March 2023 performance update

Hi friends,

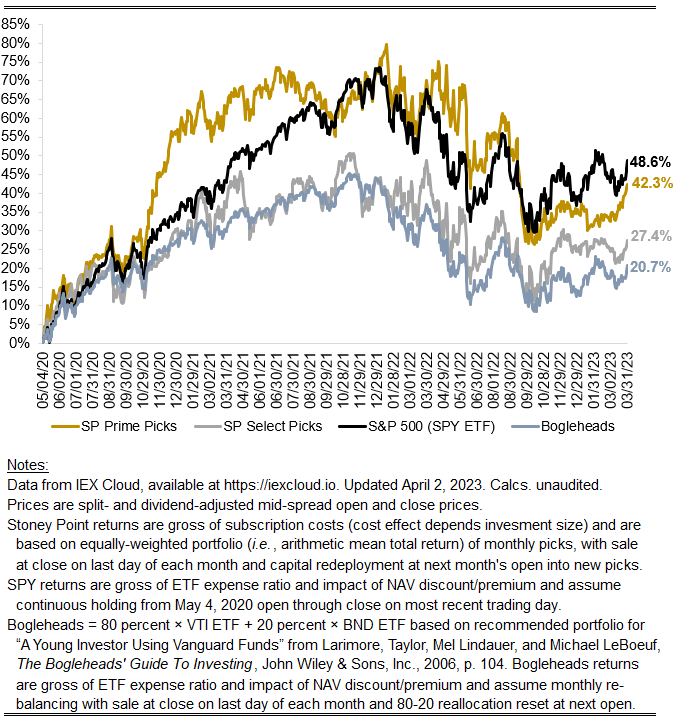

Here with an update for the month. Here are the key numbers:

Prime: +7.18%

Select: +1.75%

SPY ETF: +3.93%

Bogleheads Portfolio (80% VTI, 20% BND): 2.82%

Financial markets experienced a lot of excitement in March with the SVB blowup (and bailout), but those events did not ultimately bear much, it at all, on the performance of Prime and Select or the benchmarks listed above. Careful readers will recall that the model I use to choose stocks for Prime and Select filters out financial institutions from the universe of considered stocks. That is not because I think there is anything wrong with them, but rather because the economics of financial institutions tend to be sufficiently different from all other types of enterprises that they simply cannot be analyzed the same way, with the same ratios, etc. In the case of the benchmarks, the bank runs this month arguably did not matter much because their pricing impact was largely confined to the at-issue institutions, while the larger American banks’ stocks behaved more or less agnostically to the events.

Needless to say, Prime knocked it out of the park in March. Earlier this month, I posted an article discussing AQR’s recent strong performance and attributing it to its selection of “boring” so-called “value” stocks. If you are familiar with the composition of the Prime portfolio lately that should strike you as essentially the types of stocks currently in that portfolio. Cliff Asness, who runs AQR, insists “value” should return to prominence as general stock selection paradigm and value factors should perform better in the future than they have in the recent past. I agree.