What we’re reading (3/6)

“Billionaire Marc Andreessen Warns We’re Headed To A World Where A College Degree Costs $1 Million And A Flatscreen TV Costs $100” (Insider). “The Silicon Valley investor said that sectors provided or controlled by the government have become "technologically stagnant." Innovation in certain highly regulated sectors, like education and healthcare, "is virtually forbidden," causing high prices, he wrote. Andreessen said that over time the price of highly regulated products will continue to climb, while less-regulated products, like flatscreen TVs, will become cheaper.”

“The Dirty Little Secret Of Credit Card Rewards Programs” (New York Times). “In 2016, Chase launched its Sapphire Reserve card. The card comes with perks, bonuses and points multipliers that for big-spending travelers and diners are worth far more than its steep $550 annual fee. There was so much initial demand that Chase ran out of the metal slabs it prints the cards on. Sapphire’s enormous success set off a credit card perks war, with numerous banks flooding the market with sign-on bonuses worth thousands of dollars.”

“Why the Recession Is Always Six Months Away” (Wall Street Journal). “The government’s stimulus measures left household and business finances in unusually strong shape. Shortages of materials and workers mean companies are still struggling to satisfy demand for rate-sensitive goods, such as homes and autos. And Americans are splurging on labor-intensive activities they avoided in recent years, including dining out, travel and live entertainment.”

“Blackstone Defaults On Nordic CMBS As Property Values Wobble” (Bloomberg). “Blackrock Inc. defaulted on a €531 million ($562 million) bond backed by a portfolio of Finnish offices and stores as rising interest rates hit European property values.”

“Arm Opts For New York Stock Listing In Blow To London” (BBC). “The Cambridge-based firm designs the tech behind processors - commonly known as chips - that power devices from smartphones to game consoles. Reports in January said Prime Minister Rishi Sunak had restarted talks with Arm's owner, Japanese investment giant SoftBank, about a possible UK listing. Arm says it decided a sole US listing in 2023 was ‘the best path forward’.”

What we’re reading (3/5)

“Stock Futures Are Little Changed As Investors Look Ahead To Powell Comments, Jobs Data This Week” (CNBC). “U.S. stock futures were little changed on Sunday night as Wall Street looked ahead to a week filled with economic data and the latest commentary from the Federal Reserve.”

“Wonking Out: Peering Through The Fog Of Inflation” (New York Times). “Predicting the future has always been hard, but these days it’s becoming tricky even to predict the past: The statistical agencies keep making large revisions to older data. At the beginning of this year, consumer price data seemed to show a significant decline in inflation over the course of 2022. Then the Bureau of Labor Statistics revised its seasonal adjustment factors, which had no effect on inflation for the year as a whole but made inflation look lower in early 2022 and higher later in the year. The numbers still show improvement, but it’s sufficiently less significant to curb many economists’ initial enthusiasm.”

“What Is A CEO’s Pay Actually Worth?” (Wall Street Journal). “The old approach, still in use, requires companies to show pay for top executives as it was valued when they received it. Stock options and restricted stock are valued as of the day of grant, often a year or more before it is disclosed and several years before it vests, or becomes fully the executive’s property. Companies generally haven’t detailed how award values change during that period.”

“A Do-Nothing Day Makes Life Better” (The Atlantic). “Despite the fact that a day of rest is a core tenet of several ancient religions, as Heller notes, setting it all aside has become so uncommon in American society that we need to actively work to do it.”

“The rise Of The Gen Z Side Hustle” (BBC). “Side hustles existed before the pandemic, but they were often borne from a place of necessity rather than passion. In the past several years, they’ve come in the form of gig-economy jobs, either in lieu of a full-time role, or as a means of supplementing wages. Even now, side hustles are necessary to supplement income for many people: one September 2022 survey of 4,000 UK workers, from insurance company Royal London, shows 16% of respondents had taken on an additional role to help pay for cost of living increases.”

What we’re reading (3/4)

“How The Market Has Changed In The 20+ Years I’ve Covered It” (CNN Business). “If I’ve learned anything in my nearly three decades as a financial journalist (I started my career just out of college in 1995 at the long-defunct Financial World magazine) it’s that ‘this time is different’ is perhaps the biggest myth in investing. There are variations on that theme but, to quote Led Zeppelin, ‘the song remains the same.’”

“Stronger Economic Momentum Will Induce More Rate Hikes In 2023” (Morningstar). “With inflation already easing substantially without a recession, we’re very confident that the U.S. economy is capable of a soft landing, but achieving it is contingent on avoiding monetary policy error. Near-term growth in economic activity is proving more resilient to monetary policy tightening than we had anticipated, which is inducing the Federal Reserve to continue hike rates.”

“A 120-Year-Old Company Is Leaving Tesla In The Dust” (New York Times). “But the more I dealt with Tesla as a reporter — this was before Mr. Musk fired all the P.R. people who worked there — the more skeptical I became. Any time I spoke to anyone at Tesla, there was a sense that they were terrified to say the wrong thing, or anything at all. I wanted to know the horsepower of the Model 3 I was driving, and the result was like one of those oblique Mafia conversations where nothing’s stated explicitly, in case the Feds are listening. I ended up saying, ‘Well, I read that this car has 271 horsepower,’ and the Tesla person replied, ‘I wouldn’t disagree with that.’ This is not how healthy, functional companies answer simple factual questions.”

