What we’re reading (12/13)

“Sam Bankman-Fried’s ‘House Of Cards’ Teeters” (DealBook). “The spectacular rise and fall of Sam Bankman-Fried, the founder of the failed crypto exchange FTX, came full circle on Monday, with his arrest in the Bahamas at the request of U.S. authorities, followed by the S.E.C. filing its own charges on Tuesday.”

“FTX’s Sam Bankman-Fried Charged With Criminal Fraud, Conspiracy” (Wall Street Journal). “FTX founder Sam Bankman-Fried oversaw one of the biggest financial frauds in American history, a top federal prosecutor said in charging that the former chief executive stole billions of dollars from the crypto exchange’s customers while misleading investors and lenders.”

“FTX ‘One Of The Biggest Financial Frauds’ In History, SDNY Says” (Axios). “Federal prosecutors on Tuesday called the stunning collapse of FTX ‘one of the biggest financial frauds in American history,’ charging that founder and former CEO Sam Bankman-Fried (SBF) defrauded investors while enriching himself.”

“FTX Founder Sam Bankman-Fried Made Political Contributions Under Other People’s Names, US Authorities Allege” (Insider). “US authorities allege that former FTX CEO and co-founder Sam Bankman-Fried violated multiple campaign finance laws, including by sending donations to politicians ‘in the names of other persons.’”

“‘Depressed’ Sam Bankman-Fried Hugs His Parents As He Is DENIED Bail And Sent To Overcrowded Hellhole Bahamas Jail As Prosecutors Say He Hid $300m In Brazilian Firm Before Collapse Of FTX Exchange” (The Daily Mail). “Disgraced FTX founder Sam Bankman-Fried has been denied bail as he fights extradition to the United States in the Bahamas after being charged with one of the ‘biggest financial frauds in American history’.”

What we’re reading (12/12)

“Daily Crunch: Thoma Bravo Buys Coupa Software For $8B, But Will That Price Satisfy Shareholders?” (TechCrunch). “Ron and Alex wrote last week about Coupa’s investors warning that a sale to private equity would not be good for the company. Well, today we learned that Thoma Bravo is acquiring Coupa as the private equity firm continues its M&A rampage. It should make for some interesting investor opinion: Ron reports that the company is being acquired for $81 a share, or $8 billion. Some investors were pushing for $95 a share.”

“The Party Animal And The Island-Hopping Hermit” (Insider). “Sometimes in the course of human events, two people join forces to bring forth something greater than the sum of their parts. Lennon and McCartney. Ben and Jerry. Fred Astaire and Ginger Rogers. But, perhaps, never have two partners created as much wealth, or so radically transformed the global flow of information, as Page and Brin. Like their predecessors — Bill Gates and Paul Allen at Microsoft, Steve Jobs and Steve Wozniak at Apple — the Google visionaries were once the most iconic duo in tech. But they stayed together far longer — almost two decades — and managed to end their partnership without an acrimonious split.”

“Pop Goes The Antitrust Bubble” (The Hill). “[S]harp declines in the stock prices and revenues of many leading platforms cast doubt on the worldwide regulatory consensus that favors “moving fast and breaking things” in antitrust enforcement. Those market shifts have identified cracks in the purportedly invincible armor of network effects and switching costs that had appeared to shield some platforms against competitive threats.”

“Microsoft Buys Near 4% Stake In London Stock Exchange Group As Part Of 10-Year Cloud Deal” (CNBC). “U.S. tech giant Microsoft on Monday announced a 10-year partnership with the London Stock Exchange Group and took a near 4% stake in the U.K. bourse operator. The partnership involves next-generation data and analytics, as well as cloud computing products, according to a statement by the LSEG. It includes a new data infrastructure for the London exchange and analytics and modelling solutions with Microsoft Azure, AI, and Microsoft Teams.”

“Investors Are Losing Faith In Cathie Wood’s ARK Innovation” (Wall Street Journal). “Shares of the fund, a pandemic-era favorite largely made up of unprofitable, growth-oriented technology companies, are down 63% this year. While the S&P 500 index has rallied 12% since mid-October to cut its 2022 losses to 16%, Ms. Wood’s flagship fund is hovering near a five-year low.”

What we’re reading (12/11)

“Investors Grow More Confident Fed Will Pull Off A Soft Landing” (Wall Street Journal). “Mutual funds and hedge funds managing roughly $4.8 trillion in assets have been putting money into stocks that stand to benefit from inflation cooling, interest rates going down and the U.S. economy avoiding a recession, according to an analysis by Goldman Sachs Group Inc.”

“Third Point Struggles In November” (Institutional Investor). “Third Point suffered another monthly loss—and this time, the multistrategy fund can blame its private investment strategy. According to the firm’s monthly report, which was seen by Institutional Investor, Dan Loeb’s Third Point Offshore lost 0.5 percent in November[.]”

“I Cried Every Day Working In An Amazon Warehouse In The Run-Up To Christmas. It’s Physically And Mentally Exhausting.” (Insider). “I had sore muscles, aches and pains. A ten-hour shift is like being in the gym for ten hours because bins and pods are huge, which means you're going up and down a step ladder to reach the top. I was exhausted. I had no life outside of work and was constantly physically and mentally exhausted. I felt depressed. I didn't want to see anyone, including my husband and son.”

