What we’re reading (1/5)

“ChatGPT Creator Is In Talks For Tender Offer That Would Value It At $29 Billion” (Wall Street Journal). “OpenAI, the research lab behind the viral ChatGPT chatbot, is in talks to sell existing shares in a tender offer that would value the company at around $29 billion, according to people familiar with the matter, making it one of the most valuable U.S. startups on paper despite generating little revenue.”

“Hedge Funds Gave Startups Billions. What Are They Worth?” (Bloomberg). “Mining data from thousands of mutual funds over the past year, Bloomberg tracked down their valuations for 46 private companies that also count the five hedge fund firms as investors. Of those, about 70% of the private companies had been marked down by mutual funds through September last year, with an average decline of 35%. Some holdings were slashed by as much as 85%…In some cases, the data show hedge fund marks haven’t caught up.”

“The Perfect Fraud For Our Times” (Dealbreaker). “The special-purpose acquisition company isn’t bound by many rules. Indeed, that is one point of them—to elide the disclosure and due-diligence rules required by an ordinary initial public offering…But SPACs are bound by at least one rule, and that is: Until a deal is actually consummated, the money collected stays in an interest-earning trust account and not, say, in the CFO’s Robinhood account to play around with meme stocks and crypto, even if those might earn investors a few more basis points than the trust account. Which in the case of the aforementioned now-former CEO, they didn’t.”

“Tesla Isn't Apple, Elon Musk Isn't Steve Jobs, And Its Cars Aren’t The Next iPhone” (Insider). “What should be more concerning to investors is it's becoming less clear by the day how Tesla itself can remain competitive in an EV market that's growing fast and in danger of leaving the company behind.”

“What Is Going Wrong With American Higher Education?” (Marginal Revolution). “In my own field, economics, the prospect of having to do a “pre-doc” and then six years for a Ph.D. is driving away creative talent. On the research side, there is an obsession with finding the correct empirical techniques for causal inference. Initially a merited and beneficial development, this approach is becoming an intellectual straitjacket. There are too many papers focusing on a suitably narrow topic to make the causal inference defensible, rather than trying to answer broader, more useful but also more difficult questions.”

What we’re reading (1/4)

“Alan Greenspan Says US Recession Is Likely” (CNN Business). “Former Federal Reserve Chairman Alan Greenspan believes a US recession is the ‘most likely outcome’ of the Fed’s aggressive rate hike regime meant to curb inflation. He joins a growing chorus of economists predicting imminent economic downturn. His views are particularly important. Not only did Greenspan serve five terms as Fed chair under four different presidents between 1987 and 2006, but he was the last chair to successfully navigate a soft landing, in 1994. In the 12 months that followed February 1994 Greenspan nearly doubled interest rates to 6% and managed to keep the economy steady, avoiding recession.”

“Amazon To Lay Off Over 17,000 Workers, More Than First Planned” (Wall Street Journal). “The Seattle-based company in November said that it was beginning layoffs among its corporate workforce, with cuts concentrated on its devices business, recruiting and retail operations. At the time, the company expected the cuts would total about 10,000 people, but a person with knowledge of the issue said the number could change, The Wall Street Journal reported. Thousands of those cuts began last year.”

“Jeff Bezos May Return To Helm Amazon, Says Forecaster Of Double-Digit Stock Market Losses Last Year” (MarketWatch). “It’s still early enough in the year to look at 2023 predictions, so this time we’ll go with one from an analyst who called the market correctly at the end of 2021. ‘The S&P 500 will have its worst year since 2008,’ said Michael Batnick, managing partner at Ritholtz Wealth Management. ‘I predict this year it will fall more than 15%. The combination of high multiples, high inflation, supply chain issues, and the Fed raising interest rates will prove to be too much for investors to handle.’ The S&P 500 dropped 19% last year.”

“Microsoft And OpenAI Working On ChatGPT-Powered Bing In Challenge To Google” (The Information). “Microsoft could soon get a return on its $1 billion investment in OpenAI, creator of the ChatGPT chatbot, which gives humanlike text answers to questions. Microsoft is preparing to launch a version of its Bing search engine that uses the artificial intelligence behind ChatGPT to answer some search queries rather than just showing a list of links, according to two people with direct knowledge of the plans.”

“The Method In The Markets’ Madness” (The Atlantic). “[I]f fundamentals explain a lot of the market’s overall drop, why all the turbulence? Well, the stock market is a kind of prediction machine, and, as Yogi Berra supposedly said, ‘It’s tough to make predictions, especially about the future.’ They’re especially hard to make at the moment, when so much about what’s going to happen next year is genuinely uncertain.”

What we’re reading (1/3)

“Apple’s Market Cap Falls Under $2 Trillion As Sell-Off Continues” (CNBC). “Apple shares fell more than 3% trading on Tuesday, giving the iPhone maker a market capitalization under $2 trillion for the first time since May. Apple fell $3.74% to a price of $130.20 per share, a 52-week low, giving the company a valuation of $1.99 trillion at market close on Tuesday. Apple first hit a $2 trillion valuation in August 2020, as the pandemic boosted its sales of computers and phones for remote work and school. It briefly hit a market value over $3 trillion during trading in January 2022.”

“Remote Work Is Poised To Devastate America’s Cities” (New York Magazine). “The nation’s office buildings aren’t as empty as they were before COVID vaccines became widely available in spring 2021. But they’re still far less populated than they were in 2019. A recent analysis of Census Bureau data from the financial site Lending Tree found that 29 percent of Americans were working from home in October 2022. In New York City, financial firms reported that only 56 percent of their employees were in the office on a typical day in September.”

