What we’re reading (9/23)

“Dow Drops Nearly 500 Points To Close At New Low For 2022 On Rising Recession Fears” (CNBC). “Stocks tumbled Friday to cap a brutal week for financial markets, as surging interest rates and foreign currency turmoil heightened fears of a global recession…The major averages capped their fifth negative week in six, with the Dow giving up 4%. The S&P and Nasdaq shed 4.65% and 5.07%, respectively. It marked the fourth negative session in a row for stocks, as the Fed on Wednesday enacted another super-sized rate hike of 75 basis points and indicated it would do another at its November meeting.”

“Stock Market Continues Long Tumble As Economic Outlook Sours” (Washington Post). “Blue-chip stocks plunged to their lowest level since 2020 on Friday, continuing a bad slump that began in August as investors try to grapple with economic head winds in the United States and around the world that are only likely to worsen.”

“A Natural Gas Shortage Is Looming For The U.S.” (OilPrice.Com). “[N]atural gas prices fell by nearly a dollar per million British thermal units, helped by a respectable build in inventories. And yet, inventories remain below the seasonal average, exports are running at record rates, and producers are beginning to struggle to meet demand, both at home and abroad.”

“Is The Hyperloop Doomed?” (New York Times). “[W]hile companies have raised hundreds of millions of dollars to design and construct hyperloop systems — with projects in India, the Netherlands, Saudi Arabia and the United States — the technology remains an aspiration.”

“When Bad Things Happen To Good Stocks” (Wall Street Journal). “In this year’s market bloodbath, you might think funds with “quality” in their name—and in their holdings—would lose less money. You’d be wrong…Over the past few years, exchange-traded funds specializing in quality stocks have grown to more than $60 billion. With the S&P 500 down 20% this year, several of these ETFs have fallen even harder, losing as much as 25%.”

What we’re reading (9/22)

“‘The Party Is Over’: How Meta And Google Are Using Recession Fears To Clean House” (Vox). “As Google’s parent company Alphabet and Meta have grown into corporate giants worth $1 trillion and $385 billion, respectively, they’ve swelled their staffing to over 150,000 and 80,000. Now, economic circumstances are giving management an opportunity to reset expectations, pressure staff to start working harder with smaller budgets, and show some workers the door.”

“Treasury Yields Surge As Global Central Banks Scramble To Respond To Fed, Inflation” (Wall Street Journal). “U.S. government bond yields surged Thursday, after foreign governments and central banks rushed to raise interest rates or otherwise support local currencies pressured by the dollar’s strongest rally in a generation.”

“In The Dollar We Trust” (Jeffrey Frankel, The Financial Express). “In a sense, the dollar’s recent rally may seem puzzling. After all, surging inflation and the ongoing economic slowdown should have hurt demand for dollars. But the greenback’s current strength can be explained by the relative resiliency of the US economy and the Federal Reserve’s ongoing commitment to raising interest rates.”

“Bad News From the Fed? We’ve Been Here Before.” (New York Times). “The outlook is gloomy, but it has been worse before. The last time severe inflation tested the mettle of the Federal Reserve was the era of Paul A. Volcker, who became Fed chair in August 1979, when inflation was already 11 percent and still rising. He managed to bring it below 4 percent by 1983, but at the cost of two recessions, sky-high unemployment and horrendous volatility in financial markets.”

“Quiet Quitting Is A Fake Trend” (The Atlantic). “What people are now calling “quiet quitting” was, in previous decades, simply known as ‘having a job.’”

What we’re reading (9/21)

“Incentives: The Most Powerful Force In The World” (Morgan Housel). “[P]eople are not calculators; they are storytellers. There’s too much information and too many blind spots for people to calculate exactly how the world works. Stories are the only realistic solution, simplifying complex problems into a few simple sentences. And the best story always wins – not the best idea or the right idea, but just whatever sounds the best and gets people nodding their head the most. Ben Franklin once wrote, “If you are to persuade, appeal to interest and not to reason.” Incentives fuel stories that justify people’s actions and beliefs, offering comfort even when they’re doing things they know are wrong and believe things they know aren’t true.”

“Inflation Is High. How Will Rate Increases Fix That?” (New York Times). “[T]ime is of the essence when it comes to controlling inflation. If price increases run fast for months or years on end, people could start to adjust their lives accordingly. Workers might ask for higher wages to cover their climbing expenses, pushing up labor costs and prompting businesses to charge more. Companies might begin to believe that consumers will accept price increases, making them less vigilant about avoiding them.”

“Some WFH Employees Have A Secret: They Now Live In Another Country” (Vice). “Even more than the average person, Daniel dislikes video calls with the boss. That’s understandable, because Daniel is hiding a big, complicated secret: He doesn’t live in Birmingham, England, like his entire company believes that he does. In reality, for the past two years, he has been living 5,600 miles away—in Chiangmai, Thailand.”

“Why Index Funds Could Fade” (Barron’s). “Index funds have had a spectacular run. They collected $8.5 trillion in retail investment dollars by the end of the first quarter of this year, according to Morningstar, more than all active strategies together. Along the way, they became the dominant investment idea. Yet the stock market’s recent dip into bear-market territory raises new questions for these popular funds. Will indexing recover and go on to scale new heights? Or has the time come to consider its defects as well as its virtues?”

“Fed Raises Interest Rates By 0.75 Percentage Point For Third Straight Meeting” (Wall Street Journal). “Fed officials voted unanimously to lift their benchmark federal-funds rate to a range between 3% and 3.25%, a level last seen in early 2008. Nearly all of them expect to raise rates to between 4% and 4.5% by the end of this year, according to new projections released Wednesday, which would call for sizable rate increases at policy meetings in November and December.”