“Why Is Howard Schultz Taking This So Personally?” (New York Times). “friends and longtime colleagues say Mr. Schultz’s opposition to the union isn’t primarily about the bottom line. It’s emotional. A union clashes with his image of Starbucks as a model employer. “It’s a sore for him, I guarantee you,” said Willard Hay, a former senior vice president at the company. (Mr. Schultz declined to comment for this article.)”

“Meta Staff Are Hitting Out At Mark Zuckerberg In Blind Reviews Because They Think His Metaverse Obsession Will ‘Single-Handedly Kill’ The Company” (Insider). “‘The Metaverse will be our slow death,’ one user, who called themselves a senior software developer, posted on Wednesday. They added: ‘Mark Zuckerberg will single-handedly kill a company with the meta-verse.’”

What we’re reading (12/10)

“The Housing Slowdown Is Wreaking Havoc On The Short-Term Rental Market” (Wall Street Journal). “[W]hile the absolute number of bookings has risen, there has also been a sharp rise in supply of available short-term rental listings in the U.S., up 23.3% in October 2022 compared with October 2021.”

“Nearly 25% Of U.S. Homebuyers Want To Move — This State Is The Top Destination” (CNBC). “With escalating housing costs squeezing out buyers, more people are looking to relocate from big cities to Sun Belt states where homes are cheaper — particularly Florida.”

“Americans’ Wealth Slips Further After Massive Loss In The Spring” (CNN Business). “Americans’ wealth continued to slide in the third quarter as stock prices plunged over the summer — but many Americans still have a healthy financial cushion, compared to pre-pandemic times. That’s according to data from the Federal Reserve released Friday, which showed that the net worth of households and nonprofit organizations dropped by $400 billion to $143.3 trillion in the third quarter. The value of households’ stocks declined by $1.9 trillion, while their real estate holdings increased in value by $700 billion.”

“Bond Investors Swap Mutual Funds For ETFs At Record Pace” (Wall Street Journal). “Worn down from record losses, investors have fled bond mutual funds en masse. But many aren’t quitting on bonds—they are just turning to exchange-traded funds. One main reason: taxes. Some investors sell beaten-down positions in bond funds to harvest tax losses. In many cases this year, investors have opted to put cash into similar ETFs to maintain bond exposure in their portfolios. As long as the securities within the ETF aren’t nearly identical to those in the mutual fund, swapping the so-called wrapper around the holdings allows investors to stay invested, while capitalizing on tax benefits.”

“Dan Loeb Thinks Bath & Body Works’ Board Could Use Some Serious Exfoliation” (Dealbreaker). “Incredible though this may seem, it has been more than four years since Third Point mounted its last proxy fight. Oh, sure, founder Dan Loeb has sent quite a few of his famous barbed letters in the interim, but has shied away from battle, in spite of how well the last one—against Campbell Soup—went. Has he been cured of the need for open combat by the bitter taste of his own medicine? So afflicted by indecisiveness—as demonstrated by his flip-flopping on Disney—that he can’t choose a target, or what he’d like it to do? Oh, no: He’s just been biding his time, for something sweet-smelling but somewhat bloated.”

What we’re reading (12/8)

“BlackRock Says Get Ready For A Recession Unlike Any Other And ‘What Worked In The Past Won’t Work Now’” (Insider). “The global economy has already exited a four-decade era of stable growth and inflation to enter a period of heightened instability — and the new regime of increased unpredictability is here to stay, according to the world's biggest asset manager.”

“FTC Sues To Block Microsoft’s Acquisition Of Activision Blizzard” (CNBC). “The Federal Trade Commission said on Thursday it has filed an antitrust case against Microsoft to challenge the software maker’s attempt to acquire video game publisher Activision Blizzard, claiming it would violate U.S. law.”

“Wall Street Boom Ends As Goldman Cuts Bonuses” (Semafor). “Goldman Sachs’ bonus pool for senior employees is expected to shrink by as much as half, people familiar with the matter said, as CEO David Solomon tries to boost flagging shareholder returns in a tough year across Wall Street.”

“The U.S. Chip Boom Is Just Beginning” (Axios). “Chip giant Taiwan Semiconductor Manufacturing Co.'s decision to triple its investment in Arizona is part of a national rush to re-shore key inputs for the American economy…TSMC says the plants will create more than 10,000 high-paying tech jobs, including 4,500 directly at the plants themselves.”

“The $42 Billion Question: Why Aren’t Americans Ditching Big Banks?” (Wall Street Journal). “In theory, savers could have earned $42 billion more in interest in the third quarter if they moved their money out of the five largest U.S. banks by deposits to the five highest-yield savings accounts—none of which are offered by the big banks—according to a Wall Street Journal analysis of S&P Global Market Intelligence data.”

