What we’re reading (11/8)

“Hedge Funds Slash Risky Bets Ahead Of Midterms, CPI Data” (Bloomberg). “Fast-money traders are finding little to get excited about in a market where the S&P 500 has been stuck in a 200-point range in recent weeks. While seasonal patterns around midterm elections historically boded well for stocks, a strong grip by Democrats in Congress could raise the odds of fiscal measures, a move that’d further embolden a hawkish Federal Reserve. Meanwhile, the market’s big reversal following the last release of the consumer price index is enough reason to pause.”

“Redfin Survey: Housing Affordability Is On Voters’ Minds As They Head To The Polls” (Redfin News). “High mortgage rates, persistently high home prices, inflation, considering crime and LGBTQ protections in deciding where to live: Those are some of the housing-related issues on Americans’ minds as they head to the polls for 2022’s closely watched midterm elections. That’s according to an October Redfin survey of 2,000 U.S. residents.”

“Home Buyers Are Moving Farther Away Than Ever Before” (Wall Street Journal). “Buyers who purchased homes in the year ended in June moved a median of 50 miles from their previous residences, according to a National Association of Realtors survey released Thursday. That distance is the highest on record in annual data going back to 2005 and follows five straight years in which the median distance moved was constant at 15 miles, NAR said.”

“Mortgage Rates Too High? (Blame The Fed, Wall Street And Your Neighbor.)” (New York Times). “Since M.B.S. investors such as insurance companies expect interest rates to keep going up, they also expect people to stay in their homes longer, making them slower to prepay or refinance their mortgages. That changes investors’ calculations of the returns they expect on their holdings over a certain time frame. Rather than stick around, some investors sell the bonds in search of higher returns elsewhere. Others demand higher interest rates from lenders to compensate for the additional risk of holding mortgage bonds.”

“Binance Offers To Buy FTX’s Non-U.S. Operations To Fix ‘Liquidity Crunch’” (CNBC). “Binance CEO Changpeng Zhao tweeted Tuesday morning that ‘there is a significant liquidity crunch’ at FTX and that after FTX asked for Binance’s help, the company ‘signed a non-binding’ agreement with the intent ‘to fully acquire http://FTX.com and help cover the liquidity crunch.’ Zhao added that Binance, which was initially based in China but now claims no official headquarters, will be conducting full diligence in the coming days, and the firm has the discretion to pull out from the deal at any time. Sam Bankman-Fried confirmed the agreement in a tweet this morning.”

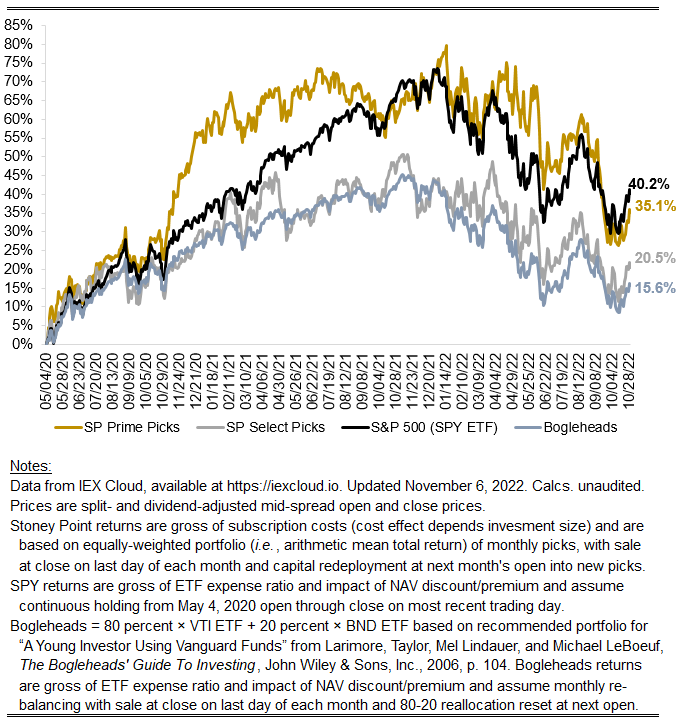

October 2022 performance update

Hi friends, here with the monthly performance update:

Prime: +6.66%

Select: +6.04%

SPY ETF: 6.96%

Bogleheads Portfolio (80% VTI + 20% BND): +5.14%

Solid month for the market overall amid a turbulent macro environment. Consumer prices continue to run hot but arguably with the first signs of abating as one would expect given the signaled path of future rates. Recession predictions abound, but the question for asset prices is the likelihood of future changes in (1) rates or (2) growth deviating from current consensus expectations. You may see the likes of Ray Dalio and Jamie Dimon and numerous others arguing that things could get much worse. That is difficult to assess in isolation, but for some perspective, recall that in January I surmised that, at that time, “a combination of a full one percentage point additional increase in benchmark rates combined with a downward revision in S&P 500 annual EPS growth of two percentage points would result in a drawdown of a little more than 40 percent.” Without doing a deep dive, it strikes me that changes in interest rates and market growth rates along those lines have (very roughly) manifested and yet here we are with the S&P 500-tracking SPY ETF only down about 14% since that time. That suggests staying cautious.