What we’re reading (9/19)

“10-Year Treasury Yield Jumps To 3.51%, The Highest Level Since 2011” (CNBC). “The benchmark 10-year Treasury yield gained 6 basis points to 3.518%, hitting its highest level since April 2011, and was last up 4 basis points to 3.49%. The yield on the 2-year Treasury bond rose 9 basis points to trade at 3.949%, trading around levels not seen since 2007.”

“Rising Bond Yields Change The Calculus For Stocks” (Wall Street Journal). “After several Fed interest-rate increases, yields across the Treasurys market are trading at multiyear highs. Now, fewer than 16% of S&P 500 stocks have dividend yields greater than the yield of the two-year U.S. Treasury note, which is approaching 4%. Fewer than 20% have dividend yields greater than the yield of the 10-year note, according to Strategas. Those numbers mark the lowest share since 2006.”

“Warnings Signs Multiply Ahead Of Pivotal Fed Meeting” (DealBook). “All eyes will be on the Fed this Wednesday. The consensus estimate is for a 75-basis-point increase, bringing the benchmark interest rate to between 3 and 3.25 percent — up from near zero at the start of the year. Higher interest rates generally slow lending and economic activity, and with it the forces that push prices higher. So far, it’s not going to plan. Last week, the government reported that consumer prices rose 8.3 percent in the past year, through the end of August.”

“Need Your Money Now? The Markets Aren’t Helping.” (New York Times). “The stock market has been painful if you have been looking at it closely. So don’t look. Set up your investments, then take a deep breath. After that, what should you do? In a word: nothing. Get on with your life.”

“The Rational Case For Monarchy” (Wrong Side of History). “The upside risk on republicanism is pretty small, since among developed liberal democracies both forms of government can be found. The downside risk, however, is gigantic. If you were to opt for a monarchy, you’d be unlucky to land in Saudi Arabia, for its repression, or Swaziland, for its poverty and ill heath. But there are far worse places to live than Saudi, for the depths of human depravity afforded by the absence of a monarch is essentially endless; just in that neighbourhood you could instead get Syria or Iran or Iraq, Libya or Yemen, and across the world everything from surveillance capitalism to anarcho-clannism to the eccentric last holdouts of Marx’s followers. If you were to go back over the past couple of centuries, the vast majority of the most appalling regimes would be republics.”

What we’re reading (9/18)

“Lower Prices Mean Higher Expected Returns” (Servo Wealth Management). “The 10-year period from November 2007 through October 2017 was predictably low, just +6.3% per year. What was the annualized return starting instead in October 2008 through October 2017, after the first stage of the decline? It was much higher, +10.7% per year. Of course, the index declined violently for another five months before bottoming out, and expected returns at that point, in March 2009, were higher still: +17.3% per year annually through October 2017.”

“Do Wages Drive Prices, Or Vice Versa? The Answer Matters For Interest Rates” (Wall Street Journal). “[S]ome economists say…the lesson of the past few decades is that while higher prices lead to higher wages, as workers try to claw back lost purchasing power, the reverse isn’t true. If so, high wage growth won’t stand in the way of getting inflation down.”

“Cracking Down On A Wall Street Trend: E.S.G. Makeovers” (DealBook). “E.S.G.-fund makeovers have become the trend du jour on Wall Street: BlackRock, J.P. Morgan, Morgan Stanley, HSBC, WisdomTree, Putnam and MassMutual have all done it. Over the past five years, about 90 mutual funds and E.T.F.s have undertaken similar revamps, according to the mutual fund rating firm Morningstar. And Wall Street firms have started up hundreds of brand-new E.S.G. dedicated funds — seeking to cash in on growing investor demand for such investments…But what may have seemed like a harmless marketing move is now causing some eyebrow raising: Securities regulators are starting to question whether their do-gooder claims are real or fraudulent, at the same time that regulators are seeking to enact new rules and guidelines for what constitutes an E.S.G. investment product or strategy.”

“The Congressional Stock Trading Ban, Explained” (The Week). “A recent in-depth analysis completed by The New York Times revealed that at least 97 members of Congress have engaged in buying or selling stock, bonds, and other financial assets that were directly affected by the committees they served on. Some of those transactions were completed by the representative, while others were reportedly the work of their spouse or a dependent child.”

“Volkswagen Targets $70.1 Billion To $75.1 Billion Valuation In Planned Porsche IPO” (CNBC). “A stock exchange prospectus is expected to be published on Monday, after which institutional and private investors can subscribe to Porsche shares.”

What we’re reading (9/17)

“Death On A Train: A Tragedy That Helped Fuel The Railroad Showdown” (Washington Post). “[D]iscontent among rail workers is still brewing. They say few details have been made available about the agreement, which leaves the points-based attendance policy in place for other types of emergencies. And some say they doubt the deal will address their fundamental concerns about quality of life amid painful labor shortages and the continued spread of covid-19.”

“Parsing Pessimism On Retail Sales” (Fisher Investments). “Whenever the economic outlook gets shaky, headlines dwell on retail discounts as evidence households are having a tough time—today’s reaction is a very well-trod one. In our experience, it is more of a sociological observation than anything else, as why and where people are shopping matters less to the economic data than the simple question of how much. Heck, people often tend to get more bang for their buck early in economic recoveries—not unlike businesses’ continuing cost-cutting for a while after economic output hits its low. Doing more with less is a big recovery hallmark.”

“Who Will Inherit The Family Business? Often, It’s Private Equity” (Wall Street Journal). “Family businesses hold particular appeal for buyout firms, and they are throwing out the traditional private-equity playbook to attract them. Management is often left intact. Owners keep big stakes. Buyout firms pledge to retain employees and plow more money into the businesses. Still, some buyout targets end up carrying heavy debt burdens that can turn a once-profitable company into a money-losing one. Families might ultimately cede control when the business is later sold so their private-equity owners can realize gains. Communities and workers, by extension, can lose their personal ties to a company’s ownership.”