What we’re reading (12/7)

“‘There Is A Slowdown Happening’ – Wells Fargo, BofA CEOs Point To Cooling Consumer Amid Fed Hikes” (CNBC). “After two years of pandemic-fueled, double-digit growth in Bank of America card volume, ‘the rate of growth is slowing,’ CEO Brian Moynihan said Tuesday at a financial conference. While retail payments surged 11% so far this year to nearly $4 trillion, that increase obscures a slowdown that began in recent weeks: November spending rose just 5%, he said.”

“What’s Going On With The Housing Market?” (Wall Street Journal). “Contradictory signals abound. Demand has tumbled, but the supply of homes is still low. Prices have fallen but are well above their pre-pandemic levels. Interest rates are sky-high compared with a year ago, but below where they stood in the decades when many older Americans bought their first homes. ‘When prices are rising, people can’t believe housing will ever go down, and then once prices fall, they can’t believe it will ever go up,’ said Glenn Kelman, chief executive at real-estate brokerage Redfin Corp.”

“An Activist Investor Takes On BlackRock Over E.S.G.” (DealBook). “[Bluebell Capital Partners] said that ‘it is not BlackRock’s role to direct the public debate on climate and energy policies or to impose ideological beliefs on the corporate world.’ The hedge fund said BlackRock’s E.S.G. push had become politicized and a distraction, as several Republican state officials have moved to withdraw funds from BlackRock in protest.”

“If There Is A ‘Male Malaise’ With Work, Could One Answer Be At Sea?” (New York Times). “Though the gender split in the industry is more even for onshore office roles, workers and applicants for jobs on the water are predominantly male. Centerline says it has roughly 220 offshore crew members and about 35 openings. Captains and company managers agree that changing attitudes toward work among young men play a part in the labor shortage. But the strongest consensus opinion is that structural demographic shifts are against them. ‘We’re seeing a gray wave of retirement,’ said Mr. Harvey, who is 38.”

“We Forgot To Fix Unemployment Insurance Yet Again” (Vox). “‘This is literally what always happens every time there is an economic downturn,’ said Michele Evermore, the former deputy director of policy at the Office of Unemployment Insurance Modernization at the Department of Labor who is now a senior fellow at the Century Foundation, a progressive think tank. ‘At the very start of it, people are pretty sympathetic to people who suddenly became unemployed, so we temporarily add benefits and add temporary fixes, and then as the economic crisis rolls on, everybody gets sick of the unemployed people and starts blaming them.’”

What we’re reading (12/6)

“Doesn’t Anyone Do Due Diligence Any More?” (Financial Times). “Doesn’t anyone do due diligence any more? The boring process of checking that potential investments can live up to their promises has fallen completely by the wayside. Due diligence once meant sending bankers to check that a mining company really had a working gold mine, hiring accountants to scour the books and asking lawyers to identify contracts that could prove troublesome in a bankruptcy.”

“Small-Cap Stocks Are Really Cheap” (Morningstar). “For smaller-company stocks, price/earnings ratios—a widely used measure for determining the value of a stock relative to its earnings—have reached their lowest levels in two decades. Lower ratios generally represent more attractive values and with a greater potential for price gains.”

“9 Dividend Aristocrat Stocks To Buy Now” (U.S. News & World Report). “[T]here's a special breed of dividend stock that takes reliability, consistency and dependability to another level. The ‘dividend aristocrats’ are a group of 65 S&P 500 stocks that have somehow managed to raise their dividend payments each year for at least 25 consecutive years.”

“Europe Can’t Count On U.S. Shale To Make Up For Russian Crude” (OilPrice.com). “U.S. oil production growth is slowing down. The shale revolution, as we knew it until a few years ago, is no longer in full-growth mode. And it may never return to it.”

“Major League Baseball Used Two Balls Again This Year, And Evidence Points To A Third” (Insider). MLB has some questions to answer: “according to a new analysis of more than 200 balls used in games during the 2022 season conducted by Dr. Meredith Wills, a Society for American Baseball Research award-winning astrophysicist, that's [MLB’s claim that all balls used in 2022 were produced under the new manufacturing process] not true. Major League Baseball did not settle into using a single, more consistent ball last season, Wills' research suggests: It used three.”

What we’re reading (12/5)

“Mutual Funds That Consistently Beat The Market? Not One Of 2,132.” (New York Times). “Over the last five years, not a single mutual fund has beaten the market regularly, using the definition that S&P Dow Jones Indices has employed for two decades. The S&P Dow Jones team looked at all the 2,132 broad, actively managed domestic stock mutual funds that had been operating for at least 12 months as of June 2018.”

“How A Basket of ETFs Mimicked The Performance Of Top Hedge Funds” (Institutional Investor). “If the performance of the best hedge fund managers can be mimicked by a cheaper fund, why invest in less liquid and more complex products?”

“PepsiCo To Lay Off Hundreds Of Workers In Headquarters Roles” (Wall Street Journal). “Hundreds of jobs will be eliminated, one of the people said. The cuts affect the company’s North America beverage business, which is based in Purchase, N.Y., and its North America snacks and packaged-foods business, which has headquarters in Chicago and Plano, Texas, the people said.”

