What we’re reading (7/20)

“Tesla Ends Streak Of Record Quarterly Profits After China Factory Shutdown” (Wall Street Journal). “Tesla Inc. reported its first sequential decline in quarterly profit in more than a year as it navigates global economic turmoil and recovers from an extended shutdown at its Shanghai assembly plant.”

“Crypto Has A Whole New Boondoggle To Sell You” (Insider). “Now, after burning through billions of dollars and getting booted from the company he founded, [WeWork cofounder Adam] Neumann is back. And this time he wants to help save the world — or at least that's what he wants us to believe.”

“Why A Middle-Class Lifestyle Remains Out Of Reach For So Many” (New York Times). “But it’s not. In February of 2020, The Atlantic published a piece on the affordability crisis that was souring a seemingly strong economy. ‘In one of the best decades the American economy has ever recorded, families were bled dry by landlords, hospital administrators, university bursars and child-care centers,’ Annie Lowrey wrote. ‘For millions, a roaring economy felt precarious or downright terrible.’ Lowrey’s framing has stuck in my mind over the last couple of years. I don’t think you can understand the broader price crisis without it.”

“‘A Bigger Paycheck? I’d Rather Watch The Sunset!’: Is This The End Of Ambition?” (The Guardian). “This has been called the age of anti-ambition: over the past two and a half years, many people have taken stock – of how they spend their time, where they find meaning, their hopes for the future – and found work wanting.”

“These Are The Keys To 401(k) Investing Success In A Falling Market” (CNN Business). “‘[T]he key to 401(k) success is consistent and ongoing contributions. Continuing to contribute during down markets allows investors to buy assets at cheaper prices, which may help your account recover faster after a market downturn.’”

What we’re reading (7/18)

“One Hedge Fund Is Up 223% This Year Thanks To A Big Bet Against Tech Stocks” (Wall Street Journal). “In late 2020, Mandeep Manku made a big contrarian bet. His hedge fund, Coltrane Asset Management, had already been hit hard when markets plunged because of Covid-19. He decided to swing Coltrane’s portfolio from favoring cheap European companies to betting against tech and other fast-growing companies in the U.S. Markets with so many stocks trading at more than 10 times their revenues, with fervor concentrated in a few sectors, “always end poorly for investors,” Coltrane told clients in a September 2020 presentation.”

“China’s Homebuyers Are Running Out Of Patience With The Real Estate Slump” (CNBC). “China’s real estate market desperately needs a boost in confidence, analysts said, after reports of homebuyers halting mortgage payments rocked bank stocks and raised worries of a systemic crisis. The size of the mortgages isn’t as worrisome as the impact of the latest events on demand and prices for one of the biggest financial assets in China: residential housing.”

“Costco’s Inflation-Proof $4.99 Rotisserie Chicken, Explained” (Vox). “The roasted birds have been hailed as an economic lifeline — most rotisserie chickens will run you $6 to $10 — but the chicken isn’t cheap because of corporate benevolence. In 2015, Costco said it was able to maintain its low price because the company considers the rotisserie chicken a “loss leader.” That means its purpose isn’t to bring in profits, but rather to bring in customers to buy more of the wholesale retailer’s bulk toilet paper and five-packs of deodorant. And it works. The item is so popular among Costco members that it has its own Facebook fan page with 19,000 followers.”

“We Were Wrong About The Great Resignation. Workers Are Still Powerless And The Looming Recession Will Make It Worse.” (Insider). “The Great Resignation — or Great Reshuffle — has been hailed as a reclamation of worker power, including by this publication. But as recession fears throw cold water on the excitement of saying, "I quit," economists told Insider that the truth about the Great Resignation isn't as rosy. Only certain workers have gained any true bargaining power, and even though the lowest-wage workers have seen raises, soaring inflation has largely canceled them out. As the economy and wage growth continues to cool, they'll be the first to see their upper hand slip away.”

“The Latest In Litigation Hotness? Pure Pettiness.” (Dealbreaker). “Madison Square Garden Entertainment is in the midst of some shareholder litigation, in which plaintiffs allege the merger between MSGE and MSG Networks Inc. devalued the stock value to the benefit of MSGE CEO James L. Dolan and his family. But this securities case is the mere background over the real story, which is just how petty some parties can get. You see, Hal Weidenfeld, senior vice president for legal and business affairs at MSGE, sent a letter to the shareholders’ counsel banning them from all MSE venues — including Madison Square Garden, Radio City Music Hall, and the Chicago Theater — until the matter is resolved[.]”

What we’re reading (7/17)

“Many Investors Are Fleeing The Stock Market, But Some Are Doubling Down: ‘If I Lose $15,000, I’m Not Going To Die’” (Wall Street Journal). “In March, individual investors bought $28 billion of U.S.-listed stocks and exchange-traded funds on a net basis—the largest monthly sum ever recorded by Vanda Research since it started tracking data in 2014. Between April and June, that slipped to about $25 billion a month on average, though that is still much higher than prepandemic levels. In April through June of 2019, for example, that number averaged $3 billion a month.”

“Dollar Lurks Below Highs As Euro Gasps For Gas” (Reuters). “Traders are holding their breath ahead of Thursday, when gas is supposed to resume flowing through the Nord Stream pipe from Russia to Germany after a shutdown for scheduled maintenance.”