Relative to the market we were about at parity. Lets see how November plays out.

A reminder that we plan to incorporate some market sentiment indicators into the model by year end. Stay tuned.

Stoney Point Total Performance History

What we’re reading (11/3)

“Layoffs Hit Tech Sector With Force As Amazon, Lyft Warn Of Economic Downturn” (Wall Street Journal). “The stream of grim news for the industry came as the Federal Reserve has moved again to raise interest rates to combat inflation, signaling greater risk that the U.S. economy is sliding into a recession. Faced with that possibility, tech company executives are warning of tougher times ahead.”

“Coinbase Reports Better-Than-Expected User Numbers Even As Third-Quarter Revenue Plunges” (CNBC). “Coinbase reported user numbers that topped analysts’ estimates even as third-quarter revenue missed estimates and the cryptocurrency exchange had a wider-than-expected loss. The stock popped in extended trading.”

“Ray Dalio On The Downturn: ‘There’s A Lot More To Come’” (Institutional Investor). “‘When interest rates go up, asset prices go down,’ Dalio said Thursday. ‘The assets have gone down reflecting the interest rate adjustment but not down reflecting the contraction. There’s a lot more to come.’ Dalio shared his views on the market and politics at the Forbes Iconoclast Summit held Thursday in New York City.”

“BlackRock Sees A ‘Revolution’ Coming In Corporate Governance” (DealBook). “As investors push for a bigger say in how companies tackle a variety of issues — including supporting or opposing environmentally and socially minded goals — Larry Fink wants to give them even more of a voice in the boardroom. In a letter to clients of BlackRock, the $8 trillion money manager that he runs, Fink wrote that a ‘revolution in shareholder democracy’ was growing. For its part, BlackRock will expand a program that lets investors in its funds choose how they vote in corporate elections, in a recognition that shareholders ‘don’t want to sit on the sidelines.’”

“A Big And Embarrassing Challenge To DSGE Models” (Marginal Revolution). “Dynamic stochastic general equilibrium (DSGE) models are the leading models in macroeconomics…most new work today is done using a variant of this type of model by macroeconomists of all political stripes and schools. Now along comes two statisticians, Daniel J. McDonald and the acerbic Cosma Rohilla Shalizi. McDonald and Shalizi subject the now standard Smet-Wouters DSGE model to some very basic statistical tests. First, they simulate the model and then ask how well can the model predict its own simulation? That is, when we know the true model of the economy how well can the DSGE discover the true parameters? […] Not well at all.”

What we’re reading (11/2)

“Fed Makes Another Big Rate Increase, Keeps Options Open For Next Moves” (New York Times). “Powell says the Fed would have expected goods inflation to come down by more than now, services prices are climbing swiftly, and overall the inflation picture has become more difficult this year, which makes it harder for the central bank to set the economy down gently.”

“Curbing Inflation Comes First, But We Can’t Stop There” (Larry Summers, Washington Post). “Those who believe the Fed is close to having done enough need to explain their view. If they believe that interest rates above 4 percent, in an economy with 7 percent core inflation, will cause a recession serious enough to reduce inflation below the Fed’s 2 percent target, they need to explain why. I find it absurd. Perhaps the argument is that preventing an overly deep recession is so important that it’s worth abandoning the Fed’s inflation target. But proponents of this view need to explain how, if inflation remains well above 2 percent, we can avoid continued erosion in real wages down the road.”

“Overemployed in Silicon Valley: How Scores Of Tech Workers are Secretly Juggling Multiple Jobs” (Vanity Fair). “On one Reddit community of 110,000, members share work hacks—like using ‘mouse jigglers,’ single-ear headsets, and a mantra (‘Always Be Interviewing’)—to help one another keep the ruse going. ‘All my paychecks are still coming in,’ one engineer claims, ‘but the fear of being found out is never-ending.’”

“U.S. Workers Have Gotten Way Less Productive. No One Is Sure Why.” (Washington Post). “Employers across the country are worried that workers are getting less done — and there’s evidence they’re right to be spooked. In the first half of 2022, productivity — the measure of how much output in goods and services an employee can produce in an hour — plunged by the sharpest rate on record going back to 1947, according to data from the Bureau of Labor Statistics.”

“Who Pays For Your Rewards? Redistribution In The Credit Card Market” (Agarwal, et al.). “We use data on the near-universe of credit cards in the US to study redistribution between consumers in retail financial markets. Comparing cards with and without rewards, we find that, regardless of income, sophisticated individuals profit from reward credit cards at the expense of naive consumers…We estimate an aggregate annual redistribution of $15 billion from less to more educated, poorer to richer, and high to low minority areas, widening existing spatial disparities.”

November picks available now

The new Prime and Select picks for November are available starting now, based on a model run put through today (October 31). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Tuesday, November 1, 2022 (at the mid-spread open price) through the last trading day of the month, Wednesday, November 30, 2022 (at the mid-spread closing price).

What we’re reading (10/30)

“Cash-Rich Consumers Could Mean Higher Interest Rates For Longer” (Wall Street Journal). “Washington’s response to the pandemic left household and business finances in unusually strong shape, with higher savings buffers and lower interest expenses. It could also make the Federal Reserve’s job of taming high inflation more difficult.”