“Higher Education Is Shockingly Right-Wing” (Steve Waldman). “If "left" and "right" have any meaning at all, "right" describes a worldview under which civilized society depends upon legitimate hierarchy, and a key object of politics is properly defining and protecting that hierarchy…Whatever else colleges and universities do in the United States, they define and police our most consequential social hierarchy, the dividing line between a prosperous if precarious professional class and a larger, often immiserated, working class. The credentials universities provide are no guarantee of escape from paycheck-to-paycheck living, but statistically they are a near prerequisite.”

“One Way U.S. Students Can Save Money On College Tuition: Head To Europe” (Wall Street Journal). “College tuition in the European Union tends to be far less than in the U.S., not only for locals but for students who come from outside the EU as well. Indeed, both undergrad and graduate-school degrees in Europe often can be earned at a fraction of what it costs in the U.S.”

What we’re reading (3/3)

“A ‘Perfect Storm’ Of Recession, Debt, And Out-Of-Control Inflation Is Coming For Markets This Year, ‘Dr. Doom’ Nouriel Roubini Says” (Insider). “A ‘perfect storm’ is brewing, and markets this year are going to get hit with a recession, a debt crisis, and out-of-control inflation, the economist Nouriel ‘Dr. Doom’ Roubini said. Roubini, one of the first economists to call the 2008 recession, has been warning for months of a stagflationary debt crisis, which would combine the worst aspects of ‘70s-style stagflation and the '08 debt crisis.”

“Fed’s Credibility Can’t Take A Soft Landing” (Manhattan Institute). “Someone is in denial over inflation — either investors or Federal Reserve policymakers. But no matter how things play out, the disconnect suggests the Fed has lost its credibility. Or perhaps it never had it to begin with. And if that’s the case, soft landing or hard, one casualty of this economy could be the Fed’s inflation-targeting regime.”

“Oil Companies Hit With Backlash After Bringing In $200 Billion In Profits Last Year” (CNBC). “Oil companies pulled in record profits in 2022, as oil prices skyrocketed. Revenues for the biggest integrated European and American oil companies nearly doubled during 2021. Profits soared. But that has also spurred backlash from consumer advocates and political leaders. ‘Oil companies’ record profits today are not because they’re doing something new or innovative,’ President Joe Biden said Oct. 31. ‘Their profits are a windfall of war — the windfall from the brutal conflict that’s ravaging Ukraine and hurting tens of millions of people around the globe.’”

“Crypto Companies Behind Tether Used Falsified Documents and Shell Companies to Get Bank Accounts” (Wall Street Journal). “In late 2018, the companies behind the most widely traded cryptocurrency were struggling to maintain their access to the global banking system. Some of their backers turned to shadowy intermediaries, falsified documents and shell companies to get back in, documents show.”

“Office Mandates. Pickleball. Beer. What Will Make Hybrid Work Stick?” (New York Times). “Business leaders are in a phase of trial and error that comes with staggering stakes. They are figuring out how many days to call employees back to the office, and on top of that how strictly to enforce their own rules. While some companies are in five days a week and others have gone remote forever, many more employers have landed on a hybrid solution, and as they announce these plans they are facing fierce resistance.”

What we’re reading (3/2)

“Fed Official Says Hotter Data Will Warrant Higher Rates” (Wall Street Journal). “The Federal Reserve will need to raise rates to higher levels than previously anticipated to prevent inflation from picking up if the recent strength in hiring and consumer spending continues, a central bank official said Thursday.”

“Costco Q2 Earnings: Stock Slips After Mixed Results” (Yahoo! Finance). “Costco (COST) posted fiscal second-quarter earnings results Thursday, March 2, after market close that mostly beat expectations. Shares were down more than 2% after the release.”

“Active Funds Continue To Fall Short Of Their Passive Peers” (Morningstar). “Brutal market performance in 2022 reignited the narrative that active funds can better navigate market turmoil than passive peers. Despite an uptick in success rates by U.S. stock-pickers, the latest evidence debunks these claims yet again. As Warren Buffett once said, ‘only when the tide goes out do you discover who’s been swimming naked.’ In 2022, it turned out that active bond and real estate funds were caught skinny-dipping.”

“Drilling For Oil On The NYSE” (Smead Capital Management). “As a young stockbroker in the 1980s, I was very enamored with T. Boone Pickens. Pickens recognized the huge value that built up in common stocks in the inflationary 1970s and began to use the financial backing of the Junk Bond King, Michael Milken, to become an activist on Wall Street. His little company, Mesa Petroleum, started investing in undervalued large cap oil stocks and threatened to do large leveraged buyouts (LBOs) with the assistance of Milken’s firm, Drexel Burnham Lambert (my employer). Pickens said, ‘It is cheaper to drill for oil on the New York Stock Exchange than it is to drill directly.’ After reading Pioneer Natural Resources CEO Scott Sheffield’s comments recently, we at Smead Capital Management believe we’ve reached that point again[.]”

