What we’re reading (10/18)

“The Rise Of ‘Luxury Surveillance’” (The Atlantic). “Imagine, for a moment, the near future Amazon dreams of. Every morning, you are gently awakened by the Amazon Halo Rise. From its perch on your nightstand, the round device has spent the night monitoring the movements of your body, the light in your room, and the space’s temperature and humidity. At the optimal moment in your sleep cycle, as calculated by a proprietary algorithm, the device’s light gradually brightens to mimic the natural warm hue of sunrise. Your Amazon Echo, plugged in somewhere nearby, automatically starts playing your favorite music as part of your wake-up routine. You ask the device about the day’s weather; it tells you to expect rain. Then it informs you that your next ‘Subscribe & Save’ shipment of Amazon Elements Omega-3 softgels is out for delivery.”

“Goldman Shuffle Aims To Reduce Reliance On M&A” (Wall Street Journal). “Goldman Sachs Group Inc. is so dependent on its investment bank that a slump in deal making sent third-quarter profit down 43%--by far the steepest slide among its big-bank peers. A broad restructuring announced Tuesday is meant to change that: Goldman will fold investment banking and trading into one unit and merge asset and wealth management into another—giving it a higher profile at the same time.”

“Companies Are Being Forced To Reveal What A Job Pays. It’s A Start.” (Vox). “You wouldn’t rent an apartment or even buy a pair of jeans online without knowing the price. Soon, many Americans won’t search for a job without knowing what it pays, either.”

“Globalism Failed To Deliver The Economy We Need” (New York Times). “We don’t yet have a new unified field theory for the postneoliberal world. But that doesn’t mean we shouldn’t continue to question the old philosophy. One of the most persistent neoliberal myths was that the world was flat and national interests would play second fiddle to global markets. The past several years have laid waste to that idea. It’s up to those who care about liberal democracy to craft a new system that better balances local and global interests.”

“The Only Direction For Xi’s Dictatorship” (Project Syndicate). “After a decade in power, Xi Jinping is all but certain to be confirmed as China’s first three-term president at the Communist Party of China’s 20th National Congress this week. But before they make Xi a potential dictator for life, the party faithful should bear in mind that dictatorships never end well. Despite his iron grip on power, Xi’s is no different.”

What we’re reading (10/17)

“Opendoor’s iBuyer Model Is A Canary In The Economic Coal Mine” (Wired). “Opendoor is taking a pounding. Forty-two percent of the homes it sold in August made a loss, according to an analysis by market research firm YipitData. In places like Phoenix, Arizona, where cookie-cutter houses have attracted so-called iBuyers en masse, the numbers are even worse. Here, three out of every four homes Opendoor sold in August lost money. The company blames its current struggles on “the most rapid change in residential real estate fundamentals in 40 years.” It’s a change that’s hitting Opendoor and its competitors hard right now—and it could be coming for millions of homeowners next.”

“Markets Approve Of U.K.’s Reversal Of Tax Cuts” (New York Times). “The British pound and government bonds rose on Monday, after Britain’s finance minister of three days, Jeremy Hunt, reversed nearly all of the government’s promised tax cuts. But the future of the current government remains uncertain, as political analysts and even fellow lawmakers say Prime Minister Liz Truss has all but lost her power.”

“Who Is Going To Buy Cadillac’s $300,000 Hand-Built EV?” (TechCrunch). “[W]ith a price tag more than three times the average transaction price of a vehicle from General Motors’ luxury marque, it’s difficult to imagine many Cadillacs of that heft — no matter how highly customized — will be quietly charging behind suburban garage doors.”

“What Warren Buffet bailing on Chinese Economy Signifies As Tensions Rise” (New York Post). “If Buffett is ditching China, it means that, in his view, the risk/reward ratio has tilted decisively into the red.”

“Why Smartphones Are Getting Cheaper While Everything Else Is Skyrocketing, According To The Government” (CNBC). “It turns out, smartphones aren’t getting cheaper. They’re getting better. And that’s why the CPI shows them deflating instead of inflating like a lot of other goods.”

What we’re reading (10/16)

“Stocks Can Always Get Cheaper” (Wall Street Journal). “My sense is there is more ugly stuff coming. Eighty percent of hedge funds are down and dumping their losers. Short-term interest rates are heading to 5% or higher, which means stocks will trade at a lower price-earnings multiple. Even worse, quarterly earnings misses are starting, and, like cockroaches, you never see only one.”

“A ‘Tectonic Shift’ In Global Wealth That Will Take Years To Recover From” (CNN Business). “ousehold wealth is on track for its first significant reduction since the financial crisis in 2008, according to a new report by financial services company Allianz. Global assets are set to decline by more than 2% in 2022, Allianz reports. That means households, on average, will lose about a tenth of their wealth this year.”

“Retirement Dreams Become Nightmares For Many Older Americans As Inflation Soars” (USA Today). “The news gets worse each month as new inflation data is released. In September, consumer prices increased 8.2% from a year ago. And for people already struggling to pay bills, higher prices for basic necessities cut deeper into already thin budgets. Food prices last month shot up 13% from the previous year and gas prices are up more than 18% from 2021.”

“Liz Truss Versus The Markets” (BBC). “[H]ow can an entity which is impossible to locate, with no central neural function, and with a reputation for being skittish, herd-like, irrational and ethically challenged, force Downing Street to abandon its plans? It has to do with risk and trust. Like an old-fashioned bank manager assessing you for a loan, those who take the individual decisions to buy a UK government bond have to make a judgement on whether the government that issued it is able to pay out interest each year and to repay the face value at the end of its term?”