“Inflation Data Shows US Prices Were Still Uncomfortably High Last Month” (CNN Business). “A new batch of inflation data released Friday showed that while prices remained uncomfortably high in September, a slowdown in wage growth indicates some relief may be in sight. That’s an encouraging development for the Federal Reserve, which is battling to bring down the highest inflation in 40 years.”

“Vivek Ramaswamy And The Larry Fink Problem” (National Review). “David is joined this week by Vivek Ramaswamy, the author of the best-selling book, Woke Inc., to talk about a moral defense of markets. They go all around the horn in looking at where the Business Roundtable got it all wrong, where so-called “stakeholder” capitalism is an exercise in futility, and what market solutions exist to the so-called ‘Larry Fink problem.’ An absolute premium episode.”

“Drain The Strategic Petroleum Reserve” (EconLib). “There are 2 justifications for his selling oil from the SPR currently. One is philosophical; the other is pragmatic. The philosophical justification is that the government shouldn’t be in the business of supplying oil. One of the strongest arguments for futures markets is that they give private actors a strong incentive to store oil when they think the price will rise in the future and to sell oil when they think it will fall in the future. The government gums up the works by being an unpredictable participant in the market for oil. So it’s best not to have the government in that market at all. The way to get to that point is to sell the oil. The pragmatic justification for selling oil right now is that the current price is unusually high and will likely be lower. The spot price of oil on October 20, reported by the Wall Street Journal on October 21, was $85.98 per barrel. The futures price for December 2023 was reported as $74.81. So this is a good time to sell.”

What we’re reading (10/29)

“COVID-19 Origins: Investigating A “Complex And Grave Situation” Inside A Wuhan Lab” (ProPublica). “The Wuhan lab at the center of suspicions about the pandemic’s onset was far more troubled than known, documents unearthed by a Senate team reveal. Tracing the evidence, Vanity Fair and ProPublica give the clearest view yet of a biocomplex in crisis…On Nov. 12, 2019, a dispatch by party branch members at the BSL-4 laboratory appeared to reference a biosecurity breach: ‘These viruses come without a shadow and leave without a trace.’”

“Pfizer, Uber And Starbucks Highlight Another Busy Earnings Week” (Wall Street Journal). “The wide range of industry leaders reporting results in the days ahead will show investors how companies are responding to shifting consumer behaviors, decades-high inflation, the run-up in the U.S. dollar and lingering supply-chain disruptions. Last week, many of the world’s biggest tech companies, from Intel Corp. to Facebook parent Meta Platforms Inc., issued largely gloomy outlooks as businesses pull back on spending and costs rise.”

“Where Do Restaurant ‘Service Fees” Really Go?” (Vox). “Service charges have become commonplace for things like online delivery and concert tickets, but they’re increasingly showing up in unexpected places — namely restaurants. While there’s no formal data yet on how many restaurants are implementing service charges, industry experts say those fees are definitely on the rise, and they expect to see even more of them soon. On the surface, service fees can be well-intentioned. They’re born out of a desire to fix what’s long been considered a broken American tradition of paying servers in tips. Increasingly, they’re also a means for restaurants to survive what’s seemed like one onslaught after another.”

“There’s A Biased, Distorted Book About Ray Dalio Coming Out And We Can’t Wait” (Dealbreaker). “As you can imagine from the title, Dalio himself is not going to like this piece of controversial literature. Actually, you don’t have to imagine it: Copeland, who’s been on the Bridgewater beat at The Wall Street Journal for years, has already made the guru-philosopher king angry on a number of occasions. Reporting on some of the arguably cult-like aspects of the Dalio regime, the plan to build an algorithmic robo-Ray and making it sound weird, the apparent flexibility of his seemingly ironclad commitment to honesty when it comes to the People’s Republic of China, his inability to loosen his control over Bridgewater, and the strange tendency of senior women at the firm to make less than their male counterparts has already earned him a place in the deepest circle of Dalio’s hell, that reserved for vindictive liars. (Just wait until Copeland’s fellow yellow journalists at The New York Times announce their volume of Dalioana.)”

“Bill Nye’s Experimental Spacecraft That Sails On Sunlight Declares Mission success” (CNN Business). “About 450 miles above Earth, a small satellite is drifting deeper into the cosmos — powered not by rocket fuel, thrusters or other contraptions. This satellite, called LightSail 2, is sailing on a sunbeam. The prototype spacecraft is the work of the Planetary Society, an international nonprofit headed by famed science communicator Bill Nye. Its mission was declared a success on Wednesday, marking the culmination of a years-long effort to prove a satellite can surf through space using sunlight as an endless fuel supply.”

What we’re reading (10/28)

“Latest GDP Numbers Aren't Calming Recession Fears” (Reason). “Economic growth ticked up ever so slightly last quarter, but not by enough to console those worried about a looming recession. Inflation-adjusted gross domestic product (GDP) grew 0.6 percent during the third quarter of 2022, for an annualized growth rate of 2.6 percent, according to new numbers released by the U.S. Commerce Department's Bureau of Economic Analysis (BEA). These numbers come after two quarters of shrinking GDP. The top-line growth rate was clouded by declining consumer spending on goods, falling investment in new single-family housing construction, and a declining savings rate.”

