What we’re reading (11/18)

“Is This The End Game For Crypto?” (Paul Krugman, New York Times). “It has never been clear exactly why anyone other than criminals would want to do this [hold/trade crytocurrency]. Although crypto advocates often talk about the 2008 financial crisis as a motivation for their work, that crisis never impaired the payments system — the ability of individuals to transfer funds via banks. Still, the idea of a monetary system that wouldn’t require trust in financial institutions was interesting, and arguably worth trying.”

“Tech Companies Were Thriving, Now They’re Laying Off Thousands. Here’s Why.” (Wall Street Journal). “Tech companies saw exceptional growth in both revenue and employee headcounts through the pandemic. But now, they’re cutting thousands of jobs. WSJ explains the macro — and micro — reasons for the industry’s massive layoffs.”

“Bearish Bets Build In The Stock Market” (Axios). “A measure of sentiment from the options markets shows that bets on falling stock prices have sharply outpaced those expecting prices to rise. This measure, known as the CBOE U.S. equity put/call ratio, has hit the highest — or most bearish — level on record in recent days.”

“Get Ready For Bigger Paychecks: Record High Increases Expected In 2023” (CNN Business). “Employers are planning to increase their salary budgets by 4.6% next year, the highest expected annual jump in 15 years. That’s according to the latest international survey from consulting firm Willis Towers Watson, which included responses from 1,550 US employers. The survey was conducted from October 3 to November 4. A large majority of the organizations attributed the big bump to inflation and a tight labor market.”

“John Mack Wouldn’t Do Anything Differently” (Dealbreaker). “Almost a dozen years ago, we sought to crowd-source a title for outgoing Morgan Stanley chief John Mack's book. Alas, even with all of that time on his hands, the best he could come up with was Up Close and All In. And, according to one of his former underlings, it doesn’t get any better from there…Does it include that time he told New York Fed Chair and future Treasury Secretary Tim Geithner to ‘get fucked’ during the global financial crisis? Of course it does. How about the one where he got so drunk at the Waldorf that a future president of the United States had to carry him out ‘on his back’? Well, we haven’t read it, but we’re guessing probably not. Does it include any doubts about how he conducted himself leading up to and during said global financial crisis, which required an emergency $9 billion cash infusion from the Japanese to keep Morgan Stanley afloat? Definitely not.”

What we’re reading (11/17)

“Sam Bankman-Fried Tries To Explain Himself” (Vox). “Bankman-Fried…apparently wanted to talk. About how FTX and his hedge fund Alameda Research had gambled with customer money without, he claims, realizing that’s what they were doing. About who gets lauded as a hero and who’s the fall guy. About regulators. (‘Fuck regulators.’) About what he regrets (‘Chapter 11,’ the decision to declare bankruptcy) and about what he would have done differently with FTX and Alameda (‘more careful accounting + offboard Alameda from FTX once FTX could live on its own’).

“FTX Auditors Doubled As Crypto Industry Cheerleaders” (Wall Street Journal). “There is a race among crypto brokers, lenders and exchanges to calm their anxious clients by getting the blessing of an auditor. But the type of audits they are getting and the collapse of an audited firm such as FTX shows how far that sector is from a traditional regulated, scrutinized industry.”

“Investor Losses From FTX’s Implosion Are Growing” (DealBook). “The breadth of the global fallout from FTX’s collapse has continued to emerge. Temasek, Singapore’s state-backed fund, said on Thursday that it had fully written down its $275 million investment in the crypto exchange, joining the Silicon Valley firm Sequoia Capital and SoftBank, the Japanese tech conglomerate, in declaring their stakes worthless.”

“FTX Suggests Sam Bankman-Fried Transferred Assets To Bahamas Government Custody After Bankruptcy: Filing” (CNBC). “FTX in a bombshell emergency court filing Thursday said evidence suggests Bahamian regulators directed former CEO Sam Bankman-Fried to gain ‘unauthorized access’ to FTX systems to obtain digital assets belonging to the company after it had filed for bankruptcy protection.”

“Tech Layoffs Signal Slowing Economy But Not Yet A Recession” (Washington Post). “Tech company layoffs are not expected to prompt a tsunami of job losses in other industries, but they are another sign of a cooling economy more broadly, economists say.”

What we’re reading (11/16)

“Welcome To The Crypto Ice Age” (Vox). “The spectacular collapse of FTX is causing shockwaves across the finance and business worlds, but it’s particularly bad for the future of crypto. Bankman-Fried — or ‘SBF’ as he is known in crypto-land — was the boy wonder of the industry, the friendly face leading the charge to integrate crypto into the traditional financial system.”

“It’s Not Just Elon Musk. Your Boss Probably Wants You To Put In ‘Long Hours At High Intensity’ Too.” (Insider). “Other employers are making the same demands that Musk is — just more subtly.”

“Taylor Swift Tour Ticket Fiasco Leads To Calls For Ticketmaster And Live Nation To Break Up” (CNBC). “Live Nation, which merged with Ticketmaster in 2010, has faced longstanding criticisms about its size and power in the entertainment industry. People amplified their complaints this week when tickets for Swift tickets went on presale on Ticketmaster’s website. The company was forced to extend presales after fans flocked to the site, causing site disruptions and slow queues.”

“Steve Jobs’ Old Birkenstocks Sell For Nearly $220,000” (The Guardian). “A suede pair of the beloved German sandals, worn by Steve Jobs in the 1970s and 1980s, sold this week for nearly $220,000, the highest price ever paid for a pair of sandals, according to an auction house.”