“Office Owners Already Reeling From Remote Work Now Face Recession Risk In 2023” (Wall Street Journal). “Owners of office buildings stumbled through 2022, when their holdings underperformed most every other type of commercial real estate. Things look poised to get worse in 2023. Landlords have been longing for employees to head back to office buildings in greater numbers. But the national return rate has crept up slowly. For the past three months, it has plateaued at about half of what it was before the pandemic.”

“Caroline Ellison Wanted To Make A Difference. Now She’s Facing Prison.” (Washington Post). “‘I agreed with Mr. Bankman-Fried and others to provide materially misleading financial statements to Alameda’s lenders,’ she said. ‘I am truly sorry for what I did. I knew that it was wrong.’ The judge asked if she knew it was illegal, too. ‘Yes,’ she said.”

“More Than A Penny’s Worth: Left-Digit Bias And Firm Pricing” (Avner Strulov-Shlain, The Review of Economic Studies). “Firms arguably price at 99-ending prices because of left-digit bias—the tendency of consumers to perceive a $4.99 as much lower than a $5.00. Analysis of retail scanner data on 3500 products sold by 25 US chains provides robust support for this explanation. I structurally estimate the magnitude of left-digit bias and find that consumers respond to a 1-cent increase from a 99-ending price as if it were more than a 20-cent increase.”

What we’re reading (1/2)

“After A Rough 2022, U.S. Stock Futures Rise Ahead Of First Trading Week Of 2023” (MarketWatch). “Markets were closed Monday in observance of the New Year’s holiday. Investors are in for a busy shortened week, with a slew of economic data due, including S&P Global manufacturing PMI and construction spending expected Tuesday, the Job Openings and Labor Turnover Survey on Wednesday and the December jobs report due Friday. On Wednesday, the Fed will also release minutes from its latest meeting.”

“3 Different Paths The Economy Could Take In 2023” (Vox). “Heading into the new year, economists say that 2023 will likely bring changes. Inflation is expected to slow as the effects of the Federal Reserve’s interest rate hikes continue to ripple through the economy. But that could also mean the United States slips into a recession and more people lose their jobs or have a difficult time finding a new one.”

“Stay For Pay? Companies Offer Big Raises To Retain Workers” (Wall Street Journal). “Workers who stay put in their jobs are getting their heftiest pay raises in decades, a factor putting pressure on inflation. Wages for workers who stayed at their jobs were up 5.5% in November from a year earlier, averaged over 12 months, according to the Federal Reserve Bank of Atlanta. That was up from 3.7% annual growth in January 2022 and the highest increase in 25 years of record-keeping. Faster wage growth is contributing to historically high inflation, as some companies pass along price increases to compensate for their increased labor costs.”

“Wealth Across The Generations” (Marginal Revolution). “[Quoting Jeremy Horpendahl] ‘The main takeaways: Millennials are roughly equal in wealth per capita to Baby Boomers and Gen X at the same age. Gen X is currently much wealthier than Boomers were at the same age: about $100,000 per capita or 18% greater[.] Wealth has declined significantly in 2022, but the hasn’t affected Millennials very much since they have very little wealth in the stock market (real estate is by far their largest wealth category)’”

“Warren Buffett Called Out Stock-Market Gamblers, Savaged Bitcoin, And Praised Elon Musk And Jeff Bezos Last Year. Here Are His 10 Best Quotes Of 2022.” (Insider). Among them: “Deceptive ‘adjustments’ to earnings – to use a polite description – have become both more frequent and more fanciful as stocks have risen. Speaking less politely, I would say that bull markets breed bloviated bull.”

What we’re reading (1/1)

“The Year That Brought Silicon Valley Back Down To Earth” (CNN Business). “Near 0% interest rates [at the start of 2022] meant startups still had easy access to the funding that had fueled their high valuations and risky ventures. But the year is ending on a much different note. A perfect storm of factors have forced a dizzying reality check for the once high-flying tech sector, making it one of the biggest losers of 2022.”

“Nasdaq Closes Out Its First Four-Quarter Slump Since Dot-Com Crash” (CNBC). “A lot has changed in technology since the dot-com boom and bust. The internet went mobile. The data center went to the cloud. Cars are now driving themselves. Chatbots have gotten pretty smart. But one thing has remained. When the economy turns, investors rush for the exits.”

“Third Of World In Recession This Year, IMF Head Warns” (BBC). “‘We expect one third of the world economy to be in recession,’ [IMF Managing Director] Ms [Kristalina] Georgieva said on the CBS news programme Face the Nation. ‘Even countries that are not in recession, it would feel like recession for hundreds of millions of people,’ she added.”

“Your Coworkers Are Less Ambitious; Bosses Adjust To The New Order” (Wall Street Journal). “Where have all the go-getters gone? At law firm Nixon Peabody LLP, associates have started saying no to working weekends, prompting partners to ask more people to help complete time-sensitive work. TGS Insurance in Texas has struggled to fill promotions, and bosses often have to coax staffers to apply. And Maine-based marketing company Pulp+Wire plans to shut down for two weeks next year now that staffers are taking more vacation than they used to.”