“From $25 Billion To $167 Million: How A Major Crypto Lender Collapsed And Dragged Many Investors Down With It” (CNBC). “In October 2021, CEO Alex Mashinsky said the crypto lender had $25 billion in assets under management. Even as recently as May — despite crashing cryptocurrency prices — the lender was managing about $11.8 billion in assets, according to its website. The firm had another $8 billion in client loans, making it one of the world’s biggest names in crypto lending. Now, Celsius is down to $167 million “in cash on hand,” which it says will provide “ample liquidity” to support operations during the restructuring process.”

“Fed Officials Preparing To Lift Interest Rates By Another 0.75 Percentage Point” (Wall Street Journal). “Federal Reserve officials have signaled they are likely to raise interest rates by 0.75 percentage point later this month, for the second straight meeting, as part of an aggressive effort to combat high inflation. Policy makers left the door open to a larger, full-percentage-point increase at the July 26-27 gathering. But some of them simultaneously poured cold water on the idea in recent interviews and public comments ahead of their premeeting quiet period, which began Saturday.”

“The Truth, And Strategy, Of Food Expiration Dates” (CNN Business). “You might think that date is the absolute last day that food is safe to eat. You'd be wrong. But you wouldn't be alone in coming to that mistaken conclusion, because the system behind food label dates is an absolute mess. There's no national standard for how those dates should be determined, or how they must be described. Instead, there's a patchwork system — a hodgepodge of state laws, best practices and general guidelines. “It is a complete Wild West,” said Dana Gunders, executive director of ReFed, a nonprofit trying to end food waste.”

What we’re reading (7/16)

“Debt-Market Jitters Come For Leveraged Loans” (Wall Street Journal). “For most of 2022, junk-rated loans made to debt-laden companies gave investors stability amid battered credit markets. Now, recession fears are pushing down loan values and cutting returns in the $1.4 trillion leveraged-loan market.”

“Nothing Short Of Terrifying” (City Journal). “The latest report from the Labor Department is nothing short of terrifying. The worst news concerns those two essentials, food and fuel. Overall, food prices rose 1.0 percent in June and are 10.4 percent above year-ago levels. The prices of food at home stood 12.2 percent above year-ago levels. Energy prices overall rose 7.5 percent in June and stand 41.6 percent above where they were in June 2021—scarcely more than a year ago. Gasoline prices rose 11.2 percent in June alone and stand a whopping 60 percent higher than a year ago.”

“AQR’s Quieter Comeback” (Institutional Investor). “AQR’s managed futures strategies are enjoying a big comeback. Both of the firm’s managed futures funds – the AQR Managed Futures Strategy HV I and the AQR Managed Futures Strategy N – delivered positive returns in June and for the year, according to information Morningstar Direct provided to II. The former earned 49.3 percent in the first half of the year, ranking it first in Morningstar’s Systematic Trend category, which includes 30 funds.”

“How Companies Subtly Trick Users Online With ‘Dark Patterns’” (CNN Business). “An ‘unsubscribe’ option that's a little too hard to find. A tiny box you click, thinking it simply takes you to the next page, but it also grants access to your data. And any number of unexpected charges that appear during checkout that weren't made clearer earlier in the process. Countless popular websites and apps, from retailers and travel services to social media companies, make use of so-called ‘dark patterns,’ or gently coercive design tactics that critics say are used to manipulate peoples' digital behaviors.”

“A Copper Shortage Is Likely Coming For The Energy Transition” (Gizmodo). “By 2035, the global demand for copper is projected to nearly double, according to a new S&P Global report released Wednesday. In the worst-case scenario, based on our current production trends, the report projects a shortfall of 9.9 million metric tons of copper in 2035.”

What we’re reading (7/15)

“China’s Shuddering Economic Engine” (DealBook). “China’s economy grew at its slowest pace last quarter since the coronavirus appeared in Wuhan in 2020, when the country shut down, shrinking the world’s second-largest economy for the first time in nearly 30 years. The economy expanded 0.4 percent in the second quarter from a year earlier, the National Bureau of Statistics reported today, much lower than the 1 percent that economists surveyed by Bloomberg had expected.”

“Citigroup Tops Profit Estimates As Bank Benefits From Rising Interest Rates, Shares Surge 13%” (CNBC). “Shares of the company surged 13% in New York trading, the bank’s biggest post-earnings stock gain in more than two decades, according to Refinitiv data.”

“Stocks End Tumultuous Week With A Rally” (CNN Business). “US stocks surged Friday as an end-of-week rally gained momentum and sent the Dow up over 600 points. A new batch of bank earnings and economic data Friday morning increased investors' optimism about the state of the economy and lessened worries that the Federal Reserve could raise rates by a full percentage point at its meeting later this month.”

“What Is The True Cost Of Inflation? It’s Complicated.” (Wall Street Journal). “Sticker shock is widespread. But not everything is going up, and there are still bargains to be had. Smartphones and TVs, for example, are much cheaper than they were a year ago, and the price of gas has cooled in recent weeks. Some predict other prices will drop as the Federal Reserve raises interest rates and inventories tick higher.”

“The Housing Shortage Isn’t Just A Coastal Crisis Anymore” (New York Times). “San Francisco, Los Angeles, New York and Washington have long failed to build enough housing to keep up with everyone trying to live there. And for nearly as long, other parts of the country have mostly been able to shrug off the housing shortage as a condition particular to big coastal cities. But in the years leading up to the pandemic, that condition advanced around the country: Springfield, Mo., stopped having enough housing. And the same with Appleton, Wis., and Naples, Fla.”