“Labor Market Mystery: Where Are The Older Gen Z Workers?” (Wall Street Journal). “An analysis of Census Bureau data by Gad Levanon, chief economist of The Burning Glass Institute, found workers in their early 20s who aren’t in school or the labor force overwhelmingly cited caretaking responsibilities, though the numbers hadn’t changed much since 2019. Covid-19 may also be keeping some of these workers on the sidelines.”

What we’re reading (11/15)

“Airbnb Is More Successful Than Ever. Why Is Everyone So Mad At It?” (Washington Post). “Industry observers say some hosts are seeing a booking slowdown, especially in markets that have become overwhelmed by short-term rentals. But despite the host and traveler complaints, overall bookings continue to grow as the company enjoys a banner year.”

“Household Debt Soars At Fastest Pace In 15 Years As Credit Card Use Surges, Fed Report Says” (CNBC). “Households increased debt during the third quarter at the fastest pace in 15 years due to hefty increases in credit card usage and mortgage balances, the Federal Reserve reported Tuesday. Total debt jumped by $351 billion for the July-to-September period, the largest nominal quarterly increase since 2007, bringing the collective household IOU in the U.S. to a fresh record $16.5 trillion, up 2.2% from the previous quarter and 8.3% from a year ago.”

“Wall Street Bonuses To Plunge As Much As 45% For Bankers - Study” (U.S. News & World Report). “Wall Street investment bankers can expect much smaller bonuses this year as the economy slows, according to projections published on Tuesday by Johnson Associates Inc, a compensation consultant in New York. Bankers who underwrite equity or debt offerings are forecast to receive payouts that are 40% to 45% lower than in 2021, while their counterparts who advise on mergers and acquisitions will get bonuses that are 15% to 20% lower than last year.”

“The Rise Of Influencer Capital: How Social Media, Celebrity Promoters, And Banks Looking For A Quick Buck Transformed The Markets.” (The Intelligencer). “Convincing people to buy something regardless of its underlying value is the job description of our era’s version of the celebrity spokesperson: the influencer. In ‘influencer marketing,’ firms hire — or, on the lower end, offer freebies to — popular social-media users to post about a product or service. These influencers are taking over an increasingly large slice of promotional budgets, with some even dancing off the screen into real-world branded collaborations…Reviewing estimates about the size of the influencer market, The Economist cited numbers between the tens and hundreds of billions of dollars, concluding, ‘Their posts seem frivolous. Their business isn’t.’”

“Why Indecision Makes You Smarter” (BBC). “[R]ecent research suggests that it [indecisiveness] can also have an upside – it protects us from common cognitive errors like confirmation bias, so that when the person does finally come to a judgement, it is generally wiser than those who jumped to a conclusion too quickly. The trick is to learn when to wait, and when to break through the inertia while it’s holding you back.”

What we’re reading (11/14)

“FTX’s Balance Sheet Was Bad” (Matt Levine, Money Stuff). “[T]he basic question is, how bad is the mismatch. Like, $16 billion of dollar liabilities and $16 billion of liquid dollar-denominated assets? Sure, great. $16 billion of dollar liabilities and $16 billion worth of Bitcoin assets? Not ideal, incredibly risky, but in some broad sense understandable. $16 billion of dollar liabilities and assets consisting entirely of some magic beans that you bought in the market for $16 billion? Very bad. $16 billion of dollar liabilities and assets consisting mostly of some magic beans that you invented yourself and acquired for zero dollars? WHAT? Never mind the valuation of the beans; where did the money go? What happened to the $16 billion? Spending $5 billion of customer money on Serum would have been horrible, but FTX didn’t do that, and couldn’t have, because there wasn’t $5 billion of Serum available to buy. FTX shot its customer money into some still-unexplained reaches of the astral plane and was like ‘well we do have $5 billion of this Serum token we made up, that’s something?’ No it isn’t!”

“The Risky Business Of Sam Bankman-Fried” (Wall Street Journal). “Nobody as rich as Sam Bankman-Fried ever spent so much time speaking to podcasters and explaining how they got rich. Weeks before the crackup of his cryptocurrency exchange and spectacular collapse of his wealth, the chief executive of FTX gave an interview that began with an illuminating question: What was the first thing his company did better than any other? ‘Manage risk,’ he said.”

“Who Bears Blame For FTX’s Failure?” (Dealbreaker). “Any time there is a boom cycle like this, otherwise smart investors do dumb things because they see their pals and peers piling in and worry they will be left out. Envy is a pernicious quality — and one that is all too human.”

“Crypto Regulation Bleg” (Scott Sumner, Econlib). “Now there is a call to regulate the crypto industry: I’m wondering if this is just a knee jerk reaction, or if there is some market failure that I missed. A few comments: 1. It’s perfectly legal for Americans to invest in all sorts of extremely risky ventures, such as biotech start-ups. Most of these firms fail, while a few achieve great success. To use the terminology of administration officials, “Americans get harmed” when risky biotech start-ups fail. Yes, investors understand that biotech is risky, but I’d say the same about crypto. 2. It’s perfectly legal to lend money to high-risk businesses, where the loans may not be repaid. Remember junk bonds? 3. Fraud is already illegal.”

“A Cryptocurrency Billionaire Implodes, Showing That The Whole Field Is Built on Quicksand” (Los Angeles Times). “At that conference [the Bloomberg crypto conference in August] — which took place in the teeth of the crypto meltdown — he [SBF] even acknowledged, in his charmingly modest manner, the vacuum at the heart of the entire crypto system: No one has yet explained what bitcoin and other virtual currencies are good for in the real world.”

