deal between the twin pillars of Swiss finance is the first megamerger of systemically important global banks since the 2008 financial crisis when institutions across the banking landscape were carved up and matched with rivals, often at the behest of regulators.”

“Two Big Ideas For Preventing Another Banking Crisis” (DealBook). “Not everyone thinks deposits should be free of risk. Sheila Bair, who was the chair of the F.D.I.C. during the financial crisis, practically groaned when I brought up the idea of insuring all deposits. ‘These were big tech companies like Roku whining and crying about their uninsured deposits,’ she said. ‘If a $200 billion bank can bring down the banking system, then we don’t have a stable, resilient system.’”

“Before Collapse of Silicon Valley Bank, the Fed Spotted Big Problems” (New York Times). “Silicon Valley Bank’s risky practices were on the Federal Reserve’s radar for more than a year — an awareness that proved insufficient to stop the bank’s demise. The Fed repeatedly warned the bank that it had problems, according to a person familiar with the matter. In 2021, a Fed review of the growing bank found serious weaknesses in how it was handling key risks. Supervisors at the Federal Reserve Bank of San Francisco, which oversaw Silicon Valley Bank, issued six citations…But the bank did not fix its vulnerabilities.”

“Fed Poised To Approve Quarter-Point Rate Hike Next week, Despite Market Turmoil” (CNBC). “Even with turmoil in the banking industry and uncertainty ahead, the Federal Reserve likely will approve a quarter-percentage-point interest rate increase next week, according to market pricing and many Wall Street experts.”

“FDIC Announces Agreement To Sell Signature Bank Assets To New York Community Bancorp” (Reuters). “A subsidiary of New York Community Bancorp (NYCB.N) has entered into an agreement with U.S. regulators to purchase deposits and loans from New York-based Signature Bank, which was closed earlier this month.”

What we’re reading (3/18)

“UBS Nears Deal To Take Over Credit Suisse” (Wall Street Journal). “The deal could come together Sunday if not sooner, the people said. Regulators have offered to waive a requirement for customary shareholder votes to expedite the sale, one of the people said. The discussions were fast-moving and a remaining sticking point was the status of who will own Credit Suisse’s substantial Swiss retail arm, the people said.”

“After A Wild Week, What Are Markets Saying About the World?” (New York Times). “The good news for most investors is that the S&P 500 was resilient to worries that centered on the banking industry, and after a big rally on Thursday, the index ended the week with a gain of 1.4 percent. It shows that, to stock investors at least, the crisis in the banking sector appears mostly contained…But investors in other markets are worried about the economy.”

“Bailouts Of Insolvent Banks Don’t Lead To Hyperinflation” (Marginal Revolution). “Let’s say there is a big hole in the solvency of a banking system. Left unaddressed, that is radically deflationary. Demand (and other) deposits will disappear, crushing aggregate demand. Cascading financial failures will occur elsewhere, again with negative demand effects. If a government ‘prints money,’ or more likely creates new electronic bookkeeping entries, that offsets the deflationary pressures. These bailouts may have other negative effects, such as on future moral hazard and rent-seeking, but they won’t bring hyperinflation. If you wanted to create hyperinflation, the bailout would have to look something like ‘for every dollar you used to have in your bank account, the Fed says you now have five!’ But that is not on the agenda.”

“Wealthy Executives Make Millions Trading Competitors’ Stock With Remarkable Timing” (ProPublica). “These transactions are captured in a vast IRS dataset of stock trades made by the country’s wealthiest people, part of a trove of tax data leaked to ProPublica. ProPublica analyzed millions of those trades, isolated those by corporate executives trading in companies related to their own, then identified transactions that were anomalous — either because of the size of the bets or because individuals were trading a particular stock for the first time or using high-risk, high-return options for the first time.”

“The Mystery Millionaire Of Gage Park” (Chicago Magazine). “When Joseph Stancak died, he left behind a secret: He was worth $11 million. How did a reclusive electrician living in a modest bungalow amass the largest unclaimed estate in American history?

What we’re reading (3/18)

“Government Fear-Mongering Over Silicon Valley Bank — And How To Profit” (New York Post). “There is lots I don’t know—like where stocks will be in 45 days. I do know that once you get to bank failures, stocks are hugely higher two years later.”

“Worried About A Recession Coming? You’re Not Alone.” (Morningstar). “We surveyed 949 preretirement U.S. investors and found it’s not just experts who are predicting a recession. Our study found that 68% of investors think a recession happening in 2023 is likely to nearly certain. In fact, less than 1% of respondents felt there was almost no chance that a recession would happen, compared with 11.9% who felt it is almost certain.”

“What Gets Lost When You Rescue Markets” (Wall Street Journal). “As my colleague Greg Ip pointed out in his 2015 book ‘Foolproof,’ however, making an environment feel safer can lull many people into complacency and excessive risk-taking. It also tends to coalesce massive power into the hands of a few people at the pinnacle of the financial system.”

“SVB Board Bickering Wasted Crucial Time Before Collapse” (Semafor). “Silicon Valley Bank lost a crucial day to raise money from investors after its board rejected executives’ financial projections, leading to a chaotic and ultimately doomed scramble for cash, people familiar with the matter said.”

“In Silicon Valley, A Boom Era Feels Like It’s Ending” (MarketWatch). “Silicon Valley is getting a reset — some could also call it a comeuppance — after the past 12 to 13 years of insane growth, often irresponsible spending, hubris and swagger. Big Tech has grown astronomically, and there were real successes in companies developing social media, cloud computing, mobile apps and electric vehicles. But there were also frauds and debacles like Theranos and WeWork.”