“The US Is Moving One Step Closer To Letting Americans File Their Taxes Online For Free Directly To The IRS, Cutting Out Private Companies Like TurboTax And H&R Block” (Insider). “Filing your taxes could soon be free and relatively painless. The US is inching closer to modernizing how Americans file their taxes and breaking the grip that private tax-prep companies, like TurboTax and H&R Block, have over the process. In the future, tax filing may require only a few clicks — or even simply replying to a text message, as is done in some European countries like Estonia.”

“What Is The Average American Net Worth By Age?” (U.S. News & World Report). “Both median and average family net worth increased between 2016 and 2019, according to the U.S. Federal Reserve. Average net worth increased by 2% to $748,800 between 2016 and 2019, the bank reported in September 2020, the most recent year it publicized such data. Median net worth, however, rose 18% over that same time period to $121,700.”

What we’re reading (9/16)

“US Yield Curve Set To Invert By Most In 40 Years, Allspring Says” (Bloomberg). “Two-year yields are likely to surge in the next six months, increasing the inversion with 10-year yields to at least 100 basis points, said Brian Jacobsen, senior investment strategist at the firm [Allspring Global Investments]. The yield gap at that part of the curve stood at minus 44 basis points on Friday, the deepest in a month, data compiled by Bloomberg show.”

“FedEx CEO Says He Expects The Economy To Enter A ‘Worldwide Recession’” (CNBC). “The chief executive, who assumed the position earlier this year, said that weakening global shipment volumes drove FedEx’s disappointing results. While the company anticipated demand to increase after factories shuttered in China due to Covid opened back up, it actually fell, he said.”

“Redfin Predicts Sharpest Turn In Housing Market Since 2008 Crash” (Fox New York). “‘Buyers just don't have the 40% extra money to put towards housing every month,’ [Daryl] Fairweather [Redfin Chief Economist] said. ‘A lot of homebuyers had to drop out and go to the rental market instead or choose not to buy that second home or investment property.’”

“As Mortgage Rates Top 6%, More Borrowers Choose Adjustable-Rate Loans” (Wall Street Journal). “The average rate on a 5/1 ARM, one of the most popular adjustable-rate loans, was 4.93% this week, more than a full percentage point lower than the 6.02% average rate for a 30-year-fixed loan, according to Freddie Mac. A 5/1 ARM has a lower fixed rate for the first five years and a variable rate, based on one of several market indexes, for each of the remaining years of the loan.”

“Spare The Bear: The Inflation Debate That Should Be Happening” (BlackRock). “[Central bankers] are mostly silent about the collateral damage. For hikes to reduce inflation, they need to hurt growth. There is no way around this. How much they will hurt needs to be part of the equation. We estimate it would require a deep recession in the U.S., with around as much as a 2% hit to growth in the U.S. and 3 million more unemployed, and an even deeper recession in Europe.”

What we’re reading (9/15)

“The Illusion of Knowledge” (Howard Marks, Oaktree Capital). “Most forecasts consist of extrapolation of past performance. Because macro developments usually don’t diverge from prior trends, extrapolation is usually successful. Thus, most forecasts are correct. But since extrapolation is usually anticipated by security prices, those who follow expectations based on extrapolation don’t enjoy unusual profits when it holds. Once in a while, the behavior of the economy does deviate materially from past patterns. Since this deviation comes as a surprise to most investors, its occurrence moves markets, meaning an accurate prediction of the deviation would be highly profitable. However, since the economy doesn’t diverge from past performance very often, correct forecasts of deviation are rarely made and most forecasts of deviation turn out to be incorrect. Thus, we have (a) extrapolation forecasts, most of which are correct but unprofitable, and (b) potentially profitable forecasts of deviation, which are rarely correct and thus are generally unprofitable. Q.E.D.: Most forecasts don’t add to returns.”

“Mortgage Rates Top 6% For The First Time Since The 2008 Financial Crisis” (Wall Street Journal). “The jump in mortgage rates is one of the most pronounced effects of the Federal Reserve’s campaign to curb inflation by lifting the cost of borrowing for consumers and businesses. Already, it has ushered in a sea change in the housing market by adding hundreds of dollars or more to the monthly cost of a potential buyer’s mortgage payment, slowing what was a red-hot market not so long ago.”

“$20 Billion Figma Deal Is A Historic Coup For Startup Investors In An Otherwise Miserable Year” (CNBC). “In a year that’s featured exactly zero high-profile tech IPOs and far more headlines about mass layoffs than big funding rounds, Adobe’s $20 billion acquisition of Figma on Thursday is what some might call a narrative violation. There was no other bidder out there driving up the price, according to a person familiar with the matter who asked not to be named because the details are confidential.”

“Bridgewater's Ray Dalio Expects Stocks To Fall 20% If Rates Rise To 4.5%” (U.S. News & World Report). “Billionaire Ray Dalio, founder of one of the world's biggest hedge funds, has predicted a sharp plunge in stock markets as the U.S. Federal Reserve raises interest rates aggressively to tame inflation. ‘I estimate that a rise in rates from where they are to about 4.5 percent will produce about a 20 percent negative impact on equity prices,’ Bridgewater Associates' founder Dalio wrote in a LinkedIn post on Tuesday.”

“Meet The Young People Working For The World's Most Evil Companies” (Vice). “Answering the question of what you do for work is just draining. Who wants to be reminded of their inbox, the sad Tupperware lunch from Tuesday or the latest brain-numbing lingo handed down from corporate? But for others who work in controversial – arguably unethical – industries like fossil fuels, tobacco and nuclear arms, this question can be deeply uncomfortable to answer, and can leave the listener wishing they’d never asked in the first place.”