What we’re reading (11/13)

“The Classic 60-40 Investment Strategy Falls Apart. ‘There’s No Place To Hide.’” (Wall Street Journal). “Despite a powerful rally last week after cooler-than-expected inflation data, the S&P 500 is down in 2022 about 15%, including dividends, while bonds are in their first bear market in decades. A portfolio with 60% of its money invested in U.S. stocks and 40% invested in the 10-year U.S. Treasury note has lost 15% this year. That puts the 60-40 investment mix on track for its worst year since 1937, according to an analysis by investment research and asset management firm Leuthold Group.”

“Tech’s Talent Wars Have Come Back To Bite It” (New York Times). “Silicon Valley tech companies have long seen hiring as more than just filling openings. The industry’s fierce talent wars showed that companies like Google and Meta were gaining the best and brightest. Ballooning staffs and a long reign atop lists of the most-desired jobs for college graduates were emblems of growth, deep pockets and prestige. And to employees, the work became something larger — it was an identity.”

“Getting Over Overdraft” (Brookings). “$30 billion is real money even for a banking system as large as America’s: The biggest banks were making over $1 billion a year on overdraft fees, while overdraft income grew to an astonishing 20% or more of earnings for smaller ones. Overdraft fees, effectively interest on loans, are extremely high cost given the small amount of money loaned via an overdraft, the short term of the loan, and the minimal chance of default. As a result, overdraft fees result in nearly pure profit for the bank (or credit union). No wonder one bank CEO named his yacht ‘Overdraft.’”

“Everyone’s Been Wrong About Inflation, And It’s Costing Workers In Salary Negotiations” (Insider). “While American workers are experiencing the strongest wage growth in many years, fueled by strong demand for labor, inflation has continued to overpower pay gains for most workers. Average hourly earnings, for instance, rose 4.7% in October, continuing to trail even the slower inflation rate.”

“All Eyes On The Consumer Ahead Of Black Friday And The Holidays” (CNN Business). “There is a LOT of data coming out in the next few days that will give important clues about the health of the economy. Beyond a slew of retail earnings reports, the government will report retail sales figures for October on Wednesday. Economists are forecasting a monthly jump of 0.9%. Sales were unchanged in September, a possible sign that inflation was taking its toll on consumers.”

What we’re reading (11/12)

“First Came The Crypto Crash. Now Comes The Taxman.” (Wall Street Journal). “The rout in cryptocurrencies worsened this week with the collapse of the offshore exchange FTX. With bitcoin recently down more than 60% in 2022, many crypto investors would surely like to forget about digital assets, at least for now. That would be a mistake. The Internal Revenue Service hasn’t lost interest in cryptocurrencies, and investors need to focus on key tax issues before year-end.”

“The Red Flags On FTX We All Seemed To Miss” (Forbes). “The clues were there, often coming straight from SBF himself. Talking to David Rubenstein, one of the founders of the Carlyle Group and a Bloomberg TV host, Bankman-Fried explained why he created FTX. It would foreshadow the exchange’s demise.”

“Reported CPI Inflation Is Mostly Rent” (Cato Institute). “Year‐to‐year percentage changes in the CPI will always be called “stubborn” in the headlines simply because each new month is averaged together with eleven previous months. Even on a year‐to‐year basis, however, CPI inflation has been falling for All Items Less Shelter (Rent)[.]”

“The Fed Has Done Enough And ‘Really, Really Should Pause’ Rate Hikes, Top Economist Paul Krugman Says” (Insider). “‘My view is that the Fed has probably done enough already. And they really, really should pause and wait to see,’ Krugman told Bloomberg TV. But he doubted the central bank would pause its rate-hike regime, as it has been scrambling to restore its credibility on fighting inflation after describing it as merely ‘transitory’ last year.”

“How Will Crypto Clearinghouses Evolve?” (Marginal Revolution). “When guessing at the future of crypto, keep in mind that the future of crypto exchanges and the future of crypto assets are very different things. For many pure crypto bugs, the exchanges are a sellout and a concession to older methods of finance and settlement. The exchanges can be regulated, controlled and co-opted, even turned against the notion of individual monetary sovereignty. Instead, the pure crypto vision stresses the notion of “every person their own bank,” through the medium of a personal wallet and beyond easy purview of the central authorities.”

What we’re reading (11/11)

“FTX Files For Bankruptcy, CEO Sam Bankman-Fried Resigns” (Wall Street Journal). “Just a week ago, FTX was an industry titan, and Mr. Bankman-Fried its smiling public face. In January, FTX raised money from Silicon Valley’s most sophisticated investors, at a valuation of $32 billion. A few weeks ago, Mr. Bankman-Fried was publicly musing about raising more, to get even bigger.”

“The Crypto Ponzi Scheme Avenger” (New York Times). “Dozens of HyperFund investors have left withering takedowns on the company review site Trustpilot. One person who said he had lost $10,000 wrote, ‘For the love of God — stay away from this scam.’ A Facebook page called ‘HyperVerse Scam — Now What!?’ has 6,200 members.”

“Disney Plans Targeted Hiring Freeze And Job Cuts, According To A Memo From CEO Bob Chapek” (CNBC). “‘We are limiting headcount additions through a targeted hiring freeze,’ CEO Bob Chapek said in a memo to division leads sent Friday and obtained by CNBC. ‘Hiring for the small subset of the most critical, business-driving positions will continue, but all other roles are on hold. Your segment leaders and HR teams have more specific details on how this will apply to your teams.’”

