November 2022 performance results

Hi friends,

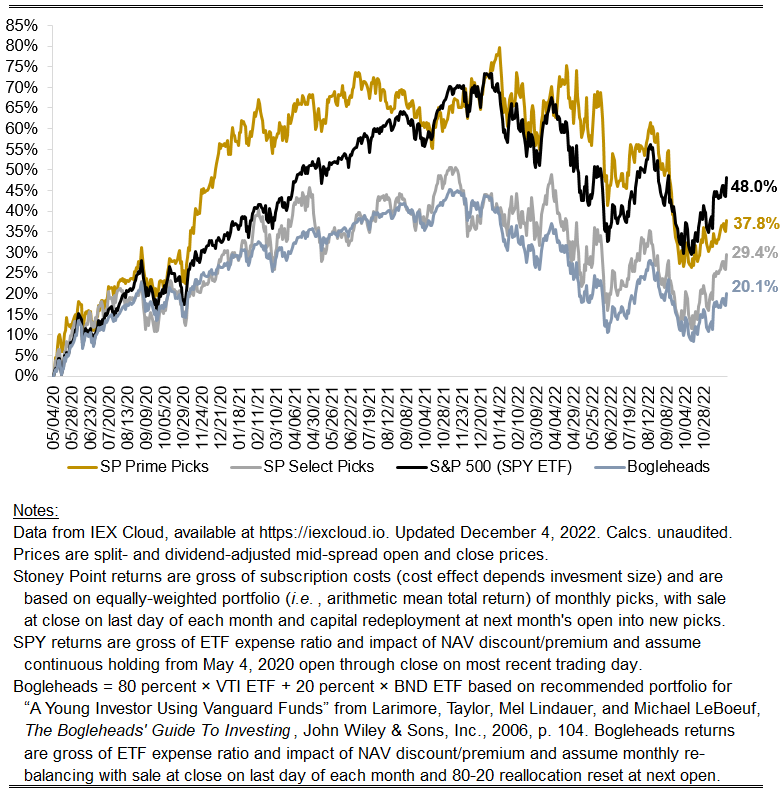

Here with a monthly performance update. Here are the numbers:

Prime: +2.02%

Select: +7.46%

SPY ETF: 4.5%

Bogleheads Portfolio (80% VTI + 20% BND): 3.91%

A solid month overall, with gains across both our portfolios outpacing the rise in consumer prices on an annualized basis. Prime underperformed the broad market, while Select significantly bettered it. Investors are paying close attention to corporate earnings and the slow-moving economic data. I am optimistic we are seeing the peak of inflation in real time and in fact are perhaps past the peak.

The de-pricing of crypto was a big story in the month, with the obliteration of FTX precipitating a noticeably different crisis of confidence for the entire asset class than we have seen before. Paul Krugman continues asking “what is the point [of crypto]?” and no one seems to have a compelling answer.

More consequentially, it seems clear at this point the recession many have been forecasting for corporates overall is most certainly manifesting in tech. All of them seem to be laying folks off, VC money has apparently completely dried up, and the usual tech “finfluencers” on Twitter seem a little quieter than they used to be.

These events strike me as bullish indicators for value-focused strategies overall. Everyone will likely end 2022 down to a significant extent, but who lifts off most strongly in the next year or so will be telling.

A quick reminder that I will be implementing some changes to the algorithm at year end to better capture changes in investor “sentiment” not readily picked up in trailing financial and market data. I will explain what I am doing in greater detail at some point in the relatively near future.