August 2022 performance update

Hi friends,

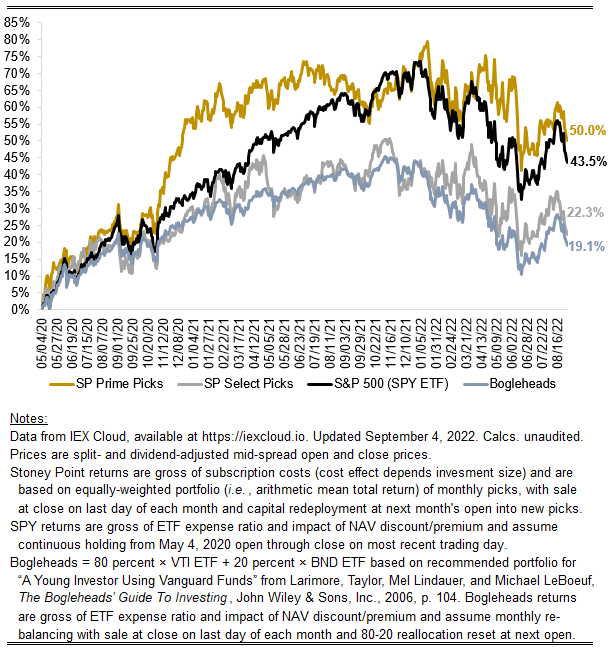

Here with a performance update for August:

Prime picks: -3.28%

Select picks: -5.70%

SPY ETF: -3.41%

Bogleheads (80% VTI, 20% BND): -3.10%

After a big July, the market was a little less sanguine about economic conditions in August. Jerome Powell’s Jackson Hole warning of “some pain” ahead apparently persuaded investors that the Fed means business when it comes to tamping down demand to break the back of inflation. Corroborative indicia of slowing demand seemed to be everywhere. Transaction volume is way down and inventories are way up in interest-rate sensitive industries (e.g., real estate). Consumer products companies have had some bad earnings reports—Walmart cut guidance at the end of July and Bed Bath and Beyond’s bad results have prompted store closures, layoffs, and, apparently, the suicide of its CFO. Asset prices have come down across most markets, including markets that purport to be uncorrelated to other asset classes (e.g., crypto), and U.S. stock funds are down nearly 20 percent this year. For us, it was a slight win for Prime and certainly a loss for Select. Let’s see how this plays out.