“What is ‘Shrinkflation’?” (The Week). “Switching between brands, or to a more generic product, is a good way to circumvent shrinkflation, CNBC suggests. Consumers can also try and submit a complaint with the manufacturer, which may be enough to score some coupons and save some money (though not enough to stop shrinkflation in its tracks, of course), Dworsky told CNBC. Financial advice website SmartAsset recommends planning your meals, avoiding impulse purchases, shopping the sale items, and using credit card rewards to save money while shrinkflation is rampant.”

“From Chicken Wings To Used Cars, Inflation Begins To Ease Its Grip” (Washington Post). “After more than a year of high inflation, many consumers are finally starting to catch a break. Even apartment rents and car prices, two items that hammered millions of household budgets this year, are no longer spiraling out of control.”

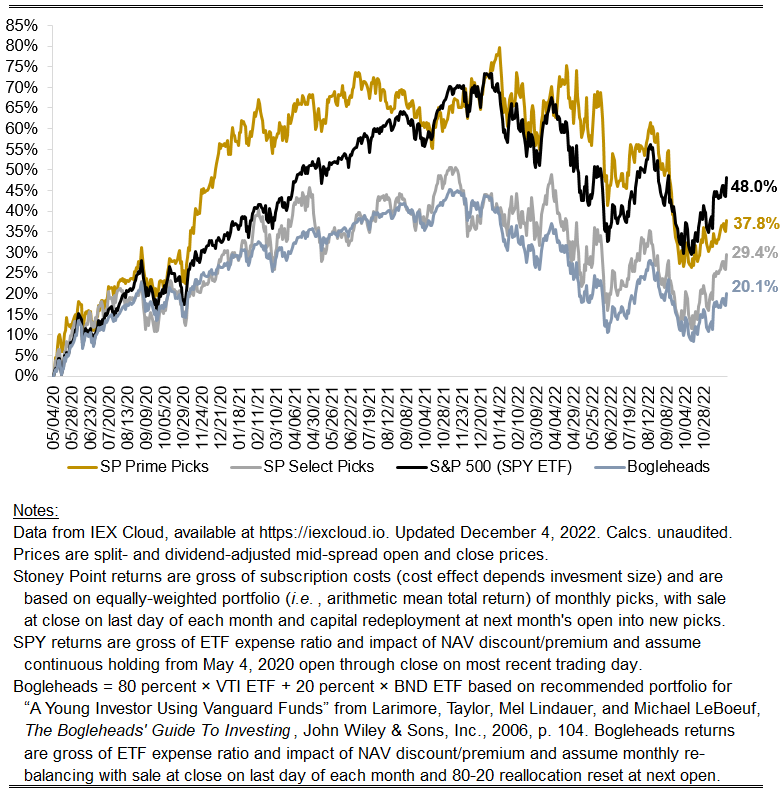

November 2022 performance results

Hi friends,

Here with a monthly performance update. Here are the numbers:

Prime: +2.02%

Select: +7.46%

SPY ETF: 4.5%

Bogleheads Portfolio (80% VTI + 20% BND): 3.91%

A solid month overall, with gains across both our portfolios outpacing the rise in consumer prices on an annualized basis. Prime underperformed the broad market, while Select significantly bettered it. Investors are paying close attention to corporate earnings and the slow-moving economic data. I am optimistic we are seeing the peak of inflation in real time and in fact are perhaps past the peak.

The de-pricing of crypto was a big story in the month, with the obliteration of FTX precipitating a noticeably different crisis of confidence for the entire asset class than we have seen before. Paul Krugman continues asking “what is the point [of crypto]?” and no one seems to have a compelling answer.

More consequentially, it seems clear at this point the recession many have been forecasting for corporates overall is most certainly manifesting in tech. All of them seem to be laying folks off, VC money has apparently completely dried up, and the usual tech “finfluencers” on Twitter seem a little quieter than they used to be.

These events strike me as bullish indicators for value-focused strategies overall. Everyone will likely end 2022 down to a significant extent, but who lifts off most strongly in the next year or so will be telling.

A quick reminder that I will be implementing some changes to the algorithm at year end to better capture changes in investor “sentiment” not readily picked up in trailing financial and market data. I will explain what I am doing in greater detail at some point in the relatively near future.

Stoney Point Total Performance History

What we’re reading (12/4)

“Blockchains, What Are They Good For?” (Paul Krugman, New York Times). “The question I’ve never heard or seen satisfactorily answered, however, is, ‘What’s the point?’ Why go to the trouble and expense of maintaining a ledger in many places, and basically carrying that ledger around every time a transaction takes place? The original rationale for Bitcoin was that it would do away with the need for trust — you wouldn’t have to worry about banks making off with your money, or governments inflating away its value. In reality, however, banks rarely steal their customers’ assets, while crypto institutions more easily succumb to the temptation, and extreme inflation that destroys money’s value generally happens only amid political chaos.”

“Crypto Stocks Teeter Near Abyss As Fink’s Warning Adds To Angst” (Bloomberg). “Analysts and investors are struggling to call a bottom in crypto stocks in the wake of a brutal month that ended with the head of BlackRock Inc. saying most digital-asset firms won’t survive.”