“Silicon Valley Layoffs Are A Reminder That Your Job Won’t Love You Back” (Vox). “There have been about 118,000 tech layoffs this year, as economic headwinds like high interest rates and low ad spending jar the industry, according to company downsizing tracker Layoffs.fyi. While that’s not enough to seriously dent the millions of US tech jobs out there, it’s an unwelcome occurrence to tech workers who have gotten used to more than a decade of relative stability.”

“Inside The $1.5 Billion Paul Allen Sale, The Most Expensive Art Auction Of All Time” (Vanity Fair). “I was trying to do the math in my head, and with the number of eight-and-nine-figure lots I realized, yes, with fees, that would add up to hit the elusive 10-figure mark. The world had its first billion-dollar art sale. The night was barely halfway over. The grand total ended up at $1.5 billion, making it the highest-grossing auction of all time. It nearly doubled the previous record, and smashed the record for most valuable private collection, soaring past the mark by more than half a billion. It’s possible no sale of physical objects—not counting any corporate takeover or any M&A megadeals—has ever come close to this total. Accounting for inflation, collectors on Wednesday spent nearly four times what Thomas Jefferson dropped on the Louisiana Purchase.”

What we’re reading (11/10)

“Shock Rally Sweeps Markets In Rebuke To Overconfident Bears” (Bloomberg). “Among much else, the session was a stark reminder that timing the market isn’t for the faint of heart -- missing marquee days like Thursday is why individual investors trail indexes when they take matters into their own hands. It was also testament to the power of positioning. A market overrun by sellers is also one where a lot people can change their mind at once, spurring bigger gains than might be warranted by any single economic report.”

“FTX Tapped Into Customer Accounts To Fund Risky Bets, Setting Up Its Downfall” (Wall Street Journal). “FTX Chief Executive Sam Bankman-Fried said in investor meetings this week that Alameda owes FTX about $10 billion, people familiar with the matter said. FTX extended loans to Alameda using money that customers had deposited on the exchange for trading purposes, a decision that Mr. Bankman-Fried described as a poor judgment call, one of the people said.”

“Redfin, The Online Real Estate Broker, Lays Off 13% Of Its Staff” (New York Times). “The real estate brokerage firm Redfin said on Wednesday that it was laying off 13 percent of its work force, the company’s latest move to cut costs amid a slowing housing market. Glenn Kelman, Redfin’s chief executive, sent an email to employees Wednesday morning announcing the latest round of firings and the closure of RedfinNow, the company’s home-flipping service, ahead of the company’s earnings call scheduled for later in the day.”

“Derek Jeter’s New York Castle Is Headed For The Auction Block” (Wall Street Journal). “Known as Tiedemann Castle, the lakefront property is located less than 50 miles from Manhattan in New York’s Orange County. It has been on and off the market since June 2018, when it was first listed for $14.75 million. At the auction slated for Dec. 15, the minimum bid on the property will be just $6.5 million, according to a marketing email from Paramount Realty USA, the company handling the auction.”

“Reports Of Facebook's Immortality Are Greatly Exaggerated” (Reason). “In October 2021, Facebook's parent company rebranded itself as Meta, indicating its intent to branch out into the virtual reality metaverse. Zuckerberg has signaled a willingness to spend $100 billion or more on the project. In the year since, the company lost half a million users in a single quarter and posted its first-ever quarterly revenue decline, and its stock price has lost nearly 75 percent of its value. This week, Meta announced its first-ever round of layoffs, in which it would cut 13 percent of its workforce and implement a hiring freeze, citing increased expenditures and lower revenues. Meanwhile, last month the company excitedly announced that virtual reality users' avatars would now have legs, before later admitting that its technology was not leg-ready quite yet.”

What we’re reading (11/9)

“Binance Walks Away From Deal To Rescue FTX” (Bloomberg). “Crypto exchange Binance reversed course on a rescue offer for FTX Wednesday, leaving the prominent digital firm with an uncertain future as it faces a shortfall of up to $8 billion, according to people familiar with the matter. Binance chose not to go ahead with the nonbinding offer following a review of the company’s finances, the exchange said. ‘In the beginning, our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help,’ Binance said in a statement.”

“Is This Crypto’s Lehman Moment?” (New York Times). “FTX’s fall — including a failed attempt to sell itself to the rival crypto exchange Binance — may turn out to be the most gripping crypto narrative of the year, a “Succession”-level drama involving feuding billionaires, rumors of sabotage and high-stakes battles over the future of the industry. It’s a stunning, sudden fall from grace for one of the crypto world’s biggest celebrities. And it signals that the industry, already reeling from a brutal year of losses, may be in for even tougher times.”

“While It Waits For That Fee Information, SEC Decides To Have A Look At Private Equity Firms’ Messaging Hygiene” (Dealbreaker). “If the private-equity industry thought that Securities and Exchange Commission couldn’t get any meaner toward it, what with all of the insistence that they stop lying to their investors, refusing to be a bit more transparent with them, and passing on the bill for their own alleged misdeeds to them, well, as with the still-uncertain outcome of an election it invested a record $146.8 million in, they’re likely to be disappointed. Because having extracted a cool $1 billion from the world’s banks for failing to properly police and track their employees’ use of messaging apps on their personal devices, to say nothing of actually retaining those messages as required by law, Gary Gensler & co. have a sneaking suspicion there’s equally ripe fruit to be plucked from the hands of p.e. firms.”

“Tech CEOs All Made The Same Dumb Mistake, Thinking The Pandemic Boom Would Last Forever. Now Employees Are Paying The Price With Massive Layoffs.” (Insider). “[W]e're in the middle of what can only be described as a bloodbath, as the tech giants shed jobs by the thousands. This week, Meta (formerly Facebook) and Salesforce made major cuts, joining firms like Stripe, Snap, Netflix, and Oracle, which have all held their own layoffs recently. Those are all very different companies, but they have one thing in common: They grew fast as the pandemic drove demand for digital products and services — and were caught flat-footed when the combination of a return to (relative) normalcy, rising interest rates, and inflation brought the good times to a halt.”