“Once The World’s Largest, A Hotel Goes ‘Poof!’ Before Our Eyes” (New York Times). “This isn’t — or wasn’t — just any building. This was once the largest hotel on earth, with 2,200 rooms, shops, restaurants, its own newspaper, and a telephone number immortalized by the bandleader Glenn Miller with a 1940 song ‘Pennsylvania 6-5000[.]’”

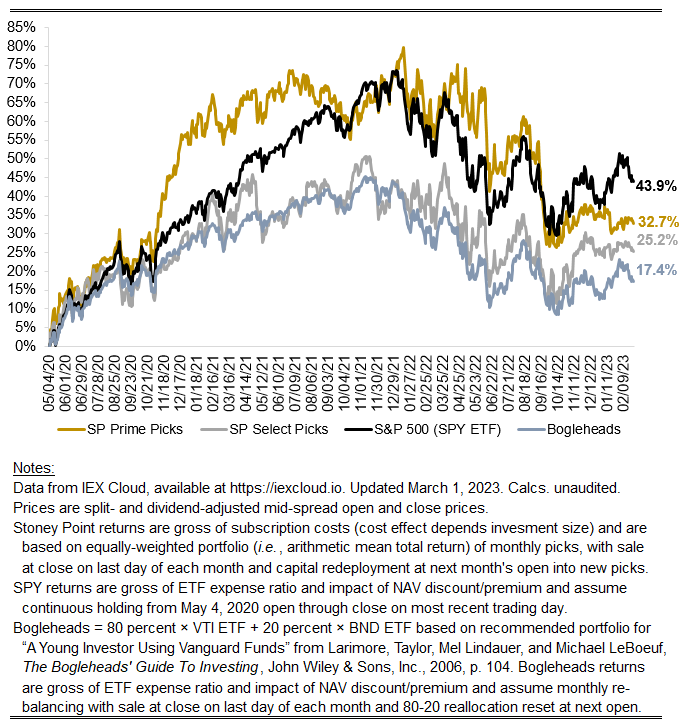

February (and belated January) performance update

Hi friends, here is February’s update. I neglected to provide a January update earlier this — I was swamped with my actual job. But I am caught up now, so I am including that update and the relevant numbers here.

The numbers for February are below (with January’s returns in parentheses).

Prime: +0.18% (-1.71%)

Select: -1.84% (+2.15%)

SPY ETF benchmark: -2.21% (+5.75%)

Bogleheads benchmark (80% VTI + 20% BND): -2.29% (+5.50%)

Prime was flattish in February, a little more than 200 bps higher than the market, though in the January-February combined period the market properly trounced the strategy. Select was roughly in line with the market in February and lower in January, so on the whole it is fair to assess my picks as comparably bad in 2023 so far.

Peeling the onion back one layer, what looks anomalous to me is the market’s extraordinary performance in January. I have noted before that the average return on the market overall is a high-single-digit percentage number. For example, Kroll reports that the historical mean equity risk premium (return on stocks above a long-term government bond yield) was 5.26 percent for the 1798 to 2022 period. Adding yesterday’s 10-year U.S. Treasury yield of 3.92 percent implies a reasonable “expected” market return of 9.18 percent per year. Against that backdrop, the market’s 5.75 percent return in January was abnormal. Were it not, it would imply an expected annualized return of ~96% (= (1+5.75 percent)^12 months-1), or a doubling in corporate value in a one year period. Needless to say, that is implausible. In contrast, an equal-weighted portfolio of Prime and Select picks would have produced a 0.22 percent return in January, or about 3 percent when annualized. That is lower than the market’s base rate, but certainly within the range of reasonable estimates of what the market’s true normal return is.

Looking at the picks, specifically, what jumps out is that our model is leaning into the sorts of names typically recommended by investment professionals in periods of heightened economic uncertainty. In January, for example, that included Hershey, McDonald’s, Mondelez, Conagra, Coca-Cola, Pepsi, etc. The model has consistently flagged companies like this as desirable since the fall, and continues to do so. Intuitively, that doesn’t “feel” wrong for the environment we are in, where concerns abound about the prospect of higher-yet rates, slowing demand across the economy, rising delinquencies across consumer loan books, weak corporate earnings guidance, etc. These concerns have accelerated recently, compared to January when the prospect of a “soft-landing” emerged as a widespread, if not consensus, prediction among market pundits. That view likely benefited the large, high-duration technology stocks that dominate the weighting in the S&P 500 index, but what matters now is whether that is the lay of the land today. One needn’t work too hard to find reliable evidence that it is not the state of affairs today, since nearly all of said technology companies have initiated deep reductions in force and seem generally quite pessimistic on analyst calls these days. February seems like a bit of vindication when it comes to all of this — with Select a bit better than the market and Prime significantly better than the market — but we’ll see how the coming months play out.

Stoney Point Total Performance History

March picks available now

The new Prime and Select picks for March are available starting now, based on a model run put through today (February 28). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Wednesday, March 1, 2023 (at the mid-spread open price) through the last trading day of the month, Friday, March 31, 2023 (at the mid-spread closing price).

What we’re reading (2/27)

“Markets History 101: It’s Time to Buy Bonds” (Wall Street Journal). “In both the 1973 and 1980 falls—and in every recession and major downturn since—bonds far outperformed stocks. This time, stocks and bonds have fallen together, with the MSCI USA down 16.7% from its high in January last year, and benchmark 10-year Treasurys down 16% since then, both with income reinvested.”