What we’re reading (9/14)

“The Fed Could Crash The Housing Market” (CNN Business). “One area of growing concern: housing. Interest rate hikes can lead to higher mortgage rates, which could cause people to think twice about buying a home. So far, sales are slipping, while prices are holding steady. But some economists warn continued historic rate hikes by the Fed could risk crashing the housing market, underscoring the difficult task ahead for the central bank.”

“U.S. Mortgage Interest Rates Top 6% For First Time Since 2008” (Reuters). “The average interest rate on the most popular U.S. home loan rose above 6% for the first time since 2008 and is now more than double the level it was one year ago, Mortgage Bankers Association (MBA) data showed on Wednesday.”

“Crypto Investors Step Up Bets Against Ether As ‘Merge’ Looms” (Wall Street Journal). “Investors ramped up their bets against ether, the second-largest cryptocurrency, on the eve of the Ethereum network’s big software upgrade slated for early Thursday morning. The cost of holding a short position—a bet that ether’s value will fall—in the perpetual futures market has risen ahead of the upgrade, a sign that investors are increasingly hedging their risk going into the network update. So-called funding rates for ether perpetual futures, a kind of futures contract that doesn’t have an expiry date, have been negative for more than a month, meaning that traders are paying a premium for pessimistic bets.”

“Google Cancels Half The Projects At Its Internal R&D Group Area 120” (TechCrunch). “The company on Tuesday informed staff of a ‘reduction in force’ that will see the incubator halved in size, as half the teams working on new product innovations heard their projects were being canceled. Previously, there were 14 projects housed in Area 120, and this has been cut down to just seven. Employees whose projects will not continue were told they’ll need to find a new job within Google by the end of January 2023, or they’ll be terminated. It’s not clear that everyone will be able to do so.”

“Billionaire No More: Patagonia Founder Gives Away The Company” (New York Times). “In mid-2020, Mr. Chouinard began telling his closest advisers, including Ryan Gellert, the company’s chief executive, that if they couldn’t find a good alternative, he was prepared to sell the company. ‘One day he said to me, ‘Ryan, I swear to God, if you guys don’t start moving on this, I’m going to go get the Fortune magazine list of billionaires and start cold calling people,’’ Mr. Gellert said. ‘At that point we realized he was serious.’ […] ‘I don’t respect the stock market at all,’ he [Mr. Chouinard] said. ‘Once you’re public, you’ve lost control over the company, and you have to maximize profits for the shareholder, and then you become one of these irresponsible companies.’ They also considered simply leaving the company to Fletcher and Claire. But even that option didn’t work, because the children didn’t want the company.”

What we’re reading (9/13)

“Stocks Suffer Worst Day Since June 2020” (Wall Street Journal). “Stocks suffered their worst day in more than two years after hotter-than-expected inflation data dashed investors’ hopes that cooling price pressures would prompt the Federal Reserve to moderate its campaign of interest-rate increases. Investors sold everything from stocks and bonds to oil and gold. All 30 stocks in the Dow Jones Industrial Average declined, as did all 11 sectors in the S&P 500. Only five stocks in the broad benchmark finished the session in the green. Facebook parent Meta Platforms dropped 9.4%, BlackRock declined 7.5% and Boeing fell 7.2%.”

“Investors Have Begun Pricing In Odds Of A 100 Basis Points Rate Hike At This Month’s Fed Meeting After The Hotter-Than-Expected August Inflation Report” (Insider). “The CME FedWatch tool showed a 34% probability of a rate increase of 100 basis points at the September 20-21 meeting after showing zero probability over the past month.”

“Who Are America’s Missing Workers?” (New York Times). “People at retirement age, who had been staying in the work force longer as longevity increased before the pandemic, dropped out at disproportionate rates and haven’t returned. More puzzlingly, men in their prime working years, from 25 to 54, have retreated from the work force relative to February 2020, while women have bounced back. Magnifying those disparities are two crosscutting factors: the long-term health complications from Covid-19, and a lagging return for workers without college degrees.”

“What The High-Profile Layoffs At Snap, Netflix, And Other Companies Could Mean For The Economy” (Vox). “Julia Pollak, the chief economist at ZipRecruiter, said the layoffs clearly signaled a slowdown in the tech industry, but she didn’t expect that to necessarily be a leading indicator for hiring trends in the broader labor market.”

“King Charles Will Not Pay Tax On Inheritance From The Queen” (The Guardian). “King Charles will not pay tax on the fortune he has inherited from the late Queen, although he has volunteered to follow his mother’s lead in paying income tax. Under a clause agreed in 1993 by the then prime minister, John Major, any inheritance passed “sovereign to sovereign” avoids the 40% levy applied to assets valued at more than £325,000. The crown estate has an estimated £15.2bn in assets, of which 25% of the profits are given to the royal family as the sovereign grant. The estate includes the royal archives and the royal collection of paintings, which are held by the monarch ‘in right of the crown’.”

What we’re reading (9/12)

“Sliding Earnings Forecasts Pose Next Test For Markets” (Wall Street Journal). “Analysts have cut their estimates for third-quarter earnings growth by 5.5 percentage points since June 30, according to John Butters, senior earnings analyst at FactSet. That is more than usual and marks the biggest cut since the second quarter of 2020, when the Covid-19 pandemic and ensuing lockdowns brought economic activity to a standstill.”

“Tuesday’s Inflation Report Could Show Prices Moderating As Gasoline And Travel Costs Fall” (CNBC). “The consumer price index will be released Tuesday at 8:30 a.m. ET, and the report could be a bit messy since headline inflation is expected to fall while core inflation, excluding energy and food, should rise. The report is also key because it is expected to influence the Federal Reserve’s decision on how much to raise interest rates next week — and more importantly, in the long term.”