“We Will See the Return of Capital Investment on a Massive Scale” (The Market NZZ). “According to [investment manager Russell] Napier, financial repression will be the leitmotif for the next 15 to 20 years. But this environment will also bring opportunities for investors. «We will see a boom in capital investment and a reindustrialisation of Western economies,» says Napier. Many people will like it at first, before years of badly misallocated capital will lead to stagflation.”

What we’re reading (10/15)

“What This Year’s Nobel Economists Can Teach Us About Financial Crises” (John Cochrane, National Review). “It’s time for another idea, generated in the 1930s and analyzed in the 2000s with the kinds of contemporary tools our Nobelists brought forth: Banks should fund risky investments by issuing equity, now extremely liquid. Run-prone securities like deposits should be backed 100 percent by reserves or short-term Treasury securities.”

“Monetary Wisdom From Milton Friedman” (Greg Mankiw’s Blog). “From his famous AEA presidential address, still relevant more than a half century later: ‘The reason for the propensity to overreact seems clear: the failure of monetary authorities to allow for the delay between their actions and the subsequent effects on the economy. They tend to determine their actions by today’s conditions—but their actions will affect the economy only six or nine or twelve or fifteen months later. Hence they feel impelled to step on the brake, or the accelerator, as the case may be, too hard.”

“Meet The Army Of Robots Coming To Fill In For Scarce Workers” (Wall Street Journal). “A new wave of robots is arriving—and, in a world short of workers, business leaders are more eager to welcome them than ever. A combination of hard-pressed employers, technological leaps and improved cost effectiveness has fueled a rapid expansion of the world’s robot army. A half-million industrial robots were installed globally last year, according to data released Thursday by the trade group International Federation of Robotics—an all-time high exceeding the previous record, set in 2018, by 22%.”

“Jamie Dimon Says Expect ‘Other Surprises’ From Choppy Markets After U.K. Pensions Nearly Imploded” (CNBC). “JPMorgan Chase CEO Jamie Dimon says investors should expect more blowups after a crash in U.K. government bonds last month nearly caused the collapse of hundreds of that country’s pension funds. The turmoil, triggered after the value of U.K. gilts nosedived in reaction to fiscal spending announcements, forced the country’s central bank into a series of interventions to prop up its markets. That averted disaster for pension funds using leverage to juice returns, which were said to be within hours of collapse.”

“Growth Push Went ‘Too Far, Too Fast’, Says UK Finance Minister Hunt” (Reuters). “Britain's new finance minister Jeremy Hunt said the government had gone "too far, too fast" in its drive for growth after Prime Minister Liz Truss was forced to fire his predecessor and make U-turns on tax-cutting plans amid market turmoil.”

What we’re reading (10/14)

“Stocks Drop After Wild Surge On Wall Street” (Wall Street Journal). “U.S. stocks fell Friday, the latest U-turn for markets after a volatile week marked by big swings in both directions.”

“U.S. Jury Convicts Nikola Founder Of fraud” (Reuters). “During the trial in federal court in Manhattan, prosecutors depicted Milton, 40, as a "con man" who sought to deceive investors about the electric- and hydrogen-powered truck maker's technology starting in November 2019.”

“Will The 60/40 Portfolio Start To Work Again?” (Morningstar). “The failure of so-called 60/40 portfolios to offer investors protection from the bear market in stocks has upended what had become conventional wisdom among the markets: Stock prices and bond prices don’t move in the same direction. That thinking has been a foundation of diversification strategies for many years. Driving this significant shift in market behavior this year has been stubbornly high inflation and the Federal Reserve’s breakneck pace of interest-rate increases.”

“Meta Has Burned $15 Billion Trying To Build The Metaverse — And Nobody’s Saying Exactly Where The Money Went” (Insider). “Meta has spent more than $15 billion on its Reality Labs metaverse venture since the beginning of last year, but so far, the company hasn't shared on what, precisely, money is being spent. Some experts are getting worried the company is spending good money after bad. ‘The problem is that they spend the money, but the transparency with investors has been a disaster,’ Dan Ives, a tech analyst at Wedbush Securities, said.”

“Meta's Shares Are A Hard Sell As Good Old Facebook Days Are Over” (Bloomberg). “Since Mark Zuckerberg’s announcement a year ago of a name change and strategy overhaul for the owner of Facebook, the stock has wiped out more than half the gain it had seen since its initial public offering a decade ago. That’s cost Meta $600 billion in market value and a spot in the elite club of the US’s 10 biggest companies.”

What we’re reading (10/13)

“Dow Closes More Than 800 Points Higher In Volatile Day” (Wall Street Journal). “U.S. stocks closed sharply higher Thursday in a head-spinning reversal, after investors decided that fresh evidence of high inflation wasn’t as bad as it initially appeared. It was the first time that the Dow Jones Industrial Average both fell at least 500 points and rose at least 800 points in a single trading day, according to Dow Jones Market Data. The whipsaw moves were reminiscent of the early stages of the Covid-19 pandemic, another time of deep uncertainty about the economic outlook.”

“Confirmed: Ads Are Coming To Netflix” (Vanity Fair). “The new plan, which will be available in the US on November 3, will cost $6.99 per month and give subscribers access to most of the broad library of movies and TV shows that they have come to expect from Netflix. In exchange for paying a lower price for the service—less than half the cost of Netflix’s popular Standard plan—subscribers can expect between an average of four to five minutes of ads for every hour of content. ‘We believe that with this launch, we’ll be able to provide a plan and a price for every Netflix fan,’ chief operating officer and chief product officer Greg Peters said during a call with press on Thursday morning, which Vanity Fair participated in.”