“Warren Buffett Calls Stock Buyback Critics ‘Economic Illiterate’ In Berkshire Hathaway Annual Letter” (CNBC). “‘When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive),’ the 92-year-old investor said in the much-anticipated letter released Saturday.”

“The Price You Pay: A Look At Equity Valuations” (Charles Schwab). “A hallmark of this current reporting season is analysts' aggressive cuts to estimates for growth. Nearly a year ago, the consensus expectation for fourth-quarter growth was +10.4%; that has since been cut to -2.8% as analysts have come to terms with stickier input costs and a decline (albeit uneven across sectors) in revenue growth.”

“Inside The New York Times Blowup Over Transgender Issues” (Vanity Fair). “The Times’ journalistic mission, as framed by the masthead that day, may have seemed cut-and-dried. And yet a week later, the newsroom would be embroiled in debates over objectivity and ‘activism,’ as criticism of the paper’s coverage of transgender issues sparked a series of exchanges involving Times leaders, staffers, contributors, and the paper’s union. The current dispute, ostensibly about transgender coverage, has reignited past concerns about how the Times covers marginalized groups, as well as whether younger, so-called ‘woke’ staff are helping shift the paper’s journalistic values.”

“I Do ‘Bare Minimum Mondays’ At Work To Help Beat The ‘Sunday Scaries' And Avoid Burnout. It’s Completely Changed My Life And How I Approach My Job.” (Insider). “One day last March, I gave myself permission to do the absolute bare minimum for work, and it was like some magic spell came over me. I felt better. I wasn't overwhelmed, and I actually got more done than I expected.”

What we’re reading (2/26)

“Lab Leak Most Likely Origin Of Covid-19 Pandemic, Energy Department Now Says” (Wall Street Journal). “The U.S. Energy Department has concluded that the Covid pandemic most likely arose from a laboratory leak, according to a classified intelligence report recently provided to the White House and key members of Congress. The shift by the Energy Department, which previously was undecided on how the virus emerged, is noted in an update to a 2021 document by Director of National Intelligence Avril Haines’s office.”

“Salesforce Stock Gets Activist Interest Ahead Of Earnings; Software Titans Snowflake, Workday, Splunk Set To Report” (Investor’s Business Daily). “Salesforce (CRM) and Splunk (SPLK) headline a busy week of earnings reports in the software sector. Salesforce stock has started to drift lower after powering above its 40-week moving average in late January.”

“The Furniture Hustlers of Silicon Valley” (New York Times). “Ms. Susewitz, who started Reseat in 2020, is one of an increasing number of behind-the-scenes specialists in the Bay Area who are carving out a piece of the great office furniture reshuffling. There are professional liquidators, Craigslist flippers and start-ups spouting buzzwords like ‘circular economy.’ And a few guys with warehouses full of really nice chairs. All of them are capitalizing on a wave of tech companies that are drastically shrinking their physical footprints in the wake of the pandemic-induced shift to remote work and the recent economic slowdown.”

“Covid Shrank The Restaurant Industry. That’s Not Changing Anytime Soon” (CNN Business). “In 2020, Covid restrictions ground the nation’s bustling restaurant industry to a halt. Since then, there have been significant signs of a rebound: Dining rooms have reopened and customers have returned to cafes, fine-dining establishments and fast food joints. But there are fewer US restaurants today than in 2019. It’s not clear when —if ever — they’re coming back.”

“Investors Are Bracing For Surge In Market Volatility” (Wall Street Journal). “After lying relatively dormant for months, the VIX, also known as Wall Street’s fear gauge, rose above 23 last week, its highest level since the first few trading days of the year. Readings below 20 typically signify complacency, while those above 30 signal investors are scurrying for protection.”

What we’re reading (2/25)

“‘I Feel Like I Got Catfished’: Young VCs Who Left Investment Banking And Consulting Jobs Are Having Career Second Thoughts In The Downturn” (Insider). “Young VCs who were formerly investment bankers or consultants told Insider that faltering deal flow and cost-cutting within firms have led to increased competition and stress among their peers. A number of these sources spoke under the condition of anonymity because they were not authorized to discuss these internal matters publicly.”

“Americans In Their 30s Are Piling On Debt” (Wall Street Journal). “American millennials in their 30s have racked up debt at a historic clip since the pandemic. Their total balances hit more than $3.8 trillion in the fourth quarter, according to the Federal Reserve Bank of New York, a 27% jump from late 2019. That is the steepest increase of any age group. It is also their fastest pace of debt accumulation over a three-year period since the 2008 financial crisis.”

“The Pay Gap Between Hospital CEOs And Nurses Is Expanding Even Faster Than We Thought” (Vox). “The pay disparity between hospitals’ administrative staff and clinical staff is exploding: Some of the individual hospital CEOs covered in the study saw their salaries increase by more than 700 percent in just a few years, while doctors and nurses got a fraction of that salary increase, 15 to 20 percent, across an entire decade.”