“Is Physical Climate Risk Priced? Evidence From Regional Variation In Exposure To Heat Stress” (Viral Acharya, et al., NBER Working Paper). “We exploit regional variations in exposure to heat stress to study if physical climate risk is priced in municipal and corporate bonds as well as in equity markets. We find that local exposure to damages related to heat stress equaling 1% of GDP is associated with municipal bond yield spreads that are higher by around 15 basis points per annum (bps), the effect being larger for longer-term, revenue-only and lower-rated bonds, and arising mainly from the expected increase in energy expenditures and decrease in labor productivity. Among S&P 500 companies, one standard deviation increase in exposure to heat stress is associated with yield spreads that are higher by around 40 bps for sub-investment grade corporate bonds, with little effect for investment grade bond spreads, and with conditional expected returns on stocks that are higher by around 45 bps.”

“The Forthcoming Rate Of Economic Growth?” (Marginal Revolution). “As Brad DeLong stresses, the second Industrial Revolution starting about 1870 was the true one, and we woke up fifty years later to an entirely different world, based on electricity and consumer society and extreme physical mobility. Yet I am not aware of any extreme gdp or productivity stats during the intermediate period. In fact the numbers I have seen seem a little….mediocre. I say side with the reality, not with the numbers, but this is one of the questions I wish was studied much more. Is it simply the case that stringing together a series of qualitatively discrete changes inevitably will outrace our ability to measure it?”

“Goodbye, Globalization?” (Daniel Drezner, Reason). “To understand the intellectual roots of today's resistance to free markets, the book to examine is Karl Polanyi's The Great Transformation. Polanyi, writing in 1944, wanted to understand how the world had arrived at a low moment of depression, fascism, and war. Where writers like F.A. Hayek saw socialism's rise as a tragic result of state interference in free markets, Polanyi viewed it as the ineluctable backlash against those same markets' volatility.”

What we’re reading (9/11)

“Inflation Sets The Scene For The Fed: What To Know This Week” (Yahoo! Finance). “Tuesday morning will bring investors the closely-watched Consumer Price Index (CPI) for August, which will likely solidify in investors' minds whether the Federal Reserve raises interest rates by 0.50% or 0.75% at its policy meeting later this month. Economists surveyed by Bloomberg expected headline CPI rose 8.1% over the prior year in August, a moderation from from 8.5% increase seen in July. On a month-over-month basis, CPI is expected to show prices fell 0.1% from July to August, primarily due to continued easing in energy prices. If realized, this would mark the first monthly decline since May 2020.”

“Inflation Showed Signs Of Easing In Several Industries In August” (Wall Street Journal). “U.S. consumer-price inflation showed signs of moderating in August for the second straight month, though the decrease was uneven across sectors and it remains unclear whether the slowdown will continue.”

“What If We’re Fighting Inflation All Wrong? (Vox). “what if the prevailing wisdom is wrong, and workers don’t have to suffer? That’s what Nathan Tankus, research director of the Modern Money Network and publisher of the newsletter Notes on the Crises, thinks. Or, at the very least, he believes that leaving inflation up to a single body — the Fed — to try to find a balance between the prices people should pay and the jobs and incomes people should have is off. He also backs the notion of a federal jobs guarantee.”

“Equities Start Month In Deeply Undervalued Territory After Latest Pullback” (Morningstar). “Equities are now trading 15% below our fair value estimate, an even greater discount than the 11% they were at to the end of July. Prices initially rose after better-than-expected news around second-quarter earnings but ended the month in retreat following a hawkish speech on inflation from Federal Reserve Chairman Jerome Powell at the Jackson Hole Economic Symposium.”

“Wall Street’s Favorite Sport Is A Failing Business” (New York Times). “If it [tennis] were a company, activist shareholders would have already descended, calling for a restructuring. In fact, some are — raising the prospect of a turnaround effort or else the risk that a competitor could emerge to steal tennis players the same way LIV Golf has sought to upend the PGA Tour.”

What we’re reading (9/10)

“Simple Models Predict Behavior At Least As Well As Behavioral Scientists” (Dillon Bowen, Wharton). “How accurately can behavioral scientists predict behavior? To answer this question, we analyzed data from five studies in which 640 professional behavioral scientists predicted the results of one or more behavioral science experiments. We compared the behavioral scientists’ predictions to random chance, linear models, and simple heuristics like “behavioral interventions have no effect” and “all published psychology research is false.” We find that behavioral scientists are consistently no better than - and often worse than - these simple heuristics and models. Behavioral scientists’ predictions are not only noisy but also biased. They systematically overestimate how well behavioral science “works”: overestimating the effectiveness of behavioral interventions, the impact of psychological phenomena like time discounting, and the replicability of published psychology research[.]”

“Outlook for Tech Stocks Darkens After Rocky Stretch” (Wall Street Journal). “Investors are bailing out of technology-focused mutual and exchange-traded funds at the fastest clip since early February, when the tech selloff was first intensifying, according to data from Refinitiv Lipper. They yanked about $2.4 billion from such funds in the three weeks ended Wednesday.”

“Anyone Who Thinks We’re Not In A Recession Is ‘Crazy,’ Says RH CEO” (CNN Business). “Gary Friedman, the CEO of luxury home goods retailer RH, is often a colorful speaker who doesn't mince words. That was on full display during the company's earnings call Thursday night as he bemoaned New York City breakfasts, dunked on industry rivals and declared that anyone who thinks the United States isn't in a recession is ‘crazy.’ […] ‘I think the Fed finally really understands what they have to do. And it's not going to be pretty when interest rates go up the way they are,’ Friedman said.”