What we’re reading (7/14)

“Stripe Cuts Internal Valuation By 28%” (Wall Street Journal). “Payments giant Stripe last valued by private investors at $95 billion, cut the internal value of its shares by 28%, people familiar with the matter said. Stripe told employees in an email Friday that the internal share price was about $29, compared with $40 in the most previous internal valuation, known as a 409A valuation, the people said. The move lowered the implied valuation of those shares to $74 billion, according to one of the people, which is calculated separately from the stock owned by” major shareholders.”

“The Inflation Numbers Are Bad — But How Bad Are They?” (Vox). “Although many economists say inflation will stay at high levels at least through the end of the year, there are some signs that prices could be moderating. Gas prices are already starting to fall from their recent peak of $5 a gallon and are now averaging about $4.63, which could be reflected in future CPI data, and the cost of home goods and apparel could come down as more retailers like Target slash prices on excess inventory. But economists say it’s difficult to tell whether inflation peaked in June, given the volatility of energy prices.”

“What The Bored Ape Yacht Club And Quontic’s Pool Party In The Metaverse Means For Your Company” (Forbes). “Investments in the metaverse surged to $12 billion in 2021 from $5.9 billion in 2020 to more than$5.9 billion in 2020 to more than. The metaverse could grow to $13 trillion – more than half the size of the entire U.S. 2022 economy – by 2030, according to Citi Bank estimates.”

“Average Rent In Manhattan Was A Record $5,000 Last Month” (CNBC). “The average apartment rent in June was $5,058, the highest on record, according to a report from Miller Samuel and Douglas Elliman. Average rental prices were up 29% over last year, while median rent was up by 25% to $4,050 a month.”

“Elon Musk Is a ‘Nightmare Client’” (The Atlantic). “Twitter’s lawsuit is an extraordinary and odd document. It paints Musk as a dishonest and unserious hypocrite, the sort of person you would never want running your company. But because this same dishonest and unserious hypocrite has signed a document offering to pay a huge premium to shareholders, Twitter’s board is bound by its fiduciary duty to enforce a merger neither Musk nor Twitter’s employees seem to want. It’s an awfully strange twist to the marriage-plot genre: I hate your guts, now marry me! This is shareholder capitalism as romantic comedy.”

What we’re reading (7/13)

“Inflation Rose 9.1% In June, Even More Than Expected, As Consumer Pressures Intensify” (CNBC). “The consumer price index, a broad measure of everyday goods and services related to the cost of living, soared 9.1% from a year ago, above the 8.8% Dow Jones estimate. That marked the fastest pace for inflation going back to November 1981.”

“Bonds Slump As Inflation Surge Fuels Bets On 100-Basis-Point Fed Rate Hike” (Bloomberg). “US Treasury yields jumped after another hotter-than-expected inflation report kindled bets that the Federal Reserve could raise rates by as much as a full percentage point this month. The increase was led by shorter-dated securities sensitive to policy changes, with yields on two-year notes climbing as much as 16 basis points to 3.21% before paring the jump. That pushed the yield above those on 10-year notes by the most since 2006, signaling increasing risk that higher rates will stall economic growth.”

“U.S. Inflation Hits New Four-Decade High Of 9.1%” (Wall Street Journal). “The consumer-price index’s advance for the 12 months ended in June was the fastest pace since November 1981, the Labor Department said on Wednesday. A big jump in gasoline prices—up 11.2% from the previous month and nearly 60% from a year earlier—drove much of the increase, while shelter and food prices were also major contributors.”

“Texas’ Power-Grid Operator Is Asking Crypto Miners To Power Down As The State’s Electricity System Grapples With Sky-High Temperatures” (Insider). “Bloomberg reported that virtually all of the state's large-scale bitcoin-mining operations had screeched to a halt as of Monday, which gave 1,000 megawatts of electricity back to ERCOT. That amounts to about 1% of what Texas' grid can distribute.”

“Oil Falls To Three-Month Low As Recession Fears Spook Market” (Bloomberg). “West Texas Intermediate shed more than 8% to settle under $96 a barrel for the first time since early April. Rising virus cases in China and looming US inflation data are stoking concerns about demand. Meanwhile, dwindling liquidity is also exacerbating price moves. Money managers have become more bearish on the main oil benchmarks, cutting their net-long positions last week to the lowest since 2020.”

What we’re reading (7/12)

“Euro Buyers Fend Off Dollar Parity In Last-Gasp Defense” (Bloomberg). “Traders mounted a last-ditch push on Tuesday to stop those options contracts from triggering after the shared currency slid to within a whisker of a pure one-for-one rate. It’s a border that could quickly collapse if fresh concern over Russian natural-gas supplies or signs of a relatively more hawkish Federal Reserve drive the euro lower.”

“Founders Of Bankrupt Crypto Hedge Fund 3AC Go Missing, As Investors Try To Recoup Assets” (CNBC). “Lawyers representing the creditors say the physical whereabouts of Zhu Su and Kyle Davies, who started Three Arrows in 2012, are “currently unknown”…[t]he documents, filed Friday evening, also allege that the founders have not yet begun to cooperate with the liquidation process ‘in any meaningful manner.’ On Monday, lawyers requested the court keep the identity of the creditors anonymous.”

“Amid All The Uncertainty, Can You Blame Millennials For Embracing ‘Meme’ Stocks?” (Real Clear Markets). “Millennials are the first generation to have less wealth than the previous generation, a fact that does not bode well for an economic model dependent on consumption growth. Contrary to previous generations, they cannot just save and invest as wage growth has not kept up with inflation.”