“Short Sellers Faced Off Against Big-Name Hedge Funds in Carvana — And Won” (Institutional Investor). “The fate of the already beaten-down Carvana turned particularly dire in recent days, as its stock fell 50 percent after a longtime bullish analyst at Morgan Stanley looked at its earnings and pulled his rating on the stock, saying the company might be worth only $1 per share. The analyst, Adam Jonas, may have been late to realize Carvana’s problems: He had a $420 price target on Carvana as recently as March. But a plucky short seller had called the company sketchy as early as November of 2019 — pitting himself against the biggest names in hedge funds.”

What we’re reading (11/8)

“Hedge Funds Slash Risky Bets Ahead Of Midterms, CPI Data” (Bloomberg). “Fast-money traders are finding little to get excited about in a market where the S&P 500 has been stuck in a 200-point range in recent weeks. While seasonal patterns around midterm elections historically boded well for stocks, a strong grip by Democrats in Congress could raise the odds of fiscal measures, a move that’d further embolden a hawkish Federal Reserve. Meanwhile, the market’s big reversal following the last release of the consumer price index is enough reason to pause.”

“Redfin Survey: Housing Affordability Is On Voters’ Minds As They Head To The Polls” (Redfin News). “High mortgage rates, persistently high home prices, inflation, considering crime and LGBTQ protections in deciding where to live: Those are some of the housing-related issues on Americans’ minds as they head to the polls for 2022’s closely watched midterm elections. That’s according to an October Redfin survey of 2,000 U.S. residents.”

“Home Buyers Are Moving Farther Away Than Ever Before” (Wall Street Journal). “Buyers who purchased homes in the year ended in June moved a median of 50 miles from their previous residences, according to a National Association of Realtors survey released Thursday. That distance is the highest on record in annual data going back to 2005 and follows five straight years in which the median distance moved was constant at 15 miles, NAR said.”

“Mortgage Rates Too High? (Blame The Fed, Wall Street And Your Neighbor.)” (New York Times). “Since M.B.S. investors such as insurance companies expect interest rates to keep going up, they also expect people to stay in their homes longer, making them slower to prepay or refinance their mortgages. That changes investors’ calculations of the returns they expect on their holdings over a certain time frame. Rather than stick around, some investors sell the bonds in search of higher returns elsewhere. Others demand higher interest rates from lenders to compensate for the additional risk of holding mortgage bonds.”

“Binance Offers To Buy FTX’s Non-U.S. Operations To Fix ‘Liquidity Crunch’” (CNBC). “Binance CEO Changpeng Zhao tweeted Tuesday morning that ‘there is a significant liquidity crunch’ at FTX and that after FTX asked for Binance’s help, the company ‘signed a non-binding’ agreement with the intent ‘to fully acquire http://FTX.com and help cover the liquidity crunch.’ Zhao added that Binance, which was initially based in China but now claims no official headquarters, will be conducting full diligence in the coming days, and the firm has the discretion to pull out from the deal at any time. Sam Bankman-Fried confirmed the agreement in a tweet this morning.”

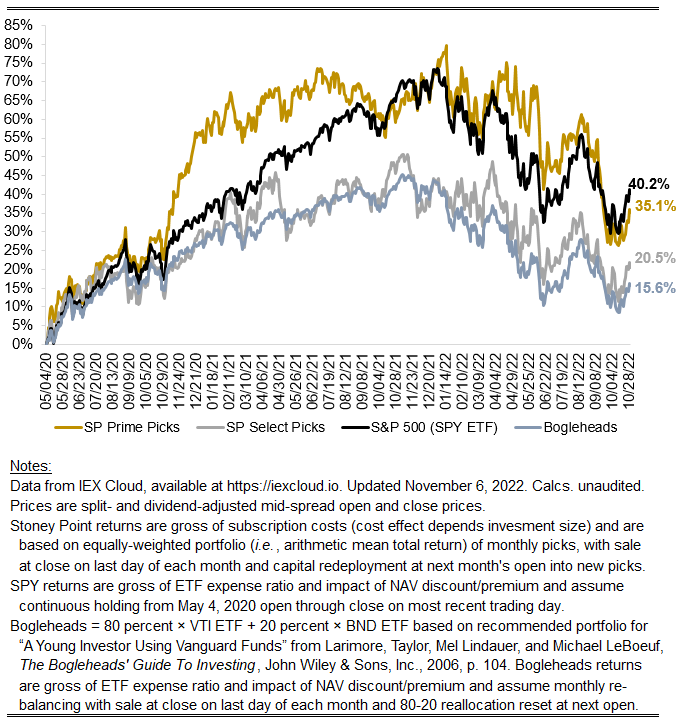

October 2022 performance update

Hi friends, here with the monthly performance update:

Prime: +6.66%

Select: +6.04%

SPY ETF: 6.96%

Bogleheads Portfolio (80% VTI + 20% BND): +5.14%

Solid month for the market overall amid a turbulent macro environment. Consumer prices continue to run hot but arguably with the first signs of abating as one would expect given the signaled path of future rates. Recession predictions abound, but the question for asset prices is the likelihood of future changes in (1) rates or (2) growth deviating from current consensus expectations. You may see the likes of Ray Dalio and Jamie Dimon and numerous others arguing that things could get much worse. That is difficult to assess in isolation, but for some perspective, recall that in January I surmised that, at that time, “a combination of a full one percentage point additional increase in benchmark rates combined with a downward revision in S&P 500 annual EPS growth of two percentage points would result in a drawdown of a little more than 40 percent.” Without doing a deep dive, it strikes me that changes in interest rates and market growth rates along those lines have (very roughly) manifested and yet here we are with the S&P 500-tracking SPY ETF only down about 14% since that time. That suggests staying cautious.