“Massive Rail Strike Next Week Could Deal Another Blow To America’s Economy” (CNN Business). “Freight railroads have been around since the 19th century, but you can't run a 21st century economy without them. The looming possibility of a strike by unions representing more than 90,000 workers at the nation's freight railroads has businesses nationwide worried. The unions are poised to go on strike on September 16, a move that could bring nearly 30% of the nation's freight to a grinding halt, according to data from the Bureau of Transportation Statistics.”

“The Obscure Economist Silicon Valley Billionaires Should Dump Ayn Rand For” (Vanity Fair). “[Henry] George’s masterwork, published in 1879, was Progress and Poverty, which set forth to explain how ‘increase of want’ could go hand in hand with ‘increase of wealth.’ Thus George took on precisely the question we face today: not the general question of poverty or inequity, but why specifically are middle-class incomes stagnating, and incomes of people at the bottom falling, while those at the top continue to rise?”

What we’re reading (9/9)

“Dow Jumps More Than 300 Points As US Stocks Break 3-Week Losing Streak After Dollar Falls From Recent Highs” (Insider). “The Dow Jones Industrial Average soared more than 300 points on Friday, cementing a three-day rally and breaking a three-week losing streak as both the US dollar and Treasury yields took a breather from their recent surges and moved lower.”

“Robinhood Unveils Index to Track Customers’ Favored Stocks” (Wall Street Journal). “Robinhood Markets Inc. is offering a peek into the favorite stocks of its millions of predominantly young, social-media-savvy customers. The brokerage firm’s new ‘Robinhood Investor Index,’ unveiled Friday, is designed to track the performance of the 100 investments most popular among its user base. Such an index could be of interest to financial professionals who monitor the activities of small investors as one of the underlying factors behind stock-market moves.”

“Behold Perhaps The Most Brazenly Incredible Investment Scam In History” (Dealbreaker). “Dear readers: There are damn-nigh undetectable scams. There are the sneaky ones, with claims that seem a bit too good to be true but with just enough trappings to make the claims believable. Then there is the whole universe of brow-raisers, head-slappers, whoppers; the incredible, the astounding, the chutzpah-laden, the literally unbelievable; in all shapes and sizes from the miniscule to the Madoffian." And then, friends, on a completely different order of magnitude, at least in respect of sheer gall and subsequent credulousness (and, of course, at the moment allegedly), there is this one[.]”

“Dissecting The Royal Family’s Wealth” (DealBook). “Dissecting the royal family’s financial empire isn’t straightforward. Last year, Forbes put the headline value of its holdings at $28 billion, theoretically making the Windsors one of the two richest clans in Britain. Among those holdings are instantly recognizable icons like Buckingham Palace and crown jewels. Also included are vast tracts of land, from office properties and a major cricket ground in London to farmland on Britain’s outer edges.”

“Confused About The Housing Market? Here’s What’s Happening Now – And What Could Happen Next” (CNBC). “The slowdown in the otherwise red-hot housing boom has been stunningly swift. The U.S. housing market surged during the pandemic as homebound people sought new places to live, boosted by record-low interest rates. Now, real estate agents who once reported lines of buyers outside open houses and bidding wars on the back deck say homes are sitting longer and sellers are being forced to lower their sights.”

What we’re reading (9/8)

“Fed Chair Powell Vows To Raise Rates To Fight Inflation ‘Until The Job Is Done’” (CNBC). “Federal Reserve Chair Jerome Powell in an appearance Thursday emphasized the importance of getting inflation down now before the public gets too used to higher prices and comes to expect them as the norm. In his latest comments underlining his commitment to the inflation fight, Powell said expectations play an important role and were a critical reason why inflation was so persistent in the 1970s and ’80s.”

“Steve Job’s Daughter Slams New iPhone 14 And Says Its ‘Same As Old Version’” (The Sun). “Eve posted an image of a man being gifted the same shirt he is wearing, implying the new iPhone 14 is the same as the last iPhone.”

“BlackRock Seeks To Defend Its Reputation Over E.S.G. Fight” (DealBook). “BlackRock says it’s looking to correct ‘misconceptions’ and ‘inaccurate statements’ about its climate position. In its letter, BlackRock says that the firm has never dictated specific emission targets to any company, and that it doesn’t coordinate its investment decisions or shareholder votes with others on climate issues, as the attorneys general claimed. Far from boycotting, BlackRock says it has invested ‘hundreds of billions of dollars’ in energy companies.”

“Why Celebrities Are So Interested In The Unglamorous World Of Private Equity” (CNN Business). “‘It's [private equity] survived by being secretive and by perpetuating a myth that it's providing great returns to investors — it fundamentally is not.’ PE firms are often seen as vultures, swooping in to feast on dying entities. But more recently, according to a report from Mother Jones, the bulk of modern PE work is ‘not to finish off sick companies, but rather to stalk and gut the healthy ones.’”

“EY Leaders Green Light Split Plan” (Wall Street Journal). “Ernst & Young’s leaders fired the starting gun Thursday on a monthslong plan to split its consulting and auditing businesses, in a radical move that will generate windfalls for the firm’s partners and could upend the business model for accounting firms. ‘This is something that will change the industry,’ Carmine Di Sibio, EY’s global chairman and chief executive, said in an interview.”

What we’re reading (9/7)

“Dow Closes More Than 400 Points Higher, Nasdaq Snaps 7-Day Slump As Wall Street Shakes Off Rate Hike Concerns” (CNBC). “Stocks rose Wednesday — trying to shake off a three-week slide — as rates and oil prices eased, cooling investor concerns about continued high inflation. The Dow Jones Industrial Average gained 481 points, or 1.55%. The S&P 500 rose 1.99% and the Nasdaq Composite ticked up 2.33%, attempting to break a seven-day losing streak.”