“Why Amazon’s Stock Price Is Tanking — And Why That Should Worry You” (Vox). “Words of caution from a top executive at one of the world’s most valuable companies and largest US employers, coupled with the weaker-than-expected holiday forecast, could be a sign that the worst days of the current economic slowdown are still ahead of us. And that should be worrying to anyone, whether they’re a fan of Amazon or a critic who doesn’t want the company to succeed.”

“Hershey’s Turnaround Story Isn’t Sweet. It’s Salty.” (Wall Street Journal). “Any stock that doubles in five years, outperforms tech giants over three years and beats more than 450 companies in the S&P 500 this year is clearly worth studying. And there is no better time to look at one of the biggest winners of a terrifying market than Halloween.”

“How Finance Enabled Civilization” (City Journal). “…another thing also that made Athens particularly special and that was its coinage. It had a tradition of tokenization, which again, that's a term we hear a lot today. The creation of tokens that can be used in a setting where you would exchange value and represent investment in a business enterprise and so forth. Well, the Athenians had silver very close to the city, and silver mines allowed them to make millions and millions of these beautiful coins that were symbols of the city, the head of Athena on the front, and an owl for wisdom on the back. Anyway, this tokenization was a way that united the tribes of people that were in Athens into a commitment to the city and a symbolization of their unity with the coinage. But it also was a way for them to measure out people's contribution to the city.”

“Yes, Greeland Is Melting, But…” (Bret Stephens, New York Times). “In the long run, we are likelier to make progress when we adopt partial solutions that work with the grain of human nature, not big ones that work against it. Sometimes those solutions will be legislative — at least when they nudge, rather than force, the private sector to move in the right direction. But more often they will come from the bottom up, in the form of innovations and practices tested in markets, adopted by consumers and continually refined by use. They may not be directly related to climate change but can nonetheless have a positive impact on it. And they probably won’t come in the form of One Big Idea but in thousands of little ones whose cumulative impacts add up.”

What we’re reading (10/27)

“U.S. Mortgage Rates Top 7%, Highest In More Than 20 Years” (Wall Street Journal). “The last time mortgage rates were this high, the dot-com bubble had recently burst. Rates were on the way down. They were in the middle of a four-decade stretch in which they mostly fell, underpinning the growth of the modern mortgage market and boosting the rate of homeownership.”

“Why Stock Multiples Say The Market Could Continue To Drop” (Morningstar). “If stocks have seen their lows for this bear market, ‘that would represent a new benchmark for the most expensive bear-market low,’ says Doug Ramsey, chief investment officer at the Leuthold Group in Minneapolis, an independent provider of financial research and analysis to institutional investors.”

“Mark Zuckerberg Says He’s ‘Pretty Confident’ Meta Is Heading In A ‘Good Direction’ As Stock Crashes 20% After Huge Earnings Miss” (Insider). “‘We've been through a couple of these cycles before already, and I'm pretty confident this is going in a good direction,’ Zuckerberg said in a call with analysts after the report was published.”

“Amazon Stock Sinks 13% On Weak Fourth-Quarter Guidance” (CNBC). “Like the rest of Big Tech, Amazon has had a rocky year so far as it confronts macroeconomic headwinds, soaring inflation and rising interest rates. Those challenges have coincided with a slowdown in Amazon’s core retail business, as consumers returned to shopping in stores.”

“Wall St Loses Over $200 Billion In Value After Report From Amazon” (Reuters). “Over $200 billion in U.S. stock market value went up in smoke in extended trade on Thursday, after a weak forecast from Amazon added to a string of downbeat quarterly reports from Big Tech companies.”

What we’re reading (10/26)

“Eating The Seed Corn: How Long Can Consumers Rely On Savings?” (Wells Fargo). “Consumers have yet to lose their staying power, and our analysis of household finances suggests consumers still have the ability to rely on their balance sheets for some time yet. The catch: The more consumers rely on their balance sheets to spend today, the larger deterioration we'll see in overall household finances and the worse the eventual economic downturn may be.”

“Stock Picking Isn’t Dead. But For Most Investors It Might As Well Be” (CNN Business). “‘Actively managed funds have failed to survive and beat their benchmarks, especially over longer time horizons,’ said Bryan Armour, director of passive strategies research for North America at Morningstar, in a report last month. He noted that just one of every four active funds beat their passive benchmarks over the ten years ending in June.”

“Tech Stocks Tumble As Growth Falters” (DealBook). “Microsoft’s sales rose at their slowest rate in five years, as rising energy costs and a strong dollar ate into profits. And Alphabet, the parent company of Google, missed analyst expectations and said growth in its core advertising business had slowed to its weakest point since 2013 (apart from a short period at the start of the pandemic), as companies slashed marketing budgets.”

“Accounting Errors To Cost Executives Their Bonuses Under SEC Rule” (Wall Street Journal). “Regulators will make public companies take back executives’ incentive pay if they find significant errors in financial statements, aiming to improve corporate accountability at a time of rising shareholder discontent over pay practices. The Securities and Exchange Commission voted 3-2 Wednesday to complete the so-called clawback rule, with all Democrats approving and Republicans dissenting. Required by the 2010 Dodd-Frank Act to discourage fraud and accounting mischief, the rule’s implementation has been delayed for years.”