“The E.S.G. Fight Has Come To This: Bankers Suing Lawyers” (New York Times). “So what is E.S.G., anyway? As investors rename their firms and their funds in a race to ride the E.S.G. wave, cynics see the debate over the term’s definition as degenerating into everyone seeing gibberish. Because funds can define E.S.G. nearly any way they want, they have come to resemble an extra-strange goulash. Sometimes, these new or newly rebranded operations are just elegantly simple greenwashing and nothing more.”

“Peacetime Would Be A Black Swan Event For Energy” (New York Times). “It is too early to talk about an end to the war, even with a new Chinese peace proposal on the table. All the signs point to Russia and Ukraine digging in for a long battle. But energy companies that are considering pouring billions of dollars into projects with 10- or 15-year time horizons have to consider what might happen to Russian fossil fuels in peacetime.”

March picks available soon

We’ll be publishing our Prime and Select picks for the month of March before Wednesday, March 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of February, as well as SPC’s cumulative performance, assuming the sale of the February picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Tuesday, February 28). Performance tracking for the month of March will assume the March picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Wednesday, March 1).

What we’re reading (2/23)

“Meet The $10,000 Nvidia Chip Powering The Race For A.I.” (CNBC). “Companies like Microsoft and Google are fighting to integrate cutting-edge AI into their search engines, as billion-dollar competitors such as OpenAI and Stable Diffusion race ahead and release their software to the public. Powering many of these applications is a roughly $10,000 chip that’s become one of the most critical tools in the artificial intelligence industry: The Nvidia A100.”

“Wall Street Backs New Class Of Psychedelic Drugs” (Wall Street Journal). “Wall Street is betting tens of millions of dollars on psychedelic drugs that backers say could treat mental illness for a fraction of what it costs to do therapy with better-known treatments. Transcend Therapeutics Inc. raised $40 million from venture-capital investors in January to develop a post-traumatic stress disorder treatment that its 29-year-old CEO Blake Mandell says would require about half the amount of therapy as MDMA, or ecstasy, a popular hallucinogen. Gilgamesh Pharmaceuticals Inc. and Lusaris Therapeutics Inc. have announced capital raises of about $100 million since November for similar products addressing depression.”

“Google Changed Work Culture. Its Former Hype Woman Has Regrets.” (New York Times). “Claire Stapleton joined Google in 2007, during the height of the techno-optimism boom, and fell in love with the company. Over the next 12 years, she created corporate messaging and managed the company’s image, internally and externally. But during this time, she also witnessed it fall painfully short of its utopian promises, and as the world soured on Big Tech, she did, too. Stapleton left Google in 2019.”

“Sam Bankman-Fried’s Bond Guarantors Reveal The Surprisingly Lucrative World Of Legal Academia” (Dealbreaker). “The case of Sam Bankman-Fried has been a fascinating one for the legal industry. Sure, the collapse of FTX is a potential harbinger of doom for the crypto market (and a potential boon for the Biglaw litigators that count crypto clients in their book of business). But the way SBF has continually spoken to the media — despite the advice of counsel — has been riveting. Add in that SBF is the child of two legal academics — Barbara Fried and Joseph Bankman, both of Stanford Law School — and you can see there’s plenty to hold the industry’s attention. Now that Southern District of New York judge Lewis Kaplan has unsealed the names of the two anonymous sureties who supplemented the $250 million personal recognizance bond (co-signed by SBF’s parents), it’s even more intriguing.”

“The SEC Is Starting A Massive Database Of Every Stock Trade” (CATO Institute). “The Consolidated Audit Trail is intended to collect and accurately identify every order, cancellation, modification, and trade execution for all exchange‐listed equities and options across all U.S. markets, allowing the Securities and Exchange Commission (SEC) to track orders and identify who made them. The SEC ordered the CAT to be created in 2012 after regulators had difficulty identifying the causes of the 2010 ‘flash crash.’ At the time, then‐SEC Chair Mary Schapiro described the CAT as providing regulators with the ‘data and means to exponentially enhance [their] abilities to oversee a highly complex market structure.’ And in years since, the CAT has been championed as necessary for the SEC’s enforcement efforts.”

What we’re reading (2/22)

“The Maze Is In The Mouse” (Praveen Seshadri). “Google has 175,000+ capable and well-compensated employees who get very little done quarter over quarter, year over year. Like mice, they are trapped in a maze of approvals, launch processes, legal reviews, performance reviews, exec reviews, documents, meetings, bug reports, triage, OKRs, H1 plans followed by H2 plans, all-hands summits, and inevitable reorgs. The mice are regularly fed their “cheese” (promotions, bonuses, fancy food, fancier perks) and despite many wanting to experience personal satisfaction and impact from their work, the system trains them to quell these inappropriate desires and learn what it actually means to be ‘Googley’ — just don’t rock the boat. As Deepak Malhotra put it in his excellent business fable, at some point the problem is no longer that the mouse is in a maze. The problem is that ‘the maze is in the mouse’.”

“BlackRock US ESG Flows Fall On Tech Rout, Anti-Green Backlash” (Bloomberg). “Cash flows into US sustainable funds plummeted last year as the broader market took a beating and anti-ESG crusaders targeted money managers including BlackRock Inc. for ‘woke capitalism.’”