Relative to the market we were about at parity. Lets see how November plays out.

A reminder that we plan to incorporate some market sentiment indicators into the model by year end. Stay tuned.

Stoney Point Total Performance History

What we’re reading (11/3)

“Layoffs Hit Tech Sector With Force As Amazon, Lyft Warn Of Economic Downturn” (Wall Street Journal). “The stream of grim news for the industry came as the Federal Reserve has moved again to raise interest rates to combat inflation, signaling greater risk that the U.S. economy is sliding into a recession. Faced with that possibility, tech company executives are warning of tougher times ahead.”

“Coinbase Reports Better-Than-Expected User Numbers Even As Third-Quarter Revenue Plunges” (CNBC). “Coinbase reported user numbers that topped analysts’ estimates even as third-quarter revenue missed estimates and the cryptocurrency exchange had a wider-than-expected loss. The stock popped in extended trading.”

“Ray Dalio On The Downturn: ‘There’s A Lot More To Come’” (Institutional Investor). “‘When interest rates go up, asset prices go down,’ Dalio said Thursday. ‘The assets have gone down reflecting the interest rate adjustment but not down reflecting the contraction. There’s a lot more to come.’ Dalio shared his views on the market and politics at the Forbes Iconoclast Summit held Thursday in New York City.”

“BlackRock Sees A ‘Revolution’ Coming In Corporate Governance” (DealBook). “As investors push for a bigger say in how companies tackle a variety of issues — including supporting or opposing environmentally and socially minded goals — Larry Fink wants to give them even more of a voice in the boardroom. In a letter to clients of BlackRock, the $8 trillion money manager that he runs, Fink wrote that a ‘revolution in shareholder democracy’ was growing. For its part, BlackRock will expand a program that lets investors in its funds choose how they vote in corporate elections, in a recognition that shareholders ‘don’t want to sit on the sidelines.’”

“A Big And Embarrassing Challenge To DSGE Models” (Marginal Revolution). “Dynamic stochastic general equilibrium (DSGE) models are the leading models in macroeconomics…most new work today is done using a variant of this type of model by macroeconomists of all political stripes and schools. Now along comes two statisticians, Daniel J. McDonald and the acerbic Cosma Rohilla Shalizi. McDonald and Shalizi subject the now standard Smet-Wouters DSGE model to some very basic statistical tests. First, they simulate the model and then ask how well can the model predict its own simulation? That is, when we know the true model of the economy how well can the DSGE discover the true parameters? […] Not well at all.”

What we’re reading (11/2)

“Fed Makes Another Big Rate Increase, Keeps Options Open For Next Moves” (New York Times). “Powell says the Fed would have expected goods inflation to come down by more than now, services prices are climbing swiftly, and overall the inflation picture has become more difficult this year, which makes it harder for the central bank to set the economy down gently.”

“Curbing Inflation Comes First, But We Can’t Stop There” (Larry Summers, Washington Post). “Those who believe the Fed is close to having done enough need to explain their view. If they believe that interest rates above 4 percent, in an economy with 7 percent core inflation, will cause a recession serious enough to reduce inflation below the Fed’s 2 percent target, they need to explain why. I find it absurd. Perhaps the argument is that preventing an overly deep recession is so important that it’s worth abandoning the Fed’s inflation target. But proponents of this view need to explain how, if inflation remains well above 2 percent, we can avoid continued erosion in real wages down the road.”

“Overemployed in Silicon Valley: How Scores Of Tech Workers are Secretly Juggling Multiple Jobs” (Vanity Fair). “On one Reddit community of 110,000, members share work hacks—like using ‘mouse jigglers,’ single-ear headsets, and a mantra (‘Always Be Interviewing’)—to help one another keep the ruse going. ‘All my paychecks are still coming in,’ one engineer claims, ‘but the fear of being found out is never-ending.’”

“U.S. Workers Have Gotten Way Less Productive. No One Is Sure Why.” (Washington Post). “Employers across the country are worried that workers are getting less done — and there’s evidence they’re right to be spooked. In the first half of 2022, productivity — the measure of how much output in goods and services an employee can produce in an hour — plunged by the sharpest rate on record going back to 1947, according to data from the Bureau of Labor Statistics.”

“Who Pays For Your Rewards? Redistribution In The Credit Card Market” (Agarwal, et al.). “We use data on the near-universe of credit cards in the US to study redistribution between consumers in retail financial markets. Comparing cards with and without rewards, we find that, regardless of income, sophisticated individuals profit from reward credit cards at the expense of naive consumers…We estimate an aggregate annual redistribution of $15 billion from less to more educated, poorer to richer, and high to low minority areas, widening existing spatial disparities.”

November picks available now

The new Prime and Select picks for November are available starting now, based on a model run put through today (October 31). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Tuesday, November 1, 2022 (at the mid-spread open price) through the last trading day of the month, Wednesday, November 30, 2022 (at the mid-spread closing price).

What we’re reading (10/30)

“Cash-Rich Consumers Could Mean Higher Interest Rates For Longer” (Wall Street Journal). “Washington’s response to the pandemic left household and business finances in unusually strong shape, with higher savings buffers and lower interest expenses. It could also make the Federal Reserve’s job of taming high inflation more difficult.”