“Where Did Young Male Workers Go?” (Wall Street Journal). “It’s not merely a result of more baby boomers retiring. Labor force participation among males ages 25 to 54 has slid to 88.4% from 89.3% before the pandemic. Don’t blame long Covid. The decline is most pronounced among young men. Labor participation among males ages 20 to 24 has fallen 1.7 percentage-points since January 2020 versus 0.5 for those ages 45 to 54.”

“Stock Market Gamblers Let It Ride Again In Brutal Year” (Bloomberg). “Active stock managers are adding to positions. Option markets show a trend toward hedging, a sign professional traders are dipping back into equities. Beyond institutional circles, demand for meme stocks springs eternal, with chat-room favorites like AMC Entertainment posting big days.”

“Why The Stock Market Is Channeling Goldilocks” (CNN Business). “The global economy is weakening and consumers are feeling financially stressed. Gas and heat prices are up significantly from last year and Federal Reserve Chair Jerome Powell indicated on Wednesday that painfully elevated interest rates will hang around for some time. It’s rough out there, but there is a silver lining: Persistently high Inflation is showing signs of slowing. Finally.”

What we’re reading (12/2)

“Payrolls And Wages Blow Past Expectations, Flying In The Face Of Fed Rate Hikes” (CNBC). “Job growth was much better than expected in November despite the Federal Reserve’s aggressive efforts to slow the labor market and tackle inflation. Nonfarm payrolls increased 263,000 for the month while the unemployment rate was 3.7%, the Labor Department reported Friday. Economists surveyed by Dow Jones had been looking for an increase of 200,000 on the payrolls number and 3.7% for the jobless rate.”

“The New York Times Newsroom Gets Ready To Walk Out” (New York Magazine). “This morning at 8 a.m., New York Times publisher A.G. Sulzberger and CEO Meredith Kopit Levien received a letter from Bill Baker, unit chair of the Times guild, that was signed by more than 1,000 employees. Subject line: ‘Enough. If there is no contract by Dec. 8, we are walking out.’”

“I-Bonds Aren’t The Only Way To Fight Inflation” (Wall Street Journal). “Thanks to the recent rout in bond prices, Treasury inflation-protected securities, or TIPS, have turned into a cheap form of insurance for the first time in more than a decade. Buying and holding them in your retirement portfolio can help assure you of a lifelong stream of income that won’t be devoured by the rising cost of living.”

“The Trains Are Getting Longer And The Job Is Getting Worse” (Slate). “[T]rain crossings aren’t a bad vantage point to understand the crisis that has engulfed American railroads, where a looming strike could snarl the nation’s supply of grain, chemicals, and Christmas presents. The longer trains are part of the corporate strategy that has driven workers to the breaking point and diminished railroads’ role in American life, as Wall Street squeezes record profits from the country’s freight network but trucking continues to gain ground.”

“The US Justice Department Wants The Fraud Allegations Against FTX To Be Investigated” (Insider). “US authorities are pushing for an independent examiner to look into fraud allegations against FTX, according to a court filing submitted by the Justice Department on Thursday. The Justice Department and US regulators were already probing Sam Bankman-Fried's crypto empire before FTX filed for bankruptcy November 11. But DOJ is now calling for a probe of alleged wrongdoing that led to its crash.”

What we’re reading (12/1)

“Bob Iger’s Disney Return: 5 Far-Fetched (or Are They?) Megadeal Scenarios” (The Hollywood Reporter). “Iger, in a Nov. 28 town hall with employees, dismissed the idea that another megadeal is what’s driving this new era for the executive at Disney. ‘We have a great set of assets here,’ Iger told staffers. ‘Nothing is forever, but I am very, very comfortable with each of the assets that we have,’ he added, and specifically called the idea that Disney could sell out to Apple ‘pure speculation.’”

“Layoffs Hit White-Collar Workers As Amazon, Walmart, Others Cut Jobs” (Wall Street Journal). “Recent rounds of layoffs at large U.S. companies mark a departure from the usual pattern as executives navigate fears of an economic slowdown: This time, white-collar workers have been among the first and hardest hit. Demand has fallen sharply for professionals in technology, legal, scientific and finance fields, and companies that ramped up staffing during the pandemic, including tech firms, are slowing down hiring or cutting jobs as they close down some projects or scale back others.”

“World Outlook 2023: The Looming Recession” (Deutsche Bank). “The recession we have now been anticipating for nine months draws nearer. A downturn may already be under way in Germany and the euro area overall thanks to the energy shock stemming from the Russia-Ukraine war. Our expectation for a recession in the US by mid-2023 has strengthened on the back of developments since early last spring.”

“Greenlight Continues To Rack Up Gains” (Institutional Investor). “David Einhorn’s Greenlight Capital posted a 2.7 percent gain in November. It lagged the major indices, which surged between roughly 4.4 percent and 5.7 percent for the month. But the folks at the heavily hedged value-driven fund are certainly not complaining.”