“Belated Bonus Watch ’17: Deutsche Bank’s First Bad Bank” (Dealbreaker). “Deutsche Bank just reported its ninth-consecutive quarterly profit, a whopping €1.1 billion, far above the level analysts expected. Which, as far as Shikha Gupta is concerned, is good, because she’d like her fair share, at last…At the time Gupta was laid off, back in March 2017, two-plus solid years of profitability at Deutsche Bank must have seemed like a hilarious pipe dream. As must have being paid “more than ever.” But then again, the Germans needed folks like Gupta to help clean up the gigantic mess they had built Chernobyl-style walls around and hung a sign reading “Bad Bank,” as though the epithet could not be applied to Deutsche Bank as a whole[.]”

November picks coming soon

We’ll be publishing our Prime and Select picks for the month of November before Tuesday, November 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of October, as well as SPC’s cumulative performance, assuming the sale of the October picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Monday, October 31). Performance tracking for the month of November will assume the November picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Tuesday, November 1).

What we’re reading (10/24)

“Rishi Sunak Calls For Stability And Unity As He Wins Contest To Be PM” (BBC News). “He won the Tory leadership contest after rival Penny Mordaunt failed to secure enough backing from MPs. In his first speech, Mr Sunak said bringing his party and the UK together would be his ‘utmost priority’. Mr Sunak will become the UK's first British Asian prime minister and the youngest for more than 200 years. Mr Sunak - a 42-year-old practising Hindu - is expected to take office on Tuesday after being formally appointed by the King.”

“The Housing Market Decline Is Not A ‘Bubble 2.0’ Due To A Key Difference From The Last Crash, Says Glenmede” (Insider). “The difference between now and the previous housing crisis, the firm noted, is that current conditions are being shaped in large part by underinvestment as opposed to irresponsible lending. The National Association of Realtors has sounded off on this as well, stating last year that decades of underbuilding in the US has helped drive a massive affordability crisis in housing. “

“Builders Say They’re Ready For This Housing Slowdown. ‘I’ve Learned My Lesson.’” (Wall Street Journal). “Mr. McCormick said his new company has less debt and fewer lenders than his former company did heading into the 2007-09 recession, and has grown more slowly and bought less land. ‘I’ve learned my lesson,’ he said. Still, he said, ‘I’ve never seen it change this fast,” referring to the rapid decline in sales.’”

“The Way Los Angeles Is Trying To Solve Homelessness Is ‘Absolutely Insane’” (New York Times). “Six years later, neither the mandate nor the money has proved to be nearly enough. In 2016, Los Angeles had about 28,000 homeless residents, of whom around 21,000 were unsheltered (that is, living on the street). The current count is closer to 42,000 homeless residents, with 28,000 unsheltered. Prop HHH has built units, but slowly, and at eye-popping cost. The city says that 3,357 units have been built, and the most recent audit found the average cost was $596,846 for units under construction — more than the median sale price for a home in Denver. Some units under construction have cost more than $700,000 to build.”

“When Karl Marx Made The Case For Capitalism” (Reason). “In November 1864, Karl Marx wrote a letter congratulating President Abraham Lincoln on his reelection to the White House. ‘From the commencement of the titanic American strife the workingmen of England felt instinctively that the star-spangled banner carried the destiny of their class,’ Marx declared. He was therefore thrilled by the news that Lincoln would continue ‘to lead his country through the matchless struggle for the rescue of an enchained race and the reconstruction of a social world.’”

What we’re reading (10/23)

“Investing In The Shadow Of A Recession” (New York Times). “Deep recessions are horrible experiences for most people, including investors. If you are living off your holdings, with no margin for error, you need safe, fixed-income assets. But if you are lucky enough to have a long horizon, of a decade or more, the best approach may be to keep buying and holding stocks and bonds, even if conditions worsen.”

“Early Earnings Reports Worry Investors Already Battered By Stock Selloff” (Wall Street Journal). “Early results from the third-quarter earnings season haven’t provided much comfort to jittery investors. While some corporate leaders noted glimmers of hope for consumers and the economy, many have reported a host of challenges to profits, including persistent inflation, rising interest rates and a generational surge in the dollar that has pressured revenue generated overseas.”

“Fed's Rx For The Economy Should Be A Tincture Of Time” (Calafia Beach Pundit). “As I've argued in recent posts, there's plenty of evidence to suggest the Fed has already tightened by enough to bring inflation down: the dollar is super-strong, real yields have risen sharply, the yield curve is inverted, commodity prices are plunging, and the housing market has run into a brick wall. Yet the Fed seems determined to tighten even more. I think they're driving by looking into the rear-view mirror. They're trying to burnish their reputation as an inflation fighter, after having fallen miserably behind the inflation curve in 2020 and 2021. And I think that the long-discredited Phillips Curve (which posits that unemployment must rise if inflation is to fall) still haunts the Fed governors' minds. It's all so unfortunate.”

