October 2022 performance update

Hi friends, here with the monthly performance update:

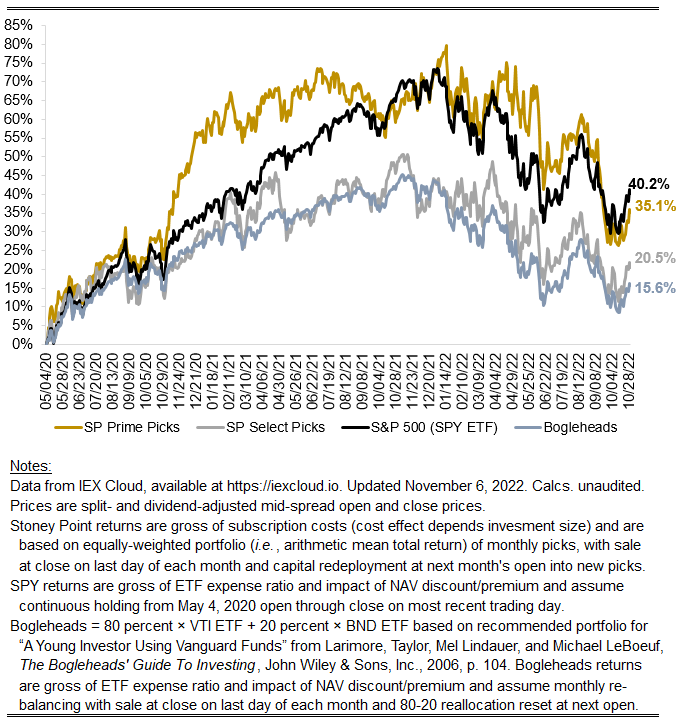

Prime: +6.66%

Select: +6.04%

SPY ETF: 6.96%

Bogleheads Portfolio (80% VTI + 20% BND): +5.14%

Solid month for the market overall amid a turbulent macro environment. Consumer prices continue to run hot but arguably with the first signs of abating as one would expect given the signaled path of future rates. Recession predictions abound, but the question for asset prices is the likelihood of future changes in (1) rates or (2) growth deviating from current consensus expectations. You may see the likes of Ray Dalio and Jamie Dimon and numerous others arguing that things could get much worse. That is difficult to assess in isolation, but for some perspective, recall that in January I surmised that, at that time, “a combination of a full one percentage point additional increase in benchmark rates combined with a downward revision in S&P 500 annual EPS growth of two percentage points would result in a drawdown of a little more than 40 percent.” Without doing a deep dive, it strikes me that changes in interest rates and market growth rates along those lines have (very roughly) manifested and yet here we are with the S&P 500-tracking SPY ETF only down about 14% since that time. That suggests staying cautious.

Relative to the market we were about at parity. Lets see how November plays out.

A reminder that we plan to incorporate some market sentiment indicators into the model by year end. Stay tuned.