“Physicists Create A Holographic Wormhole Using A Quantum Computer” (Quanta Magazine). “Physicists have purportedly created the first-ever wormhole, a kind of tunnel theorized in 1935 by Albert Einstein and Nathan Rosen that leads from one place to another by passing into an extra dimension of space. The wormhole emerged like a hologram out of quantum bits of information, or “qubits,” stored in tiny superconducting circuits. By manipulating the qubits, the physicists then sent information through the wormhole, they reported today in the journal Nature.”

What we’re reading (11/30)

“Jerome Powell Signals Fed Prepared To Slow Rate-Rise Pace In December” (Wall Street Journal). “Federal Reserve Chair Jerome Powell provided a clear signal that the central bank is on track to raise interest rates by a half percentage point at its next meeting, stepping down from an unprecedented series of four 0.75-point rate rises aimed at combating high inflation.”

“How Jay Powell Is Bending Time And Upending The Business World” (Slow Boring). “There’s a perpetual dynamic on Twitter where VCs — who are enthusiasts by nature — get enthusiastic about stuff, and then journalists — who are haters by nature — point out that the stuff sounds dumb. Looking back on the past 15 years, the journalists feel vindicated because a huge share of the stuff VCs get excited about turns out to be dumb. But the VCs also feel vindicated because they’re really rich, and skeptical journalists conveniently forget that they called seven out of the past two stock market crashes and said Facebook could never make money. At the end of the day, venture capital is just a slightly odd line of endeavor where flopping a lot is fine as long as you score some hits. I think most of us find this to be an unnatural way of thinking because, when you’re out there hunting and gathering, it’s very important to not be impaled by a bear or to accidentally feed your kid a poison berry. Good investors are able to internalize the much more abstract nature of finance and embrace prudent levels of embarrassing failure.”

“Here’s What History Says About Stock Market Performance In December” (MarketWatch). “While historical data is only a rough guide, December’s track record is an impressive one when it comes to the ‘winning percentage’ for the Dow Jones Industrial Average DJIA, the S&P 500 and the small-cap Russell 2000. The Nasdaq Composite’s December performance isn’t too shabby either[.]”

“The Not-So-Obvious Costs of ‘Buy Now, Pay Later’ Plans” (Slate). “BNPL firms like to advertise themselves as risk-free credit options. But it’s only free if you follow all the rules. Many consumers complained to the Consumer Financial Protection Bureau that these BNPL firms aren’t disclosing the costly hidden fees and interest rates that can be incurred when someone falls behind on payments.”

“DoorDash Lays Off 1,250 Employees To Rein In Operating Expenses” (TechCrunch). “DoorDash is laying off 1,250 people in an effort to rein in costs, the company’s CEO Tony Xu said in a message to employees on Wednesday. Xu’s message notes that the pandemic presented unprecedented opportunities to serve merchants and consumers, and as a result, DoorDash sped up hiring to catch up with growth. Xu says although most of the company’s investments are paying off, it did not properly manage team growth.”

December picks available now

The new Prime and Select picks for December are available starting now, based on a model run put through today (November 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Thursday, December 1, 2022 (at the mid-spread open price) through the last trading day of the month, Friday, December 30, 2022 (at the mid-spread closing price).

What we’re reading (11/29)

“What The Heck Happened To Salesforce?” (CNN Business). “Shares of Salesforce (CRM) have plunged about 40% so far in 2022. That makes it the second-worst performer in the Dow, trailing only chip leader Intel (INTC). Salesforce (CRM) has lagged the performance of top cloud software rivals such as Microsoft (MSFT), Germany’s SAP (SAP) and Oracle (ORCL). Salesforce isn’t really doing all that badly. In fact, the company reported sales growth of 22% from a year ago back in August, but it also cut its revenue and profit forecasts at the time.”

“Elon Musk Takes On A Goliath” (DealBook). “Mr. Musk complained that Apple had paused most of its advertising on Twitter, continuing his berating of companies that have done so. But it’s his allegation that Apple ‘threatened to withhold Twitter from its App Store but won’t tell us why’ that could prove more important. Apple is a major source of ad dollars for Twitter. It was the biggest advertiser on the platform in the year’s first quarter, spending $48 million, according to The Washington Post.”

“The Data Show Twitter Is Far From Dying” (RealClearWire). “As #RIPTwitter trends and the media is awash with coverage lamenting the site’s apparently imminent demise, a look at the actual data on Twitter’s usage suggests that the platform is far from dead. While Twitter is losing both employees and advertisers, and a few high-profile celebrities have departed, the platform’s core user base appears to be as engaged as ever – a point Elon Musk himself made recently.”

“Activist House Flippers Take On Wall Street To Keep Homes From Investors” (Wall Street Journal). “Activist flippers say they are leveling the playing field. Many home sellers prefer cash buyers because they are viewed as the fastest and most reliable purchaser. Nonprofits want to offer an alternative all-cash option. ‘We’re going to make you a competitive offer,’ Mr. Gosman said.”