“Are Cryptocurrencies On Their Last Legs? Hedge Fund Managers Certainly Don’t Think So.” (Institutional Investor). “Thirty-two percent of hedge fund managers think that digital assets will offer the largest alpha-generating opportunity over the next three years, topping equities (18 percent) and fixed income (15 percent), according to the latest report from SigTech, a quantitative technologies provider. Twenty-three percent of hedge fund managers plan to dramatically increase their allocations to digital assets, while 60 percent plan to increase slightly.”

“Advanced E.V. Batteries Move From Labs To Mass Production” (New York Times). “For years, scientists in laboratories from Silicon Valley to Boston have been searching for an elusive potion of chemicals, minerals and metals that would allow electric vehicles to recharge in minutes and travel hundreds of miles between charges, all for a much lower cost than batteries available now. Now a few of those scientists and the companies they founded are approaching a milestone.”

What we’re reading (7/11)

“U.S. Stocks End Lower Ahead Of Inflation Data, Earnings Season” (Wall Street Journal). “All three major indexes opened lower, regained some ground and then lost steam into the close. The S&P 500 fell 44.95 points, or 1.2%, to 3854.43. The blue-chip Dow Jones Industrial Average lost 164.31 points, or 0.5%, to finish at 31173.84. The Nasdaq Composite Index shed 262.71, or 2.3%, to 11372.60 as technology stocks lost ground.”

“US Job Market Provides Hopeful Signs Against Recession And Inflation, But Other Data Are Worrisome” (Jason Furman and Wilson Powell, The Peterson Institute). “The employment report strongly suggests that the economy was not in recession in the first half of 2022. At the same time, however, it provides only limited reassurance about the future because previous recessions were not always evident in the employment data several months prior to the peak.”

“Is South Florida's Housing Market Too Hot?” (Reason). “Already in 2019, some were sounding the alarm about Miami's rising housing prices. One study commissioned by the housing group Miami Houses for All in collaboration with city and county officials found that Miami was the third-most expensive metropolitan area in the entire country for housing costs. The same study found that over 50 percent of households in Miami were spending more than they could afford on rents and mortgage payments.”

“Homebuyers Are Canceling Deals At The Highest Rate Since The Start Of The Pandemic” (CNBC). “The share of sale agreements on existing homes canceled in June was just under 15% of all homes that went under contract, according to a new report from Redfin. That is the highest share since early 2020, when homebuying paused immediately, albeit briefly. Cancelations were at about 11% one year ago.”

“Is The Stock Market Slump A Buying Opportunity?” (Dealbreaker). “Savvy investors know that time after time, again and again, a bad stock market inevitably turns itself around and surges back into the black. When that will happen is anyone’s guess. It could be coming faster than you might think though, especially if the Fed successfully engineers that soft landing they’ve been shooting for. When the stock market recovery does come, you definitely don’t want to be left behind. So, stick in there, stay with it, and try not to give in to all the economic gloom.”

What we’re reading (7/10)

“Twitter Didn’t Seek A Sale. Now Elon Musk Doesn’t Want To Buy. Cue Strange Legal Drama.” (Wall Street Journal). “Elon Musk’s showdown with Twitter Inc. has set the stage for what could become one of the most unusual courtroom battles in corporate-takeover history—a spurned acquisition target that never sought to be bought potentially trying to force the buyer who soured on the deal to see it through.”

“What’s Next In The Elon Musk-Twitter Saga? A Court Battle” (New York Times). “Now that Elon Musk has signaled his intent to walk away from his $44 billion offer to buy Twitter, the fate of the influential social media network will be determined by what may be an epic court battle, involving months of expensive litigation and high-stakes negotiations by elite lawyers on both sides.”

“Uber Broke Laws, Duped Police And Secretly Lobbied Governments, Leak Reveals” (The Guardian). “The unprecedented leak to the Guardian of more than 124,000 documents – known as the Uber files – lays bare the ethically questionable practices that fuelled the company’s transformation into one of Silicon Valley’s most famous exports.”

“How Many F-Bombs Trigger An R Rating? An Obscure Movie Industry Panel Decides” (CNBC). “How many F-bombs can a movie have before it’s rated R? That’s up to Kelly McMahon and a secretive panel of raters that is charged with dishing out the movie industry’s five all-important designations — G, PG, PG-13, R and the extremely rare NC-17. Though it toils in relative obscurity, the panel’s ratings for about 700 movies each year can help determine whether films are suitable for children and have a big impact on a movie’s box office performance.”

“The S&P 500 Will Eke Out A Small Gain This Year As The Index Recovers First Half Losses On The Back Of A Solid Economy, Oppenheimer Says” (Insider). “Oppenheimer this week slashed its outlook for the S&P 500, stating that the benchmark index will do worse than the firm had expected but will still jump 25% through the rest of the year to end 2022 with a small gain.”

What we’re reading (7/9)

“Twitter, Elon Musk Set For Unprecedented Legal Battle Over Deal Collapse” (Wall Street Journal). “With Elon Musk attempting to terminate his $44 billion takeover of Twitter Inc. and the company vowing to force him to follow through, the social-media powerhouse and the world’s richest person appear headed for a messy” courtroom battle. The company says it plans legal action and is any day expected to file a lawsuit in the Delaware Court of Chancery, arguing he is required to close the agreed-upon deal.”

“The Housing Market, At Last, Appears To Be Cooling Off” (Washington Post). “The slowdown has, so far, provided little relief to buyers. Instead, analysts say, a growing affordability crisis ― driven by the collision of inflation and rising interest rates ― is forcing many would-be buyers to walk away.”