“U.S. Pours Money Into Chips, But Even Soaring Spending Has Limits” (New York Times). “The new chip factories would take years to build and might not be able to offer the industry’s most advanced manufacturing technology when they begin operations. Companies could also delay or cancel the projects if they aren’t awarded sufficient subsidies by the White House. And a severe shortage in skills may undercut the boom, as the complex factories need many more engineers than the number of students who are graduating from U.S. colleges and universities.”

December 2022 performance update

Hi Friends, wrapping up 2022 with December’s performance:

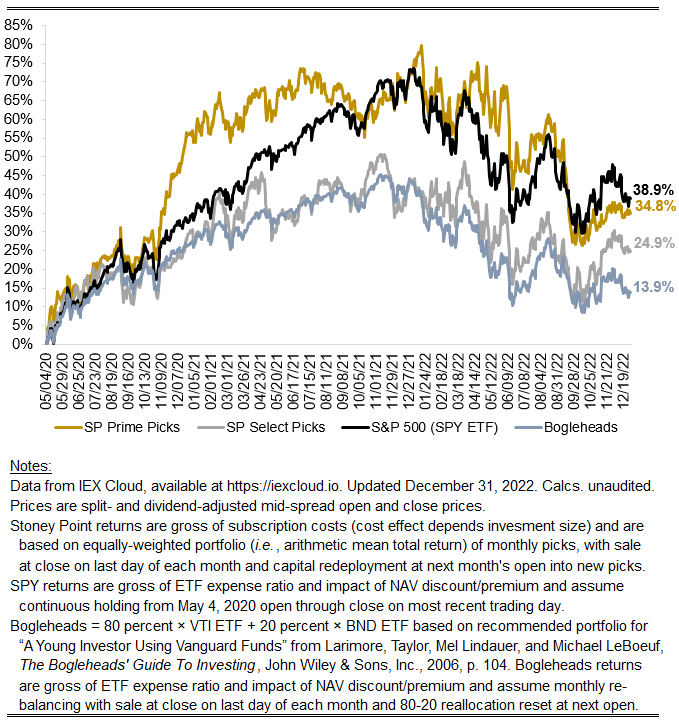

Prime: -2.16%

Select: -3.53%

SPY ETF: -6.01%

Bogleheads Portfolio (80% VTI + 20% BND): -5.17%

It was strong December with both Stoney Point portfolios significantly outperforming the market (by nearly 4 percentage points for Prime and roughly 2.5 percentage point for Select). Volatility remains elevated and, qualitatively, “fear” seems to be the predominant sentiment, at least among outspoken institutional market participants.

The headline for 2022 overall was that it was a bad year for equities. The market (as proxied by the SPY ETF) was down roughly 19.5 percent, the biggest calendar-year evaporation in aggregate corporate net worth since 2008. Prime’s performance broadly mirrored that although a bit worse, being down roughly 21.7 percent. Encouragingly after a slow few years, the drawdown in equities allocated to the Select strategy was considerably more muted, with that portfolio being down only 12.4 percent for the year.

The story in 2022 was mostly about rate hikes. More recently, on the back of the rate hikes, concerns are growing about a steep deceleration or decline in corporate earnings in 2023. Everyone seems to agree that a recession is coming. Alas, consensus on something like that is usually a good indicator that the valuation consequences of the presenting event have already been impounded into asset prices. I continue to believe “value”-oriented strategies will re-emerge as big winners in the years ahead after a long hiatus. While value has underperformed for a long time recently, it is noteworthy that the samples used in early studies quantifying the strong, positively predictive power of value ratios (e.g., Fama and French 1992) generally included the rate-hiking cycle of the early 80s and long period of elevated rates thereafter.

Some months ago I mentioned changes I anticipated putting through to the algorithm that guides my selection of securities for the Prime and Select portfolios. I am happy to say those edits—which are the first I have made to the algorithm since the start of this endeavor in May 2020—have now been fully incorporated. I am excited to see if and how they affect performance in 2023. The strategy (or system used to rank particular stocks against one another in the cross section) now reflects a weighted average of three factors:

The original Stoney Point value factor: until recently, this was the sole factor used to rank stocks for both Prime and Select. It is a proprietary value ratio that attempts to merge the insights of more traditional value factors (e.g., book-to-market ratios) and a less-famous literature on what scholars call the “implied cost of capital.” The essential logic of the latter literature is that the market’s expectation of returns for various securities can be extracted from current prices and various cash flow forecasts.

A new risk factor: this uses extensions of Merton’s (1974) famous structural credit risk model based on options pricing techniques to construct a novel risk factor. Statistical tests performed by yours truly suggest it relates to returns in a way that is not already captured by the most common extant asset pricing models.

Sentiment: I mentioned this before, but an intuitive flaw in any fundamentals-based algorithmic stock selection strategy is that reported fundamentals are inherently backward looking. This can be avoided somewhat by looking at things like analyst forecasts, but documented bias in analyst forecasts casts serious doubt on the reliability of their estimates as forward-looking measures (the analysts were basically the last to pick up on Enron’s frauds, after all). I use information from the analyst community in this new sentiment factor, but not in isolation. Market prices themselves, and other market data, provided alternative close-to-real-time measures of changes in sentiment with respect to particular stocks.

Let’s see what 2023 has in store.

Stoney Point Performance History

January picks available now

The new Prime and Select picks for January are available starting now, based on a model run put through today (December 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Tuesday, January 3, 2023 (at the mid-spread open price) through the last trading day of the month, Tuesday, January 31, 2023 (at the mid-spread closing price).