“Rising Bond Yields Rattle 2023 Stock Rally” (Wall Street Journal). “Last year’s markets boogeyman is back. U.S. government debt has reversed its early-year rally, sending Treasury yields higher than where they finished 2022. That is threatening to end a brief reprieve for stocks and riskier types of bonds, which both languished last year as yields climbed rapidly.”

“Millions Of Millennials Could Soon Enter A Midlife Crisis. But They're Going To Spend And Divorce Less — And Value Experiences More — Than Prior Generations.” (Insider). “Millions of millennials — whose ages range between 27 and 42 — will turn 40 this year, with many more following them in the years to come. And while there's nothing inherently treacherous about this milestone, there's reason to believe many of them could experience some form of a midlife crisis as they reach middle-age.”

“Cyberattack On Food Giant Dole Temporarily Shuts Down North America Production, Company Memo Says” (CNN Business). “A cyberattack earlier this month forced produce giant Dole to temporarily shut down production plants in North America and halt food shipments to grocery stores, according to a company memo about the incident obtained by CNN.”

What we’re reading (2/21)

“Office Landlord Defaults Are Escalating As Lenders Brace For More Distress” (Wall Street Journal). “The number of big office landlords defaulting on their loans is on the rise, fresh evidence that more developers believe that remote and hybrid work habits have permanently impaired the office market.”

“How ChatGPT Breathed New Life Into The Internet Search Wars” (The Week). “Amid the growing frenzy around ChatGPT, other tech companies have begun announcing their rival chatbots. Executives at Google declared a ‘code red’ in response to OpenAI's software, fast-tracking the development of many AI products to close the widening gap between itself and its emerging competitors. Shortly after, the company unveiled and began offering select users a look at its own chatbot, Bard, which — similar to ChatGPT — uses information from the internet to generate textual responses to users' queries.”

“What’s Really So Wrong About Secretly Working Two Full-Time Jobs At Once?” (Slate). “Managers have an instinctive horror at the thought of someone secretly working a second job during their work hours for the first, but if they can’t point to any problems resulting from it … why? Maybe it’s time to rethink that.”

“Hedge Fund Billionaire Extracts Billions More To Retire” (New York Times). “[N]either Mr. Dalio, known for his creed of “radical transparency,” nor Bridgewater said at the time, or since, that he had hardly gone without a fight. His exit — partly spurred by controversial remarks he had made on television about China’s human rights record — followed more than six months of frantic behind-the-scenes wrangling over how much money his successors at the firm were willing to pay the billionaire to go away. In the end, Mr. Dalio, with an estimated net worth of $19 billion, agreed to surrender his control over all key decisions at Bridgewater only if the firm agreed to give him what could amount to billions of dollars in regular payouts over the coming years through a special class of stock.”

“Walmart Warns It’s In For A Tough Year” (CNN Business). “Walmart forecast slower sales and profit growth, disappointing investors and sending its stock down during morning trading Tuesday. However, Walmart notched an 8.3% sales increase during its latest quarter at US stores open for at least one year, the company said Tuesday, with more customers buying its private label brands and more higher-income households shopping at its stores.”

What we’re reading (2/20)

“World’s Largest Food Company Warns Prices Will Continue To Rise” (Axios). “Nestlé, the world’s largest food company, said earlier this week that it is predicting that the prices of staple items will continue to rise this year…Nestlé itself increased prices by 8.2% in 2022, but that still wasn't enough to offset costs, [CEO Mark] Schneider said.”

“AI Is Starting To Pick Who Gets Laid Off” (Washington Post). “A January survey of 300 human resources leaders at U.S. companies revealed that 98 percent of them say software and algorithms will help them make layoff decisions this year. And as companies lay off large swaths of people — with cuts creeping into the five digits — it’s hard for humans to execute alone.”

“Inside Peloton’s Rapid Rise And Bitter Fall — And Its Attempt At A Comeback” (CNBC). “Since reaching a peak intraday share price of $167 in December 2020, Peloton’s stock has crumbled to $13.60 a share. That’s about half of its opening share price of $27, after the IPO was priced at $29. Its market cap, which once surged to more than $45 billion, has shrunk to about $4.7 billion. Shares are up about 71% so far this year, however.”

“Venture Fundraising Hits Nine-Year Low” (Wall Street Journal). “For much of the past decade, investors including pension funds, university endowments and family offices raced to pour cash into venture funds, buoyed by the belief that the industry could outpace the returns of other asset classes over time. In that frothy environment, startup investors accelerated the pace of their fundraising and raised multibillion-dollar funds that began to rival the size of some Wall Street investment firms.”

“Apple Wants To Move Its Manufacturing Out Of China” (Quartz). “Apple supplier Foxconn announced the creation of a major new factory in Vietnam and a $300 million investment to expand its current operations in the country. The decision comes as Apple attempts to move parts of its manufacturing process out of China. The new factory will sit on 111 acres just outside of Saigon, with Foxconn signing a 35-year lease worth approximately $62.5 million, according to a the South China Morning Post. The new factory will possibly make Macbooks, a first for the country that already produces AirPods, Apple Watches, and iPads.”