“Big-Sounding Job Titles Are Feeding Egos In Tight Labor Market” (Bloomberg). “The tight US labor market isn’t just boosting wages, it’s also bidding up job descriptions. Once prevalent mostly with startups, job-title inflation has gone increasingly mainstream, said Shawn Cole, president of Cowen Partners, a nationwide executive search firm. It ‘exploded’ during the pandemic as companies competed for talent in the Covid-19 economy and more of them leveraged titles to entice experienced workers. ‘Entire careers of job titles are being condensed into a decade, 10 years worth of titles are being condensed into five, so new titles have had to be invented,’ Cole said. ‘Firms can only offer so much money.’”

“Tech Giants Like Meta And Snap Are Facing A ‘Perfect Storm’ Of Weak Growth Prospects That Could Lead To Limited Upside For Stocks Already Down More Than 50% This Year” (Insider). “‘We think this cocktail of events is likely to generate the lowest growth rate for the sector in years,’ Barclays said, adding that current valuations only partially reflect this scenario. Barclays expects 3% year-over-year growth for the industry this year.”

“US Will Plunge Into Recession — But It Didn’t Have To, Former IMF Chief Economist Says” (CNN Business). “It's ‘almost impossible’ for the Fed to tamp down inflation without tipping the US economy into a recession, says Former IMF Chief Economist Ken Rogoff. ‘[The Fed] would have to be very lucky,’ Rogoff told CNN's Christine Romans on Early Start. ‘They have to decide: Do they have to have inflation get down quickly, or are they going to throw us into a recession? I think they are saying that they will get inflation down. I think they will blink,’ Rogoff said he thinks the Fed will "blink" and slow down aggressive rate hikes.”

What we’re reading (7/8)

“Musk Backs Out Of $44 Billion Twitter Deal Over Bot Accounts” (Bloomberg). “Elon Musk is trying to end an agreement to buy Twitter Inc. for $44 billion and take it private, alleging that the company misrepresented user data and setting the stage for an arduous court brawl.”

“How The FBI Wiretapped The World” (Vice). “For years criminal organizations around the world were buying a special phone called Anom. The pitch was that it was completely anonymous and secure, a way for criminals to do business without authorities watching over their shoulder. It turned out that the whole thing was an elaborate honeypot and that the FBI and law enforcement agencies around the world were listening in. They’d help develop the phones themselves.”

“How Will We Know If We’re In A Recession?” (Vox). “By many measures, the economy still looks pretty resilient. In June, employers added a robust 372,000 jobs to the economy. Job openings have dipped slightly, but at 11.3 million, they still remain well above pre-pandemic levels. Wage growth continues to climb in certain sectors, and new jobless claims are low. The unemployment rate stands at 3.6 percent, just slightly above its level before the pandemic, which was at a 50-year low.”

“Start Investing Early And Stick With It, Especially When Stocks Fall” (New York Times). “Consider what would have happened if you had started to invest in the first commercially available stock index fund, the Vanguard 500 stock index fund, in July 1980. You would have experienced a nasty bear market that began in November 1980 and lasted until mid-August 1982. The S&P 500 index lost 27.1 percent in that stretch. You might have been tempted to sell all your shares and forget about stock investing entirely. But suppose that you had stuck with it, not only through that bear market but through the six others that followed over the next 40 years, including this one. According to FactSet, your initial investment would have grown 6,600 percent, including reinvested dividends.”

“Bankers Go Behind Closed Doors To Sell Junk Debt In Big Shake-Up” (Bloomberg Law). “Struggling to launch high-yield deals as recession fears swirl, investment bankers in Europe are conducting more business behind closed doors in order to sell big chunks of corporate debt in a market that’s increasingly closed.”

What we’re reading (7/7)

“Big Cities Can’t Get Workers Back To The Office” (Wall Street Journal). “The problem is most pronounced in America’s biggest cities. Nationally, office use hit a pandemic-era high of 44% in early June, while cities like Philadelphia, Chicago, San Francisco and New York have lagged behind, according to Kastle Systems, which collects data on how many workers swipe into office buildings each day.”

“Even Bosses Are Joining The Great Resignation” (Vox). “Data shows that managers are leaving their jobs at elevated levels, and that even though resignation rates for workers overall have declined from their peak, lots of people are still quitting their jobs. The breadth of quits could exacerbate an already tight labor market as quits in one area precipitate quits in another, and this cycle could ensure that the Great Resignation — also known as the Great Reshuffling or Great Reconsideration — won’t stop anytime soon.”

“The Big 4’s Tax Problem” (New York Times). “Regulators are turning up the heat on the Big 4, the largest accounting firms in the U.S. — Deloitte, PwC, EY and KPMG. Increasingly, their size and the variety of services they offer, like tax consulting, are raising questions about the independence of their audits and landing the firms in hot water, writes The Times’s Jesse Drucker.”

“Luxury Brand Tom Ford Hires Goldman Sachs To Explore Potential Sale” (Financial Post). “A deal could value the company at several billion dollars and may include an option that would give any new owner of Tom Ford the right to work with its founder after the sale, one of the people said.”

“Guy Who Policed Insider Trading Before Claiming Insider Trading Doesn’t Exist Pleads Guilty To Insider Trading” (Dealbreaker). “You might expect that enforcing a company’s insider-trading policies would give a person a pretty good insight into how one might evade them. And, to be fair to him, Gene Levoff did a pretty decent job: He managed to get away with it for five years, possibly because he aimed fairly low—earning just $220,000 and skirting just $377,000 in losses trading on tidbits he gleaned reviewing the company’s draft results—or possibly because as the person charged with holding Apple employees to the relevant blackout periods, he chose to exempt himself from scrutiny. But unfortunately for Levoff, he didn’t do quite as good a job as he undoubtedly hoped[.]”