What we’re reading (12/30)

“Stock, Bond And Crypto Investors Remain On Edge After Brutal Year For Markets” (Wall Street Journal). “This year was a bust for markets. Stocks tumbled. Bonds were hit by their worst selloff ever. And cryptocurrencies were eviscerated, leading to the collapse of industry giants including FTX. The tumult across global markets had a chilling effect on Wall Street and beyond. Companies that hoped to go public scrapped their plans. Banks that typically cash in on fees for advising on deals and initial public offerings are slashing bonuses because of the drought. And retirees saw their savings shrink. The S&P 500 fell 19% for the year, while the Dow Jones Industrial Average dropped 8.8%. The Nasdaq Composite declined 33%, hurt by a steep slide in technology shares. All three indexes logged their biggest declines since 2008, the year Lehman Brothers collapsed. Trading was quiet ahead of the holiday weekend, with stocks ending a touch lower.”

“The Year The Long Stock Market Rally Ended” (New York Times). “Jan. 3, the first day of market trading in 2022, looked like just another day in a stock rally that began when Barack Obama was still president. The S&P 500 hit a record high. Tesla, the company that upturned the auto industry and made many investors rich, rose 13.5 percent and came close to its own all-time peak. That Monday, it turned out, was actually the end of a market that for over a decade had gone mostly in one direction, with the S&P 500 rising more than 600 percent since March 2009.”

“Stocks Fall To End Wall Street’s Worst Year Since 2008, S&P 500 Finishes 2022 Down Nearly 20%” (CNBC). “As the calendar turns to a new year, some investors think the pain is far from over. They expect the bear market to persist until a recession hits or the Fed pivots. Some also project stocks will hit new lows before rebounding in the second half of 2023.”

“After $18 Trillion Rout, Global Stocks Face More Hurdles In 2023” (Bloomberg). “More tech tantrums. China’s Covid surge. And above all, no central banks riding to the rescue if things go wrong. Reeling from a record $18 trillion wipeout, global stocks must surmount all these hurdles and more if they are to escape a second straight year in the red.”

“Deal-Making Thrived, Then Hit A Road Bump” (DealBook). “Heading into 2022, Wall Street’s deal-makers thought it would be hard to maintain last year’s record-breaking pace for mergers and acquisitions. Still, few thought their businesses would fall by too much. But the M.&A. business hit turbulence in the middle of the year and hasn’t recovered.”

What we’re reading (12/29)

“Consumers Kept The Economy Hot In 2022. Now They’re Losing Steam” (CNN Business). “Consumer spending remained resilient throughout much of 2022. However, stubbornly high inflation has taken its toll and knocked the stuffing out of the financial cushion. With interest rates poised to go higher in 2023 and economic uncertainty sure to grow, consumers could be starting to run dry at the worst time.”

“Just 5 Trading Days Accounted For 94% Of The S&P 500’s Decline In 2022 - And They Could Signal What’s To Come In 2023, DataTrek Says” (Insider). “In fact, just five days are responsible for 94% of the index's losses this year. Those days saw markets fall as much as 4.3% and center around inflation concerns, big corporate earnings misses, and reactions to the Federal Reserve's monetary tightening decisions. And these down days could shed some light on how the stock market moves in 2023. ‘This framework of 'a handful of days make the year' is also a good one with which to consider 2023,’ DataTrek said.”

“Here’s Why Egg Prices Surged In 2022. Those Elevated Costs Could Last Into The First Quarter Of 2023, Expert Says” (CNBC). “Average egg prices jumped 49.1% in November compared with those a year earlier — the largest annual percentage increase among all grocery items in that period, according to the consumer price index, a barometer of inflation. By comparison, the overarching ‘food at home’ category was up 12%. The increase is even more acute when measured by the cost of a dozen large, Grade A eggs, which more than doubled to $3.59 in November from $1.72 the year-earlier month, according to data from the Federal Reserve Bank of St. Louis…About 57.8 million birds have been affected by avian flu in 2022, according to U.S. Department of Agriculture data as of Dec. 28. These figures include birds such as turkeys and ducks.”

“GE Is Not A Lost Cause As Healthcare Spinoff Gets Set To Join S&P 500” (TheStreet). “News broke on Wednesday evening that GE Healthcare will enter the S&P 500 when it is spun off from General Electric (GE) and begins trading at the Nasdaq under the symbol GEHC. This happens next Wednesday, January 4, 2023.”

“An Epic Dollar Rally Goes Into Reverse—And Investors Expect Further Declines” (Wall Street Journal). “As of Dec. 28, the dollar has risen 8.9% this year as measured by the WSJ Dollar Index, which tracks its value against 16 other currencies. That would mark its biggest yearly rise since 2014. The index peaked in late September at the highest level in data going back to 2001. But the dollar is ending the year on the defensive, having given back roughly half of its gains since that high-water mark, as investors bet that U.S. inflation is slowing.”

What we’re reading (12/28)

“The Bull-And-Bear Case For 2023” (DealBook). “Wall Street as a whole hasn’t been so divided about the prospects for the next year since the global financial crisis, reflecting deep uncertainty over U.S. monetary policy, corporate profits and a wider debate about whether the world’s biggest economy will fall into recession. The average forecast expects the S&P 500 to end 2023 at 4,009, according to Bloomberg, the most bearish outlook since 1999. But the predictions range from a low of 3,400 to as high as 4,500, representing [the widest dispersion since 2009].”