“You’re Going Back To The Office. Your Boss Isn’t.” (Vox). “The relationship between rank-and-file office workers and their bosses has never been equal. But remote work is creating a new kind of imbalance between certain people in leadership and their employees, and it’s stirring up resentment at work. Many managers — from middle management to the C-suite, depending on the workplace — are continuing to work remotely, but at the same time are calling their employees back to the office. Employees are getting angry and fighting back in the few ways they can: looking for work someplace else.”

“It’s Time For Employers To Stop Caring So Much About College Degrees” (CNN Business). “Despite the need for revamping our existing talent strategies to keep pace, employers have been slow to move on what we see as the most sustainable way to hire and grow more effective, engaged workforces: hiring for skills, instead of just relying on pedigree. The old set of indicators – the right degree from the right school, the right network to endorse you and the right past employers on your resume – are weak predictors of what actually matters: a candidate’s ability to do the job.”

“Who Had Bernie Madoff In Their Last Game Of ‘Six Degrees Of Kevin Bacon’?” (Dealbreaker). “In fact, according to The Oracle of Bacon website (yes, technology has inserted itself even into this extremely stupid game), it’s vanishingly rare to have a Bacon number higher than four: It’s found just over 10,000 actors with fives or sixes, and less than 200 with numbers higher than that—compared to 447,801 with fours or less (including Bacon himself with a Bacon number of zero). Still, even with those statistics—and even taking into account the broader philosophical notion that all people on earth are connectable within six social connections—there’s someone with the surprisingly low Bacon number of one [Bernie Madoff].”

What we’re reading (10/12)

“Fed Minutes Show Concerns Of More Persistent High Inflation” (Wall Street Journal). “Federal Reserve officials expressed concern at their meeting last month over the persistence of high inflation, underscoring their intention to continue raising interest rates in large steps despite the pain that could cause. Policy makers revised higher their expectations for rate increases, though some signaled caution about overdoing them amid risks of economic and financial volatility, according to minutes of the Sept. 20-21 gathering released Wednesday.”

“Heating Costs Forecast To Soar This Winter” (CNN Business). “No matter how you heat your home, the cost of that heat is likely to soar, according to a forecast Wednesday from the Energy Information Administration. Based on current estimates for fuel prices if, as forecast, there’s a slightly colder winter ahead, the EIA estimates that heating a home with natural gas heating costs will rise about $200 on average, or 28% to $931 for the winter.”

“Europe Likely Entering Another COVID Wave, Says WHO And ECDC” (Reuters). “Another wave of COVID-19 infections may have begun in Europe as cases begin to tick up across the region, the World Health Organization and European Centre for Disease Prevention and Control (ECDC) said on Wednesday.”

“‘No Housing Market Is Immune To Home-Price Declines’: Home Values Are Already Falling In These Pandemic Boomtowns.” (MarketWatch). “Rising rates and waning buyer demand is finally weighing on home prices. With the 30-year fixed-rate mortgage averaging at 7.12%, according to Mortgage News Daily, Zillow, Realtor.com, and John Burns Real Estate Consulting, all noted price drops in cities that were hot over the last two years. Most of these cities were pandemic boomtowns, as remote work enabled many workers to find housing outside of big, expensive mega-cities.”

“These Factors Outperform During Recessions” (Institutional Investor). “According to the latest report from Investment Metrics, a Confluence company, growth and value factors have little impact on investment returns during periods of low consumer confidence, with value stocks losing an average of 1 basis point and growth stocks gaining an average of 1 basis point. The numbers are so close to zero that Alex Lustig, author of the report, concluded that neither factor offered any premiums during these periods. Meanwhile, the volatility factor lost 37 basis points, suggesting that highly volatile stocks have consistently underperformed during recessionary periods. Quality and large-cap stocks, on the other hand, have outperformed their respective benchmarks when consumer confidence has plunged into recessionary territory.”

What we’re reading (10/11)

“Nasdaq Falls Into Bear Market After Volatile Day” (Wall Street Journal). “The S&P 500 and the Nasdaq Composite fell Tuesday in volatile trading, upended by Bank of England Gov. Andrew Bailey’s remark that the U.K. central bank’s plan to rescue pension funds hit by interest-rate increases will end as scheduled Friday. The Nasdaq Composite slipped into a bear market, its second of the year. The S&P 500 and the Dow are already in bear markets, defined in Wall Street parlance as a decline of 20% or more from a recent peak.”

“US Stocks Trade Mixed As Investors Struggle To Regain Momentum Ahead Of Earnings Deluge And Inflation Data” (Insider). “Thursday's inflation report will be a key moment for US stocks, JPMorgan said Tuesday in a note. If Consumer Price Index data clocks in above 8.3%, markets could see another swift 5% sell-off, the bank said, with other shocks to the market potentially bringing the S&P 500 down to around 3,000 by the end of the year.”

“Federal Officials Trade Stock In Companies Their Agencies Oversee” (Wall Street Journal). “More than 2,600 officials at agencies from the Commerce Department to the Treasury Department, during both Republican and Democratic administrations, disclosed stock investments in companies while those same companies were lobbying their agencies for favorable policies. That amounts to more than one in five senior federal employees across 50 federal agencies reviewed by the Journal.”