What we’re reading (7/6)

“Inflation Fears Drove Larger Fed Rate Increase In June” (Wall Street Journal). “Since last month’s meeting several Fed bank presidents and governors have endorsed a 0.75-point rate rise this month. ‘We’re not getting traction on inflation in a way that I had hoped,’ said San Francisco Fed President Mary Daly in comments to reporters on June 24 explaining her support for the larger rate rise.”

“After Tough Second Quarter, U.S. Stocks Look Cheap” (Morningstar). “Based on a composite of the intrinsic valuation of all the stocks we cover that trade on U.S. exchanges, we calculate that the broad U.S. stock market is trading at a price/fair value of 0.83 times. Growth stocks are the most undervalued, trading at a price/fair value of 0.78, followed by the value category trading at 0.83. Core stocks are trading closer to fair value at 0.91 times.”

“The Stock Market Is Gearing Up For A Strong Recovery In The 2nd Half As ‘Transitory’ Inflation Begins To Cool, Fundstrat Says” (Insider). “Concerns of elevated inflation will likely abate over the coming months as surging prices prove to be more transitory than structural, according to Fundstrat's Tom Lee. That means the stock market is poised for a strong second half recovery, as lower inflation will give the Federal Reserve breathing room in its current interest rate hike cycle, Lee argued in a Wednesday note.”

“The Virtue Of Complexity In Return Prediction” (Bryan Kelly, Semyon Malamud, and Kangying Zhou, NBER Working Paper). “The extant literature predicts market returns with “simple” models that use only a few parameters. Contrary to conventional wisdom, we theoretically prove that simple models severely understate return predictability compared to “complex” models in which the number of parameters exceeds the number of observations. We empirically document the virtue of complexity in US equity market return prediction. Our findings establish the rationale for modeling expected returns through machine learning.”

“The Shift To Remote Work Lessens Wage-Growth Pressures” (Jose Maria Barrero, Nicholas Bloom, Steven Davis, Brent Myers, and Emil Mihaylov). “The recent shift to remote work raised the amenity value of employment. As compensation adjusts to share the amenity-value gains with employers, wage-growth pressures moderate. We find empirical support for this mechanism in the wage-setting behavior of U.S. employers, and we develop novel survey data to quantify its force. Our data imply a cumulative wage-growth moderation of 2.0 percentage points over two years.”

What we’re reading (7/5)

“Cryptoverse: The Bonfire Of The NFTs” (Reuters). “The market shone gloriously last year as crypto-rich speculators spent billions of dollars on the risky assets, pumping up prices and profits. Now, six months into 2022, it's looking ugly. Monthly sales volume on the largest NFT marketplace, OpenSea, plunged to $700 million in June, down from $2.6 billion in May and a far cry from January's peak of nearly $5 billion.”

“Crypto Crashed. Wall Street Won.” (DealBook). “Unlike in the 2008 crisis, the fortunes of Wall Street and Main Street have diverged. Plunging digital asset prices have left some retail investors with large losses. Lured by the promise of quick returns and astronomical wealth, many individuals bought new digital currencies or stakes in funds that held these assets. That’s not the case for most banks, which generally don’t own crypto or run funds that invest in it. Nor have they lent much into the emerging market for new money.”

“Euro Slides To 20-Year Low Against The Dollar As Recession Fears Build” (CNBC). “The euro fell to its lowest level in two decades on Tuesday as fears of a recession in the euro zone ramped up, with gas prices soaring and the Ukraine war showing no signs of abating. The euro shed around 1.3% for the session to hit $1.029 by mid-afternoon in Europe, having earlier been as low as $1.028.”

“Why Consumers’ Inflation Psychology Is Stoking Anxiety At The Fed” (Wall Street Journal). “Recessions are painful because millions of people lose their jobs. But central bankers, scarred by the experience of the 1970s, think high inflation is worse because it distorts economic behavior and is likely to lead to a more severe downturn later. High inflation became entrenched in the 1970s after high inflation expectations took hold. In the early 1980s, the Fed delivered shock therapy with punishing rate increases that brought down inflation but triggered recessions that featured the highest unemployment rates since the Great Depression.”

“How much do interest rates help?” (John Cochrane, The Grumpy Economist). “inducing recessions is not particularly effective at lowering inflation…[p]erhaps counting on the Fed to stop inflation all by itself is not such a great idea…[a] few Twitter commenters say that we really don't get much out of ‘normal times’ and we have to look to big ‘regime shifts.’ 1980 is an example, and the results with and without 1980 are telling. But that is perhaps the point. If so, then it will take a ‘regime shift’ to tame inflation not the usual ‘tools.’”

What we’re reading (7/4)

Happy Fourth!

“How Crazy Prices And Yearslong Wait Times Could Doom The Electric-Car Experiment” (Vanity Fair). “According to Cars.com, which tracks sales across the U.S., demand is so high that dealer inventory of all new vehicles has plummeted by 70% over the past three years: Car dealers had 3.4 million vehicles available for sale in April 2019; by this April, that number had dropped to just over one million. The consumer-research company J.D. Power reported in April that the average number of days a new car sits at a dealership before it’s purchased was on pace to be only three weeks, compared to 49 days just a year prior.”