“Wall Street’s Bankers Brace For Big Pay Cuts, But Bosses Don’t Want Whining” (Wall Street Journal). “Fees from advising on deals, stock offerings and bond sales are down more than 40% from this time last year, wiping out more than $50 billion in revenue, according to data from Dealogic. That is the biggest year-over-year dollar decline on record, worse even than in the financial crisis.”

“Why So Many Accountants Are Quitting” (Wall Street Journal). “More than 300,000 U.S. accountants and auditors have left their jobs in the past two years, a 17% decline, and the dwindling number of college students coming into the field can’t fill the gap.”

“To See The Weakness Of The ‘Inflation’ Argument, Walk The Aisles Of Whole Foods” (RealClear Markets). “For the purposes of this write-up, the question that emerges from expensive groceries and nosebleed sunscreen is whether the relatively high costs at a grocery chain where more and more Americans shop is indicative of ‘inflation.’ Aren’t rising prices inflation? Actually, no. To say they are inflation is like saying suntans cause the sun to shine. Causation is plainly reversed. At best, higher prices are a consequence of inflation, not a driver. With Whole Foods and its relatively higher prices, it’s important to stress that there’s no inflation to speak of.”

“Southwest Ruined Holiday Flying Almost All By Itself, Data Shows” (Insider). “Southwest canceled 2,694 flights on Tuesday, accounting for 84% of all US cancellations that day, according to data from flight-tracking site FlightAware. The data shows that in total, 3,210 flights into, out of, or within the US were canceled on Tuesday. Spirit came in second place in terms of US flight cancellations, cutting 102 flights.”

What we’re reading (12/27)

“Did the Tesla Story Ever Make Sense?” (Paul Krugman, New York Times). “The question is: Where are the powerful network externalities in the electric vehicle business? Electric cars may well be the future of personal transportation. In fact, they had better be, since electrification of everything, powered by renewable energy, is the only plausible way to avoid climate catastrophe. But it’s hard to see what would give Tesla a long-term lock on the electric vehicle business.”

“Tesla’s 2022 Collapse Hits 69% After Deepest Selloff Since April” (Bloomberg). “The tailspin in Tesla Inc. shares accelerated Tuesday, marking their longest losing streak since 2018, as a report of a plan to temporarily halt production at its China factory rekindled fears about demand risks.”

“Cash Cushions Dwindle At U.S. Pension Funds” (Wall Street Journal). “Cash holdings hit 1.9% of assets at state and local government pension funds and 1.7% of assets at corporate pension funds as of June 30, according to an annual snapshot from Wilshire Trust Universe Comparison Service. Those figures compare with the 15-year average of 2.45% at public pensions and 2.07% at corporate pensions. The recent figures are lower than in 2008, when some retirement funds had to sell whatever they could to pay benefits during the financial crisis. Pension managers have always faced a dilemma: keep too much of a fund’s assets in cash and you drag down returns. Keep too little in cash and you risk having to liquidate assets at unfavorable prices.”

“The World Just Doesn’t Have Enough Planes As Travel Roars Back” (The Straits Times). “Boeing and Airbus, the planemaking giants that largely enjoy a duopoly supplying passenger jets, are sold out for their most popular single-aisle models through until at least 2029. Compounding the demand from airlines as people once again take to the skies with a vengeance and carriers look to refresh ageing fleets are supply chain challenges – everything from getting the necessary components to labour shortages.”

“The Economy’s Fundamental Problem Has Changed” (The Atlantic). “After the Great Recession, we went through a decade in which economic life was defined by a lack of demand. Now, after the COVID recession, we’ve entered a period in which economic life is defined by a lack of supply.”

January picks available soon

We’ll be publishing our Prime and Select picks for the month of January before Monday, January 2 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of December, as well as SPC’s cumulative performance, assuming the sale of the December picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Friday, December 30). Performance tracking for the month of January will assume the January picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Monday, January 2).

What we’re reading (12/24)

“Investors Just Pulled A Record $42 Billion From Stocks In One Week In An Attempt To Cut Their Tax Bill After Grim 2022 Losses, BofA Says” (Insider). “Outflows from equities boomed to $41.9 billion, the largest ever amount for ‘tax-loss harvesting,’ said the investment firm said in its weekly Flow Show note, the last one to close out a bruising year for stocks.”

“Goldman Grumbling Grows For Banking Giant To Sack CEO David Solomon” (New York Post). “[T]he grumbling about Solomon is spreading to the managing director and partner class. High-priced Wall Street talent don’t call all the shots at any firm, of course. But Goldman’s MDs and partners have historically been a powerful force when the board decides the fate of current management, which makes Solomon’s hold on his job increasingly precarious as more and more of them defect from his camp.”

“Michael Bloomberg Eyes Dow Jones, WaPo Purchase As Media Ramps Up M&A: Report” (Yahoo! Finance). “Dow Jones is ultimately owned by News Corp's (NWSA) Rupert Murdoch, who is himself reportedly considering a recombination of Fox (FOXA) and the mass media and publishing company. According to an October report from Murdoch-owned The Wall Street Journal (WSJ), the 91-year-old businessman is in early discussions to rejoin the two entities of his media empire, which formerly split in 2013. Disney acquired the bulk of Fox's entertainment assets in a $71 billion deal back in 2019. The WSJ report added that both companies have established special board committees to study a possible deal and evaluate potential financial terms.”

