June 2022 performance update

Hi friends,

Here with the numbers for June.

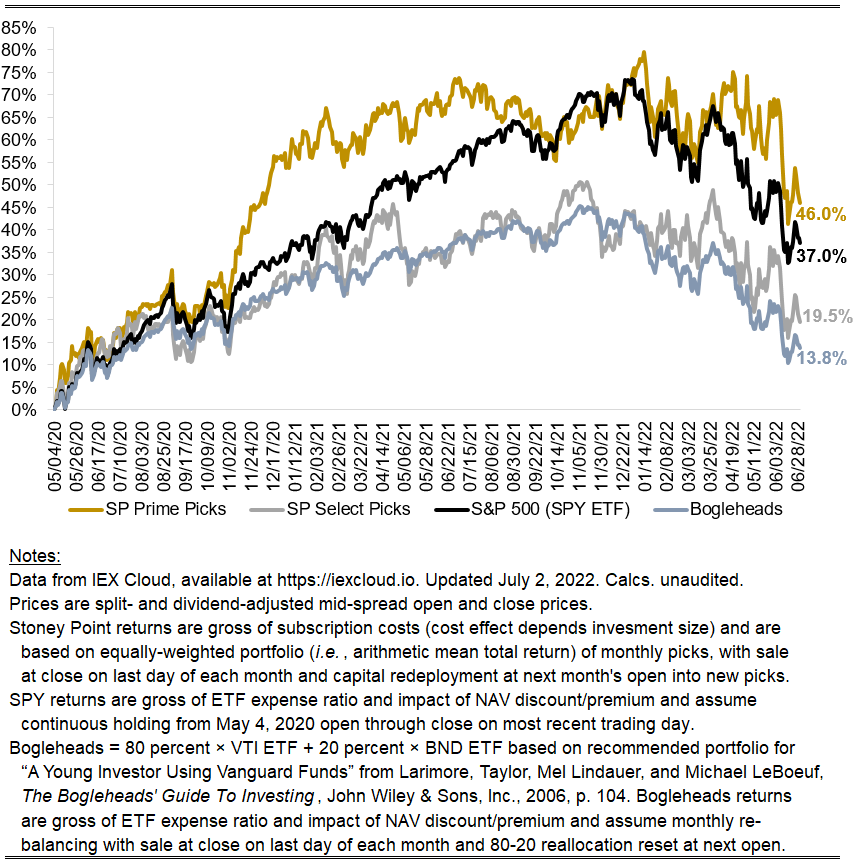

Prime: -13.07%

Select: -11.00%

SPY ETF: -8.74%

Bogleheads portfolio (80% VTI, 20% BND): -7.39%

Not a great month for the market overall (down nearly 9 percent), which was a fitting end to the worst first half of trading in 50 years.

This month’s results for Prime were incrementally weighed down to a great extent by Micron Technologies, which many readers will know is economically similar to a closed-end bitcoin fund. The bitcoin crash has (rightfully) punished the stock, which was down nearly 26 percent last month. That the company chooses to hold a lot of crypto on its balance sheet does not make it unsuitable for Stoney Point, however. As longtime readers will know, my model selects stocks mechanistically as a function of the ratio of earnings (and a variety of other fundamental cash flow drivers) relative to price, and is generally agnostic as to how the firm generates those earnings. On that basis, Micron was attractive at the start of the month, and is likewise attractive for the current month, as the stock remains a Prime pick. There were a couple of other big losers that, to my eye, were similarly idiosyncratically affected by one-off events one either would not expect to continue indefinitely or would not expect to affect average performance significantly.