“Inflation Data Shows US Prices Were Still Uncomfortably High Last Month” (CNN Business). “A new batch of inflation data released Friday showed that while prices remained uncomfortably high in September, a slowdown in wage growth indicates some relief may be in sight. That’s an encouraging development for the Federal Reserve, which is battling to bring down the highest inflation in 40 years.”

“Vivek Ramaswamy And The Larry Fink Problem” (National Review). “David is joined this week by Vivek Ramaswamy, the author of the best-selling book, Woke Inc., to talk about a moral defense of markets. They go all around the horn in looking at where the Business Roundtable got it all wrong, where so-called “stakeholder” capitalism is an exercise in futility, and what market solutions exist to the so-called ‘Larry Fink problem.’ An absolute premium episode.”

“Drain The Strategic Petroleum Reserve” (EconLib). “There are 2 justifications for his selling oil from the SPR currently. One is philosophical; the other is pragmatic. The philosophical justification is that the government shouldn’t be in the business of supplying oil. One of the strongest arguments for futures markets is that they give private actors a strong incentive to store oil when they think the price will rise in the future and to sell oil when they think it will fall in the future. The government gums up the works by being an unpredictable participant in the market for oil. So it’s best not to have the government in that market at all. The way to get to that point is to sell the oil. The pragmatic justification for selling oil right now is that the current price is unusually high and will likely be lower. The spot price of oil on October 20, reported by the Wall Street Journal on October 21, was $85.98 per barrel. The futures price for December 2023 was reported as $74.81. So this is a good time to sell.”

What we’re reading (10/29)

“COVID-19 Origins: Investigating A “Complex And Grave Situation” Inside A Wuhan Lab” (ProPublica). “The Wuhan lab at the center of suspicions about the pandemic’s onset was far more troubled than known, documents unearthed by a Senate team reveal. Tracing the evidence, Vanity Fair and ProPublica give the clearest view yet of a biocomplex in crisis…On Nov. 12, 2019, a dispatch by party branch members at the BSL-4 laboratory appeared to reference a biosecurity breach: ‘These viruses come without a shadow and leave without a trace.’”

“Pfizer, Uber And Starbucks Highlight Another Busy Earnings Week” (Wall Street Journal). “The wide range of industry leaders reporting results in the days ahead will show investors how companies are responding to shifting consumer behaviors, decades-high inflation, the run-up in the U.S. dollar and lingering supply-chain disruptions. Last week, many of the world’s biggest tech companies, from Intel Corp. to Facebook parent Meta Platforms Inc., issued largely gloomy outlooks as businesses pull back on spending and costs rise.”

“Where Do Restaurant ‘Service Fees” Really Go?” (Vox). “Service charges have become commonplace for things like online delivery and concert tickets, but they’re increasingly showing up in unexpected places — namely restaurants. While there’s no formal data yet on how many restaurants are implementing service charges, industry experts say those fees are definitely on the rise, and they expect to see even more of them soon. On the surface, service fees can be well-intentioned. They’re born out of a desire to fix what’s long been considered a broken American tradition of paying servers in tips. Increasingly, they’re also a means for restaurants to survive what’s seemed like one onslaught after another.”

“There’s A Biased, Distorted Book About Ray Dalio Coming Out And We Can’t Wait” (Dealbreaker). “As you can imagine from the title, Dalio himself is not going to like this piece of controversial literature. Actually, you don’t have to imagine it: Copeland, who’s been on the Bridgewater beat at The Wall Street Journal for years, has already made the guru-philosopher king angry on a number of occasions. Reporting on some of the arguably cult-like aspects of the Dalio regime, the plan to build an algorithmic robo-Ray and making it sound weird, the apparent flexibility of his seemingly ironclad commitment to honesty when it comes to the People’s Republic of China, his inability to loosen his control over Bridgewater, and the strange tendency of senior women at the firm to make less than their male counterparts has already earned him a place in the deepest circle of Dalio’s hell, that reserved for vindictive liars. (Just wait until Copeland’s fellow yellow journalists at The New York Times announce their volume of Dalioana.)”

“Bill Nye’s Experimental Spacecraft That Sails On Sunlight Declares Mission success” (CNN Business). “About 450 miles above Earth, a small satellite is drifting deeper into the cosmos — powered not by rocket fuel, thrusters or other contraptions. This satellite, called LightSail 2, is sailing on a sunbeam. The prototype spacecraft is the work of the Planetary Society, an international nonprofit headed by famed science communicator Bill Nye. Its mission was declared a success on Wednesday, marking the culmination of a years-long effort to prove a satellite can surf through space using sunlight as an endless fuel supply.”

What we’re reading (10/28)

“Latest GDP Numbers Aren't Calming Recession Fears” (Reason). “Economic growth ticked up ever so slightly last quarter, but not by enough to console those worried about a looming recession. Inflation-adjusted gross domestic product (GDP) grew 0.6 percent during the third quarter of 2022, for an annualized growth rate of 2.6 percent, according to new numbers released by the U.S. Commerce Department's Bureau of Economic Analysis (BEA). These numbers come after two quarters of shrinking GDP. The top-line growth rate was clouded by declining consumer spending on goods, falling investment in new single-family housing construction, and a declining savings rate.”

“Why Amazon’s Stock Price Is Tanking — And Why That Should Worry You” (Vox). “Words of caution from a top executive at one of the world’s most valuable companies and largest US employers, coupled with the weaker-than-expected holiday forecast, could be a sign that the worst days of the current economic slowdown are still ahead of us. And that should be worrying to anyone, whether they’re a fan of Amazon or a critic who doesn’t want the company to succeed.”