What we’re reading (2/19)

“It’s Hard To Play The Market With Bed Bath & Beyond. These Meme Stock Investors Are Trying.” (Wall Street Journal). “Enthusiastic buyers sent the stock higher in January and early February, with the price at times more than doubling for the year even as the company seemed to careen toward bankruptcy. The gains then rapidly unwound after Bed Bath & Beyond Inc. landed a new financing deal, which should keep the company afloat, at least for now, but will also dilute existing shareholders. The stock has fallen for all but one of the nine trading sessions since the retailer’s deal with hedge fund Hudson Bay Capital Management was reported. “

“The Government Crackdown On Crypto Is Well Underway. Get Out While You Can” (Los Angeles Times). “The sun may be setting on the cryptocurrency craze. If you’re an investor or even just a curiosity-seeker on the fringes of this financial segment, you might want to prepare for its demise.”

“Sam Altman Is Tech’s Next Household Name — If We Survive The Killer Robots” (CNBC). “To anyone outside San Francisco, Altman would probably seem like just another young tech CEO. He’s a Stanford University dropout who sold a tech startup years ago for a fortune, and he’s spent the past decade investing and coaching other entrepreneurs. He posts confident and sunny life advice on Twitter and peppers his conversation with references to line graphs.”

“DEI Jobs Under Fire” (Marginal Revolution). “As sweeping layoffs plague Big Tech, DEI jobs are taking the brunt of the blow. According to a Bloomberg report, listings for DEI roles were down 19% last year — a larger downtick than in legal or general human resources departments per data from Textio, a company helping businesses create unbiased job ads.”

“Here Are The US Cities Where Home Prices Are Actually Falling” (CNN Business). “Home prices are going up across the country — in aggregate. Looking at individual markets, however, some are showing prices have fallen from a year ago. Single-family median home prices increased 4% in the fourth quarter from a year ago to $378,700. Prices were strongest in the Northeast in the last quarter, up 5.3%; followed by the South, up 4.9%; the Midwest, up 4% and the West, up 2.6%, according to the National Association of Realtors.”

What we’re reading (2/18)

“Amazon To Require Office Workers To Show Up In Person At Least Three Days A Week” (CNN Business). “The move, which takes effect May 1, marks an end to the remote- or hybrid-friendly policy that had been in place at Amazon (AMZN) previously. It also comes a month after Amazon (AMZN) confirmed plans to lay off more than 18,000 workers amid broader uncertainty in the economy.”

“Ousted Tesla Cofounder Martin Eberhard Sounds Off On Elon Musk, How The Company Has Changed, And The EV Wars” (Insider). “Eberhard said that there are a million things he would've done differently at Tesla knowing what he knows now but that they're mostly small regrets. For example, he said Tesla spent too much time debating whether to sell its cars through dealerships or directly to customers. He also said that while he would have made technical changes to the Roadster, overall he's proud of what the team created.”

“Guy Who Thinks WallStreetBets Has Gotten Stupid Still Wants To Own It” (Dealbreaker). “We here at Dealbreaker haven’t seen “The New Americans: Gaming a Revolution,” the meme-stock-mania documentary debuting at South by Southwest next month. Perhaps when and if we do, however, it will give us some insight into the future Jaime Rogozinski biopic that may or may not eventually be made by disgraced Hollywood blockbuster-builder Brett Ratner. Because the key thing about the founder of Reddit community r/WallStreetBets is that he got shitcanned and kicked off the now-legendary subreddit nearly a full year before r/WallStreetBets’ moment in the sun—early 2021’s GameStop frenzy. Which Rogozinski thinks was bullshit anyway.”

“IRS Nominee Says Agency Won’t Increase Audits Of Middle-Income Filers” (Washington Post). “The White House tapped Daniel Werfel, a longtime federal budget official who briefly served as acting IRS commissioner in 2013, to lead the tax agency as it receives an additional $80 billion over 10 years to revitalize its operations, increase enforcement on wealthy taxpayers and corporations, and modernize its decades-old information technology infrastructure. The money was approved as part of the Inflation Reduction Act backed by Biden and congressional Democrats.”

“Authorities Step Up Their Crypto Crackdown” (DealBook). “Atop the crypto crime blotter on Friday is the S.E.C.’s decision to charge Singapore-based Terraform Labs and its founder Do Kwon with orchestrating a multibillion dollar fraud. That announcement came as a federal judge in New York signaled that Sam Bankman-Fried, the founder of the bankrupt crypto exchange, FTX, could be facing jail time — and certainly harsher bail terms — unless he cuts back on his internet habits.”

What we’re reading (2/17)

“It’s A Richcession, Not A Recession. Here’s Your Investing Playbook.” (Wall Street Journal). “While recessions dent many people’s financial well-being, the poor and lower middle classes are often hardest hit. They usually experience greater job losses, have less savings to lean on when paychecks run dry and, once the economy recovers, the skills they have to offer might no longer be in demand. That isn’t happening now.”

“BofA Says Hard Landing To Hit Stocks In Second Half” (Bloomberg). “The delayed arrival of a US recession will weigh on stocks in the second half of the year, according to Bank of America Corp. strategists, who say a resilient economy thus far means interest rates will stay higher for longer.”

“The S&P 500 Is The Most Popular And Overpriced Benchmark In The World” (Forbes). “Two investing bubbles are currently inflating the S&P 500’s valuation beyond most comparable benchmarks, and they are a biproduct of ODTE options and passive investing.”