“Here's Why The US Dollar May Be Closer To A Peak Than Markets Think, Even As Inflation Rages And The Fed Remains Hawkish” (Insider). “The US dollar could be closer to peaking than markets think, even as inflation rages and the Federal Reserve remains hawkish, according to Goldman Sachs. The greenback has soared this year, pummeling rivals like the euro, yen, and yuan, thanks to the Federal Reserve's aggressive rate hikes. The central bank has raised its policy rate by 300 basis points so far this year as it scrambles to get a lid on inflation and is expected to keep raising them until next year.”

“Vacancies Show A Hot Labor Market. But They Could Overstate How Hot.” (Washington Post). “For most of the past year there have been roughly two open jobs for each person looking for work in the United States. That’s good news for workers, millions of whom have found higher wages and new opportunities. But the dynamic also has kept the labor market unsustainably hot and fueled persistent labor shortages that have helped push inflation to 40-year highs.”

What we’re reading (10/22)

“How Institutions Game Benchmarks” (Institutional Investor). “In a new paper cheekily entitled ‘Lies, Damn Lies and Performance Benchmarks: An Injunction for Trustees,’ Ennis concludes that the benchmarks that institutions use to judge their returns underperform gauges that are far more representative of the actual market exposures and risks in their portfolios by 1.4 to 1.7 percentage points annually. Not surprisingly, a majority of pensions, endowments, and mutual funds have beaten the benchmarks they devise. By using flawed benchmarks, pensions and endowments are painting a picture that shows that they’ve beaten a low-cost, passive portfolio, when in fact they’ve dramatically underperformed it.”

“Apple, Amazon, McDonald’s Headline Busy Earnings Week” (Wall Street Journal). “Nearly a third of the S&P 500, or 161 companies, are slated to report earnings in the coming week, according to FactSet. Twelve bellwethers from the Dow Jones Industrial Average, including Boeing Co. and McDonald’s Corp., are expected to report as well.”

“How Binance CEO And Aides Plotted To Dodge Regulators In U.S. And UK” (Reuters). “A plan to "insulate" itself from the SEC. A backdated document. An exodus of compliance staff. The world’s biggest crypto exchange and its billionaire founder swerved scrutiny by regulators, Reuters found. Now there are signs the strategy is fraying.”

“Wall Street Warns Of Trouble Brewing In Auto Loans As Prices Dip” (Bloomberg). “Wells Fargo & Co. said that higher loss rates for loans it originated late last year contributed to an increase in write-offs for the period. Ally Financial Inc., the country’s second-largest auto lender, saw charge-offs for retail auto loans quadruple in the third quarter. And Fifth Third Bancorp said it’s pulling back on originations.”

“U.S. Home Prices Could Fall As Much As 20% Next Year” (CBS News). “Home prices have plunged during the second half of 2022 with demand for residential real estate cooling off in a number of states and cities across the U.S.. And prices could continue to fall by as much as 20% next year as mortgage rates climb and the housing market normalizes in wake of the pandemic, according to a noted Wall Street economist.”

What we’re reading (10/20)

“Why I Fear The Fed May Be Overdoing It” (Greg Mankiw’s Blog). “The question is, how much monetary tightening is in order? This question is hard, and anyone who claims to know the answer for sure is not being honest either with you or with themselves. The reason it is hard is that monetary policy works with a substantial lag. It is no surprise that the recent Fed tightening hasn't had much impact on inflation yet. That is no reason to think the Fed needs to tighten a lot more. The Fed made the mistake of waiting for inflation to appear before starting to tighten. It would be a similar mistake to wait for inflation to return to target before stopping the tightening cycle.”

“Valuations and Earnings Growth” (Larry Swedroe). “The historical evidence demonstrates that an investment strategy that bets on growth is a strategy likely to disappoint because growth is neither persistent nor predictable and because value stocks should have an embedded risk premium (noting that risks, of course, can and do show up).”

“U.K. Government Is High-Profile Casualty In World Of Higher Borrowing Costs” (Wall Street Journal). “For the past decade, low inflation and ultralow interest rates gave governments around the world room to spend more and pile on debt without alarming investors. Those days are over. With central banks tightening monetary policy, political leaders are less able to borrow money without raising questions about how they will repay it, in part because higher borrowing costs make debt more expensive and in part because governments already loaded up on debt during the Covid-19 pandemic.”

“How The ‘Black Death’ Left Its Genetic Mark On Future Generations” (New York Times). “When the Black Death struck Europe in 1348, the bacterial infection killed large swaths of people across the continent, driving the strongest pulse of natural selection yet measured in humans, the new study found. It turns out that certain genetic variants made people far more likely to survive the plague. But this protection came with a price: People who inherit the plague-resistant mutations run a higher risk of immune disorders such as Crohn’s disease.”

“A Vision Of Metascience” (Science Plus). “How does the culture of science change and improve? Many people have identified shortcomings in core social processes of science, such as peer review, how grants are awarded, how people are selected to become scientists, and so on. Yet despite often compelling criticisms, strong barriers inhibit widespread change in such social processes. The result is near stasis, and apathy about the prospects for improvement.”

What we’re reading (10/19)

“Oops, We Forgot To Fix The Supply Chain” (Vox). “[T]he structural problems that enabled many of the delays, price hikes, and shortages over the past few years haven’t gone away. Shipping prices have not quite returned to their pre-pandemic levels, truck drivers are still in short supply, and some in the logistics industry are already predicting that there will be problems during the upcoming holiday season.”