“The Period Of Abundance Is Over” (Jupiter Asset Management). “According to his [Jeffrey Gundlach’s] view, one of the biggest risks right now is that the Federal Reserve is doing considerable damage to the economy with its aggressive rate hikes: ‘The next shock is that we’re having to put in a big overreaction to the inflation problem which we created from our initial reaction of excess stimulus,’ Mr. Gundlach says. ‘My guess is that we will end up creating momentum that’s more deflationary than a lot of people believe is even possible.’”

“Summer Is Over. And The Battle To Get Workers Back To The Office Is Heating Up” (CNN Business). “Many companies experimenting with a hybrid work schedule have said they want employees to be in the office a set number of days each week. But thus far, they have not done much to enforce those mandates, even as employees remain adamant in their desire to work remotely for more days than many CEOs want. But now that summer vacations and Labor Day are behind us, more employers may start taking a harder line.”

“Apple Event Recap — iPhone 14, Apple Watch 8, New AirPods Pro And More” (Tom’s Guide). “That's plenty of product news for one afternoon, and if there was a common theme to all the new features, it's that Apple wants to make its devices as indispensable as ever. The new iPhones and Apple Watches have a crash detection feature, for example, and your iPhone will be able to send emergency messages via satellite connectivity.”

“Kim Kardashian’s Newest Business Venture: Private Equity” (Wall Street Journal). “Kim Kardashian and a former partner at Carlyle Group Inc. are launching a new private-equity firm focused on investing in and building consumer and media businesses. Ms. Kardashian is teaming up with Jay Sammons, who ran consumer investing at Carlyle, to launch SKKY Partners, they said in separate interviews. SKKY will make investments in sectors including consumer products, hospitality, luxury, digital commerce and media as well as consumer-media and entertainment businesses.”

What we’re reading (9/6)

“Junk-Loan Defaults Worry Wall Street Investors” (Wall Street Journal). “Defaults on so-called leveraged loans hit $6 billion in August, the highest monthly total since October 2020, when pandemic shutdowns hobbled the U.S. economy, according to Fitch Ratings. The figure represents a fraction of the sprawling loan market, which doubled over the past decade to about $1.5 trillion. But more defaults are coming, analysts say.”

“One Of The Biggest Strikes In US History Is Brewing At UPS” (CNN Business). “Over the past year, the nascent labor movements at mighty corporations like Starbucks and Amazon have grabbed national attention. But less well-known is a looming high-stakes clash between one of America's oldest unions and the world's biggest package courier. Contract negotiations are set to begin in the spring between UPS and the Teamsters Union ahead of their current contract's expiration at the end of July, 2023. Already, before the talks have even started, labor experts are predicting that the drivers and package handlers will go on strike…If that happens, a strike at UPS would affect nearly every household in the country. An estimated 6% of the nation's gross domestic product is moved in UPS trucks every year.”

“How Passive Are Markets, Actually?” (Financial Times). “The harsh reality is that the investment industry as a whole makes a staggering amount of money — listed US asset managers had an average profit margin of almost 26 per cent in 2021, more than twice the S&P 500’s average — and yet do a bad job on average. Despite the march of passive over the decades, there are still more mutual and hedge fund managers than ever before, many of which in practice do little more than extract rents from the financial system.”

“The Other Doomsday Scenario Looming Over Markets” (Wall Street Journal). “The Fed doubles the pace of its bond runoff this month, aiming to reduce its Treasury holdings by $60 billion and its mortgage-backed securities by $35 billion monthly. Those concerned about the impact include hedge fund giant Bridgewater, which thinks markets will fall into a ‘liquidity hole’ as a result.”

“Politico’s New German Owner Has A ‘Contrarian’ Plan For American Media” (Washington Post). “A newcomer to the community of billionaire media moguls, Döpfner is given to bold pronouncements and visionary prescriptions. He’s concerned that the American press has become too polarized — legacy brands like the New York Times and The Washington Post drifting to the left, in his view, while conservative media falls under the sway of Trumpian ‘alternative facts.’ So in Politico, the fast-growing Beltway political journal, he sees a grand opportunity.”

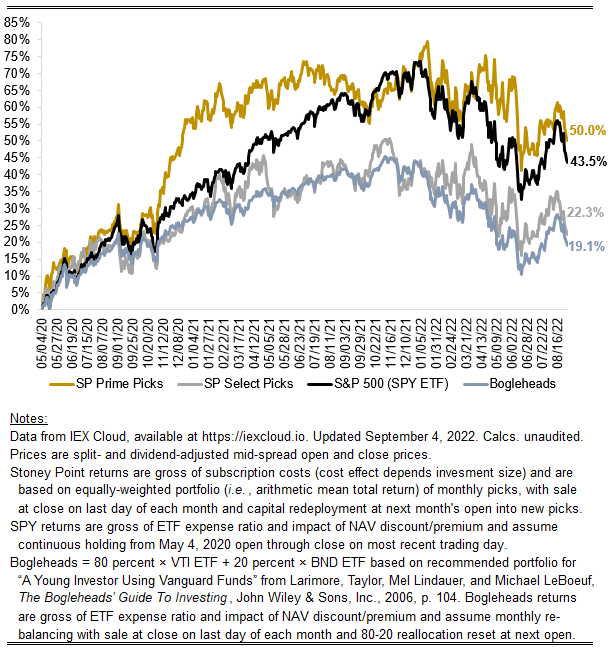

August 2022 performance update

Hi friends,

Here with a performance update for August:

Prime picks: -3.28%

Select picks: -5.70%

SPY ETF: -3.41%

Bogleheads (80% VTI, 20% BND): -3.10%

After a big July, the market was a little less sanguine about economic conditions in August. Jerome Powell’s Jackson Hole warning of “some pain” ahead apparently persuaded investors that the Fed means business when it comes to tamping down demand to break the back of inflation. Corroborative indicia of slowing demand seemed to be everywhere. Transaction volume is way down and inventories are way up in interest-rate sensitive industries (e.g., real estate). Consumer products companies have had some bad earnings reports—Walmart cut guidance at the end of July and Bed Bath and Beyond’s bad results have prompted store closures, layoffs, and, apparently, the suicide of its CFO. Asset prices have come down across most markets, including markets that purport to be uncorrelated to other asset classes (e.g., crypto), and U.S. stock funds are down nearly 20 percent this year. For us, it was a slight win for Prime and certainly a loss for Select. Let’s see how this plays out.

Stoney Point Total Performance History

What we’re reading (9/4)

“U.S.-Stock Funds Are Down 17.3% So Far In 2022” (Wall Street Journal). “The average U.S.-stock mutual fund or exchange-traded fund is down 17.3% for the year to date, through August, according to Refinitiv Lipper data. That includes a 3.5% average decline in August, reflecting the stock market’s reaction to Fed Chairman Jerome Powell’s comments that the central bank will keep raising interest rates to fight inflation, despite recession risk.”

“Flash Boys Face Fund Managers In Treasury-Market Feud Over Data” (Bloomberg Law). “There’s a battle raging in the $23 trillion US Treasury market, and it’s not over the trajectory of interest rates. Rather, it’s all about data. On one side, you have high-speed traders, hedge funds and electronic market makers. On the other, some of the biggest US banks and asset managers. At issue: whether the publication of real-time transaction figures will help or harm a market already suffering from faltering liquidity.”

“Car Companies Are Making A Deadly Mistake With Electric Vehicles” (Slate). “On Aug. 16, President Biden signed the Inflation Reduction Act, whose climate investments include a muscular effort to convince more Americans to purchase an electric vehicle. The new law offers $7,500 off many new electric or plug-in hybrid cars or trucks, without restricting the number of credits that a carmaker can receive. A day later the National Highway Traffic Safety Administration announced that American road deaths soared once again in the first quarter of 2022, rising 7 percent to 9,560 fatalities—the highest quarterly toll since 2002. The two news items may seem unrelated, but they are not.”

“The Family That Mined The Pentagon’s Data For Profit” (Wired). “What turned into a business opportunity for the Poseys began as a Cold War-era fight for government transparency. In 1947, President Harry Truman signed an executive order that gave the executive branch power to investigate and fire any federal employee who was deemed to be disloyal to the country, without having to supply evidence. The results of those investigations were held in secret FBI files. In the mid-1950s, the US government, and the Pentagon, in particular, hoarded information as compulsively as atom bombs. In the midst of the Red Scare, the design of a bow and arrow was deemed too sensitive for public release. The amount of peanut butter American soldiers consumed annually was a military secret. Shark attacks on sailors could neither be confirmed nor denied.”

“Jefferies CEO Pushes Return To Office, End To ‘Lonely Home Silos’” (New York Post). “Jefferies CEO Richard Handler signaled the firm will take a lighter approach than other firms by not tracking office attendance and allowing staffers to occasionally work from home.”

What we’re reading (9/3)

“Entering The Superbubble’s Final Act” (GMO). “The U.S. stock market remains very expensive and an increase in inflation like the one this year has always hurt multiples, although more slowly than normal this time. But now the fundamentals have also started to deteriorate enormously and surprisingly: between COVID in China, war in Europe, food and energy crises, record fiscal tightening, and more, the outlook is far grimmer than could have been foreseen in January. Longer term, a broad and permanent food and resource shortage is threatening, all made worse by accelerating climate damage.”

“Enough, Bosses Say: This Fall, It Really Is Time To Get Back To The Office” (Wall Street Journal). “After months of encouraging white-collar employees to return, or attempting to coax them back with free pizza, warm cookies and catered lunches, many executives now say they feel emboldened to take a tougher stance. No longer can workers merely come to the office if they so choose; this fall, executives say, attendance is expected and the office resisters will be put on notice.”

“Interview: Vitalik Buterin, Creator Of Ethereum” (Noahpinion). Per Vitalik: “I was surprised that the crash did not happen earlier. Normally crypto bubbles last around 6-9 months after surpassing the previous top, after which the rapid drop comes pretty quickly. This time, the bull market lasted nearly one and a half years. People seemed to adjust into the mentality that the higher prices are a new normal. The whole time, I knew that eventually the bull market will end and we’re going to get the drop, but I just did not know when. Today, it feels like people are reading too much into what is ultimately cyclical dynamics that crypto has always had and probably will continue to have for a long time. When the prices are rising, lots of people say that it's the new paradigm and the future, and when prices are falling people say that it's doomed and fundamentally flawed. The reality is always a more complicated picture somewhere between the two extremes.”

“1 In 5 Home Sellers Are Now Dropping Their Asking Price As The Housing Market Cools” (CNBC). “Homes are simply not selling at the breakneck pace they were six months ago, when strong demand butted up against tight supply, bidding wars were the norm, and a seller could often get a signed contract in under a weekend. Homes in August sat on the market an average five days longer than they did a year ago — the first annual increase in time on the market in more than two years.”

“The Optimal Amount Of Fraud Is Non-Zero” (Bits About Money). “This fraud [payments fraud] is possible by design. The very best minds in government, the financial industry, the payments industry, and business have gotten together and decided that they want this fraud to be possible. That probably strikes you as an extraordinary claim, and yet it is true.”