“Stock Selloff Hits Life Insurers’ Fastest-Growing Product” (Wall Street Journal). “The hottest thing in life insurance for more than a decade might be cooling off. A long-running stock-market rally and low interest rates combined to create the perfect conditions for indexed universal-life policies. Sales of these policies rose from 4% of life-insurance sales in 2008, as measured by new annualized premiums, to 28% in the third quarter, according to industry-funded research firm Limra. The millions of Americans who now own them saw those ideal conditions reversed in 2022, exposing the policies’ high fees and complexity.”

“Two Sigma Insurance Quantified Has Brought Sophisticated Data Analysis To Underwriting” (Forbes). “Two Sigma, a New York-based hedge fund that uses sophisticated technology, has taken its analytical skills into insurance underwriting with Two Sigma Insurance Quantified.”

What we’re reading (12/23)

“S&P 500 And Nasdaq Close Higher Friday, But Fall For A Third Straight Week” (CNBC). “The major indexes oscillated earlier in the session after the core personal consumption expenditures price index, the Federal Reserve’s preferred gauge of inflation, came in slightly hotter than economists expected on a year-over-year basis, indicating that inflation is sticking despite the Fed’s efforts to fight it.”

“Are You ‘Extremely Hardcore’ Or Not? How Elon Musk Is Dividing Silicon Valley’s Elite” (Wall Street Journal). “Elon Musk has sometimes seemed like the person Silicon Valley would create if venture-funded engineers figured out how to build humans in a lab: the bold innovator fearlessly disrupting one industry after another with a nerdy verve. And yet these days, Silicon Valley’s investors, leaders and commentators are profoundly divided about tech’s billionaire icon, in ways that are revealing about Mr. Musk and about the state of the industry.”

“Why Is Elon Musk Lighting Billions Of Dollars On Fire?” (The Atlantic). “Maybe you have not had the best year. But take some consolation from the fact that you did not YOLO yourself into overpaying for an unprofitable social-media platform, publicly try to wriggle out of the deal, get lawyered into ponying up, liquidate billions of dollars of stock in a down market to do so, take over a company you did not really want, shitpost your way into a revenue crisis, quit paying your bills, antagonize your super-users, wink-wink at Nazis, and decimate your staff, all the while damaging your other, more lucrative businesses. Or at least probably not, unless you are Elon Musk. Twitter’s new owner might have fared better than Sam Bankman-Fried, the disgraced cryptocurrency magnate who improbably saved Musk from winning the title of Tech Fortune–Craterer of the Year. But Musk nevertheless spent 2022 lighting billions of dollars and his reputation on fire.”

“Bill Gates Shares His Plans To No Longer Be One Of The World's Richest People” (Vanity Fair). “Bill Gates said that after his recent divorce and discovering that he's going to become a grandfather for the first time, he's realized just how unimportant being one of the richest men on earth is if he can't use that money to improve the world.”

“Protester, 45, Is Charged With Disorderly Behaviour After Allegedly Shouting ‘Who Elected Him?’ During Proclamation Ceremony For King Charles” (Daily Mail). “A man has been charged after he allegedly shouted ‘Who elected him?’ at King Charles proclamation ceremony. Thames Valley Police said on Friday that Symon Hill, 45, of Church Hill Road, Oxford, has been charged with using threatening or abusive words, or disorderly behaviour…Hill is due to appear at Oxford Magistrates’ Court on January 31.”

What we’re reading (12/22)

“A New Chat Bot Is A ‘Code Red’ For Google’s Search Business” (New York Times). “Although ChatGPT still has plenty of room for improvement, its release led Google’s management to declare a “code red.” For Google, this was akin to pulling the fire alarm. Some fear the company may be approaching a moment that the biggest Silicon Valley outfits dread — the arrival of an enormous technological change that could upend the business.”

“Housing Market Doesn’t Need Much For Buyers To Return” (Washington Post). “A better guess about where the housing market will stabilize would take into account the fact that housing activity was still just fine up until April, even though affordability was much worse than pre-pandemic. You also would need to account for the squiggles in the data as mortgage rates have moved up and down since then. And those measures suggest it wouldn’t take much for the housing market to get back into balance with more stable pricing and transactions. It might take as little as mortgage rates falling back to below 6%, or some additional modest declines in home prices combined with a little more wage growth for workers.”

“What The Fed Should Do Next On Inflation” (Larry Summers, Washington Post). “It is very unlikely that we will have a recession so severe as to drive the underlying inflation rate below the 2 percent target. Hence, overshooting on inflation reduction is not the primary risk, and the Fed is right to emphasize its inflation objective going forward. This judgment is supported by another consideration. There has been a transitory element in inflation’s recent deterioration caused by bottlenecks in sectors such as used cars. As these bottlenecks ease, and prices return to normal, there will be a transitory deflationary impact hitting the statistics. This must not be confused with enduring resolution of the inflation problem.”

“A Strong Signal That Recession Is Looming” (New York Times). “[G]oing back to 1968, every time the long-term rate was at least 0.07 percentage points higher than the short-term rate, the economy escaped recession. And every time the long-term rate became at least 0.07 percentage points lower than the short-term rate, the economy entered a recession within six to 17 months. The average gap so far in December is 0.81 percentage points, which is the biggest since 1981 and deep into recessionary territory.”