“Today’s Global Economy Is Eerily Similar To The 1970s, But Governments Can Still Escape A Stagflation Episode” (Brookings). “The stagflation of that era [the 1970s] ended with a global recession and a series of financial crises in EMDEs [emerging market and developing economies]. In light of the lessons of that stagflation episode, these economies need to do a quick rethink of policies to cope with the consequences of rapidly tightening global financing conditions.”

“If The U.S. Is In A Recession, It’s A Very Strange One” (Wall Street Journal). “Today, something highly unusual is happening. Economic output fell in the first quarter and signs suggest it did so again in the second. Yet the job market showed little sign of faltering during the first half of the year. The jobless rate fell from 4% last December to 3.6% in May. It is the latest strange twist in the odd trajectory of the pandemic economy, and a riddle for those contemplating a recession. If the U.S. is in or near one, it doesn’t yet look like any other on record.”

“What To Do Now To Prepare For The Next Recession” (The New York Times). “Perhaps the program most obviously in need of changes is unemployment insurance. Congress acted to shore up the program in the early days of the pandemic, expanding benefit eligibility to people typically left out, like tipped restaurant workers and gig workers, adding weeks of benefits and increasing them by $600 a week. Without those emergency actions, however, many Americans would most likely have gotten very little pay for a paltry number of weeks — or been unable to qualify at all.”

“Another Crypto Lender Vauld Pauses Withdrawals As Market Crash Takes Its Toll” (CNBC). “Crypto lender Vauld on Monday paused all withdrawals, trading and deposits on its platform and is exploring potential restructuring options, the company said.”

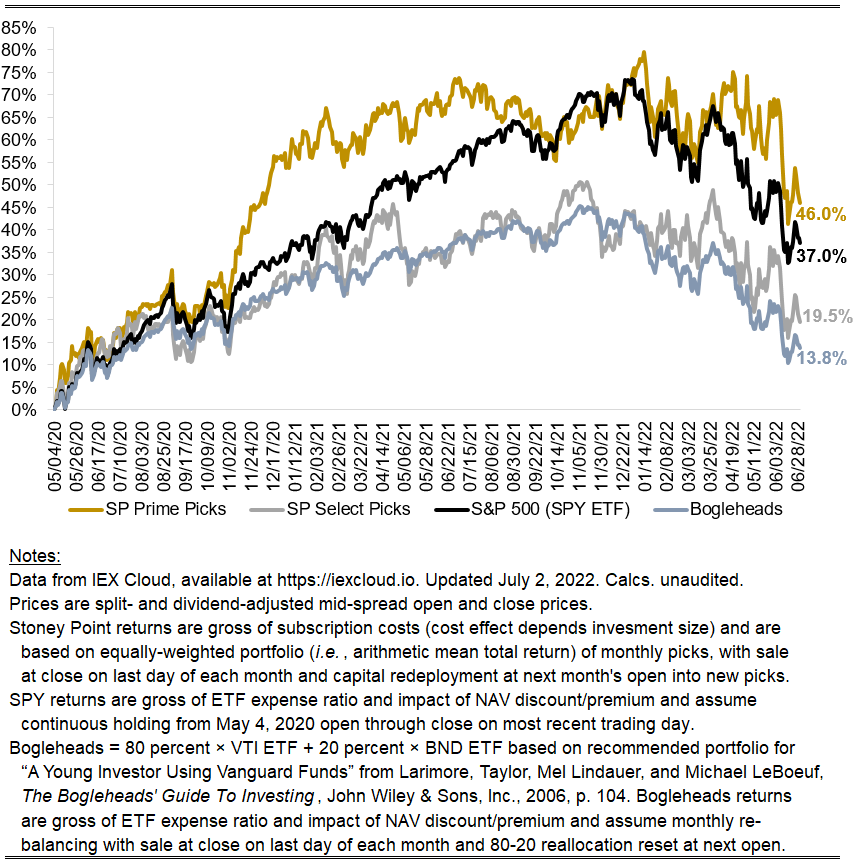

June 2022 performance update

Hi friends,

Here with the numbers for June.

Prime: -13.07%

Select: -11.00%

SPY ETF: -8.74%

Bogleheads portfolio (80% VTI, 20% BND): -7.39%

Not a great month for the market overall (down nearly 9 percent), which was a fitting end to the worst first half of trading in 50 years.

This month’s results for Prime were incrementally weighed down to a great extent by Micron Technologies, which many readers will know is economically similar to a closed-end bitcoin fund. The bitcoin crash has (rightfully) punished the stock, which was down nearly 26 percent last month. That the company chooses to hold a lot of crypto on its balance sheet does not make it unsuitable for Stoney Point, however. As longtime readers will know, my model selects stocks mechanistically as a function of the ratio of earnings (and a variety of other fundamental cash flow drivers) relative to price, and is generally agnostic as to how the firm generates those earnings. On that basis, Micron was attractive at the start of the month, and is likewise attractive for the current month, as the stock remains a Prime pick. There were a couple of other big losers that, to my eye, were similarly idiosyncratically affected by one-off events one either would not expect to continue indefinitely or would not expect to affect average performance significantly.

Stoney Point Total Performance History

What we’re reading (7/2)

“Markets Had A Terrible First Half Of 2022. It Can Get Worse.” (Wall Street Journal). “Almost any economic outcome is likely to prove a fresh surprise. If there’s a soft landing, stocks should do well as the recent recession panic reverses. If there’s a recession, there could easily be a big loss still to come, since only the drop of recent weeks appears to be related to recession risk.”