“With Penguin Random House Out Of The Picture, What Happens To Simon & Schuster Now?” (Vanity Fair). “In a nutshell, it’s back to the old drawing board for Paramount Global, which remains firm in its determination that S&S is a ‘non-core asset’ and ‘therefore does not fit strategically within Paramount’s broader portfolio’ of video-based assets—CBS, Showtime, the former Viacom networks, the Paramount+ streaming service, etc. Even before Pan’s decision came down, Bakish had privately reiterated that Paramount wasn’t having second thoughts about selling S&S, which I’m told will remain a ‘discontinued operation’ in Paramount Global’s quarterly earnings calculations. With the holidays upon us, it will take a bit of time for the M&A process to really get going again. But the company does expect interest, as one source put it, from ‘a mix of strategic and financial buyers.’”

What we’re reading (11/28)

“Wall St Falls As U.S. Crude Oil Shakes Off Losses” (Reuters). “Wall Street equities deepened losses on Monday while U.S. oil futures reversed course to settle higher on production rumors after starting the day mired in worries that China's strict COVID-19 restrictions would stunt global economic growth. While a surge in COVID cases and clashes between police and protesters across several major Chinese cities over the weekend helped push U.S. Treasury yields lower, that move had also reversed course in afternoon trading.”

“China’s Covid Contagion” (DealBook). “Protests across China over the country’s strict zero-Covid policies shook up global markets over worries that the authorities will take longer to reopen the world’s second-largest economy. The visuals were jarring: Thousands took to the streets over the weekend in the biggest challenge to the authority of the Chinese Communist Party in years.”

“Crypto Lender BlockFi Follows FTX Into Bankruptcy” (Wall Street Journal). “Cryptocurrency lender BlockFi Inc. filed for chapter 11 on Monday, following FTX into bankruptcy and spotlighting the contagion effects that the failure of the crypto exchange has unleashed. BlockFi blamed its chapter 11 filing on the downturn in cryptocurrency prices this summer and this month’s failure of FTX, a big exchange with ties throughout the largely unregulated industry. FTX’s affiliated trading firm, Alameda Research, defaulted on $680 million owed to BlockFi earlier this month, the firm disclosed in court papers.”

“A Man Won The Legal Right To Not Be ‘Fun’ At Work After Refusing To Embrace ‘Excessive Alcoholism’ And ‘Promiscuity’” (Insider). “A French court has ruled that companies can't fire their workers for failing to be sufficiently ‘fun.’ The ruling comes after a man, referred to as Mr T, was fired from the Paris consultancy firm Cubik Partners in 2015 for refusing to participate in after-work drinks and team-building activities.”

“Have The Anticapitalists Reached Harvard Business School?” (New York Times). “[T]oday’s business school students are also learning about corporate social obligations and how to rethink capitalism, a curriculum shift at elite institutions that reflects a change in corporate culture as a whole. Political leaders on the left and right are calling for business leaders to reconsider their societal responsibilities. On the left, they argue that business needs to play some role in confronting daunting global threats — a warming planet, fragile democracy. On the right, they chastise executives for distracting from profits by talking politics.”

December picks available soon

We’ll be publishing our Prime and Select picks for the month of December before Thursday, December 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of November, as well as SPC’s cumulative performance, assuming the sale of the November picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Wednesday, November 30). Performance tracking for the month of December will assume the December picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Thursday, December 1).

What we’re reading (11/24)

“Apple’s Holiday iPhone Shortage Is A Symptom Of A Much Larger Problem” (Macworld). “Apple…has one large weakness that can bring the company to its knees: its overreliance on China. Yes, the region provides a big chunk of the company’s sales, but even more to the point, it’s the epicenter of Apple’s global manufacturing and assembly. And when that’s threatened–by political issues, supply chain problems, or COVID-related conundrums–it can put a serious dent in the company’s bottom line.”

“Goldman Sachs To Pay $4 Million To Settle Investigation Over ESG Funds” (Wall Street Journal). “The Securities and Exchange Commission said Goldman marketed the ESG funds and a similar investment strategy without always following a consistent framework spelled out in its compliance plans. That meant Goldman violated an SEC compliance rule that requires investment advisers to implement plans designed to prevent potential regulatory violations. Goldman neither admitted nor denied the SEC’s allegations.”

“The Premium in Private Credit Has Disappeared. That’s Not Stopping Allocators.” (Institutional Investor). “Investors aren’t getting a bump for putting their money into private credit rather than public securities, but many are shrugging it off. The yield parity between the two comes after steep declines in the public markets. It’s not just that allocators’ current commitments to private credit funds are locked up for years. Many investors are ponying up new money for private credit, even as the decline in liquid markets has created better opportunities than they’ve seen in years.”

“Binance Deploys $1 Billion To Keep Crypto Industry Afloat After FTX Collapse” (CNBC). “Cryptocurrency exchange Binance on Thursday announced new details about its industry recovery fund, which aims to prop up struggling players in the wake of FTX’s calamitous bankruptcy. In a blogpost, Binance said it will devote $1 billion in initial commitments to the recovery fund. It may increase that amount to $2 billion at a point in time in the future ‘if the need arises,’ the company added.”

“‘No Buyers In Sight’: A Senior Economist Says Home Prices Will Fall By 25% As Supply And Demand Dynamics In The Housing Market Have Created A Perfect Environment For Declines” (Insider). “Such a decline on a national scale would be similar to the home-price slump seen during the 2008 crisis, when the index fell 27% from its peak in July 2006 through its bottom in February 2012. Case-Shiller data, being an average of the prior three months, lags more than other home price data. But individual cities like Phoenix and San Francisco had it worse during the crisis, with price declines of up to 30%. As of September 2022, the average home price in Phoenix had dropped 10% from June, according to Realtor.com.”