“How Does The Russo-Ukrainian War End?” (Timothy Snyder). “Here I would like to suggest just one plausible scenario that could emerge in the next few weeks and months. Of course there are others. It is important, though, to start directing our thoughts towards some of the more probable variants. The scenario that I will propose here is that a Russian conventional defeat in Ukraine is merging imperceptibly into a Russian power struggle, which in turn will require a Russian withdrawal from Ukraine. This is, historically speaking, a very familiar chain of events.”

“NATO To Hold Nuclear Deterrence Exercise As Russia Rages At Ukraine” (Washington Examiner). “An annual NATO exercise focused on nuclear weapons deterrence will take place next week in a regular show of force displayed against the backdrop of the war in Ukraine.”

What we’re reading (10/10)

“Nobel Prize In Economics Winners Include Former Fed Chair Ben Bernanke” (Wall Street Journal). “A quiet academic who spent most of his career studying the Great Depression and central banking at Princeton University and the Stanford Graduate School of Business, Mr. Bernanke rose to the forefront of policy-making just as the U.S. was entering a potential replay of the subject he mastered from history books. Historians now credit Mr. Bernanke for averting an economic calamity by quickly devising aggressive new monetary policies—rock-bottom interest rates, loans to banks and controversial bond-buying programs—during and after a financial crisis that started in 2007 and spanned nearly two years.”

“The Economic Contributions Of Ben Bernanke” (Marginal Revolution). “Bernanke’s doctoral dissertation was on the concepts of option value and irreversible investment. Modest increases in business uncertainty can cause big drops in investment, due to the desire to wait, exercise “option value,” and sample more information. This work was published in the QJE in 1983. I have long felt Bernanke does not receive enough credit for this particular idea, which later was fleshed out by Pindyck and Rubinfeld. In sum, Ben is a broad and impressive thinker and researcher. This prize is obviously deserved. In my admittedly unorthodox opinion, his most important work is historical and on the Great Depression.”

“Get Ready For Some Earnings” (CNN Business). “There’s lots of anxiety swirling about a possible recession. Is Corporate America starting to get nervous, too? We’ll get a better sense this week when several top financial firms and consumer companies report third-quarter earnings.”

“‘This Is Serious’: JPMorgan’s Jamie Dimon Warns U.S. Likely To Tip Into Recession In 6 To 9 Months” (CNBC). “Dimon, chief executive of the largest bank in the U.S., said the U.S. economy was ‘actually still doing well’ at present and consumers were likely to be in better shape compared with the 2008 global financial crisis. ‘But you can’t talk about the economy without talking about stuff in the future — and this is serious stuff,’ Dimon told CNBC’s Julianna Tatelbaum on Monday at the JPM Techstars conference in London.”

“Cathie Wood Just Wrote An Open Letter To The Fed Accusing It Of Stoking ‘Deflation’ And Looking At The Wrong Economic Indicators” (Fortune). “[Wood] argues that Chair Jerome Powell & Co. are using “lagging indicators”—including employment and headline inflation—to justify tighter monetary policy when they should be using “leading indicators” such as commodity, used car, and home prices that tell a very different story.”

What we’re reading (10/9)

“A Jittery Stock Market Heads Into Earnings Season” (Wall Street Journal). “The S&P 500 has fallen 24% in 2022 as the central bank ratchets up rates and investors attempt to reassess stock valuations and the durability of corporate profits. The third-quarter earnings season that kicks off in earnest this week will give analysts the broadest look yet at how business has held up as costs continue to rise, higher rates threaten demand and a strong dollar squeezes overseas income.”

“‘Last Year Was The Party. This Year Is The Hangover.’” (Tech Crunch). “[According to Mark Goldberg, partner at Index Ventures:] ‘The crude analogy I’ve been using internally is last year was the party and this year is the hangover. That’s really how it feels to me — that we’re starting to understand the excesses of last year. We’ve seen now the retrenchment period after the fact. At Index, we’re probably more aggressively investing in what we think the next generation of fintech companies is going to be right now.’”

“‘Deer In The Headlights’: Young Bankers On Wall Street Have Had It Easy For Years — But They're About To Face A Bloodbath” (Insider). “Merger and acquisition deals for the first nine months of this year are down by 34% compared with the same period last year. And dozens of huge US companies have cut earnings guidance, citing heightened uncertainty due to, well, everything.”

“Risk Of £50bn Bond Sale Sparked Emergency Bank Of England Move” (BBC News). “The aftermath of the mini-budget could have seen a £50bn fire sale of UK government bonds by funds connected to the pensions industry, the Bank of England has said. There was risk of a downward ‘spiral’, it said, as increases in the cost of government borrowing hit the funds. The Bank feared these funds would be forced to sell their government debt holdings, adding to the market turmoil. The cost of borrowing saw record increases for two days, the Bank said. The rise in borrowing costs over four days was ‘three times larger than any other historical move’.”

“The Secret Microscope That Sparked A Scientific Revolution” (Wired). “1674, Antonie Van Leeuwenhoek, a fabric seller living just south of The Hague, Netherlands, burst forth from scientific obscurity with a letter to London’s Royal Society detailing an astonishing discovery. While he was examining algae from a nearby lake through his homemade microscope, a creature ‘with green and very glittering little scales,’ which he estimated to be a thousand times smaller than a mite, had darted across his vision. Two years later, on October 9, 1676, he followed up with another report so extraordinary that microbiologists today refer to it simply as ‘Letter 18’: Van Leeuwenhoek (lay-u-when-hoke) had looked everywhere and found what he called animalcules (Latin for ‘little animals’) in everything.”