“US Chip Sanctions ‘Kneecap’ China’s Tech Industry” (Wired). “Last month, the Chinese ecommerce giant Alibaba revealed a powerful new cloud computing system designed for artificial intelligence projects. It is used by Alibaba’s cloud customers to train algorithms for tasks like chatbot dialogue and video analysis, and was built using hundreds of chips from US companies Intel and Nvidia.”

“Recession Fears Hit Risky Mortgage Debt Amid Default Concerns” (Wall Street Journal). “Investors are unloading securities sold by Fannie Mae and Freddie Mac that shift the risk of mortgage defaults away from taxpayers, a sign of growing concern about defaults if rising interest rates cause a severe recession. The securities, called credit-risk transfers, could incur losses if rising defaults creep into the massive swaths of mortgage debt backed by the housing-finance giants.”

“Jeff Bezos Is The Latest To Warn On The Economy, Saying It’s Time To ‘Batten Down The Hatches’” (CNBC). “In a tweet posted Tuesday evening, the former president and CEO of the online retailing giant echoed comments that Goldman Sachs Chief Executive David Solomon made to CNBC earlier in the day. ‘Yep, the probabilities in this economy tell you batten down the hatches,’ Bezos said in a comment attached to a clip of Solomon’s ‘Squawk Box’ interview.”

“Alleged Fraudsters Who Nearly Settled For $15 Million Now Begging To Explain Why They Should Not Be Indicted” (Dealbreaker). “At first, the allegations against ‘boutique private equity firm’ StraightPath Venture Partners sounded very serious, indeed…[t]hen, it seemed all of that may have been a bit of puffery from the Securities and Exchange Commission, which all of a sudden seemed content to settle for about $15 million. Since then, however, things sound terribly serious once again, including from the mouths of the defendants themselves, and even more so from the court-appointed receiver attempting to sort through the mess. Especially now that the Justice Department has asked everyone else to stand aside and let it handle things.”

What we’re reading (10/18)

“The Rise Of ‘Luxury Surveillance’” (The Atlantic). “Imagine, for a moment, the near future Amazon dreams of. Every morning, you are gently awakened by the Amazon Halo Rise. From its perch on your nightstand, the round device has spent the night monitoring the movements of your body, the light in your room, and the space’s temperature and humidity. At the optimal moment in your sleep cycle, as calculated by a proprietary algorithm, the device’s light gradually brightens to mimic the natural warm hue of sunrise. Your Amazon Echo, plugged in somewhere nearby, automatically starts playing your favorite music as part of your wake-up routine. You ask the device about the day’s weather; it tells you to expect rain. Then it informs you that your next ‘Subscribe & Save’ shipment of Amazon Elements Omega-3 softgels is out for delivery.”

“Goldman Shuffle Aims To Reduce Reliance On M&A” (Wall Street Journal). “Goldman Sachs Group Inc. is so dependent on its investment bank that a slump in deal making sent third-quarter profit down 43%--by far the steepest slide among its big-bank peers. A broad restructuring announced Tuesday is meant to change that: Goldman will fold investment banking and trading into one unit and merge asset and wealth management into another—giving it a higher profile at the same time.”

“Companies Are Being Forced To Reveal What A Job Pays. It’s A Start.” (Vox). “You wouldn’t rent an apartment or even buy a pair of jeans online without knowing the price. Soon, many Americans won’t search for a job without knowing what it pays, either.”

“Globalism Failed To Deliver The Economy We Need” (New York Times). “We don’t yet have a new unified field theory for the postneoliberal world. But that doesn’t mean we shouldn’t continue to question the old philosophy. One of the most persistent neoliberal myths was that the world was flat and national interests would play second fiddle to global markets. The past several years have laid waste to that idea. It’s up to those who care about liberal democracy to craft a new system that better balances local and global interests.”

“The Only Direction For Xi’s Dictatorship” (Project Syndicate). “After a decade in power, Xi Jinping is all but certain to be confirmed as China’s first three-term president at the Communist Party of China’s 20th National Congress this week. But before they make Xi a potential dictator for life, the party faithful should bear in mind that dictatorships never end well. Despite his iron grip on power, Xi’s is no different.”

What we’re reading (10/17)

“Opendoor’s iBuyer Model Is A Canary In The Economic Coal Mine” (Wired). “Opendoor is taking a pounding. Forty-two percent of the homes it sold in August made a loss, according to an analysis by market research firm YipitData. In places like Phoenix, Arizona, where cookie-cutter houses have attracted so-called iBuyers en masse, the numbers are even worse. Here, three out of every four homes Opendoor sold in August lost money. The company blames its current struggles on “the most rapid change in residential real estate fundamentals in 40 years.” It’s a change that’s hitting Opendoor and its competitors hard right now—and it could be coming for millions of homeowners next.”

“Markets Approve Of U.K.’s Reversal Of Tax Cuts” (New York Times). “The British pound and government bonds rose on Monday, after Britain’s finance minister of three days, Jeremy Hunt, reversed nearly all of the government’s promised tax cuts. But the future of the current government remains uncertain, as political analysts and even fellow lawmakers say Prime Minister Liz Truss has all but lost her power.”