“Stocks And Bonds Hurt Alike Under Stagflation” (American Institute of Economic Research). “When bonds and stocks decline a lot and simultaneously it suggests inflation is rising rapidly even as the economy is stagnating or contracting (or will soon do so). For most economists today, that combination is near-impossible. Trained in Keynesian demand-side models – and taught to ignore or ridicule supply-side models – they deny that higher inflation is likely to accompany a weakening, let alone stagnating or contracting economy.”

“10-year Treasury Yield Falls To Lowest Level Since May” (CNBC). “U.S. Treasury yields fell Friday as recession fears and disappointing economic data left investors looking for safety. The yield on the benchmark 10-year Treasury note traded lower by 8 basis points at 2.889%, near its lowest level since late May. Meanwhile, the yield on the 30-year Treasury bond slid less than 1 basis point to 3.116%.”

“‘How Quickly The Tables Have Turned’: Falling Mortgage Rates Have Homebuyers So Emboldened They’re Asking Sellers For Cash” (MoneyWise). “The lower rate on a 30-year fixed mortgage is a relief for home shoppers who have been watching rates climb, but it’s also a sign that a recession could very well be around the corner as the market slows. Rates tend to mirror 10-year Treasury yields, which have fallen as investors seek safer, more stable assets in the face of higher inflation and slower economic growth.”

“Crypto’s Systemic Stress Test” (Axios). “Much of the current crypto winter is a function of two familiar markets phenomena — failed arbitrages and commingling of customer funds.”

What we’re reading (7/1)

“U.S. Stocks Finish Higher After Worst Start To Year In Decades” (Wall Street Journal). “The S&P 500 was up around 1.1% in 4 p.m. trading Friday, offering investors a respite after a downbeat second quarter that reflected fears that the Federal Reserve’s efforts to tame inflation could tip the economy into a recession.”

“Crypto Billionaire Sam Bankman-Fried Says More Exchanges Will Fail: ‘There Are Companies That Are Basically Too Far Gone’” (CNBC). “There are ‘some third-tier exchanges that are already secretly insolvent,’ Bankman-Fried told Forbes. The 30-year-old’s own fortune has taken a significant cut this year as crypto has crashed, but still sits at $8.1 billion, according to Bloomberg.”

“Layoffs Are Coming. The Outsourcing Industry Will Benefit.” (Institutional Investor). “The outsourcing industry ‘was basically born out of crisis,’ Lych explained. The industry, which she defined as including both back-office and investment services, has grown tremendously since the GFC, because outsourcing is often used as a strategy for cost-cutting.”

“Apple Ex-Corporate Law Chief Admits Years Of Insider Trading” (Bloomberg). “Gene Levoff, Apple’s former director of corporate law, pleaded guilty on Thursday to six counts of securities fraud between 2011 and 2016. Levoff, 48, was co-chairman of the company’s disclosure committee, which allowed him to see Apple’s revenue and earnings statements before they were filed with the Securities and Exchange Commission.”

“‘Cryptoqueen’ Ruja Ignatova Has Been Added To FBI’s 10 Most Wanted List” (New York Post). “Ruja Ignatova, who is accused of defrauding investors of more than $4 billion, was added to the federal bureau’s Ten Most Wanted Fugitive list, the law enforcement agency announced Thursday. The 42-year-old joins a list of sought after suspects that includes alleged killers and accused drug cartel leaders.”

What we’re reading (6/30)

“Markets Post Worst First Half Of A Year In Decades” (Wall Street Journal). “Accelerating inflation and rising interest rates fueled a monthslong rout that left few markets unscathed. The S&P 500 fell 21% through Thursday, suffering its worst first half of a year since 1970, according to Dow Jones Market Data. Investment-grade bonds, as measured by the iShares Core U.S. Aggregate Bond exchange-traded fund, lost 11%—posting their worst start to a year in history.”

“After Stock Market’s Worst Start In 50 Years, Some See More Pain Ahead” (New York Times). “Wall Street set records in the first half of the year, none of them good. The economy is on the cusp of a recession, battered by high inflation and rising interest rates, which eat into paychecks, dent consumer confidence and lead to corporate cutbacks. As it has teetered, markets have tanked.”

“The Fed’s Preferred Inflation Gauge Hints At Moderation In May.” (New York Times). “The Personal Consumption Expenditures price measure, which the Fed officially targets when it aims for 2 percent inflation on average over time, climbed by 6.3 percent in the year through May, matching the April increase. Over the past month, it picked up 0.6 percent, a rapid pace of increase as gas prices rose.”

“7 Things Investors Should Know About A Bear Market” (U.S. News & World Report). “Historically, bear markets have provided investors with excellent opportunities to buy high-quality stocks at a discounted valuation. When the entire stock market falls, even most high-quality stocks are dragged down with it. Assuming the overall market eventually recovers, this downdraft in stock valuations provides investors with periodic opportunities to scoop up shares of some of the best stocks in the market at a cheap price relative to their longer-term earnings and cash flow outlooks.”

“Prevalence Of Psychological Distress Among Working-Age Adults In The United States, 1999–2018” (Michael Daly, American Journal of Public Health). “The prevalence of psychological distress in the past 30 days increased from 16.1% in 1999–2000 to 22.6% in 2017–2018, an increase of 6.5 percentage points (95% confidence interval [CI] = 5.6, 7.3) or 40% from 1999–2000 levels. Statistically significant increases in the prevalence of distress were observed across all age, gender, race/ethnicity, and educational attainment subgroups examined. Rates of serious psychological distress increased from 2.7% in 1999–2000 to 4% in 2017–2018, an increase of 1.3 percentage points (95% CI = 0.9, 1.6).”