What we’re reading (10/8)

“Wharton’s Jeremy Siegel Says Today’s Biggest Threat Isn’t Inflation — It’s Recession” (CNBC). “The U.S. Federal Reserve has been raising rates too quickly, and recession risks will be ‘extremely’ high if it continues to do so, said Jeremy Siegel, professor emeritus of finance at the Wharton School of the University of Pennsylvania.”

“Bill Gross Sides With Pimco Bond Bulls In Seeing Yields Peaking” (Bloomberg). “Bill Gross and his former colleagues at Pacific Investment Management Co. can agree on at least one thing: bonds are attractive now. Why? Because the market is now pricing in the Federal Reserve’s key borrowing costs will peak at 4.5%. That’s too high, according to Gross, the co-founder of Pimco who was ousted from the bond powerhouse in 2014.”

“Low-Price Grocers Like Aldi Are Winning As Consumers Trade Down” (CNN Business). “Aldi, which requires a 25-cent deposit to use grocery carts, sells mostly store brands and doesn’t waste time on elaborate displays, might not be for everyone. But more than one million new households shopped at Aldi in the year through September, helping rack up double-digit sales growth in that period. Foot traffic across most of its 2,200 US stores jumped about 10.5% year over year, according to Placer.ai — even as grocery sector visits were about flat.”

“Howard Schultz’s Fight To Stop A Starbucks Barista Uprising” (Washington Post). “Howard Schultz, the billionaire founder of Starbucks, stood alone beside the auditorium stage at the company’s global headquarters. The room was packed with 200 of his top executives, all waiting for him to speak. But first Schultz wanted them to hear from their employees across the country. The lights dimmed and their recorded voices filled the room. ‘My last three shifts I’ve cried,’ said one barista. ‘We’re stressed out at work. We’re stressed out at home,’ said another.”

“Alleged Fraudster Who Managed To Evade The Cops For All Of Five Days Certainly Doesn’t Sound Like A Special Forces Veteran” (Dealbreaker). “While allegedly drumming up some $35 million in at least five separate but occasionally interrelated alleged scams, Justin Costello allegedly told his alleged victims a great many things: That he was a Harvard M.B.A. That he worked for 14 years on the Street. That he was a hedge-fund billionaire. That he would totally take care of that client’s tax bill. That one company he led had $1.6 billion in its care and 10 acquisition deals in hand, and that another was worth 9,000% more than it really was. That he was a decorated Special Forces veteran.”

What we’re reading (10/7)

“U.S. Job Growth Eases, But Is Too Strong To Suit Investors” (New York Times). “Employers added 263,000 jobs on a seasonally adjusted basis, the Labor Department said Friday, a decline from 315,000 in August. The number was the lowest since April 2021 but still solid by prepandemic standards. The unemployment rate fell to 3.5 percent, equaling a five-decade low.”

“Is ‘Green Capitalism’ Total BS?” (Wired). “It seems like a self-evidently ridiculous question, borderline obscene—whales are majestic creatures whose worth transcends the human impulse to quantify, obviously! Yet it is one which has been seriously considered by economists in an effort to convince governments and corporations to value wildlife. In her new book, The Value of a Whale: On the Illusions of Green Capitalism, Adrienne Buller dissects the asinine logic of ‘green’ capitalist thinking, from putting a dollar value on cetaceans to carbon offsets to financial products like ‘sustainability-linked bonds.’”

“Global Fallout From Rate Moves Won’t Stop The Fed” (New York Times). “It is a recipe for globe-spanning turmoil and even recession. Despite that, the Fed is poised to continue raising interest rates. That’s because the Fed, like central banks around the world, is in charge of domestic economy goals: It’s supposed to keep inflation slow and steady while fostering maximum employment. While occasionally called ‘central banker to the world’ because of the dollar’s foremost position, the Fed goes about its day-to-day business with its eye squarely on America.”

“Holding Airlines Accountable For Flight Delays And Cancellations” (The Hill). “[F]light cancellations are at the highest they have been in more than a decade, and consumer complaints spiked by 270 percent in June 2022 compared to 2019. This is an absolute nightmare for travelers who were already paying more than they should because of fewer flights and a spike in demand. It should never have been allowed to get this bad.”

“Credit Suisse Ramps Up Efforts To Strengthen Finances” (Wall Street Journal). “Credit Suisse Group AG has intensified efforts to sell or shrink holdings in key businesses in recent days, part of a planned restructuring to remake the bank, people familiar with the matter said. Around 10 bidders have submitted offers for the bank’s securitized products group, some of the people said. The Swiss bank put the business, one of its most profitable, on the block in July, saying it wanted to find an outside investor to conserve capital.”

What we’re reading (10/5)

“Markets Break When Interest Rates Rise Fast: Here Are The Cracks” (Wall Street Journal). “Major U.S. stock markets recorded their worst first nine months of a calendar year since 2002, before rallying this week. Treasury bonds, one of the world’s most widely held securities, have become harder to trade. There also are signs of strain in markets for corporate debt and concerns about emerging-market debt and energy products.”

“Is The Era Of Low Interest Rates Over?” (Paul Krugman, New York Times). “Many commentators have asserted that the era of low interest rates is over. They insist that we’re never going back to the historically low rates that prevailed in late 2019 and early 2020, just before the pandemic — rates that were actually negative in many countries. But I don’t see that happening. There were fundamental reasons interest rates were so low three years ago. Those fundamentals haven’t changed; if anything, they’ve gotten stronger. So it’s hard to understand why, once the dust from the fight against inflation has settled, we won’t go back to a very-low-rate world.”