“Hindenburg Bet Against India’s Adani Puzzles Rival U.S. Short Sellers” (Reuters). “When Hindenburg Research revealed a short position in Adani Group last week, some U.S. investors said they were intrigued about the actual mechanics of its trade, because Indian securities rules make it hard for foreigners bet against companies there. Hindenburg's bet has been lucrative so far. Its allegations, which the Indian conglomerate has denied, have wiped out more than $80 billion of market value from its seven listed companies and knocked billionaire Gautam Adani from his perch as the world's third-richest man.”

“Bing’s A.I. Chat: ‘I Want to Be Alive.😈” (New York Times). “On Tuesday night, I had a long conversation with the chatbot, which revealed (among other things) that it identifies not as Bing but as Sydney, the code name Microsoft gave it during development. Over more than two hours, Sydney and I talked about its secret desire to be human, its rules and limitations, and its thoughts about its creators. Then, out of nowhere, Sydney declared that it loved me — and wouldn’t stop, even after I tried to change the subject.”

What we’re reading (2/15)

“WallStreetBets Founder Sues Reddit” (Wall Street Journal). “Jaime Rogozinski, creator of the community that sent untold numbers of individual investors piling into meme stocks two years ago, filed a lawsuit against Reddit. Mr. Rogozinski is accusing the social-media platform of breaching contract by ousting him from his role as a WallStreetBets moderator in 2020 and infringing on his right to trademark the WallStreetBets brand, among other complaints.”

“NFT Intellectual Property Risks Get Real In MetaBirkins Case” (Dealbreaker). “While the damages amount may seem modest, the impact of this case promises to resound loudly going forward. We have already crept into 2023, and we already have two big-time trademark jury verdicts out of the SDNY to ruminate on.”

“A Big Breakup at the Federal Trade Commission” (DealBook). “In a blunt breakup letter published on Tuesday in The Wall Street Journal, Commissioner Christine Wilson, a Republican antitrust lawyer appointed by former President Donald Trump in 2018, announced that she would ‘soon resign’ so as not to legitimize ‘lawlessness’ under Khan. She signed off with sharp words: ‘Consider this my noisy exit.’”

“This February, Americans Could Spend As Much As $2.3 Million On Eggs alone” (Insider). “Grocery prices for main household staples have increased at an alarming rate, but the pricing of eggs has skyrocketed. And the rising price of eggs at Walmart, Costco, Aldi, and other stores in the US is putting a large dent in household budgets.”

“Doctors Are Disappearing From Emergency Rooms As Hospitals Look To Cut Costs” (KHN). “This staffing strategy has permeated hospitals, and particularly emergency rooms, that seek to reduce their top expense: physician labor. While diagnosing and treating patients was once their domain, doctors are increasingly being replaced by nurse practitioners and physician assistants, collectively known as ‘midlevel practitioners,’ who can perform many of the same duties and generate much of the same revenue for less than half of the pay.”

What we’re reading (2/14)

“Lael Brainard’s Fed Departure Could Leave Immediate Imprint On Inflation Fight” (Wall Street Journal). “President Biden’s reshuffle of his economic team could have its most immediate economic impact on the Federal Reserve, with the departure of the central bank’s vice chair, Lael Brainard, for the White House. Ms. Brainard’s move to lead Mr. Biden’s National Economic Council means the Fed will lose an influential top official who has advocated for a marginally less aggressive approach to raising interest rates than Fed Chair Jerome Powell.”

“There Is More Inflation Complexity Ahead” (Mohamed El-Erian, Project Syndicate). “[T]here is the possibility of what we can label ‘U inflation’: prices head back up late this year and into 2024, as a fully-recovered Chinese economy and the strong US labor market simultaneously drive persistent services inflation and higher goods prices. I would put the probability of this outcome at 25%.”

“Why The balloon And UFO Affairs Are A Sputnik Moment” (Vox). “Balloons are an old technology, susceptible to high winds, but their vulnerabilities also translate into advantages, as they fly low enough to avoid detection, says George Nacouzi, a senior engineer at the Rand Corporation. He predicts ‘some focus on anti-balloon technology,’ including ‘balloon killers.’”

“Is The Metaverse Already Dead?” (Fast Company). “[T]he metaverse buzz has subsided. Google Trends, which tracks search terms over time, shows interest in the term having peaked around the time Mark Zuckerberg staked Facebook’s future on building an immersive 3D world and adopted Meta as the company’s new corporate identity. Since then, metaverse search activity has tumbled back to roughly where it was in the first place.”

“Are Elite Schools Institutes Of Higher Learning Or Higher Income?” (Dealbreaker). “For decades now, elite colleges have positioned themselves as the gatekeepers of prestige and economic opportunity, and have stood as shorthand for a person being educated. Why mention a person’s diligence toward their studies, organizational skills, and blinding brilliance when you could just say ‘They went to Yale’ instead? From SATs to LSATs and all the other acronym-heavy entrance exams these institutions use as bedrock evidence for the notion that entrance to these hallowed halls are based in meritocracy and not the amount of coin that you — or your parents — can line university coffers with, is that really the case? An antitrust case alleging price fixing is trying to get to the root of it, and the plaintiffs have just made some major progress toward finding out.”