“Japan’s Consumer Inflation Hits Fresh 40-Year High” (CNN Business). “Japan’s core consumer inflation hit a fresh four-decade high as companies continued to pass on rising costs to households, data showed, a sign price hikes were broadening and could keep the central bank under pressure to whittle down massive stimulus.”

What we’re reading (12/21)

“How Much Have 401(k)s Lost In 2022?” (U.S. News & World Report). “If you’re concerned by dipping figures on your 401(k) financial statements, you’re not alone. Ongoing market swings have impacted retirement accounts, and the last 12 months indicate losses for many retirement savers. During the last year, 401(k) balances have dropped 22.9%, according to a Fidelity Investments analysis of 24,500 corporate retirement accounts.”

“Disney Stock On Its Way To Worst Year Since 1974 After ‘Avatar’ Sequel Disappoints” (MarketWatch). “Disney shares sank nearly 5% to their lowest level since March 2020 on Monday, after the blockbuster sequel and one of the priciest movies in Hollywood history fell short of the hype in its opening weekend. ‘Avatar: The Way of Water’ hauled in $134 million domestically and had the second-largest global opening of 2022, but fell short of tracking estimates based on advance U.S. ticket sales and disappointed in one of the biggest markets for the franchise, China.”

“Nike Raises Outlook After Making Progress With Inventory Woes” (Wall Street Journal). “Nike Inc. on Tuesday raised its revenue outlook and said that its inventory challenges are abating, signs that the sneaker giant’s efforts to use discounts to clear out excess merchandise are helping the business.”

“Tesla Stock Gets More Cautious Comments From Wall Street” (Yahoo!Finance). “EvercoreISI analyst Chris McNally slashed his price target on Tesla's stock to $200 from $300 on Tuesday, joining bearish takes in the past week from Goldman Sachs, Wedbush, and Oppenheimer.”

“Tech Bros Who Ran $800M Events Startup To Bankruptcy Spent Lavishly On Drug-Fueled Parties: Report” (New York Post). “Two British tech entrepreneurs who led an events and travel startup that was worth as much as $800 million spent hundreds of thousands of dollars on drug- and alcohol-fueled parties and ran a ‘frat boy’ culture rife with sexual harassment before the company imploded, according to a report.”

What we’re reading (12/19)

“Stocks Bulls Losing Support As $4 Trillion of Options Set To Expire” (Bloomberg). “Bulls reeling from the Federal Reserve’s still-hawkish tilt are about to lose a major force that helped tamp down turbulence in US stocks during this week’s macroeconomic drama.”

“Problem Gambling Is On The Rise Among Young Men” (Wall Street Journal). “Gaming and gambling problems are surfacing among young men, and increasingly, teen boys, say counselors, therapists and addiction experts. They cite the rise in time spent online during the pandemic, the legalization of sports betting in a growing number of states, and the increasing presence of gambling-like elements in videogames.”

“‘Big Short’ Investor Michael Burry Says Crypto Reserve Reviews Like Binance’s Are ‘Essentially Meaningless’” (Insider). “Michael Burry, the legendary investor who foresaw the subprime mortgage crisis, is wary of so-called proof of reserves that crypto exchanges have touted since FTX crashed. The ‘Big Short’ former hedge fund manager tweeted on Friday that such reviews on a firm's digital holdings are “essentially meaningless.”

“Tesla Gets Downgraded On Wall Street Over Elon Musk’s Twitter Antics, Banning Of Journalists” (CNN Business). “Oppenheimer & Co. downgraded its rating on Tesla, where Musk is the CEO, solely because of risks posed by the billionaire’s ownership and management of Twitter. ‘We believe Mr. Musk is increasingly isolated as the steward of Twitter’s finances with his user management on the platform. We see potential for a negative feedback loop from departure of Twitter advertisers and users,’ Oppenheimer analyst Colin Rusch wrote to clients.”

“Rising Production Cost – And Rising Resentment” (Inside Higher Ed). “Understanding the rising cost of producing higher education starts with the fact that the wealthiest, most elite colleges and universities, which set the norms in higher education, are admitted "cookie monsters," whose insatiable and competitive need for revenue has long been viewed as beneficial -- until recent decades.”

What we’re reading (12/18)

“Forget Stock Predictions For Next Year. Focus On The Next Decade.” (New York Times). “Consider how bad Wall Street forecasts have been. In 2020…the median Wall Street forecast since 2000 had missed its target by an average 12.9 percentage points a year. That error over two decades was astonishing: more than double the actual average annual performance of the stock market! Imagine a weather forecast as bad as that. A meteorologist says the high temperature the next day will be 25 degrees Fahrenheit and it will snow, so you dress for a winter storm. Actually, the temperature turns out to be 60 degrees and the skies are clear. That’s about the level of accuracy for Wall Street strategists through 2020.”

“Will Investors Care If The Fed Lessens Its Commitment To 2 Percent Inflation?” (The Hill). “The key issue for many economists is that raising the target rate could undermine the Fed’s credibility. As Dudley states: ‘Moving the goal posts would be interpreted as a failure, making it more difficult to anchor expectations around the new objective.’ This begs an important question: Will investors care if the Fed tolerates inflation of 3 percent to 4 percent if the economy slips into recession?”

“Holiday Discounts Are Already Hard To Resist. The Best Bargains Are Yet To Come” (CNN Business). “Stores are drowning in a glut of merchandise this holiday season, keeping the discounts fast and furious in the runup to Christmas. And the deals are only getting juicier. So if you have the patience and the willpower to wait to grab a few bargains for yourself, you’ll be richly rewarded.”