“Housing Is Slumping, But This Real Estate CEO Explains Why It’s Not 2008 All Over Again” (CNN Business). “‘We probably are technically in a housing recession,’ he [Howard Hughes Corp. CEO David O’Reilly] said, referring to a term used to describe a decline in home sales for at least six months. ‘We are clearly in a downturn, but this is much different.’ O’Reilly said that in the years leading up to the 2008 collapses of Bear Stearns, Lehman Brothers, Washington Mutual and others, there was a glut of new homes that had been built. ‘We had a massive oversupply when Lehman hit the wall,’ he said. ‘But housing starts now have significantly trailed formations.’”

“Is The Efficient Market Hypothesis True?” (U.S. News & World Report). “A 2003 study published in the Journal of Finance pointed to another stock market quirk. The study examined "the relationship between morning sunshine in the city of a country's leading stock exchange and daily market index returns" in 26 countries between 1982 and 1997. ‘Sunshine is strongly significantly correlated with stock returns,’ it reads, noting that sunny weather is associated with positive moods.”

“Fugitive Justin Costello Arrested For $35 Million Fraud Based On ‘Mirage’ Of Being Billionaire, Harvard MBA, Iraq Vet” (CNBC). “Las Vegas resident Justin Costello, 42, is accused by federal prosecutors and the Securities and Exchange Commission of swindling thousands of investors and others as part of a complex scam that touted his purported efforts to build a cannabis conglomerate, among other things.”

What we’re reading (10/4)

“Twitter Shares Surge 22% After Elon Musk Revives Deal To Buy Company At Original Price” (CNBC). “Elon Musk has reversed course and is again proposing to buy Twitter for $54.20 a share, according to a regulatory filing on Tuesday. Twitter shares closed up more than 22% on the news. The social media company issued a statement saying it had received the letter and said, “The intention of the Company is to close the transaction at $54.20 per share.”

“Dow Surges More Than 800 Points In Second Day Of Big Gains” (Wall Street Journal). “The S&P 500 surged 112.50, or 3.1%, to 3790.93, its best day in more than four months. The technology-heavy Nasdaq Composite climbed 360.97, or 3.3%, to 11176.41. The gains were broad-based, spanning different sectors, and encouraged market optimists hoping for a more enduring recovery.”

“Credit Suisse CDS Hit Record High As Shares Tumble” (Financial Times). “Credit Suisse’s five-year CDS soared by more than 100 basis points on Monday, with some traders quoting it as high as 350bp, according to quotes seen by the Financial Times. The bank’s shares tumbled to historic lows of below […] 3.60, down close to 10 per cent when the market opened, before paring losses. The market moves were even more dramatic in the bank’s shorter-term CDS, with one trading desk quoting Credit Suisse’s one-year CDS at 440bp higher than on Friday at 550bp.”

“The First Global Deflation Has Begun, And It’s Unclear Just How Painful It Will Be” (New York Times). “The outline of this pattern is familiar. But the breadth is new. We now find ourselves in the midst of the most comprehensive tightening of monetary policy the world has seen. While the interest rate increases are not as steep as those pushed through by Paul Volcker as Fed chair after 1979, today’s involve far more central banks.”

“Ray Dalio Makes His Exit From Bridgewater” (Institutional Investor). “Dalio turned Bridgewater into the best money manager of all time, according to an annual list compiled by by Rick Sopher, chairman of LCH Investments in London. As of the end of last year, Bridgewater had made investors $52.2 billion since 1975, according to Sopher — even though Bridgewater’s returns in 2021 were only $5.7 billion on assets under management of $99.2 billion.”

What we’re reading (10/3)

“Stocks Kick Off October With A Huge Rally” (CNN Business). “The Dow rose 765 points, or 2.7%. That was its biggest gain since mid-July. The Nasdaq and S&P 500 gained 2.3% and 2.6%, respectively. Stocks ended September (and the third quarter) with a resounding thud on Friday.”

“Elon Musk’s Texts Shatter The Myth of the Tech Genius” (The Atlantic). “What is so illuminating about the Musk messages is just how unimpressive, unimaginative, and sycophantic the powerful men in Musk’s contacts appear to be. Whoever said there are no bad ideas in brainstorming never had access to Elon Musk’s phone.”

“Why Interest Rates Are Rising Everywhere—Except Your Savings Account” (Wall Street Journal). “‘The biggest reason consumers don’t seem to reoptimize their finances seems to be a belief that it will be a huge hassle,’ said Christopher Palmer, a professor of finance at MIT’s Sloan School of Management and a co-author of the study. The study also found that customers tend to overestimate how much of a hassle it actually is, and underestimate how much their interest rate might increase.”

“Advanced Economies Need To Change Course On Monetary Policy As Excessive Central Bank Tightening Risks Sparking A Global Recession, UN Trade Group Says” (Insider). “‘Excessive monetary tightening could usher in a period of stagnation and economic instability,’ the United Nations Conference on Trade and Development warned in a statement on Monday, shortly after releasing a report on growing recession risks.”

“Useless Meetings Waste Time And $100 Million A Year For Big Companies” (Bloomberg). “Unnecessary meetings are a $100 million mistake at big companies, according to a new survey that shows workers probably don’t need to be in nearly a third of the appointments they attend.”