“Who Is Going To Buy Cadillac’s $300,000 Hand-Built EV?” (TechCrunch). “[W]ith a price tag more than three times the average transaction price of a vehicle from General Motors’ luxury marque, it’s difficult to imagine many Cadillacs of that heft — no matter how highly customized — will be quietly charging behind suburban garage doors.”

“What Warren Buffet bailing on Chinese Economy Signifies As Tensions Rise” (New York Post). “If Buffett is ditching China, it means that, in his view, the risk/reward ratio has tilted decisively into the red.”

“Why Smartphones Are Getting Cheaper While Everything Else Is Skyrocketing, According To The Government” (CNBC). “It turns out, smartphones aren’t getting cheaper. They’re getting better. And that’s why the CPI shows them deflating instead of inflating like a lot of other goods.”

What we’re reading (10/16)

“Stocks Can Always Get Cheaper” (Wall Street Journal). “My sense is there is more ugly stuff coming. Eighty percent of hedge funds are down and dumping their losers. Short-term interest rates are heading to 5% or higher, which means stocks will trade at a lower price-earnings multiple. Even worse, quarterly earnings misses are starting, and, like cockroaches, you never see only one.”

“A ‘Tectonic Shift’ In Global Wealth That Will Take Years To Recover From” (CNN Business). “ousehold wealth is on track for its first significant reduction since the financial crisis in 2008, according to a new report by financial services company Allianz. Global assets are set to decline by more than 2% in 2022, Allianz reports. That means households, on average, will lose about a tenth of their wealth this year.”

“Retirement Dreams Become Nightmares For Many Older Americans As Inflation Soars” (USA Today). “The news gets worse each month as new inflation data is released. In September, consumer prices increased 8.2% from a year ago. And for people already struggling to pay bills, higher prices for basic necessities cut deeper into already thin budgets. Food prices last month shot up 13% from the previous year and gas prices are up more than 18% from 2021.”

“Liz Truss Versus The Markets” (BBC). “[H]ow can an entity which is impossible to locate, with no central neural function, and with a reputation for being skittish, herd-like, irrational and ethically challenged, force Downing Street to abandon its plans? It has to do with risk and trust. Like an old-fashioned bank manager assessing you for a loan, those who take the individual decisions to buy a UK government bond have to make a judgement on whether the government that issued it is able to pay out interest each year and to repay the face value at the end of its term?”

“We Will See the Return of Capital Investment on a Massive Scale” (The Market NZZ). “According to [investment manager Russell] Napier, financial repression will be the leitmotif for the next 15 to 20 years. But this environment will also bring opportunities for investors. «We will see a boom in capital investment and a reindustrialisation of Western economies,» says Napier. Many people will like it at first, before years of badly misallocated capital will lead to stagflation.”

What we’re reading (10/15)

“What This Year’s Nobel Economists Can Teach Us About Financial Crises” (John Cochrane, National Review). “It’s time for another idea, generated in the 1930s and analyzed in the 2000s with the kinds of contemporary tools our Nobelists brought forth: Banks should fund risky investments by issuing equity, now extremely liquid. Run-prone securities like deposits should be backed 100 percent by reserves or short-term Treasury securities.”

“Monetary Wisdom From Milton Friedman” (Greg Mankiw’s Blog). “From his famous AEA presidential address, still relevant more than a half century later: ‘The reason for the propensity to overreact seems clear: the failure of monetary authorities to allow for the delay between their actions and the subsequent effects on the economy. They tend to determine their actions by today’s conditions—but their actions will affect the economy only six or nine or twelve or fifteen months later. Hence they feel impelled to step on the brake, or the accelerator, as the case may be, too hard.”

“Meet The Army Of Robots Coming To Fill In For Scarce Workers” (Wall Street Journal). “A new wave of robots is arriving—and, in a world short of workers, business leaders are more eager to welcome them than ever. A combination of hard-pressed employers, technological leaps and improved cost effectiveness has fueled a rapid expansion of the world’s robot army. A half-million industrial robots were installed globally last year, according to data released Thursday by the trade group International Federation of Robotics—an all-time high exceeding the previous record, set in 2018, by 22%.”

“Jamie Dimon Says Expect ‘Other Surprises’ From Choppy Markets After U.K. Pensions Nearly Imploded” (CNBC). “JPMorgan Chase CEO Jamie Dimon says investors should expect more blowups after a crash in U.K. government bonds last month nearly caused the collapse of hundreds of that country’s pension funds. The turmoil, triggered after the value of U.K. gilts nosedived in reaction to fiscal spending announcements, forced the country’s central bank into a series of interventions to prop up its markets. That averted disaster for pension funds using leverage to juice returns, which were said to be within hours of collapse.”

“Growth Push Went ‘Too Far, Too Fast’, Says UK Finance Minister Hunt” (Reuters). “Britain's new finance minister Jeremy Hunt said the government had gone "too far, too fast" in its drive for growth after Prime Minister Liz Truss was forced to fire his predecessor and make U-turns on tax-cutting plans amid market turmoil.”