What we’re reading (11/23)

“Fed Minutes Show Most Officials Favored Slowing Rate Rises Soon” (Wall Street Journal). “Most Federal Reserve officials thought they should slow the pace of interest-rate increases after approving a 0.75-percentage-point rate rise at their meeting earlier this month to battle high inflation. Their discussion at the meeting, described in minutes of the gathering released Wednesday, suggests they could downshift to a rate rise of 0.5 percentage point, or 50 basis points, at their meeting next month.”

“The Worst Bond Market Ever” (Morningstar). “In the grand scheme of things, balanced portfolios have not performed terribly in recent months…The same, regrettably, cannot be said for bonds. Among fixed-income securities, there has been no refuge. Interest rates have spiked across the yield curve, thereby sinking all investment-grade debt. Lower-quality notes have also struggled. Sometimes when interest rates rise, junk bonds perform well, because credit spreads tighten. Not this year. Instead, credit spreads have widened owing to fears of a recession. The result has been comprehensive bond market losses.”

“The Bad Bet Tech Companies Made That Got Them Into This Mess” (Slate). “One by one, the tech CEOs apologized. They had failed to anticipate that their users’ extremely online behavior would return to normal once COVID restrictions lifted. So their projections for growth—in streaming, e-commerce, and the like—were way off. …That Big Tech completely missed its COVID surge ending—something that seemed obvious—is astonishing, but it’s more than a simple oversight. These companies understood their lockdown-augmented growth curves might not last forever, but they planned as if they would. Because while being wrong would mean cutting staff and missing earnings expectations, not attacking the opportunity would mean losing a market if COVID-inspired behavior did persist. So they took the risk.”

“How Airlines Squeeze You For Every Penny” (Vox). “‘It’s a behavioral economics question — airlines try to figure out how people are going to behave, and they have policies and prices that respond to that,’ said Bob Mann, an aviation analyst. ‘It’s a game.’ And an annoying one at that. It’s not just that fees add onto the final price tag; they can also warp travel in other ways, making the experience more miserable, however much money passengers fork over.”

“Poverty’s End?” (American Institute for Economic Research). “Worldwide, the fraction of humans living in extreme poverty (defined by the U.N. as less than $1.90 per day) declined from more than 80 percent in the early 1800s to less than 10 percent today. This, despite a six-fold increase in the world population. Since the 1990s, the absolute number of people living in extreme poverty has fallen 60 percent, while the population increased almost 40 percent.”

What we’re reading (11/22)

“‘This Is False!’ META Uses Twitter To Deny Claims Mark Zuckerberg Is Resigning As CEO - As Its Share Price Rallies After Rumors Of Billionaire Facebook Founder’s Potential Departure” (The Daily Mail). “Meta officials have denied rumors that billionaire Mark Zuckerberg is planning to step down as CEO of the company he has built from the ground up. Insiders had told The Leak that the 38-year-old has decided to step down as the head of Meta, the parent company of Facebook and Instagram.”

“FTX Says Substantial Amount Of Crypto Assets Stolen Or Missing” (Wall Street Journal). “A substantial amount of FTX’s assets are either missing or stolen, a lawyer for the failed crypto exchange said in court, vowing to cast a wide net to secure potentially billions of dollars in funds that passed through the firm he called the ‘personal fiefdom’ of co-founder Sam Bankman-Fried.”

“HP Says It Will Lay Off Up To 6,000 Workers Over The Next Couple Years” (CNN Business). “The computer maker disclosed the major job cuts in a statement accompanying its lackluster quarterly earnings report on Tuesday afternoon, where it also said sales dropped more than 11% compared to the same period last year.”

“How The Great Depression Shaped People’s DNA” (Nature). “The worst recession in US history shaped how well people would age — before they were even born. Researchers have found1 that the cells of people who were conceived during the Great Depression, which lasted from 1929 to 1939 and, at its height, saw about 25% of the US workforce unemployed, show signs of accelerated ageing…In the earliest stages of development, an embryo is a packet of potential, containing genetic instructions to build the molecular components of the body. Over time, however, cells add and remove chemical modifiers known as epigenetic tags to their DNA, and these shape how those cells and their descendants execute the instructions. The tags are influenced by a variety of factors, including hormones, diet and people’s environment.”

“Are 8 billion People Too Many — Or Too Few?” (Vox). “The truth is that human population is complicated, and there may be 8 billion ways to be wrong about it. Fevered fears about overpopulation ignore the fact that the carrying capacity of the Earth is not and never has been fixed. Technological advances, improved efficiency, and changing consumption patterns allow us to get more people out of the same amount of planet, a possibility Malthus, writing at a time when human population had taken tens of thousands of years to reach just 1 billion, simply couldn’t imagine…But those who fret about underpopulation miss the fact that demographic trends for the entire planet don’t move in a single direction.”