“Mortgage Buydowns Are Making A Comeback” (Wall Street Journal). “Scores of lenders including Rocket Mortgage and United Wholesale Mortgage are touting temporary buydowns as a way to soften the blow of rates that have roughly doubled over the past year. Home builders are also using them to entice buyers. About 75% of builders surveyed in early December by John Burns Real Estate Consulting said they were paying to reduce buyers’ mortgage rates, either for the full mortgage term or for a shorter period.”

“A New EU Rule Can Expose Greenwashers” (Wired). “In 2023, all companies listed on regulated markets in the European Union will begin applying the Corporate Sustainability Reporting Directive (CSRD), a new rule that will require them to publish, from 2024, detailed information about how they relate to the environment, the treatment of employees, human rights, anti-corruption, bribery, and boardroom diversity.”

What we’re reading (12/16)

“The Big Story On The Market Downturn: The Wealth Bubble Is Popping” (The Hill). “Before 1990 in the U.S., asset price inflation and income followed similar trajectories. The aggregate value of all households’ net assets, including homes and retirement accounts, grew in line with economic output. That connection was long ago broken through a combination of loose fiscal and monetary policy and a worldwide glut of savings. In the 1947 to 1990 period, the net worth of all households and nonprofit institutions on average equaled about four times the annual economic output; at the end of 2021, the ratio equaled about six and a half times an output of $23 trillion.”

“Quant Hedge Funds Post Historic Returns In Ugly Year For Wall Street” (Bloomberg). “The math wizards of Wall Street are notching dream returns in this nightmare year for global markets. Famous quant firms like AQR Capital Management, Man Group and Aspect Capital are riding high as inflation-fueled turmoil trashes many of their human counterparts in the stock and bond world.”

“Quant Hedge Funds Are Back. Here’s Why.” (Institutional Investor). “Hedge funds that use quantitative techniques to spot opportunities, even those focused on equities, have generated some envious returns in a year marked by huge losses in both stocks and bonds. Take equity quant strategies, which are up 5.1 percent year-to-date through November, according to PivotalPath’s index tracking these funds. ‘Anything touching equities being up at all — and up more than 5 percent — is going to feel pretty good for investors,’ said Jon Caplis, CEO of PivotalPath.”

“Goldman Sachs Plans Thousands Of Layoffs, Expects To Eliminate Some Bonuses” (Wall Street Journal). “Like other Wall Street banks, Goldman hired aggressively throughout 2020 and 2021, bringing in new employees to help it keep up with an M&A boom. This year was a different story: An economic slowdown, war in Europe and rising interest rates triggered a bear market for stocks and a slump in deal making. Morgan Stanley also laid off workers this month, and similar cutbacks have swept through American companies.”

“Who Gains And Loses From The New AI?” (Marginal Revolution). “One striking feature of the new AI systems is that you have to sit down to use them. Think of ChatGPT, Stable Diffusion, and related services as individualized tutors, among their other functions. They can teach you mathematics, history, how to write better and much more. But none of this knowledge is imparted automatically. There is a relative gain for people who are good at sitting down in the chair and staying focused on something. Initiative will become more important as a quality behind success.”

What we’re reading (12/16)

“Dow Tumbles On Recession Fears. So Much For A Santa Claus Rally” (CNN Business). “Christmas is just 10 days away, and investors hoping for a Santa Claus rally have found little holiday cheer on Wall Street this month – especially Thursday. The Dow plummeted nearly 765 points, or 2.3%, Thursday, and it is down 4% in December following solid gains the previous two months. Verizon (VZ) was the only one of the 30 Dow stocks in positive territory.”

“Wall Street Fears the Fed Could Cause ‘Some Damage’” (DealBook). “[I]nvestors grow concerned about just how far central banks will push up interest rates to tame inflation. The Bank of England on Thursday raised its prime lending rate by 0.5 percentage points, and the European Central Bank is expected to follow suit with a similar increase. The market volatility was on full display on Wednesday in the U.S. Stocks jumped at the open as investors anticipated that Jay Powell, the Fed chair, would signal that the central bank would soon pull back on its policy of aggressive rate increases. But he did the opposite, and stocks slumped.”

“Services Prices Should Cool In Time, Too” (Fisher Investments). “Services are simply a few links further down the supply chain, so they felt the effect at more of a delay, hence why services inflation has lagged goods inflation…[b]ut just as spiking commodity prices are busy working through the goods side of the economy, so should they soon work their way through services.”

“Everyone Wants to Know What Private Assets Are Really Worth. The Truth: It’s Complicated.” (Institutional Investor). “Private equity valuations have become a lightning rod for investors over the past year, as many have pointed out the lag in performance reporting: Private equity firms don’t report returns to their limited partners until 45 to 90 days after a quarter ends. This practice, coupled with the fact that these firms are not subject to the whims of a public market, has made it seem like the asset class has posted better returns with less volatility than its public equity peers. The truth, though, is much more complicated than that.”

“Is That Co-Worker Really ‘Off To A New Adventure’?” (Wall Street Journal). “Vague, euphemistic announcements about chief executive officers’ departures are practically an art form…nonbosses are carefully managing [their] farewell messages too…Controlling the narrative can feel especially important when many businesses are cutting staff, and as economists are warning of a looming recession.”