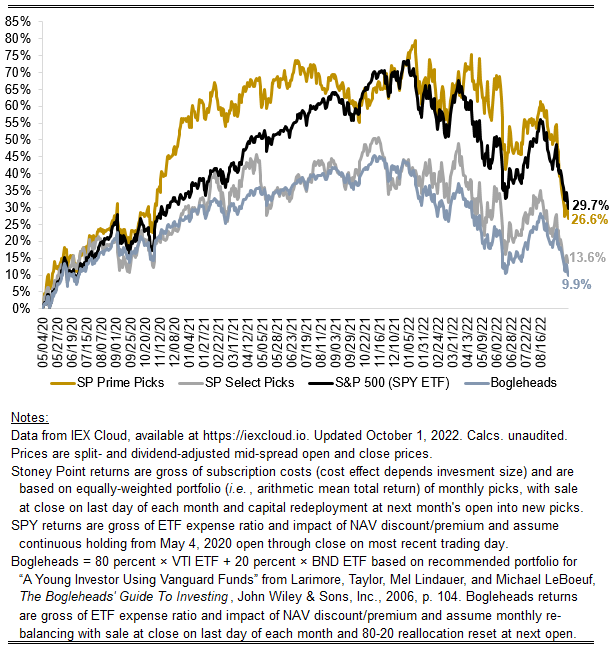

September 2022 performance update

Hi friends, here with a performance update for the month. If you’ve been following the news, you probably understand it was a veritable nightmare of a month for capital asset prices. Currently, 30-year fixed rate mortgages are running about 7 percent in the U.S., the GBPUSD rate is near parity, and as of this writing there are rumors on Twitter that a major international investment bank is “on the brink.” As Matt Levine pointed out in Bloomberg this week, certain pension funds in the U.K. received margin calls receive, so it isn’t all that crazy to assume that most major pools of capital have experienced steep losses and, as a matter of sheer probability, some are probably having liquidity or even solvency problems.

Stock markets were down big this month. Our Prime model was caught especially flat-footed, though Select outperformed the market. Here are the numbers:

Prime: -15.59%

Select: -7.11%

S&P 500 (SPY ETF): -8.72%

Bogleheads model (80% VTI + 20% BND): -7.69%

In terms of a post-mortem analysis, I think I have a pretty good understanding of why Prime was shredded last month. Less interesting (and, I think, controversial) than the “why” I will offer is whether it could have been foreseen. The why (perhaps one among others): Prime was unusually heavily concentrated in logistics providers last month. Careful readers may have noticed that among the Prime picks last month were UPS, Fedex, CH Robinson, and Expeditors International of Washington, all of which were hit hard and down more than the market overall. These aren’t exactly companies that one would expect to perform well heading into a recession—such as the recession that the market is now pricing and is being discussed daily in the media.

These stocks surely looked attractive to our algorithm because it extrapolates past profitability into the future and compares that to price (like any “value”-oriented approach). The upside to that strategy is that it aligns with the empirical observation that, historically, such “value” portfolios outperform. A natural downside is that it doesn’t reflect rapid shifts in sentiment, such as what markets experienced last month. In fact, it in a rapidly downshifting environment, the algo likely actually adversely selects worse-than-average stocks (focusing only on near-term performance). That is because prices, being market-based data points, adjust at a high frequency, unlike accounting data, which is reported at a low frequency. When prices for some stocks fall sharply, our model sees those stocks as “discounts” (assuming the infrequently reported accounting data still look good). But that begs the question of why did the prices go down in the first place? In an efficient market, the price declines can only be interpreted as the market seeing darkness on the horizon that isn’t quite picked up in earnings yet.

Of course, I don’t interfere with the model and try to step in and make alterations to account for factors it may not pick up. I think my attempt to do so would be guesswork and I would be wrong as often or more than I would be right. More important, my belief is that the model should outperform over the long term (a multi-year horizon) without such interference, even if there are hiccups along the way. Empirically, that is true when backtesting historically, and in terms of performance assessment for posterity such interference would contaminate results and cause serious replicability issues and doubts about out-of-sample validity.

The results do bring questions to the fore and that I have raised in the past about whether it makes sense to incorporate automated sentiment indicates in the algorithm. Many quants do this (a simple example would be to have the model look at trends in the relationship between the recent simple moving average of price and a longer-term historical simple moving average, or to incorporate proxies for the well-established “momentum” concept). I’m working on some things on this front that I will plan to incorporate by year end. Results are promising so far, and a few of these sentiment indicia are things that theoretically make a lot of sense (unlike many “technical” indicators) but that few, if any, seem to be using (or least no one seems to be discussing).

Stoney Point Total Performance History

October picks available now

The new Prime and Select picks for October are available starting now, based on a model run put through today (October 1). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Monday, October 3, 2022 (at the mid-spread open price) through the last trading day of the month, Monday, October 31, 2022 (at the mid-spread closing price).

What we’re reading (9/30)

“Stocks Finish A Losing Week, Month And Quarter” (Wall Street Journal). “Major indexes have sustained deep losses this year as the Federal Reserve raises interest rates in an attempt to tame rising prices. The S&P 500, Dow Jones Industrial Average and Nasdaq Composite on Friday all recorded their worst first nine months of a calendar year since 2002, according to Dow Jones Market Data.”

“Bonds May Be Having Their Worst Year Yet” (New York Times). “It is a horrible time for stocks, which have spent the year in a bear market. But guess what? When you look at the historical record, bonds are worse. This year is the most devastating period for bonds since at least 1926, the numbers show. And, in the estimation of one bond maven, 2022 is shaping up to be the worst year for bonds since reliable record-keeping began in the late 18th century.”