“Hershey’s Turnaround Story Isn’t Sweet. It’s Salty.” (Wall Street Journal). “Any stock that doubles in five years, outperforms tech giants over three years and beats more than 450 companies in the S&P 500 this year is clearly worth studying. And there is no better time to look at one of the biggest winners of a terrifying market than Halloween.”

“How Finance Enabled Civilization” (City Journal). “…another thing also that made Athens particularly special and that was its coinage. It had a tradition of tokenization, which again, that's a term we hear a lot today. The creation of tokens that can be used in a setting where you would exchange value and represent investment in a business enterprise and so forth. Well, the Athenians had silver very close to the city, and silver mines allowed them to make millions and millions of these beautiful coins that were symbols of the city, the head of Athena on the front, and an owl for wisdom on the back. Anyway, this tokenization was a way that united the tribes of people that were in Athens into a commitment to the city and a symbolization of their unity with the coinage. But it also was a way for them to measure out people's contribution to the city.”

“Yes, Greeland Is Melting, But…” (Bret Stephens, New York Times). “In the long run, we are likelier to make progress when we adopt partial solutions that work with the grain of human nature, not big ones that work against it. Sometimes those solutions will be legislative — at least when they nudge, rather than force, the private sector to move in the right direction. But more often they will come from the bottom up, in the form of innovations and practices tested in markets, adopted by consumers and continually refined by use. They may not be directly related to climate change but can nonetheless have a positive impact on it. And they probably won’t come in the form of One Big Idea but in thousands of little ones whose cumulative impacts add up.”

What we’re reading (10/27)

“U.S. Mortgage Rates Top 7%, Highest In More Than 20 Years” (Wall Street Journal). “The last time mortgage rates were this high, the dot-com bubble had recently burst. Rates were on the way down. They were in the middle of a four-decade stretch in which they mostly fell, underpinning the growth of the modern mortgage market and boosting the rate of homeownership.”

“Why Stock Multiples Say The Market Could Continue To Drop” (Morningstar). “If stocks have seen their lows for this bear market, ‘that would represent a new benchmark for the most expensive bear-market low,’ says Doug Ramsey, chief investment officer at the Leuthold Group in Minneapolis, an independent provider of financial research and analysis to institutional investors.”

“Mark Zuckerberg Says He’s ‘Pretty Confident’ Meta Is Heading In A ‘Good Direction’ As Stock Crashes 20% After Huge Earnings Miss” (Insider). “‘We've been through a couple of these cycles before already, and I'm pretty confident this is going in a good direction,’ Zuckerberg said in a call with analysts after the report was published.”

“Amazon Stock Sinks 13% On Weak Fourth-Quarter Guidance” (CNBC). “Like the rest of Big Tech, Amazon has had a rocky year so far as it confronts macroeconomic headwinds, soaring inflation and rising interest rates. Those challenges have coincided with a slowdown in Amazon’s core retail business, as consumers returned to shopping in stores.”

“Wall St Loses Over $200 Billion In Value After Report From Amazon” (Reuters). “Over $200 billion in U.S. stock market value went up in smoke in extended trade on Thursday, after a weak forecast from Amazon added to a string of downbeat quarterly reports from Big Tech companies.”

What we’re reading (10/26)

“Eating The Seed Corn: How Long Can Consumers Rely On Savings?” (Wells Fargo). “Consumers have yet to lose their staying power, and our analysis of household finances suggests consumers still have the ability to rely on their balance sheets for some time yet. The catch: The more consumers rely on their balance sheets to spend today, the larger deterioration we'll see in overall household finances and the worse the eventual economic downturn may be.”

“Stock Picking Isn’t Dead. But For Most Investors It Might As Well Be” (CNN Business). “‘Actively managed funds have failed to survive and beat their benchmarks, especially over longer time horizons,’ said Bryan Armour, director of passive strategies research for North America at Morningstar, in a report last month. He noted that just one of every four active funds beat their passive benchmarks over the ten years ending in June.”

“Tech Stocks Tumble As Growth Falters” (DealBook). “Microsoft’s sales rose at their slowest rate in five years, as rising energy costs and a strong dollar ate into profits. And Alphabet, the parent company of Google, missed analyst expectations and said growth in its core advertising business had slowed to its weakest point since 2013 (apart from a short period at the start of the pandemic), as companies slashed marketing budgets.”

“Accounting Errors To Cost Executives Their Bonuses Under SEC Rule” (Wall Street Journal). “Regulators will make public companies take back executives’ incentive pay if they find significant errors in financial statements, aiming to improve corporate accountability at a time of rising shareholder discontent over pay practices. The Securities and Exchange Commission voted 3-2 Wednesday to complete the so-called clawback rule, with all Democrats approving and Republicans dissenting. Required by the 2010 Dodd-Frank Act to discourage fraud and accounting mischief, the rule’s implementation has been delayed for years.”

“Belated Bonus Watch ’17: Deutsche Bank’s First Bad Bank” (Dealbreaker). “Deutsche Bank just reported its ninth-consecutive quarterly profit, a whopping €1.1 billion, far above the level analysts expected. Which, as far as Shikha Gupta is concerned, is good, because she’d like her fair share, at last…At the time Gupta was laid off, back in March 2017, two-plus solid years of profitability at Deutsche Bank must have seemed like a hilarious pipe dream. As must have being paid “more than ever.” But then again, the Germans needed folks like Gupta to help clean up the gigantic mess they had built Chernobyl-style walls around and hung a sign reading “Bad Bank,” as though the epithet could not be applied to Deutsche Bank as a whole[.]”