February (and belated January) performance update

Hi friends, here is February’s update. I neglected to provide a January update earlier this — I was swamped with my actual job. But I am caught up now, so I am including that update and the relevant numbers here.

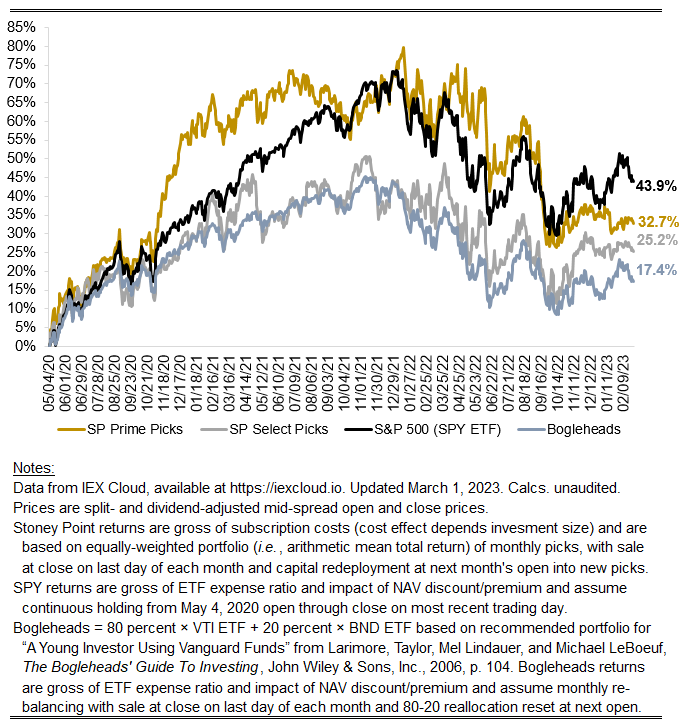

The numbers for February are below (with January’s returns in parentheses).

Prime: +0.18% (-1.71%)

Select: -1.84% (+2.15%)

SPY ETF benchmark: -2.21% (+5.75%)

Bogleheads benchmark (80% VTI + 20% BND): -2.29% (+5.50%)

Prime was flattish in February, a little more than 200 bps higher than the market, though in the January-February combined period the market properly trounced the strategy. Select was roughly in line with the market in February and lower in January, so on the whole it is fair to assess my picks as comparably bad in 2023 so far.

Peeling the onion back one layer, what looks anomalous to me is the market’s extraordinary performance in January. I have noted before that the average return on the market overall is a high-single-digit percentage number. For example, Kroll reports that the historical mean equity risk premium (return on stocks above a long-term government bond yield) was 5.26 percent for the 1798 to 2022 period. Adding yesterday’s 10-year U.S. Treasury yield of 3.92 percent implies a reasonable “expected” market return of 9.18 percent per year. Against that backdrop, the market’s 5.75 percent return in January was abnormal. Were it not, it would imply an expected annualized return of ~96% (= (1+5.75 percent)^12 months-1), or a doubling in corporate value in a one year period. Needless to say, that is implausible. In contrast, an equal-weighted portfolio of Prime and Select picks would have produced a 0.22 percent return in January, or about 3 percent when annualized. That is lower than the market’s base rate, but certainly within the range of reasonable estimates of what the market’s true normal return is.

Looking at the picks, specifically, what jumps out is that our model is leaning into the sorts of names typically recommended by investment professionals in periods of heightened economic uncertainty. In January, for example, that included Hershey, McDonald’s, Mondelez, Conagra, Coca-Cola, Pepsi, etc. The model has consistently flagged companies like this as desirable since the fall, and continues to do so. Intuitively, that doesn’t “feel” wrong for the environment we are in, where concerns abound about the prospect of higher-yet rates, slowing demand across the economy, rising delinquencies across consumer loan books, weak corporate earnings guidance, etc. These concerns have accelerated recently, compared to January when the prospect of a “soft-landing” emerged as a widespread, if not consensus, prediction among market pundits. That view likely benefited the large, high-duration technology stocks that dominate the weighting in the S&P 500 index, but what matters now is whether that is the lay of the land today. One needn’t work too hard to find reliable evidence that it is not the state of affairs today, since nearly all of said technology companies have initiated deep reductions in force and seem generally quite pessimistic on analyst calls these days. February seems like a bit of vindication when it comes to all of this — with Select a bit better than the market and Prime significantly better than the market — but we’ll see how the coming months play out.