“Wary Investors Struggle To Evade Market Tumult” (Wall Street Journal). “‘In 50 years we haven’t seen debt and equity markets fall this much in unison,’ said Rick Rieder, chief investment officer of global fixed income and head of the global allocation team at BlackRock Inc. ‘I’ve never spoken with clients so much in my life—everyone wants to know when this is going to be over.’”

“Barclays Fined $200 Million For Losing Itself $600 Million” (Dealbreaker). “You might think losing some $600 million because some back-office person forgot to keep track of how many structured notes you’ve sold and/or some lawyer forgot to file the boilerplate with the Securities and Exchange Commission informing it that you’d be selling some more would be enough to ensure that something like that never happens again. Certainly, a screw-up of similar magnitude at Citigroup seems to have done that trick. But when it comes to Barclays, well, the SEC [is] just not sure. So it has a little reinforcement to remind the Brits not to cross it again.”

“One Of The Hottest Trends In The World Of Investing Is A Sham” (Hans Taparia). “Wall Street’s current system for E.S.G. investing is designed almost entirely to maximize shareholder returns, falsely leading many investors to believe their portfolios are doing good for the world.”

What we’re reading (9/29)

“Apple Downgrade Sparks Tech Sell-Off, Sending Alphabet And Microsoft To One-Year Lows” (CNBC). “Shares of large technology companies suffered heavy losses on Thursday, dragging down many other U.S. stocks along with them, after analysts at Bank of America lowered Apple’s stock rating. Tech stocks have been pushed down all year as investors have rotated out of growth and flocked to more defensive assets to deal with higher interest rates and to get ahead of a possible recession.”

“Porsche Takes Off In Trading Debut” (DealBook). “Shares in Porsche rose in their trading debut this morning, after the sports car maker priced its initial public offering at the top end of its expected range last night. The long-awaited offering was an increasingly rare bright spot for I.P.O.s, but it may not be enough to revive the moribund market on its own.”

“Pension Strategy Left Funds Vulnerable To Rate Increases” (Wall Street Journal). “‘A vicious cycle kicks in and pension funds are selling and selling,’ said Calum Mackenzie, an investment partner at pension-fund adviser Aon PLC. ‘What you start to see is a death spiral.’”

“UK Pensions Got Margin Calls” (Bloomberg). “This all makes total sense, in its way. But notice that you now have borrowed short-term money to buy volatile financial assets. The thing that was so good about pension funds — their structural long-termism, the fact that you can’t have a run on a pension fund: You’ve ruined that! Now, if interest rates go up (gilts go down), your bank will call you up and say ‘you used our money to buy assets, and the assets went down, so you need to give us some money back.’ And then you have to sell a bunch of your assets[.]”

“Inside Supersonic Plane That Will Get You From London To New York In 80 Minutes At Speeds Of 2,486 Mph” (The U.S. Sun). “The plane would travel at a speed of 2,486mph – twice as fast as Concorde. Measuring 328 feet long with a 168-foot wingspan, the aircraft is also nearly twice its size.”

What we’re reading (9/28)

“The Mysterious Ad Slump Of 2022” (Vox). “Not every truism is true, but there’s one for the ad industry that is pretty truthy: When the economy goes south, the ad market is the first thing to go. The idea behind this one is pretty straightforward. If a company needs to cut costs, it’s much easier to get rid of ad budgets than anything else, like workers. So people in media have been trained to expect ad dollars to disappear in the wake of economic shocks.”

“10-Year Yield Drops The Most Since 2020 After Touching 4%” (CNBC). “The benchmark 10-year Treasury yield dropped the most since 2020 on Wednesday, despite briefly topping 4% earlier in the session, after the Bank of England announced a bond-buying plan to stabilize the British pound. The yield on the 10-year Treasury fell 25 basis points or the most it’s declined since 2020. It yielded 3.705%.”

“Global Bonds Rally After 10-Year Treasury Yield Touches 4%” (Wall Street Journal). “A wild run for global government bonds took an unexpected turn on Wednesday after the Bank of England stepped in to stop a rout in the U.K. gilts market, spurring a furious rally on both sides of the Atlantic. The sharp move added to a stretch of highly volatile trading sessions and came just after the 10-year U.S. Treasury note had climbed above 4% for the first time in more than a decade—a significant milestone that was quickly swept away by the day’s events.”

“‘Act of Sabotage’ Hits Europe’s Energy And Stocks Markets” (DealBook). “There is still no official explanation for what caused the explosions that ruptured the Nord Stream 1 and 2 pipelines, sending natural gas gurgling to the surface of the Baltic Sea. But that hasn’t stopped some E.U. officials from calling the episode an “act of sabotage,” with Prime Minister Mateusz Morawiecki of Poland publicly blaming Russia. Then last night, the pipelines’ operator, Gazprom, threatened to shut down the only pipeline that’s still pumping Russian gas to Western Europe.”

“Make Sure To Delete That Incriminating Message About Deleting Potentially Incriminating Messages, Too” (Dealbreaker). “There are non-nefarious reasons bankers and the like might choose to use a messaging service such as WhatsApp or Signal (well, probably not Signal) on a personal device. Specifically, they’re a lot quicker, more convenient and interactive than the sort of modes of communication officially sanctioned by their employers, and those employers’ regulators, such as e-mail. Of course, there are also nefarious reasons, specifically that no one is looking at what you’re saying or doing on those devices. Allow one Bank of America trader explain: ‘We use WhatsApp all the time but we delete convos regularly.’”